Everybody knows that there is a lot of money to be made day trading cryptocurrencies. But there are some key factors that massively impact your profitability.

Day traders care about a few things: Fees, leverage, liquidity, spread, and transaction speed. I can assure you that all of the presented exchanges are at the top of the game when it comes to these factors.

Being a day trader myself, I have tested over 100 crypto exchanges in the last 8 years. I have experienced everything, from high fees to ridiculous spreads, lack of liquidity, and no volume. To cut the noise, in this guide, we will cover the best crypto exchanges for crypto day traders.

Top 10 Crypto Exchanges for Day Trading

| Exchange | Futures Contracts | Futures Fees | Max Leverage | Bonus | KYC Requirement |

|---|---|---|---|---|---|

| 1. MEXC | 433+ | Maker: 0% Taker: 0.02% |

200x | $20,000 | No KYC |

| 2. Binance | 352+ | Maker: 0.02% Taker: 0.05% |

125x | $100 | KYC Required |

| 3. Bybit | 386+ | Maker: 0.02% Taker: 0.055% |

100x | $30,000 | KYC Required |

| 4. OKX | 207+ | Maker: 0.02% Taker: 0.05% |

125x | $10 | KYC Required |

| 5. Bitget | 246+ | Maker: 0.02% Taker: 0.06% |

125x | $20,000 | KYC Required |

| 6. BingX | 246+ | Maker: 0.02% Taker: 0.05% |

200x | $5,000 | No KYC |

| 7. Phemex | 260+ | Maker: 0.01% Taker: 0.06% |

100x | $8,800 | No KYC |

| 8. WooX | 152+ | Maker: 0.02% Taker: 0.05% |

100x | None | No KYC |

| 9. Kraken | Not Listed | Maker: 0.02% Taker: 0.05% |

50x | None | KYC Required |

| 10. Kucoin | 182+ | Maker: 0.02% Taker: 0.06% |

125x | $10,500 | KYC Required |

Best Crypto Exchanges For Day Trading Reviewed

1. MEXC

MEXC Global became a top-tier exchange in the last couple of years for day traders from all around the world, including the US. With the lowest trading fees, high leverage, high liquidity, low spreads, and high volume, the centralized exchange is every crypto trader’s dream. Furthermore, you can trade over 1600 assets on MEXC.

Fees

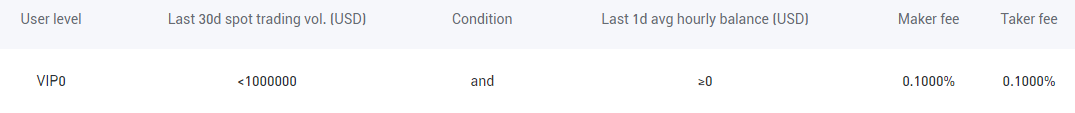

One of the key features of MEXC are the low trading fees. MEXC has the lowest fees of all Tier 1 crypto exchanges, making it the best choice for day traders seeking to reduce their order costs. The spot market fees are 0% completely, while the futures fees start at 0% maker and 0.02% taker fees. No other trading platform comes even close to these rates for Level 1 traders. On other exchanges, you would have to trade billions of dollars to climb up the VIP ranks and it would still be hard to come close to these fees.

Leverage

As MEXC focuses on providing the best day trading environment, the exchange introduced up to 200x leverage on selected major cryptos such as BTC, ETH, MATIC, ADA, and more. While we would not recommend using this much leverage, some high-frequency traders will certainly find this useful!

Furthermore, you can of course choose between cross and isolated margin mode as well as long and short simultaneously with the hedge mode. The only downside is that MEXC does not offer a unified multi-asset mode, however, this is only important for the most advanced traders as it is adding another layer of complexity to risk management strategies.

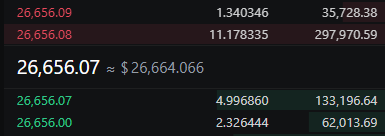

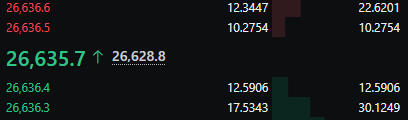

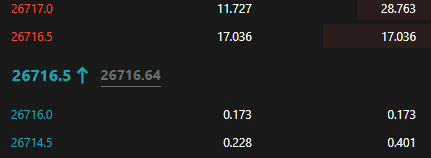

Volume, Spread, and Liquidity

If you think MEXC is compromising on liquidity, you are wrong. MEXC is known to be one of the deepest liquidity exchanges for major crypto futures (e.g. BTC and ETH). In fact – MEXC has the second deepest liquidity of all exchanges we tested, and it has deeper liquidity than Binance, the largest exchange in the world.

This might surprise you just as it surprised us. MEXC did an amazing job onboarding top-notch liquidity providers.

It is important to understand that MEXC focuses most on the futures market, thus the liquidity on the spot market is worse.

In terms of volume, MEXC reaches $6-10 billion per day, making it one of the most active exchanges according to coinmarketcap.

The spread on MEXCs spot market is 1 cent.

The spread on MEXCs futures market is 10 cents.

Supported Coins

If you don’t just care about Bitcoin, MEXC has you covered with over 1600 coins and 2500+ trading pairs. This ranks MEXC at #2 on our list of the crypto exchanges with the most coins and trading pairs. But more listed coins also means more risks of absolutely horrible cryptos. Furthermore, many of the projects listed on MEXC are fairly unknown and don’t have proper liquidity providers, making them bad choices to trade. We recommend sticking with the big names like BTC, ETH, XRP, etc. if you are interested in day trading.

Trading Interface

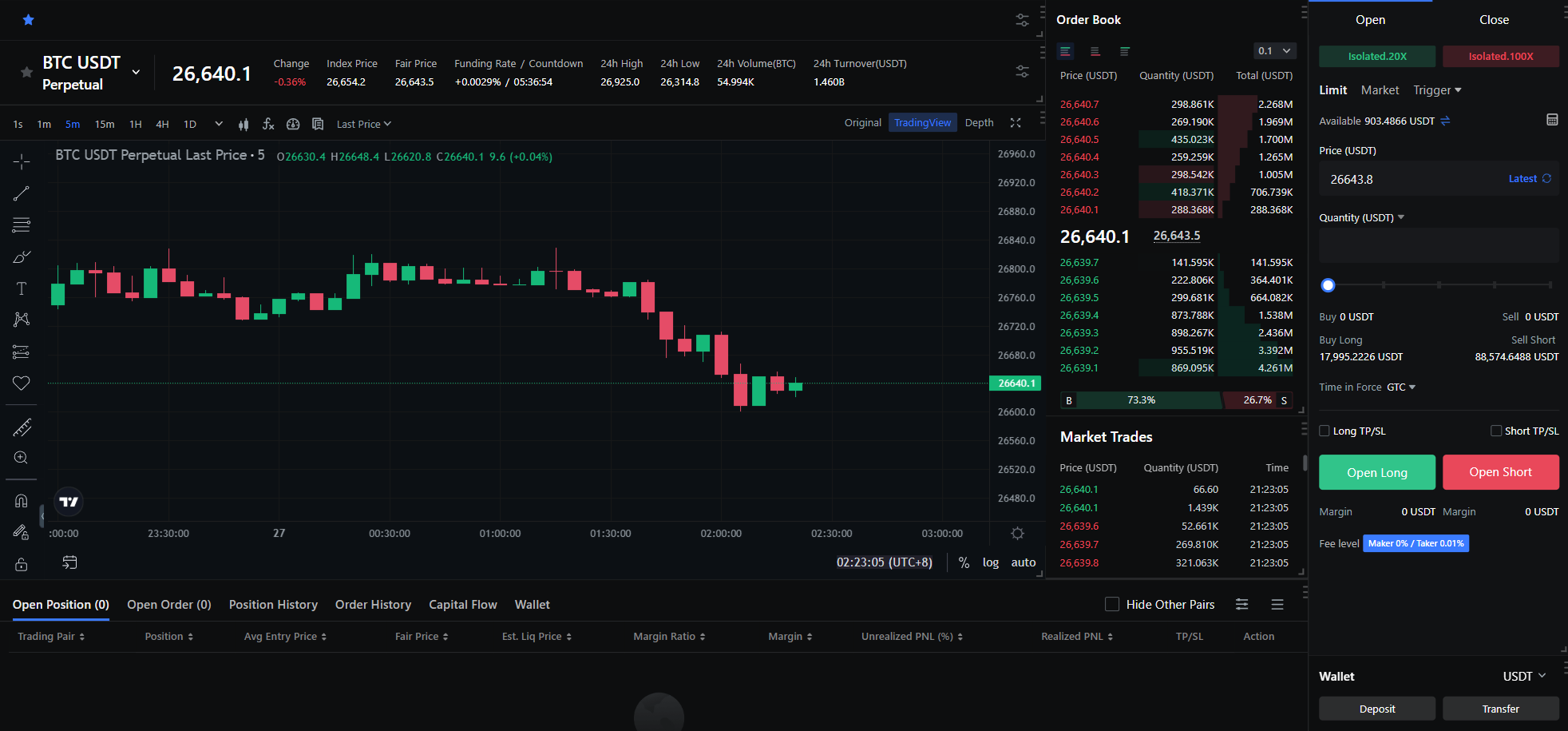

Lastly, the interface of MEXC is running smoothly without any issues. It is very user-friendly, well designed and we did not encounter any lags or other network issues. All of our orders were executed immediately and the trade management was fairly simple due to the user-friendly design.

