- •Aster DEX offers liquid staking for USDF, BNB, CAKE, and BTC with auto-compounding rewards.

- •Aster Staked Tokens like asUSDF and asBNB can be redeemed anytime or used in pools for extra yield.

- •USDF staking gives up to 15% APY, with redemptions processed in about T+2 hours.

Aster DEX has been growing steadily, with TVL reportedly crossing $700M after a 100% rise in recent days. The trend suggests more users are exploring its Earn features alongside trading. If you’re looking for a simple way to put assets to work, Aster DEX offers up to 5+ staking options with yields up to 15% APY, depending on pools and conditions. This guide walks through how to stake on Aster DEX step by step, move funds into Earn pools, and track rewards so you can participate carefully and understand what to expect.

How Does Aster Earn Works

Aster Earn is a yield product on Aster DEX that allows users to put idle assets to work. Supported assets can be staked directly, and rewards are added to the position automatically in real time. There is no manual claiming process, and funds can be redeemed at any time.

Aster Liquid Staking Explained

When a user stakes a base asset, such as BNB, they receive a liquid token called asBNB (Aster Staked BNB). This token represents the staked position and gradually increases in value as yield accrues. When asBNB is redeemed, the user receives their original BNB plus the accumulated yield.

Using Aster Staked Tokens

Minted tokens such as asBNB, asUSDF, asCAKE, or asBTC do not need to remain idle. They can be supplied to liquidity pools on platforms like PancakeSwap or Pendle, allowing users to generate additional yield on top of the base staking rewards.

USDF Stablecoin

USDF is Aster’s fully collateralized stablecoin, issued with custodial support from Ceffu. It can be minted directly on Aster using USDT. Users may stake USDF through Aster Earn or provide it as liquidity, with yields that vary based on market conditions.

How to Mint USDF?

Minting USDF can only be done directly on the Aster DEX platform, as it is not available on other exchanges. The stablecoin is issued by Aster, with custodial services handled by Ceffu. It is fully backed by crypto assets and short perpetual positions, keeping its exposure delta-neutral while generating yield.

Since you cannot stake a stablecoin directly on Aster Earn, minting USDF becomes a key step for users looking for a lower-risk, yield-generating option. Here’s how you can mint it step by step.

