- No KYC required.

- Available in over 120 countries worldwide.

- User-friendly and responsive interface.

- Over 679+ futures contracts are available for trading with up to 125x leverage.

- 0% spot fees and 0.01% futures fees

- No withdrawal fees

- Lacks passive income products e.g. staking, bots, or copy trading

- Only supports crypto deposits and withdrawals

- FIAT is not supported.

Most traders first hear about KCEX because of its reputation for low fees, which naturally sparks curiosity and leads them to search for a detailed KCEX review. But an exchange is never just about cost, factors like platform usability, security measures, funding options, and customer support play an equally important role. In this guide, we’ll take a closer look at all these elements to give you a clear and balanced view of what KCEX offers and whether it aligns with your trading needs.

| Stats | KCEX |

|---|---|

| 🚀 Founded | 2021 |

| 🌐 Headquarters | Seychelles |

| 👤 Active Users | 300K+ |

| 🪙 Supported Cryptos | 908+ |

| 🪙 Supported Perpetual Contracts | 679+ |

| 🔁 Spot Trading Fees (Maker/Taker) | 0.00% / 0.00% |

| 🔁 Leverage Trading Fees (Maker/Taker) | 0.00% / 0.01% |

| 📈 Max Leverage | 125x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.2/5 |

| 💰 Bonus | $16,000 (Claim Now) |

KCEX Overview

KCEX is a Seychelles-based cryptocurrency exchange founded in 2021 that has quickly built a global user base of over 300,000 traders. While the founders remain publicly unidentified, the company notes its team is made up of experienced professionals from both the blockchain and finance sectors.

The platform offers wide market access with 908+ spot cryptocurrencies and 679+ futures contracts, paired with leverage up to 125x. Its fee structure is one of the lowest in the industry, with spot trading at 0.00% for both maker and taker orders, and futures trading starting at 0.00% maker and 0.010% taker. KCEX also runs promotional campaigns with bonuses of up to $16,000, adding extra appeal for active traders.

KCEX operates as a no-KYC exchange, allowing withdrawals of up to 15 BTC per day without identity verification. Daily spot trading volumes exceed $4.22 billion, positioning it among the higher-liquidity platforms in the market. KCEX appears to offer decent security for its users, with 24-hour support service. The platform has never been hacked.

On the security side, KCEX is considered moderate, but the exchange emphasizes compliance efforts, holding regulatory licenses in the United States, Canada, and other regions, with ongoing applications to expand coverage. This mix of accessibility, low fees, and broad listings has helped KCEX grow quickly despite its relatively recent entry.

KCEX Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Extremely low trading fees | ❌ No fiat withdrawals, only crypto |

| ✅ Wide selection with 879+ spot cryptos and 522+ futures | ❌ Offers limited products for passive earning |

| ✅ Fast and responsive trading interface | ❌ Founders are not publicly identified |

| ✅ Strong liquidity with $4.22B+ daily spot volume | |

| ✅ No KYC required with a 15 BTC daily withdrawal limit | |

| ✅ Advanced and interactive trading tools |

KCEX Sign-up and KYC

KCEX offers a quick and simple signup process that can be completed in just seconds. Since KYC is not required at the basic level, you can register with only an email address or mobile number and a strong password, and begin trading immediately.

One of the main advantages is that KCEX is cost-optimized, with zero fees on spot trading and some of the lowest futures fees in the market. Users also benefit from a generous no-KYC withdrawal limit of 15 BTC per day, which is significantly higher than most non-KYC exchanges where limits are often much lower and less practical.

For those who want higher limits, KCEX provides an optional KYC verification. Completing basic KYC raises the withdrawal cap to 30 BTC. The process is straightforward: simply tap the profile icon, choose “verify”, select your nationality, and upload the required identification document. Accounts are typically verified within minutes.

However, there are a few restricted regions where KCEX services are not available. Before starting the signup process, make sure to check availability through our KCEX country checker.

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, KCEX does not support every country. To ensure that you are eligible to register on the exchange, you can use our free KCEX country checker.

🌍 Free KCEX Country Checker

Simply type your country and see if you can use the platform or if your country is restricted.

KCEX Trading

Trading is a must-have for any exchange, but what really matters is what the platform offers inside its trading environment. That’s where you see whether it supports your trading style and enhances your overall experience.

