Do you want to create a cryptocurrency trading bot? Then you’ve come to the correct spot. Let us begin by examining what cryptocurrency trading bots are and how they function.

The cryptocurrency market is growing more prominent and is quickly evolving into one of the most traditional types of investing. On the other hand, trading is a highly complicated operation that demands a great deal of attention and effort.

What exactly is a cryptocurrency trading bot?

A cryptocurrency trading bot is a computer program that buys and sells multiple cryptocurrencies optimally to maximize profit. It performs transactions depending on predefined parameters.

Crypto trading bots ensure that traders do not lose out on successful deals by operating a collection of algorithms and opening orders on time.

How Crypto Trading Bots Function

A bitcoin exchange bot responds to the investor’s algorithm. The parameters are determined by the investor, who enters a method and a collection of indicators against which the bot responds, such as pricing, volumes, or liquidity. The bot constantly evaluates these parameters, producing buy or sell indications and performing transactions following the strategic plan.

Repeated Tasks

Cryptocurrency exchange bots are frequently employed to automate repetitive processes. It includes investment portfolios and rebalancing, reducing risk by ensuring the overall portfolio balance leans toward the investor’s competence. It could be a tedious and time-consuming operation.

Assume the investor desired that cryptocurrencies comprise 70% of the investment and indexes comprise 30%. If indexes were to perform well, the weighting should begin to move in their favor. Under the investor’s directions, the bot may adjust the portfolio by trading indices or purchasing cryptocurrencies.

Active Investing

The second significant use of cryptocurrency bots is to supplement an active trading approach. Bots are often used for collecting data and processing and validating tactics against previous data. Arbitrage selling is, however, one approach that takes advantage of minor price differences across marketplaces. Suppose the cryptocurrency exchange bot is strong and quick. In that case, it may conduct an arbitrage purchase before exchanges’ rates have been changed, purchasing the virtual money at a low cost and then selling it at a gain on another exchange.

Computer vision, often referred to as artificial intelligence (AI), refers to the ability of cryptocurrency exchange bots to learn from previous data. You may use supervised learning to fine-tune effective tactics for optimizing transactions and buying or selling at the ideal moment, improving profits.

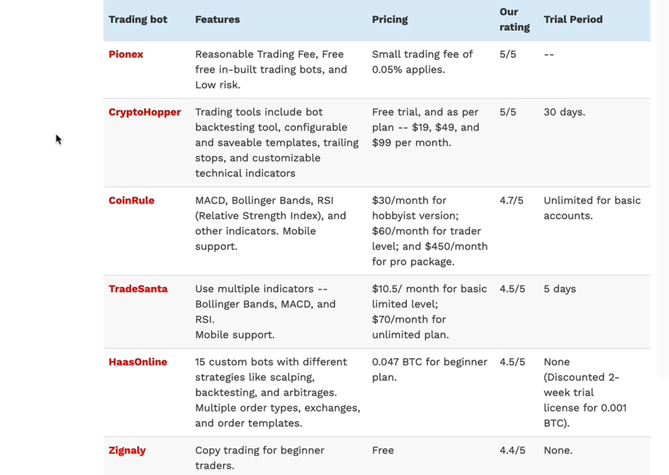

What Should You Look For in a Crypto Bot?

Numerous cryptocurrency bots are available that are both easy to use for novices and sophisticated enough to manage a large quantity and rate of transactions. Because you could allow the bot to perform actual transactions 24 hours a day, they must be dependable. To prevent crypto trading bot frauds, do a thorough study.

The finest bitcoin bot is largely dependent on the requirements. Forums like Reddit, Discord, Bitcointalk, and Telegram are great places to look for information on the dependability and appropriateness of a bitcoin exchange bot, as well as advice and instructions from those other traders.

There are several things to keep an out for if you use a creator’s bot:

Reputation: Confirm that the programmer operates on a cryptocurrency exchange bot with a renowned team. Examine the top management and the firm’s history.

Returns: Check whether the cryptocurrency exchange bot has a track record of high returns. The clarity in employee evaluations and backtesting is desirable.

Security: Similar to selecting a trustworthy supplier, security is critical since you are providing the cryptocurrency exchange bot with access to your funds.

