- •Crypto is legal and regulated in El Salvador, traders should prefer platforms aligned with Central Bank guidelines.

- •Top exchanges like MEXC, Kraken, and Binance offer deep liquidity, low fees, and both USD and BTC rails.

- •Choose your platform based on your needs, whether that’s no-KYC access, high leverage, or Salvadoran banking support.

Picking the right exchange is pivotal for any active trader in El Salvador, especially now that Bitcoin payments remain routine, about 215 crypto ATMs operate nationwide, even though legal‑tender status was scaled back in January 2025.

Salvadoran traders prioritize platforms that support Lightning withdrawals, offer seamless USD off‑ramps, and most importantly, comply with national law. Under the Digital Assets Law, all crypto platforms must register with the Central Bank of El Salvador, specifically through its Digital Assets Unit, within 20 business days to legally serve residents.

So while convenience matters, security, transparency, and regulatory alignment are what truly set the best exchanges apart in El Salvador.

Top 5 Cryptocurrency Exchanges in El Salvador

Here are the top five crypto exchanges that Salvadoran traders trust the most, whether for buying Bitcoin with Chivo dollars, swapping altcoins, or cashing out to local banks. Each of these platforms offers different strengths in terms of fees, features, and compliance with local regulations.

- MEXC – Best zero-fee & altcoin haven

- Kraken – Most secure & compliant for Salvadoran users

- Bybit – Top derivatives & leveraged trading

- Binance – Largest global liquidity & features

- OKX – Best for passive income & DeFi tools

| Exchange | Cryptos | Spot Fees | Future Fees | Max Leverage | Bonus | KYC |

|---|---|---|---|---|---|---|

| 1. MEXC | 3137+ | 0.05% / 0.05% | 0.00% / 0.02% | 500x | $20,000 | Yes |

| 2. Kraken | 516+ | 0.16% / 0.26% | 0.02% / 0.05% | 50x | None | Yes |

| 3. Bybit | 726+ | 0.10% / 0.10% | 0.02% / 0.055% | 100x | $30,000 | Yes |

| 4. Binance | 508+ | 0.10% / 0.10% | 0.02% / 0.05% | 125x | $100 | Yes |

| 5. OKX | 349+ | 0.08% / 0.10% | 0.02% / 0.05% | 125x | $10 | Yes |

1. MEXC

MEXC is one of the fastest-growing global crypto exchanges, established in 2018 by John Chen and headquartered in Singapore. With a presence in over 170 countries and more than 6+ million registered users, MEXC offers Salvadoran traders access to one of the broadest crypto markets available anywhere.

What makes MEXC stand out in El Salvador is its unbeatable fee structure and massive trading selection. The platform supports over 3,137+ spot cryptocurrencies and 433+ futures contracts, making it ideal for those looking to diversify into both mainstream and emerging tokens. Spot trading on MEXC is completely free; 0.05% maker and 0.05% taker fees, which is especially attractive for high-frequency traders or users with smaller budgets. On the futures side, MEXC charges 0.00% for makers and just 0.02% for takers, while also offering up to 200x leverage.

Beyond low fees and token variety, MEXC is loaded with advanced features. It supports copy trading, grid and DCA trading bots, demo trading, and even staking for passive income. For Salvadoran residents, the exchange accepts USD deposits via cards, SEPA transfers, and multiple third-party gateways like Alchemy Pay and Simplex.

With deep liquidity, professional-grade tools, and zero spot fees, MEXC is a top choice for crypto traders in El Salvador in 2026.

To learn more about MEXC, check out our full MEXC review.

- Supported Cryptos: 3,137+

- Futures Contracts: 433+

- Spot Fees: 0.05% maker/ 0.05% taker

- Futures Fees: 0.00% maker/ 0.02% taker

- Customer Support: 24/7 live chat

MEXC Pros and Cons

| 👍 MEXC Pros | 👎 MEXC Cons |

|---|---|

| ✅ Over 3137+ cryptocurrencies available on Spot Trading | ❌ Moderate Security |

| ✅ Up to 500x leverage | ❌ Interface may be overwhelming for beginners unfamiliar with pro-level tools |

| ✅ Lowest trading fees | |

| ✅ Advanced products and features |

2. Kraken

Founded in 2011 by Jesse Powell and headquartered in San Francisco, Kraken is one of the oldest and most trusted crypto exchanges in the world. With over 9 million users across 100+ countries, including El Salvador, Kraken is known for its strong regulatory compliance and unmatched security standards.

