Are you searching for the optimal crypto exchange platform to kickstart your swing trading journey?

In this article, provide insights into the leading cryptocurrency trading platforms that are best suited for crypto swing trading. These crypto exchanges offer the tools and features necessary to begin your swing trading journey effectively.

When it comes to successful swing trading, several key factors should be on your radar, including liquidity, trading fees, security, reliability, and advanced order types.

These aspects are pivotal to your trading strategy, whether you prioritize user-friendliness, security, versatility, or performance.

Top 5 Crypto Exchanges for Swing Trading

We have selected the following cryptocurrency exchanges for swing trading:

- BingX: Offers Low Fees for Crypto + TradFi assets

- Binance: Deep Liquidity, and Most Advanced Trading Options.

- Bybit: Offers a Reliable and Versatile Trading Experience.

- Bitunix: Serves U.S. Traders with an MSB License.

- MEXC: Offers Low Fees, High Liquidity, and User-Friendly Interface

| Exchange | Futures Contracts | Futures Fees | Max Leverage | Bonus | KYC Requirement |

|---|---|---|---|---|---|

| 1. BingX | 246+ | Maker: 0.02% Taker: 0.05% |

200x | $5,000 | No KYC |

| 2. Binance | 352+ | Maker: 0.02% Taker: 0.05% |

125x | $100 | KYC Required |

| 3. Bybit | 386+ | Maker: 0.02% Taker: 0.055% |

100x | $30,000 | KYC Required |

| 4. Bitunix | 218+ | Maker: 0.02% Taker: 0.06% |

125x | $5,500 | No KYC |

| 5. MEXC | 433+ | Maker: 0% Taker: 0.02% |

200x | $20,000 | No KYC |

1. BingX

BingX stands out as a versatile social trading cryptocurrency exchange, accommodating traders across all skill levels, from beginners to pros.

With low fees of 0.02% maker and 0.045% taker on the futures market, BingX offers an attractive trading platform for swing traders.

What makes BingX special is its wide range of supported assets. Over 600 cryptocurrencies are available for trading. On top of that, traders can access traditional assets such as indices, stocks, and even forex pairs.

With a bank-grade custody solution regulating permissions across departments and certified security audits by renowned firms like CertiK and SlowMist, BingX maintains airtight security.

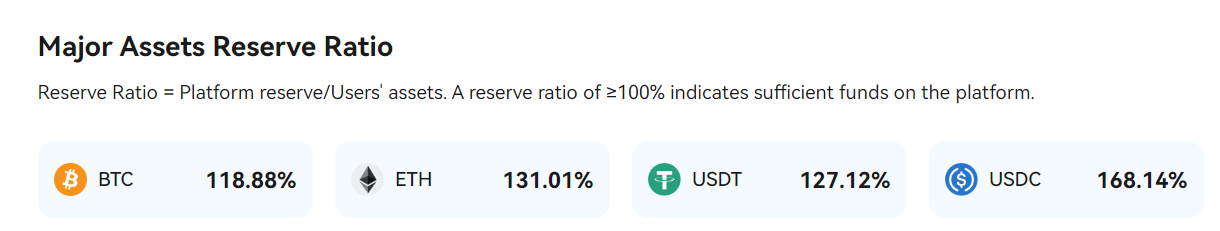

To ensure the safety of user assets, BingX employs a robust security system that combats internal and external threats. BingX provides 100% proof of reserves, meaning that customer assets are backed on the platform 1:1.

Collaborating closely with SlowMist, BingX continually optimizes its security measures and even incentivizes users to report security concerns through its “Security Breach and Threat Intelligence Bounty Program.”

Lastly, Bingx has an amazing demo trading feature directly integrated into the platform, so you can practice without having to risk your money.

Learn more about the exchange in our BingX review.