When testing the MEXC mobile app which is available for Android and iOS devices, we concluded that the app is just fine. We didn’t notice any bugs and the speed was also good. Just the marketing notifications on the MEXC mobile application were annoying and we had to turn them off.

Order Types

MEXC supports the most important order types for day traders and also all advanced types except for TWAP orders. However, what we really like about MEXC is that you can set multiple TP and SL levels instead of just one level.

- Long/Short

- Limit and market orders

- Market to Limit

- Stop-Limit

- Stop market

- Trailing stop

- Post only

- Single TP/SL

- Multiple TP/SL

- Post Only

- Conditional: GTC, IOC, FOK

2. Binance

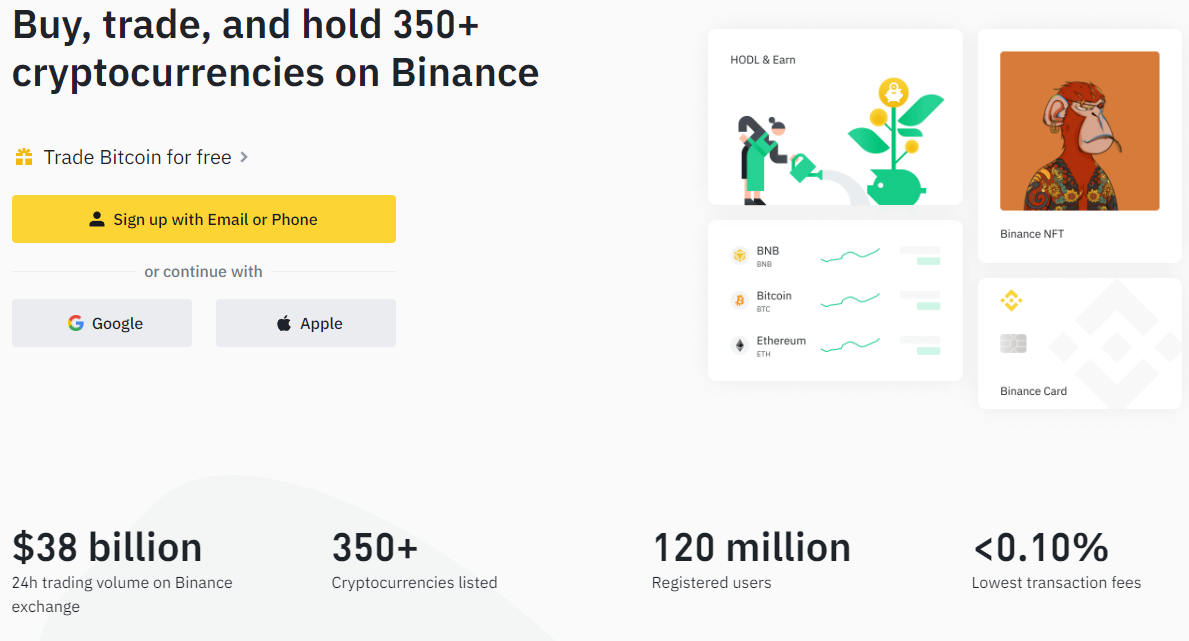

Binance, the largest crypto exchange launched in 2017, is number two on our list of the best crypto trading platforms for day traders. With low fees, a reasonable number of supported coins, high liquidity, and a great interface, it is no surprise that Binance is a top choice for day traders.

Fees

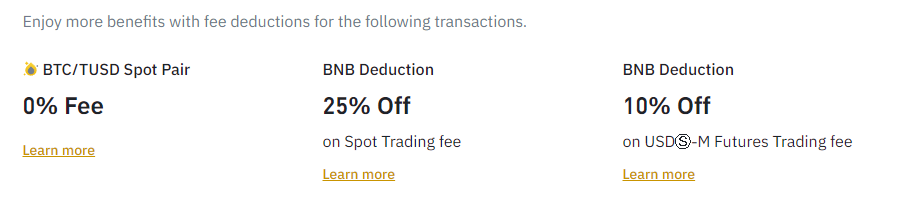

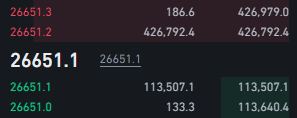

On the spot market, Binance charges a flat fee of 0.1% for makers and takers which is the industry standard. On the futures market, Binance has some of the lowest rates in the space with 0.02% maker and 0.04% taker fees. One thing to note is that you can reduce your spot fees by 25% and futures fees by 10% if you are holding BNB and turn on the BNB fee deduction feature.

On top of that, you can choose to trade BUSD pairs on the futures market, instead of USDT, as BUSD pairs have a lower fee rate. The BUSD maker/taker fees are 0.012%/0.03%, making Binance the most affordable exchange after MEXC.

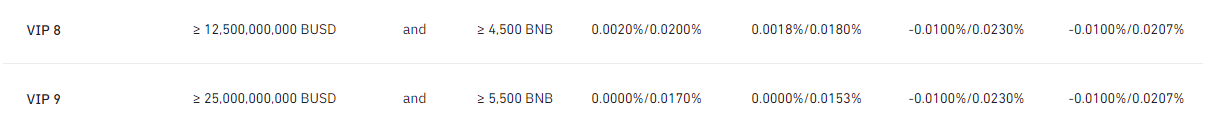

Based on your monthly trading volume, you can reduce your fees to incredibly low levels, however, this requires billions in monthly trading volume. So if you are a “whale” Binance is slightly cheaper than MEXC at the highest VIP level. But getting there requires $25,000,000,000 in monthly trading volume which is quite a lot. If you are just starting out or even “just” trading with a multi-million monthly trading volume, MEXC is still the best option in terms of fees.

Leverage

The leverage on Binance goes to 125x on major cryptos such as BTC and ETH when traded against USDT. On pairs with less volume and liquidity such as KAVA, the highest available leverage is 25x.

Binance also offers a Unified account, called “Multi-Asset Mode” which is amazing for advanced traders. With the Multi-Asset Mode on Binance, you can offset unrealized losses with unrealized gains and assets in other margin positions. Disclaimer: Please stay away from this mode if you are new to trading as you can lose all of your money if things go south.

Volume, Spread, and Liquidity

It is no surprise that Binance has some of the best liquidity in the crypto space. You can easily open large positions on major pairs such as BTC/UST or ETH/USDT without having a big impact on the price. On the spot market, Binance even ranks number one in terms of liquidity score, according to coinmarketcap. On the futures market, Binance also has great liquidity. Not just for major cryptos such as BTC or ETH, but also for less traded pairs which is a very big deal for versatile day traders that don’t just focus on a handful of trading pairs.

On the Binance spot market, the spread is 1 cent.

The futures spread on Binance is 10 cents.

Supported Coins

As the biggest crypto exchange in the world, Binance must carefully select the projects that it will list. On the spot market, Binance supports over 380 different cryptocurrencies, while on the futures market, you can trade up to 260 pairs. While Binance might not support as many cryptos as other platforms, you will still find all major cryptos. Especially for day traders, Binance covers every relevant cryptocurrency while also providing great liquidity for them.

