Spot trading means the buying and selling of a commodity. It involves buying crypto at a lower market price and selling it when the price increases. It provides an easy method of investing in crypto, especially for beginners. Spot trading is safer when compared to Futures, Derivatives, or Options. You do not have to leverage exchanges to increase funds to purchase crypto. You can buy as much as you can afford.

Read our BTSE review for a comprehensive look at the exchange.

What Is BTSE Spot Trading

BTSE Spot trading offers simple, secure, and efficient crypto trading. It provides an improved trading experience with a user-friendly platform and a clear chart. Also, BTSE spot trading offers timely execution of trades with transparent prices that reflect market position.

BTSE Spot Trading Guide

Below are the steps involved in spot trading in BTSE

Step 1: Open an account at BTSE

Opening an account on BTSE is easy and quick. Here are the steps to register.

- Visit the website through a web browser.

- Click the ‘Register’ button on the top right corner of the page.

- Enter an accessible email address, a username, and a password.

- The page automatically suggests a username from your email. However, you can use a preferred username.

- A verification code will be sent to your email.

- Enter the verification code to complete your registration.

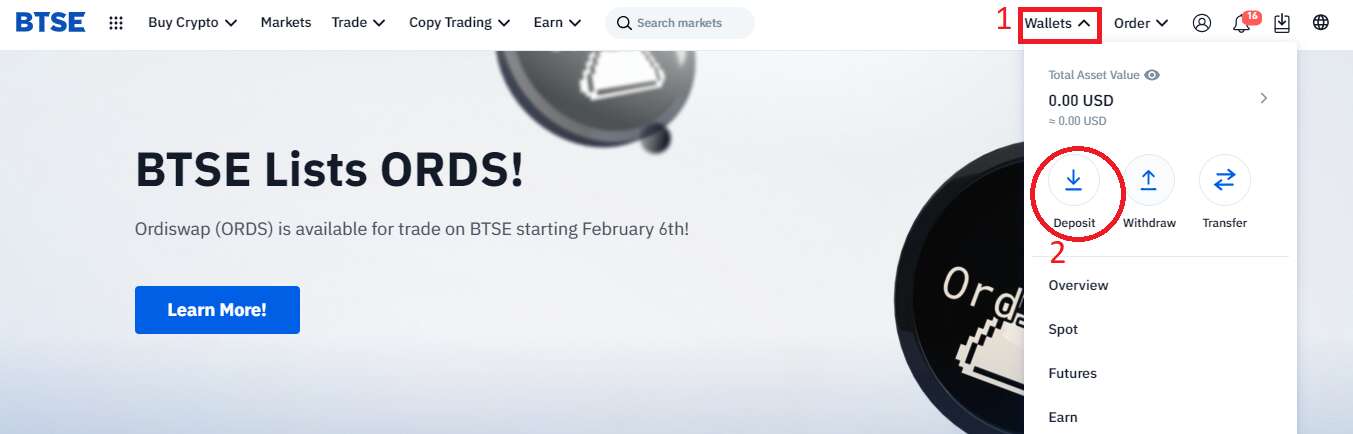

Step 2: Deposit

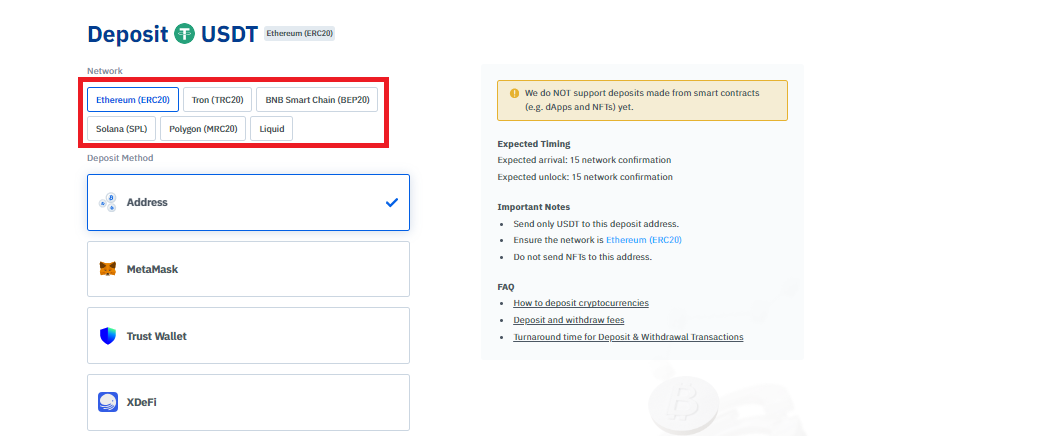

- Click the ‘Wallets’ tab on the top right corner.