Additional Info about BingX

24-Hour Trading Volume (Futures): $3,868,421,554

Supported Cryptos: 600+

Spot Fees: 0.1% maker / 0.1% taker

Futures Fees: 0.02% maker / 0.05% taker

Leverage: 150x

Spot Margin: 10x

BingX Pros & Cons

| 👍 BingX Pros | 👎 BingX Cons |

|---|---|

| ✅ 800+ Cryptos supported | ❌ Relatively new |

| ✅ Forex, Stocks, Indices, and more | ❌ B-book for TradFi assets |

| ✅ Low fees | |

| ✅ 200x leverage |

2. Binance

Founded by Changpeng Zhao in 2017, Binance has emerged as the global leader in the world of crypto exchanges, serving over 150M users worldwide.

The exchange stands out as an ideal crypto exchange for swing traders mainly for its low futures fees of 0.02% maker and 0.05% taker. With outstanding liquidity, Binance offers a great solution for whale traders with large position sizes.

Notably, Binance provides a versatile platform for experienced traders, offering some of the most advanced order types, such as OCO, TWAP, and other conditional orders. That also means that Binance is rather complicated to use, making it confusing for beginners.

Binance’s ecosystem offers a wide range of services helpful for swing traders. These include 1200 trading pairs, both quarterly and perpetual futures with up to 125x leverage, and margin trading for the spot market

In terms of security, Binance utilizes cold storage wallets to store most cryptocurrencies offline, protecting them from potential cyber threats. Two-factor authentication (2FA) options, including hardware devices like Yubikey, add an extra layer of account protection.

Binance also places a strong emphasis on the security of its traders’ assets through the “SAFU” fund, an acronym for “Secure Asset Fund for Users.” This fund serves as an emergency backup, safeguarding investor assets on the exchange with a value of over $1 billion.

Learn more about the exchange in our Binance review.

Additional Info about Binance

24-Hour Trading Volume (Futures): $29,057,588,984

Supported Cryptos: 320+

Spot Fees: 0.1% maker / 0.1% taker

Futures Fees: 0.02% maker / 0.05% taker

Leverage: 125x

Spot Margin: 10x

Binance Pros & Cons

| 👍 Binance Pros | 👎 Binance Cons |

|---|---|

| ✅ Low Trading Fees | ❌ Regulatory issues |

| ✅ Good Liquidity | ❌ Complex for beginners |

| ✅ 300+ Cryptos | ❌ Limited features for US users |

| ✅ Security fund |

3. Bybit

Bybit, founded in 2018 and based in Dubai, is another one of the major players in the cryptocurrency world, with over 20 million traders worldwide.

As a versatile trading platform for swing traders, Bybit supports futures trading with 100x leverage and spot margin 10x leverage. It also serves as one of the few crypto exchanges providing inverse perpetual swap futures for cryptocurrencies such as XRP.

While Bybit fees are average, the liquidity is some of the best in the crypto industry, making it an excellent choice for crypto swing traders.

In terms of security for crypto swing trading, Bybit employs multi-signature cold wallet storage, ensuring that your funds are safeguarded against potential threats. Their zero-trust architecture manages software lifecycles meticulously.

ByBit has also partnered with white hat hackers to proactively detect cybersecurity vulnerabilities. Additionally, Bybit provides 100% proof of reserves, meaning that all customer assets are backed by Bybit at a ratio of 1:1, aiming to prevent bank runs.

With ByBit’s robust security measures, swing traders can focus on their strategies without worrying about the safety of their assets.

Learn more about the exchange in our Bybit review.

Additional Info about Bybit

24-Hour Trading Volume (Futures): $9,019,489,574

Supported Cryptos: 510+

Spot Fees: 0.1% maker / 0.1% taker

Futures Fees: 0.02% maker / 0.055% taker

Leverage: 100x

Spot Margin: 10x

Bybit Pros & Cons

| 👍 Bybit Pros | 👎 Bybit Cons |

|---|---|

| ✅ Very reliable | ❌ Regulatory issues |

| ✅ Good Liquidity | ❌ Complex for beginners |

| ✅ 400+ Cryptos | ❌ Lower leverage |

| ✅ 50 fiat currencies supported |

4. Bitunix

Bitunix, a recent addition to the cryptocurrency space, is tailored to cater to the unique requirements of crypto swing traders by offering a reliable trading platform.

