Arbitrage trading in cryptocurrency markets is becoming increasingly popular among traders looking to maximize profits. It involves taking advantage of price discrepancies between different exchange platforms or different currencies, buying low and selling high in order to generate a profit. This article will explain the basics of arbitrage trading, its advantages and disadvantages, and some tips on making it work for you. We’ll also discuss important factors such as liquidity, volume, fees and more that can affect your success when engaging in arbitrage trading. Whether you’re an experienced trader or just getting started with cryptocurrencies, this guide should provide all the information you need to get started with crypto arbitrage trading today!

- 4.5

150+ Million Users

- Bonus

- Spot fees

- Futures fees

- Assets

- 24h Volume

Alternative

1. What is Arbitrage Trading in Crypto?

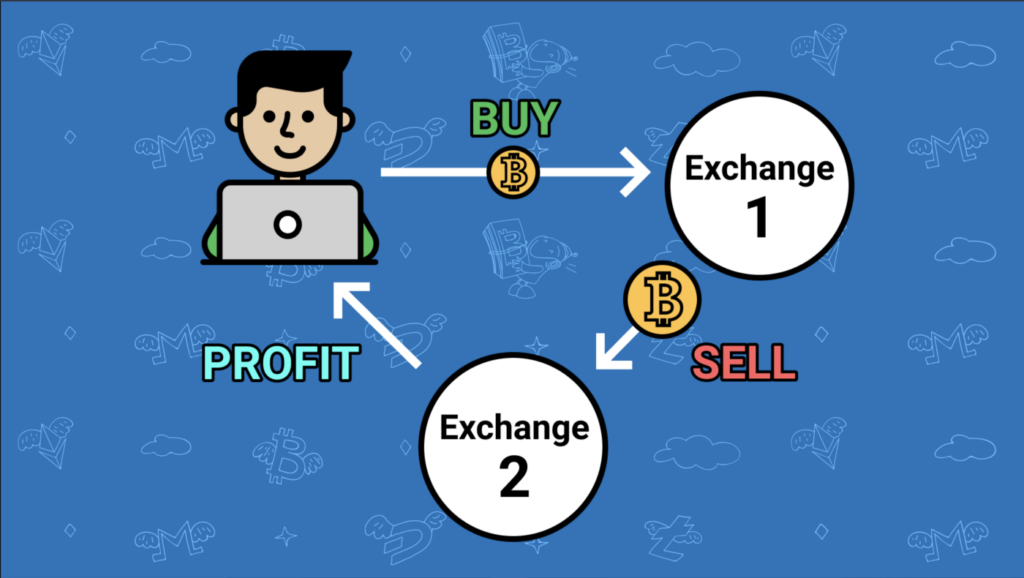

Arbitrage is a trading method that uses the price difference between multiple exchanges of an asset. There are many styles of arbitrage transactions, all of which involve buying and selling assets quickly to take advantage of market price deviations.

Crypto arbitrage trading is popular, but this strategy existed long before Bitcoin (BTC). Investors can find arbitrage opportunities in any transactable asset, including stocks, bonds and fiat currency.

So, Arbitrage trading is a type of trading where traders attempt to capitalize on price discrepancies by buying and selling the same asset simultaneously across different exchanges. By taking advantage of price differences between two or more platforms or different currencies, arbitrage traders can make a profit without taking any additional risks. Also, arbitrage trading can hedge risk and protect gains in volatile markets.

How it works: Arbitrage trading works by taking advantage of price discrepancies between different markets. To start, traders will monitor prices on multiple exchanges and look for opportunities where the same asset is traded at different prices. Once a discrepancy occurs, traders can buy the asset in one market and then immediately sell it in another for a profit. For example, imagine that Bitcoin is trading at $5,000 on one exchange and $5,050 on another. A trader could purchase Bitcoin from the first exchange and then sell it on the second for a quick $50 profit. Similarly, if Bitcoin was trading at higher prices in one market and lower prices in another, traders could buy from the cheaper exchange and sell on the more expensive one.

2. Why is crypto Arbitrage so common in crypto traders?

Cryptocurrencies are highly volatile, making them prime targets for arbitrage trading. Cryptocurrency markets are often inefficient, and prices vary significantly between exchanges. This price difference creates opportunities for traders to buy low and sell high to generate profits.

In addition to the opportunity for quick profits, crypto arbitrage trading is also attractive due to its low risk. Since the trades are completed instantly on both markets, traders don’t have to worry about the price of their assets changing dramatically between purchases and sales. This means that even if prices suddenly move in an unfavourable direction, traders can still exit their positions without experiencing large losses.

Lastly, it allows traders to explore the emerging DeFi ecosystem and take advantage of the new investment opportunities it provides.

