- •Aster DEX is a multi-chain, non-custodial exchange supporting Ethereum, BNB Chain, Arbitrum, and Solana.

- •No KYC required, simply connect a Web3 wallet to start trading.

- •Offers spot, perpetuals, forex, and stock markets with leverage up to 1001x on BTC/ETH.

- •Competitive trading fees: 0.10%/0.04% for spot and 0.010%/0.035% for perpetuals.

- •Grid trading with 80+ pre-built bots and support for custom bot creation.

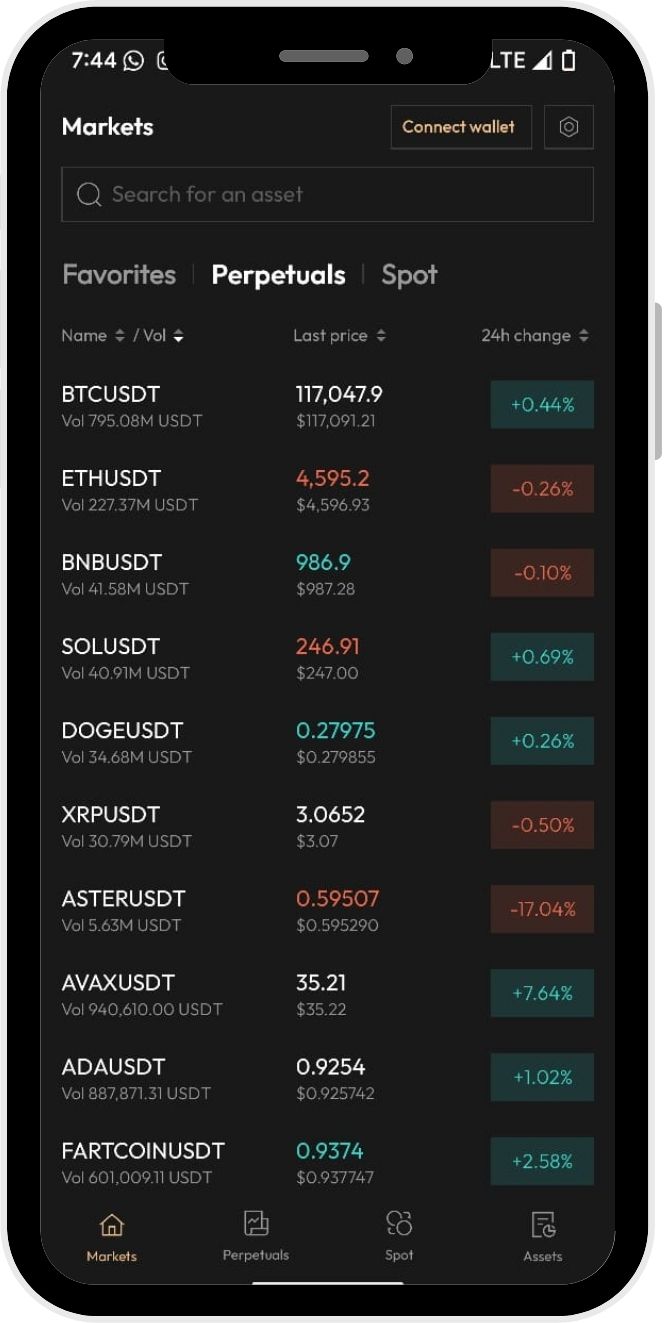

- •Mobile app available for Android.

- •Privacy-focused tools like hidden orders help reduce MEV exposure.

We’ve seen crypto evolve from Bitcoin crossing $100k to the entire market reaching trillions in market cap. With that growth, it was inevitable that exchanges, the gateways for users to access these digital assets, would also evolve. Aster DEX, a non-custodial trading platform, has gained attention with daily trading volume doubling after Binance co-founder CZ named it Hyperliquid’s top competitor.

But hype only goes so far. What really matters is whether a platform delivers value to its users. In this Aster DEX review, we’ll break down its features, fees, products, and performance so you can see if it’s worth your time.

| Stats | Aster DEX |

|---|---|

| 🚀 Founded | 2025 |

| 🔎 Founder | Unknown |

| 👤 Active Users | 2M+ |

| 🪙 Spot Cryptos | 8+ |

| 🪙 Futures Contracts | 93+ |

| 🔁 Spot Fees (maker/taker) | 0.04% / 0.10% |

| 🔁 Futures Fees (maker/taker) | 0.005% / 0.040% |

| 📈 Max Leverage | 1001X |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.7/5 |

Aster DEX Overview

Aster DEX is powered by Aster Chain, registered in Mahé, Seychelles, backed by YZi Labs (affiliated with Binance Labs), and led by CEO Leonard. The exchange was created following the merger of Astherus and APX Finance, with its rebrand finalized on March 31, 2025.

