BTSE is a growing crypto exchange gradually gaining acceptance in most parts of the world. The exchange has over 150 crypto assets for trading spots and futures. Some features that make the exchange attractive to new and experienced traders are its low trading fees, friendly user interface, and security structure. We will take a comprehensive BTSE review in this article, looking at its trading options, supported cryptocurrencies, fee structure, security, customer support, and more.

BTSE Quick Overview

BTSE, which stands for buy, trade, sell, and earn, is a relatively new crypto exchange headquartered in the Western US. BTSE was founded by Jonathan Leong and Brian Wong in 2018.

The crypto platform provides trading services ranging from spot, futures, and other investment opportunities to institutions, retail users, and new traders. They offer over 150 crypto assets, including BTSE token, their traditional token.

BTSE is available in most countries globally, except North Korea, Cuba, Russia, Sudan, Singapore, Canada, the USA, China, etc.

BTSE Pros And Cons

Like every other business, BTSE has its advantages and disadvantages. We will explore both in this section.

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Numerous Trading Options: With a BTSE account, you can trade over 150 cryptocurrencies. They offer spot and futures trading. In addition, customers also earn through their referral program, affiliate program, etc. | ❌ Regulatory Issues: People in certain regions, like the US, North Korea, Canada, Sudan, etc, can't trade on BTSE because of regulatory issues |

| ✅ Low Trading Fees: BTSE offers a tiered trading fee structure for customers, which is affordable compared to other exchanges. | ❌ Limited Payment Options: BTSE payment options are limited to SEPA, Swift, Astropay, and others |

| ✅ Reliable Security Architecture: BTSE ensures the safety of users' funds by providing an in-house security architecture, using cold wallets, and providing a user insurance fund | ❌ Minimum Deposit Requirement: Before trading on BTSE, you must deposit a minimum of 100 USD into your wallet |

| ✅ Free USD Deposit Fee: When depositing USD on BTSE, you don't need to pay a fee |

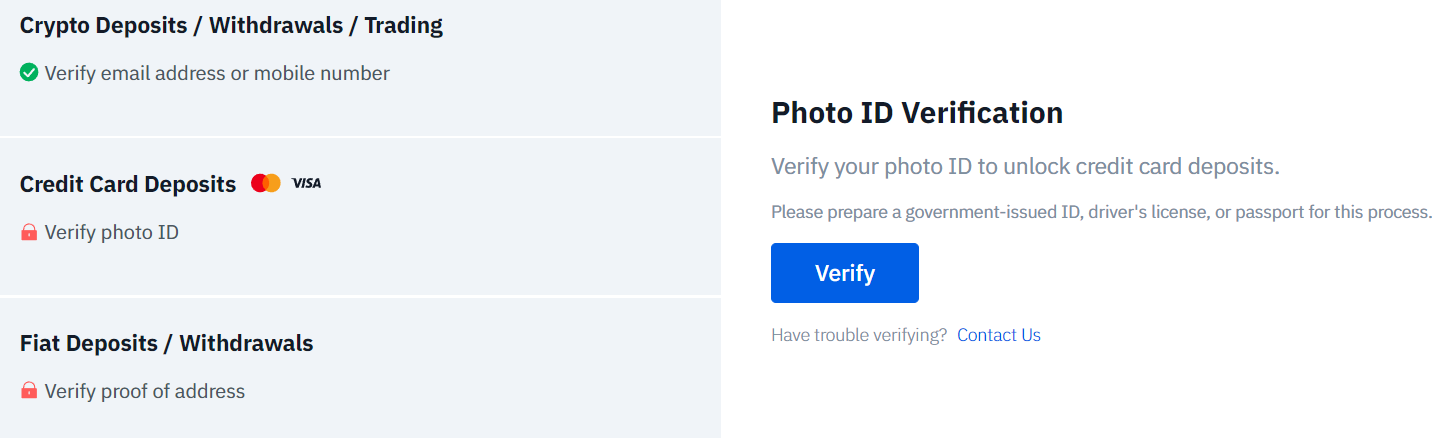

BTSE Sign Up & KYC

BTSE is a no-KYC crypto exchange, meaning you can get started with trading right away. The signup process on BTSE is simple and requires an email or phone number and a strong password.

As users don’t have to verify their identity, you can deposit cryptos, trade, and eventually withdraw your cryptos again.

However, there are some limitations based on your KYC levels. Unverified users don’t have access to credit/debit card payment methods. Additionally, unverified users can’t access fiat support on BTSE.

What we like about BTSE are its generous 24-hour withdrawal limits. No KYC users can withdraw up to $100,000. For higher withdrawal limits, you must verify your identity with personal details such as a government-issued ID or Passport and proof of address.

