- •edgeX is a self custodial perpetual DEX built on a CLOB trading model.

- •edgeX supports perpetual and spot trading, including tokenized stocks and metals.

- •Trading settles on Ethereum using StarkEx zero knowledge rollups.

- •Fees are competitive, with 0.018% maker and 0.038% taker on perps, and 0.04% maker and 0.07% taker on spot trading.

- •Liquidity is supported by Amber Group market making activity.

- •Spot markets are available but currently limited in asset selection.

- •A mobile app is available on both iOS and Android.

CEX level performance paired with transparency and self custody is now a baseline expectation for modern perpetual DEXs. Traders want speed without sacrificing on chain verification, and edgeX is built around that demand, offering a hybrid Central Limit Order Book model, with off chain order matching and on chain settlement via StarkEx ZK rollups. In this edgeX review, we take a close look at the platform’s core features, trading fees, vault structure, supported assets, and overall trading experience.

| Stats | edgeX |

|---|---|

| 🚀 Founded | 2024 |

| 🌐 Headquarters | Singapore |

| 🔎 Founder | Christina X |

| 👤 Active Users | 259K+ |

| 🪙 Spot Cryptos | 2+ |

| 🪙 Futures Contracts | 81+ |

| 🔁 Spot Fees (maker/taker) | 0.04% / 0.07% |

| 🔁 Futures Fees (maker/taker) | 0.018% / 0.038% |

| 📈 Max Leverage | 100x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.5/5 |

edgeX Overview

edgeX launched in 2024 as a perpetual DEX incubated by Amber Group and operates as a Layer 2 solution on Ethereum using StarkWare technology on EDGE Stack, an app specific execution layer designed to deliver centralized exchange level performance with decentralized verification. While many platforms relied on AMM based models with higher slippage, edgeX uses a Central Limit Order Book (CLOB) structure to support a CeFi like trading experience in a decentralized environment, with high throughput, low latency, and verifiable matching for complex derivatives such as perpetuals. The platform has recorded cumulative trading volume of $702.97B, with 264,314 active users.

The platform initially focused on derivatives trading, offering 81+ USD settled perpetual contracts with leverage up to 100x. Spot trading was added recently, though asset support remains limited. edgeX supports deposits across 3 networks, Ethereum, BNB Chain, and Arbitrum, allowing users to fund accounts using either USDT or USDC. edgeX is primarily designed for professional traders, with advanced order types and liquidity supported through Amber Group’s market making activity.