Aster DEX is a multi-chain, non-custodial Perp DEX platform that offers perpetual, spot, and 1001x trading. Users can trade 93+ perpetual contracts with up to 100x leverage at fees of 0.010% maker and 0.035% taker. Spot trading supports more than 8+ crypto pairs with fees of 0.10% maker and 0.04% taker, while 1001x mode currently supports BTC and ETH with up to 1000x leverage. The platform also lists forex and stock markets.

According to DefiLlama, Aster DEX recently crossed $1.1B in daily trading volume, with over 2 million users, and its TVL continues to climb steadily, indicating growing user participation. Additional features include grid trading, a mobile application, and privacy tools such as hidden orders aimed at reducing MEV exposure. The platform’s native token, ASTER, is used for governance, rewards, and ecosystem participation.

Aster DEX provides a single venue for multi-chain trading with derivatives and yield features, positioning it as a direct competitor to other decentralized perpetual exchanges such as Hyperliquid.

Aster DEX Pros and Cons

| 👍 Aster DEX Pros | 👎 Aster DEX Cons |

|---|---|

| ✅ No KYC required, trade directly with your wallet | ❌ Liquidity still catching up with top players like Hyperliquid |

| ✅ Wide mix of markets: spot, perpetuals, forex, and stocks | ❌ Fewer spot trading options |

| ✅ Fully decentralized | ❌ No fiat support |

| ✅ Competitive trading fees | ❌ iOS app not yet available |

| ✅ Self custody (DEX) | |

| ✅ High leverage | |

| ✅ Grid trading bots with 80+ pre-built strategies | |

| ✅ Earn program with staking and USDF stablecoin liquidity pools | |

| ✅ Fully functional Android mobile app |

Aster DEX KYC and Sign-up

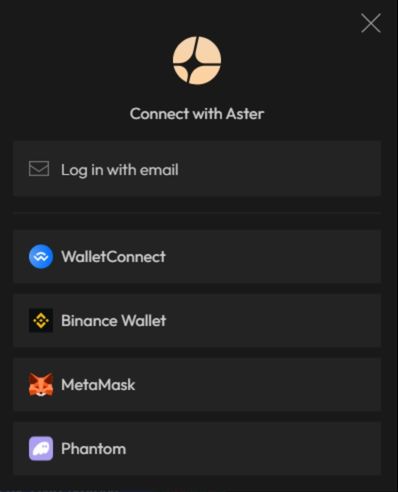

Since Aster DEX is a decentralized perpetual exchange, it does not require any KYC. To start trading, users simply connect a Web3 wallet to the Aster app.

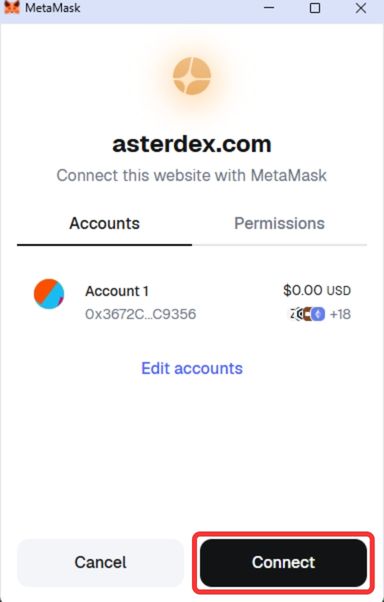

Currently, Aster DEX supports four networks; Ethereum, BNB Chain, Arbitrum, and Solana, so you will need a Web3 wallet that supports one of these chains. MetaMask is a convenient choice as it supports all four. Here’s how to get started:

