- Ourbit offers zero spot trading fees, ideal for cost-conscious or frequent traders.

- Withdrawals up to 30 BTC daily require no KYC, ensuring strong privacy.

- Up to 400x leverage is available on USDT futures for aggressive strategies.

- The exchange lists 716 spot and 523 futures pairs, covering a wide range of assets.

- New users can access bonuses up to $10,000, mostly as futures credit with conditions.

- Demo trading lets users practice futures without risking real funds.

- Its clean, beginner-friendly interface lacks some advanced charting tools.

- Passive income options like staking and savings are available via the Earn section.

Centralized exchanges have played a key role in driving crypto adoption by making it easier for users to buy, sell, and manage digital assets. As competition among exchanges intensifies, many are expanding their offerings to attract users with better tools, features, and overall experiences.

One such platform is Ourbit, a relatively new exchange that launched in 2023. While still in its early stages, it has steadily introduced new trading options and features aimed at enhancing the user experience. In this Ourbit review, we’ll take a closer look at what the exchange offers, including its core products and services, to help you assess whether it aligns with what you’re looking for in a crypto platform.

| Stats | Ourbit |

|---|---|

| 🚀 Founded | 2023 |

| 🌐 Headquarters | British Virgin Islands |

| 🔎 Founder | Joseph Han |

| 👤 Active Users | 100K+ |

| 🪙 Spot Cryptos | 716+ |

| 🪙 Futures Contracts | 523+ |

| 🔁 Spot Fees (maker/taker) | 0.00% / 0.00% |

| 🔁 Futures Fees (maker/taker) | 0.02% / 0.04% |

| 📈 Max Leverage | 400X |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4/5 |

| 💰 Bonus | $10,000 (Claim Now) |

Ourbit Overview

Ourbit, founded in 2023 by Joseph Han, has positioned itself as a cost-conscious option for traders by offering zero trading fees on all spot trades. With a selection of over 716+ cryptocurrencies available to trade, the platform aims to attract users who prioritize a wide range of digital assets without the burden of additional fees.

For those interested in more advanced trading strategies, Ourbit provides access to 523+ USDT-margined perpetual futures contracts. Traders can leverage up to 400x on these contracts, with a fee structure set at 0.02% for maker orders and 0.04% for taker orders. This competitive fee model is particularly appealing to users who seek lower costs when engaging in higher-risk, higher-reward strategies.

Ourbit does not require KYC verification, allowing users to get started quickly. Security measures are classified as moderate, and the platform has grown to a user base exceeding 100,000 accounts. New users can take advantage of welcome bonuses of up to $10,000, though eligibility requirements apply.

Beyond active trading, Ourbit’s Earn platform offers passive income opportunities by allowing users to allocate idle assets into various savings and staking options. This feature targets those who want to put their holdings to work without engaging in day-to-day trading. Overall, Ourbit’s combination of zero spot fees, extensive futures offerings, and passive earning opportunities creates a factual snapshot of what the exchange provides.

Ourbit Pros and Cons

| 👍 Ourbit Pros | 👎 Ourbit Cons |

|---|---|

| ✅ Zero spot trading fees | ❌ Limited advanced charting/customization tools |

| ✅ No KYC for withdrawals up to 30 BTC | ❌ New platform, still building trust in the market |

| ✅ High leverage up to 400x on futures | |

| ✅ Demo trading feature available | |

| ✅ Offers both CEX and DEX | |

Ourbit KYC and Sign-up

Ourbit can be really attractive if you’re looking for an exchange that allows you to start trading without any KYC verification. Simply sign up using your email account or phone number and you will be able to trade and use Ourbit products and services. There are certain limitations on withdrawals; for example, without KYC your withdrawal limit is set at 30 BTC/day. However, this can be increased by verifying your account.

