- •Ethereum L2 perp DEX focused on provable execution and verifiable trading mechanics.

- •Supports 117+ perpetual contracts with up to 50x leverage.

- •Standard accounts have zero trading fees but higher execution latency.

- •Premium tier offers faster execution with low maker and taker fees.

- •Supports crypto, forex, equities, and commodity perpetual contracts.

- •Non-custodial design with audited zk-based security architecture.

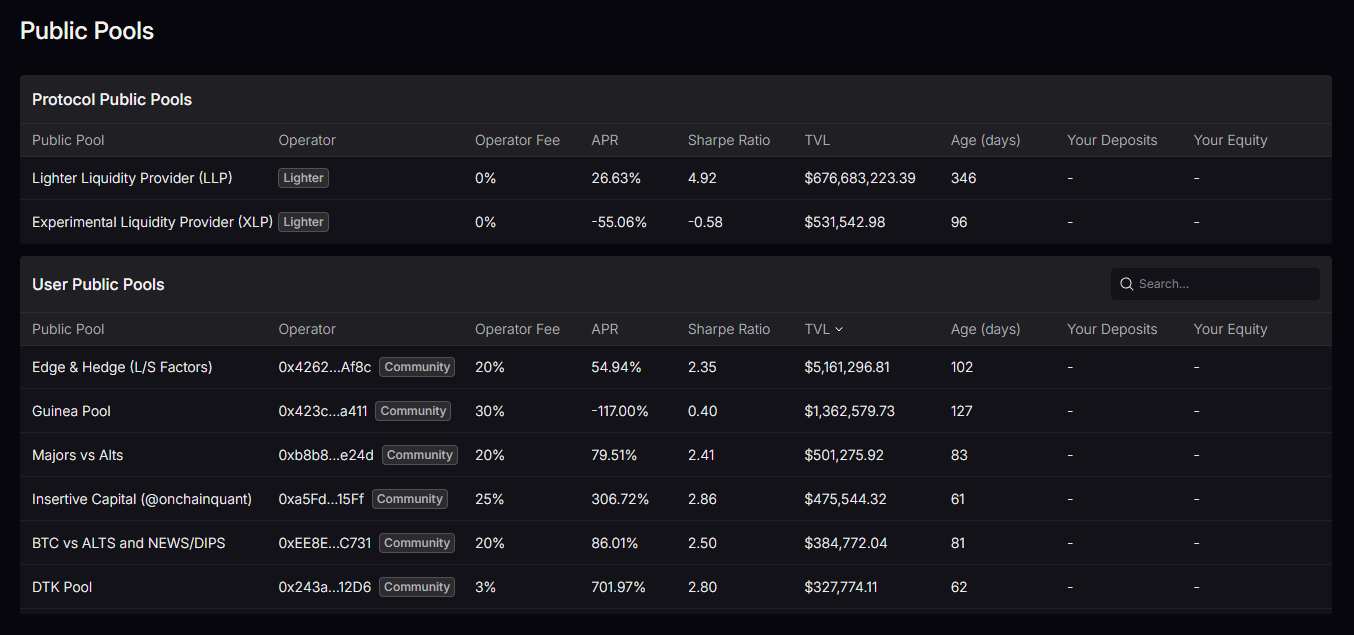

- •Earn pools offer variable APR rather than fixed yields.

Lighter has positioned itself among the more active perpetual DEXs in 2025, at a time when onchain futures trading is starting to scale. Several perp DEXs now regularly process $2B+ in daily volume, while centralized platforms like Binance Futures still clear $30B+ per day, highlighting how much room decentralized perps still have to grow. Lighter’s adoption can be traced to a small set of clear design choices, including its use of Ethereum L2 infrastructure, ZK proofs for execution verification, and a zero-fee model for retail traders. In this Lighter review, we examine Lighter’s features, fee structure, and trading setup to help you assess whether it fits your needs.