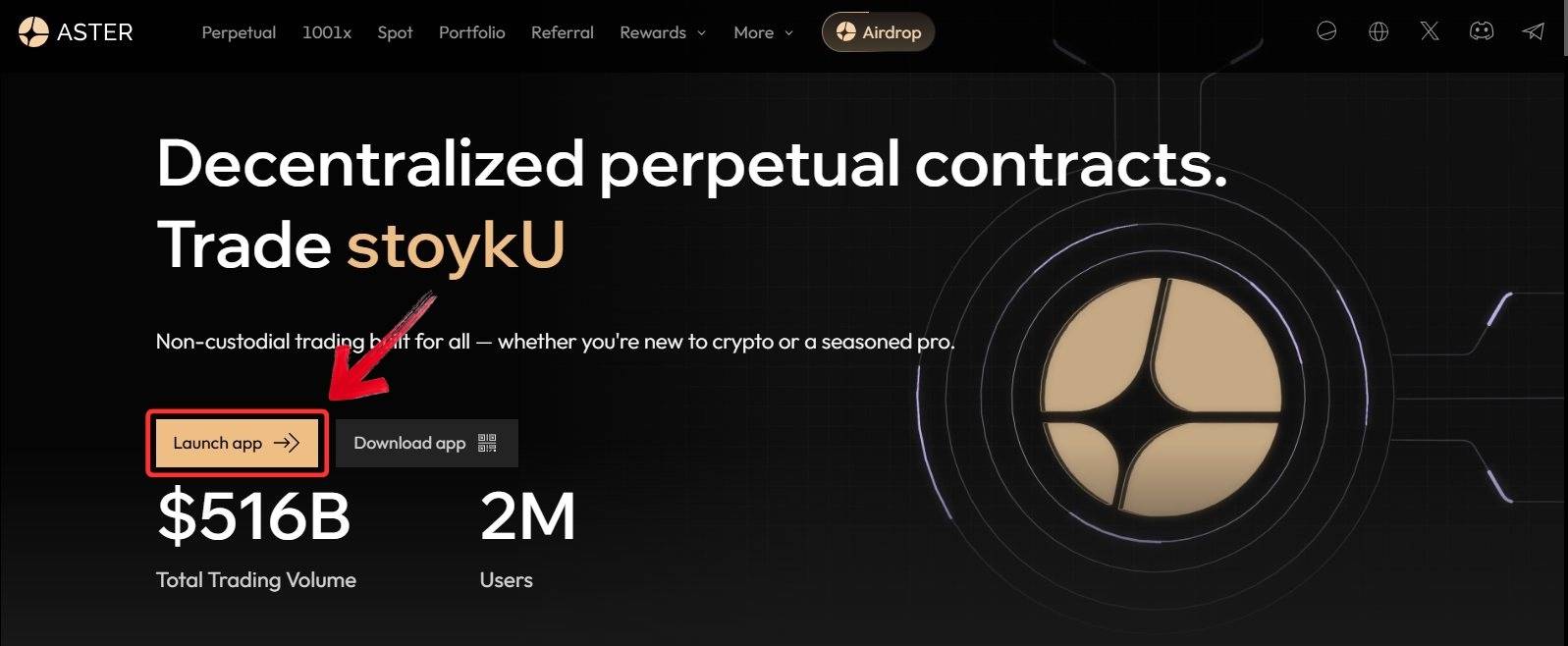

Step 1: Go to the official Aster DEX website in your browser and click “Launch App”.

Step 2: Click the “Connect Wallet” button in the top-right corner.

Step 3: From the list of supported wallets, select the wallet you want to connect.

Step 4: If you are using MetaMask, a pop-up will appear asking for permission to connect. Click “Connect” to proceed.

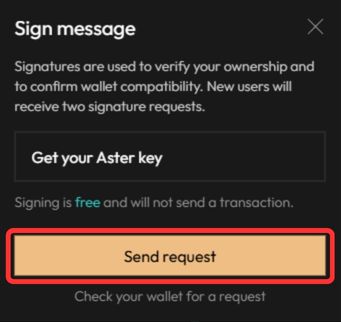

Step 5: You will be prompted to generate your Aster Key, which allows Aster DEX to approve your trade requests and enable frictionless trading. Click “Send Request”.

Step 6: Approve the signature request in your wallet pop-up by clicking “Confirm”. This creates your Aster DEX account.

Once your wallet is connected, you can trade perpetuals, spot pairs, or use staking features on Aster DEX, all without VPN or KYC.

Aster DEX Trading

Aster DEX offers both spot and perpetual trading with a clean, TradingView-powered interface that shows order books, trading tools, and charts on a single screen. The platform supports four major networks; Ethereum, BNB Chain, Arbitrum, and Solana, making it accessible for a wide range of users.

Traders can use USDT collateral or switch to multi-asset mode to trade with other supported cryptocurrencies, including restaked tokens, as margin. The minimum order size is $5 or equivalent. Order types include Market and Limit, along with advanced ones such as Stop Limit, Stop Market, Post Only, and Trailing Stop. Aster DEX also supports hidden orders, allowing traders to place limit orders without publicly revealing their size. Modifiers like TP/SL, Reduce Only, and Time-in-Force (GTC, IOC, FOK) are available for precise order execution.

Also read: How to Trade on Aster DEX

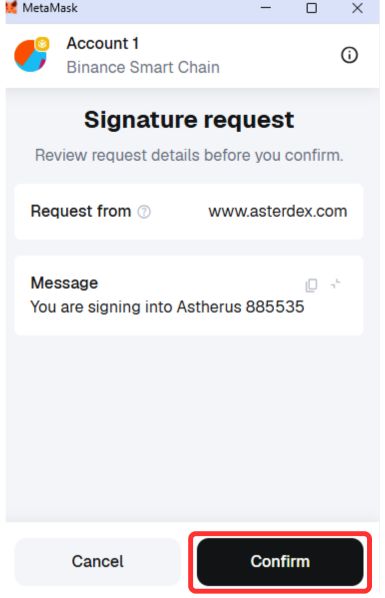

Spot Trading

Aster DEX offers a selection of 8+ spot crypto pairs for users looking to swap tokens directly on-chain. While the liquidity depth is more limited compared to major centralized exchanges, the platform compensates with low fees; 0.10% maker and 0.04% taker, which keep trading costs minimal.