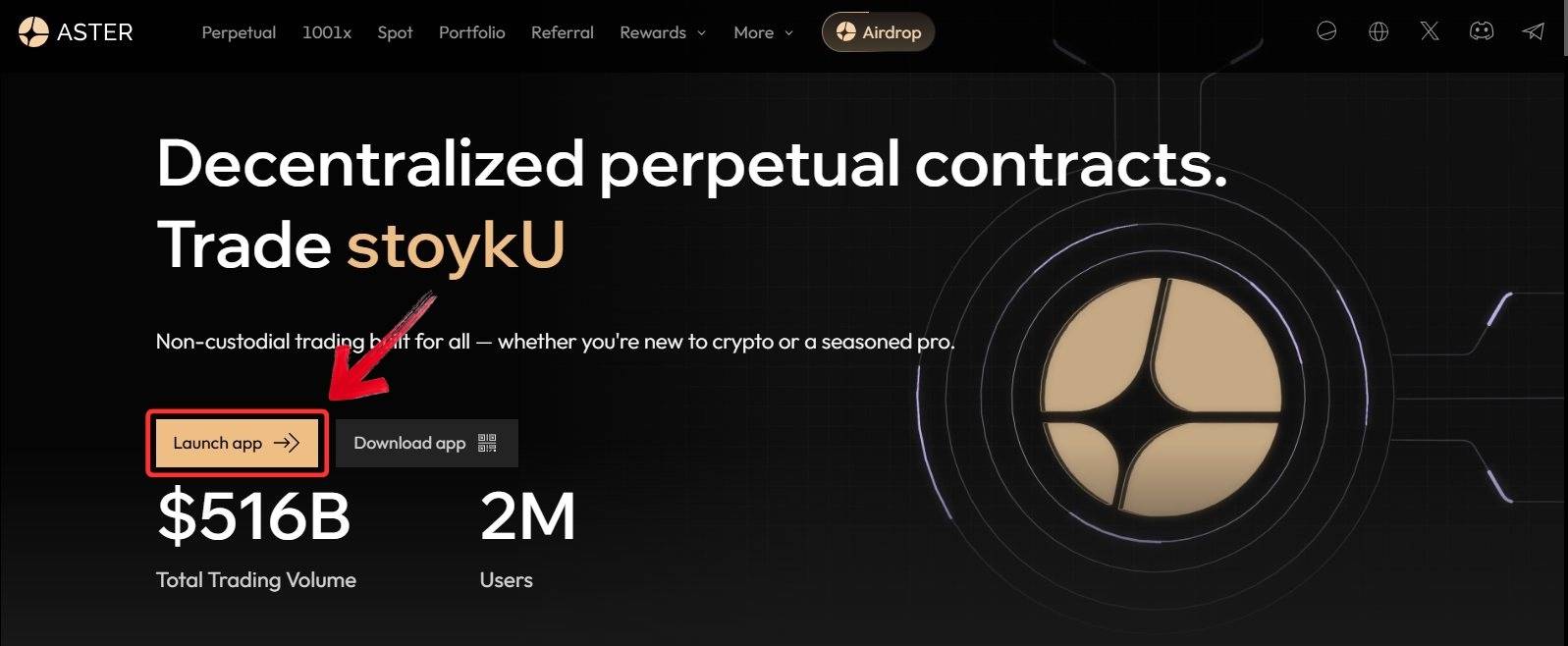

Step 1: Open your browser and head to the official Aster DEX platform, then click the “Launch App” button.