| Stats | Lighter |

|---|---|

| 🚀 Founded | 2025 |

| 🔎 Founder | Vladimir Novakovski |

| 👤 Active Users | 779K+ |

| 🪙 Spot Cryptos | 1+ |

| 🪙 Futures Contracts | 117+ |

| 🔁 Spot Fees (maker/taker) | 0.00% / 0.00% |

| 🔁 Futures Fees (maker/taker) | 0.00% / 0.00% |

| 📈 Max Leverage | 50x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | No |

| ⭐ Rating | 4.7/5 |

Lighter Overview

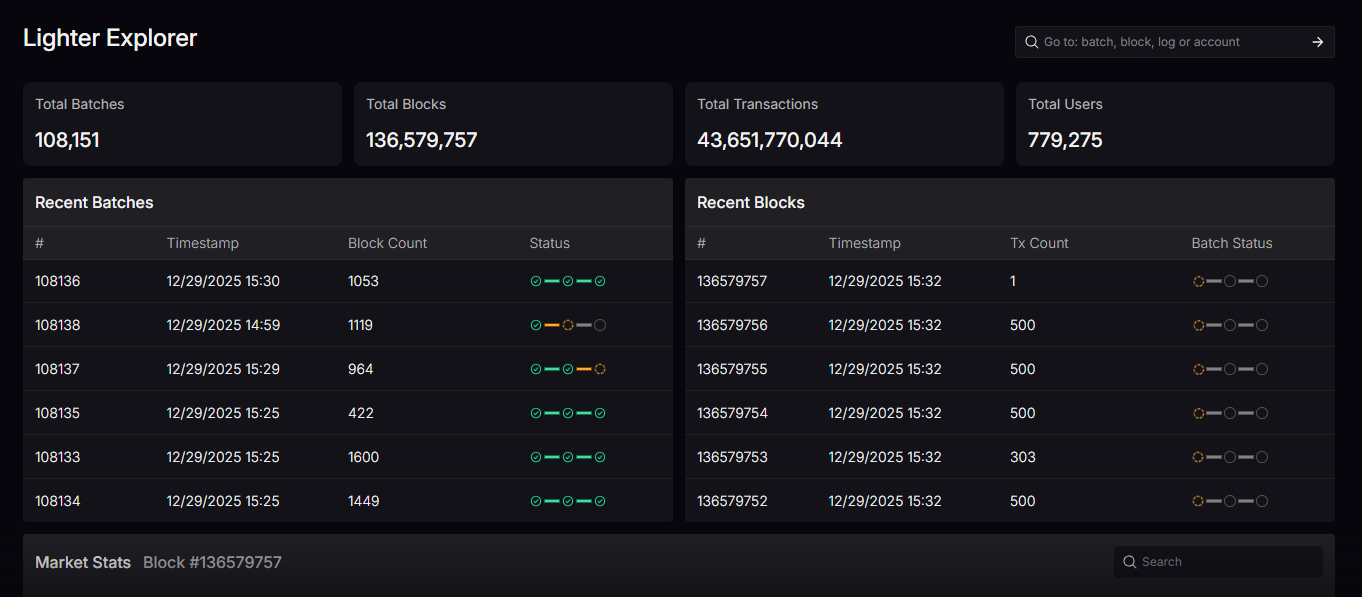

Lighter is a decentralized perpetual futures exchange that went public in 2025, founded by Vladimir Novakovski, who comes from a high-frequency trading background. By 2025, Lighter has grown to 779K+ users, processes roughly $2.5B in daily trading volume, and holds around $600M in TVL, placing it firmly among the most active perp DEXs today.

Lighter is clearly designed with perpetual futures trading as the priority. Lighter supports 117+ futures contracts with up to 50x leverage, all settled in USDC, with no USDT pairs. Spot trading is intentionally limited, currently offering only an ETH/USDC market. On the infrastructure side, it connects to Ethereum, Arbitrum One, Base, Solana, Avalanche C-Chain, and HyperEVM, making it easy for traders already operating across major ecosystems.

From a cost perspective, Lighter uses a zero-fee retail model for lower trading volumes, while higher-volume and professional traders pay fees in exchange for reduced rate limits and lower latency. The platform also offers public liquidity pools with variable yields, advertised around 26% APR, though returns depend on market conditions.

What ties this together is Lighter’s focus on provable execution, using ZK proofs on an Ethereum L2 to verify order matching and liquidations, aiming to make execution behavior auditable rather than assumed.