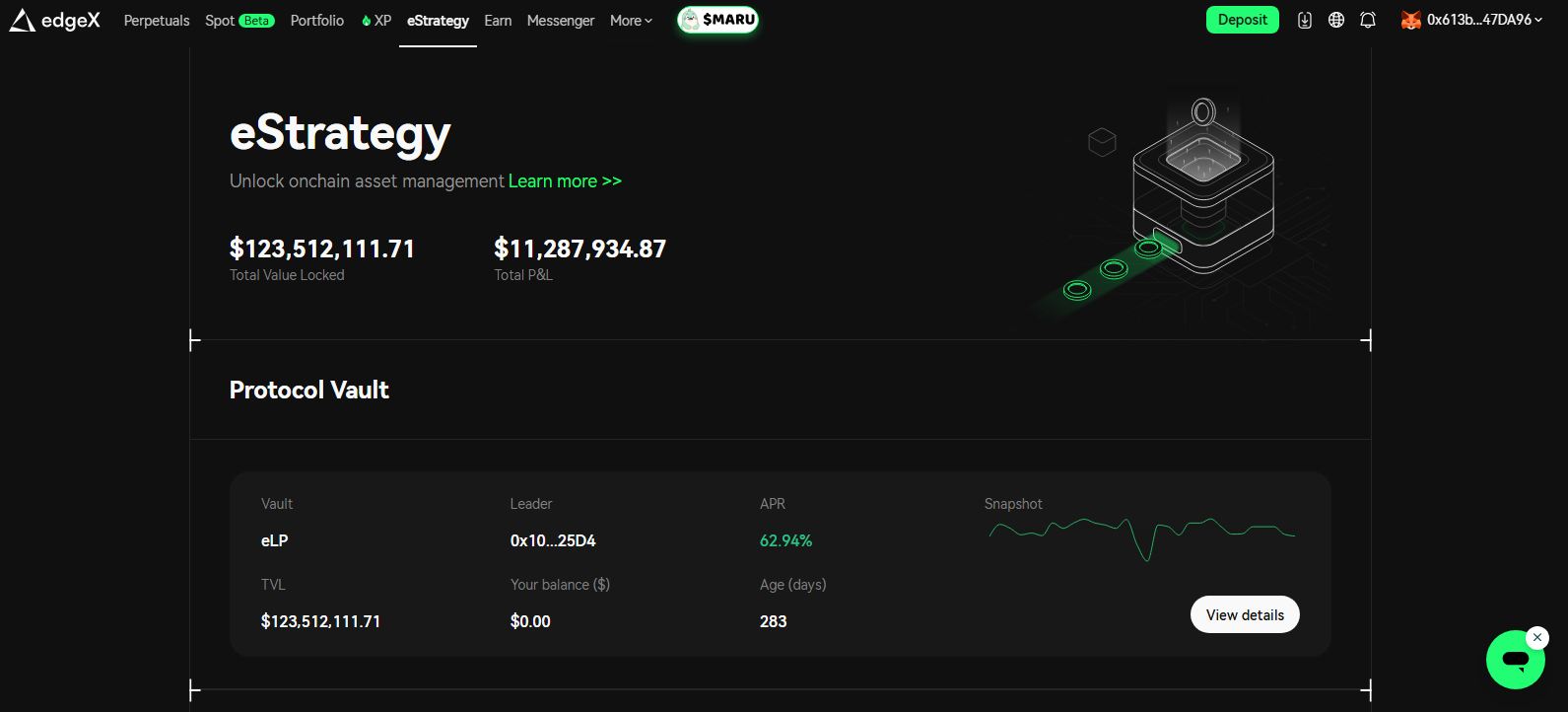

Apart from trading, edgeX also offers yield opportunities through its vault system. The platform’s main vault product is the eLP vault under the eStrategy module. This vault functions as a liquidity provision mechanism for users who want passive exposure without actively trading. By depositing USDT into the eLP vault, users contribute to order book liquidity while earning yield generated from trading activity on the platform.

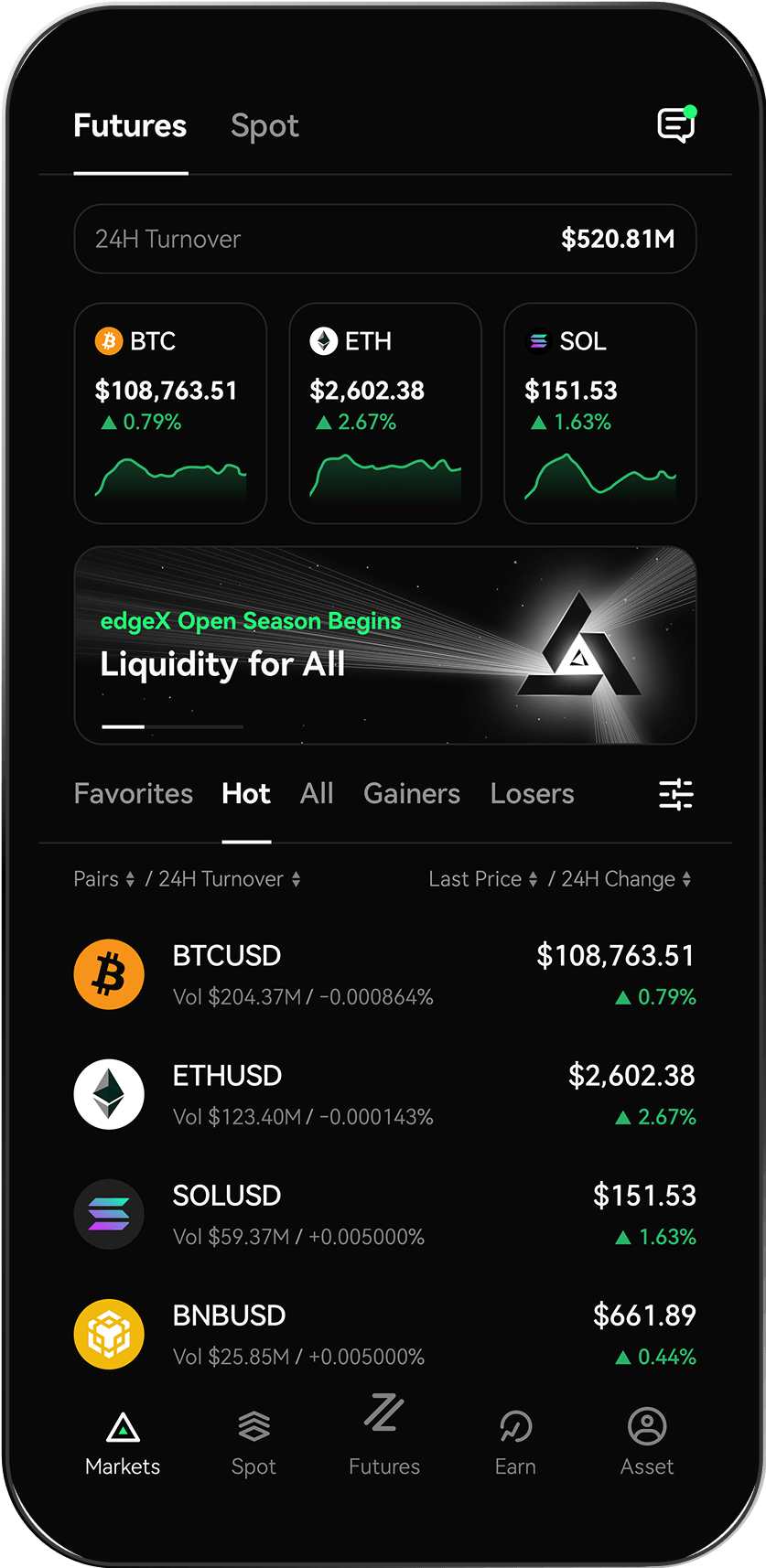

edgeX also provides a mobile application, available on both iOS and Android. The app allows users to manage positions, place trades, monitor vault performance, and handle deposits and withdrawals, offering feature parity with the web platform.