- On the drop-down menu, click the ‘deposit’ icon

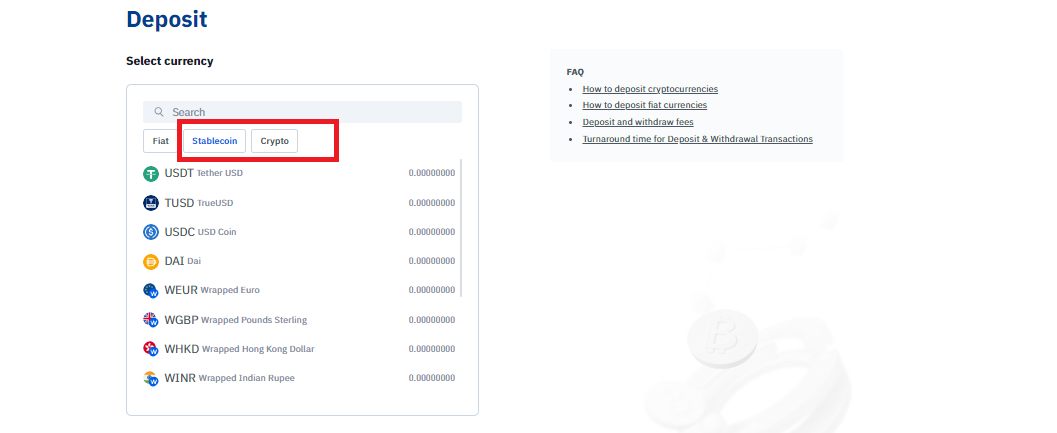

3. Select the preferred stablecoin or cryptocurrency you want to deposit.

4. Select the desired network. Click ‘Next’ and your network address will be generated alongside a QR code for easy payment.

Note: Ensure you deposit the right cryptocurrency to the correct address to guarantee the safety of your funds. Deposit from Smart Contracts is not supported.

Also, you can deposit fiat currency. To unlock this feature, verify your account with a photo ID and proof of address.

Step 3: Spot Trading

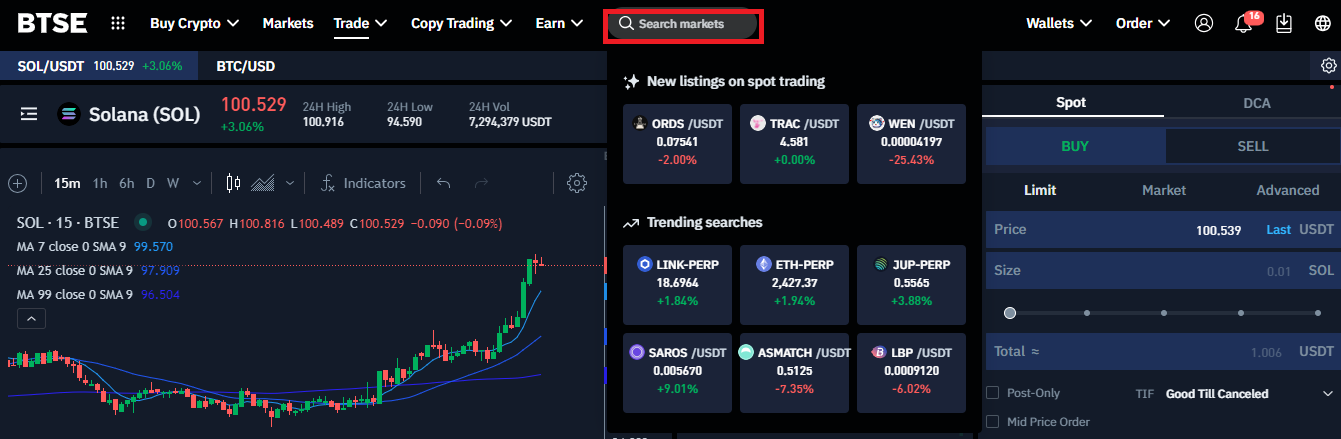

Log in to the BTSE website with the details you provided during registration. Click the ‘Trade’ tab on the menu bar and select ‘Spot’ on the drop-down menu.

Step 4: Select the trading pair

Click the ‘search markets’ icon in the middle of the menu bar. Search and select the pair of crypto you want to trade on.