Lighter Pros and Cons

| 👍 Lighter Pros | 👎 Lighter DEX Cons |

|---|---|

| ✅ Non-custodial, self-custody by design | ❌ Latency higher on free tier |

| ✅ Zero trading fees for retail | ❌ Limited spot market selection |

| ✅ Fully decentralized | ❌ Discord-only customer support |

| ✅ Multi-asset markets beyond crypto | ❌ No mobile app |

| ✅ No-KYC | |

| ✅ Ethereum L2 security inheritance | |

| ✅ Provable execution using ZK proofs |

Lighter KYC and Sign-up

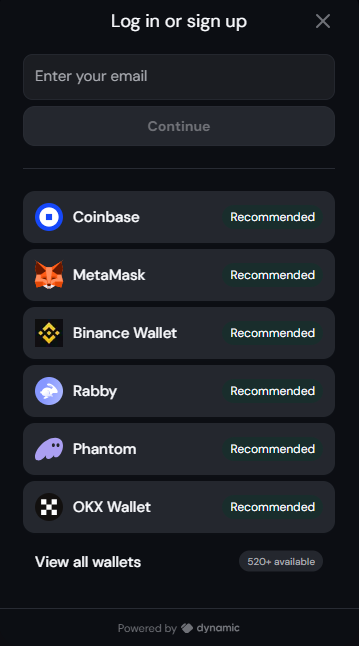

Getting started on Lighter is fairly simple. The platform does not require KYC, so users can begin trading by connecting a Web3 wallet directly. Wallets that support Ethereum and EVM-compatible networks work best with Lighter. Common options include MetaMask and Trust Wallet, both of which support networks like Ethereum and Arbitrum. Once a wallet is connected, users can fund their account and start trading without additional registration steps.