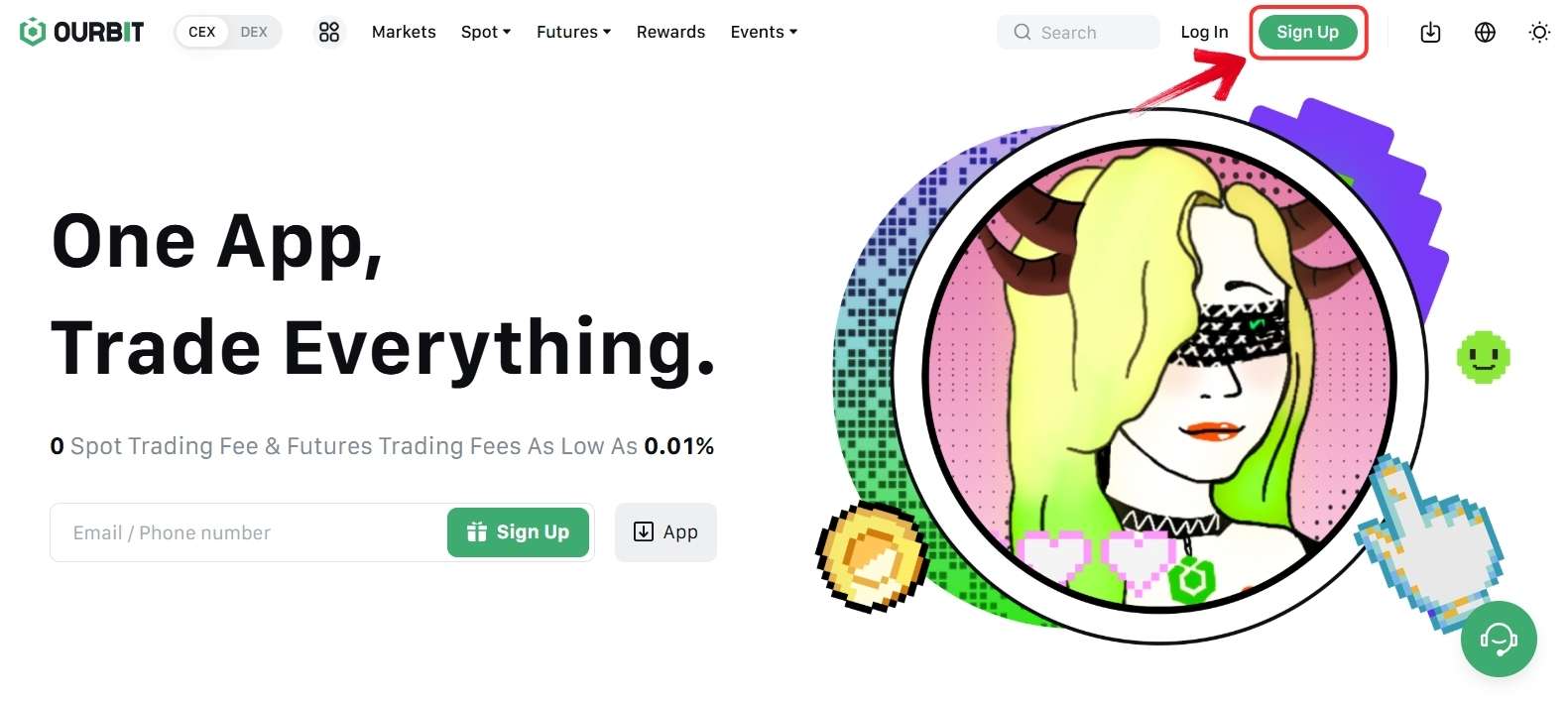

Let’s walk through the process of creating an account on Ourbit:

Step 1: Open a browser; Chrome, Edge, or Firefox, and navigate to the Ourbit exchange website.

Note: Make sure you visit the official website. Double-check the URL to avoid phishing sites.

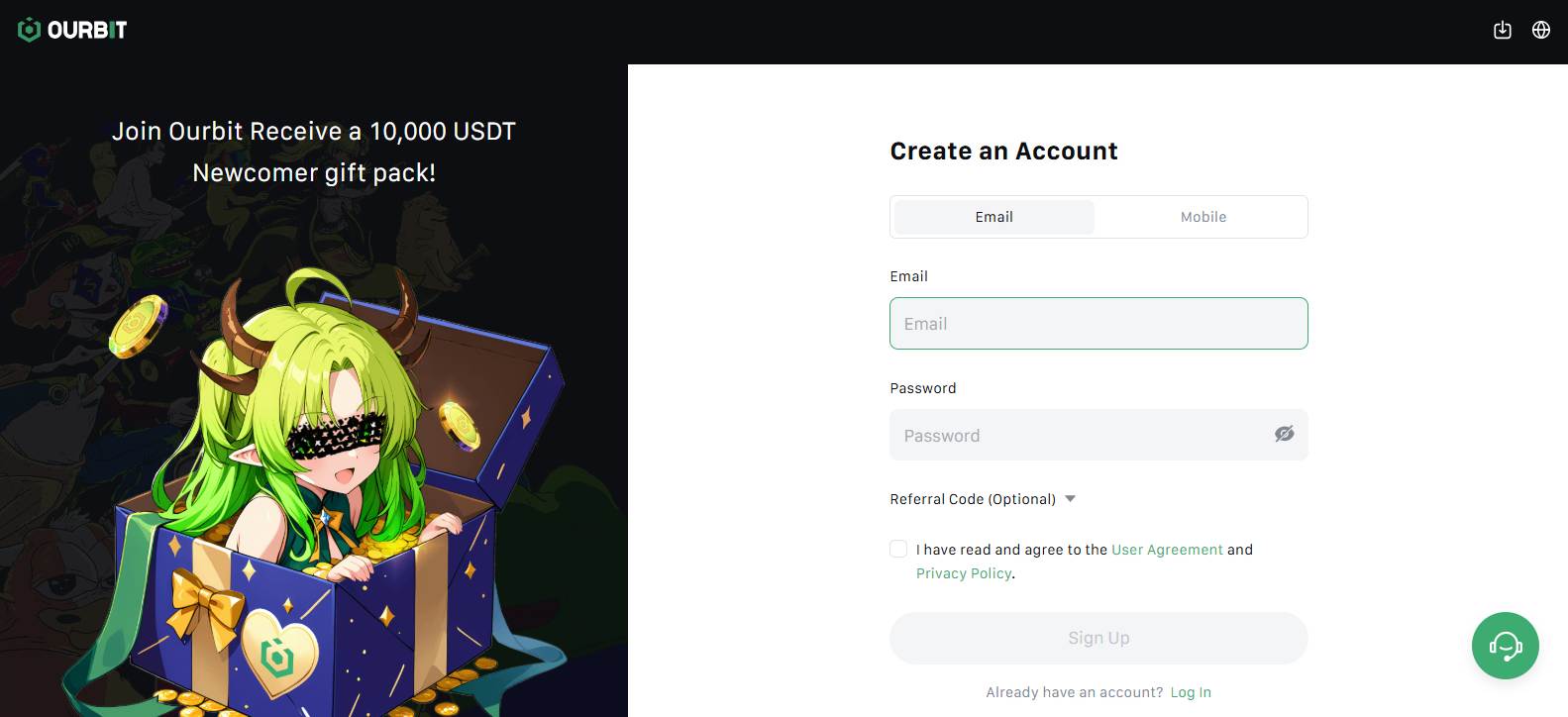

Step 2: Once on the website, click on the “Sign Up” button located in the top right corner to create an account.

Step 3: Now on the sign-up page, enter your email address or sign up using your phone number, then set up a password for your account.

Step 4: You will be sent a verification code to your email to verify the address, and your account will be created and ready to use.

Step 5: You can then begin using the Ourbit platform. Navigate to their Spot section to trade from 716+ spot assets available at zero trading fees.

However, as you proceed, keep in mind that there are certain countries where Ourbit’s services are restricted. Before proceeding, make sure your country of origin is not on the list by using our free Ourbit Country Checker tool.

🌍 Free Ourbit Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, Ourbit does not support every country. To ensure that you are eligible to register on the exchange, you can use our free Ourbit country checker.

Simply type your country and see if you can use the platform or if your country is restricted.