3. Types of Crypto Arbitrage

There are several types of crypto Arbitrage that traders can take advantage of. The most common are:

- Inter-exchange Arbitrage: This takes place when traders purchase an asset on one exchange and simultaneously sell it on another. This type of Arbitrage capitalizes on the price differences between different exchanges, allowing traders to make a profit without taking any additional risks. Moreover, some exchanges also offer margin funding, allowing traders to take advantage of interest rates to increase profits further.

- Spatial Arbitrage: This Arbitrage occurs when traders take advantage of price differentials between two geographically distinct markets. For example, a trader in the US may take advantage of the exchange rate between USD and EUR by buying BTC in Europe and selling it in the US for a profit. Actually, it is an inter-currency arbitrage that requires a trader to monitor multiple markets and takes advantage of the changing exchange rates.

- Triangular Arbitrage: Triangular Arbitrage is a more complex form of Arbitrage that relies on price discrepancies between three different assets. Traders will buy and sell the same asset across three different markets, exploiting the difference in prices to generate a profit. This type of trading requires traders to have a deep understanding of the markets and advanced technical analysis skills.

4. How to find arbitrage opportunities?

Here is the step-by-step process to successfully execute an arbitrage trade:

Monitor Prices: The first step is to monitor the prices of different assets across multiple exchanges. Traders should look for price discrepancies between different markets and note any opportunities they find. It’s important to remember that price differences can occur for various reasons, so traders should always take the time to analyze the different markets before investing.

Calculate Prices: The next step is accurately calculating asset prices across different exchanges. This will help traders determine the amount of profit that can be made from a given trade and ensure that they are making an informed decision about their investments.

Place Orders: Once the prices have been calculated and a profit margin has been established, traders need to place their orders on both exchanges simultaneously. This will ensure that the trades are executed quickly and efficiently, allowing traders to take advantage of even small price discrepancies.

Monitor Performance: Finally, it’s important to monitor the Performance of the trades and adjust them as needed. This will help traders maximize their profits and ensure that they are always staying on top of the markets.

5. Advantages of Arbitrage Trading in the Crypto Market

Arbitrage trading in the crypto markets has several advantages, including:

Low Risk: Since trades are executed instantly on both markets, traders don’t have to worry about potential losses due to market fluctuations. This makes Arbitrage one of the safest forms of trading in the crypto market.

Quick Profits: Traders can quickly capitalize on price discrepancies between different exchanges to generate profits in a short amount of time. This makes arbitrage trading highly suitable for traders who are looking to make quick returns. Access to

Diverse Markets: Crypto arbitrage allows traders to take advantage of markets around the world, giving them access to a wide range of investment opportunities. This can be especially beneficial for investors who would otherwise not have access to certain international markets.

High Liquidity: The main crypto currencies are highly liquid, meaning that traders can easily enter and exit positions without having to worry about liquidity issues. This allows traders to move quickly and capitalize on price discrepancies before they disappear.

6. Disadvantages of Arbitrage Trading in the Crypto Market

Although arbitrage trading in the crypto market can be a profitable venture, it does come with some risks. These include:

High Fees: Crypto exchanges usually charge fees for each trade, meaning that traders must consider this cost when calculating their potential profits from an arbitrage trade.

Time-Consuming: Crypto Arbitrage requires traders to monitor multiple markets constantly in order to identify price discrepancies. This can be a time-consuming activity, as prices may change quickly, and traders must be ready to capitalize on these opportunities.

Market Volatility: The crypto market is highly volatile, meaning that prices can move quickly in either direction. This can make it difficult to successfully execute arbitrage trades, as prices may move against the trader before they have a chance to capitalize on the price discrepancy.

Technical Analysis Required: Crypto Arbitrage requires traders to understand and use technical Analysis in order to identify potential opportunities with low volatility to avoid sudden price movements that could invalidate the arbitrage opportunity.

Overall, arbitrage trading can be a lucrative venture in the crypto market. However, traders must consider the risks involved and ensure they are comfortable with their strategies. With the right strategy and a good understanding of the markets, traders can take advantage of price discrepancies to generate consistent profits.

7. Factors to Consider when Doing Crypto Arbitrage Trading

When engaging in crypto arbitrage trading, there are some important factors to consider. These include:

Liquidity: The liquidity of the markets that you are trading in is an important factor to consider, as this will determine how quickly and efficiently your trades will be executed.

Volume: The volume of trades can also affect the success of an arbitrage trade; higher volume leads to more efficient markets, thus making price differences smaller. So it is important to consider the volume of trades when engaging in arbitrage trading.

Fees: Cryptocurrency exchanges charge fees for every trade, deposit and withdrawal. This means that traders must consider these costs when calculating their potential profits.