The interface is simple and uses TradingView charts, making it easy to monitor price action, place market or limit orders, and track filled trades. Spot trading on Aster is designed for straightforward transactions rather than high-frequency execution, making it most suitable for casual traders or those looking for basic token swaps.

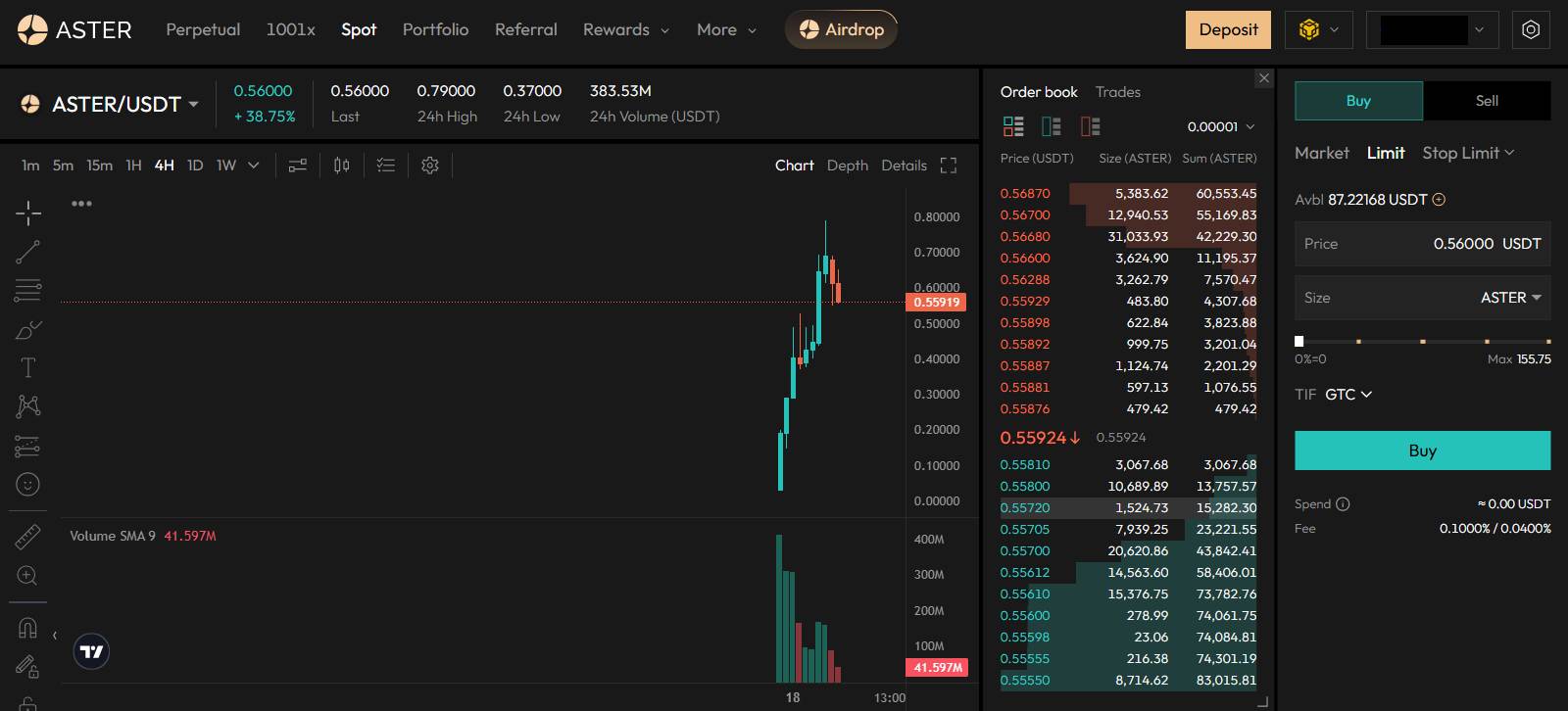

Perpetual Trading

Aster DEX supports 93+ perpetual contracts with leverage of up to 100x on supported pairs and highly competitive fees; 0.010% maker and 0.035% taker. The exchange also offers exposure to forex and stock markets, giving users a wider range of assets to trade.

For high-risk traders, Aster includes a 1001x mode for BTC and ETH, enabling extreme leverage trades with one-click execution. The perpetual interface is powered by TradingView charts and features order books, advanced order types (Stop Limit, Trailing Stop, Post Only), and TP/SL options, allowing users to manage risk and execute trades with precision.

