CoinTiger is a centralized cryptocurrency exchange that is located in Singapore. It was founded on the 15th of November 2017 and has grown to be increasingly recognized in Southeast Asia. It is currently recognized in over 100 countries across Southeast Asia and possesses a 24/hr trading volume of $421 million at the time of writing. The CoinTiger exchange platform is not suitable for expert traders.

Disclaimer: Due to regulatory and security concerns, we do not recommend using CoinTiger. Check out top alternatives such as OKX and Bitget.

CoinTiger Overview

CoinTiger is a high-risk cryptocurrency exchange that was started in November 2017 by CoinTiger Labs. The exchange claims to be the first platform to have introduced an equity mechanism using its native token. CoinTiger allegedly allocated 50% of the annual net profits derived from the native token to TCH holders at the ratio of 100TCHs: 0.05 BitCNY. CoinTIger exchange also supports the withdrawal and deposit of CNY.

As an exchange, CoinTiger offers 286 trading pairs but possesses relatively high trading fees. It is not a good exchange for beginner and expert traders. The crypto exchange platform reportedly gained a user engagement volume of 2 million users in the middle of 2019.

The exchange also claims to provide its users with the possibility of earning through various investment opportunities in blockchain projects and token platforms, trading, and buying of corporate shares. The exchange currently has 260 cryptocurrencies, 2 fiat currencies, and 286 trading markets.

There are no minimum deposits in the exchange. There are only withdrawal fees and trading fees. The platform offers many different crypto assets like BTC, ETH, TRON, LTC, ADA, and many others. There are also fiat trading pairs including USD, CNY, GBP, EUR, and others. There are also altcoins and DeFi coins traded on the platform. CoinTiger provides users with a TradingView web unit for professional traders, and a basic version for amateurs to learn with.

CoinTiger has both web and mobile platforms for Android and iOS users, which is proven to be glitch-free and smooth for amateur and professional navigation.

Overall, the exchange is slow, poorly designed, and not a reliable crypto trading platform.

Pros and Cons of Exchange

| 👍 CoinTiger Pros | 👎 CoinTiger Cons |

|---|---|

| ✅ Tutorial guidelines for beginners and amateur traders | ❌ No direct call center for customer service |

| ✅ Multicurrency wallet for users | ❌ Highly unreliable for expert traders |

| ✅ Referral point for users | ❌ Slow response times |

| ✅ Separate trading units for beginners and professionals | ❌ High trading fees |

CoinTiger Products, Services, and Features

Trading on Exchange

There are two different trading options for users on the CoinTiger exchange; CoinTiger Spot and Futures market. There is also a margin trading option on the spot market involving crypto-crypto and crypto-fiat trading. It provides leverage of 1:125% for traders. There is also a wide range of trading pairs, consisting of 618 cryptocurrencies.

The exchange also claims to be the world’s largest one-stop digital asset trading platform, which is completely bogus. CoinTiger’s derivative trading platform is also ranked as 4th on Coinmarketcap with a 24/hr volume of $ 2 billion, mostly from fake/wash trading.

CoinTiger Spot trading

CoinTiger exchange provides users with a traditional spot market interface and trading options. The trading fees are extremely high when compared to traditional markets.

The industry standard for spot trading is 0.1% for both maker and taker, but CoinTiger ridiculously charges a fee of 0.15% for takers and 0.08% for makers. The fees are high and unreasonable for a poorly ranked exchange.

CoinTiger Futures trade

CoinTiger exchange makes use of perpetual Futures with relatively high trading fees. Though users are free to open and close trades at any time, the trading fees for CoinTiger Futures are equally as high as the spot trade.

Like traditional futures markets, CoinTiger uses a protocol to encourage the futures market to adjust to the ‘mark price’ via funding rates. While this will encourage long-term convergence of prices between spot and futures for the BTC/USDT contract, in the short term there may be periods of relatively large price differences.

The trading fee for futures on CoinTiger is the same as the spot market, with an average of 0.15% and 0.08% taker and maker. Though trades are based on USDT, traders can also switch through cryptocurrency margins with a leverage ratio reaching up to 1:125%.

CoinTiger provides users with a stop-market order. The exchange however lacks advanced order types, a poor liquidity pool, and a very basic trading software.