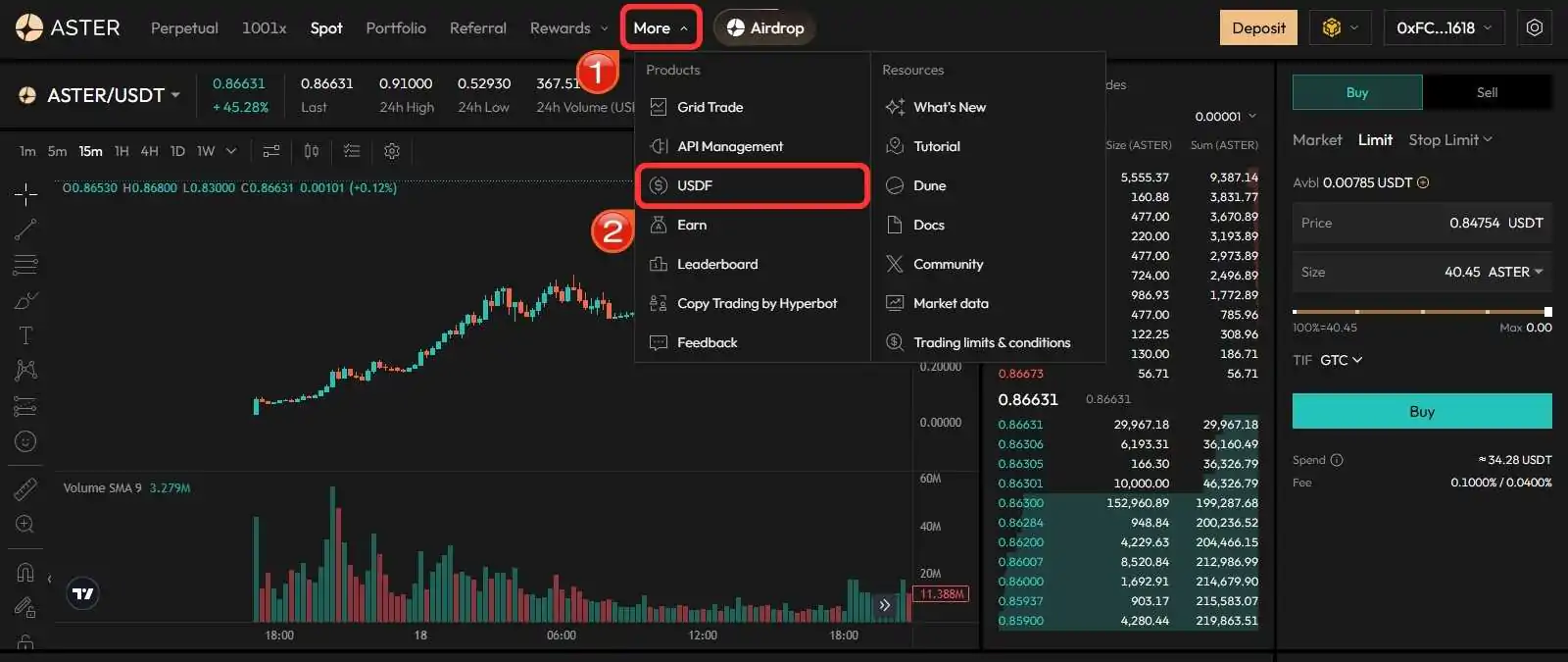

Step 2: In Aster DEX, hover over the “More” tab in the toolbar and select “USDF”.