Ourbit Trading

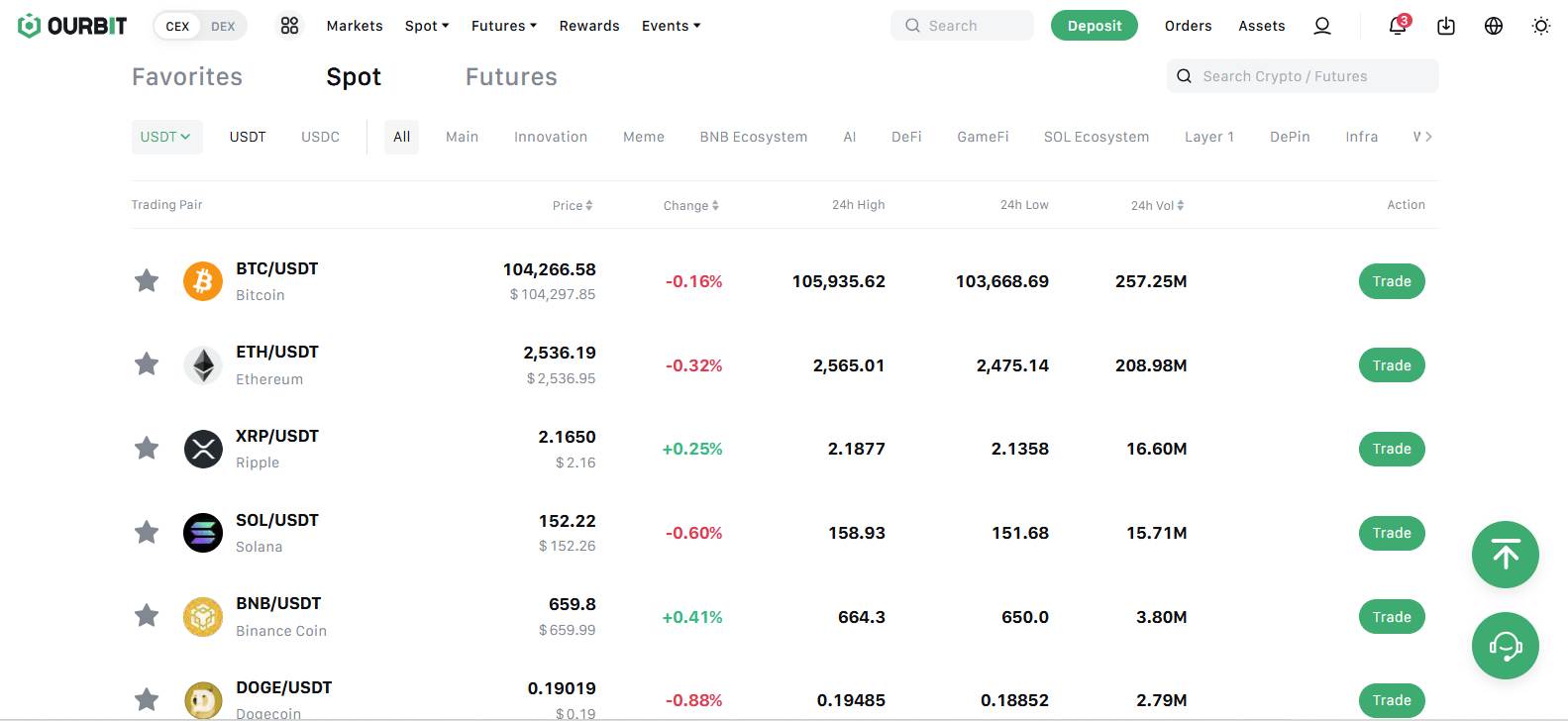

Any exchange’s primary offering is its trading platform, as this is where most users begin. In evaluating Ourbit’s spot market, we’ll look at the range of assets, overall trading volume, available tools, ease of use, and supported order types.

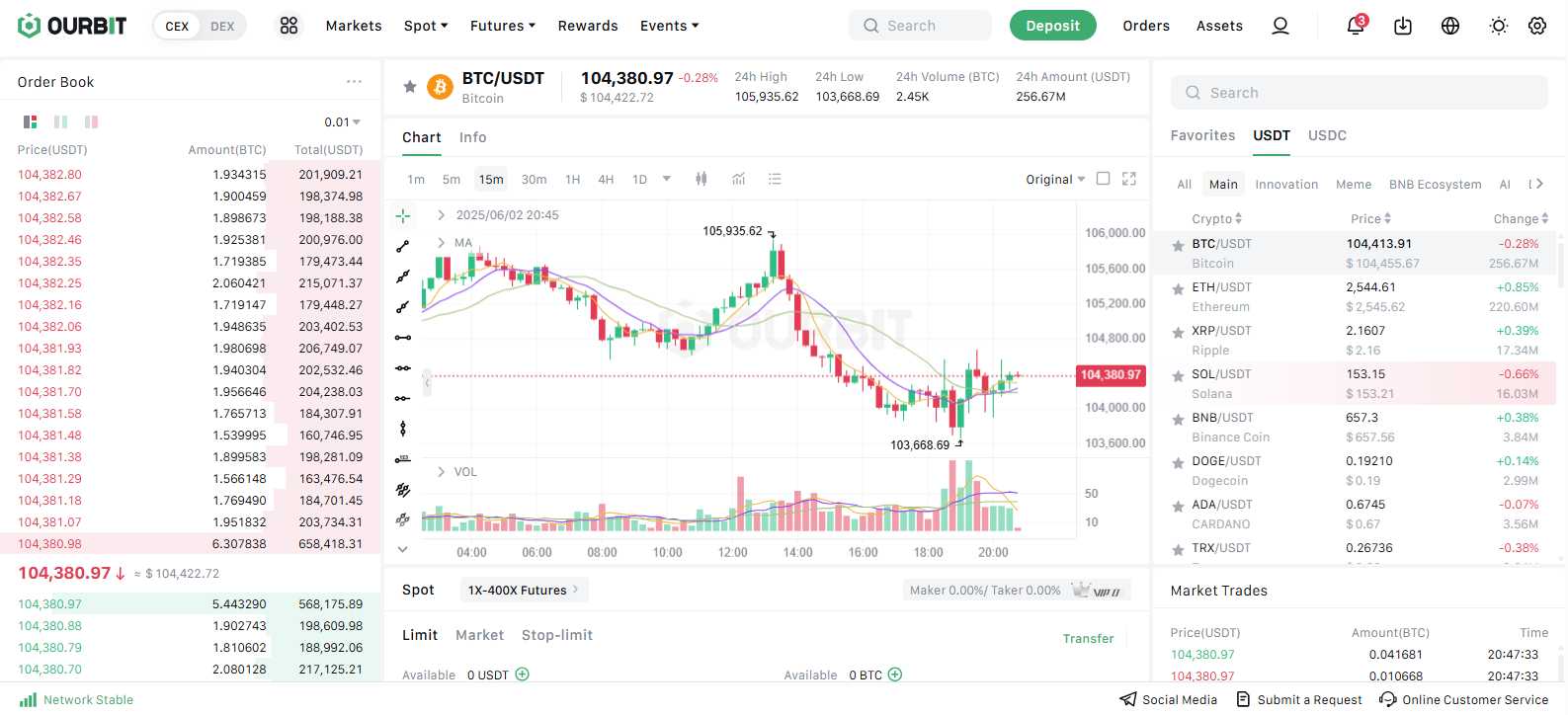

Spot Trading

Ourbit’s spot platform handles a daily trading volume of around $2B+ placing it among the top 50 spot exchanges by activity. A significant factor driving this volume is the availability of over 716+ different spot assets paired with USDT or USDC, combined with zero trading fees for all spot trades.