For more information, check out our in-depth BTSE KYC guide.

If you want to learn more about the restricted & banned countries on BTSE, read our in-depth BTSE banned countries guide.

BTSE Trading

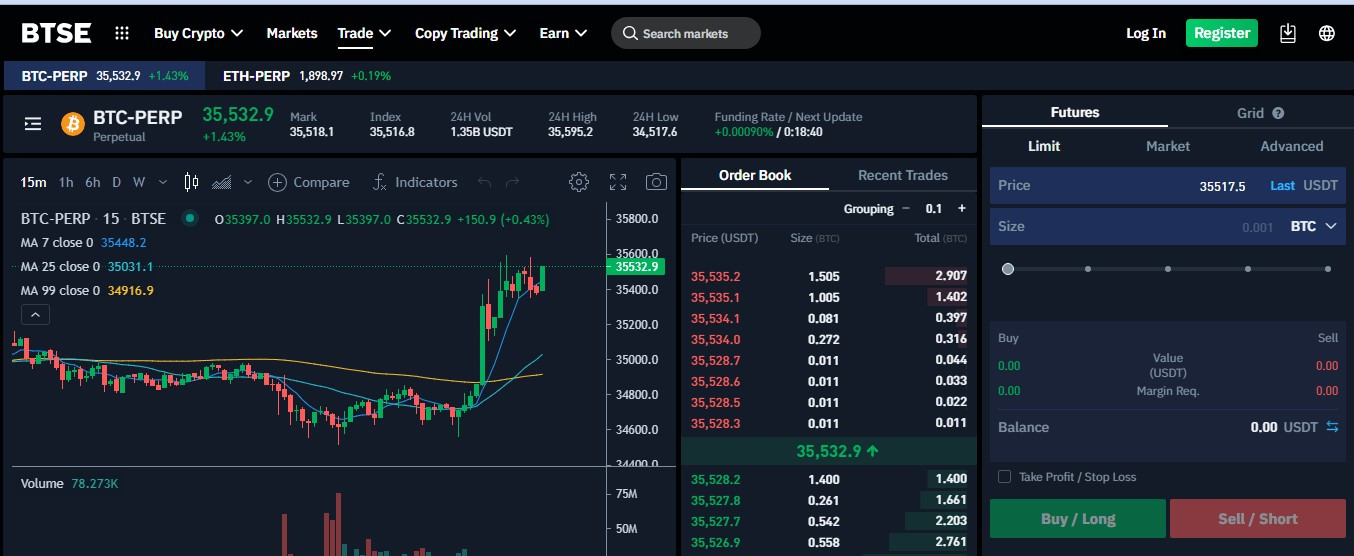

BTSE offers various trading products, including spot, futures, and NFT trading. You can trade crypto on the exchange from their mobile app or website.

BTSE trading interface is both user-friendly and advanced. The interface features a trading view to monitor price movements when trading.

Spot Trading

BTSE has a spot tab for trading various cryptocurrencies on the spot market. The exchange provides over 174 spot trading pairs with an average trading volume of about $ 779 million.

BTSE offers 3 major order types for users’ different trading needs and to improve their experience. They include limit, market, and advanced orders.

The advanced orders also have various types, including stop orders, take profit orders, trailing stop orders, TWAP orders, OCO orders, and index orders.

TWAP order stands for Time-Weighted Average Price order. With this advanced order, you can break down a single order into smaller parts over a particular period. This way, you will reduce the slippage use and trade at an average price.

Learn more in our BTSE spot trading guide.

Future Trading

BTSE upgraded their future trading to future 2, allowing multi-asset collateral and settlement. That means you now have other options to use as your margin asset when trading apart from BTC.

On average, BTSE trading volume is about $2.5 billion. Depending on how much profit you want, you can trade the future with as much as 100x leverage on the exchange.

Like on their spot trading portal, you will also find advanced orders like stop orders, take profit orders, trailing stop orders, TWAP orders, OCO orders, and index orders.

Learn more in our BTSE futures guide.

BTSE Exchange Fees

When you carry out certain activities like trading, withdrawal, and deposit, BTSE charges you a certain fee. We will explore them here.

Spot Trading Fees

Whether buying or selling crypto assets on the BTSE spot market, you will pay a maker or taker fee after completing the transaction. Spot trading on this exchange includes both a maker and taker fee. Furthermore, the fee structure on the BTSE spot market is tiered, i.e., based on your trading volume. Also, you get a discount on your fee when you hold a specific amount of BTSE tokens.

For the general user with no minimum 30-day trading volume, they charge 0.2% as both the maker and taker fee. Those trading as much as 2 million USDT in 30 days pay 0.02% as a maker fee and 0.06% as a taker fee.