Compatibility: The top exchanges are Binance, Kraken, and Coinbase. Check if the crypto bot is compatible with the platform you intend to use. Cryptohopper, for example, might be a good alternative if you want to utilize a bot on Bitcoin, HIBTC, or Bittrex.

How to Build a Crypto Trading Bot From Scratch

Now that you know crypto bots and how they work, let’s switch to workflow of the cryptocurrency bot development. Follow the following steps mentioned below to build a useful bot:

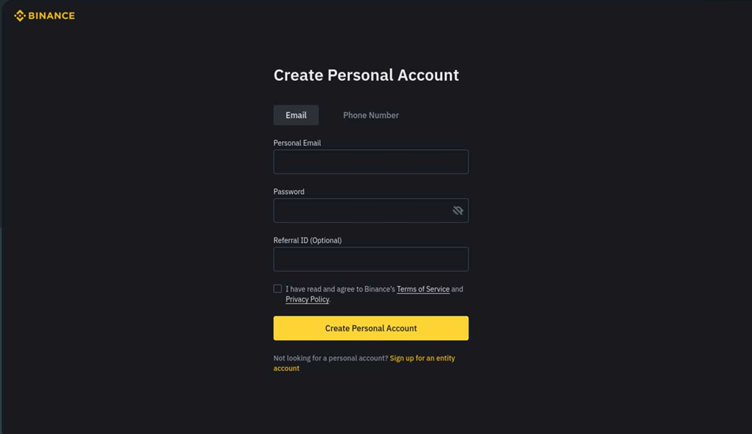

- The first thing you need to do is to create a Binance account (if you still need to create one). Signing up for Binance is a quick and painless process for most people, so you should be ready in minutes.

- Before you even set up a cryptocurrency trading bot, you must choose the right one.