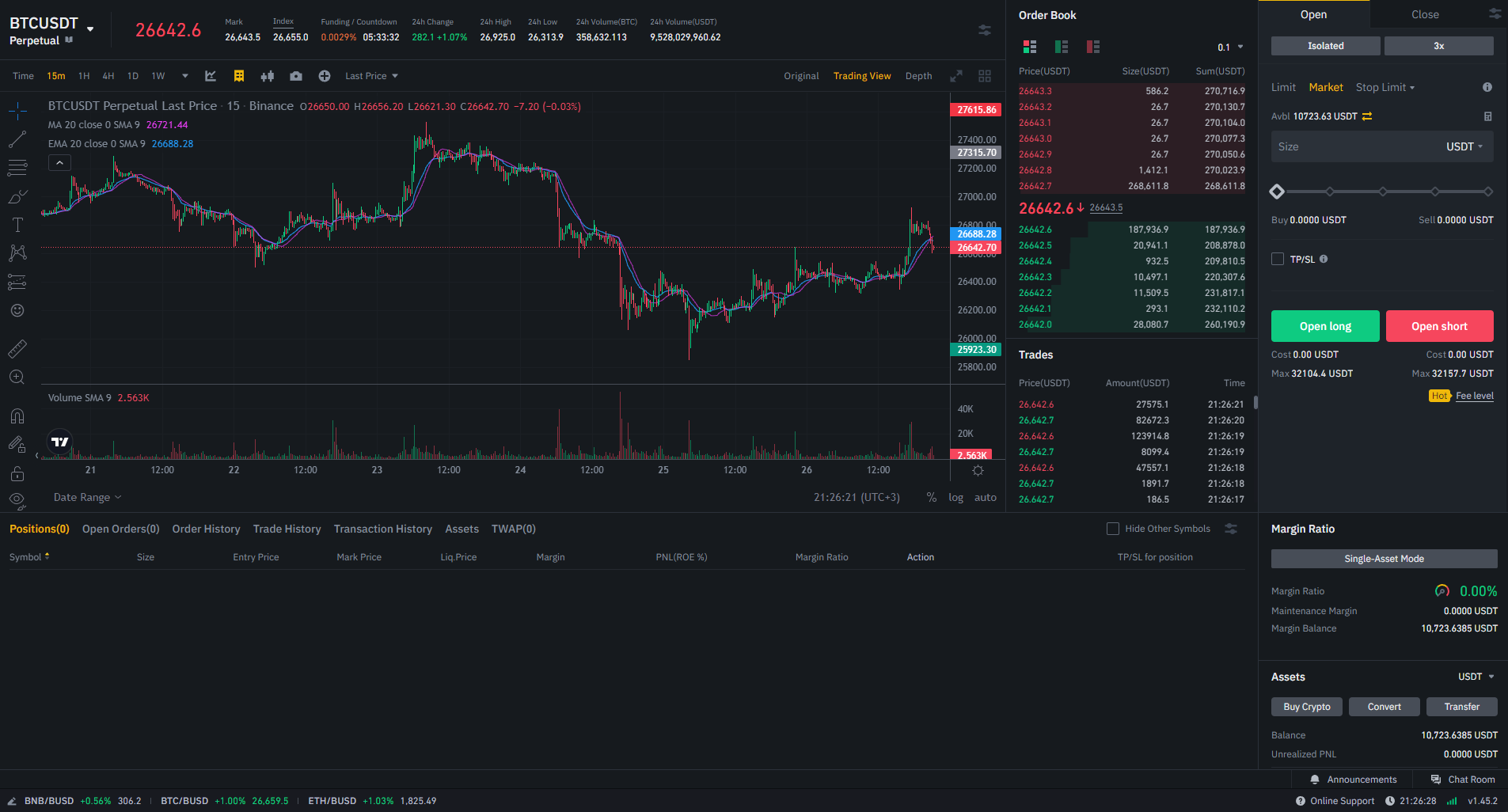

Trading Interface

The interface of Binance is unfortunately not the best, however, it is the most comprehensive one and Binance offers some of the most advanced trading features such as a TWAP order. Other than that, the Binance web interface is fairly stable and we did not encounter any issues with it. However, the desktop application runs surprisingly well and comes very close to the performance of MEXC, I highly recommend you download it and check it out if you decide to trade on Binance!

Having a look at Binances mobile application, we must say that we were a little bit disappointed as it can be too slow at times of high volatility. The Binance desktop website and application are perfect, but the mobile app not so much.

Order Types

This is where Binance is the market leader. Binance has the most advanced order types and is the only exchange offering TWAP orders.

- Long/Short

- Limit and market orders

- Stop-Limit

- Stop market

- Trailing stop

- Post only

- Single Limit TP/SL

- TWAP

- Post Only

- Conditional: GTC, IOC, FOK

3. Bybit

Founded in 2018, Bybit quickly rose to the top of the crypto space and is now the second-largest crypto trading platform in the world. With fair fees, great liquidity, and one of the most user-friendly trading interfaces, Bybit makes millions of day traders want to stay on the exchange.

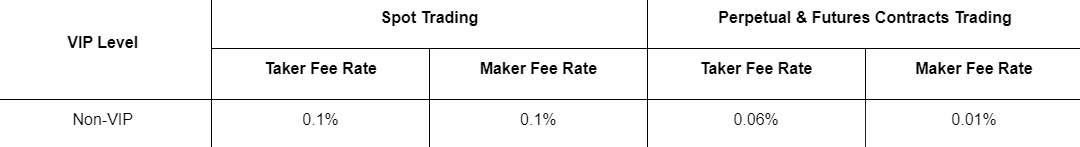

Fees

The fees on Bybits spot market are 0.1% for makers and takers. For day traders, the futures fees are a little better than average. Bybit charges 0.01% maker and 0.06% taker fees which is not high but also not the lowest. Keep in mind that 70% of orders are taker orders (market orders).

Based on your monthly trading volume you can reduce your futures and spot fees further. At Pro 3 Level you will enjoy the lowest available trading fees on Bybit with 0% maker and 0.03% taker on the futures market, and 0.005%/0.02% on the spot market. While these fees are still higher than MEXC and Binance, you should consider the low trading volume requirements to unlock these fees on Bybit which is only $60m in monthly trading volume.

Leverage

As Bybit is a professional derivatives trading platform that focuses on day trading, you get to enjoy leverage up to 100x on major pairs such as BTC and ETH against USDT and 125x against USDC, while less-known cryptos are supported with 10-50x leverage.

Just like every serious exchange, Bybit supports cross and isolated margin mode as well as one-way and hedge mode. One great thing about Bybit is the feature of a unified trading account where you can offset losses with funds in other Bybit wallets to avoid liquidations and manage risk. Yet again, we highly recommend staying away from it if you are new. However, for advanced traders, this is a great tool.

Volume, Spread, and Liquidity

With almost $10 billion in daily trading volume, Bybit is consistently ranking in the top 3 derivatives platforms as many crypto traders enjoy the service it provides. In terms of liquidity, Bybit ranks number 2 right after MEXC. Bybit also has slightly better liquidity than Binance, making it a top crypto exchange for day traders.

The Bitcoin spread on Bybit is 10 cents on the futures market and 1 cent on the spot market which is both to be expected and industry standard.

Supported Coins

Unfortunately, Bybit does not offer as many coins as other trading platforms, however, it still covers all major coins that most crypto day traders care about.

On the spot market, you can trade 390 coins as of 2023 while on the derivatives market, you can trade 223 different cryptocurrencies against USDT, USDC, and USD.