Future Trading Fees

Future trading fees on BTSE are deducted from your margin balance when you open and close futures contract positions. The fee structure is similar to their spot trading, where the fee decreases as your trading volume increases. You can also get fee discounts when you hold a specific amount of BTSE tokens.

The general user with no required trading volume charges 0.01% as a maker fee and 0.05% as a taker fee. However, people who trade as much as $5 billion in 30 days pay 0.036% as a taker fee and 0.02% as a maker fee.

Fiat Deposit & Withdrawal Fees

BTSE supports about 8 fiat currencies for withdrawal on the exchange. Some of them include USD, GBP, EUR, AUD, etc. They use payment methods like SWIFT, Sepa, credit cards, AstroPay, internet banking, eWallet, FPS, etc.

Withdrawing fiat currencies aside from USD on BTSE attracts a bank charge, remittance, or transfer fee. These fees are not imposed by the exchange but by the servicing bank concerned. USD withdrawals, on the other hand, attract a $50 minimum fee.

Learn more in our BTSE deposit guide.

Crypto Withdrawal Fees

The withdrawal fees for crypto on BTSE differ for each crypto and network. For instance, you will pay 0.0005 USD when withdrawing BTC through the BITCOIN network. Other cheap crypto withdrawal fees include that of algorand network at 0.01 USD, doge (BEP20) at $0.82, DOT (POLKADOT) at $0.1, LINK (ERC20) at $0.419, etc.

BTSE Services Offered

In addition to spot and futures trading for users, BTSE also offers a wide range of services. We will look at each of them here.

Copy Trading

That is one service new traders can use before becoming familiar with advanced trading strategies. Here, you are copying the trading strategies of experienced traders and then implementing them to make profits.

Copy trading works for both spot and futures trading. On the copy trading dashboard, you will find several traders you can copy their technique. While copying most trading techniques is free, a few require a fee.

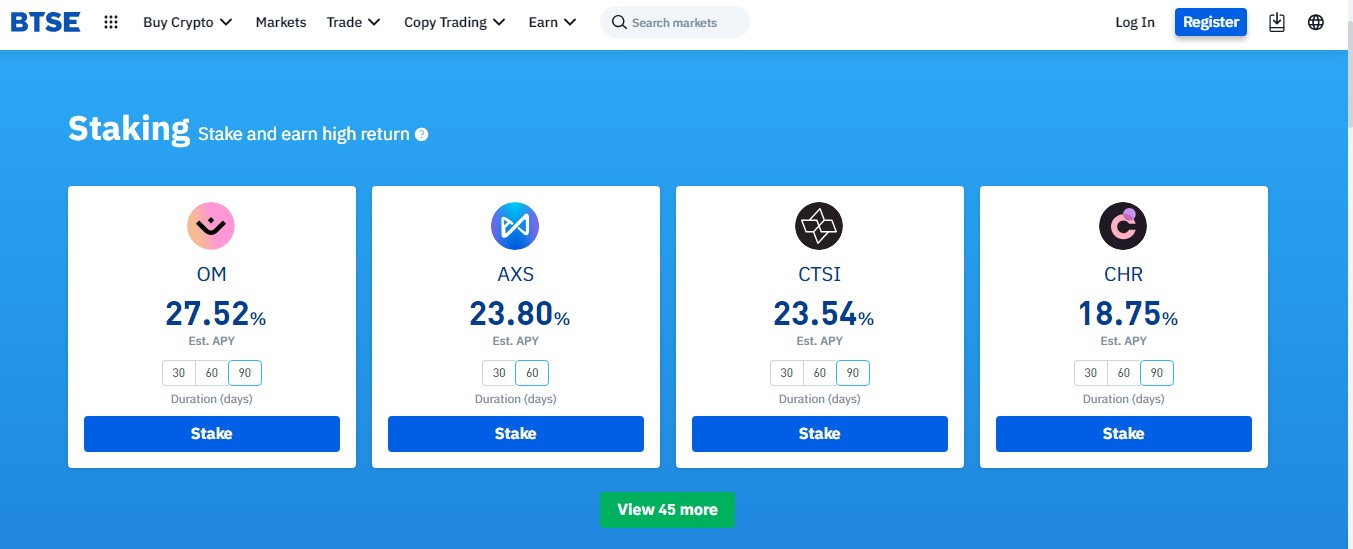

BTSE Earn

You can earn from your assets on BTSE in several ways, including staking and lending. With staking, you earn interest on specific crypto assets by holding them in your wallet for a particular period. Staking is a flexible term deposit, meaning you can redeem your asset anytime.

Lending, on the other hand, is a fixed-term deposit product. You earn interest on your assets when you lend them to BTSE’s capital pool.