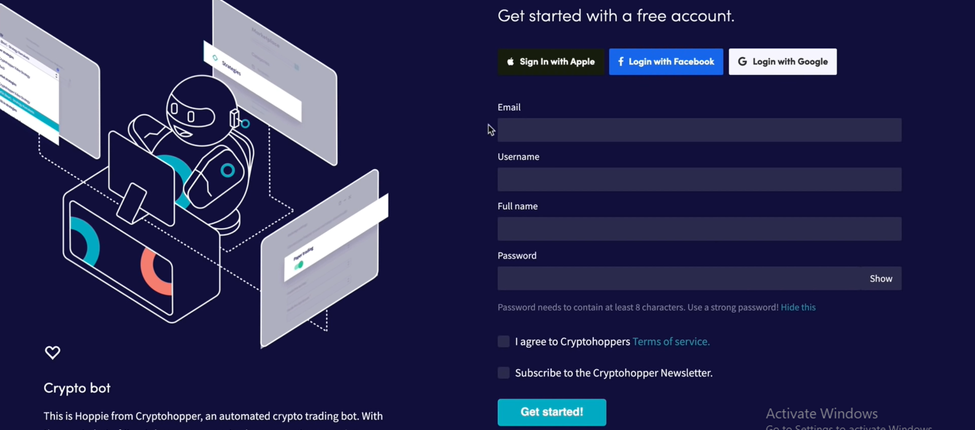

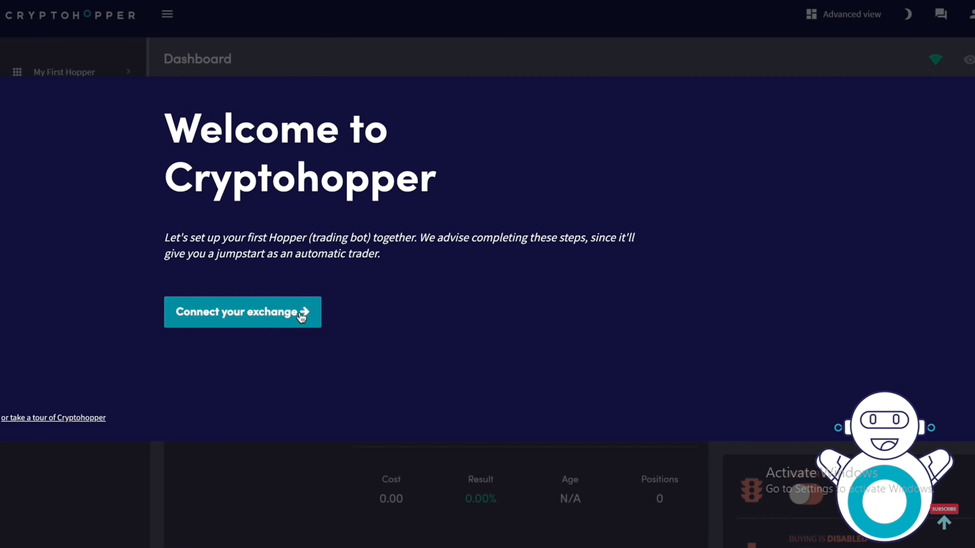

- Now you will go to get started, and start a free account in Crypto Hopper. All you need to do is enter your email, username, full name, and password.

- Next, you need to tap on “connect your exchange” that it will work with, or you could take a tour of the crypto hopper.

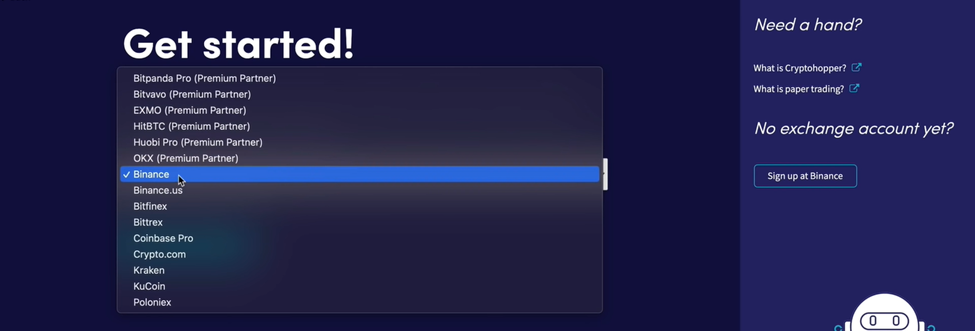

- Once you have created your Binance account, click on the Binance option. And click on “go to the next step.”

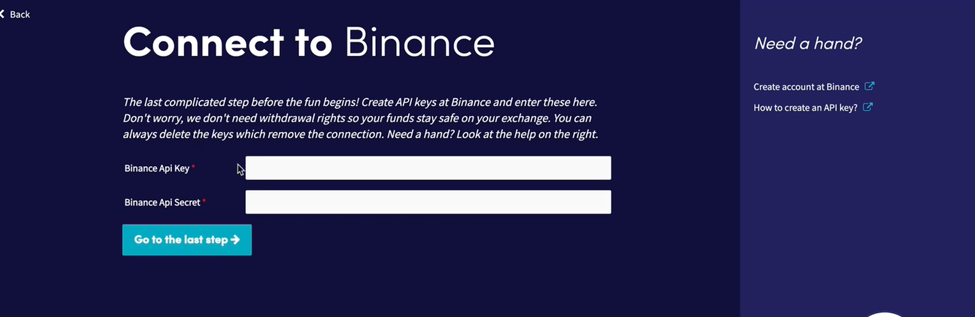

- Now you need to put in your Binance API key and secret key.