What makes Bitunix stand out is its no-KYC policy. That means users can sign up and start trading right away without having to verify their identity. This makes Bitunix the best crypto swing trading exchange for traders who want to remain anonymous.

As a rapidly expanding exchange, Bitunix conducts seamless execution of up to 300,000 transactions per second (TPS) while maintaining order response times of less than 1 millisecond.

This high level of efficiency extends to the user experience, characterized by a user-friendly interface designed to simplify trading for individuals of all experience levels.

Bitunix has taken proactive steps to attain regulatory compliance, including becoming a U.S. MSB registrant and securing an SEC compliance license in the Philippines.

Moreover, the exchange has secured substantial funding to support its global expansion, including the establishment of offices in Dubai.

Learn more about the exchange in our Bitunix review.

Additional Info about Bitunix

24-Hour Trading Volume (Futures): $6,122,464,659

Supported Coins: 127

Spot Fees: 0.08% maker / 0.1% taker

Futures Fees: 0.02% maker / 0.06% taker

Leverage: 100x

Spot Margin: N/A

Bitunix Pros & Cons

| 👍 Bitunix Pros | 👎 Bitunix Cons |

|---|---|

| ✅ Available in USA | ❌ Relatively new |

| ✅ Good Liquidity | ❌ $10 minimum deposit |

| ✅ Low fees | ❌ Only 150 cryptos |

| ✅ 125x leverage |

5. MEXC

MEXC, renowned for its competitive fee structure and deep liquidity pool, emerges as an optimal choice for swing traders seeking a robust crypto exchange.

With a user base exceeding 10 million traders worldwide, MEXC has strengthened its reputation as a trusted exchange characterized by its efficiency and reliability.

What makes MEXC stand out most is its impressive fee structure. Spot traders enjoy 0% fees, meaning they don’t pay any fees at all. Futures traders enjoy 0% maker and 0.01% taker fees, making MEXC the cheapest crypto exchange.

MEXC ensures asset security using 100% proof of reserves for cryptocurrencies like USDT, USDC, BTC, and ETH.

Adding an extra layer of security, the crypto exchange has also obtained compliance licenses in Canada, Switzerland, and Australia.

Furthermore, with a secure track record free from any hacks or privacy concerns, MEXC ensures extreme account security.

For this, the exchange implements security features like 2FA, email or mobile verification, anti-phishing codes, security activity monitoring, device management, and withdrawal whitelists.

Learn more about the exchange in our MEXC review.

Additional Info about MEXC

24-Hour Trading Volume (Futures): $4,475,797,045

Supported Coins: 1600+

Spot Fees: 0%

Futures Fees: 0% maker / 0.01% taker

Leverage: 200x

Spot Margin: 10x

MEXC Pros & Cons

| 👍 MEXC Pros | 👎 MEXC Cons |

|---|---|

| ✅ Lowest Trading Fees | ❌ Lacks FIAT support |

| ✅ Best Liquidity | ❌ Lacks Passive Income Products |

| ✅ 1700+ Cryptos | ❌ Inferior Copy Trading |

| ✅ No KYC | |

| ✅ 200x Leverage |

What is Swing Trading in Crypto?

Swing trading is a popular strategy in crypto. Unlike certain other trading methods that focus on short-term movements, crypto swing trading operates in a middle to long ground.

This means that swing trades are typically held for more extended periods than day trading but not as long as traditional long-term investments.

In most cases, swing trades extend beyond a single day but typically last up to a few weeks. However, some successful swing trades can span up to months.