In terms of interface, the spot section is straightforward and easy to navigate. The main view displays an order book, real-time coin charts powered by TradingView (complete with indicators and strategy templates), and a set of trading tools loathe at the bottom, right below the charts. While the interface is fixed; meaning you cannot drag and rearrange components, it offers a simple, uncluttered entry point for placing orders.

As for order types, Ourbit supports limit orders for setting a specific entry or exit price, market orders for immediate execution at the best available rate, and stop-limit orders that trigger a limit order once a defined price level is reached. While these options focus on core functionality rather than advanced strategies, they provide everything you need to execute standard trades efficiently. If you value ease of use and straightforward order placement, the spot platform delivers precisely that.

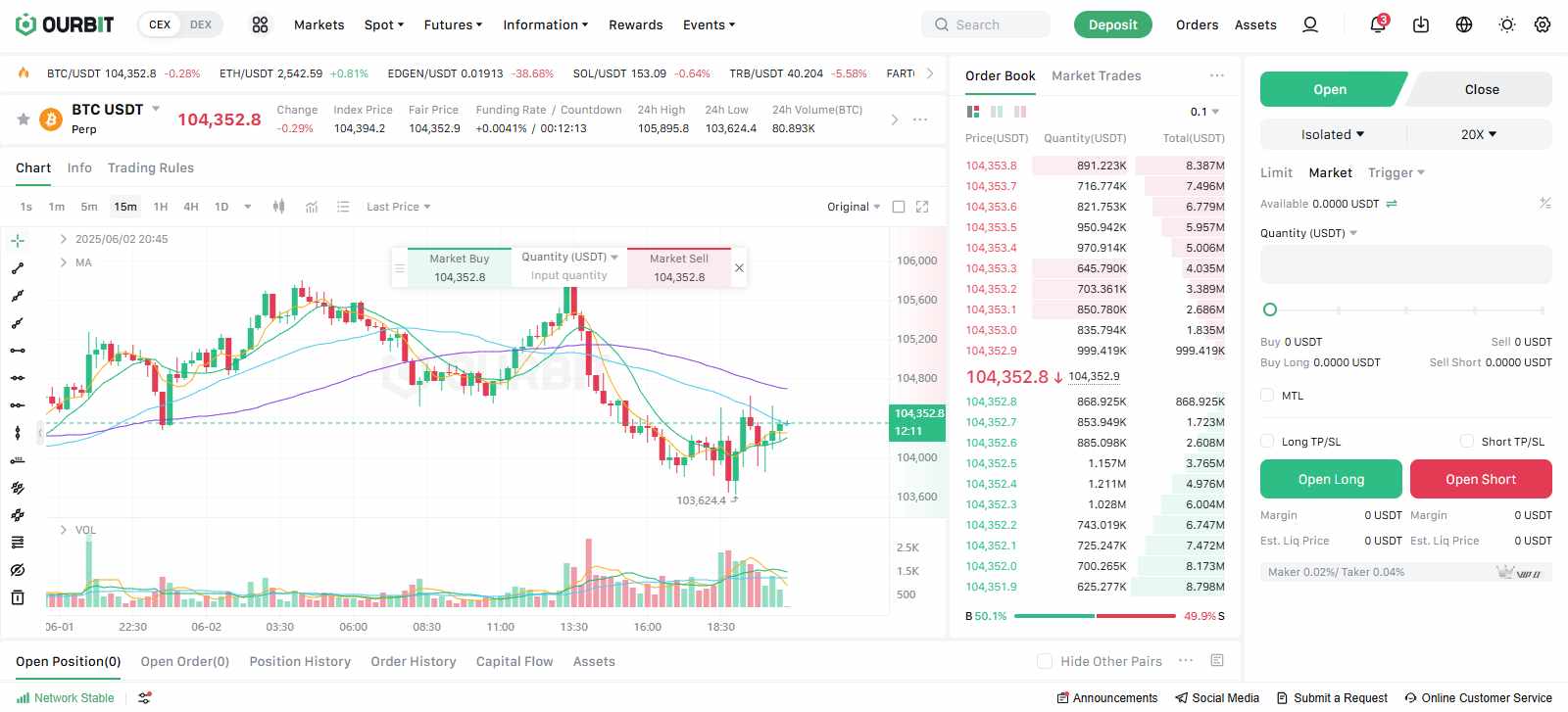

Futures Trading

Ourbit’s futures market focuses on USDT-margined perpetual contracts, offering access to more than 523+ different futures options with up to 400× leverage. When you enter the futures trading section, you’ll see a layout that mirrors the spot interface but with additional information relevant to leveraged positions.

The trading interface brings together real-time price charts powered by TradingView, a live order book that displays bid and ask depth alongside current funding rate information, and a comprehensive trading panel where you can choose contract size, leverage level, and margin mode. Because the platform integrates these elements into a unified view, you have everything you need to analyze market conditions and place trades without switching screens.

Order placement is straightforward: you can choose between limit and market orders, but Ourbit also gives you more fine-tuned control through three distinct trigger options; standard trigger, trailing stop order, and post-only.