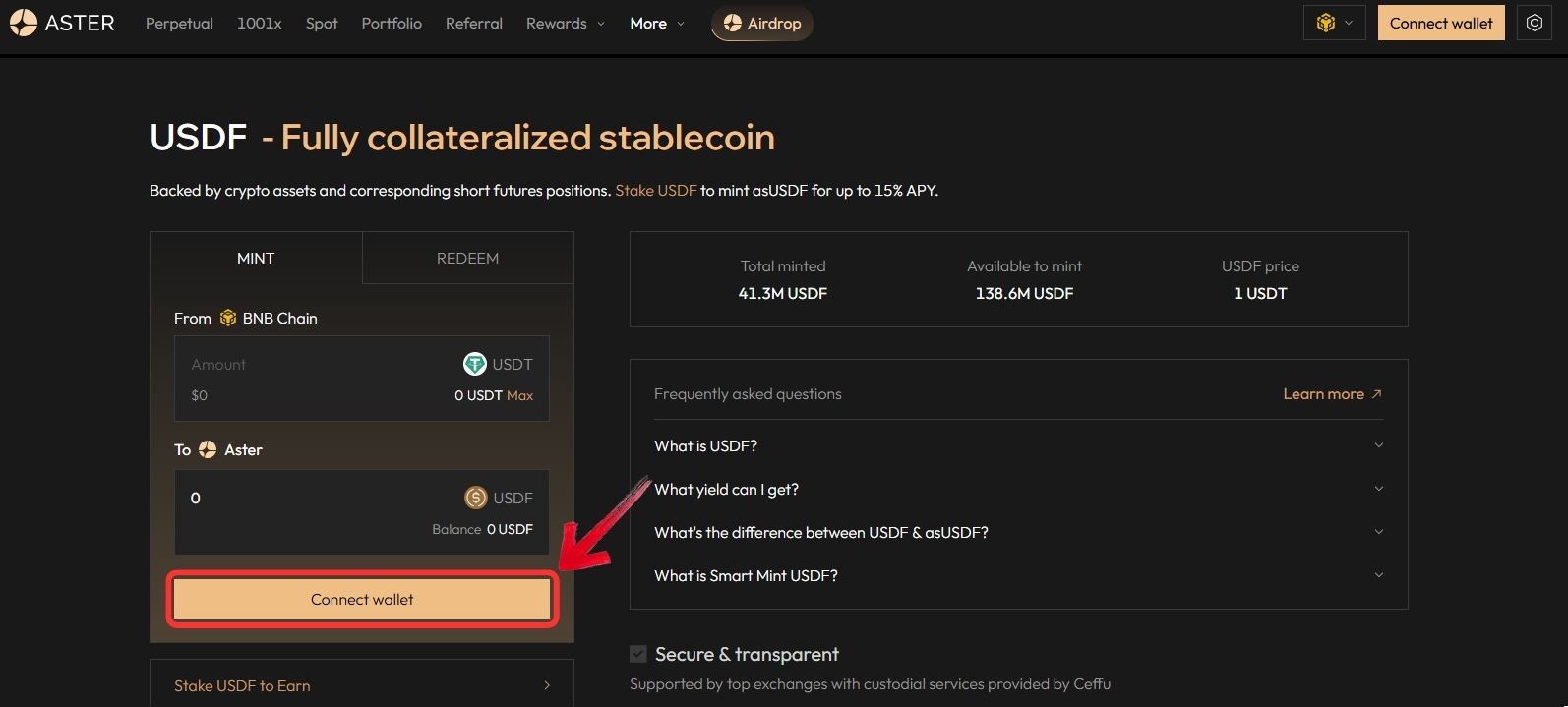

Step 3: You will be redirected to the USDF page, where you can Mint or Redeem USDF tokens for USDT.

Step 4: Click on the “Connect