From a security perspective, edgeX settles all final transaction data and asset states on the Ethereum mainnet using zero knowledge proofs, ensuring on chain verifiability. Price feeds are sourced from the Stork decentralized oracle network, reducing reliance on a single data provider. The platform’s smart contracts and infrastructure have undergone audits by multiple security firms, including RigSec and SlowMist, while the underlying StarkEx layer has been audited by PeckShield.

edgeX Pros and Cons

| 👍 edgeX Pros | 👎 edgeX Cons |

|---|---|

| ✅ CEX-level performance & execution | ❌ Spot market options remain limited |

| ✅ Supports perpetual and spot trading, including tokenized stocks and metals. | ❌ Feature set is more focused on execution quality than breadth |

| ✅ Superior liquidity for realistic trade sizes | |

| ✅ Low & competitive fees | |

| ✅ Excellent mobile & UX | |

| ✅ Passive yield via eStrategy Vaults (eLP) |

edgeX KYC and Sign-up

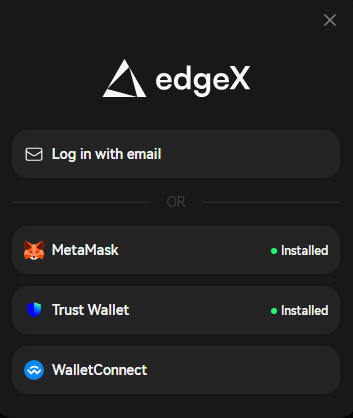

edgeX is a decentralized platform, so there are no mandatory KYC requirements. Creating an account only requires connecting an EVM compatible wallet, though users also have the option to sign up using an email address. Once connected, there are no preset deposit or withdrawal limits imposed by the platform. If you want to start trading on edgeX, the steps below explain how to create an account and get started.

Step 1: Visit the edgeX platform using your preferred browser and click the “Launch App” button to open the exchange.

Step 2: On the edgeX exchange interface, click “Connect Wallet” at the top right corner.

Step 3: A connection window will appear. You can either sign up using an email address or connect an EVM compatible wallet such as MetaMask or Trust Wallet.

Step 4: After selecting a wallet, a connection request will appear in your wallet for pro.edgex.exchange. Approve the request to continue.

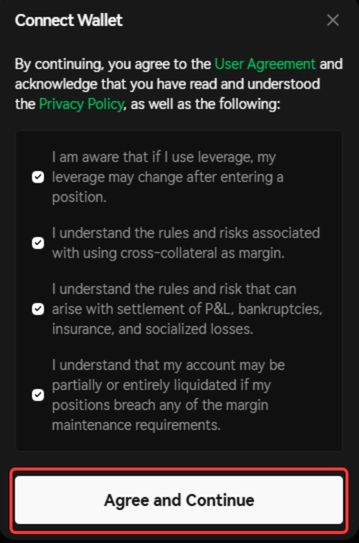

Step 5: A terms and conditions pop up will appear. Review the details, check all required boxes, and click “Agree and Continue”.

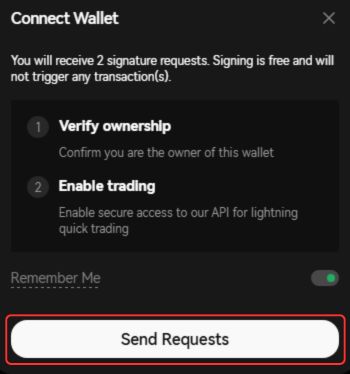

Step 6: edgeX will then verify wallet ownership by requesting signatures. Click “Send Requests” and approve both signature requests in your wallet to start trading.

Before signing up, it is important to note that edgeX applies certain regional restrictions due to regulatory requirements. Access to some services may be limited depending on your location. Before creating an account, use the edgeX country checker to confirm that your region is supported and avoid potential issues later.

🌍 Free edgeX Country Checker

We strive to keep this information up to date, but regulations may change. Always verify eligibility before using the platform.

Due to regulations, edgeX does not support every country. To ensure that you are eligible to use the platform,

use our free edgeX country checker.

Type your country and see if you can use the platform or if your country is restricted.