Kraken is fully licensed for crypto trading and complies with all relevant regulations, including oversight by the Central Bank of El Salvador. This makes it a highly reliable option for Salvadoran traders who prioritize transparency, user protection, and legal clarity.

The exchange supports over 516+ cryptocurrencies for spot trading and 348+ futures contracts with up to 50X leverage, covering all major assets like BTC, ETH, USDT, XRP, and more. In terms of pricing, Kraken is more favorable to derivatives traders. Futures fees are set at 0.02% for makers and 0.05% for takers, while spot trading fees are higher; 0.16% maker and 0.26% taker, which may be a downside for active spot traders.

For Salvadoran users, Kraken supports USD and several other fiat currencies, allowing easy deposits via credit/debit cards, SEPA, SWIFT, and ACH transfers. This makes funding your account and buying crypto relatively seamless, even for beginners.

Kraken has never been hacked and regularly publishes proof of reserves to verify user fund safety. It supports USD and other fiat currencies, with payment methods including credit/debit cards, SEPA, and SWIFT.

While Kraken may not offer copy trading or bot automation tools, its reputation for regulatory clarity, deep liquidity, and institutional-grade security makes it the most secure exchange option for users in El Salvador in 2026.

To learn more about Kraken, check out our full Kraken review.

- Supported Cryptos: 516+

- Futures Contracts: 348+

- Spot Fees: 0.16% maker/ 0.26% taker

- Futures Fees: 0.02% maker/ 0.05% taker

- Customer Support: 24/7 live chat

Kraken Pros & Cons

| 👍 Kraken Pros | 👎 Kraken Cons |

|---|---|

| ✅ FCA-registered and operational since 2011 | ❌ Futures leverage capped at 50x |

| ✅ Strong security record and proof-of-reserves transparency | ❌ No copy trading or advanced automation tools |

| ✅ Offers staking, margin trading, and educational tools | |

| ✅ GBP deposits and withdrawals via Faster Payments |

3. Bybit

Founded in 2018 by Ben Zhou and headquartered in Dubai, Bybit has grown into one of the leading global crypto exchanges, now serving over 15 million users across 160+ countries, including El Salvador. Bybit is fully licensed and operates in compliance with the Central Bank of El Salvador’s crypto trading guidelines, making it a secure and accessible platform for local users.

Known for its strength in derivatives, Bybit offers over 726+ spot cryptocurrencies and 578+ futures contracts, with leverage of up to 100x on perpetual trading pairs. Spot trading fees are 0.10% for both makers and takers, while futures trading fees are 0.02% for makers and 0.055% for takers, making it cost-efficient for active traders.

The platform also supports P2P trading, allowing Salvadoran users to buy and sell crypto directly using USD and other fiat currencies. For added flexibility, Bybit offers copy trading, trading bots, and demo trading for beginners and advanced users alike. There’s also access to NFTs, staking, and a variety of passive income products.

Fiat onramps include Visa, Mastercard, Google Pay, Apple Pay, SEPA, and more, ensuring smooth USD deposits for users in El Salvador.

With low fees, powerful trading tools, and deep futures liquidity, Bybit is the go-to exchange in El Salvador for serious traders seeking performance and flexibility.

To learn more about Bybit, check out our full Bybit review.

- Supported Cryptos: 726+

- Futures Contracts: 578+

- Spot Fees: 0.10% maker/ 0.10% taker

- Futures Fees: 0.02% maker/ 0.055% taker

- Customer Support: 24/7 live chat

Bybit Pros and Cons

| 👍 Bybit Pros | 👎 Bybit Cons |

|---|---|

| ✅ MiCAR-compliant platform | ❌ KYC is mandatory |

| ✅ SEPA support for EUR deposits | ❌ Not available in the US, UK, and other major countries |

| ✅ Tier-1 liquidity and deep futures markets | |

| ✅ Supports copy trading, demo mode, and multiple bots (Grid, DCA, Martingale, etc.) | |