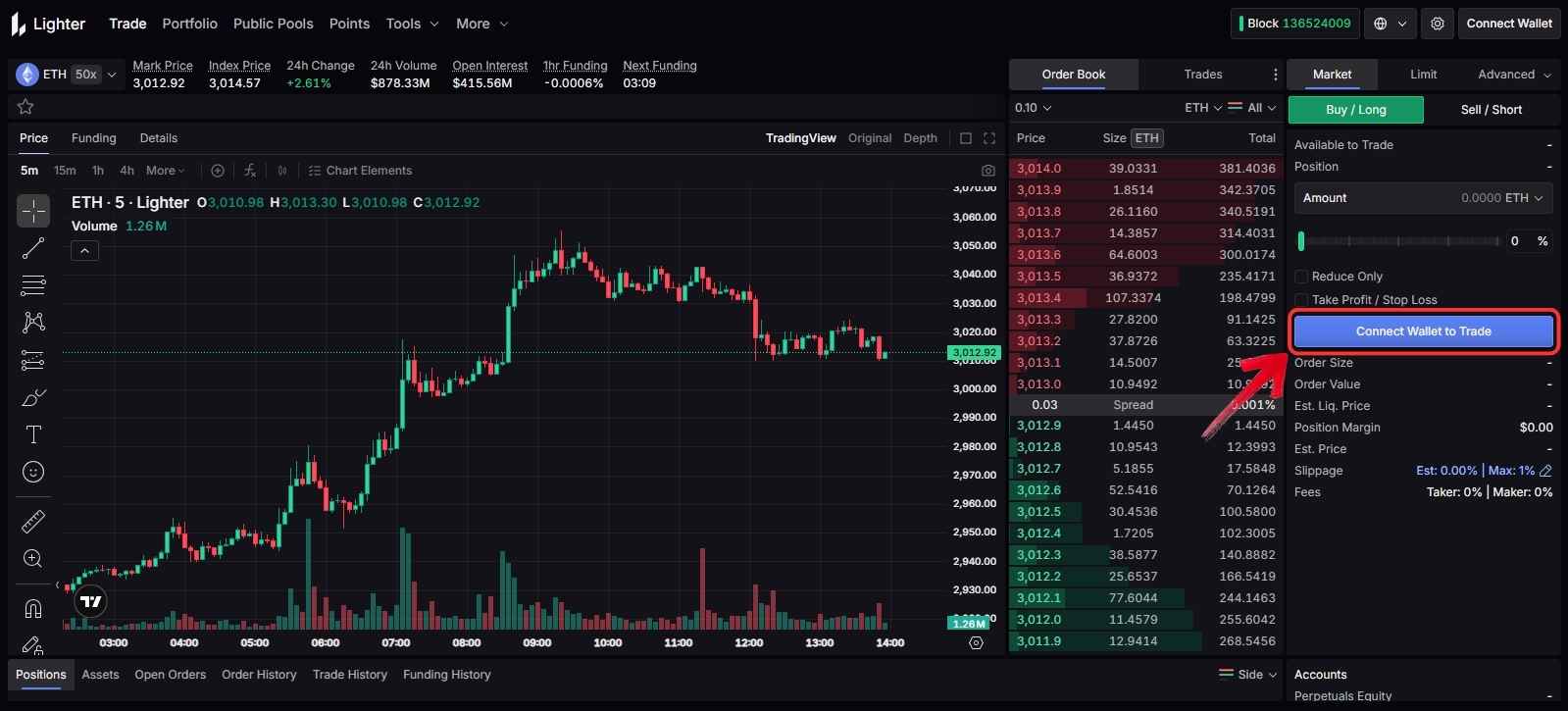

Step 1: Open your browser and navigate to the Lighter app on your preferred browser.

Step 2: Click on the “Connect Wallet to Trade” button to connect your Web3 wallet to Lighter.

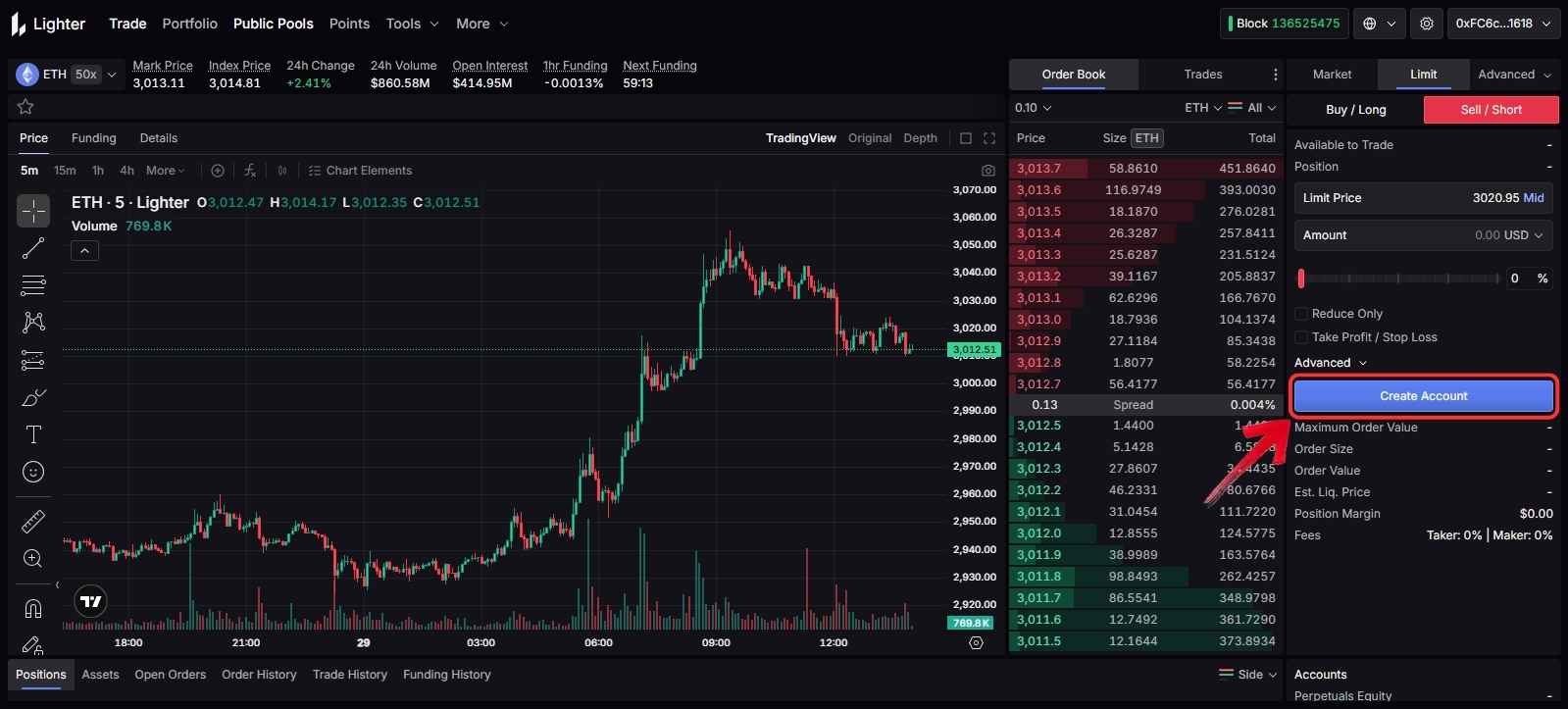

Step 3: Once your wallet is connected, click “Create Account” and deposit funds to start trading on Lighter.