Wallet” button and connect your Web3 wallet to Aster DEX.

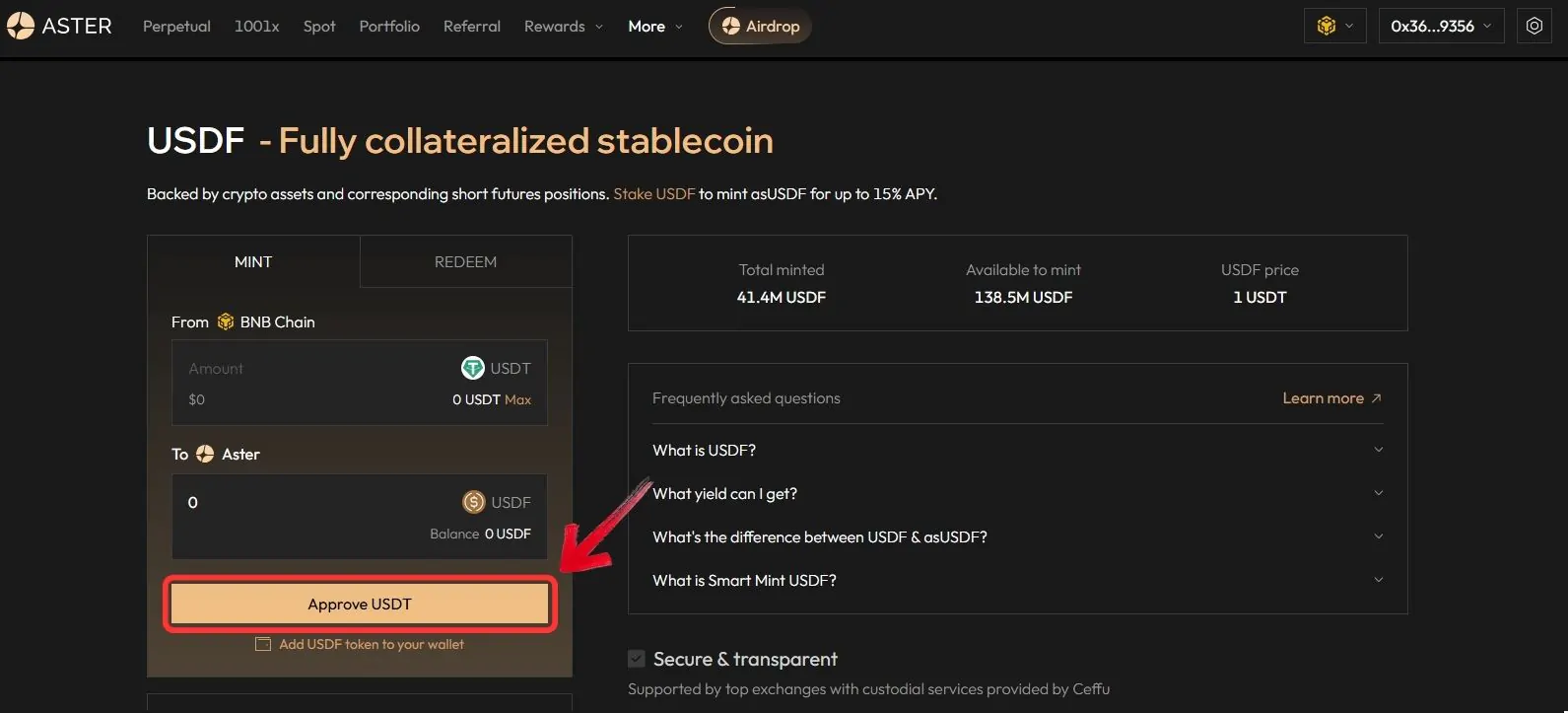

Step 5: Click “Approve USDT” to give on-chain approval to Aster.

