BTSE, short for “Buy, Trade, Sell, Earn,” is a trusted digital asset exchange. Based in the British Virgin Islands with offices across the globe, it has been facilitating secure and user-friendly cryptocurrency trading since September 2018.

The crypto exchange specializes in derivatives trading, focusing on instruments like stocks or bonds. BTSE also facilitates crypto trading, allowing users to trade their preferred digital tokens. Now, let’s jump into the details of how to start trading futures on the BTSE platform.

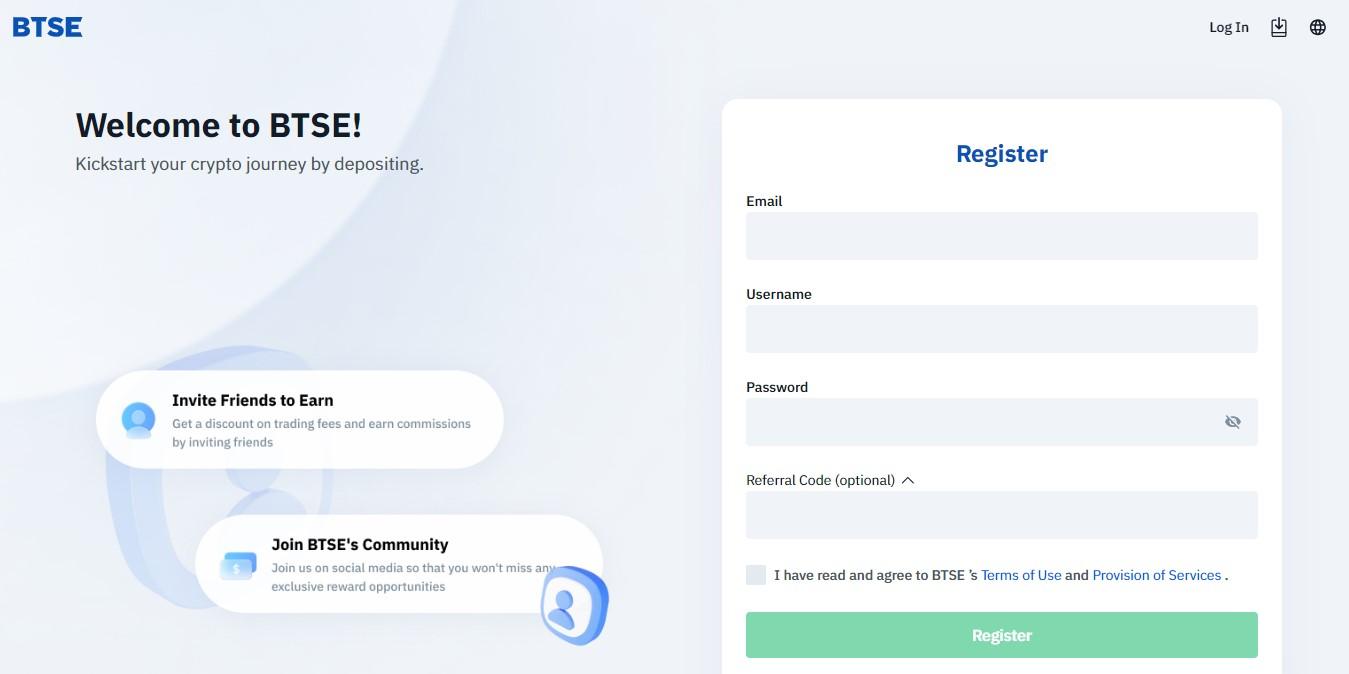

Opening a BTSE Futures Account

From BTSE.com’s home page, click “Register” or click here to fill out the registration form

Please note the following crucial guidelines for creating your password:

- Include both lower (a-z) and upper (A-Z) case letters.

- Ensure at least one number (0-9) or a symbol.

- Maintain a password length between 8 and 72 characters.

- Avoid using spaces in your password.

If you have a referrer or event redemption code, click on “Referral Code” and fill in the relevant fields.

BTSE KYC Verification

While many BTSE features are available without completing KYC, verifying your identity opens up additional services, like crypto-to-fiat transactions to bank accounts. The KYC process on BTSE is simple, involving three steps on the Identity Verification Page:

- Upload a photo ID (passport or driver’s license).

- Provide proof of address (bank statement, credit card bill, utility bill, or national ID).

- Submit a clear selfie.

Verification usually takes 1 to 2 business days, and confirmation is sent via email upon completion.