You can fund your Lighter account using USDC or ETH. Funds can be added in two ways. You may first deposit assets into your Web3 wallet and then transfer them to your Lighter account, or you can deposit directly from a centralized exchange if that is more convenient.

To deposit USDC, it must be on one of Lighter’s supported networks, including Base, Arbitrum, Solana, HyperEVM, or Avalanche C-Chain.

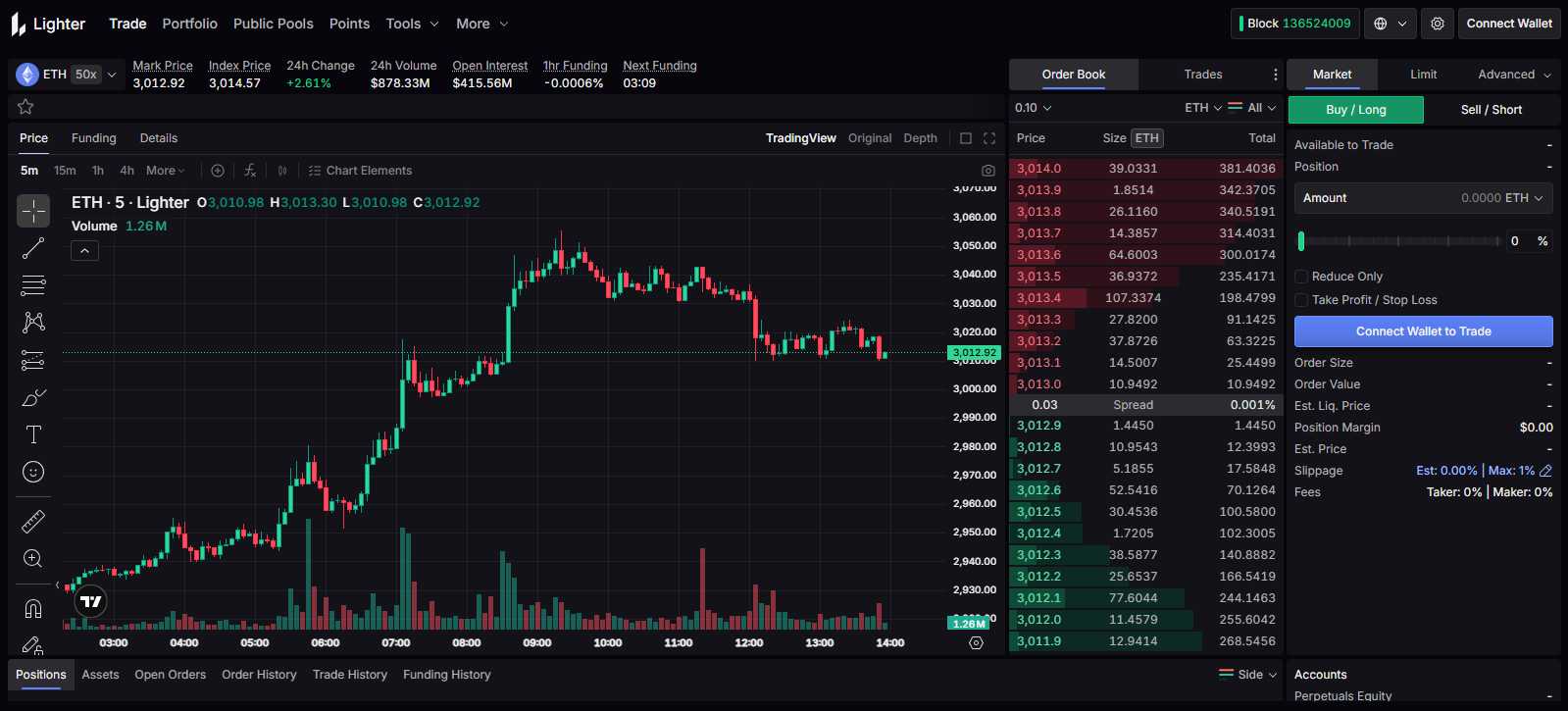

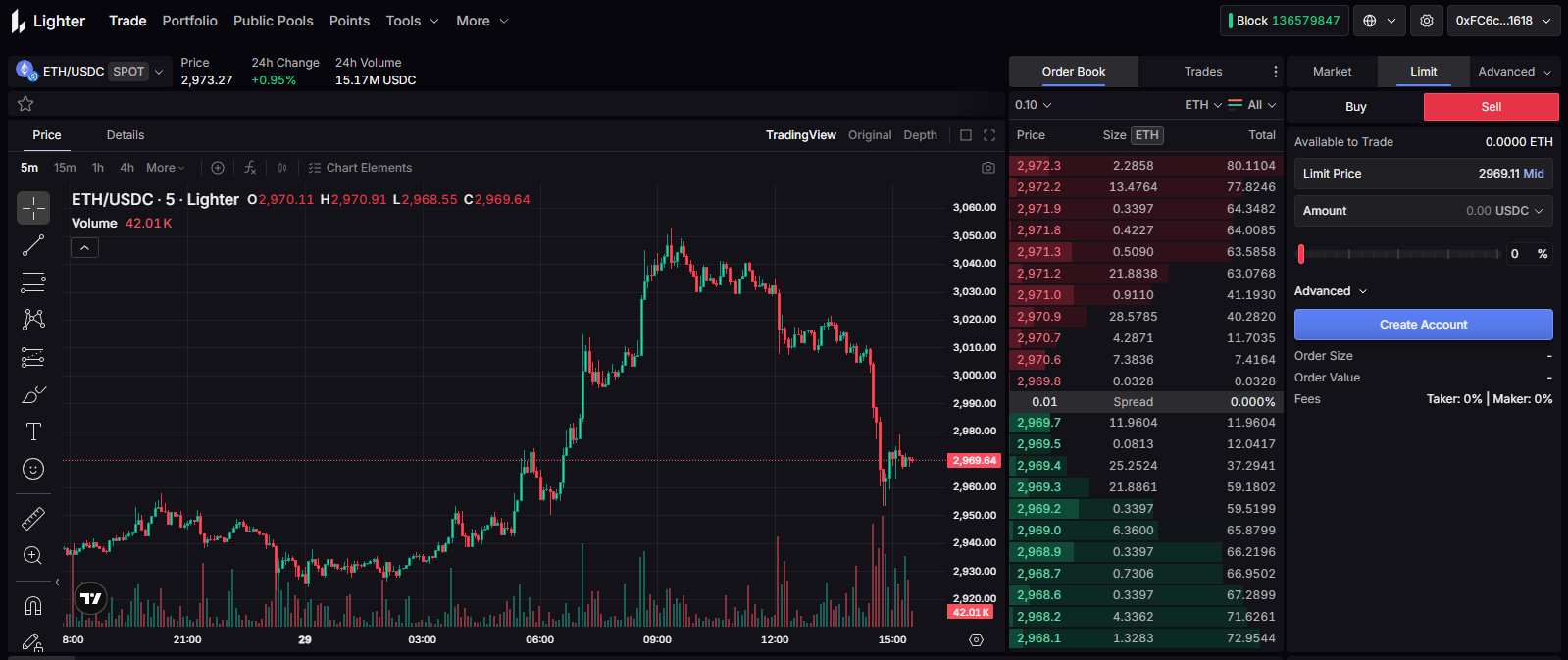

Lighter Trading

Trading on Lighter is built around an advanced, professional-style trading interface. The trading panel includes all core components, such as real-time charts powered by TradingView, an order book, open positions, and execution controls. Charts support indicators and drawing tools, and the interface itself can be customized using drag-and-drop panels. The platform is available in 7+ languages, catering to an international user base.

Lighter offers 117+ perpetual futures contracts with up to 50x leverage across multiple asset classes. Alongside crypto markets, traders can access contracts tied to forex, equities, and commodities. Spot trading is limited by design and currently includes a single ETH/USDC market.

The exchange supports a wide range of order types. Basic options include Market and Limit orders, while advanced orders include Stop Market, Stop Limit, Take Profit Market, Take Profit Limit, TWAP, and Scale orders. Execution behavior can be refined using time-in-force settings, such as Good Till Time and Immediate or Cancel. Liquidity on major markets is supported by professional market makers, helping maintain competitive bid-ask spreads under normal trading conditions.