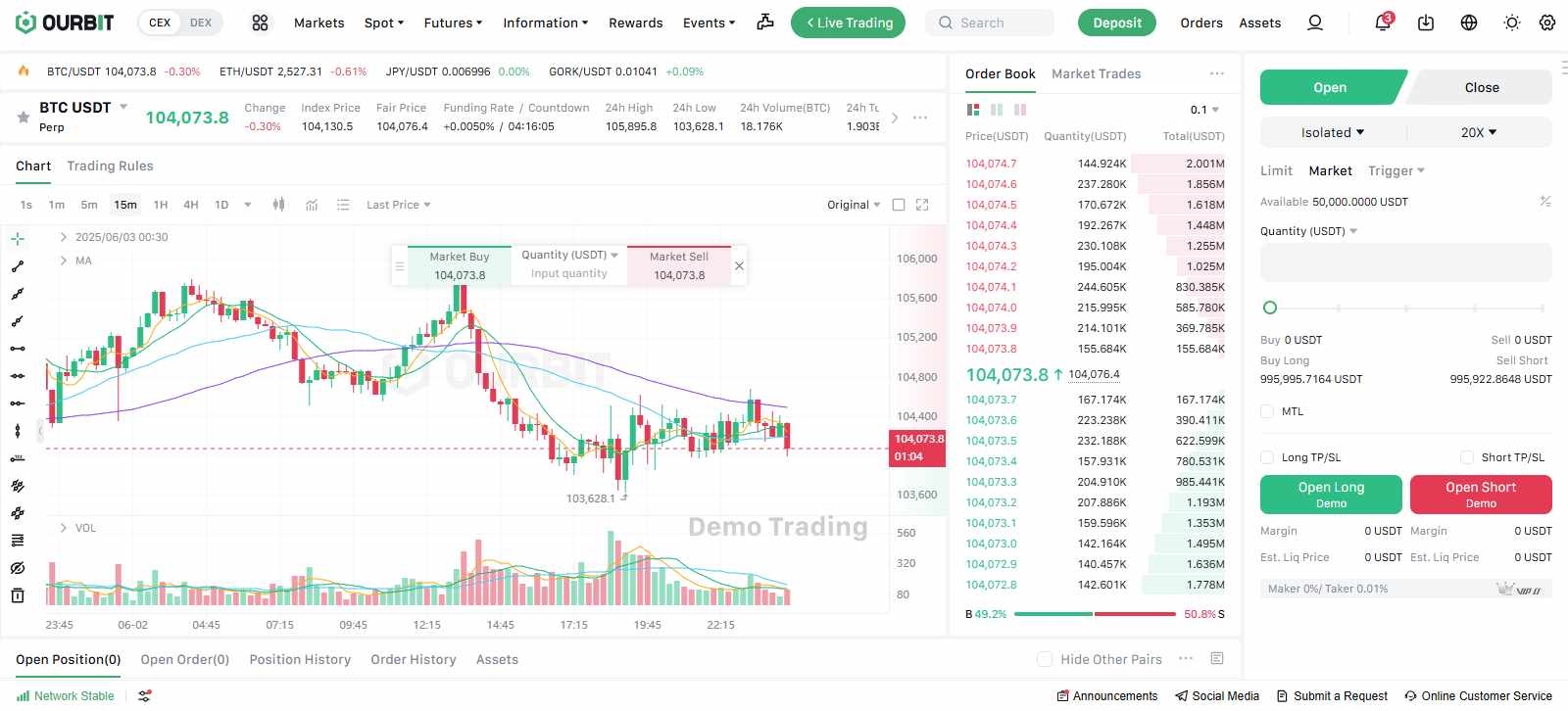

To help newcomers get comfortable with leveraged trading, Ourbit includes a demo trading environment where you can practice opening and closing futures positions without risking real capital. This simulated setting replicates live market conditions, making it easier to learn how leverage, margin, and risk management work before moving into the actual futures market.

Ourbit Fees

Trading Fees

Knowing the fee structure is important because it directly impacts your trading costs and potential returns. Ourbit keeps its fee model simple: on the spot platform, both maker and taker fees are set to zero, so you don’t pay anything when trading assets. In the futures market, makers are charged 0.02% and takers 0.04% on all USDT-margined perpetual contracts. This transparent setup can give you a cost advantage, whether that means minimizing fees on quick in-and-out trades or managing expenses on longer-term positions.