Deposits and Withdrawals Methods

Since Aster DEX connects directly to your Web3 wallet, you can fund your wallet using on-chain transfers or fiat ramps like MetaMask’s card purchase option. Once funded, you must transfer assets to Aster DEX via a supported network, currently BNB Chain, Ethereum, Arbitrum, and Solana. Withdrawals work the same way, sending funds back to your wallet, where you can move or cash out as needed.

Also read: How to Make Deposits and Withdrawals on Aster DEX

Aster DEX Fees

Fees play an important role when trading on any DEX, as users must consider both platform trading fees and network gas fees for deposits, withdrawals, and trade execution.

Trading Fees

Aster DEX charges flat fees across both spot and perpetual markets. Spot trades are charged 0.10% maker and 0.04% taker, while perpetual contracts carry 0.035% maker and 0.01% taker fees. These rates are competitive compared to most decentralized perpetual exchanges. The platform’s native token, ASTER, is used mainly for governance and ecosystem rewards, but holding or staking it does not currently provide any fee discounts.

Spot Fees

0.10% Maker

0.04% Taker

Perpetual Fees

0.010% Maker

0.035% Taker

Deposits and Withdrawals Fees

Deposits on Aster DEX are free, and users only pay the network gas fees required by the blockchain. Withdrawals have a flat $0.10 fee per transaction, regardless of the amount being withdrawn. Internal transfers between Spot and Perpetual accounts are instant and free of charge, allowing users to move funds within the platform without incurring any additional costs.

Aster DEX Products and Services

When it comes to products and services, Aster DEX offers more than just its spot and perpetual trading platform. In addition to its core markets, the exchange includes features designed to enhance the trading experience and give users more ways to interact with their funds.

Aster DEX Trading

Aster DEX offers a range of tools for spot and perpetual trading, with up to 100x leverage on perpetual contracts. Traders can use advanced order types like Stop Limit, Stop Market, Post Only, Trailing Stop, and hidden orders to keep order size private. The platform also supports forex and stock trading, giving users exposure beyond crypto.