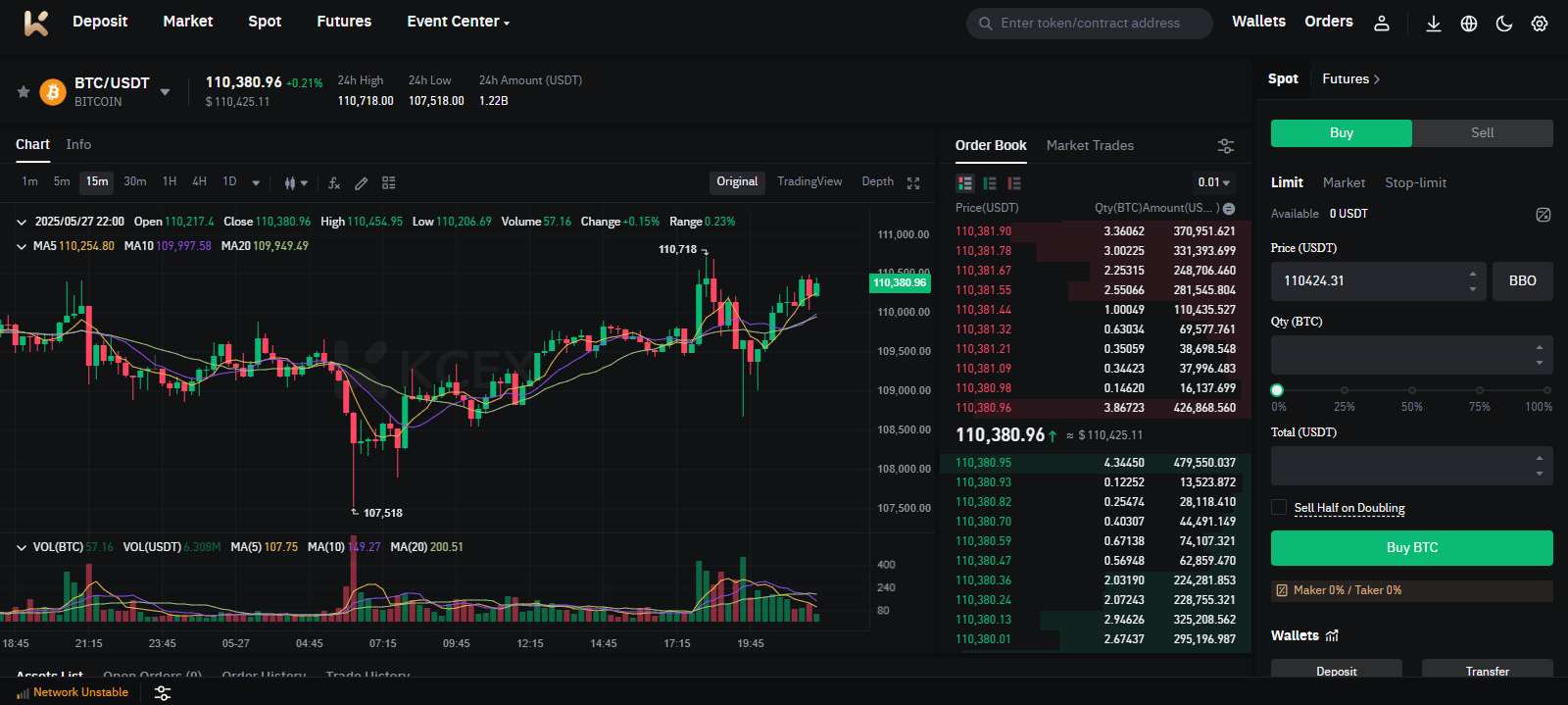

Spot trading

KCEX offers spot trading across 908+ cryptocurrencies with zero trading fees, making it one of the most cost-effective options in the market. The platform gives flexibility to switch between its original charting interface or a TradingView-integrated setup. Both options include access to indicators and basic charting tools, supported by deep liquidity order books and tight spreads.

Order types are kept simple, with basics; Limit and Market orders, along with essentials like take profit (TP) and stop loss (SL). What makes the spot section stand out is the addition of social news and market updates directly on the platform, allowing traders to stay informed about sentiment alongside technical setups. KCEX’s own charting interface is also more than just plain price charts, featuring candlestick patterns and a built-in future trend indicator. Traders can further personalize their workspace by dragging and dropping different elements to create a layout that suits their style.