Deposit and Withdrawal Methods

Deposits and withdrawals on Lighter are handled entirely on-chain. Users can deposit USDC or ETH, with USDC being the primary settlement asset for trading. Lighter supports deposits across several networks, including Ethereum, Arbitrum One, Base, Solana, Avalanche C-Chain, and HyperEVM.

In practice, EVM-compatible networks work best, especially Ethereum, Arbitrum, and Base, as they integrate smoothly with most Web3 wallets and offer consistent tooling. Users can fund their account either by transferring assets from a connected wallet or by depositing directly from a centralized exchange.

Lighter does not charge protocol-level fees for deposits or withdrawals. Users only pay standard network gas fees. For wallet setup and security best practices, it’s recommended to review a reliable hot wallet guide before moving funds on-chain.

Lighter DEX Fees

Next, let’s look at the fees you may encounter while using Lighter, including trading, deposits, and withdrawals.

Trading Fees

Lighter uses a tiered fee and latency model rather than a flat trading fee, where execution speed, not commissions, is the main differentiator between accounts.

The default Standard account charges 0% maker and taker fees but operates with higher latency, with maker orders around 200ms, taker orders near 300ms, and cancellations roughly 100ms. This tier is designed for retail or latency-insensitive trading, where visible fees are minimized but execution quality can vary during fast markets. This fee structure shifts part of the trading cost into execution quality, a trade-off explored in more detail in our 0% trading fees breakdown.

The opt-in Premium account introduces explicit fees of 0.002% maker and 0.02% taker in exchange for faster execution. Maker and cancel orders are processed with effectively zero latency, while taker orders see latency closer to 150ms. This tier targets higher-volume and latency-sensitive traders and supports volume-based incentive programs.

Spot Fees

0.00% Maker

0.00% Taker

Future Fees

0.00% Maker

0.00% Taker

Deposits and Withdrawals

Lighter does not charge any protocol-level fees for deposits or withdrawals. Users only pay the standard network gas fees associated with the chain they use, such as Ethereum or other supported networks. The minimum deposit requirement is relatively low, set at 5 USDC or 0.001 ETH, making it accessible for smaller traders. Trading fees remain separate from this, with standard accounts paying zero maker and taker fees, while premium accounts incur fees in exchange for faster execution.

Lighter DEX Products and Services

Next, let’s take a look at what else Lighter has to offer beyond trading.

Lighter DEX Trading Experience

The trading experience on Lighter is designed to feel familiar to active traders while remaining accessible to new users. Standard accounts can trade with 0% maker and taker fees, which lowers the entry barrier for testing strategies or smaller position sizes. More experienced traders can opt into the Premium tier, paying 0.002% maker and 0.02% taker fees in exchange for faster execution, reduced latency, and more consistent bid-ask spreads during volatile conditions.

The interface is fully customizable, allowing users to arrange charts, order books, and trading tools through simple drag-and-drop controls. TradingView charts are integrated with indicators and drawing tools. Beyond crypto perps, Lighter also offers contracts linked to forex, commodities, and equities. A public testnet is available as well, giving users 500 testnet USDC to explore the platform without real capital.

Earn

The Earn section on Lighter shows a wide range of outcomes across public pools, with APR varying significantly based on strategy, market conditions, and operator behavior. Protocol-managed pools such as the Lighter Liquidity Provider (LLP) have historically delivered more stable returns, with APRs in the mid-20% range, while community-run pools display much higher dispersion. Some user pools report triple-digit APRs during favorable periods, while others experience drawdowns, reflected in negative APR and lower Sharpe ratios.

Lighter Explorer

Lighter Explorer provides onchain transparency into how the protocol operates in real time. Users can track batches, blocks, transactions, and total user activity, along with market-level data such as prices, open interest, and funding rates. This allows traders to independently verify execution activity and monitor overall network usage.

Lighter DEX Security

Lighter focuses on provable security through a zk-rollup architecture built on Ethereum, using Arbitrum as its execution layer. Core exchange actions, including order matching, executions, and liquidations, are verified using custom zero-knowledge proofs. This design allows participants to independently verify correctness without relying on a centralized operator.

The protocol is non-custodial, meaning users retain control of their funds. It also includes recovery mechanisms such as reconstructable exits via Ethereum and an emergency exit hatch that allows withdrawals if the sequencer becomes unavailable.