| ✅ Fiat onramps via cards, MoonPay, BTCDirect, and more |

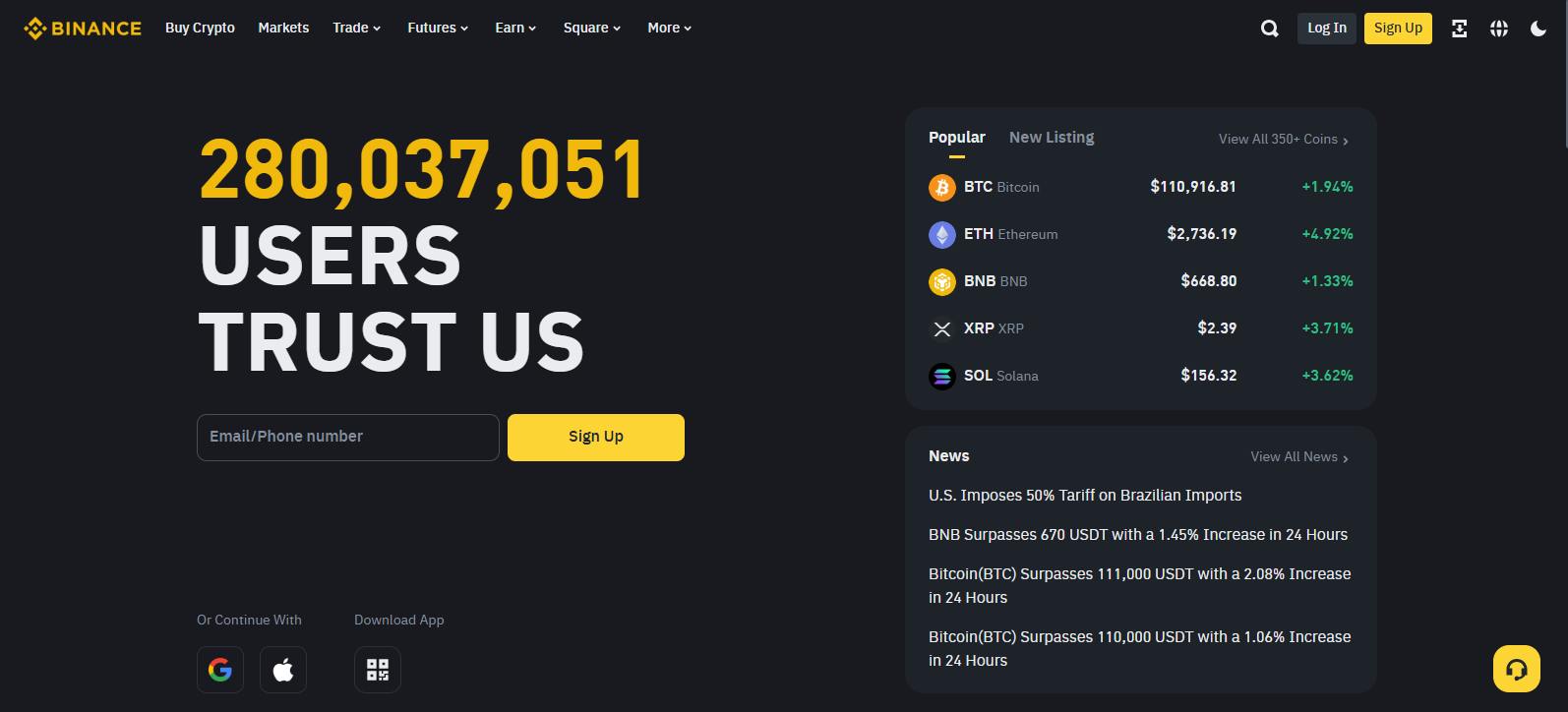

4. Binance

Founded by Changpeng Zhao in 2017, Binance has grown into the world’s largest cryptocurrency exchange, with over 280 million users across 180+ countries, including a strong user base in El Salvador. Binance is fully compliant with the Central Bank of El Salvador’s crypto trading regulations, making it a trusted and legal platform for Salvadoran traders and investors.