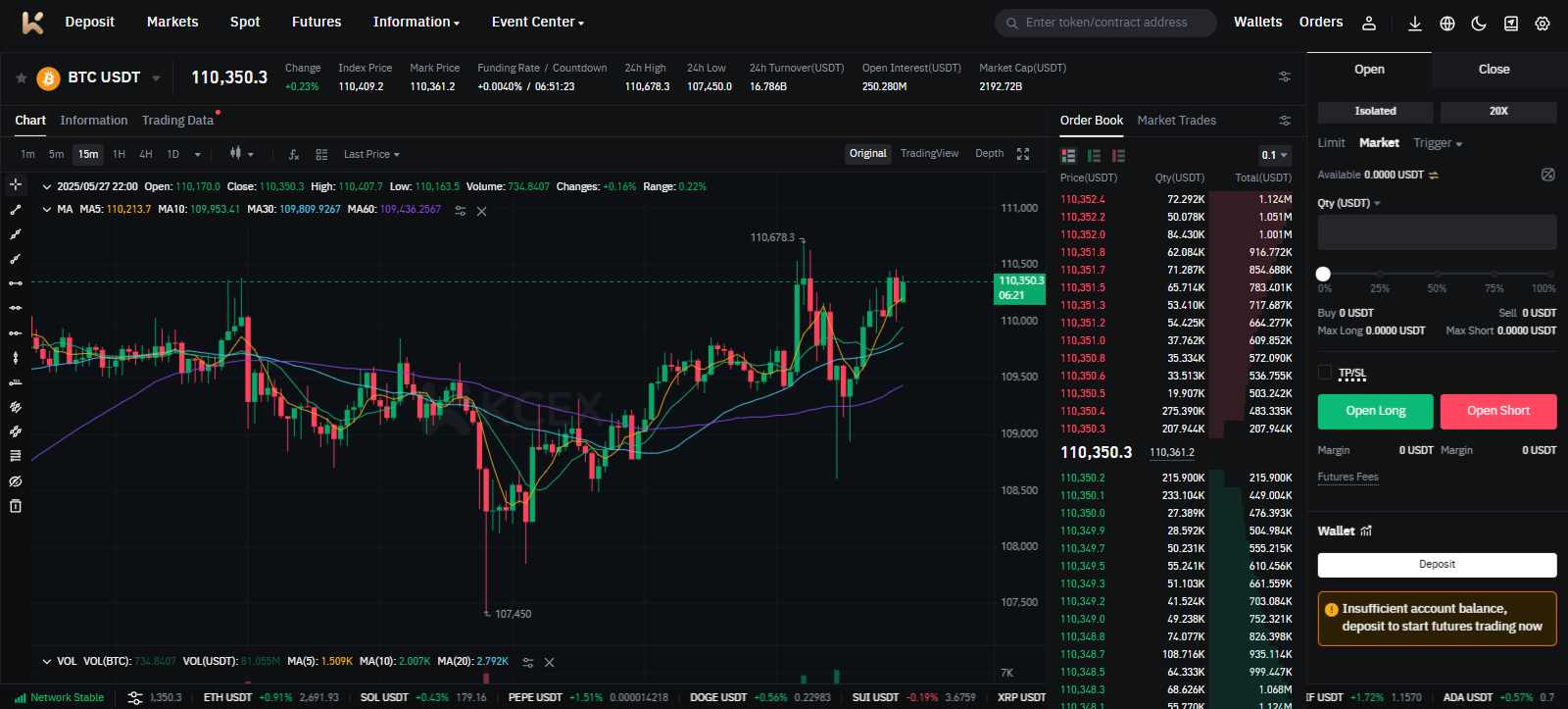

Futures trading

For derivatives, KCEX provides access to 679+ futures contracts with fees as low as 0% maker and 0.01% taker. Leverage is available up to 125x, appealing to high-risk, high-reward strategies. The charting options mirror spot trading, with both the original interface and full TradingView integration available.

Order types remain basic but effective, and just like in spot trading, traders can customize their layout through drag-and-drop functionality. The platform also includes the same candlestick trend indicator to help anticipate potential market directions, adding an extra layer of insight for futures traders.