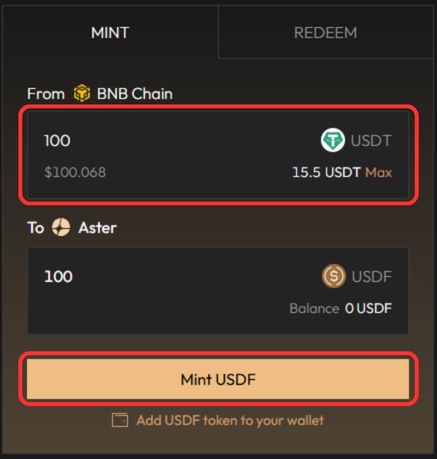

Step 6: Once approved, enter the amount of USDF you wish to mint, then click “Mint USDF”.

Once you have minted USDF, you can directly provide liquidity to the USDT/USDF pool on PancakeSwap, where you can currently earn up to 4.58% APY based on market rates.

How to Mint asUSDF on Aster DEX

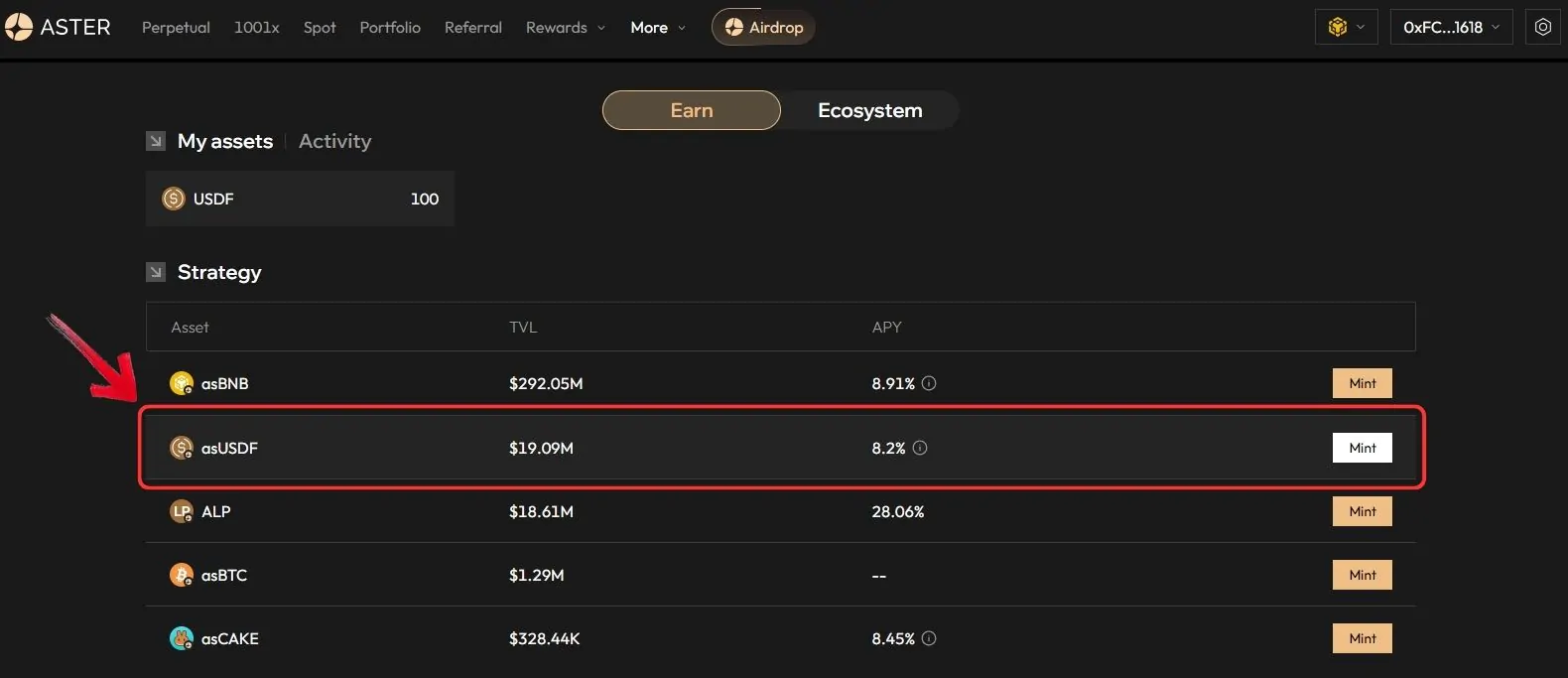

Once you have minted USDF, the next step is to stake it on Aster DEX to receive asUSDF, the staked version of USDF. This token represents your position and automatically accrues yield, meaning the token’s value grows as rewards are added. Currently, Aster offers up to 15% APY for staking USDF, making it a strong option for users seeking passive returns through liquid staking.