One crucial aspect to consider when engaging in swing trading strategies is the choice of a suitable crypto exchange platform. The selection of the right trading platform can significantly impact your success in swing trading.

So, while picking a certain crypto exchange from our list below, make sure that it complies with your specific trading needs and requirements.

Swing Trading and Day Trading Difference

When comparing the two, day trading relies heavily on technical analysis for quick profits. The goal is mainly to make a living by capping losses on unprofitable trades and avoiding overnight positions.

Swing Trading, in contrast, identifies price swings over days to weeks, allowing traders to maintain other jobs. It requires less technology investment and offers the potential for larger returns due to longer holding periods.

Here’s a concise table summarizing the key differences:

| Day Trading | Swing Trading | |

|---|---|---|

| Frequency: | Multiple daily trades | Trades span ranges from days to weeks (based on your availability) |

| Profit Potential: | Rapid compounding on smaller accounts | Potential for steadier but smaller gains |

| Risk Management: | High-risk with more changes of severe losses early on | Lower risk with the potential for larger losses |

| Time Commitment: | Requires substantial daily attention | Requires less active monitoring |

| Technology: | Day traders need high-speed internet, powerful computers, and access to real-time market data for effective trading. | While having access to real-time data and decent trading software is advantageous, it’s not as critical for swing traders because their positions are held for days or weeks. |

4 Effective Crypto Swing Trading Strategies

Crypto swing trading involves the use of various trading styles to maximize profit potential while minimizing risk. Here, we’ll explore four effective swing trading strategies tailored for crypto markets:

Strategy #1: Breakout and Retest Strategy

This strategy involves identifying key support and resistance levels and trading the breakouts that occur when the price exceeds these levels. Swing traders typically wait for a retest after a breakout, looking for confirmation that the former resistance has become support.

Popular indicators such as moving averages and Bollinger bands can assist in confirming breakout signals. For example, if Bitcoin’s price breaks above a significant resistance level, traders wait for a retest before entering a long position.

In the image below, you can see the DYDX chart on the daily time frame (one candlestick represents one day). DYDX broke through a resistance (marked in red) and then retested it before shooting up 70%. The retest of the (previous) resistance would have been a great entry for a swing trade.

Strategy #2: Reversal Strategy

Reversal traders seek to capitalize on shifts in price momentum, anticipating a potential change in the prevailing market trend.

For instance, if Ethereum (ETH) has been in an uptrend and starts showing signs of a reversal, swing traders may initiate short positions after the price breaks below a critical support level.

Indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Average Directional Index (ADX) can aid in identifying reversal signals.

Below, you can see the Bitcoin chart on the 4-hourly time frame. After trending upwards and making higher highs and higher lows, $BTC finally broke the trend by retracing below the previous higher low. This is a big indication of a trend reversal, so in this case we want to open a short position.

Strategy #3: Trend Trading

Trend trading is ideal for swing traders aiming to ride market trends, whether they are upward, downward, or sideways. This strategy involves identifying the prevailing trend and trading in alignment with it.

Swing traders use tools such as trendlines, rectangles, and various indicators, including moving averages, ADX, and RSI, to confirm trend direction and potential entry points.

In trading, a popular saying is, “The trend is your friend.” In the chart below, you can see Celestia (TIA) on the 4-hour time frame. The chart is consistently making higher highs and higher lows, indicating a strong uptrend. Try to get an entry when a pullback happens.

Strategy #4: Retracement Strategy

In contrast to trend trading, some swing traders prefer to enter trades during minor price corrections or retracements within an existing trend. This approach allows them to buy at lower prices during uptrends or sell at higher prices during downtrends.

Swing traders often employ the Fibonacci retracement tool in combination with other indicators to identify potential retracement levels and entry points.

Each of these swing trading strategies comes with its unique advantages and considerations. So, it is important to make every trade through careful analysis, disciplined execution, and risk management.