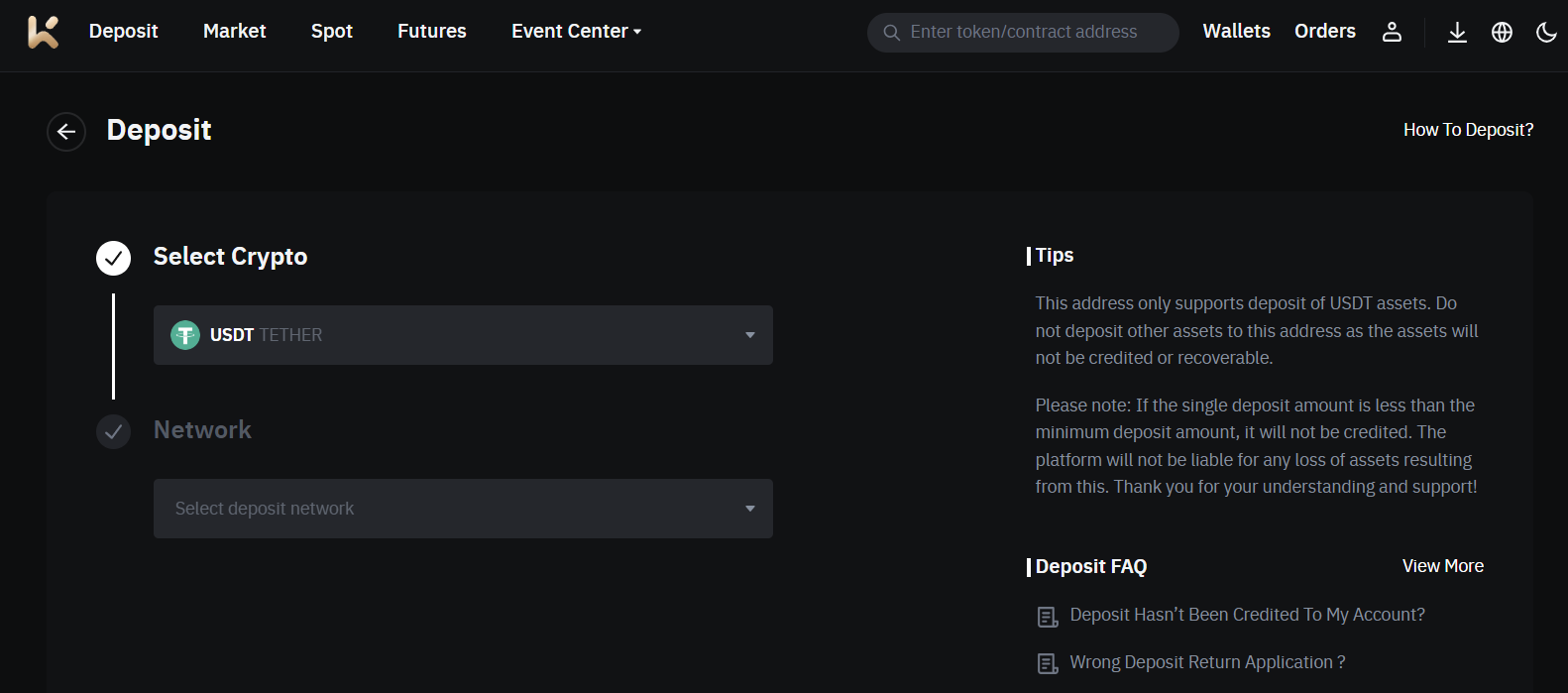

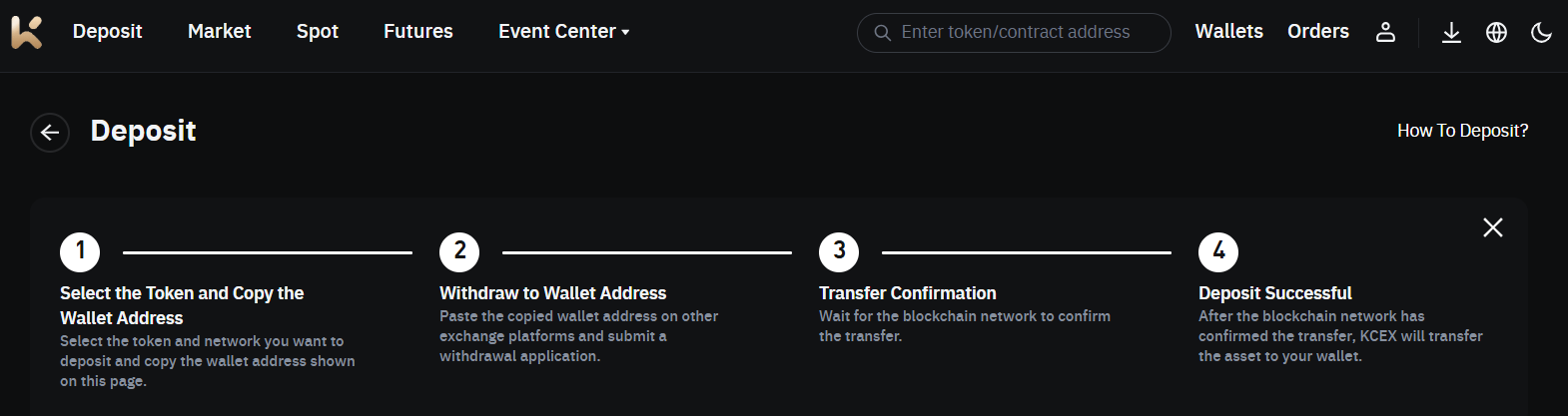

KCEX Deposits and Withdrawals Methods

KCEX currently does not provide any FIAT On- or Off-ramp options. There are no third-party payment integrations or P2P platforms available, so deposits and withdrawals can only be made through cryptocurrencies. The exchange supports a wide range of major networks, including Solana, Ethereum, Tron, BNB Smart Chain, and several popular Layer 2 networks, giving users flexibility in how they move funds in and out of the platform.

KCEX Fees

Trading Fees

KCEX keeps its fee structure simple and highly competitive. Spot trading is completely free, with a flat 0% fee for both makers and takers and no tiered structure. Futures trading is charged at 0% maker and 0.01% taker, but the platform also runs promotions on selected pairs where fees are waived entirely. Currently, pairs such as DOGE/USDC, DOGE/USDT, and PEPE/USDC are offered with zero trading fees.

Spot Fees

0.00% Maker

0.00% Taker

Future Fees

0.00% Maker

0.01% Taker

Deposits and Withdrawal fees

Fiat deposits and withdrawals are not supported on KCEX. Instead, all transactions are handled through cryptocurrency. Withdrawals come with zero platform fees, meaning the only cost to users is the standard blockchain network fee, which varies depending on the asset and network used.

KCEX Products and Services

KCEX offers a limited range of products and services, particularly because it is still a growing exchange. However, some products such as bonuses for new users, with its mobile app make it stand out.

KCEX Trading Tools

At present, KCEX offers two core trading products; spot and futures, which also serve as its main trading tools. Spot trading covers 908+ cryptocurrencies with zero fees, while futures trading includes 679+ contracts with leverage up to 125x.

Both products are supported by KCEX’s own charting interface as well as full TradingView integration. Traders get access to indicators, candlestick patterns, and a built-in trend indicator designed to help anticipate future market moves. Layouts are fully customizable through drag-and-drop functionality, so order books, charts, and news feeds can be arranged to match personal trading styles.

Basic order types like take profit and stop loss are available across both spot and futures. KCEX also integrates market and social news directly into the platform, ensuring users can balance technical setups with sentiment analysis. With deep liquidity and fast execution, the trading environment is structured to support both beginners and advanced traders.