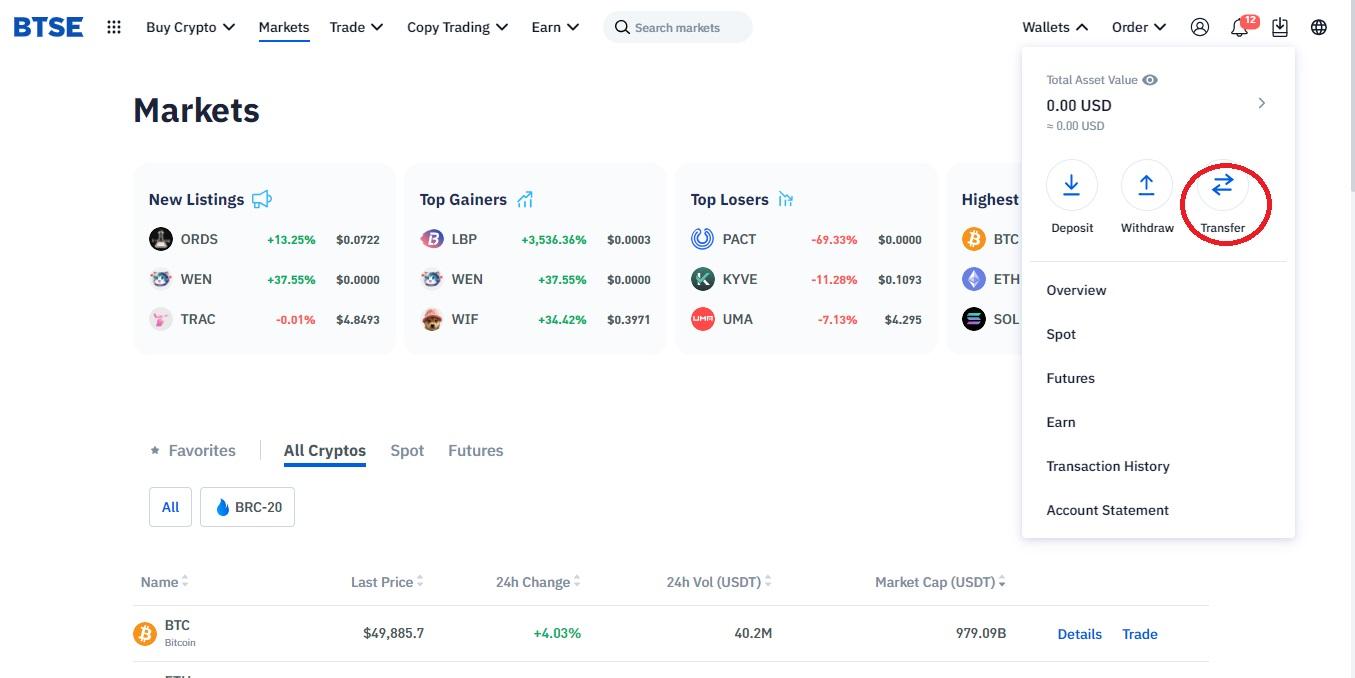

Funding your BTSE Futures Account

The first step in trading futures contracts on BTSE is funding your Futures wallet. This process is intentionally designed to be effortless.

You have flexibility in funding your BTSE wallet, with options including:

- Fiat currencies

- Cryptocurrencies

For fiat currencies, you can deposit funds into your BTSE wallet using your credit card through Mastercard or Visa. Alternatively, when dealing with cryptocurrencies, you can select from a growing variety of tokens supported by BTSE to fund your wallet.

After a successful deposit, you can then transfer funds from your spot wallet to your futures wallet.

Transfering Your Funds

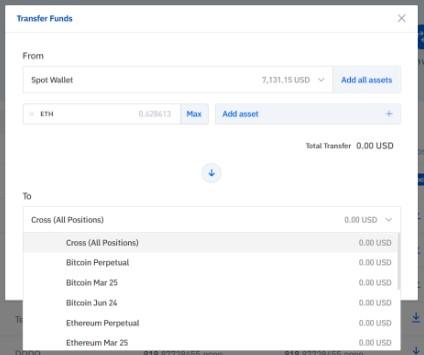

Once you’ve successfully funded your Spot Wallet, the next step is to transfer it to your BTSE Futures Wallet. To do this;

1. Go to your “My Wallet” dashboard and find the “Transfer” option. Click on it to continue.

2. From the drop-down menu on your “My Wallet” dashboard, choose “Spot Wallet.”

3. Select one of the supported options on BTSE. The first choice is “Cross,” allowing you to fund all futures positions at once. On the other hand, you can opt for specific BTSE futures contracts like Ethereum Perpetual, Bitcoin Perpetual, Litecoin Perpetual, among others.