edgeX Trading

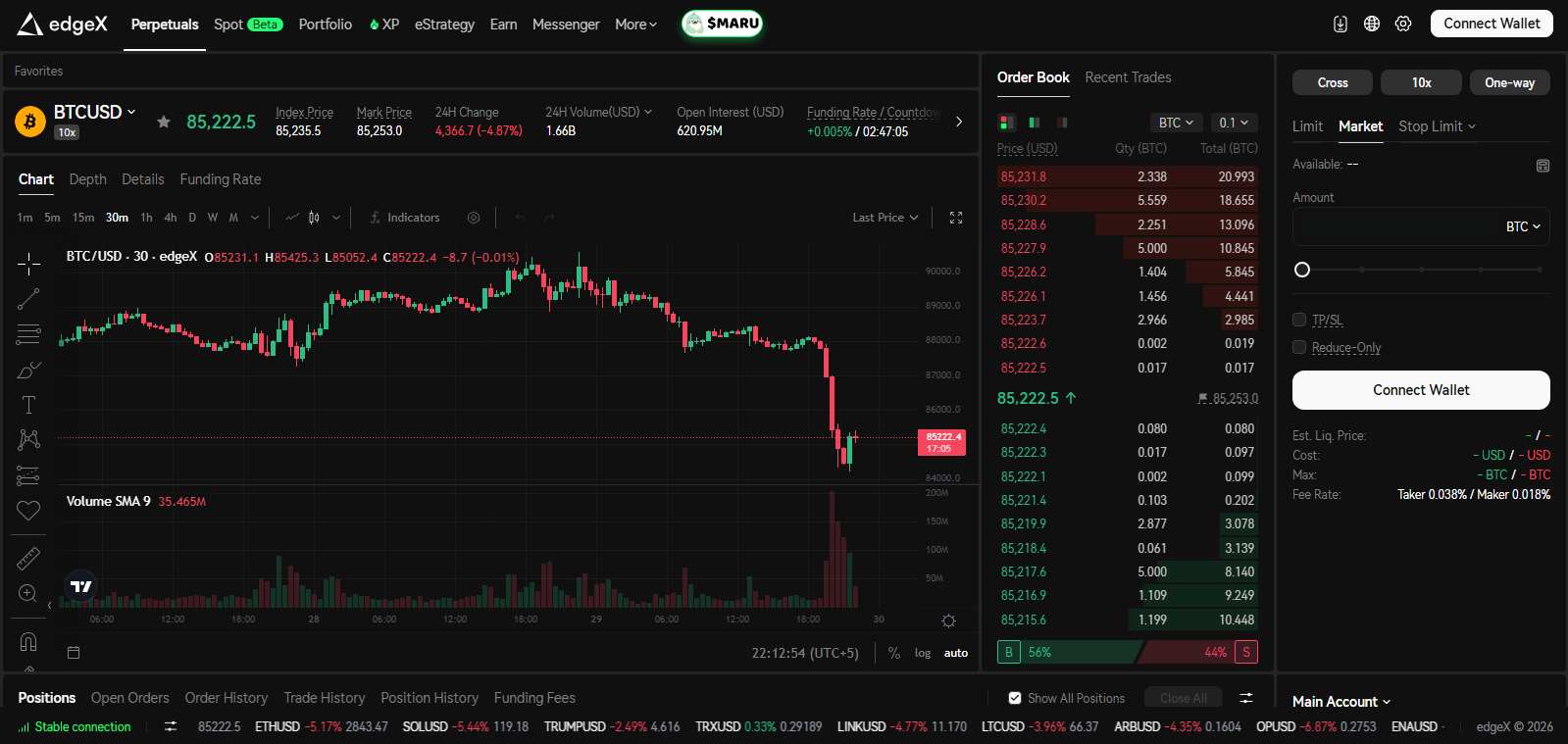

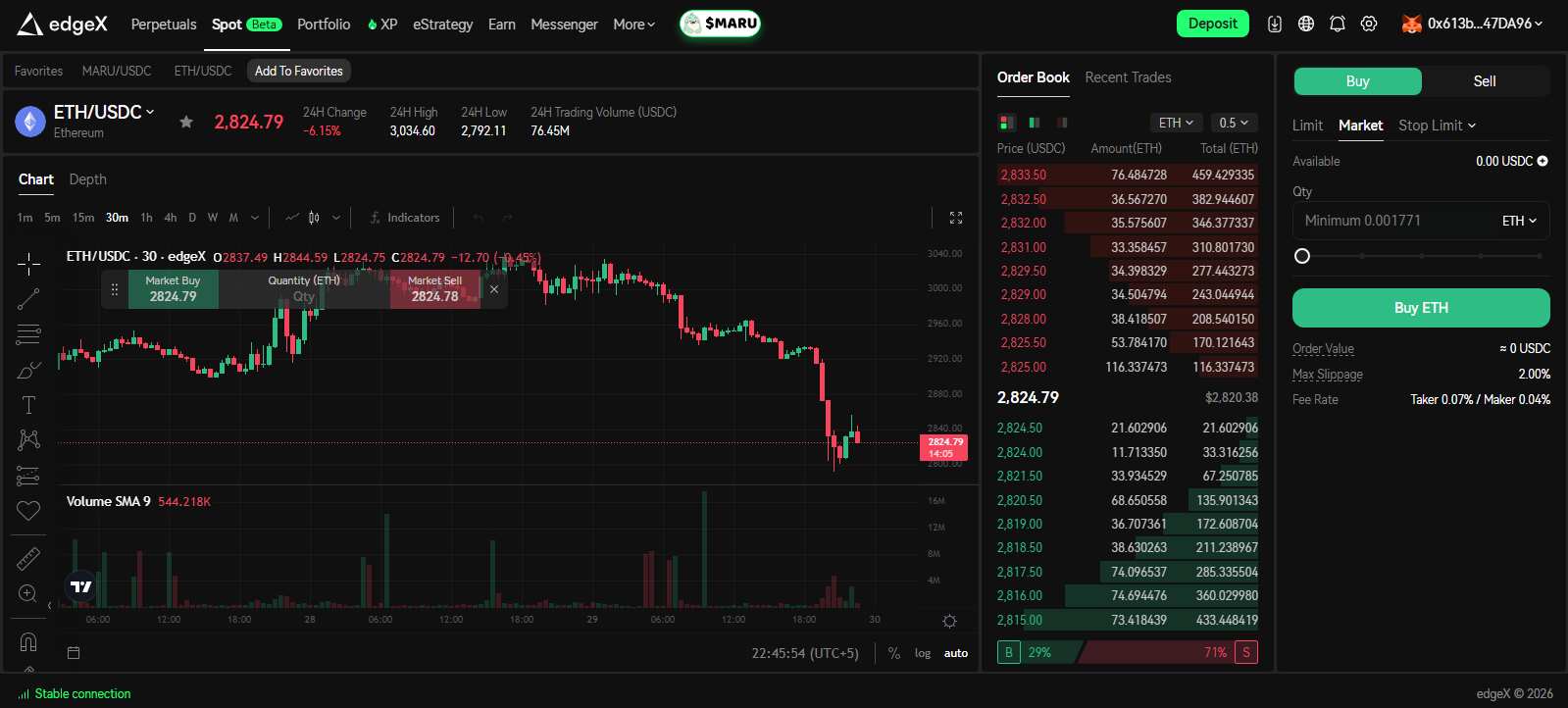

edgeX offers a clean, customizable, and dark mode friendly interface built around a traditional perpetual trading layout. Users coming from centralized exchanges such as Binance will find the trading environment familiar and easy to navigate.

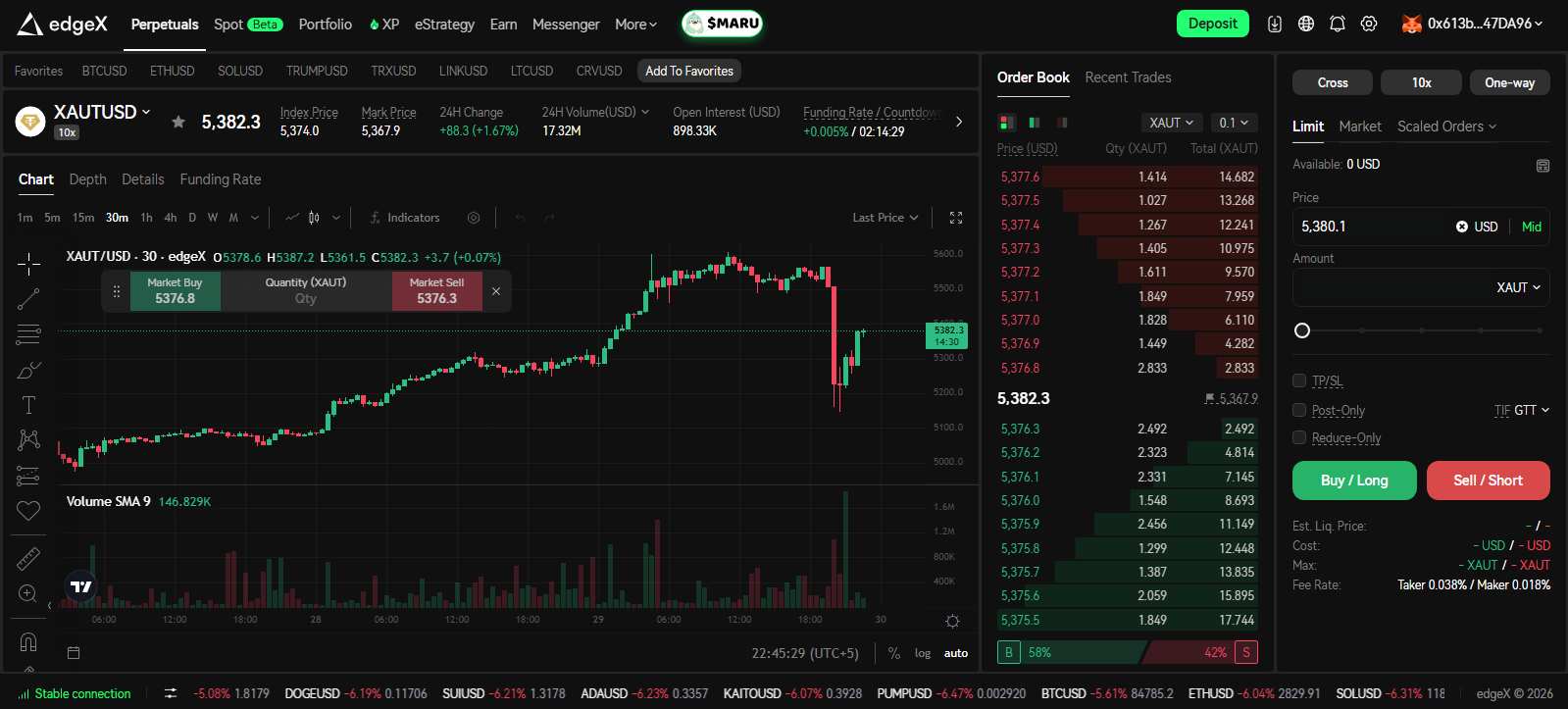

The platform integrates TradingView charts, giving access to real time candlesticks, indicators, and depth data. The market selector is positioned on the left, charts are centered, and order placement tools are located on the right. Unlike AMM based perp DEXs, edgeX uses a Central Limit Order Book (CLOB) model, allowing precise order execution with lower slippage.

edgeX supports multiple order types, including market and limit orders, stop market and stop limit orders, and scaled orders for advanced strategies. The platform also supports subaccounts. Users can open one directional positions from the main account, while hedged or bidirectional positions require creating subaccounts and transferring funds between them.