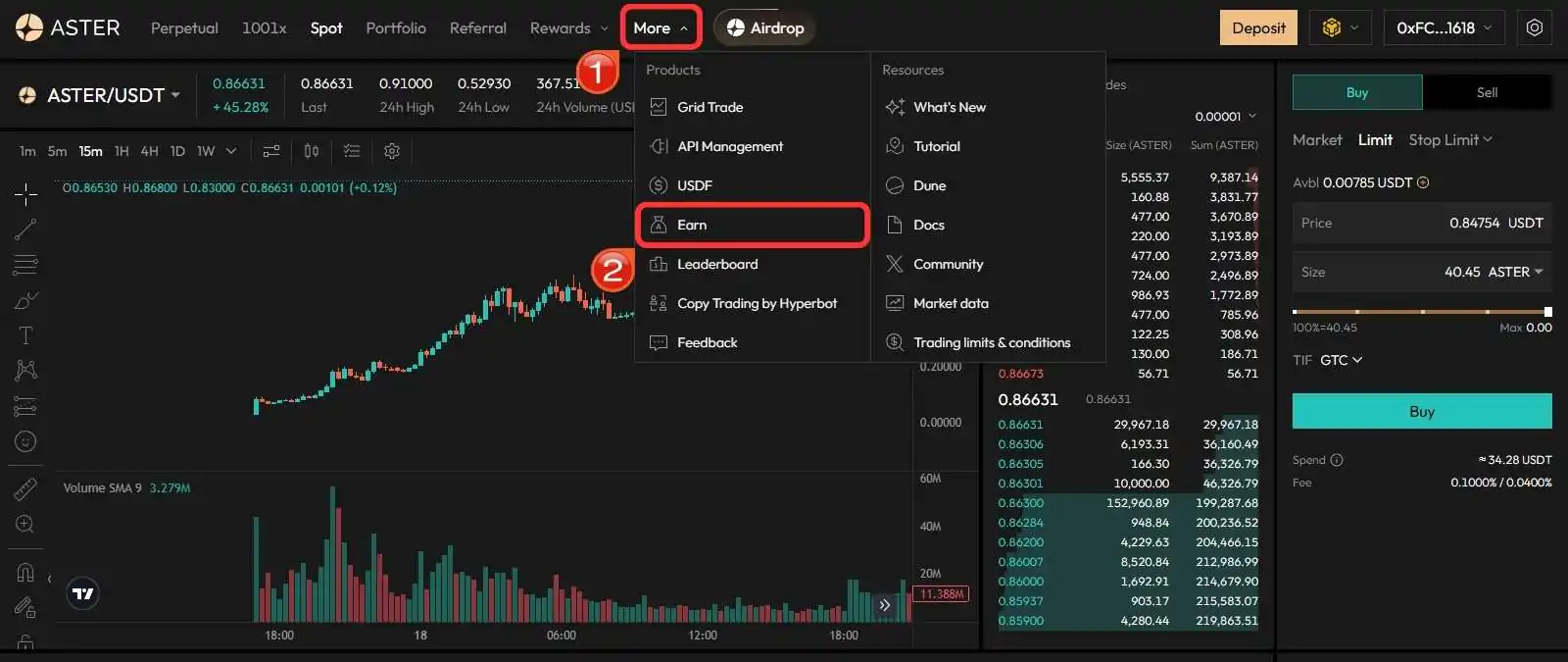

Step 1: On Aster DEX, hover over the “More” tab and click on “Earn”.

Step 2: In the Earn dashboard, find asUSDF and click the “Mint” button next to it.