Tip: Consider practicing and refining these strategies in a demo or paper trading environment before applying them to live markets to enhance your chances of success.

Crypto Swing Trading Tips

Are you new to swing trading crypto or looking to improve your strategy? Here are some valuable tips to consider.

Start with a Demo Account

For new swing traders, it’s important to begin by opening a demo account with your chosen broker. This allows you to practice your trading strategies in a risk-free environment using virtual funds.

Use this opportunity to familiarize yourself with the crypto exchange and test your strategies thoroughly before investing real money.

Check out our guide about the top 5 crypto demo trading accounts.

Pay Attention to Bitcoin

Keep a close eye on Bitcoin’s price movements, as it often sets the tone for the entire crypto market. This means that when Bitcoin experiences significant price swings, it can influence the prices of other cryptocurrencies.

Consider incorporating Bitcoin analysis into your trading strategy and be prepared to adjust your positions accordingly when Bitcoin’s price surges or drops unexpectedly.

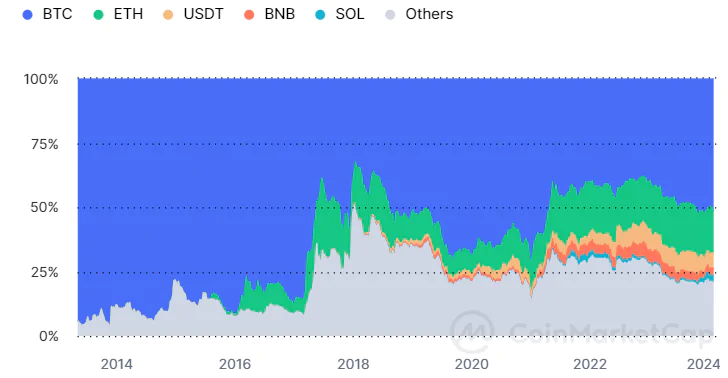

A great indicator to look at is the Bitcoin dominance. When the Bitcoin dominance is low, Altcoins are stronger. If the Bitcoin dominance is high, Altcoins are weaker.

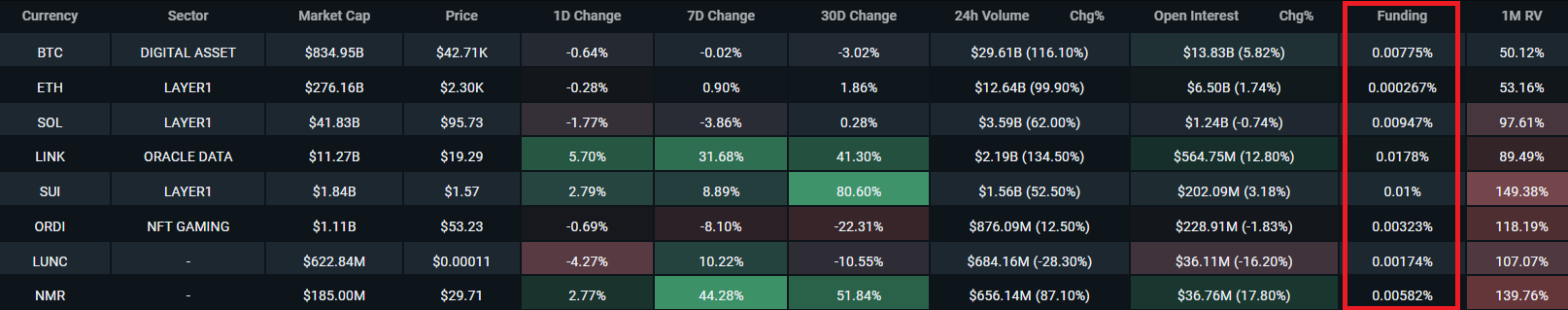

Manage Fees and Costs

Another key factor to consider here is funding fees, typically occurring every 8 hours, although certain exchanges might alter this to 4 or 2 hours. These fees can swing between being positive or negative.