The exchange offers a wide range of trading options, including spot, margin, and futures markets, with access to over 508+ cryptocurrencies in spot and 520+ futures contracts. It caters especially well to experienced traders, offering powerful tools such as advanced order types, real-time technical indicators, and customizable trading interfaces.

For derivatives trading, Binance provides leverage up to 125x, allowing users to maximize position sizes with relatively small capital. The spot trading fee is 0.1% for both makers and takers, while futures trading fees are 0.02% for makers and 0.05% for takers. Traders can also get up to 25% off fees when paying with BNB (Binance Coin).

Additionally, Binance supports USD deposits and a wide range of fiat payment methods, including credit/debit cards, bank transfers, and third-party processors. This makes onboarding and buying crypto in El Salvador simple, fast, and cost-effective.

With its unmatched liquidity, low fees, advanced features, and global reputation, Binance remains a top choice for crypto traders in El Salvador in 2025.

To learn more about Binance, check out our full Binance review.

- Supported Cryptos: 508+

- Futures Contracts: 520+

- Spot Fees: 0.10% maker/ 0.10% taker

- Futures Fees: 0.02% maker/ 0.05% taker

- Customer Support: 24/7 live chat

Binance Pros and Cons

| 👍 Binance Pros | 👎 Binance Cons |

|---|---|

| ✅ Low spot and futures trading fees | ❌ Not beginner friendly |

| ✅ Passive income products | ❌ Poor regulation |

| ✅ High liquidity | |

| ✅ Full proof of reserves | |

| ✅ Advanced trading tools |

5. OKX

Founded in 2018 and headquartered in Seychelles, OKX has become one of the world’s largest crypto exchanges, now serving over 50 million users in 100+ countries, including El Salvador. OKX gives Salvadoran traders access to 349+ cryptocurrencies for spot and derivatives trading, with a strong reputation for low fees. On the spot market, trading fees are set at 0.08% for makers and 0.10% for takers. For futures trading, fees drop even lower; 0.02% for makers and 0.055% for takers, making it a cost-efficient platform for active users.

The platform is fully licensed and operates in line with the Central Bank of El Salvador’s crypto regulations, providing a secure and compliant trading environment for local users.

Beyond trading, OKX also offers a wide suite of passive income features, including staking, copy trading, and automated trading bots, helping users grow their assets even when they’re not actively trading. Advanced tools such as real-time price charts and technical indicators are also built-in, catering to both casual users and experienced traders.

OKX supports USD deposits and allows Salvadoran users to buy crypto using various payment options like credit cards, bank transfers, and third-party services, all at low cost and with fast processing.

With its low fees, diverse trading options, and strong passive income ecosystem, OKX stands out as a powerful all-in-one platform for crypto users in El Salvador.

If you want to learn more about OKX, check out our full OKX review.

- Spot Fees: 0.08% maker/ 0.10% taker

- Futures Fees: 0.02% maker/ 0.05% taker

- Supported Cryptos: 349+

- Futures Contracts: 290+

- Customer Support: 24/7 live chat

OKX pros and Cons

| 👍 OKX Pros | 👎 OKX Cons |

|---|---|

| ✅ Supports 350+ cryptocurrencies | ❌ KYC is mandatory |

| ✅ High liquidity | ❌ Some trading tools are complex, which may overwhelm beginners |

| ✅ Modern and user-friendly interface | |

| ✅ Diverse passive income options | |

| ✅ Low trading fees |

How to Choose the Best Crypto Exchange in El Salvador

Picking the right platform isn’t just about low fees or having access to hundreds of coins, it’s about choosing what fits your needs in El Salvador’s regulatory and banking environment. Ask yourself:

- Do you need a platform with USD deposit support from Salvadoran banks?

- Are you looking for high-leverage trading, or just simple spot buying?

- Do you prefer no-KYC platforms with quicker access, or licensed exchanges with stronger compliance?

- How important is mobile support, local language, or Lightning withdrawals for you?

Every trader’s setup is different. Whether you’re a beginner stacking sats or a full-time degen chasing alt swings, the best exchange is the one that fits your workflow and respects local regulations.

Is Crypto Legal in El Salvador?