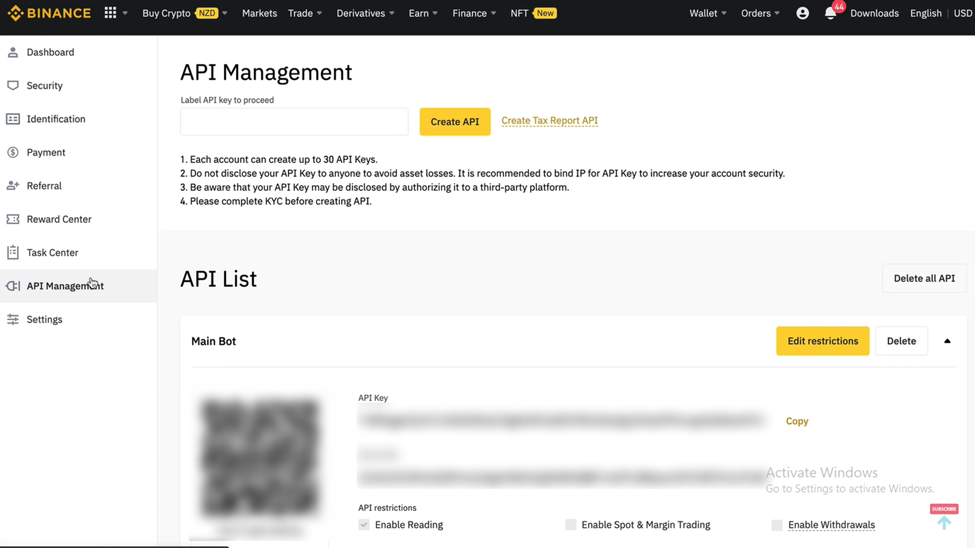

- So in Binance, you go to the settings page, Then go to API management; after that, copy the API key(highlighted in red) and post it in. Again, copy the secret key and put that in the section.

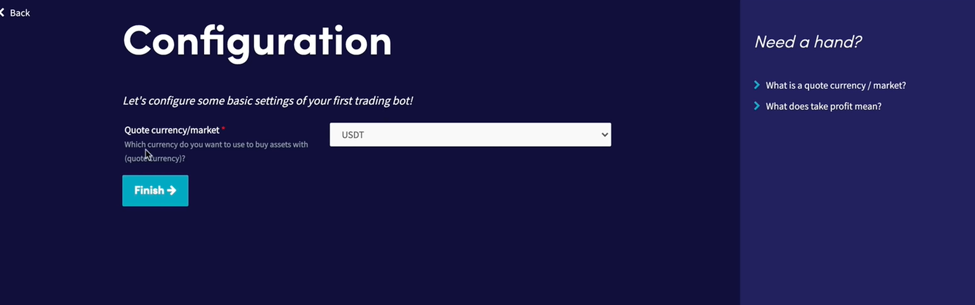

- After Clicking on the last step, change to the “USDT” and click on the “Finish” option. After that, click on “Go To Your Hoppers .”Now your hoppers are essentially your bots, and they will do their job.

- Now, as it takes you through many tutorials, you can follow. It will give you everything you need to do, so you must go through the tips because this is very important. These can be complex if you don’t understand how this works.

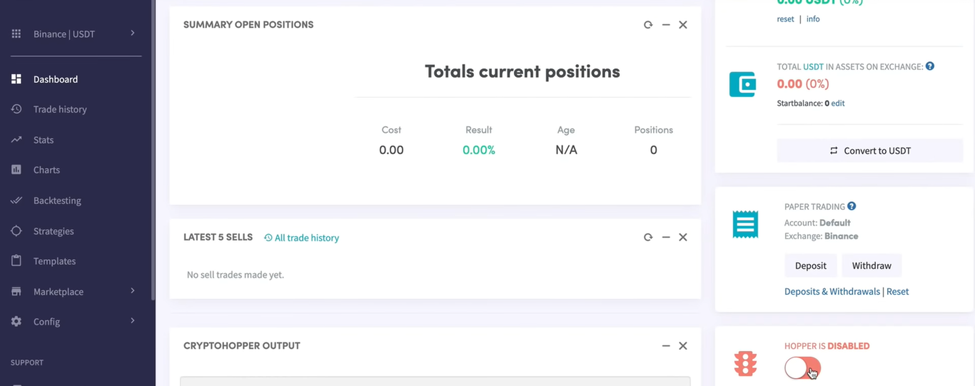

- After the tutorial, click on “add new hopper.” Now, the way bots work is you need to understand these are not designed to get you rich. They’re not some secret way to make a bunch of cryptos. They essentially trade for you based on signals and information.

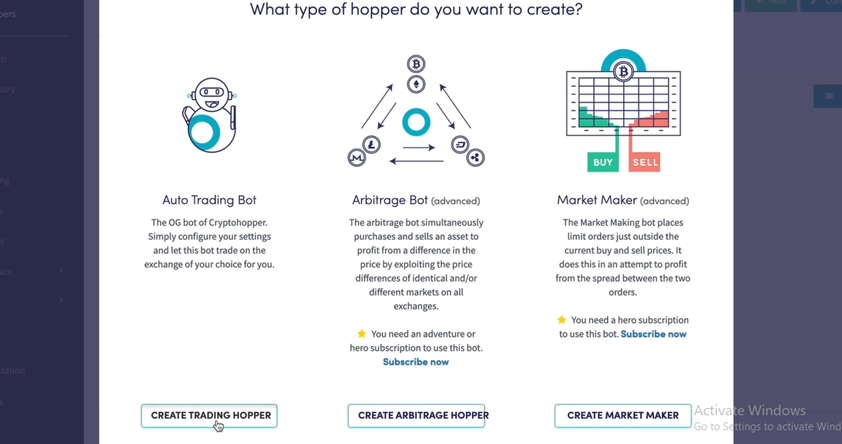

- Click on the “Create trading hopper” because the auto trading bot is just your normal trading bot compared to the market maker bot.

