- •Hot wallets have evolved into full Web3 access layers, powering DeFi, perps trading, prediction markets, and on-chain activity.

- •With non-custodial wallets now leading adoption, control, network coverage, and integrations matter more than brand recognition.

- •Choosing the best crypto hot wallet depends on how you use Web3, whether for DeFi, NFTs, perps, or Bitcoin-native assets.

Crypto wallets started as basic tools for storing private keys and sending transactions. Over time, they have become the primary interface for using Web3. In 2025, more than 820 million crypto wallets are active globally, accounting for roughly 7.4% of internet users, with retail users representing the majority. As non-custodial wallets now make up close to 60% of total usage, wallets are no longer passive storage tools. They are where users trade on DEXs, access perpetual markets, interact with dApps, and manage on-chain activity.

This shift means choosing the best crypto hot wallet now directly shapes how smoothly and efficiently someone experiences Web3, as wallets increasingly compete on features, integrations, and network support rather than basic functionality alone.

What is a Hot Wallet in Crypto?

A hot wallet in crypto refers to a wallet that stays connected to the internet, allowing users to store assets, sign transactions, and interact with on-chain applications in real time. Unlike cold storage, a crypto hot wallet is designed for active use, making it the preferred choice for trading, DeFi, and everyday Web3 activity.

The role of hot wallets has evolved significantly. Earlier, they were viewed mainly as tools for basic transfers. Today, they serve as active gateways into Web3, enabling users to trade, access decentralized applications, and participate in on-chain ecosystems directly from the wallet interface. As adoption grows and usage expands beyond simple transactions, hot wallets are increasingly treated as everyday tools rather than temporary solutions.

Top 8 Crypto Hot Wallets in 2026

As hot wallets continue to evolve beyond basic storage, choosing the right one now depends on how you actually use Web3. Some wallets focus on simplicity and broad network support, while others are built for active trading, DeFi access, or deeper dApp integrations. The wallets listed below reflect how hot wallets are used in 2026, balancing security, usability, and on-chain functionality.

| Wallet | Custody | Networks | Best For | Key Feature |

|---|---|---|---|---|

| 1. MetaMask | Non-custodial | 120+ | Advanced Web3 users | Bridge, perps, predictions |

| 2. Trust Wallet | Non-custodial | 111+ | Mobile-first users | Perps & predictions |

| 3. Coinbase Wallet | Exchange-linked | 13+ | Long-term holders | On-chain staking |

| 4. Rabby Wallet | Non-custodial | 95+ | EVM power users | Built-in perps |

| 5. Phantom Wallet | Non-custodial | 8+ | Solana users | Phantom Terminal |

| 6. Exodus Wallet | Non-custodial | 15+ | Desktop users | Polished UI |

| 7. OKX Wallet | Exchange-linked | 7+ | Active on-chain traders | DEX & perps aggregation |

| 8. UniSat Wallet | Non-custodial | 1+ | Bitcoin-native users | Ordinals & BRC-20 |

1. MetaMask

MetaMask is one of the most widely used crypto hot wallet options and remains a default entry point into Ethereum-based Web3. Originally built as an EVM-only Web3 wallet, MetaMask has expanded significantly in recent years. It now supports over 120+ networks and includes built-in swaps, bridging, staking access, and perpetual trading integrations through partner protocols such as Hyperliquid. MetaMask now integrates perpetual DEXs and prediction markets such as Polymarket directly into the wallet, letting users trade and participate without leaving the MetaMask interface.

In its broader effort to improve accessibility, MetaMask has expanded support beyond EVM networks. Following the addition of the Solana network, MetaMask recently introduced native Bitcoin support, allowing users to manage BTC alongside EVM assets without relying on wrapped tokens. Unlike earlier expansions that depended on MetaMask Snaps, these additions reflect a shift toward more native, first-class network support within the wallet itself.

As a non-custodial wallet, private keys are stored locally, giving users full control over funds. MetaMask works especially well as a wallet for Web3 dApps, making it suitable for DeFi, NFT platforms, prediction markets, and on-chain trading. As a non-custodial wallet, private keys are stored locally, giving users full control over their funds. MetaMask is widely used as a wallet for Web3 dApps across DeFi, NFTs, and on-chain trading.