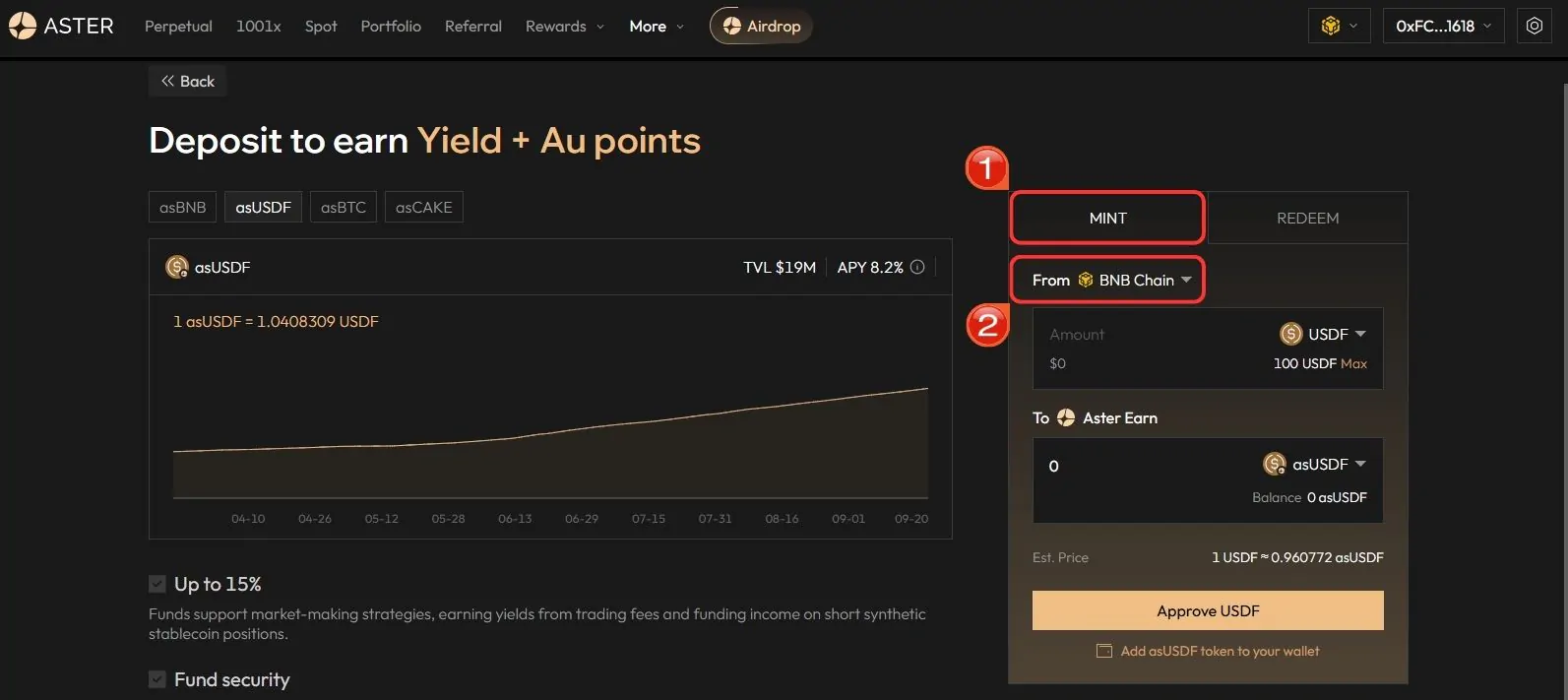

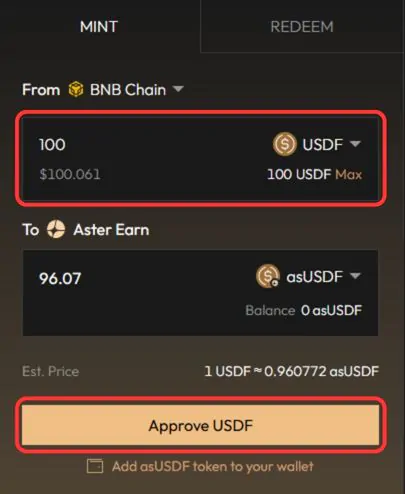

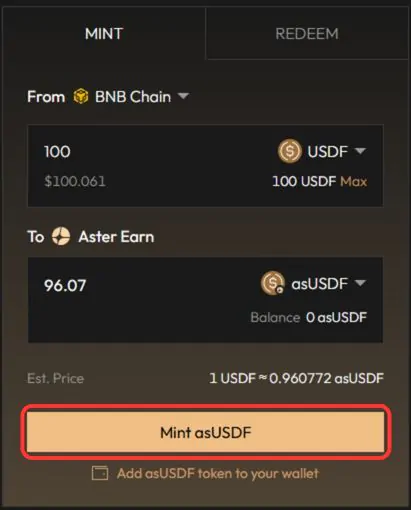

Step 3: Switch to the “Mint” tab and confirm that “BNB Chain” is selected under the Networks field.

Step 4: Enter the amount of USDF you want to stake, the equivalent asUSDF amount will be shown below.

Step 5: Click “Approve USDF” to grant Aster on-chain approval.

Step 6: Once approved, click “Mint asUSDF” to complete the process.

You can redeem asUSDF for USDF at any time as there is no lock period. After submitting a redemption request, the process takes approximately T+2 hours, after which you can claim your USDF tokens.

Bottom Line

Aster DEX is still in its early stages but is shaping up to be an interesting option for traders and yield seekers. It combines spot, perpetual, and forex markets with extra features like 1001x leverage, grid trading, and a simple-to-use mobile app. You can learn more about its features and performance in our full Aster DEX review.

Liquidity is still catching up to established players like Hyperliquid, so comparing them directly might be a bit premature. Still, if you’re exploring new decentralized exchanges or want to experiment with DeFi staking opportunities like USDF and asBNB, Aster DEX can be worth trying while keeping an eye on how its ecosystem and TVL continue to grow.

FAQs

1. How long does it take to redeem asUSDF on Aster DEX?

Redemption requests are typically processed in around T+2 hours, after which you can claim your USDF back to your wallet.

2. Is there a lock period for asUSDF on Aster DEX?

No, there is no lock period. You can redeem asUSDF for USDF at any time by submitting a redemption request.

3. How do I mint USDF on Aster DEX?

You can mint USDF directly on the Aster DEX app using USDT on BNB Chain. Once minted, you can provide liquidity to earn passive yields.

4. What is asBNB and why is it useful?

asBNB is Aster’s liquid staking token for BNB. Its price appreciates as rewards accrue, and you can use it in liquidity pools or other DeFi strategies.

5. Can I use Aster Earn on the mobile app?

No, the Aster DEX mobile app currently supports only spot and perpetual trading. Aster Earn and staking features are available through the web app only.

6. Do I need to claim rewards manually on Aster DEX?

No. The yield is built into the value of asUSDF itself, so your rewards accumulate automatically.

![How to Change the Language in Phantom [2026]](https://www.cryptowinrate.com/wp-content/uploads/2026/02/How-to-Change-the-Language-in-Phantom-2026-1024x576.jpg)