Spot Trading

edgeX’s spot trading platform is currently in beta and supports a limited number of assets. At present, only two assets are available, both paired with USDC. Trading fees are set at 0.04% for makers and 0.07% for takers.

Derivatives Trading

After depositing USDT or USDC, users can trade more than 81 perpetual contracts with leverage of up to 100x. All contracts are USD settled and offered at fees of 0.018% for makers and 0.038% for takers. In addition to cryptocurrencies, edgeX also supports trading in tokenized stocks and tokenized metals such as gold, silver, and copper.

edgeX Deposit and Withdrawal Methods

edgeX currently supports three networks: Ethereum, Arbitrum, and BNB Chain. Users can deposit and withdraw both USDT and USDC directly on chain using any supported network.

The platform is compatible with all EVM compatible wallets, allowing users to connect and manage funds using wallets such as MetaMask, Trust Wallet, and similar options.

edgeX Fees

Let’s take a closer look at the fees users pay when trading on edgeX, as well as charges related to other services such as vault participation, deposits, and withdrawals.

Trading Fees

edgeX uses a tiered fee model for both perpetual and spot trading, with additional discounts based on a user’s 30 day trading volume on the platform. For perpetual trading, fees decrease as volume increases. At higher tiers, maker fees can be reduced to 0.000% and taker fees to 0.024% at VIP 6, which requires more than $7B in cumulative trading volume. Spot trading fees are set separately and start at 0.040% for makers and 0.070% for takers, which aligns with fee structures commonly seen across perpetual focused DEXs.

Spot Fees

0.04% Maker

0.07% Taker

Future Fees

0.018% Maker

0.038% Taker

Deposit and Withdrawal Fees

edgeX does not charge platform fees on deposits. However, standard network gas fees still apply. These fees can be higher when using the Ethereum network and generally lower when using Layer 2 networks such as Arbitrum or BNB Chain.

Withdrawal fees depend on the selected network. Withdrawals on Ethereum do not carry a platform fee, but gas fees apply, and due to batching and zero knowledge rollup settlement on Layer 1, processing times can take up to 14 hours. Withdrawals on Arbitrum and BNB Chain incur a fixed platform fee of $1.

edgeX Products and Services

While perpetual trading remains the core offering on edgeX, the platform also provides additional products and features worth exploring. Below is an overview of the main services available to users.

edgeX Trading

edgeX offers a trading experience that feels familiar if you have used centralized exchanges before. The platform is built around a Central Limit Order Book, with TradingView charts, order book depth, and a full set of order types including market, limit, stop, and scaled orders. You can trade both perpetual and spot markets from the same interface, with access not only to cryptocurrencies but also tokenized stocks and metals, all while trades settle on chain.

Mobile App

The edgeX mobile app is available on both iOS and Android and lets you trade directly from your phone. You can open and manage perpetual and spot positions, adjust leverage, monitor PnL, and place orders using the same account as the web platform. Wallet based and email based logins are supported, making onboarding and account access straightforward.