Read more: MetaMask Full Review

MetaMask Wallet Pros and Cons

| 👍 MetaMask Pros | 👎 MetaMask Cons |

|---|---|

| ✅ Broad Ethereum and EVM compatibility | ❌ Swap and Bridge fees of around 0.875% |

| ✅ Full self custody of keys | ❌ No native non EVM support |

| ✅ Smart accounts with gas abstraction | ❌ No built in two factor authentication |

| ✅ In wallet token swaps | ❌ NFT support inconsistent across devices |

| ✅ Improving interface for beginners | |

| ✅ Snaps enable third party integrations |

2. Trust Wallet

Trust Wallet is a mobile-first crypto wallet designed around native multi-chain access and self-custody. Launched in 2017 and later acquired by Binance, it has evolved from an Ethereum-only app into one of the most widely used Web3 wallets, supporting more than 111+ networks across both EVM and non-EVM ecosystems. All supported networks are available natively, without manual configuration or add-ons, which removes a common friction point seen in many wallets.

As a non-custodial wallet, Trust Wallet stores private keys locally on the user’s device. Its functionality extends beyond basic storage and includes swaps, staking, NFTs, perpetual trading, and prediction markets, all accessible directly within the wallet interface. Notably, Trust Wallet provides perps trading support via Aster DEX, enabling leveraged derivative trading directly from the wallet. Features like gas sponsorship and Binance P2P funding further reduce entry friction for on-chain activity.

Read more: Trust Wallet Full Review

Trust Wallet Pros and Cons

| 👍 Trust Wallet Pros | 👎 Trust Wallet Cons |

|---|---|

| ✅ Fully non custodial with user controlled private keys | ❌ More optimized for mobile than browser workflows |

| ✅ No wallet fees for swaps, perps, or prediction markets | ❌ Support ticket responses can be slow |

| ✅ No Trust Wallet fees on fiat on and off ramps | ❌ Hardware wallet support limited to browser extension |