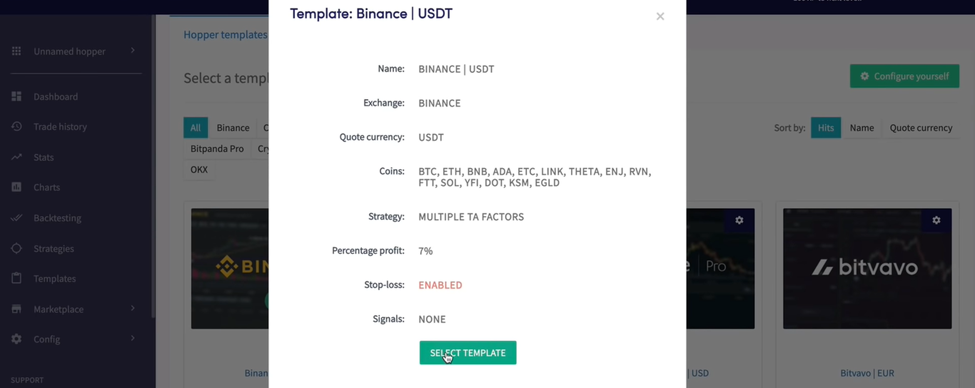

- Now the next step is we want to create a hopper. Now you can configure it yourself, but experts would only recommend something else. But you have to go towards “Binance | USDT” and click on “Select Template,” which is the best alternative. Now your hopper has been configured based on the selected template.

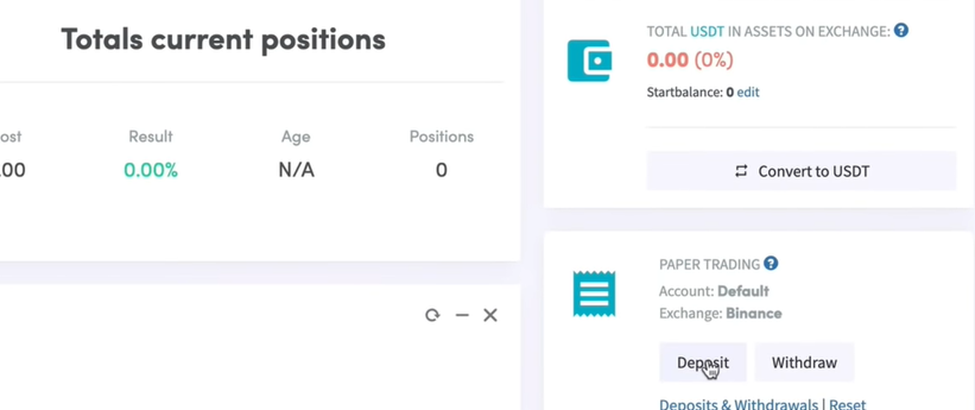

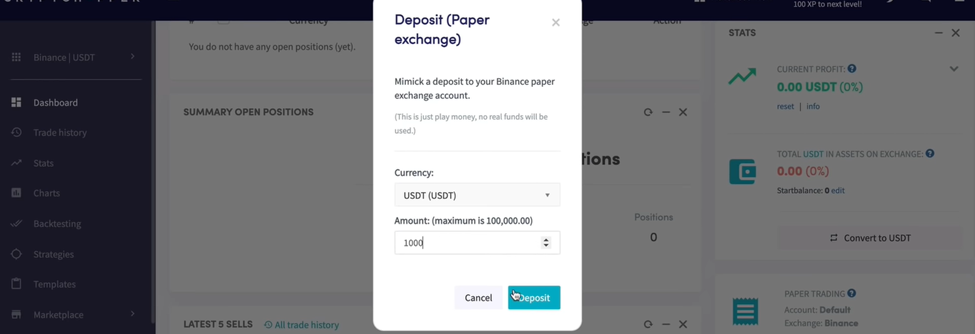

- If you are doing paper trading, click on the “deposit” option.