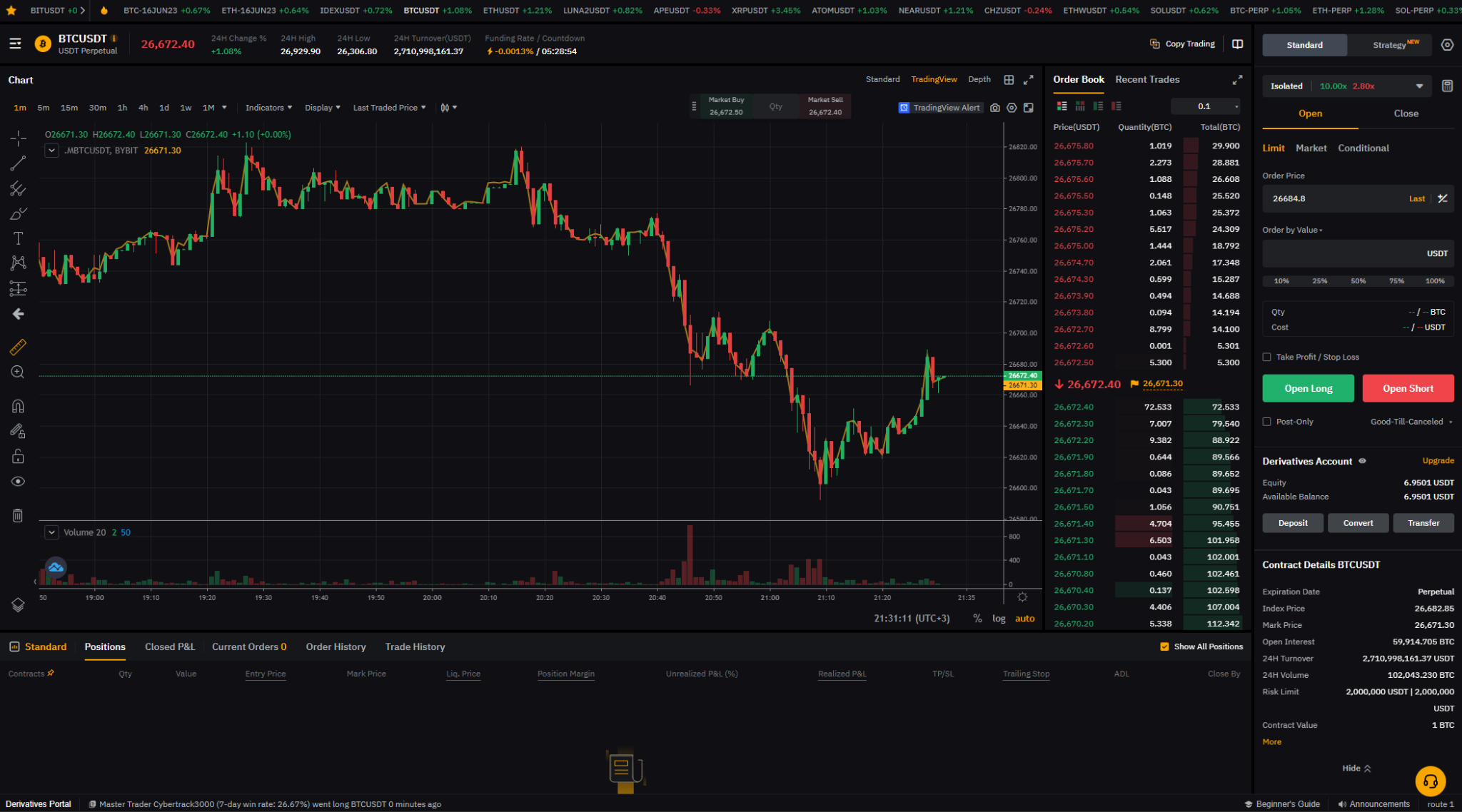

Trading Interface

Bybit is known for having an extremely user-friendly interface. This is great, especially for new traders as the navigation is super simple. The website works relatively smoothly, but when comparing exchanges side by side, we noticed that it is slower than MEXC and Binance. Yet, Bybit is still a fast exchange overall, we just think they could improve their code a little bit to make the experience even better.

The mobile app from Bybit is the fastest in the crypto space that we tested so far. It runs extremely well on iOS, Android, and Windows mobile devices. So if you will be trading a lot from the go, Bybit is the best option and even has the best rating in the app and play store.

Order Types

Bybit is very similar to MEXC in terms of available order types. You can also add partial TP/SL prices which is something we really like!

- Long/Short

- Limit and market orders

- Market to Limit

- Stop-Limit

- Stop market

- Trailing stop

- Post only

- Single TP/SL

- Multiple TP/SL

- Post Only

- Conditional: GTC, IOC, FOK

4. OKX

Continuing with OKX at number 4. OKX was launched in 2017 and is now a Tier 1 centralized crypto exchange and many day traders call it their home. OKX is the crypto exchange with the deepest liquidity, making it an amazing crypto exchange for day traders.

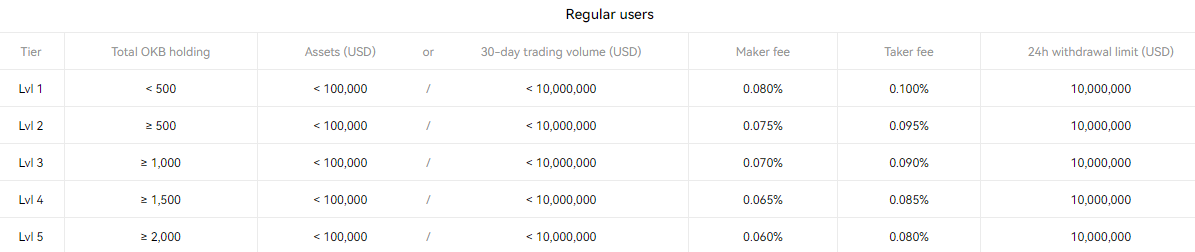

Fees

On the OKX spot market, traders enjoy fees of 0.08%/0.1% maker/taker.

On the perpetual futures market, OKX charges 0.02% maker and 0.05% taker fees which is slightly better than the industry average of 0.02%/0.06%. While a difference of 0.01% might sound small, this will add up a lot especially when trading with leverage on the futures market.

Based on your trading volume, you can reduce your futures fees to as low as -0.015% maker (you get paid for limit orders) and 0.02% maker orders. While the maker fees deal sounds great, this requires a 30-day trading volume of over $2 billion, making it pretty hard to obtain.

Leverage

Being an advanced crypto exchange, OKX offers up to 125x leverage on major USDT pairs such as BTC and ETH. Aside from that, OKX has an integrated calculator you can use to calculate the PNL based on the leverage of the trade you are planning.

Furthermore, you can choose between one way and hedge mode. For beginners, we recommend sticking to one-way mode.

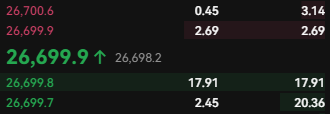

Volume, Spread, and Liquidity

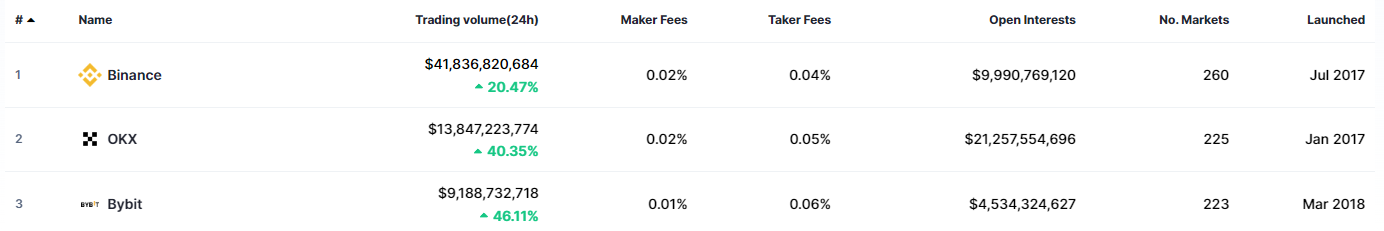

OKX is one of the largest crypto exchanges worldwide with millions of day traders, accumulating over $13 billion in daily trading volume as of 2023. This puts OKX at rank 2 sorted by volume, just behind Binance.

Unfortunately, the spread on OKX is a little higher than on other Tier 1 exchanges with 10 cents on the Bitcoin spot market as well as 10 cents on the Bitcoin futures market.

Lastly, the liquidity of OKX is out of this world. We have never seen so much liquidity on an exchange. It tops other exchanges by a factor of up to 10x. OKX surely did a great job onboarding the best market makers in the cryptocurrency space to provide liquidity for their derivatives trading platform.

Supported Coins

OKX is fairly slow when it comes to listing coins. As always, you will find all major pairs, however, new coins will not be available on OKX. With 342 coins on the spot market and 225 pairs on the futures market, OKX has the least amount of supported cryptos and trading pairs in this list.

But this is not necessarily a bad thing. This just means that OKX likes to do more due diligence and carefully considers which projects to list and which not. This can also protect customers from purchasing bad coins, or even scam coins.