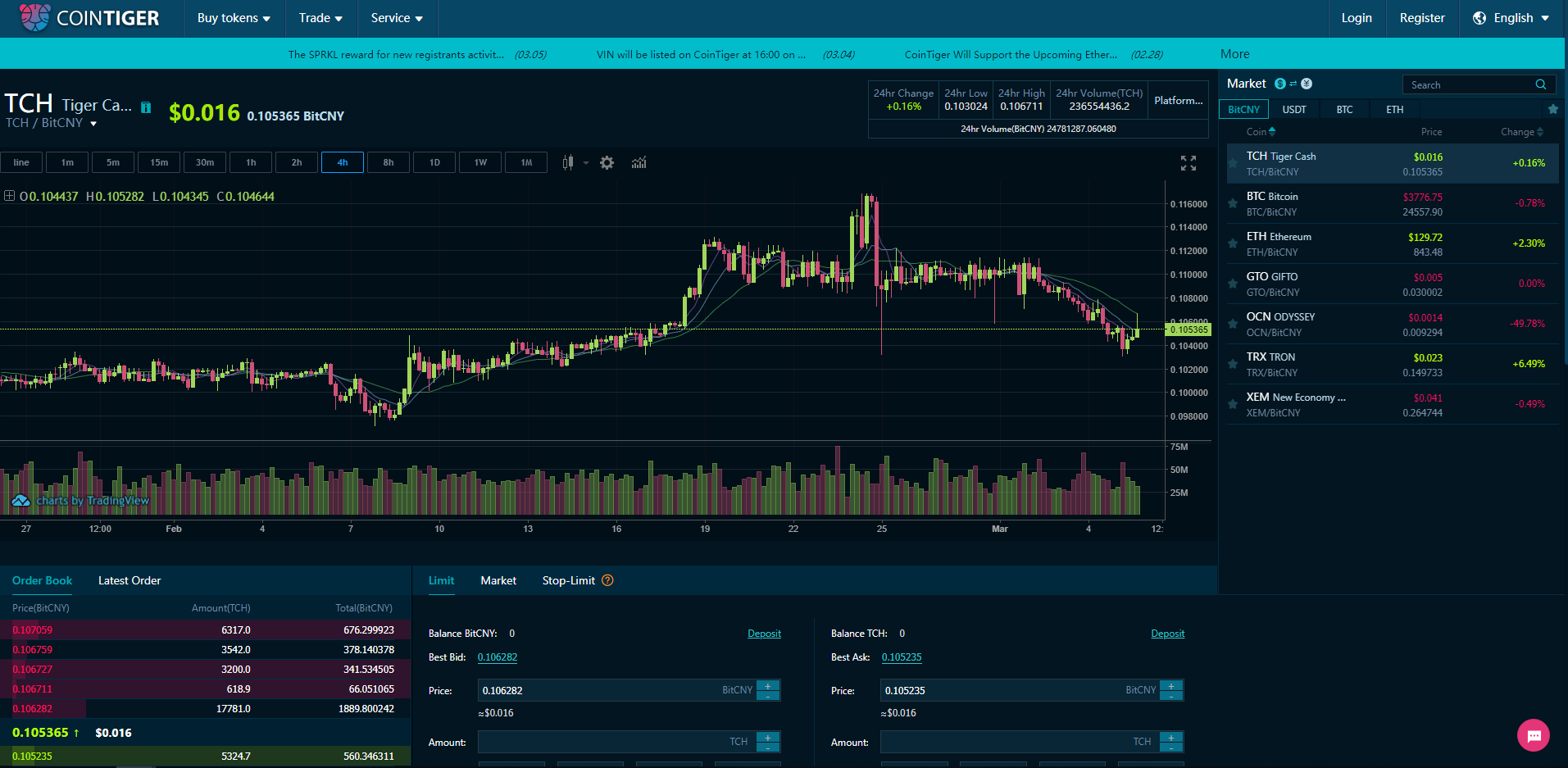

CoinTiger Tradingview terminal

Users are provided with a Tradingview web terminal with its unique protocols. The exchange possesses a different Tradingview terminal for beginners and another for professional traders.

As with other platforms, CoinTiger’s Tradingview provides users with an order book, price chart for the selected cryptocurrency, and order history.

CoinTiger Exchange fees

Exchange fees on the CoinTiger platform are , high, and unreasonable. Although there are no fees for depositing crypto assets on the exchange, transporting funds on the exchange can be very slow and unreliable.

Deposit fees

On CoinTiger, there are no deposit fees for crypto assets. There is also no minimum deposit available, meaning that users are free to deposit funds with zero costs on the CoinTiger platform.