Yes, cryptocurrency trading is fully legal in El Salvador. In fact, the country made headlines back in 2021 for adopting Bitcoin as legal tender. Today, the Central Bank of El Salvador continues to regulate and oversee crypto activities to ensure a secure and transparent environment for traders and investors.

How to Buy Crypto in El Salvador

If you’re just getting started with crypto in El Salvador, here’s a simple step-by-step guide to help you make your first purchase:

1. Pick an Exchange: Choose a platform from the top list above that supports users in El Salvador. Compare their fees, supported coins, and user experience.

2. Sign Up: Create your account by registering with your email or phone number.

3. Complete KYC: Most exchanges require identity verification to unlock full access. Have your ID and documents ready.

4. Deposit USD: Add funds using your preferred method, whether it’s bank transfer, credit/debit card, or even Chivo wallet in some cases.

5. Buy Crypto: Use your USD balance to buy Bitcoin, Ethereum, or any other supported cryptocurrency.

6. Secure Your Assets: You can either leave your crypto in the exchange wallet or move it to a private wallet for added control and security.

Crypto Regulation in El Salvador

El Salvador made history in 2021 by becoming the first country to adopt Bitcoin as legal tender. Since then, its regulatory framework has matured considerably. The Central Reserve Bank now oversees all registered exchanges through its Digital Assets Unit, ensuring platforms follow anti-money laundering (AML) protocols, custody rules, and user protections.

In 2023, new reforms introduced DASP licenses (Digital Asset Service Provider), making it mandatory for locally operating exchanges to register within 20 business days. Platforms like Bitfinex and Freedx are among the first to gain full authorization. While foreign exchanges are still widely used, traders are encouraged to use platforms that cooperate with local guidelines.

Bottom Line

Trading crypto in El Salvador is wide‑open, but “easy” doesn’t mean “risk‑free”. Global heavyweights; MEXC, Binance, Kraken, Bybit, OKX, offer rock‑bottom fees, deep liquidity, and Lightning‑fast BTC rails, yet your first check should still be: Does this platform report to the Central Bank’s Digital Assets Unit, publish proof‑of‑reserves, and spell out USD/BTC withdrawal limits?

Match the exchange to your priorities. Altcoin hunters might prefer MEXC or Binance; security‑first traders often choose Kraken; derivatives fans lean on Bybit or OKX. Pause, verify, then trade, so your next block confirms both quickly and safely.

FAQs

1. Do I pay tax on crypto gains in El Salvador?

At the moment, there is no dedicated capital‑gains tax on Bitcoin or other digital assets purchased and sold inside El Salvador. If you’re a foreigner, the 2021 Bitcoin Law explicitly grants zero capital‑gains on BTC. That said, ordinary income earned in crypto (e.g., freelance work) can still fall under standard income tax, so keep records and consult a local accountant.

2. Is KYC always required for Salvadoran users?

Most global exchanges demand at least basic identity verification once you exceed small withdrawal caps, in line with FATF guidelines. A few platforms offer low‑tier, no‑KYC trading, but expect tight limits and no fiat off‑ramp. If you plan to deposit or withdraw USD via bank transfer, or access high leverage, you’ll need full KYC on every major exchange.

3. What’s the safest way to store crypto after buying?

Hardware wallets (Ledger, Trezor, BitBox) remain the gold standard because private keys stay offline. If you prefer mobile convenience, multi‑sig setups like Nunchuk or Casa add extra protection, important if you hold larger sums beyond day‑trading funds.

4. Can I link the Chivo wallet to a foreign exchange?

Not directly. Chivo supports Lightning and on‑chain BTC only. The workaround is to withdraw BTC via Lightning from the exchange to Chivo, then convert or spend locally. For other coins, swap to BTC first (watch fees) before piping it into Chivo.

5. Can I fund my exchange account with a Salvadoran bank or credit card?

Yes, most large exchanges (Binance, Kraken, Bitfinex, OKX) now support local USD bank transfers via ACH‑like rails rolled out after the 2023 Digital Assets Law update. Processing usually settles within one business day and costs 0‑0.5 % depending on the platform. For instant buys, you can still use Visa or Mastercard, but expect a higher processing fee (2‑4 %) and lower daily limits.