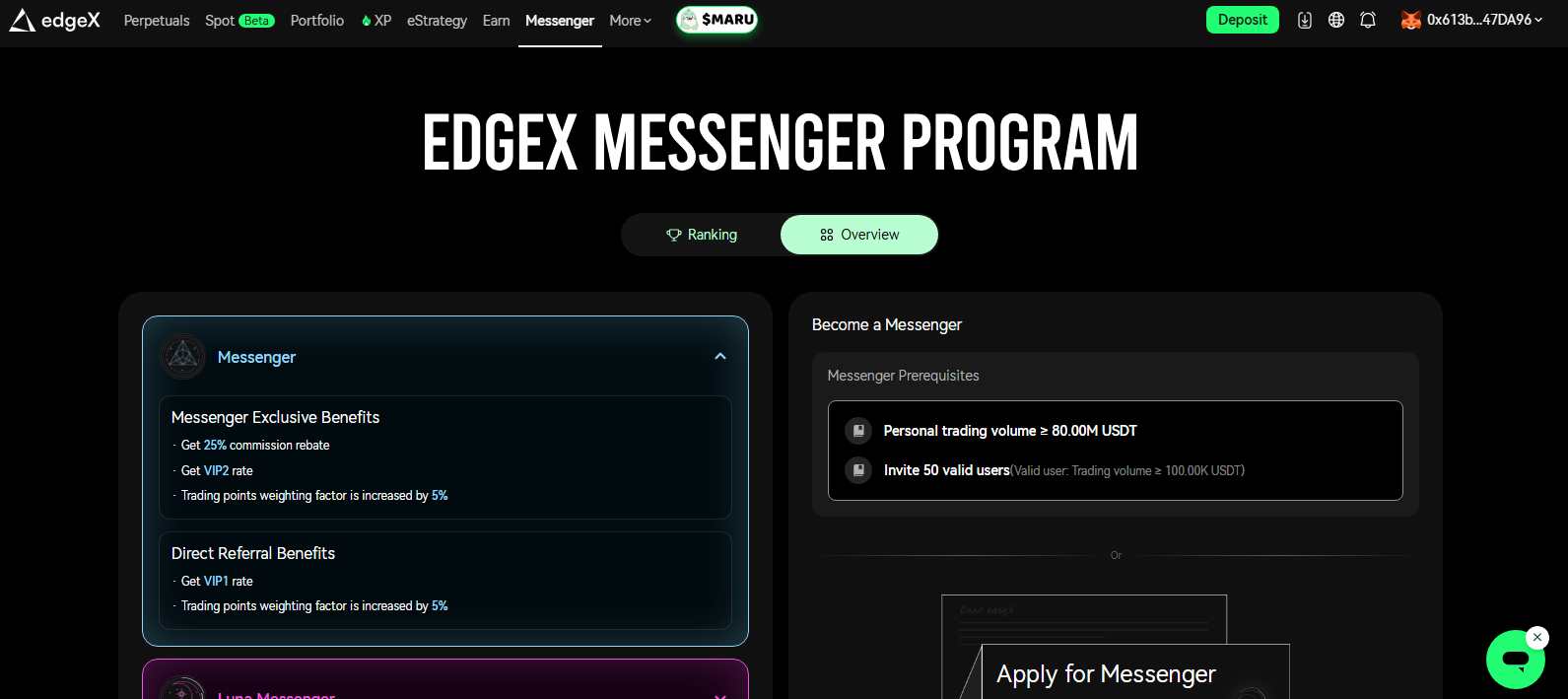

Messenger Program

The Messenger Program is edgeX’s community participation initiative. If you create content, help onboard users, or stay active within the ecosystem, you can earn points, tokens, and other rewards. Participation usually involves completing tasks, sharing updates, or engaging on social platforms and is connected directly with the platform’s rewards and XP system.

eStrategy Vault

eStrategy is edgeX’s vault based system designed for users who want passive exposure without active trading. The main product is the eLP vault, where you deposit assets such as stablecoins to provide liquidity to the platform. Funds are deployed into liquidity strategies that support order book depth, and returns come from spreads, fees, and liquidations. Interest starts accruing 24 hours after deposit. You can request a withdrawal at any time, and funds are transferred back to your wallet within 48 hours, and vault activity also contributes to points and XP.