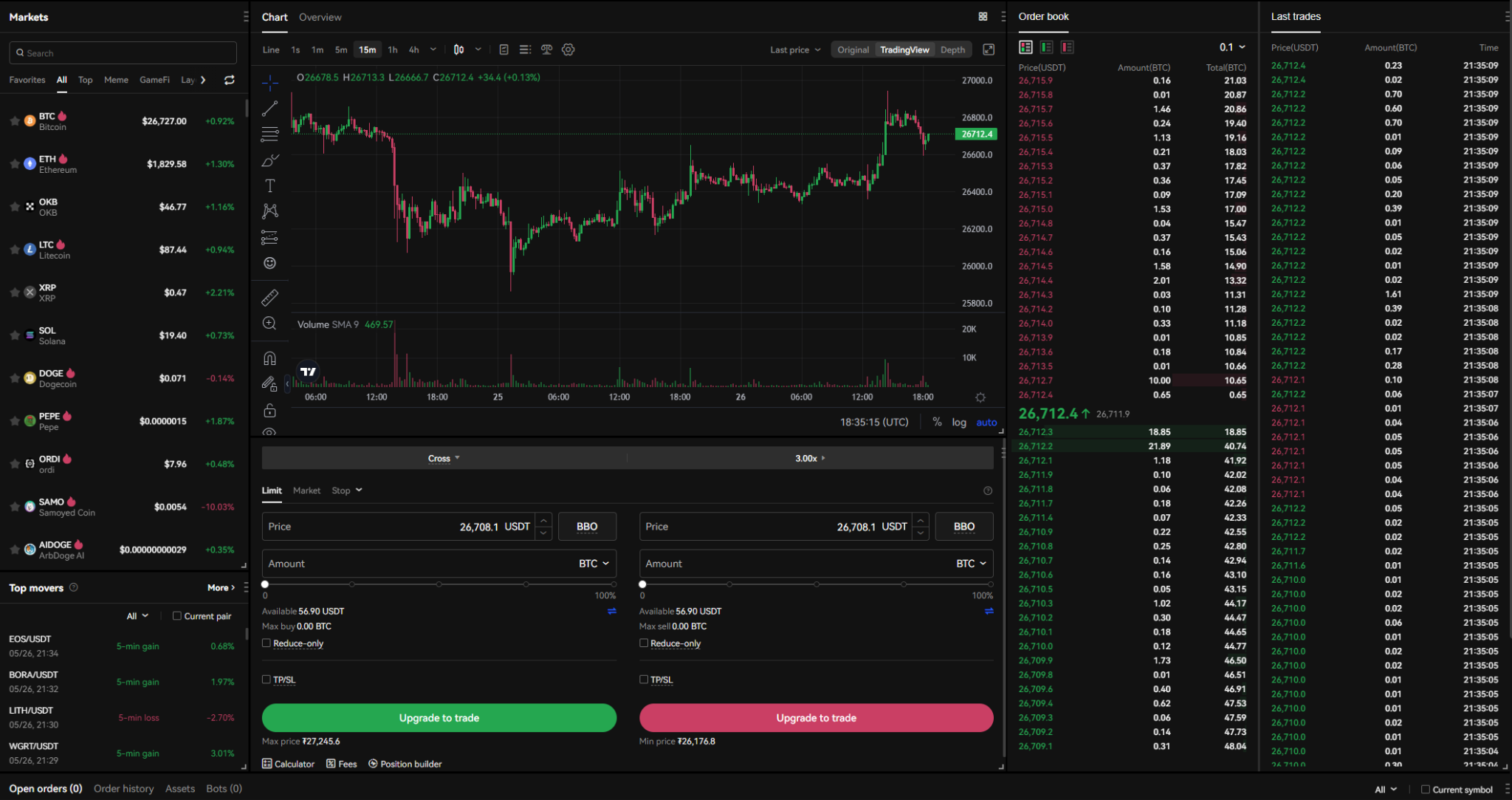

Trading Interface

The trading interface on OKX is not the best design-wise. It is harder to navigate than other exchanges, especially compared to MEXC and Bybit. While we would not consider OKXs interface as user-friendly as the competition, it is still one of the fastest and smoothest interfaces we have come across.

OKX definitely did a great job developing a stable website which plays a big part in the day trading experience. We did not encounter any bugs, lags, or network issues.

The mobile app which is available for iOS and Android is also great and covers all required features. Definitely a top choice for trading on your phone.

Order Types

OKX offers the most important, basic order types but it is lacking some advanced order types that we would have liked to see. Traders can place the following order types on OKX:

- Long/Short

- Limit and market orders

- BBO (Buy Best Offered Price)

- Stop-Limit

- Stop market

- Trailing stop

- Post only

- Single TP/SL

- Multiple TP/SL

- Post Only

- Conditional: OCO

5. Bitget

Bitget was launched in 2018 and quickly became one of the biggest crypto exchanges in the world. It now serves over 10 million crypto traders from 100 countries. The exchange offers fair fees, and an amazing interface and is getting more popular every day!

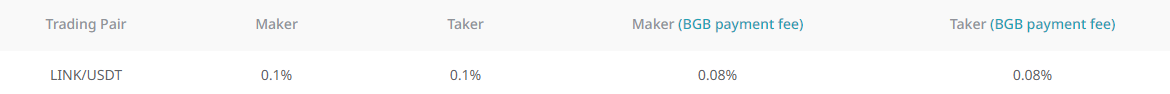

Fees

The fee structure on Bitget starts with 0.1% maker and taker on the spot market. A feature not to underestimate is the BGB fee deduction feature. BGB is the native token of Bitget which you can hold to receive a 20% fee discount, lowering your spot market fees to 0.8%.

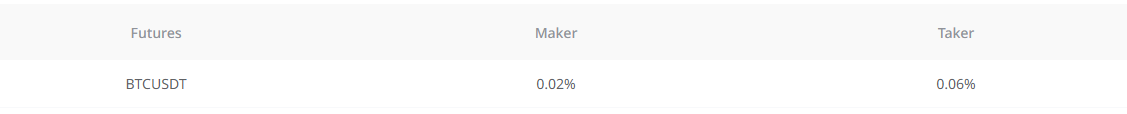

On the futures market, you are paying the industry standard rate of 0.02%/0.06% maker/taker. Based on your 30-day trading volume, you can climb the VIP ladder and receive additional fee discounts. At VIP 5 you will enjoy fees of only 0.0015% maker and 0.035% taker which is a great deal.

Leverage

The leverage on Bitget goes up to 125x leverage on 50 different major cryptocurrencies while less known cryptos support leverage from 10-50x which is still more than enough. You can separate the leverage for longs and shorts and you can of course long and short at the same time with the hedge mode.

Volume, Spread, and Liquidity

In terms of volume, Bitget consistently ranks in the top 10 crypto exchanges worldwide with $6-10 billion traded each day. The liquidity is also one of the best in the space with a fairly thick orderbook. One major downside of Bitget is the high futures spread on Bitcoin of 50 cents and the spot spread of up to 30 cents.

Supported Coins

As Bitget tries to keep up with the requests of its traders, the platform consistently adds hyped projects to its portfolio. As of 2023, Bitget supports over 540 cryptos and 740 different trading pairs on the spot market. On the futures market, Bitget is a little bit slower and only supports 182. While Bitget has more coins than most exchanges overall, the amount of training pairs on the futures market is relatively low. But of course, you will find all popular cryptos such as Bitcoin, Ethereum, Cardano, etc. with high volume and high liquidity.

Trading Interface

The design of Bitgets platform is modern, amazing, and easy to navigate, making it one of the most user-friendly crypto exchanges for day traders. While the interface is great for new and advanced traders, it can be slow in times of huge volatility. That’s the biggest downside we have encountered on Bitget. While there are no bugs, the page loading speed can be slow when the crypto market is very volatile and many traders are connecting to the page.

On the upside, Bitget did a great job with its mobile application which you can download on iOS and Android devices. The app runs smoothly and we did not encounter any bugs or lags.

Order Types

Bitget supports the most important order types for day traders and also all advanced types except for TWAP orders. One downside is that you can not add multiple TP and SL prices.

- Long/Short

- Limit and market orders

- Market to Limit

- Stop-Limit

- Stop market

- Trailing stop

- Post only

- Single TP/SL

- Post Only

- Conditional: GTC, IOC, FOK

6. BingX

On rank 6 we have a fairly hidden gem exchange. BingX is a platform that focuses on derivatives crypto trading as well as copy trading. They also call themselves the first “social exchange” due to the large copy trader network. With low fees and a great interface, BingX is a good choice for crypto day traders.

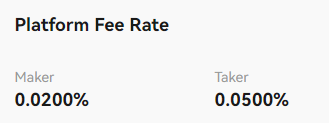

Fees

On the spot market, you pay a flat fee of 0.1% for maker and taker orders which is the industry standard.

With 0.02% maker and 0.05% taker fees on the perpetual futures market, BingX slightly beats the average fee rate of 0.02/0.06. Based on your monthly trading volume, you can reach the VIP 5 rank and lower your fees to 0.0015% maker and 0.035% taker. While the maker fees seem great, we would have liked to see bigger discounts at the maximum VIP level. Still, BingX has some of the most competitive fees in the crypto space, thus it is included in our list of the best crypto exchanges for day traders!

Leverage

As a professional derivatives trading platform, BingX offers high leverage of up to 125x on selected pairs like BTC and ETH. On most other pairs you get leverage from 10-50x, depending on the popularity of the asset. Furthermore, you can long and short at the same time with the BingX hedge mode and switch between cross and isolated margin mode. Unfortunately, we could not find any information about a unified trading account on BingX. However, this feature is most important for very advanced day traders.

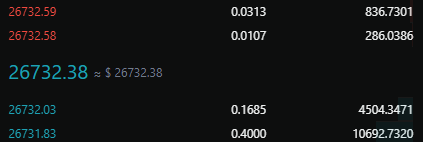

Volume, Spread, and Liquidity

With $5-7 billion traded each day, BingX is one of the big players in the crypto space and consistently ranks in the top 10 exchanges sorted by daily trading volume.

The spread on BingX spot market is $5 for Bitcoin. This is very high and we do not recommend day trading on the spot market of BingX. Instead, you should day trade cryptos on the derivatives market, as BingX has a low spread of $0.1 for BTC which is great. The liquidity on BingX is also good for day traders.

Supported Coins

BingX offers 515 cryptocurrencies on the spot market and 200 trading pairs on the futures market.