Step 5: Place an order

Spot trades on BTSE can be placed in two ways: a limit order or a market order. Here is a guide on how to place orders using each method.

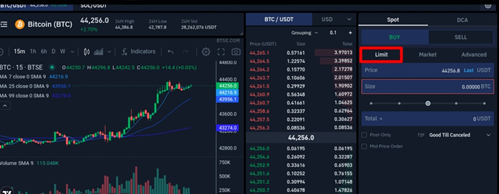

Limit Order

Limit Order offers the option of trading in crypto at a price of your choice. It helps traders control how much they will pay. In a buy limit order, traders purchase a crypto at a specified price or below. Traders sell at a particular price or above in a sell Limit Order.

For example, here is how to place a limit order assuming you want to trade on the BTC/USDT pair.

- Select either the buy or sell option

- Make sure the Limit Order option is selected.

- In the price section, enter the amount you are willing to buy or sell.

- Enter the size or quantity of BTC you want to transact.

- Click ‘Buy Order’ or ‘Sell Order’ to complete your order.

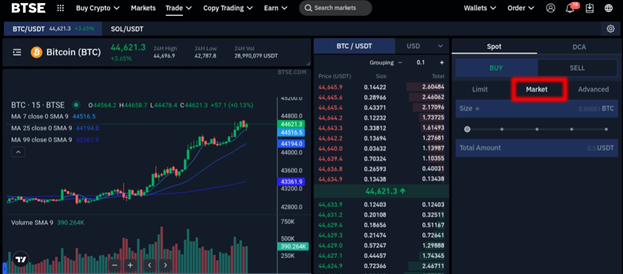

Market Order

Market Order allows traders to buy or sell crypto at the market price as soon as an order is placed. The trader buys or sells assets at the current market price.

Here is how to place a market order in spot trading on BTSE.

- Select the Market Order option.

- Enter the size of the BTC you want to buy or sell. Also, you can use the percentage lever. In a Buy Order, the lever allows you to use a percentage of USDT to buy BTC. It will purchase the BTC worth of the set percent.

For instance, if you have 5,000 USDT and set a buy percentage of 50%, the platform will purchase 2,500 USDT worth of BTC.

- Select ‘Buy Order’ or ‘Sell Order’ to complete the order.

- The exchange executes the transaction immediately at a current market price.

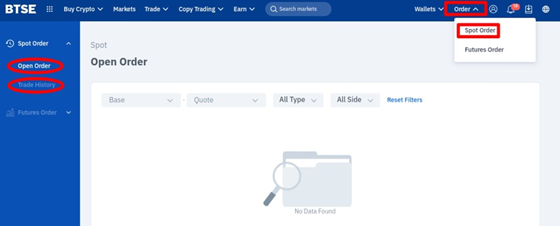

Order History

You can monitor your spot trading journey through the order history. It contains two sections: the Open Order and the Trade History.

Open Order provides insight into the progress of your open trades. It shows the type and side of the spot trade you placed. Trade History offers information on closed trades. It also shows the time and side of such trades. The date filter feature provides the option of searching trades within a specific timeframe.

To access the Spot Order history, Click the ‘Order’ tab on the top right corner of the page. Select ‘Spot Order’ and choose Open Trade or Trade History on the panel on the left.

Step 6: Add funds

Ensure that you have sufficient funds before trading. You can instantly fund your account using the Deposit option.

Why choose BTSE for spot trading?

BTSE offers spot traders an enhanced trading experience. The platform has an All-in-One order book for better pricing and liquidity. It has over 150 spot trading pairs.

BTSE charges a low trading fee. The platform offers a 0.2% trader and maker fee. Traders with a 30-day trading volume of $2 million and above enjoy discounts on trading fees.

Bottom Line

Spot trading offers a straightforward method of trading in crypto. It allows short-term traders to enter and exit trades quickly. Also, it is a low-risk trading method, especially for beginners.

BTSE offers a seamless trading experience with easy and quick execution of trades. Also, referred users are eligible for a 25% discount on trading fees for the first 30 days. Visit our review of the exchange to gain more insight about the platform.

3. Select the preferred stablecoin or cryptocurrency you want to deposit.

3. Select the preferred stablecoin or cryptocurrency you want to deposit. 4. Select the desired network. Click ‘Next’ and your network address will be generated alongside a QR code for easy payment.

4. Select the desired network. Click ‘Next’ and your network address will be generated alongside a QR code for easy payment.