| ✅ Supports 111+ networks with native built in access | |

| ✅ Built in perpetual trading via Aster DEX | |

| ✅ In wallet crypto swaps across multiple networks | |

| ✅ Prediction markets available directly inside the wallet | |

| ✅ Easy wallet funding through Binance P2P | |

| ✅ Built in DEX and NFT spam protection |

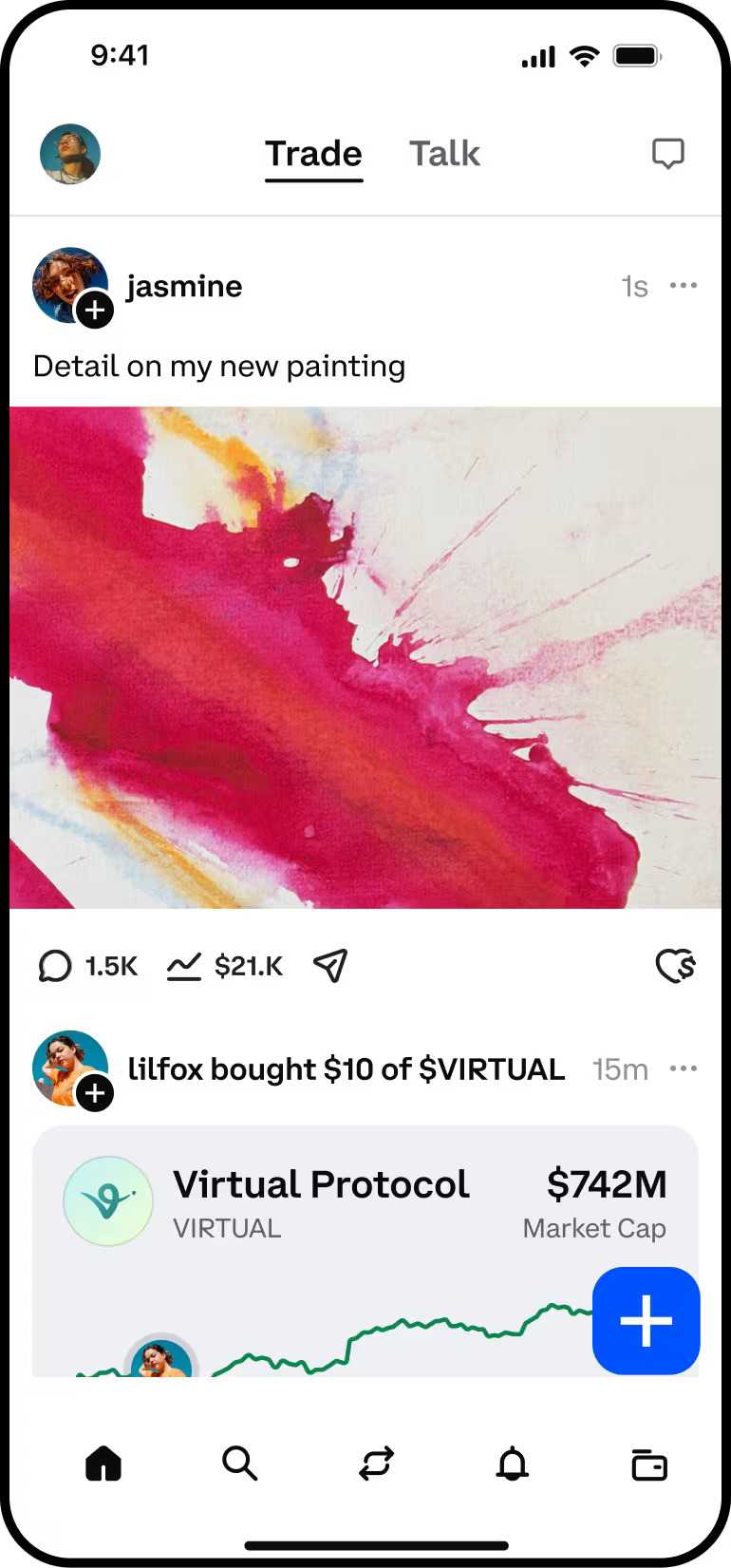

3. Base App (formerly Coinbase Wallet)

Coinbase Wallet has recently been rebranded as the Base App, marking a shift from a traditional wallet toward a broader Web3 super app. While it remains a non-custodial wallet with local key storage, its focus has expanded beyond basic asset management. The Base App is positioned as an “everything app” for on-chain activity, combining trading, on-chain earning, mini apps, and secure messaging within a single interface.

The wallet is EVM-only and comes with built-in support for 13+ EVM networks, including Base and other major Ethereum-compatible chains. Additional EVM networks can also be configured manually using custom RPC settings, allowing users to extend network coverage beyond the default list while remaining within the Ethereum ecosystem.

Built on Base, Coinbase’s Layer 2 network, the app emphasizes creator and community participation, allowing users to support projects directly on-chain and share in network activity. This evolution reflects Coinbase’s broader goal of making Web3 interactions feel unified rather than fragmented across separate tools.

Read more: Base App (Coinbase Wallet) Review

Base App Pros and Cons

| 👍 Base App Pros | 👎 Base App Cons |

|---|---|

| ✅ Non-custodial self-custody model | ❌ Mobile-only experience |

| ✅ Super app Web3 approach | ❌ Feature set still evolving |

| ✅ Built on Base network | ❌ Heavily Base-centric |

| ✅ On-chain earning and staking | |

| ✅ Integrated mini apps |

4. Rabby Wallet

Rabby Wallet is a non-custodial wallet built specifically for Ethereum and EVM-compatible networks. It supports more than 95+ EVM chains and is designed for users who interact frequently with DeFi protocols and on-chain applications. One of Rabby’s defining features is automatic network detection, which switches to the correct chain when connecting to a dApp, reducing manual configuration and common errors.

Rabby places strong emphasis on transaction safety, offering simulation previews, approval checks, and MEV protection before signing. Core functionality includes swaps, bridging, lending via Aave and Compound, and perpetual trading through Hyperliquid. The GasAccount feature further simplifies activity by removing the need to hold native gas tokens across different EVM networks.

Read more: Rabby Wallet Review

Rabby Wallet Pros and Cons

| 👍 Rabby Wallet Pros | 👎 Rabby Wallet Cons |

|---|---|

| ✅ Automatic network switching | ❌ No non EVM network support |

| ✅ Strong transaction simulation tools | ❌ Swap fee higher than some wallets |

| ✅ Supports 95+ EVM networks | |

| ✅ Integrated swaps, bridges, perps | |

| ✅ dApp balance tracking built in | |

| ✅ GasAccount reduces friction |

5. Phantom Wallet

Phantom Wallet is a non-custodial wallet built around fast on-chain interaction and a polished user interface. It supports 8+ networks and brings together asset management, swaps, NFT handling, staking, and dApp access directly within the wallet, keeping most actions contained in a single interface rather than redirecting users to external tools.

A major recent addition is Phantom Terminal, which is currently in beta. Terminal introduces integrated trading functionality, allowing users to trade tokens, meme assets, and access perpetual markets with charts and execution tools without leaving the wallet. Phantom has also integrated Kalshi prediction markets, enabling users to participate in event-based markets directly from within the wallet. Together, these additions reflect Phantom’s transition from a basic wallet into a more complete Web3 interaction layer focused on integrated trading and usability.