Spot Fees

0.00% Maker

0.00% Taker

Future Fees

0.02% Maker

0.04% Taker

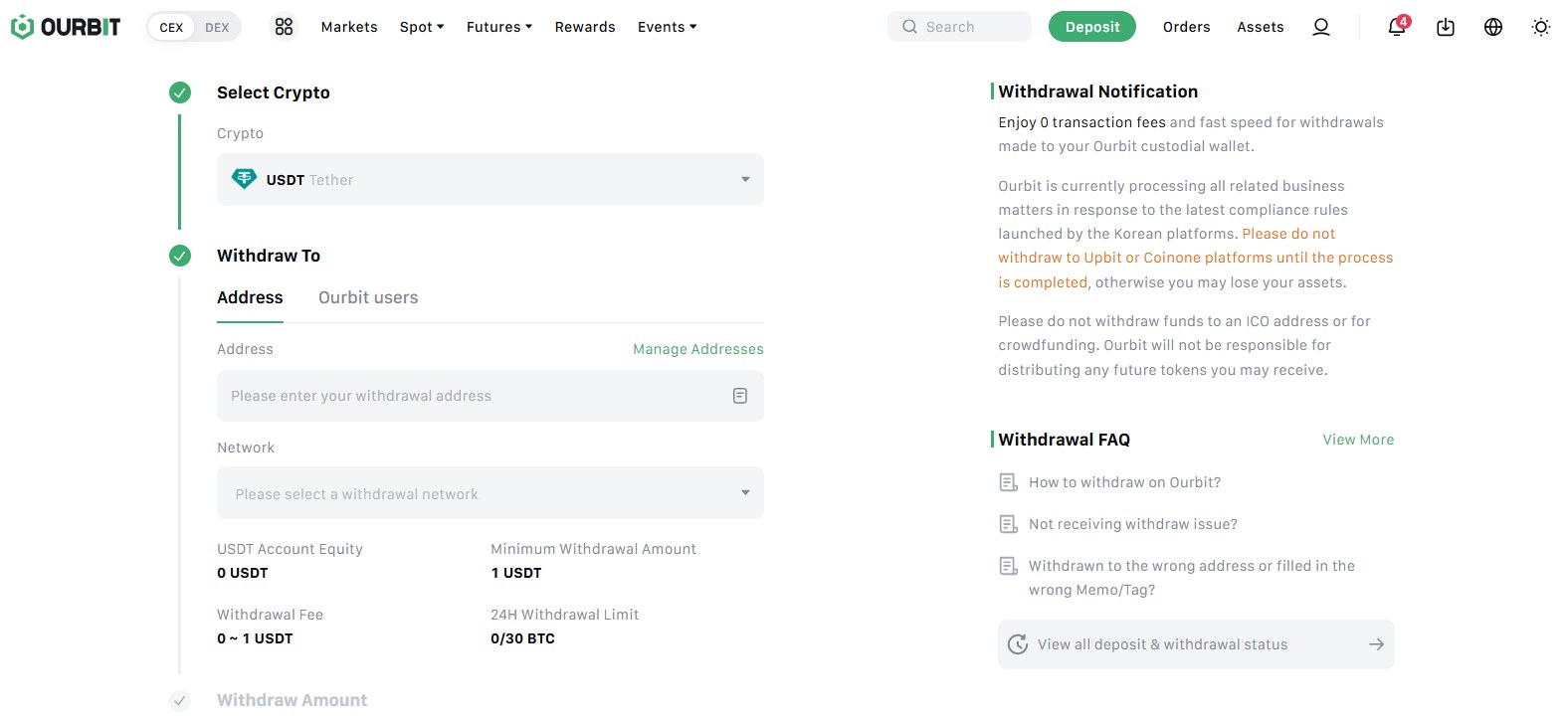

Deposits and Withdrawals

Ourbit does not support on-ramp or off-ramp services, so you cannot fund your account with fiat. Instead, you can deposit any of the 668 supported cryptocurrencies using networks like Ethereum or Binance Smart Chain. There are no fees charged by Ourbit for deposits or withdrawals, you only pay the standard network gas fees.

Ourbit Products and Services

Exchanges today often provide more than just a trading platform, additional services can be decisive when choosing where to trade. In this section, we’ll review the range of services offered by Ourbit.

CEX

Ourbit’s centralized exchange handles both spot and futures trading. On the spot side, you can buy and sell over 716+ tokens without any trading fees. For futures, the platform supports more than 523+ USDT-margined perpetual contracts with up to 200× leverage. The trading interface is straightforward: clear buy/sell tools sit alongside TradingView charts, giving you access to various indicators, strategies, and drawing tools.

However, if you’re used to setting up complex order types, such as bracket orders or conditional orders, you’ll find only basics here (limit, market, and stop-limit). This simplicity keeps things accessible for beginners, but advanced traders may miss more sophisticated options.

DEX

With meme-trading becoming a new strategy in itself, more exchanges have started featuring a DEX platform, and Ourbit offers one as well. This lets users trade coins currently available on platforms like pump.fun. Ourbit’s DEX supports three chains; Solana, BSC, and Ethereum, and uses a familiar decentralized exchange layout with straightforward buy tools for quick swaps, plus options to adjust slippage, gas fees, and MEV protection.

All transactions settle on-chain, ensuring transparency and reducing counterparty risk. Currently, the DEX does not support leverage; only spot trades are available. There’s no need for a separate wallet; you can simply transfer funds from your spot wallet to your Ourbit DEX wallet and start trading. This setup makes it easy to access emerging tokens without navigating a centralized order book.

Earn

Ourbit’s Earn feature lets you put idle assets to work, helping you generate passive income if you plan to hold tokens for the long term. The process is straightforward: you search for the asset you want to stake, review the annual percentage yield (APY) on offer, and choose between a fixed or flexible deposit.

With a fixed deposit, your assets are locked for a set period, often yielding a higher APY; a flexible deposit lets you withdraw at any time, though with slightly lower returns. Keep in mind that the selection of assets featured in the Earn platform is currently limited, so you may not find every token you hold. Still, for the assets that are available, this option can help you maximize returns without actively trading.

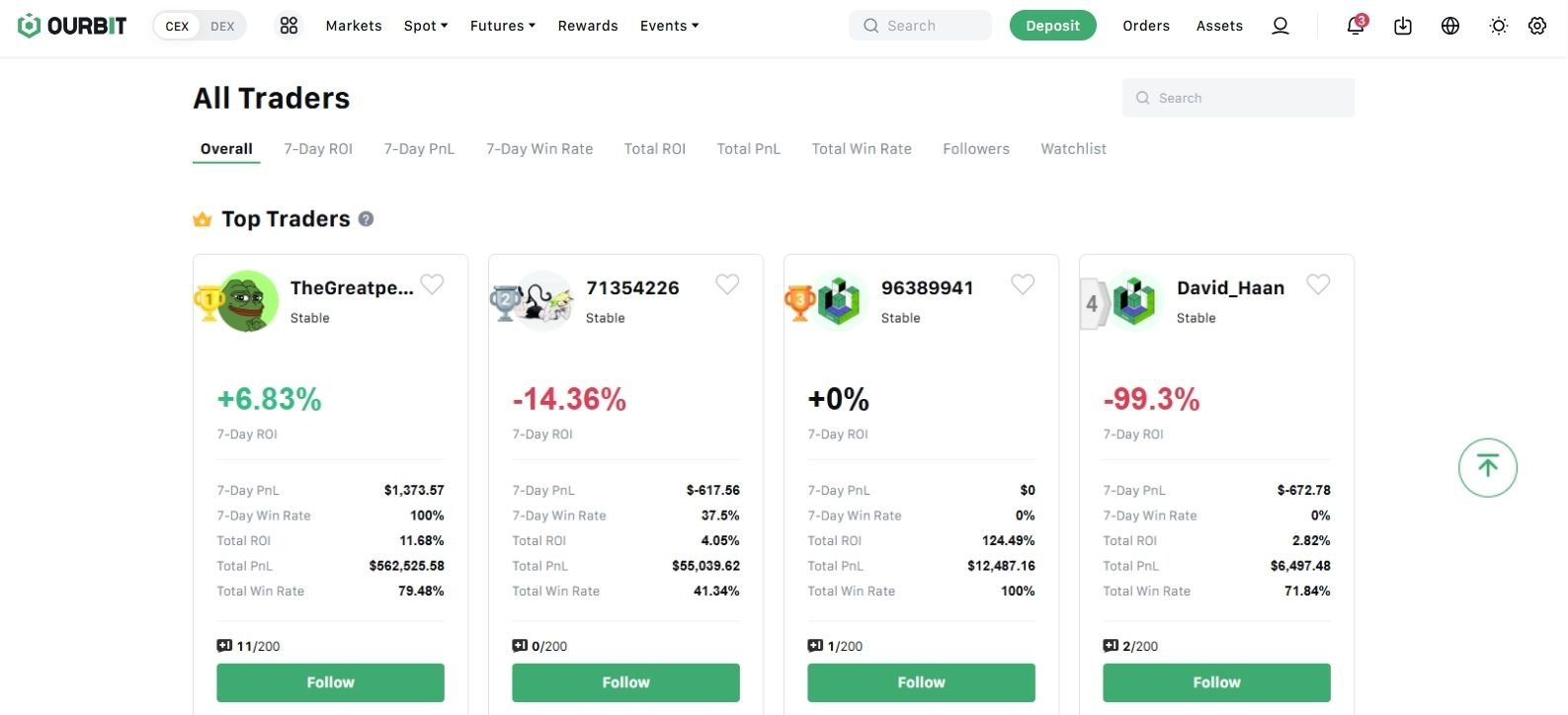

Copy Trading

Ourbit offers a copy trading feature that lets users mirror experienced traders’ moves in real time, making it easier for beginners or anyone who prefers a hands-off approach. You can browse a list of active traders, review their performance history, and start following them with just a click.