4. Once the transfer is complete, confirm if it’s successful by visiting the “Futures” section on your dashboard.

Trading BTSE Futures

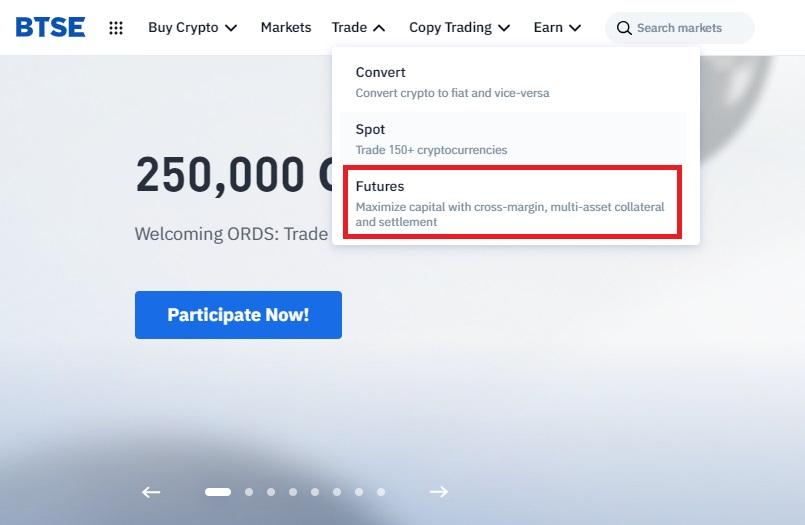

1. Go to the Futures page.

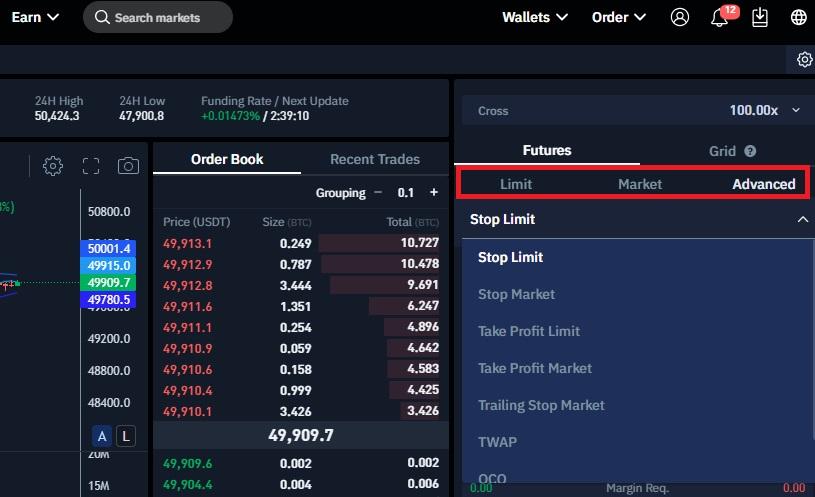

2. Choose an Order Type.

BTSE offers a variety of order types to accommodate diverse trading needs and risk management preferences:

- Limit Orders: Traders specify a precise price for buying or selling an asset. These orders wait in the order book and are executed when a matching bid or ask price is found.

- Market Orders: Execute instantly at the current market price, ideal for traders needing immediate execution. They secure the best bid or ask price in the order book.

- Stop Orders: Placed at a user-defined trigger price, activating when the market reaches that level. They serve as risk management tools or automate market entry.

- Take Profit Orders: Trigger Market or Limit Order execution at a specified price level to secure profits.

- Trailing Stop Orders: Adjust trigger prices based on recent market price changes, helping to secure profits and limit losses during market fluctuations.

- TWAP Orders: Split a single order into smaller ones over a set period to reduce slippage and execute at an average price.

- OCO Orders: Combine a stop-limit order with a limit order. If one part executes, the other is canceled, minimizing potential losses.

- Index Orders: Place orders based on a percentage above or below the BTSE index price.