Read more: Phantom Wallet Review

Phantom Wallet Pros and Cons

| 👍 Phantom Wallet Pros | 👎 Phantom Wallet Cons |

|---|---|

| ✅ Strong Solana-native performance and tooling | ❌ No custom EVM network support |

| ✅ Supports major blockchains | ❌ Feature depth strongest only on Solana |

| ✅ Liquid SOL staking with PSOL | |

| ✅ Built-in swaps, perps, and prediction markets | |

| ✅ All-in-one Cash and payments support | |

| ✅ Ledger hardware wallet compatibility | |

| ✅ Multi-chain NFT management support |

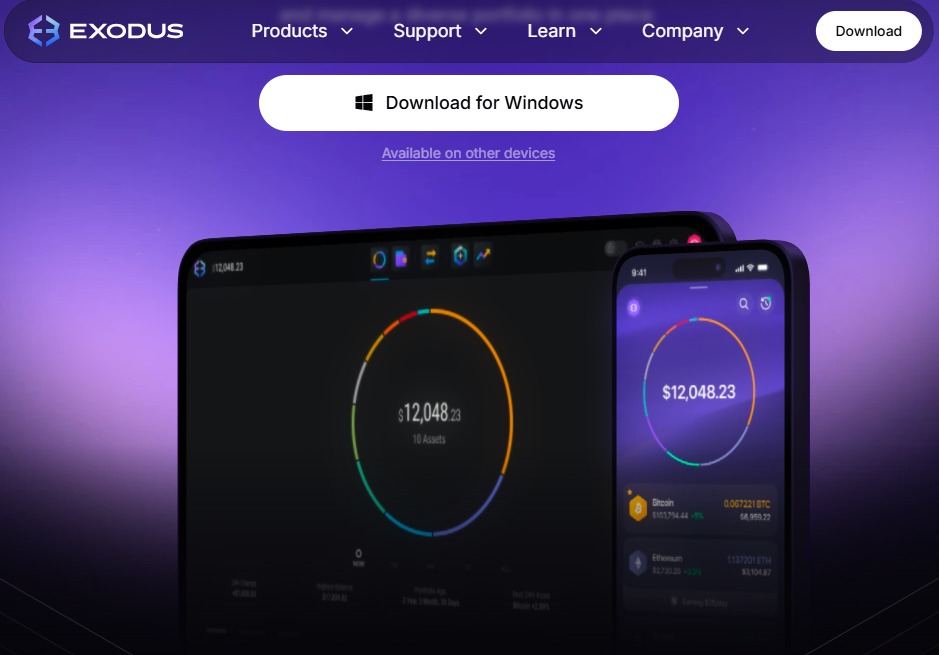

6. Exodus Wallet

Exodus Wallet is a self-custody wallet designed around simplicity and consistency across desktop, mobile, and browser environments. Launched in 2015, it focuses on making private key ownership approachable without exposing users to complex configuration. Exodus supports a curated set of 15+ networks, covering major EVM and non-EVM chains, but does not allow manual network or RPC additions.

Core functionality includes built-in swaps, staking, NFT management, and fiat purchases, all handled directly within the wallet interface. Exodus does not charge wallet-level fees, though swaps and fiat services include third-party costs. Security relies entirely on local key storage, recovery phrase protection, and device safety, with optional Trezor hardware wallet integration on desktop.