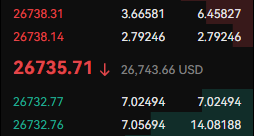

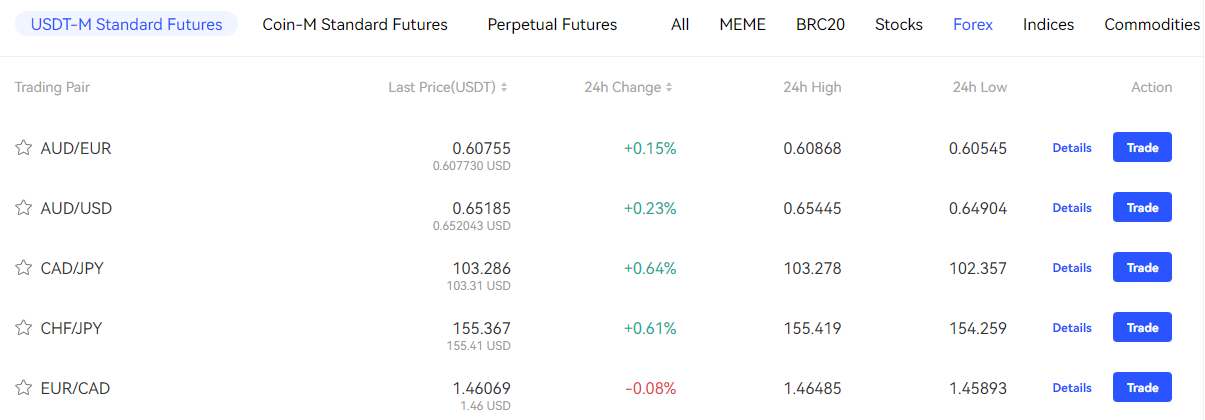

However, there is one key area where BingX stands out. The platform does not only offer cryptocurrencies but also forex, indices, commodities, and stock trading pairs.

So if you plan to not only trade cryptos but also TradFi assets, BingX is the right choice for you!

Some of the TradFi assets on BingX include (but are not limited to): Gold, Silver, Crude Oil, S&P 500, NASDAQ, Tesla, Google, Amazon, EUR, USD, GBP, CAD and so much more!

Trading Interface

As for the web trading interface, BingX did an amazing job. It is very well designed and runs smoothly without any interruptions or slow loading times. It is very simple to navigate and displays all the information you require.

The mobile app of BingX is available for Android and iOS devices and it is also working very well, just like the web version.

Order Types

- Long/Short

- Limit and market orders

- BBO (Buy Best Offered Price)

- Stop-Limit

- Stop market

- Trailing stop

- Post only

- Single TP/SL

- Multiple TP/SL

- Post Only

- Conditional: OCO

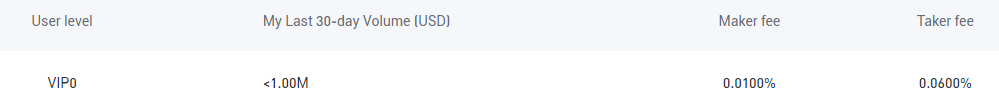

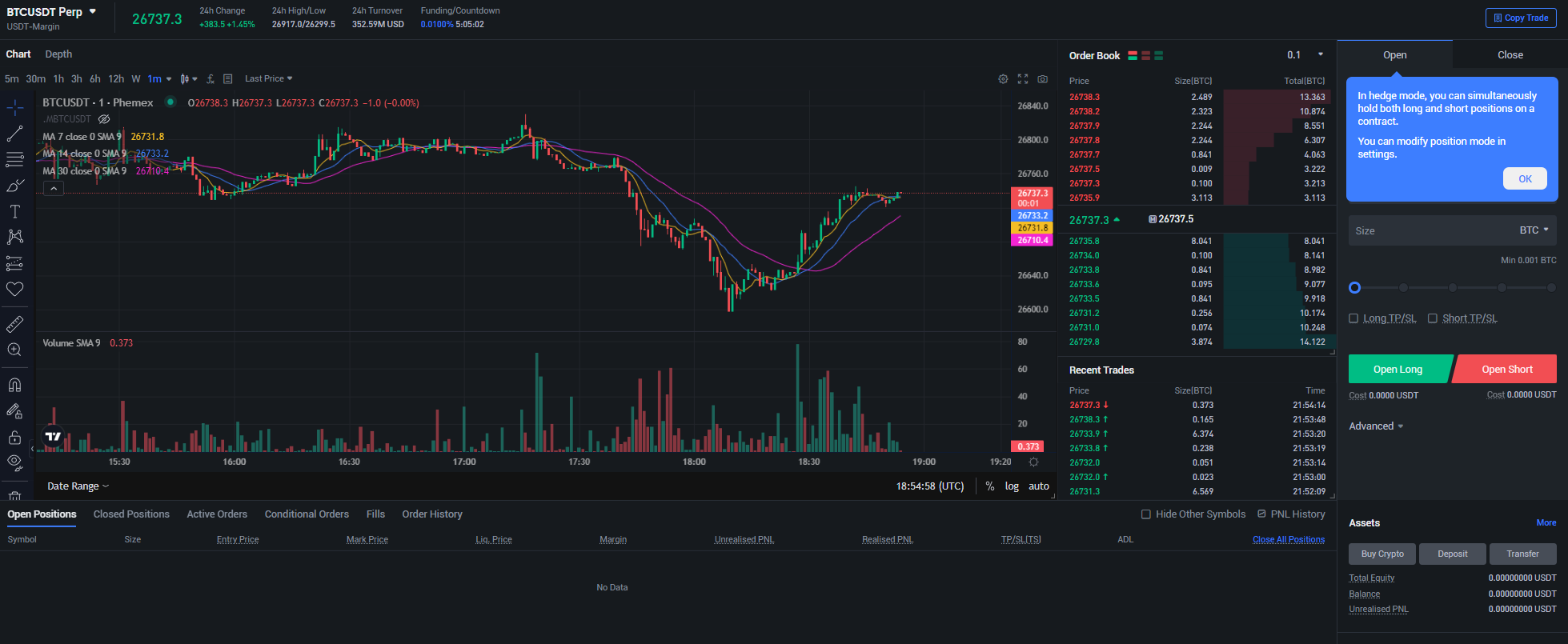

7. Phemex

Phemex is a top-tier exchange, especially for users from the US. With over 30% of Phemex traffic coming from the United States, it is safe to say that US residents love the platform. Phemex was launched in 2019 and is now a well-respected player in the crypto space with many professional crypto day traders using it. While Phemex is not the biggest exchange, it is still a top choice for crypto traders from all around the world.

Fees

The spot market fees on Phemex are 0.1% for makers and takers which is just like almost any exchange nowadays.

On the futures market, Phemex fees start at 0.01% maker and 0.06% taker. This is a fair rate but slightly higher than the competition in this list, especially considering that most orders are taker orders. It is still a fair rate to charge for a top-tier trading service.

Leverage

On the futures market, you can scale your leverage up to 100x for longing and shorting. Of course, you can also use the hedge mode, as well as choose cross or isolated margin mode. We are just missing a unified margin account, but other than that you have all the tools you require.

Volume, Spread, Liquidity

Phemex has a daily trading volume of $1.5-3 billion, actually placing it last sorted by volume. However, the spread on Phemex is really low with $0.01 on the spot market and $0.1 on the futures market, making it one of the best exchanges in terms of spread in this list.

What was surprising to see was the liquidity on Phemex. While the trading volume on Phemex is (relatively) low compared to the competition, the platform offers top-tier liquidity.

Supported Coins

Phemex is one of the more regulated crypto trading platforms, thus being a lot slower and more careful with listing new projects. On the spot market you can choose between 205 different coins while on the futures market, you can trade 150 crypto pairs. Phemex is not the most versatile exchange when it comes to supported coins.

Trading Interface

Phemex has designed a unique and well-working interface matching its brand well. It is very easy to navigate and certainly one of the more user-friendly interfaces that we came across. The mobile app unfortunately is a little slower compared to the competition.