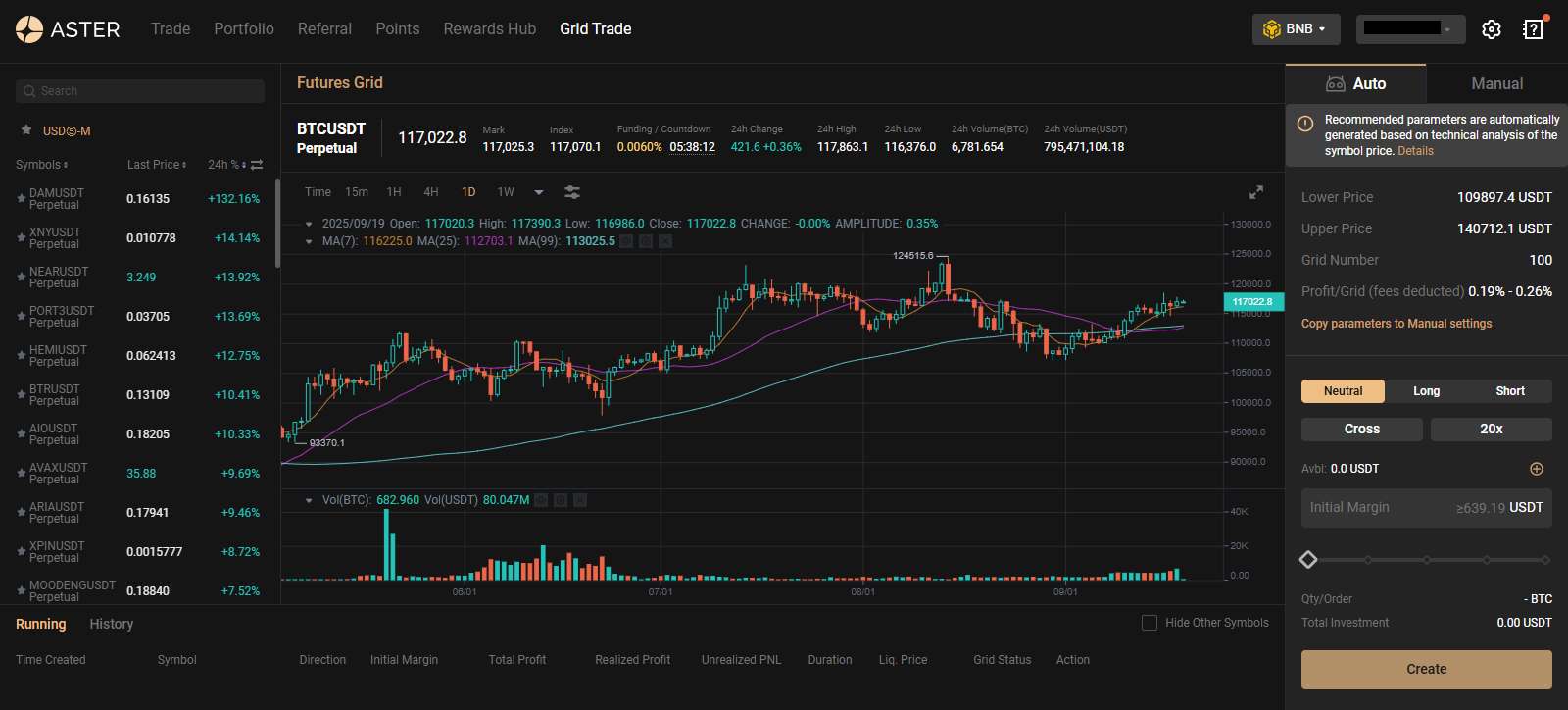

For higher-risk strategies, the 1001x mode allows extreme leverage trading on BTC and ETH. Aster also includes grid trading tools, letting traders automate orders across a price range to capture volatility. Together, these tools make Aster DEX suitable for both simple trades and more advanced strategies.

Mobile App

Aster DEX offers a fully functional Android app, one of the few perpetual DEXs with a dedicated mobile experience. The app provides access to both spot and perpetual markets, allowing users to place and manage trades on the go. However, it is not yet available on iOS. The app currently lacks built-in chat support or additional security features like 2FA, so users must rely on their wallet’s security setup.

Grid Trading

Aster DEX offers over 80+ pre-built futures grid bots, tested with historical strategies for automated trading. Users can also create and deploy their own custom grid bots directly on the platform. The same futures trading fees and leverage options apply, allowing traders to capture price volatility with minimal manual intervention.

Aster Token

Aster’s native token, $ASTER, is a BEP-20 token on Binance Smart Chain and the core driver of the Aster ecosystem. It powers governance, rewards users for participation, and funds ecosystem growth. $ASTER plays a role in decentralizing decision-making while supporting staking and future incentive programs. First introduced during its Token Generation Event (TGE), it anchors Aster DEX’s long-term vision of building a fast, flexible, and community-first DeFi platform.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