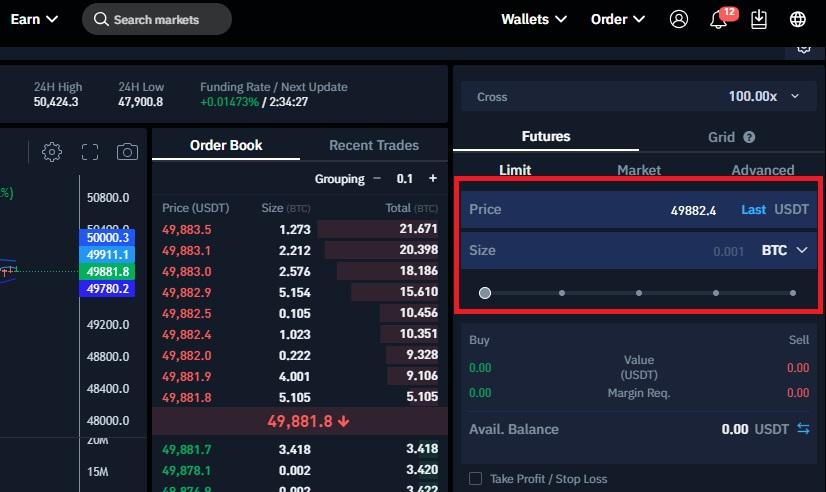

3. Input the Order Price and Size.

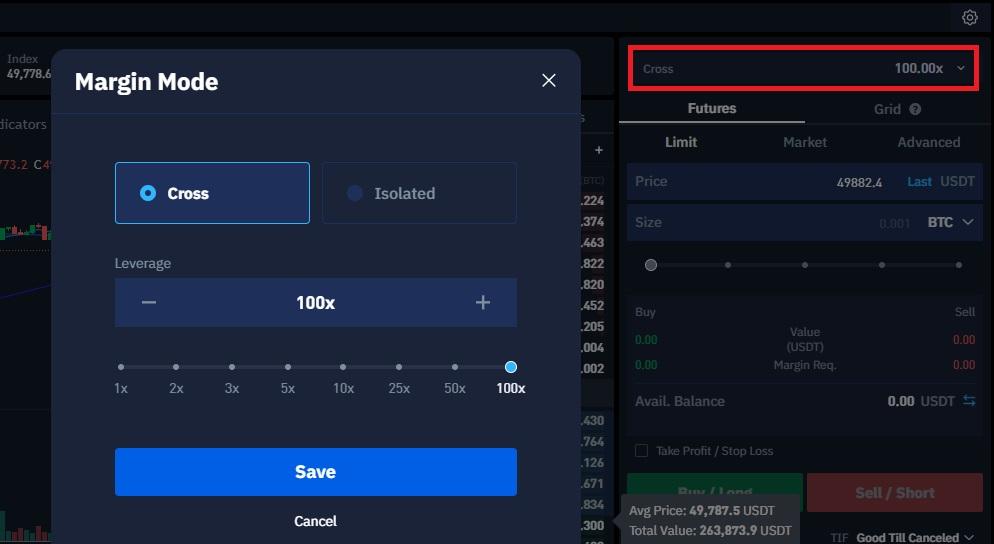

4. Choose a Leverage and Futures Wallet

Leverage

BTSE offers two leverage options for trading:

- Leverage – Cross (100x)

- With a leverage of 100x, traders can amplify their positions significantly.

- Margin for trades at this leverage level is withdrawn from the Cross Wallet.

- Leverage – 1-100x:

- This option allows users to select leverage ranging from 1x to 100x.

- Margin for trades at this variable leverage is withdrawn from the Isolated Wallet.

In the trading interface, the Margin field under the leverage option will specify whether the funds are sourced from the Cross Wallet or the Isolated Wallet, depending on the selected leverage. This distinction ensures clarity and precision in managing your trading positions.

Futures Wallet

- Cross Wallet

The funds stored in Cross Wallets are versatile and can serve as the margin source for multiple positions concurrently. For instance, if you hold two positions, an ETH Time-based position, and a BTC Perpetual position, the Cross Wallet can be used as a margin source for both positions. This flexibility allows for efficient management and allocation of funds across different trading positions.

- Isolated Wallet

Funds stored in the Isolated Wallet have a specific and dedicated purpose. The balance in the Isolated Wallet can only be used as the margin source for the corresponding contracts. For example, the Bitcoin Perpetual Wallet balance can exclusively be used as the margin source for Bitcoin Perpetual Contracts.

This distinction ensures a clear and precise association between wallet balances and their designated trading contracts. It provides a focused and structured approach to managing margins.

5. Choose “Buy / Sell” to Finalize Your Order.

Bottom Line

Trading on the BTSE platform is designed to be remarkably simple, ensuring a seamless experience for beginners and seasoned traders. The user-friendly interface facilitates easy navigation through essential processes, from swift registration to straightforward funding of the BTSE Futures wallet.

The platform’s commitment to simplicity is evident in the intuitive steps outlined in the guide, covering everything from KYC verification to executing diverse order types.

Need more info? We have a more detailed exploration and an in-depth BTSE review that will answer all your questions. Happy Trading!

![How to Withdraw funds from MetaMask [2024]](https://www.cryptowinrate.com/wp-content/uploads/2024/06/Add-a-little-bit-of-body-text-1024x597.jpg)