- Now change the currency to USDT, put in an amount of 1000, and click on “deposit.”

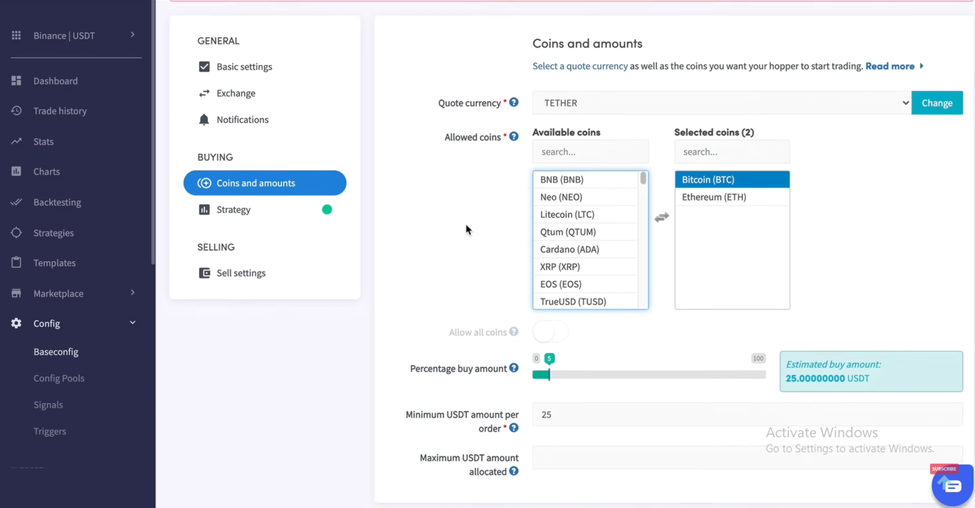

- Now you notice “hopper is idle” on the right. What you have to do is to go to the config settings. Afterward, go to the coin and amounts and change the currency to “TETHER .”The selected coins must be BTC and Ethereum. Change the percentage buy amount to five percent. After all that, save the settings.

- In the end, enable the hopper, so it should start working. That’s how you can go and start your cryptocurrency trading bot online.

Key benefits of Using Cryptocurrency Trading Bots

Performance

Trading bitcoin assets with a crypto bot has always been more efficient. There is no need to be concerned regarding delays or personal mistakes. As soon as the bot obtains the correct data and uses appropriate algorithms, it may trade resources with the highest profit opportunity. Another advantage is that such bots may run continuously.

Emotionless

Cryptocurrency bots perform every choice based on the information it indicates. Bots, unlike people, are neither worried about losing nor greedy for gains. Ideal investors make reasonable judgments by controlling their feelings, but this is rarely the case, particularly for newbies.

Preset objectives

It’s estimated that over half of all traders lose money due to circumstances that involve emotional judgments. Cryptocurrency bots may assist you in setting objectives, removing the need for human involvement.

Faster than Humans

The bitcoin market is fluctuating. A bitcoin may increase by twenty-five percent in a short time and then drop in a short amount of time. Because it takes time, individuals may lose out on such gain if they perform it manually. It is when trading cryptocurrency exchange bots come in handy. You rarely lose money when you start utilizing bots to earn money.

Historical Data Testing

When employing bots, you can perform paper trading or backtesting and analyze records to see if a strategy or trading approach is effective. Everyone, whether seasoned or inexperienced, may profit greatly from this equipment. Prediction, when paired with backtesting, may assist traders in determining if the technique they wish to pursue will create big gains.

Restrictions Imposed by Predetermined Trading Rules

People lose a lot of money for various reasons, including panic. For example, if the currency you invest in fails, you may stress and transfer this without hesitation. Bots are impervious to these flaws.

Conclusion

The cryptocurrency market is regaining strength and attracting more risk-taking traders. If you want to test your chances and consider this a temporary craze, you may use open-source trading bots. There are various inexpensive membership options if you want to practice and test your investment talents. If you intend to make bitcoin trading a regular source of revenue, try developing your trading bot for maximum performance and security.

![How to Withdraw funds from MetaMask [2024]](https://www.cryptowinrate.com/wp-content/uploads/2024/06/Add-a-little-bit-of-body-text-1024x597.jpg)