Order Types

- Long/Short

- Limit and market orders

- Market to Limit

- Stop-Limit

- Stop market

- Trailing stop

- Post only

- Single TP/SL

- Post Only

- Conditional: GTC, IOC, FOK

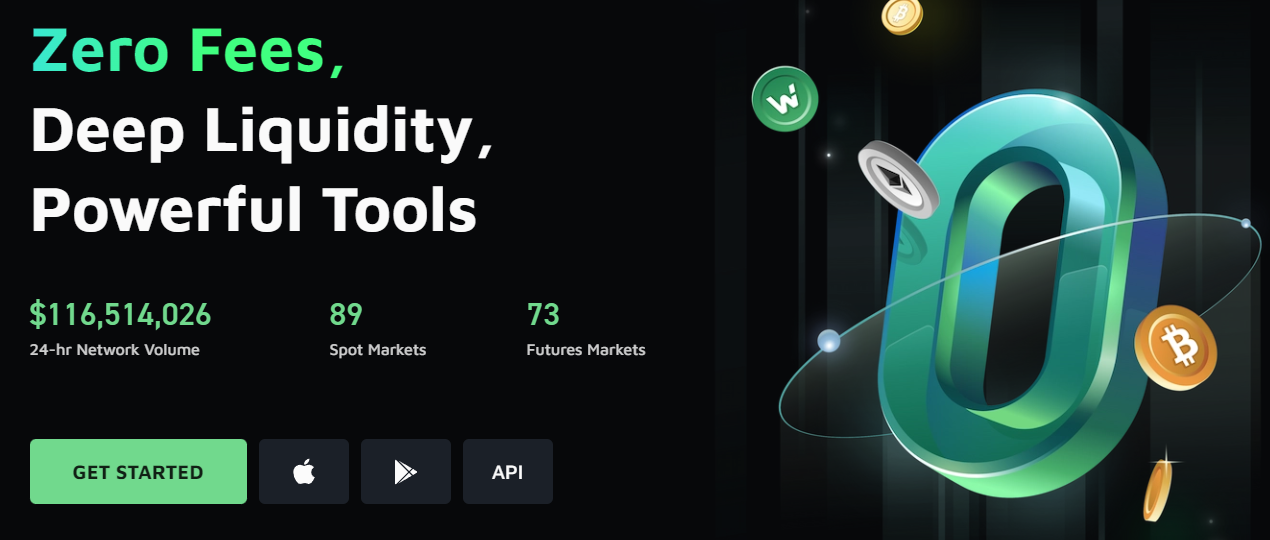

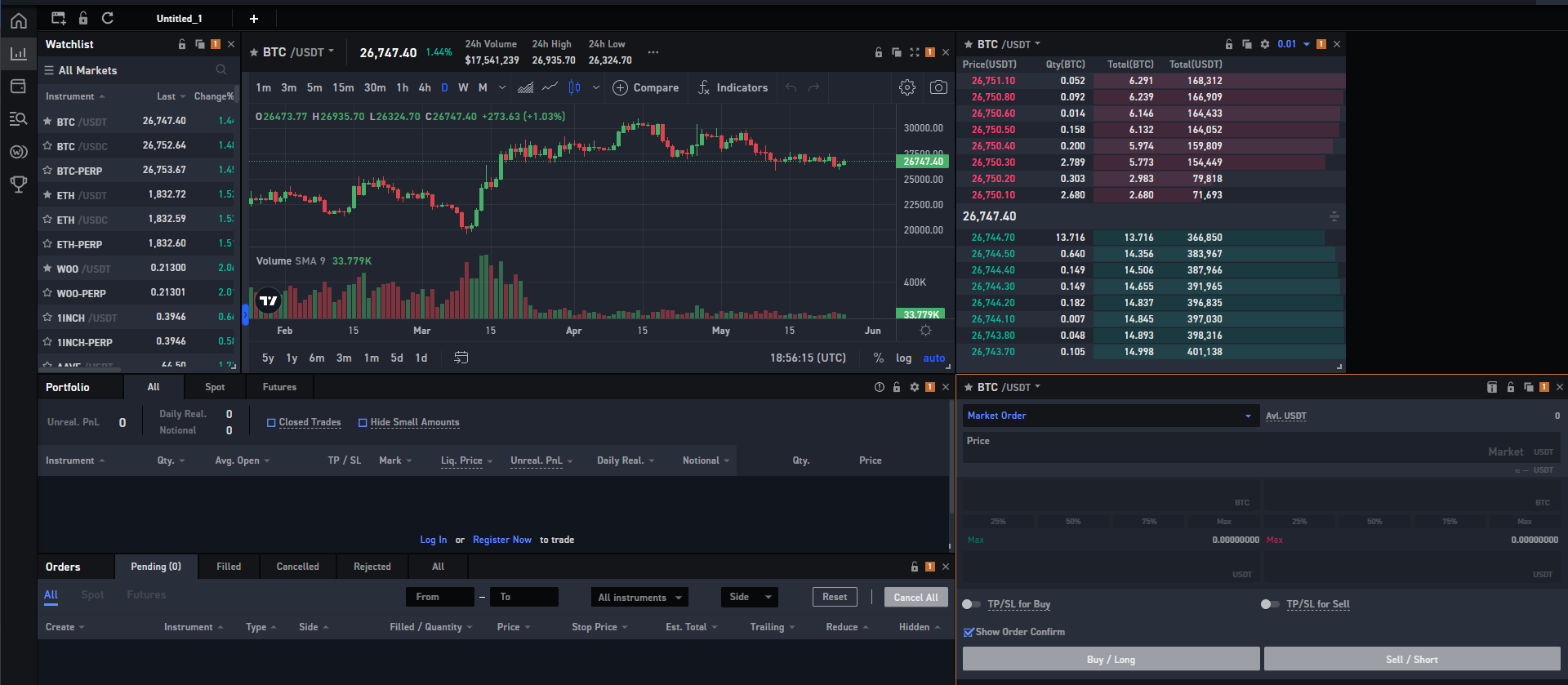

8. WooX Network

The WooX exchange is fairly unknown but not to be underestimated. The platform was launched in 2018 and is located in WooX specialized in high frequency.

WooX has a very unique fee structure, offering 0.03% maker and 0.03% taker fees on the spot market. Only MEXC can beat these rates with their 0% spot fees. However, WooX also offers a way to trade completely for free when holding their native WooX token (WOO). You must stake at least 1800 WOO tokens to enjoy 0% fee trading on WooX for 50.000 traders per day. The trade limit will only be relevant for algorithms that trade via API, so day traders do not have to worry about this.

With $400 million trade each day, WooX has the lowest trading volume in this list, but even this will be enough for regular day traders. One major downside of day trading on WooX is the spread which can be as high as $5, similar to BingX, but the liquidity on WooX is great. WooX has also made clear that it will continue to focus on providing some of the best liquidity in the crypto space.

WooX Network offers over 150 coins to trade on the spot market and 70 pairs on the futures market.

What can be confusing on WooX is the interface. It is not user-friendly at all and looks like it is meant for more advanced traders rather than newbies. If you are new to day trading cryptos, WooX may not be for you as it is a lot more complicated to navigate than other exchanges. WooX also does not offer a mobile application.

The order types on WooX include the most important orders but lack some advanced features. The current order types available on WooX are:

- Limit/Market

- Stop limit

- Stop market

- Trailing Stop

- OCO

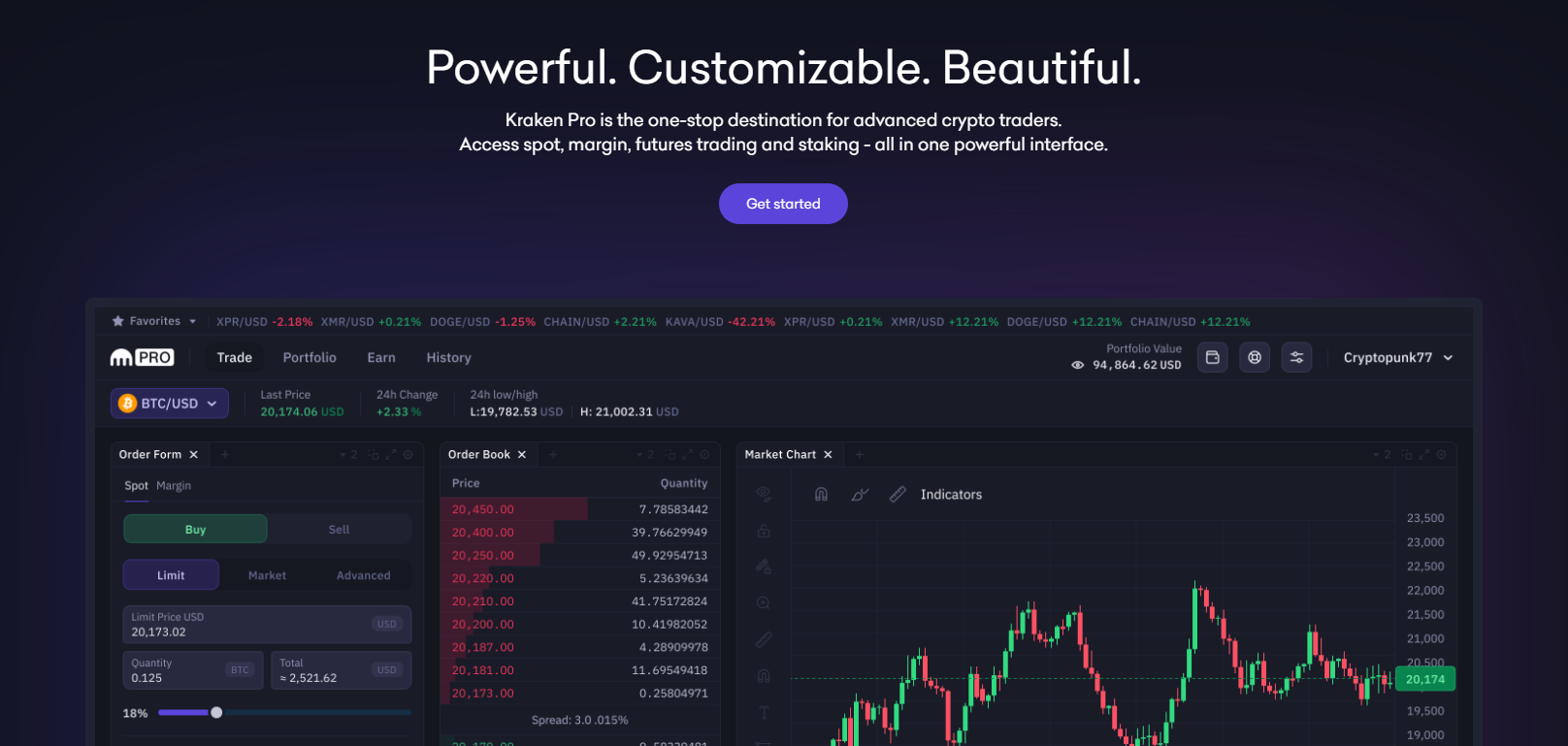

9. Kraken

Kraken is one of the oldest cryptocurrency trading platforms and most crypto OGs have used it for day trading in the past. While Kraken is not the number 1 crypto exchange anymore, it is still one of the greatest day trading platforms. Kraken Pro is also one of the top options for day traders from the US looking for a reliable, licensed, and regulated exchange. As of 2023, Kraken has over 15 million users worldwide in 170 countries. It is just important to note that serious trading on Kraken happens on Kraken Pro, which is the dedicated trading platform.

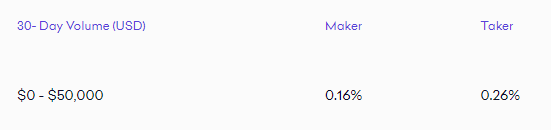

The spot trading fees on Kraken are relatively high with 0.16% maker and 0.26% taker fees, so we recommend sticking with the futures market.

With 0.02% maker and 0.05% taker fees on the Kraken Pro futures market, Kraken has a very fair fee schedule for Level 1 traders. Based on your monthly trading volume, you can climb up the VIP leader. With only $100.000+ monthly trading volume, you reduce your fees to 0.015% maker and 0.04% taker. No other crypto exchange makes it this easy to reduce the fees. On the highest VIP level, you get to enjoy 0% maker and 0.01% taker fees after trading over $100 million per month.

The spread on the Kraken Pros futures market is $0.1 with outstanding liquidity. The average daily trading volume on Kraken Pro is $100 million.

On the spot market you can trade 229 coins while on the futures market, Kraken Pro supports 115 trading pairs.

The interface of Kraken is unique and designed with ease of use in mind. It is one of the most user-friendly interfaces and very easy to navigate. One key downside of Kraken is the supported order types. In the trading terminal you will find the following order types:

- Limit/Market

- Stop loss/Take Profit

- Post only

- Reduce only

10. Kucoin

Last, but not least we have Kucoin (for a very specific reason). Kucoin is by far the best exchange for trading low market-cap altcoins. The amount of supported coins on Kucoin is near 900, making it a great place looking for some great setups on small coins on the spot market.

The spot market fees on Kucoin start at 0.1% maker and taker fees. If you hold the native Kucoin token KCS, you get an instant 20% fee discount which reduces your spot fees to 0.08% which is an amazing rate for day trading on the spot market.

On the futures market, Kucoin supports 125x leverage and went with the industry standard fee rate of 0.02% maker and 0.06% taker. Based on your monthly trading volume, you can reduce your futures fees to as low as -0.015% maker and 0.03% taker. While the -0.015% maker fee rebate seems great, keep in mind that most orders are taker orders. Kucoin has higher futures fees even at the highest VIP level, compared to the other day trading platforms in this list. That’s why we recommend Kucoin as a spot day trading platform rather than a futures day trading exchange.

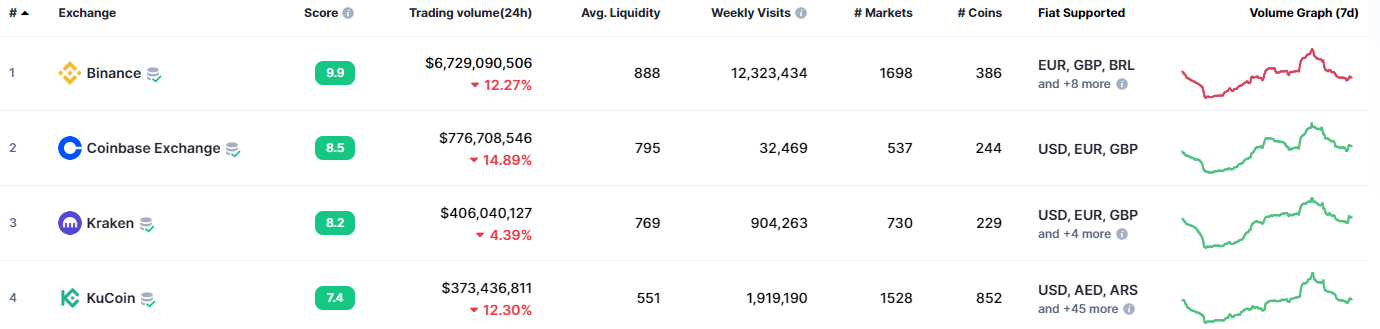

The daily trading volume on Kucoins spot market is $400 million. Coinmarketcap even ranked Kucoin at number 4 of all cryptocurrency spot exchanges.

On the futures market, Kucoin is reaching $1.5 billion in daily trading volume. The futures Bitcoin spread is $1 which is high, however, the Bitcoin spot futures spread on Kucoin is just $0.3. What surprised us was the liquidity of Kucoin which was much better than expected.

One key critique point about Kucoin is the trading interface. Unfortunately, the platform can be slow sometimes and feels not as smooth as other platforms. Also, you must type in a trading password every time you want to access the order dashboard which can be annoying.

The order types on Kucoin include:

- Long/Short

- Limit and market orders

- Market to Limit

- Stop-Limit

- Stop market

- Trailing stop

- Post only

- Single TP/SL

- Post Only

Key Factors for the Best Day Trading Exchanges

Trading Fees

First, we got trading fees which are one of the biggest factors to consider when choosing an exchange for day trading cryptocurrencies. Trading Fees are applied every time you open an order and close an order. There are two types of fees in crypto trading. Maker fees, which are applied to limit orders, and taker fees, which are applied to market orders. Over 70% of all orders in the crypto space are market orders. Especially for day traders, it is crucial to be in and out of a trade rather quickly, which means you will mainly rely on market orders which typically are a little more expensive.

Leverage

When day trading cryptos, you will sometimes rely on small moves. Especially when the market is ranging, even a 1% move can be exciting when done right. That’s where leverage comes into play to accelerate your gains. Day trading without leverage can be very limiting as it is not just accelerating your gains, but also gives you more room to use your margin freely and distribute it in several trades at the same time.

Liquidity

Liquidity is provided by market makers through limit orders in the order book. Every time a trader opens a market order, he takes liquidity out of the order book. Without liquidity, day trading would not be possible. That’s why it is required to use a trading platform with reliable market makers that provide as much liquidity as possible. If the liquidity of an exchange is bad, your orders will impact the price and your average entry price will be a lot worse.

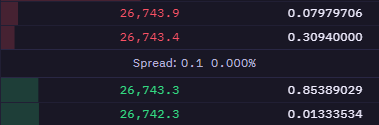

Spread

The spread is the difference between the bid and the ask. In the crypto space, the average spread on BTC is around 10 cents for the spot market and 1 cent for the futures market, which is low and won’t have much of an impact.

Volume

To have a reliable price chart, you need enough market participants on the exchange. If there would be only very little trading volume on an exchange, the moves would not be accurate and it might even look like the market took a little break. On top-tier exchanges, you will have billions of dollars transacted by millions of day traders each day.

Final Verdict

Day trading cryptocurrencies can be highly profitable – everybody knows that. One key factor many traders underestimate is the right crypto exchange. Always look into the documentation of the platform. Compare the fees, volume, and liquidity and see if a platform is reliable. As of 2023, MEXC seems to be the best overall cryptocurrency exchange for day trading. It not only has the lowest fees, but furthermore high volume, liquidity, and an amazing interface.

We recommend giving the exchanges a try where you thought that they sounded best to you. Hopefully, we could help you find your new favorite crypto trading platform for your day trading!