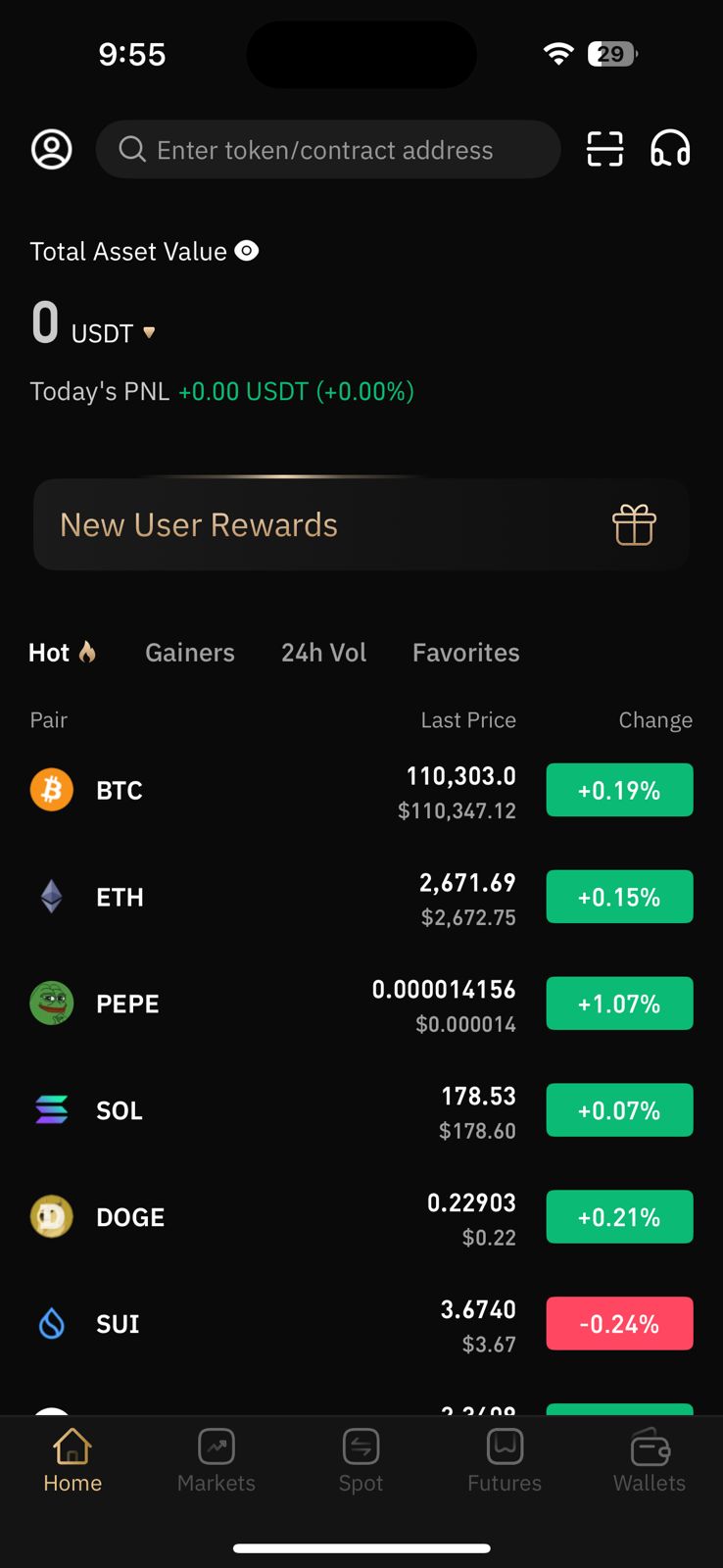

Mobile App

The KCEX mobile app is the go-to platform for accessing all of the exchange’s features on the move. Everything available on the web version, from spot and futures trading to account management. is also fully accessible within the app. It includes real-time charts, TradingView integration, and order management, ensuring traders don’t miss opportunities while away from their desktops.

The KCEX mobile app offers the following features:

1. User-Friendly Interface: The app aims to provide an intuitive experience, allowing users to access their accounts, view real-time market data, and execute trades seamlessly from their smartphones or tablets.

2. Supported Cryptocurrencies: KCEX offers a variety of cryptocurrencies for trading. The available coins and tokens may vary over time, so it’s essential to check their official website or app for the most up-to-date list.

3. Security Measures: KCEX emphasizes security features such as two-factor authentication (2FA) to protect user accounts. Most of the users’ funds are stored in cold wallets (offline storage) for enhanced security.

4. Fees and Payout Percentages: KCEX charges fees for trading, withdrawals, and other services. Payout percentages depend on market conditions and liquidity.

5. Customer Support: In case of any issues, KCEX provides customer support through its website or app.

The mobile app is available for download on Playstore and Apple Store.

KCEX Bonuses

KCEX offers a few bonus options for users, right from their onboarding onto the platform. There are three major bonuses that the platform offers; the welcome bonus, airdrops, and promo code bonuses.

1. Welcome Bonus: When you sign up on KCEX, you may be eligible for a welcome bonus. For instance, some users have reported receiving a 20 USDT bonus after using KCEX for two weeks. To qualify, you typically need to make an initial deposit (e.g., 100 USDT) upon sign-up and engage in trading activities.

2. Airdrops and Regular Events: KCEX occasionally hosts airdrops and events where users can earn additional rewards. These events may include zero-fee trading periods, special promotions, or other incentives. Keep an eye on their announcements to participate and benefit from these opportunities.

3. Promo Codes and Referrals: KCEX periodically releases exclusive promo codes that provide substantial benefits. Additionally, using a referral code during registration can amplify your advantages. As your referred users actively trade, your bonuses accumulate.

Check out our full KCEX referral code guide to learn how to claim the latest bonuses and get the most out of the platform.

KCEX Additional Products

Beyond trading, KCEX also provides a set of additional products and resources designed to support users and create more ways to engage with the platform.

One of the key offerings is the KCEX Affiliate Program. This built-in system allows users to sign up directly as affiliates of the exchange and earn commissions from the trading activity they refer. According to the exchange, affiliates can receive up to 70% of both spot and futures commission, making it an attractive option for traders or influencers looking to monetize their networks.