When they’re negative, shorts pay longs, and when positive, the tables turn. This dynamic is essential for maintaining equilibrium between futures and spot prices.

Furthermore, it’s essential to be aware that various brokers can impose commissions and other account-related fees. So, before selecting a broker, conduct thorough research to ensure these charges align with your specific trading style and financial preferences.

A great tool to check out funding fees is laevitas, which allows you to sort cryptocurrencies b

Invest in Education

To become a successful swing trader, invest in your education. Explore resources such as crypto trading courses, community forums, or online swing trading guides.

These educational materials can help you build a strong foundation of knowledge and trading skills. Many crypto exchanges offer dedicated academies to support your learning journey.

Utilize Technical and Fundamental Analysis

Incorporate both technical and fundamental analysis into your trading strategy. Start by mastering daily candlestick charts and basic indicators to identify potential entry and exit points.

Additionally, stay informed about fundamental events and news that can impact the crypto market. Regularly follow reputable sources for crypto-related updates and insights.

Choose the Right Cryptocurrency

With thousands of cryptocurrencies available, it’s crucial to select the most suitable ones for swing trading.

If you’re new to the game, focus on cryptocurrencies with substantial market capitalization, such as Bitcoin (BTC), Tether (USDT), and Ethereum (ETH). These widely traded tokens offer liquidity and stability, making them ideal for beginners.

Stay Informed with Market News

Keep a watchful eye on cryptocurrency news, announcements, and events. Developments can heavily influence market sentiment in the crypto world.

Pay attention to what influential figures, celebrities, businesses, and governments are saying about cryptocurrencies. Additionally, be aware of tokens gaining recognition as legitimate forms of payment, as this can impact their value.