Read more: Exodus Wallet Review

Exodus Wallet Pros and Cons

| 👍 Exodus Pros | 👎 Exodus Cons |

|---|---|

| ✅ Full-featured desktop application | ❌ No custom network support |

| ✅ Simple and intuitive interface | ❌ Limited Web3 dApp access |

| ✅ Built-in swaps and staking | ❌ No token bridging features |

| ✅ Multi-device availability | ❌ No perpetuals or derivatives |

| ✅ Integrated fiat on-ramp | |

| ✅ Hardware wallet support |

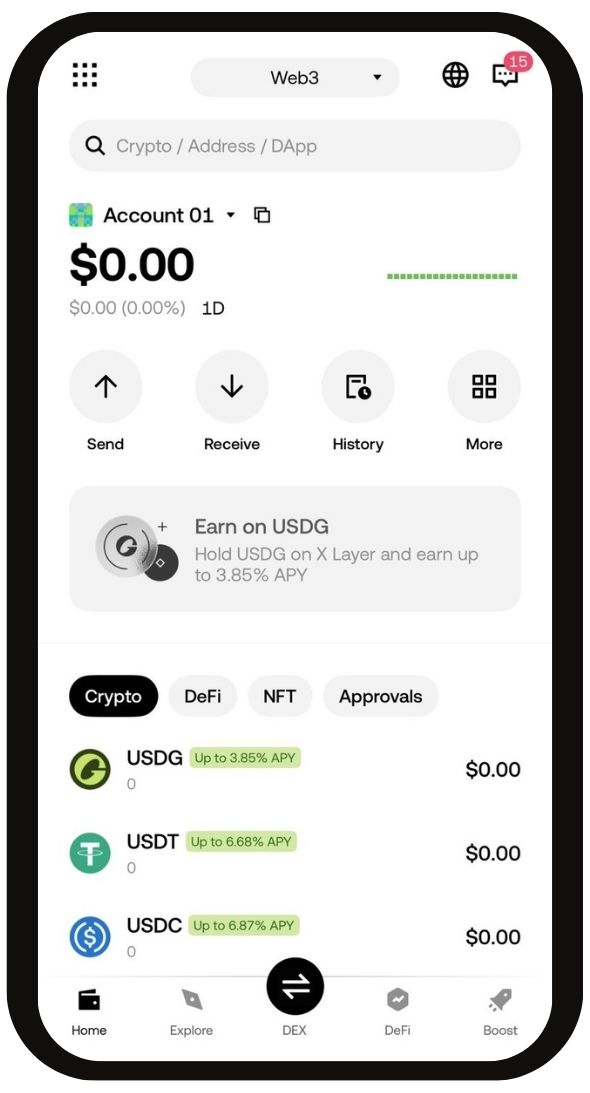

7. OKX Wallet

OKX Wallet is an exchange-linked Web3 wallet focused on active on-chain trading rather than long-term storage. It supports 7+ networks and operates as a non-custodial wallet, with private keys controlled by the user. The wallet includes built-in swap functionality, cross-chain bridging, meme token trading, and DEX trading access across supported networks. These features are available directly within the wallet interface, allowing users to move between chains, trade tokens, and interact with decentralized markets without relying on external tools.

OKX Wallet Pros and Cons

| 👍 OKX Wallet Pros | 👎 OKX Wallet Cons |

|---|---|

| ✅ Non-custodial key control | ❌ Limited network coverage |

| ✅ Built-in swap and bridge | ❌ Mobile-only experience |

| ✅ Meme token trading support | |

| ✅ DEX trading access |

8. UniSat Wallet

UniSat Wallet is a non-custodial wallet built specifically for the Bitcoin network. It focuses on native Bitcoin assets such as Ordinals inscriptions, BRC-20 tokens, and Runes, rather than multi-chain support. UniSat allows users to store, send, mint, and manage these assets directly within the wallet, without relying on external tools. Its tight integration with Bitcoin-native standards is the main reason users prefer it. For those active in the Ordinals and BRC-20 ecosystem, UniSat offers a focused experience that prioritizes control, transparency, and compatibility with emerging Bitcoin applications.

Learn more: How To Get Started With UniSat Wallet

UniSat Wallet Pros and Cons

| 👍 UniSat Pros | 👎 UniSat Cons |

|---|---|

| ✅ Native Bitcoin self-custody | ❌ No EVM or DeFi |

| ✅ Ordinals and BRC-20 support | ❌ Limited general wallet features |

| ✅ Direct inscription management |

How to Choose the Best Hot Wallet?

Choosing a hot wallet today is less about finding a place to store crypto and more about matching a wallet to how you actually use Web3. Wallets now sit at the center of trading, DeFi access, prediction markets, and on-chain activity, so the right choice depends on usage patterns rather than brand recognition.

- Custody model

Decide whether full self-custody or an exchange-linked setup fits your risk tolerance and control preferences.

- Network coverage

Some wallets focus only on EVM chains, others support multiple ecosystems, while a few are built purely for Bitcoin.

- On-chain features

Look for support that matches your activity, such as swaps, perps trading, prediction markets, staking, or NFTs.

- Interface depth

Simpler wallets prioritize clarity, while advanced ones surface more data and transaction controls.

- Platform availability

Mobile-only, desktop, or browser extension support can shape daily usability.