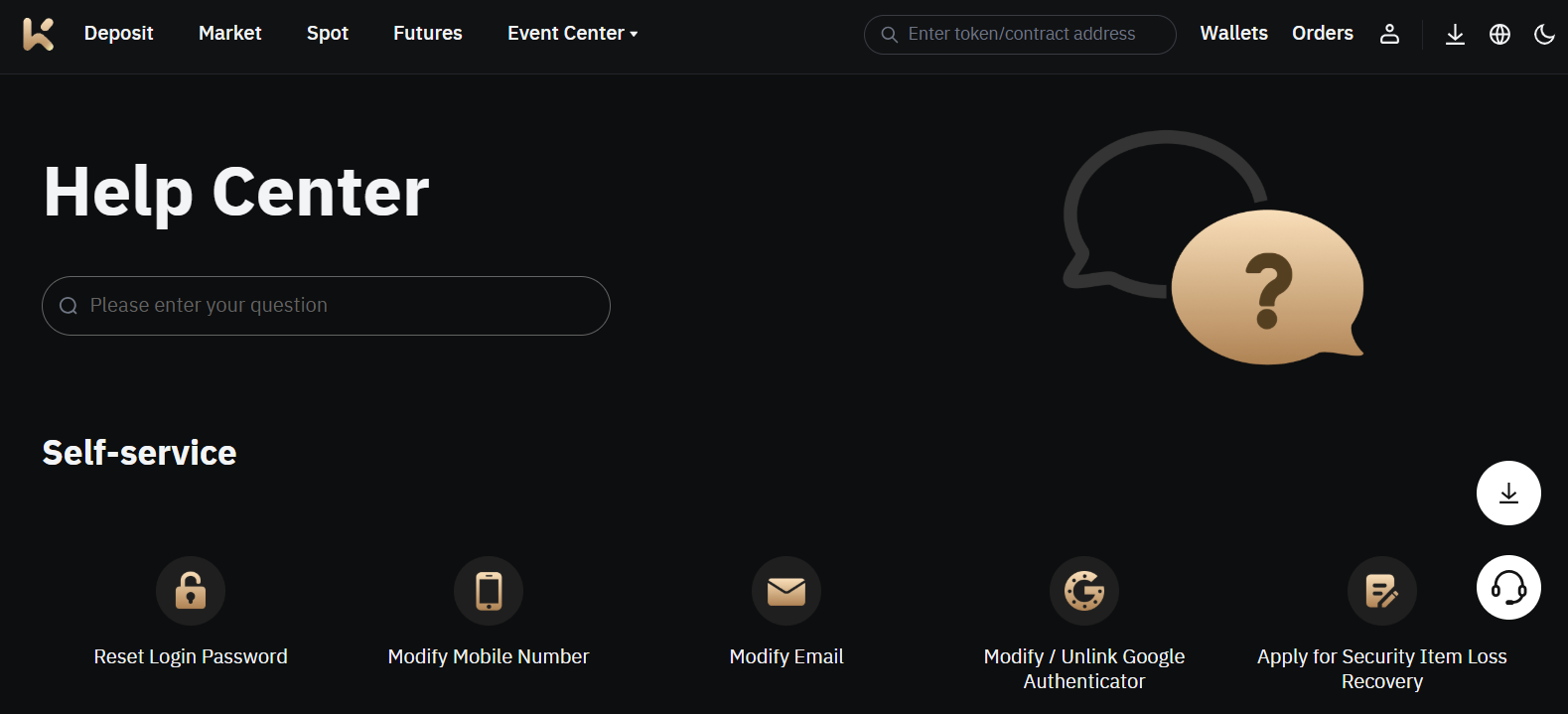

KCEX also maintains a dedicated Blog and News Hub through its Help Center. Here, users can track updates on new listings, platform maintenance, and ongoing events. It’s a useful resource for staying informed about changes that could affect your trading activity.

Finally, the exchange provides a collection of Guides and FAQs. These cover essentials like setting up an account, understanding order types, managing security, and resolving common issues. For beginners in particular, this resource helps reduce the learning curve and makes navigating the platform more straightforward.

KCEX Security

Security is one of the most important aspects of any crypto exchange, and KCEX has taken steps to provide features that are often missing on non-KYC platforms. Users can enable Google Authenticator for two-factor authentication, set up SMS notifications for account activity, and activate an anti-phishing code for extra protection against scams. Strong password requirements and wallet address management further strengthen account safety. On top of that, SSL encryption ensures sensitive data and user information remain secure.