Deposits can be made in fiat currencies (USD and CNY) through wire transfer or debit card and credit card payment, helping users enjoy easy transactions.

Withdrawal fees

Unlike deposits, CoinTiger collects withdrawal fees for every transaction made on the platform. Fees are taken when transferring funds from the exchange to an external wallet. The fees differ between assets based on the current market structure of the coin.

Withdrawal fees on CoinTiger are quite standard when compared with other crypto exchange platforms. The standard withdrawal fee on the exchange is 0.0005 BTC, as against the worldwide average of 0.0008 BTC, giving the platform a competitive edge over other platforms.

CoinTiger Services

Trading interface

Chief among CoinTiger’s services is its dual interface for traders. The platform possesses a basic interface and an advanced interface for its users based on their level of experience.

The basic interface for beginner traders comes with a simple and easy structure that they can relate to. The advanced interface on the other hand comes with much more extensive tools to assist professional traders with market predictions and evaluation. The advanced traders interface allows users to adjust timeframes, add indicators to charts, and adjust scales.

CoinTiger Labs

CoinTiger Labs is a protocol that oversees Blockchain projects that are carried out on the platform. The role of the labs is to provide these projects with services like consulting, design models for tokens, strategy planning, management, and marketing support. It helps blockchain entrepreneurs to develop projects and add value. Some of the common projects that it has taken on are MockingBot, TCT, and BCG.

CoinTiger Pool

CoinTiger Pool is the official staking unit for the CoinTiger exchange. It provides users with ample opportunity to invest in the exchange, but to do so KYC authentication is paramount. CoinTiger Pool has grown increasingly popular over time, with returns of up to 180 days.

CoinTiger Rocket

CoinTiger Rocket is an IEO specific to the platform that supports new crypto ventures with the possibility of expansion and the potential to bring huge returns. The Initial Exchange Offering provides users with a list of tokens with good potential for them to invest in and reap huge Returns On Investment when the newbie tokens eventually skyrocket. CoinTiger Rocket is a good place for investors to locate the nearest project token to invest in.

Mobile App

CoinTiger recently developed a mobile app for Android and iOS devices to help users enjoy free access to their platform without necessarily having to go on the web. All the trading features available on the web terminal of the exchange can be found on the mobile app, except the TradingView terminal.

CoinTiger’s mobile app is fast and handy, and an easy way for users to continue enjoying the benefits of the exchange.

Customer Support

CoinTiger provides 24-hour customer support (though, not reliable) to its users through a live Chatbot. The customer service is operated by bots and not actual people. The major issue that has raised questions and criticism though, is the absence of a direct call center for the platform.

CoinTiger Security

The exchange experienced some security downtime in 2019 after its platform was hacked and it ended up losing over 400 million Proton Tokens. Though they were able to safely secure 280 million of the tokens, the damage was already done, and the token received a 100% drop in value.

Since then, CoinTiger has worked to improve its security measures. On the mobile app, it employs a 2-factor Authentication (2FA) for users to help secure their identity and funds. Users are also required to finish the KYC authentication before they can partake in some of the exchange’s higher features.

Conclusion

CoinTiger is a high-risk cryptocurrency exchange that is based on the trade of both crypto and fiat currencies, with high trading fees and a terrible trading experience

The exchange is way below the first 100 crypto exchanges in the market, showing just how unreliable and unsafe it is to invest your money in. Many crypto review platforms disclaim the authenticity of the platform. Users who were once actively involved in the exchange left after complaining frequently of slow network and regulatory issues.

It is not a good platform for amateur or professional traders to delve into, as its trading systems can be confusing at times and as some have even complained, too basic.

This platform is unregulated in many different parts of the world.

Due to regulatory and security concerns, we do not recommend using CoinTiger. Check out top alternatives such as OKX and Bitget.

FAQS

Is CoinTIger a good exchange?

CoinTiger is an unreliable exchange with high standard fees and regulatory concerns. We recommend to stay away from them.

How much does CoinTiger charge for Withdrawals?

CoinTiger charges a standard 0.0005 BTC for every withdrawal, which puts it in competition with other crypto exchanges around the world.

Does CoinTiger require KYC authentication?

CoinTiger requires that users perform the KYC authentication before they can begin to enjoy certain benefits on the platform like Staking on the CoinTiger Pool platform.

Where is CoinTiger based?

CoinTiger is a centralized cryptocurrency exchange platform based in Singapore.

What is the native token of CoinTiger?

CoinTiger’s native token is TigerCash(TCH).