Earn

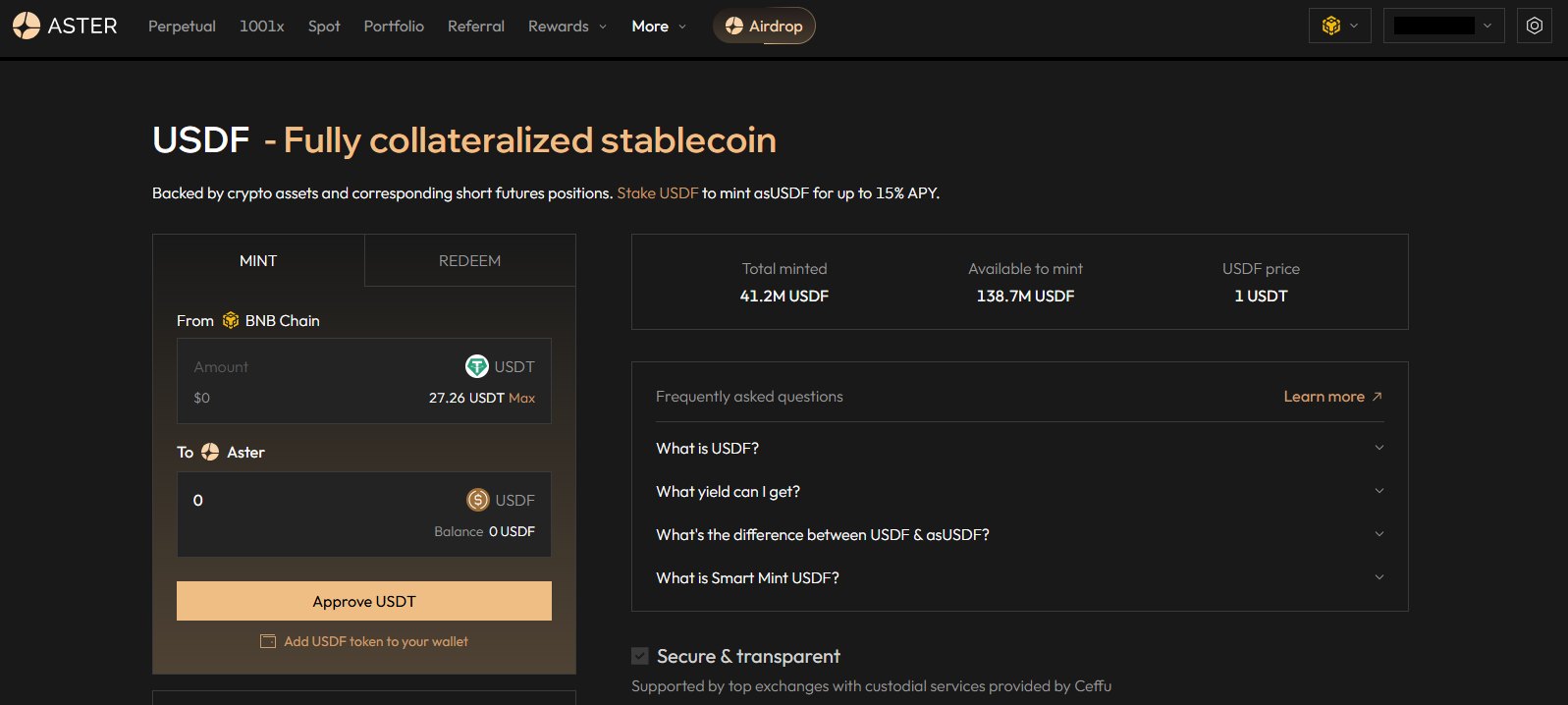

Aster DEX supports 5+ assets that users can mint and stake in the Aster Earn pool to earn yield and AU points, which count toward eligibility for Aster’s airdrop round 2. The platform also issues USDF, a fully collateralized stablecoin backed by crypto assets and hedged with short perpetual positions, offering yields of up to 15% when providing liquidity.

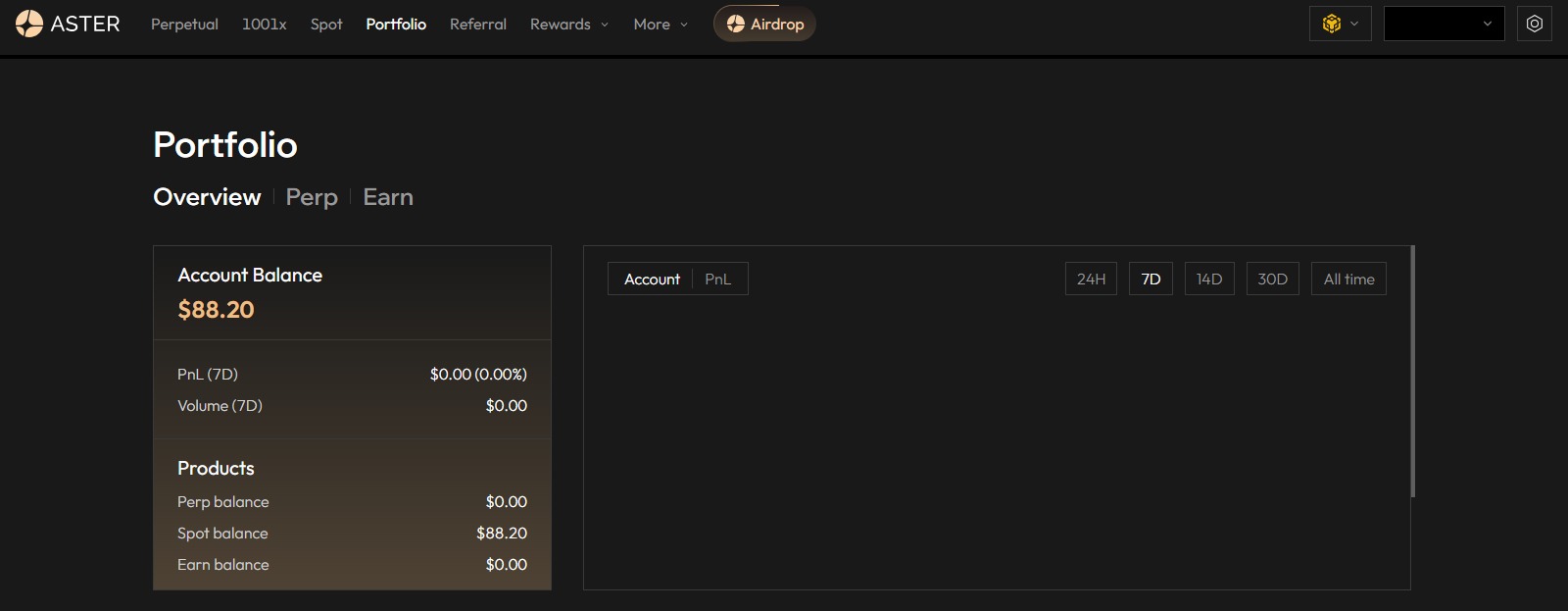

Aster DEX Portfolio

The Portfolio tab provides an overview of your entire Aster account, including PnL, trading volume, and performance metrics. Users can view details for individual accounts like Perpetual, Spot, and Earn, making it easy to track positions and manage funds in one place.