Lighter has undergone multiple external security audits, including reviews by Nethermind for core contracts and the deposit bridge, and zkSecurity for its ZK circuits. Identified issues were addressed, and audit reports are publicly available. As of late 2025, no hacks or fund losses have been reported. While the platform has experienced occasional technical outages, these incidents did not compromise user funds.

Lighter DEX Customer Support

Lighter does not provide traditional customer support channels such as email tickets, phone assistance, or live chat. Support is primarily handled through its official Discord server, where users can ask questions and report issues. Documentation at docs.lighter.xyz serves as the main self-help resource for trading, fees, and technical topics.

User feedback suggests that response times on Discord can be inconsistent, with moderators having limited authority to resolve account-specific issues. During periods of high activity or outages, communication has also been described as slower than expected. This community-driven model is common in DeFi, but it may not suit users who expect centralized, real-time support.

Lighter Vs. Aster Vs. Hyperliquid

Lighter focuses on execution correctness rather than just custody. Built on Ethereum L2, it uses zero-knowledge proofs to verify orders, cancellations, and liquidations, pairing this with a zero-fee retail model where execution speed becomes the primary trade-off.

Hyperliquid prioritizes raw performance. Running on a custom Layer 1, it offers ultra-low latency, deep liquidity, and a trading experience closest to centralized exchanges, making it attractive for high-frequency and size-sensitive traders.

Aster positions itself around versatility. It supports perps, spot, forex, and equities across multiple chains, with higher leverage options and trading tools like grid bots, appealing to traders who want broader market exposure.

In short;

- Lighter: Ethereum L2 perp DEX focused on provable execution, verifiable trading, and zero-fee retail access.

- Hyperliquid: Custom L1 perp DEX focused on ultra-low latency, deep liquidity, and execution speed.

- Aster DEX: Multi-chain DEX offering perps, spot, forex, and extreme leverage with grid trading tools.

| Feature | Aster | Hyperliquid | Lighter |

|---|---|---|---|

| Established | 2025 | 2024 | 2024 |

| Spot Fees (Maker/Taker) | 0.10% / 0.04% | 0.04% / 0.07% | 0.00% / 0.00% |

| Futures Fees (Maker/Taker) | 0.010% / 0.035% | 0.015% / 0.045% | 0.00% / 0.00% |

| Max Leverage | 1001x | 50x | 50x |

| KYC Required | No | No | No |

| Supported Cryptos (Spot) | 8+ | 238+ | 1 (ETH/USDC) |

| Futures Contracts | 93+ | 173+ | 117+ |

| No KYC Withdrawal Limit | Unlimited | Unlimited | Unlimited |

| 24h Futures Volume | $4.07B+ | $1.84B+ | $2.51B+ |

| Key Features | • 1001x leverage (BTC/ETH) • Grid trading & mobile app |

• Custom L1 chain • Zero gas fees • Vaults + HYPE staking |

• Ethereum L2 (zk-rollup) • Provable execution • Zero-fee retail trading |

| Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

Lighter is built for traders who care about execution correctness, transparent mechanics, and Ethereum-aligned security. Its use of zero-knowledge proofs, non-custodial design, and support for multiple asset classes make it a strong option for structured, onchain futures trading. The platform favors verifiability and risk controls over raw speed, which may not suit every trading style.

If you value provable execution and composability, Lighter is worth considering. If you prioritize ultra-low latency, deeper liquidity, or different leverage profiles, other platforms may fit better. Rather than forcing a single choice, we recommend comparing Lighter alongside other leading platforms in our best perpetual DEX guide, where different trading priorities are broken down side by side.

FAQs

1. What are the trading fees on Lighter?

Standard accounts trade with 0% maker and taker fees. Premium accounts pay 0.002% maker and 0.02% taker for faster execution. Deposits and withdrawals only incur network gas fees.

2. What is the minimum deposit and how do I get started?

The minimum deposit is 5 USDC or 0.001 ETH. Connect a Web3 wallet at app.lighter.xyz, deposit supported assets, and start trading. No KYC is required.

3. What leverage and order types does Lighter support?

Lighter supports up to 50x leverage and offers market, limit, stop, take profit, TWAP, and advanced order types.

4. How does Lighter compare to Hyperliquid or dYdX?

Lighter focuses on provable execution and zero retail fees, while competitors often lead in liquidity and raw trading volume.

5. Is Lighter safe?

No major hacks or fund losses have been reported. Lighter is non-custodial, audited, and secured with zk-based verification, though trading risks still apply.