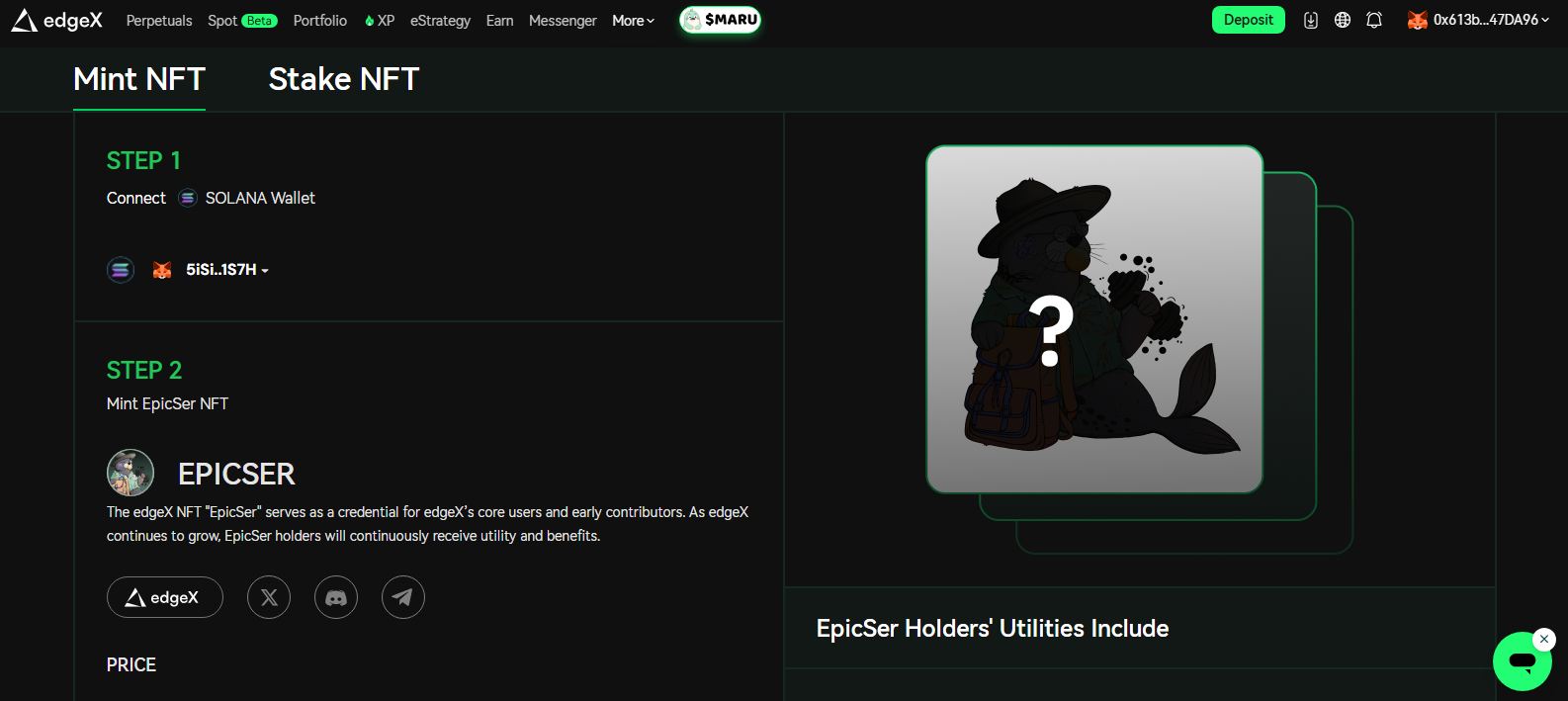

EpicSer

EpicSer is edgeX’s genesis NFT collection and acts as a credential within the ecosystem. If you hold an EpicSer NFT, you may receive trading fee benefits, early access to certain features, and eligibility for future rewards. EpicSer also ties into the platform’s broader points system, where holding the NFT can increase your overall participation score.

edgeX Security

edgeX operates as a self custodial platform. Your funds are never held by the exchange, and you retain control of your wallet at all times. This removes one of the main risks associated with centralized exchanges, where user assets are pooled under a single custodian.

All final transaction data and asset states are proven and settled on the Ethereum mainnet using zero knowledge proofs. This setup inherits Ethereum’s established security model and enables tamper resistant records, forced withdrawals if the operator becomes unavailable, and strong settlement finality.

For pricing, edgeX relies on the Stork decentralized oracle network, reducing the risk of single source price manipulation. The platform’s smart contracts and infrastructure have been audited by multiple security firms, including RigSec and SlowMist, while the underlying StarkEx layer has been audited by PeckShield.

edgeX Customer Support

edgeX provides online web chat support alongside community driven channels. Most user support is handled through Discord, where tickets can be opened for issues such as withdrawals, wallet connections, or trading related problems. Response times are generally fast for basic issues, with more complex cases taking longer. The team is active and transparent during incidents, while Telegram and Discord communities also provide announcements and peer assistance.

edgeX Alternatives

If edgeX does not fully match your trading style or risk preference, several alternative perpetual DEXs offer different strengths worth considering.

1. Hyperliquid: Known for deep liquidity and consistent execution on large positions, Hyperliquid is often preferred by high volume traders who prioritize scale, open interest depth, and on chain transparency.

2. Aster: Aster attracts traders seeking aggressive leverage and points based incentives. Its multi chain access and frequent reward campaigns appeal to users focused on high risk, high reward strategies.

3. Lighter: Lighter focuses on ultra low latency execution with a zero fee model. It suits scalpers and short term traders who prioritize speed, privacy, and cost efficiency over market breadth.

| Feature | edgeX | Aster | Hyperliquid | Lighter |

|---|---|---|---|---|

| Established | 2024 | 2025 | 2024 | 2024 |

| Spot Fees (Maker/Taker) | 0.04% / 0.07% | 0.10% / 0.04% | 0.04% / 0.07% | 0.00% / 0.00% |

| Futures Fees (Maker/Taker) | 0.018% / 0.038% | 0.010% / 0.035% | 0.015% / 0.045% | 0.00% / 0.00% |

| Max Leverage | 100x | 1001x | 50x | 50x |

| KYC Required | No | No | No | No |

| Supported Cryptos (Spot) | 2+ | 8+ | 238+ | 1+ |

| Futures Contracts | 169+ | 93+ | 173+ | 117+ |

| 24h Futures Volume | $4B+ | $4.07B+ | $1.84B+ | $2.51B+ |

| Key Features | • CLOB + StarkEx L2 • Tokenized stocks & metals • Mobile app |

• 1001x leverage • Grid trading |

• Custom L1 • Zero gas |

• ZK rollup • Zero-fee retail |

| Sign Up | Sign Up |

Sign Up |

Sign Up |

Sign Up |

Bottom Line

edgeX ranks among the more established perpetual DEXs, reflected in its cumulative trading volume and consistent activity. It focuses on a CLOB based trading model that many traders prefer, offering tight spreads, reliable liquidity, low latency execution, and a usable mobile app. That said, edgeX focuses more on execution quality than feature breadth, so options like leverage ranges and spot market coverage are more limited. Because of that, edgeX may not suit every trading style or preference, even if performance itself is not a concern. If you want to compare other platforms, our guide on the top perpetual DEXs breaks down how alternatives differ in fees, liquidity, and overall trading features.

FAQs

1. Is edgeX a centralized or decentralized exchange?

edgeX is a decentralized exchange. You trade directly from your own wallet, and the platform does not custody user funds at any point.

2. Which networks and tokens are supported for deposits?

edgeX supports Ethereum, Arbitrum, and BNB Chain. You can deposit and withdraw USDT or USDC using any EVM compatible wallet.

3. Does edgeX offer a mobile app?

Yes. edgeX has a mobile app available on both iOS and Android, allowing you to trade, manage positions, and monitor accounts on the go.

4. How is edgeX secured?

edgeX is self custodial and settles final transaction data on Ethereum using zero knowledge proofs. It also uses decentralized oracles for pricing and has undergone multiple third party security audits.

5. How does edgeX differ from Hyperliquid or other perp DEXs?

edgeX focuses on mid size liquidity, lower baseline fees, a strong mobile app, and professional trading tools with up to 100x leverage. Hyperliquid leads in overall scale and open interest, while platforms like Aster focus more on high leverage and incentives.