How Web3 Adoption Is Driving Hot Wallet Growth

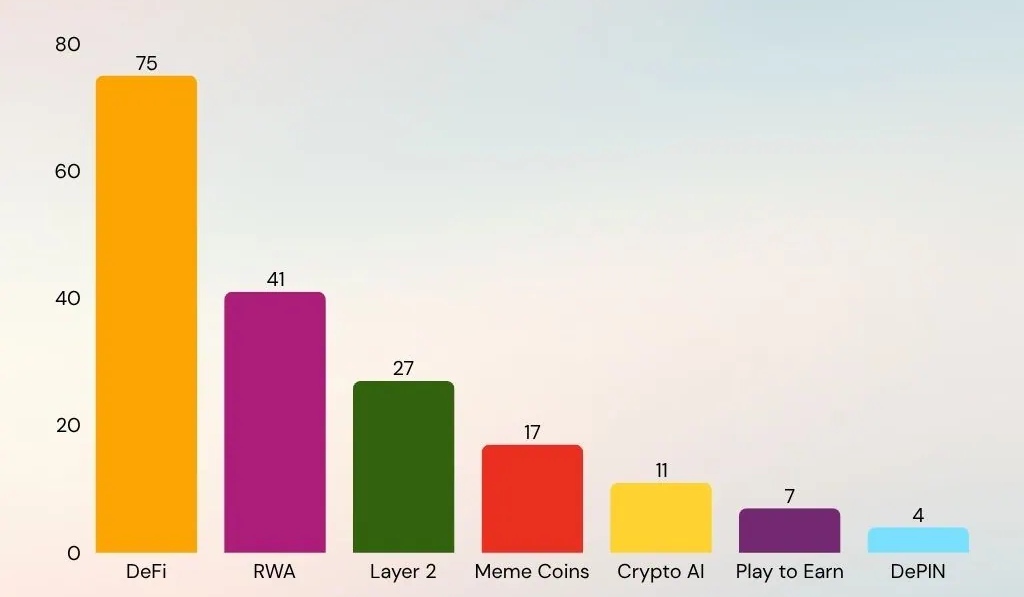

Web3 adoption has moved beyond early experimentation and into everyday usage, and that shift is directly reflected in hot wallet growth. As of 2025, more than 820 million unique cryptocurrency wallets are active globally, with retail users accounting for roughly 82% of total wallet holders. At the same time, monthly active users across Web3 dApps now range between 5 and 10 million, driven by activity in DeFi, perpetual DEXs, NFTs, gaming, and prediction markets.

Non-custodial wallets now hold an estimated $250 billion in digital assets, up from $180 billion two years ago, and represent 59% of total wallet usage. With crypto wallets reaching 7.4% of global internet users, wallets are no longer passive storage tools. They have become the primary access layer for how users trade, earn, and interact across Web3 ecosystems.

Bottom Line

Hot wallets are no longer just tools for holding crypto. They now shape how users trade, earn, and interact across Web3, from DeFi and prediction markets to perpetual trading and on-chain applications. As adoption grows, choosing the right wallet comes down to matching features with how you actually use Web3, not chasing the longest feature list.

If your activity extends into on-chain trading, especially derivatives, the wallet is only part of the setup. It’s worth pairing it with the right trading venue. Our guide on the best perpetual DEXs breaks down where most on-chain perp volume is happening today and how traders are accessing it through modern hot wallets.

FAQs

1. Should I use a hot wallet for daily activity?

Yes. Hot wallets are designed for frequent use such as swaps, DeFi, NFTs, staking, and on-chain trading. For larger balances, most users keep only active funds in a hot wallet and store the rest offline.

2. How much crypto should I keep in a hot wallet?

Only what you actively need. Think of it like cash in a physical wallet. Amounts vary, but many users keep a small portion for daily usage and move excess funds to cold storage.

3. Do hot wallets support multiple blockchains?

Most modern hot wallets support multiple networks, though coverage varies. Some focus on EVM chains, others support non-EVM networks, and some are Bitcoin-only. Network support should match your on-chain activity.

4. Are hot wallets free to use?

Most hot wallets are free to download and use. Fees usually come from network gas costs or built-in swaps and services. Always review fees before confirming a transaction.

5. Can I combine hot and cold wallets?

Yes. Many users follow a hybrid setup. A hot wallet handles daily activity, while a cold wallet stores long-term funds. This balances convenience with better risk control.

![How to Change the Language in Phantom [2026]](https://www.cryptowinrate.com/wp-content/uploads/2026/02/How-to-Change-the-Language-in-Phantom-2026-1024x576.jpg)