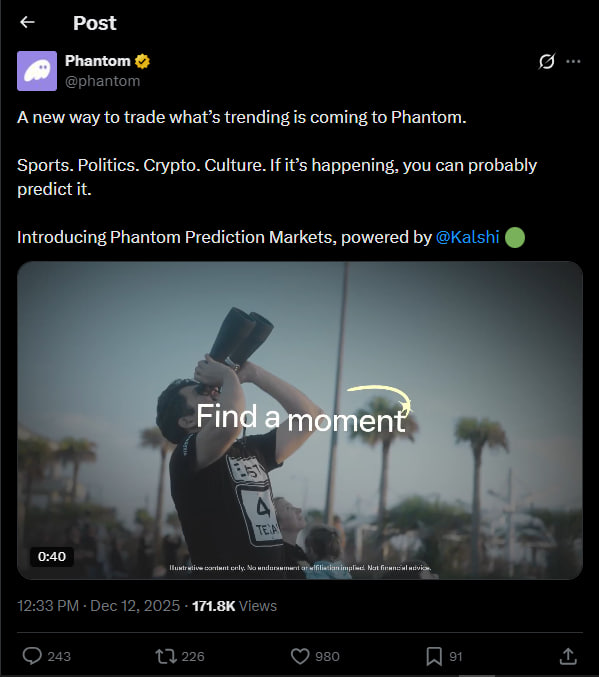

- •Phantom has integrated Kalshi’s regulated prediction markets directly into its wallet for seamless event trading.

- •Users will gain access to real-time community chat features for sharing insights and tracking shifting market sentiment.

- •The integration supports Kalshi’s push for on-chain market leadership as its $11B+ platform taps into Phantom’s 20M+ user base.

Phantom has integrated Kalshi Prediction Markets’ regulated events market directly into its platform to Expand In-Wallet Trading. The company stated the aim is to give users a streamlined way to trade real-world outcomes while signaling a broader shift toward blending DeFi tools with US-regulated prediction products.

Phantom Integrates Kalshi’s Regulated Events Market

Phantom has expanded trading activity within its wallet by adding Kalshi’s regulated event markets directly to its interface, giving users a way to explore active questions, track changing probabilities, and take positions on real-world outcomes without leaving the app.

This release stands out as one of Phantom’s biggest feature additions this year and shows how decentralized finance tools are converging with US-regulated prediction markets.

The company explained in a press release that the update allows users to trade tokenized forms of Kalshi’s event contracts. These contracts are built around outcomes that can be verified across politics, macroeconomic indicators, crypto-driven events, sports, and broader cultural topics.

Phantom noted that users can open these tokenized trades with SOL or its in-wallet CASH stablecoin. With this, traders are able to fund and settle positions using what they already hold in their balances. The company said the setup is designed to reduce friction and remove the need for extra accounts or transfers.

Kalshi’s system powers the trading layer behind the feature, and the prediction platform recently shifted its infrastructure to the Solana network while partnering with DFlow and Jupiter to push its order-book liquidity into on-chain channels.

With that setup in place, Phantom will launch Kalshi’s tokenized markets on Solana first, even though the wallet already supports networks like Ethereum and Polygon, aligning the rollout with Kalshi’s strategy of building its on-chain stack around Solana’s speed and settlement capacity.

Community Features and User Experience Enhancements

Phantom revealed that the integration comes with an added feature that brings real-time community chat rooms inside each market, so users can watch sentiment move as prices and probabilities change. Phantom CEO Brandon Millman echoed this by saying, “We built Phantom to make crypto feel intuitive for everyone, and now we are bringing that same simplicity to prediction markets”.

The company added that the new tool fits into its wider range of trading features, which already includes swaps and perpetual futures.

This partnership arrives during a period of strong growth for Kalshi. The company recently passed $5.8 billion in monthly trading volume, its highest level yet, and completed a $1 billion fundraising round that lifted its valuation to $11 billion.

Tarek Mansour, the CEO of Kalshi, said that the update further extends Kalshi’s network as Phantom opens access to a large base of crypto-native users. He also added, “At Kalshi, we’re looking to be a leader on-chain like we are off-chain, and partnering with Phantom is a significant step in helping us achieve that goal”.

Kalshi further emphasizes the benefits of the collaboration in a post on its X page, hailing Phantom, which boasts of hosting more than $20 million users as the largest Crypto wallet.

Kalshi’s Expansion and Rising Industry Competition

While Kalshi’s CEO stated that the collaboration significantly supports its plan to distribute regulated event markets across leading digital asset platforms, this strategy has already pushed its data into products offered by Google Finance, CNN, CNBC, the NHL, and Robinhood.

Meanwhile, the wider crypto sector is moving rapidly into event-driven trading. Gemini Titan, linked to the Gemini exchange, recently received a designated contract market license from the US Commodity Futures Trading Commission, giving it the ability to launch event-based products.

After screenshots of an unreleased Coinbase prediction market interface appeared online and Bloomberg reported that Coinbase could pair prediction markets with tokenized equities in an upcoming rollout, many now expect the exchange to enter the field soon.

Also read: Coinbase Taps Chainlink CCIP for Cross-Chain Wrapped Tokens

Conclusion

This integration places Phantom in the middle of a rapidly changing environment where crypto platforms, event-driven markets, and compliance requirements are starting to merge more closely. As regulated event trading continues shifting into retail-facing crypto products, updates like this set the stage for a wider adoption of on-chain prediction markets in the coming year.