Key metrics, such as historical returns, win rate, maximum drawdown, and assets under management, are displayed to help you choose a trader whose style and risk level suit you. By replicating trades automatically, you can generate passive income without constantly watching charts or executing orders yourself.

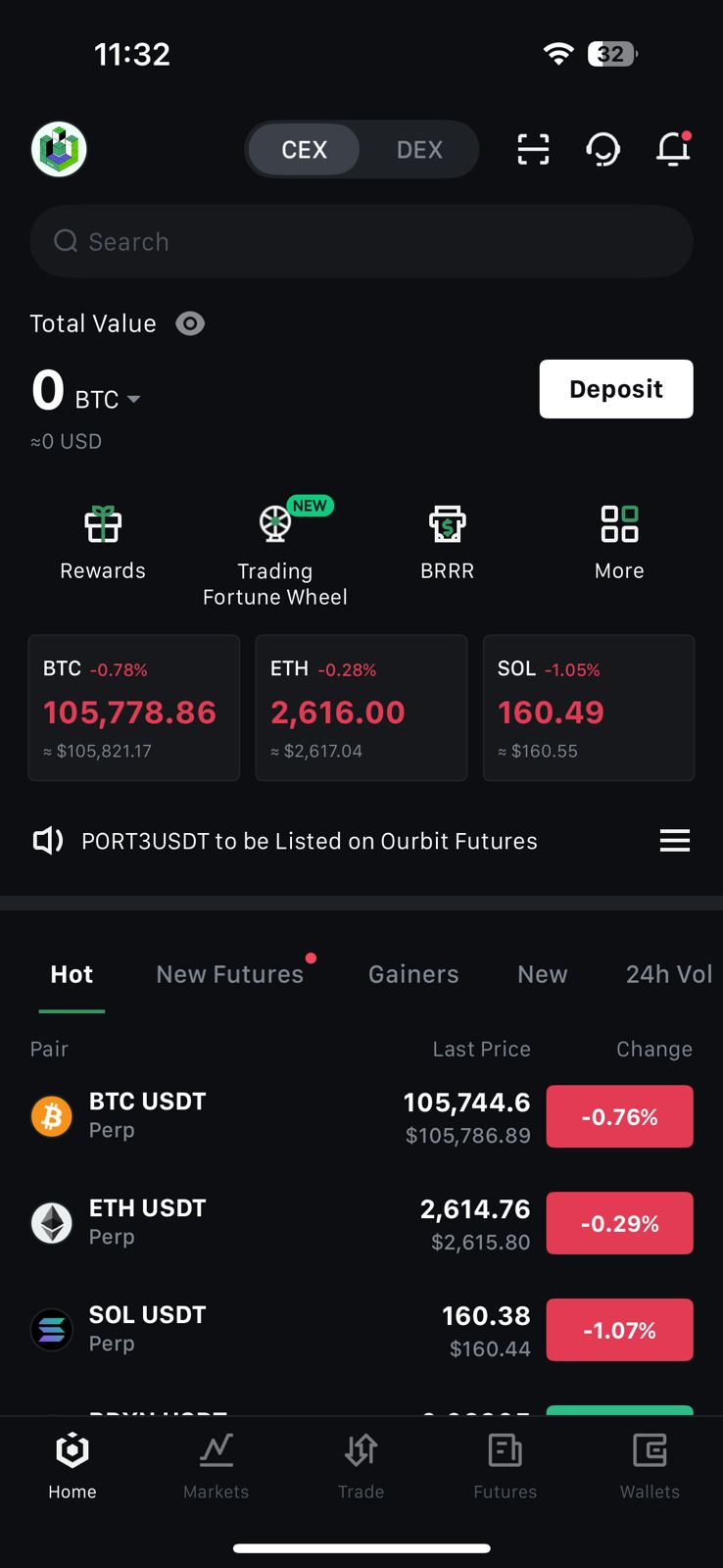

Mobile App

Ourbit’s mobile app is available for both iOS and Android. After logging in, you can view your account balances, recent deposits or withdrawals, and basic performance charts for spot and futures markets. The interface includes TradingView charts where you can apply indicators and view price movements, alongside an updated order book and order entry fields for selecting leverage, order type, and position size.

Notifications can be enabled for price alerts, order executions, and margin updates. The app also provides access to the Earn feature, copy trading, and a switch to the demo environment, replicating most of the functionality found on the desktop version in a mobile format.

Demo Trading

Ourbit’s demo trading environment allows users to practice with virtual funds under simulated market conditions. By switching to a demo account, you can request up to $50,000 in test assets via a faucet. The demo uses the same interface as the live platform, supporting limit, market, and stop orders, as well as adjustable leverage for futures.

Market data, including price movements and funding rates, is updated in real time, letting you experiment with different strategies without risking real capital. This setup is intended to help users become familiar with the platform’s mechanics before trading live.