Referral and Affiliate Program

BTSE offers a referral program rewarding you for inviting your friends to join and trade on the exchange. You do this by sending them a referral link to join the platform. As a reward, you will earn a commission of 25% on every trading fee of the person you referred. Users can also passively earn from BTSE by engaging in their affiliate program.

If you are considering joining the BTSE affiliate program, you should definitely check out our full BTSE affiliate program review.

BTSE Reward Hub

Here, you get rewarded for being active on the platform and engaging in different tasks. The reward can be token airdrops, BTSE cash, and future trading test funds.

Read our full BTSE bonus guide to learn more about the best perks and benefits on the platform.

Mobile App, Standalone Desktop Application

BTSE offers both a mobile app and a desktop app for trading. Their mobile app is user-friendly and has almost all the trading features as their desktop app. The BTSE mobile app on Google Play Store has over 10,000 downloads and rated 4.7 stars.

Learn Center

BTSE has a learning center where users can access crypto resources that could improve their trading experience. In addition, this learning center also guides users on how to use the BTSE exchange platform. The learning center includes a blog section, a support center, and a YouTube channel.

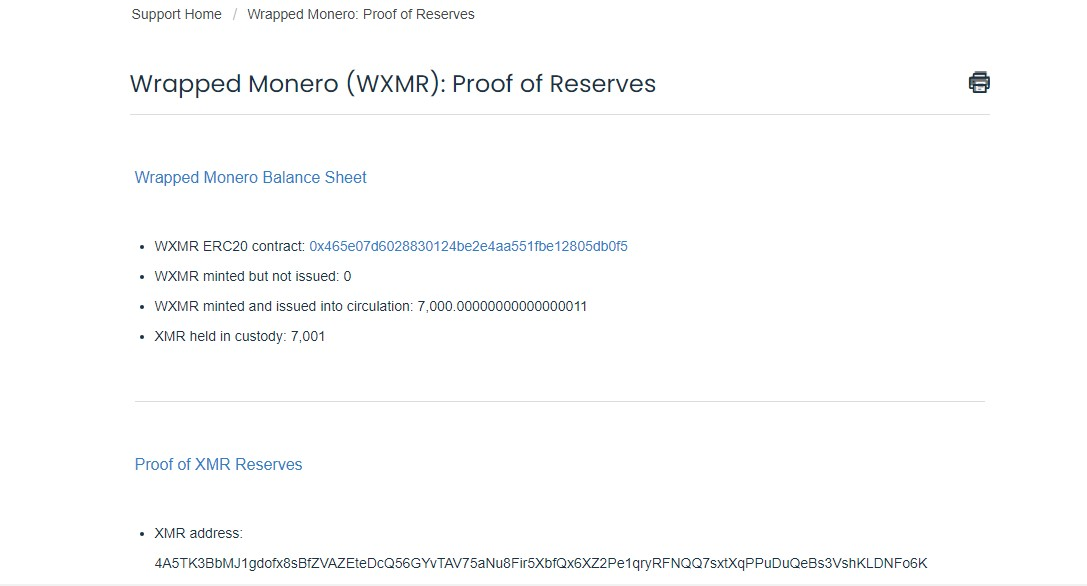

BTSE Security

BTSE has implemented several security measures to ensure your funds are safe. The exchange uses an in-house security infrastructure, i.e., they don’t depend on third parties for security.

They also separate customer’s funds from theirs by storing about 99% of them in a cold wallet. Furthermore, they also have an insurance fund that they use to compensate customers during any security incidents.

BTSE Customer Support

There are various ways in which BTSE offers support to their customers. They include email support, AI chatbot, and social media support. They have an active presence on Twitter, Telegram, LinkedIn and Youtube.

The AI chatbot is a new addition, where customers get immediate responses to their queries online. You can access the AI bots through a female icon named Selene on the bottom right corner of the page.

Conclusion

BTSE exchange offers trading services and a platform with various features that meet the needs of both new and pro traders. Their affordable trading fee structure, security measures, and reward programs are some of the things that stand them out. However, the exchange has limited trading options and is restricted to specific locations.

If you want to limit your trading to future and spot trading, you can try the BTSE exchange.

FAQ

How Do I Verify My BTSE Account?

You can verify your BTSE account by visiting the KYC section when you log into your account. To verify your account, you must provide relevant documents such as a government-issued ID, proof of address, and a clear selfie.

How Long Does It Take For BTSE Verification?

It takes about 1 to 2 business days to verify your account on BTSE. However, this can vary depending on the volume of demand.

What Are The Payment Methods For BTSE?

BTSE supports various payment methods, including credit cards, SWIFT, Sepa, and Astro Pay.