While KCEX has never been hacked since its launch in 2021, it does not currently provide proof of reserves, which some users may expect as an added layer of transparency. The lack of mandatory verification may also be seen as a drawback for those who prefer exchanges with more traditional safeguards.

Overall, the security setup on KCEX is suitable for everyday trading and offers peace of mind to many users. However, those seeking a platform with stricter compliance and verifiable reserve audits may find KCEX’s approach somewhat limited.

KCEX Customer Support

KCEX offers round-the-clock customer support through live chat and email, with live chat responses usually arriving in under a minute. Support is available in multiple languages, reflecting the platform’s global user base. In addition to direct assistance, KCEX maintains a Help Center where users can find guides, announcements, and troubleshooting resources. Together, these options provide traders with reliable access to information and timely support whenever needed.

KCEX Alternatives

KCEX is a competitive exchange with zero spot fees and strong futures options, but if you’re exploring other no-KYC platforms, here are a few to consider:

1. Zoomex: Zoomex is another no-KYC exchange that appeals to traders with its very high leverage and straightforward trading setup.

2. Bitunix: Bitunix is also no-KYC but offers a more modern, user-friendly interface along with attractive bonuses for new users.

3. MEXC: MEXC stands out for its low trading fees, high leverage, and one of the largest selections of altcoins available on any exchange.

| Feature | KCEX | Zoomex | Bitunix | MEXC |

|---|---|---|---|---|

| Established | 2021 | 2021 | 2022 | 2018 |

| Spot Fees (Maker/Taker) | 0.00% / 0.00% | 0.10% / 0.10% | 0.10% / 0.10% | 0.05% / 0.05% |

| Futures Fees (Maker/Taker) | 0.000% / 0.010% | 0.020% / 0.060% | 0.020% / 0.060% | 0.000% / 0.020% |

| Max Leverage | 125x | 1000x | 125x | 500x |

| KYC Required | No | No | No | Yes |

| Supported Cryptos (Spot) | 908+ | 468+ | 541+ | 3137+ |

| Futures Contracts | 679+ | 451+ | 400+ | 433+ |

| No KYC Withdrawal Limit | 15 BTC | 0.1 BTC | $500,000 | None |

| 24h Futures Volume | $15.07B+ | $9.41B+ | $6.91B+ | $33.76B+ |

| Trading Bonus | $16,000 | $100 | $5,500 | $20,000 |

| Key Features | • Zero spot fees • 908+ cryptos • No KYC with high limits |

• High leverage up to 1000x • No KYC • Hybrid DEX + CEX |

• No KYC • User-friendly design • Strong bonuses |

• Massive altcoin list • Very low fees • Deep liquidity |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Conclusion

KCEX may be a relatively new exchange, but it has carved out space in the market with ultra-low trading fees, a wide range of cryptocurrencies, and higher no-KYC withdrawal limits than most competitors. With support for 908+ spot assets and 679+ futures contracts, plus leverage up to 125x, it gives traders plenty of options to build strategies. Features like TradingView integration, customizable layouts, and fast execution further enhance the trading experience. Importantly, the exchange has never been hacked since its launch in 2021, which adds weight to its security claims despite not providing proof of reserves.

The appeal of KCEX lies in its cost-optimized structure and the freedom to trade anonymously with limits that remain practical for active traders. However, it does come with limitations. There is no fiat support, no P2P marketplace, and no additional products like staking or copy trading. Transparency on regulation also remains somewhat unclear compared to larger exchanges.

For users who value privacy, low fees, and a large asset selection, KCEX stands as a strong option among no-KYC exchanges. Those seeking broader features or fiat integration may still prefer more established platforms.

FAQs

1. Is KCEX legit?

KCEX is a Seychelles-based platform that has obtained regulation from prominent countries around the world, including the United States and Canada.

2. What are KCEX fees?

KCEX offers zero fees on its spot trading platform for both makers and takers. On futures, the fees are set at 0% for makers and 0.01% for takers, with occasional promotions on selected pairs offering zero fees.

3. Is KCEX available in the United States?

KCEX claims to be registered and available to traders in the US, although this has not been confirmed by any certification from their regulatory bodies.

4. Is KCEX safe to use?

KCEX has never been hacked since its launch in 2021 and offers key security features like two-factor authentication, and anti-phishing codes. However, it does not provide proof of reserves, which some users may consider a limitation.

5. Does KCEX have a native token?

There is currently no native token for the KCEX exchange.