- •Zero trading fees don’t remove costs, they shift them into execution quality.

- •Latency and order priority affect fills, slippage, and realized entry or exit prices.

- •Over many trades, hidden execution costs can outweigh transparent maker and taker fees.

The idea of 0% trading fees has become one of the most effective hooks in crypto trading. As perpetual DEX competition increased in 2024 and 2025, fee compression became inevitable. Exchanges needed a simple message that could travel fast across social feeds, dashboards, and referral pages. Removing visible fees solved that problem instantly. But visible fees were never the full cost of trading. They were just the easiest part to point at.

How Zero-Fee Models Actually Work

Zero-fee trading does not exist in isolation. Exchanges still need to monetize order flow, manage infrastructure costs, and attract professional liquidity. When fees disappear, pricing shifts into execution mechanics, particularly latency and order handling priority.

In practice, this means not all users interact with the market at the same speed. Orders submitted by different accounts arrive at the matching engine with measurable delays. During that time, prices continue to change, liquidity adjusts, and faster participants react. The result is that slower orders are more likely to be filled at slightly worse prices, even if no explicit fee is charged.

This structure is subtle, which is why it works. The cost does not appear as a deduction. It appears as slippage, missed fills, or marginally worse execution that only becomes obvious when measured over many trades rather than one.

Latency as an Invisible Trading Cost

Latency sounds technical, but its financial impact is straightforward. In volatile markets, prices move continuously. Even modest volatility implies small price changes every second, and when execution is delayed by a few hundred milliseconds, trades interact with a different version of the market than the one the trader intended.

Research into market microstructure shows that informed participants tend to extract value from slower flow. When faster traders see price movement first, they adjust positions or remove liquidity before slower orders arrive. This creates adverse selection, where slower traders are more likely to trade at moments that favor the counterparty.

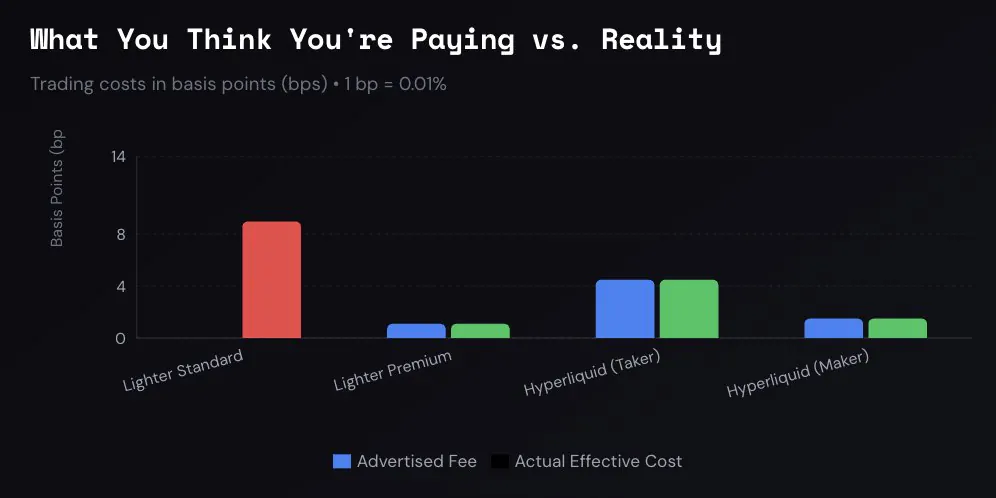

The chart below illustrates how advertised fees differ from real execution costs across popular perpetual DEXs.

Over time, these small differences add up. A trader who places many orders may lose more through execution drag than they would have paid through transparent fees. The cost is real, even if it never appears on a fee schedule.

Platforms like Lighter make this trade-off explicit by pairing zero retail trading fees with tiered execution speeds, shifting the real cost of trading from commissions to order handling priority.

Who Zero-Fee Trading Favors

Zero-fee models tend to favor two groups. The first is the exchange, which can increase adoption while monetizing execution quality instead of commissions. The second is professional or latency-sensitive traders who pay explicit fees in exchange for faster order handling and more predictable fills.

Retail traders gain simplicity and lower friction at entry, but they also become the least time-sensitive layer of the market. Their activity helps shape price discovery, while faster participants optimize around it. This is not inherently unfair, but it is rarely explained clearly.

For low-frequency traders, occasional users, or those testing strategies, zero-fee access can still make sense. Execution differences may be negligible at small scale. For active traders, however, execution quality often matters more than the absence of fees.

Execution Costs Still Matter

The core point is not that zero-fee platforms are bad. It is that 0% trading fees do not remove trading costs. They change how those costs are paid. Instead of commissions, traders pay through execution quality, timing, and order priority.

Understanding this trade-off matters more than comparing fee tables. Different platforms optimize for different behaviors, and no single model fits everyone. Traders evaluating zero-fee venues should look beyond marketing labels and consider how orders are handled in real market conditions.

For readers comparing execution models, fee structures, and liquidity profiles across platforms, reviewing alternatives side by side in a broader best perpetual DEX guide provides a clearer framework than focusing on one headline number alone.

![How to Change the Language in Phantom [2026]](https://www.cryptowinrate.com/wp-content/uploads/2026/02/How-to-Change-the-Language-in-Phantom-2026-1024x576.jpg)