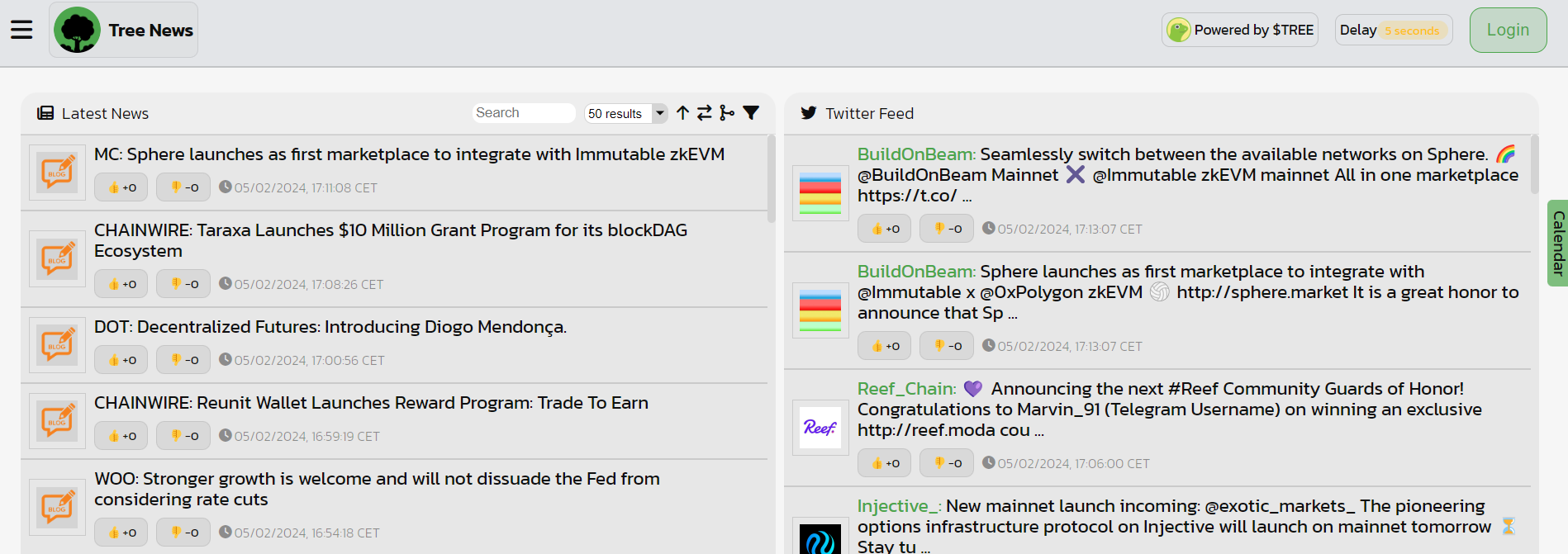

The best news terminal for cryptocurrency is Tree News. Tree News is a real time news aggregator provided by Tree of Alpha (@Tree_of_Alpha on Twitter)

Final Thoughts

Crypto swing trading offers a valuable strategy for those aiming to profit from medium-term market movements with a more relaxed approach compared to day trading. This method is particularly suitable for traders with limited time to closely monitor the markets.

In this article, we’ve examined five prominent cryptocurrency exchanges, each tailored to the needs of swing traders. Our top pick, MEXC, stands out with exceptionally low fees, tight spreads, deep liquidity, and no mandatory KYC, appealing to crypto swing traders from all around the world.

At the same time, Binance offers reliability, low fees, extensive liquidity, and a vast user base. Bybit provides a versatile and secure crypto exchange with competitive fees and excellent liquidity. Bitunix caters to US-based traders with regulatory compliance. Lastly, BingX combines low fees with a diverse range of trading options.

Ultimately, to succeed in swing trading on crypto exchanges, consider your priorities, like fees, liquidity, and regulatory compliance, when choosing the right exchange. With this knowledge, you can confidently navigate the cryptocurrency landscape and work toward your crypto swing trading goals.

FAQ

Is Swing Trading Profitable?

Swing trading crypto can be a profitable trading strategy, but its success depends on various factors. It offers several advantages, including the potential to maximize short-term profits, flexibility in managing capital, and a relatively low time commitment compared to day trading.

However, swing traders must be aware of the risks associated with holding positions overnight or through weekends, as unexpected market gaps can impact their trades.

Additionally, swing trading’s focus on shorter-term price movements may cause traders to miss out on longer-term trends. Ultimately, the profitability of swing trading depends on a trader’s skill, discipline, and ability to manage risk effectively.

Is Swing Trading a Good Strategy?

Yes, swing trading can be an effective strategy for traders aiming to achieve higher returns compared to day trading or long-term investing.

It involves capitalizing on price movements over a short to medium-term timeframe, providing opportunities for potentially greater profits without the constant monitoring required in day trading.

However, success in swing trading depends on effective market analysis, trend identification, and risk management, along with dedication to research and strategy development.

What is the 1% Rule in Swing Trading?

In crypto swing trading, the 1% rule is a risk management strategy used by traders to limit potential losses.

It involves allocating a portion of your trading capital to a single trade, ensuring that if the trade moves against you and hits your predetermined stop-loss level, you won’t lose more than 1% of your total trading account.

This rule helps traders control risk and avoid significant account drawdowns while still participating in profitable trading opportunities. It’s a crucial aspect of responsible trading and capital preservation.

What is the 3-5-7 Rule in Trading?

The 3-5-7 rule in trading is a straightforward strategy used to identify potential reversals in the market. Traders observe the number of consecutive days, hours, or bars that a price trend has been moving in one direction.

Specifically, they look for situations where the trend has continued for three, five, or seven consecutive increments. On the third, fifth, or seventh increment, traders watch for signs of a reversal, such as a bounce in the opposite direction.

This rule is a basic tool for traders seeking to identify potential trend changes and make informed trading decisions based on trend duration.