Aster DEX Security

Aster DEX undergoes regular audits by Salus Security, with the latest report finding no high-severity issues and only one medium-risk centralization concern, which the team addressed by committing to implement multi-sig with timelocks. Four low-risk findings were either mitigated or acknowledged, including token pause behavior and oracle data concerns.

As a non-custodial platform, Aster DEX leaves full control, and responsibility, with users. Your wallet and private keys are your only access to funds. This improves security but also means lost keys or wrong approvals cannot be recovered. Users should bookmark the official site, avoid phishing links, and regularly review wallet approvals to reduce risk.

Aster DEX Customer Support

Aster DEX provides support through its Telegram and Discord communities, where users can interact with moderators and other traders. For specific issues, users can open a support ticket to get assistance. There is no email or live chat support available yet. Being a relatively new platform, support response times may vary, though helpful tutorials and guides are available to help new users get started quickly.

Aster DEX vs. Hyperliquid

Both Aster DEX and Hyperliquid are positioned as leading decentralized perpetual exchanges, but they cater to slightly different priorities.

Hyperliquid currently leads in terms of liquidity and trading volume, making it a preferred choice for larger traders. It runs on a custom Layer 1 chain, which allows frictionless trading and full decentralization. The platform offers more perpetual contracts, lower trading fees, and a wider range of order types. Users can also stake through HYPE staking or participate in vaults, adding yield opportunities. Leverage is capped at around 40x, which limits risk but offers lower capital efficiency compared to newer platforms.

Aster DEX, on the other hand, is newer but growing quickly, recently surpassing $1.1B daily volume. It allows up to 1000x leverage on BTC and ETH in its 1001x mode and offers access to spot trading, forex, and stocks, making it more versatile. The platform has a mobile app, grid trading tools, and more diverse staking options through Aster Earn, although its native token does not provide fee discounts. Liquidity is still building, and being new, the trust factor is developing, but it has strong backing from CZ and YZi Labs.

For traders prioritizing deep liquidity, low fees, and proven stability, Hyperliquid is the safer choice. Those seeking higher leverage, multi-asset markets, and a growing ecosystem may find Aster DEX more appealing.

| Feature | Aster DEX | Hyperliquid |

|---|---|---|

| Established | 2025 | 2024 |

| Spot Fees (Maker/Taker) | 0.10% / 0.04% | 0.04% / 0.07% |

| Futures Fees (Maker/Taker) | 0.010% / 0.035% | 0.015% / 0.045% |

| Max Leverage | 1001x | 50x |

| KYC Required | No | No |

| Supported Cryptos (Spot) | 8+ | 238+ |

| Futures Contracts | 93+ | 173+ |

| No KYC Withdrawal Limit | Unlimited | Unlimited |

| 24h Futures Volume | $483.92M+ | $2.78B+ |

| Key Features | • 1001x leverage (BTC/ETH) • Spot + Perps + Forex/Stocks • Grid trading & mobile app |

• Custom L1 chain • Zero gas fees • Vaults + HYPE staking |

| Sign Up | Sign Up | Sign Up |

Bottom Line

Aster DEX is still in its early stages but is building quickly, offering a mix of spot, perpetual, and even forex markets under one roof. The platform brings features like 1001x leverage, grid trading, and a mobile app, which make it appealing for traders who want flexibility. Hyperliquid remains ahead in terms of liquidity, maturity, and trust, so a direct comparison right now might not be fair. Still, Aster DEX shows strong signs of growth, and if you’re exploring newer DEXs or looking for something beyond the usual players.

That said, Aster DEX is gaining traction fast, its daily volume has been climbing steadily, and the backing from CZ and YZi Labs adds to its credibility. If you’re exploring fresh DEX options or want to get in early on a platform that’s still growing, Aster DEX can be worth checking out while keeping an eye on how its ecosystem and liquidity evolve in the coming months.

FAQs

1. Does Aster DEX require KYC?

No, Aster DEX does not require KYC. You can start trading by simply connecting a compatible Web3 wallet like MetaMask.

2. What networks does Aster DEX support?

Currently, Aster DEX supports four major networks: Ethereum, BNB Chain, Arbitrum, and Solana. Your funds must be on one of these chains to trade.

3. What is the minimum trade size on Aster DEX?

The minimum order size is $5 or its equivalent, which makes it accessible for smaller traders.

4. Does Aster DEX have a mobile app?

Yes, Aster DEX has a fully functional Android app that supports both spot and perpetual trading. There is no iOS app available yet.

5. How secure is Aster DEX?

Aster DEX undergoes regular audits by Salus Security. The latest audit reported no critical issues, though users must still practice Web3 safety since they control their own keys.

6. Can I earn yield on Aster DEX?

Yes. Aster Earn lets you stake supported assets and mint USDF (Aster’s stablecoin) to earn yield and AU points. These points may count toward future airdrops.