Speed: Speed is also key in crypto arbitrage trading, as traders must be able to move quickly and capitalize on price discrepancies before they disappear.

Tax Implication: As with all trading activities, traders must also consider tax implications when engaging in crypto Arbitrage. They should be aware of the applicable tax laws in their jurisdiction and make sure that they are compliant.

By considering all of these factors, traders will have a better chance of making profitable trades in the crypto market.

8. Tips for Successful Cryptocurrency Arbitrage Trading

Here are some tips for successful cryptocurrency arbitrage trading:

Set Up Multiple Accounts: Setting up multiple accounts on different exchanges will give traders access to more markets and allow them to take advantage of price discrepancies. Trade Small Amounts: To minimize the risk, it is recommended to start with small amounts. This will allow traders to practice and gain experience without risking too much capital. But traders need to make larger trades for larger returns and earn healthy amounts.

Have accounts abroad: Scanning for arbitrage opportunities in only one market or region can be very hard. Sometimes you will find much better opportunities in completely different regions. Find ways to sign up for Japanese, Korean or Indian crypto exchanges.

Monitor Prices Closely: Traders must monitor prices closely in order to identify potential trading opportunities and capitalize on them quickly. For this you can use an app, such as koinknight which is focused on arbitrage opportunities in crypto.

By following these tips, traders will have a better chance of making successful arbitrage trades in the cryptocurrency markets.

9. Is Arbitrage legal in the crypto market?

Yes, arbitrage trading is legal in the crypto market. However, traders must be aware of their jurisdiction’s applicable laws and regulations when engaging in this activity. Additionally, some exchanges may impose certain restrictions on arbitrage trading, so traders should check with the exchange before executing any trades. In addition, traders should also be aware of any fees or charges that may be imposed on their arbitrage trades. Also make sure that you will comply with the tax laws in your country. These can differ depending on where you live.

10. Does Crypto Arbitrage work in 2023?

Yes, crypto Arbitrage can still work in 2023. The cryptocurrency markets are always evolving, and new opportunities for Arbitrage may arise. Additionally, traders must keep up to date with the markets and stay informed of any new developments that may affect their trades. By doing so, they will be able to capitalize on any potential trading opportunities and maximize their profits. Ultimately, crypto Arbitrage can still be a profitable venture in 2023 if traders take the time to understand the markets and employ the right strategies. Finally, traders should also manage their risk to minimize potential losses. With the right strategies, traders can make a good amount of money from arbitrage trading in the crypto markets.

Conclusion

In conclusion, arbitrage trading in cryptocurrency markets is a popular and potentially profitable way to make money. However, traders must be aware of the various factors involved in order to maximize their profits and manage their risks. Before engaging in this activity, they should also be mindful of any applicable laws or fees that exchanges may impose. By following these tips and understanding the markets, traders can have a better chance of making successful arbitrage trades in the crypto market.

For more information about the crypto world, please visit our website CryptoWinrat.com. CryptoWinrat strives to bring you the very best trading platforms. We provide the best services to help traders maximize their profits while reducing risks in the crypto market. You can also follow us on Twitter (@CryptoWinrate) or subscribe to our YouTube channel to learn about the crypto industry. Thank you for your time! Have a great day!

FAQs

Is Arbitrage trading risky?

Yes, arbitrage trading can be risky if not managed properly. Traders must understand the markets, manage their risks and take the time to learn technical Analysis in order to increase their chances of success.

Can I make money with crypto Arbitrage?

Yes, traders can make money with crypto Arbitrage if they understand the markets and employ the right strategies. However, traders must manage their risk to minimize potential losses.

What other strategies can I use to make money in the crypto market?

In addition to arbitrage trading, other strategies such as day trading, swing trading and long-term investments can be used to make money in the crypto market. Traders should research the various strategies and understand the associated risks before engaging in any of these activities.

Is Arbitrage trading suitable for Beginners?

Arbitrage trading is suitable for Beginners if they take the time to understand the markets, manage their risks and employ the right strategies. This can be a very profitable venture if done correctly. However, it is important for traders to be aware of the various factors involved in order to maximize their profits and minimize any potential losses.

What advice would CryptoWinrate give to someone starting with arbitrage trading?

CryptoWinrate advice to someone starting out with arbitrage trading would be to first understand the markets, manage their risks and take the time to learn technical Analysis. Additionally, they should also be mindful of any applicable laws or fees that exchanges may impose before engaging in this activity. By following these tips and understanding the markets, traders can increase their chances of successful arbitrage trades.

![How to Withdraw funds from MetaMask [2024]](https://www.cryptowinrate.com/wp-content/uploads/2024/06/Add-a-little-bit-of-body-text-1024x597.jpg)