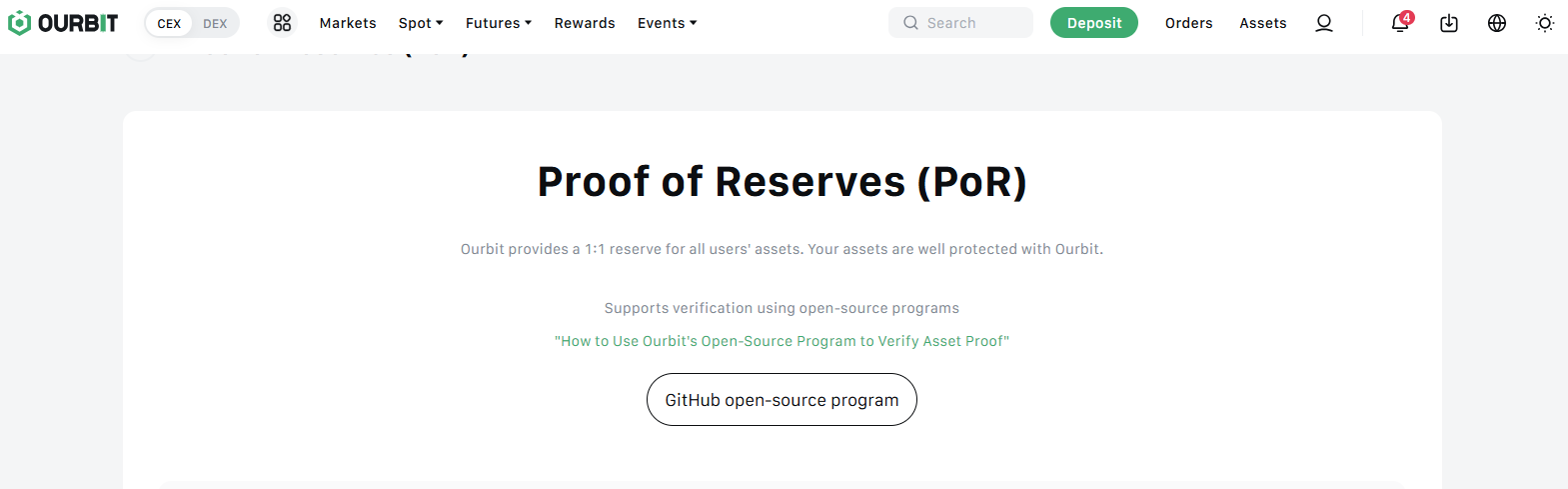

Ourbit Security

Ourbit maintains a proof-of-reserves protocol and undergoes regular third-party audits to verify that user assets are fully backed. To secure individual accounts, the platform supports two-factor authentication, requiring either an authenticator app or SMS codes. Accounts can also be bound to a verified email address, ensuring notifications and confirmations are sent securely.

Additional verification is enforced through email and SMS confirmations for critical actions, such as withdrawals or changes to account settings. These combined measures aim to reduce the risk of unauthorized access and ensure that the exchange’s reserves match customer holdings.

Ourbit Customer Support

Ourbit provides an online chat support system that connects you directly with a representative—response times typically average around two minutes. If your question is more general, the help center offers a searchable collection of articles addressing common issues, such as deposit methods, withdrawal limits, and troubleshooting login problems. Whether you need immediate assistance through live chat or prefer to browse the help center for self-service, these resources are designed to offer timely, straightforward guidance without excessive wait times.

Ourbit Alternatives

Ourbit is still growing as a trading platform, but if you’re looking for alternatives with similar features or fewer limitations, here are a few worth checking out:

- MEXC: Gives you access to thousands of altcoins and offers high leverage on futures. It’s a solid option if you’re focused on low fees and don’t want to deal with KYC right away.

- BYDFi: Keeps things simple with no KYC needed for basic usage, and offers leverage up to 500x. It’s useful if you want to test high-risk strategies without lengthy signups.

- WEEX: Ideal if you just want to trade futures without dealing with verifications. The interface is clean, fees are competitive, and there’s enough liquidity for most major pairs.

| Feature | Ourbit | MEXC | BYDFi | WEEX |

|---|---|---|---|---|

| Established | 2023 | 2018 | 2019 | 2017 |

| Spot Fees (Maker/Taker) | 0.00% / 0.00% | 0.05% / 0.05% | 0.00% / 0.10% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.020% / 0.040% | 0.000% / 0.020% | 0.020% / 0.060% | 0.020% / 0.080% |

| Max Leverage | 400x | 500x | 200x | 400x |

| KYC Required | No | Yes | No | No |

| Supported Cryptos (Spot) | 716+ | 3137+ | 801+ | 1070+ |

| Futures Contracts | 523+ | 433+ | 421+ | 640+ |

| No KYC Withdrawal Limit | 30 BTC | 30 BTC | 1 BTC | $50,000 |

| 24h Spot Volume | $2.41B+ | $3.01B+ | $195M+ | $2.21B+ |

| Trading Bonus | $10,000 | $20,000 | $300 | $30,000 |

| Key Features | • Zero spot trading fees • DEX on Solana, BSC, and Ethereum |

• Most cryptocurrencies (3137+) • High Leverage (500X) |

• No KYC | • No KYC required • High leverage (400X) |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

Ourbit delivers on its promise of minimal trading costs; zero spot fees and competitive futures rates, making it a practical choice if you’re focused on crypto-to-crypto trading and don’t mind a lean feature set. Its no-KYC entry point (up to 30 BTC/day withdrawals) and demo environment are welcome for beginners, but the absence of fiat on-ramps means you’ll need external services to buy crypto, and only basic order types (limit, market, stop-limit) are available. The Earn section’s limited asset list also narrows passive-income opportunities compared to larger exchanges.

In short, if cutting fees is your top priority and you’re comfortable operating in a purely digital-asset ecosystem, Ourbit holds its own; but if you need fiat integration, advanced order functionality, or a wider range of staking options, you’ll likely find more suitable platforms elsewhere.

FAQs

1. Does Ourbit require KYC?

No, Ourbit does not require KYC to start trading. Users can register with just an email or phone number. However, unverified accounts are limited to a withdrawal cap of 30 BTC per day.

2. Is Ourbit a legit exchange?

Yes, Ourbit is a centralized crypto exchange founded in 2023. It offers transparent fee structures, over 668 tradable assets, and has gained a growing user base. However, as with any exchange, users should do their due diligence before trading.

3. What are the Ourbit Fees?

Spot trading on Ourbit is completely free, there are zero maker and taker fees. For USDT-margined futures, the maker fee is 0.02% and the taker fee is 0.04%.

4. Does Ourbit offer demo trading?

Absolutely. Ourbit has a demo trading environment for futures where users can practice with virtual funds under real-time market conditions.

5. Is Ourbit Exchange safe to use?

While Ourbit claims to have basic security features like two-factor authentication and cold wallet storage, it’s a relatively lesser-known exchange. As with any smaller platform, users should do their own research (DYOR) and avoid keeping large amounts on the exchange.

6. Can I earn passive income on Ourbit?

Yes, Ourbit offers an Earn feature that allows users to stake or save assets for passive income. This is ideal for users who want to put idle funds to work.

7. Does Ourbit offer demo trading?

Absolutely. Ourbit has a demo trading environment for futures where users can practice with virtual funds under real-time market conditions.