- •Tezos is a self-amending proof-of-stake blockchain where token holders vote on upgrades, helping the network evolve without hard forks.

- •XTZ is available on many exchanges, but fees, liquidity, security, and features like futures or earn products change the overall buying value.

- •Bitunix offers competitive spot fees, optional KYC, and a clean interface, making it a practical choice for buying XTZ and accessing futures markets.

As privacy-focused assets return to the spotlight, many traders are also looking at networks built for long-term resilience. Tezos stands out with its self-upgrading design, on-chain governance, and steady staking rewards, which appeal to users who value adaptability and control. In this guide, we will walk through where Tezos is available, compare key exchange factors, and then choose the best option to buy Tezos tokens based on overall value.

Where to Buy Tezos?

Tezos has quietly built a reputation as a self-upgrading blockchain with active governance, steady staking rewards, and a growing ecosystem across DeFi and digital assets. As adoption has expanded, XTZ is now listed on many major exchanges, giving traders plenty of options when it comes to buying the token. Today, you can buy XTZ on a wide range of platforms.

Still, each exchange offers a different mix of fees, liquidity, security, and extra features like futures or earn products. Instead of choosing the first option you see, it helps to compare what each platform provides. Below, we look at several exchanges where you can buy XTZ and how they differ.

How to Buy $XTZ on Bitunix

Among the exchanges that list Tezos, Bitunix stands out for its balance of low fees, optional KYC, and a simple onboarding process. Rather than choosing a platform at random, we selected Bitunix because it offers a clean, intuitive interface that works well for both new and experienced traders. It is a relatively new exchange, but it has been expanding its product lineup and liquidity quickly.

Users can access competitive spot trading fees, and XTZ is also available in the futures market for those who want more advanced options. New sign-ups can receive bonuses of up to $5,500 when using a Bitunix referral code, adding extra value while getting started.

Just follow the steps below to buy Tezos (XTZ) on Bitunix:

Step 1: Open the official Bitunix website in your browser and create an account to start trading.

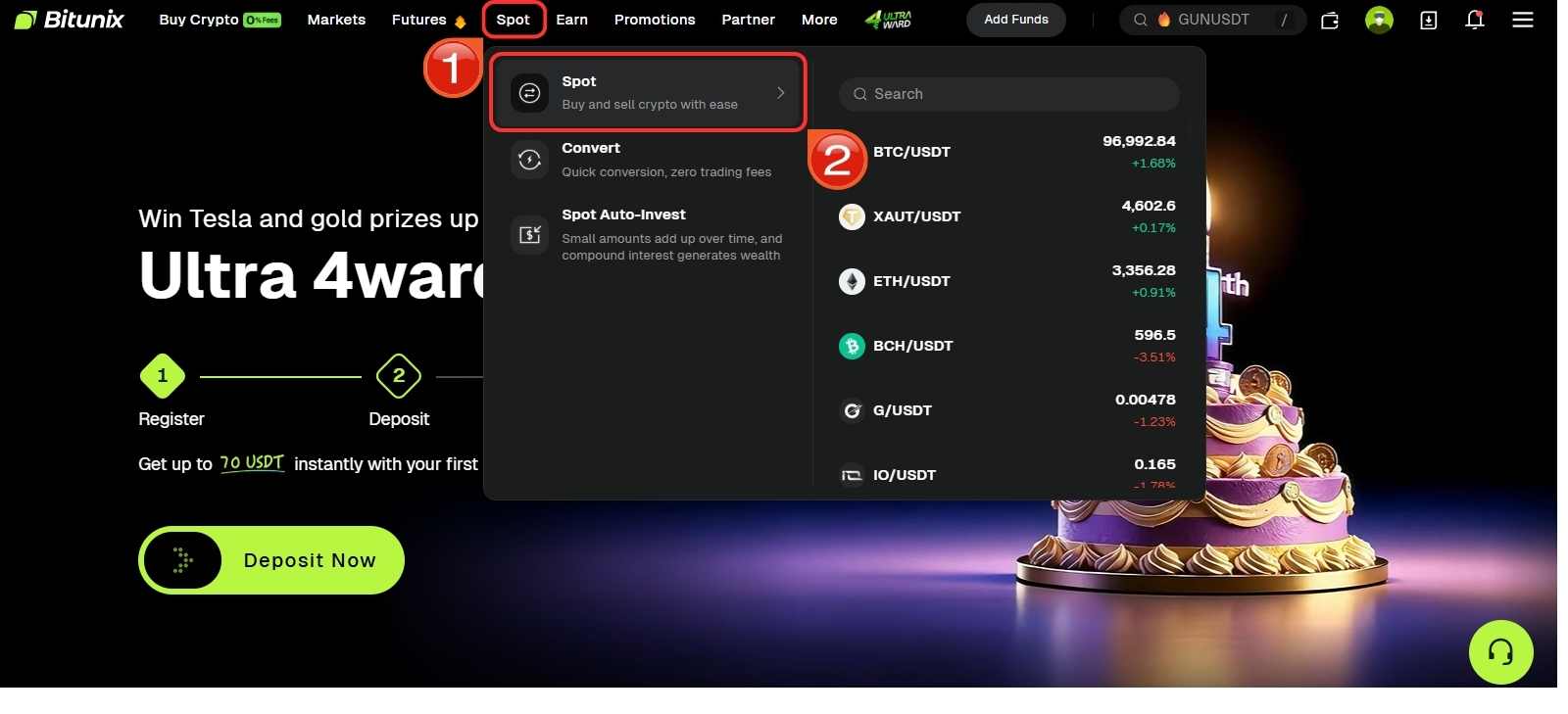

Step 2: After logging in, go to the main navigation bar, hover over the Spot section, and select Spot from the dropdown.

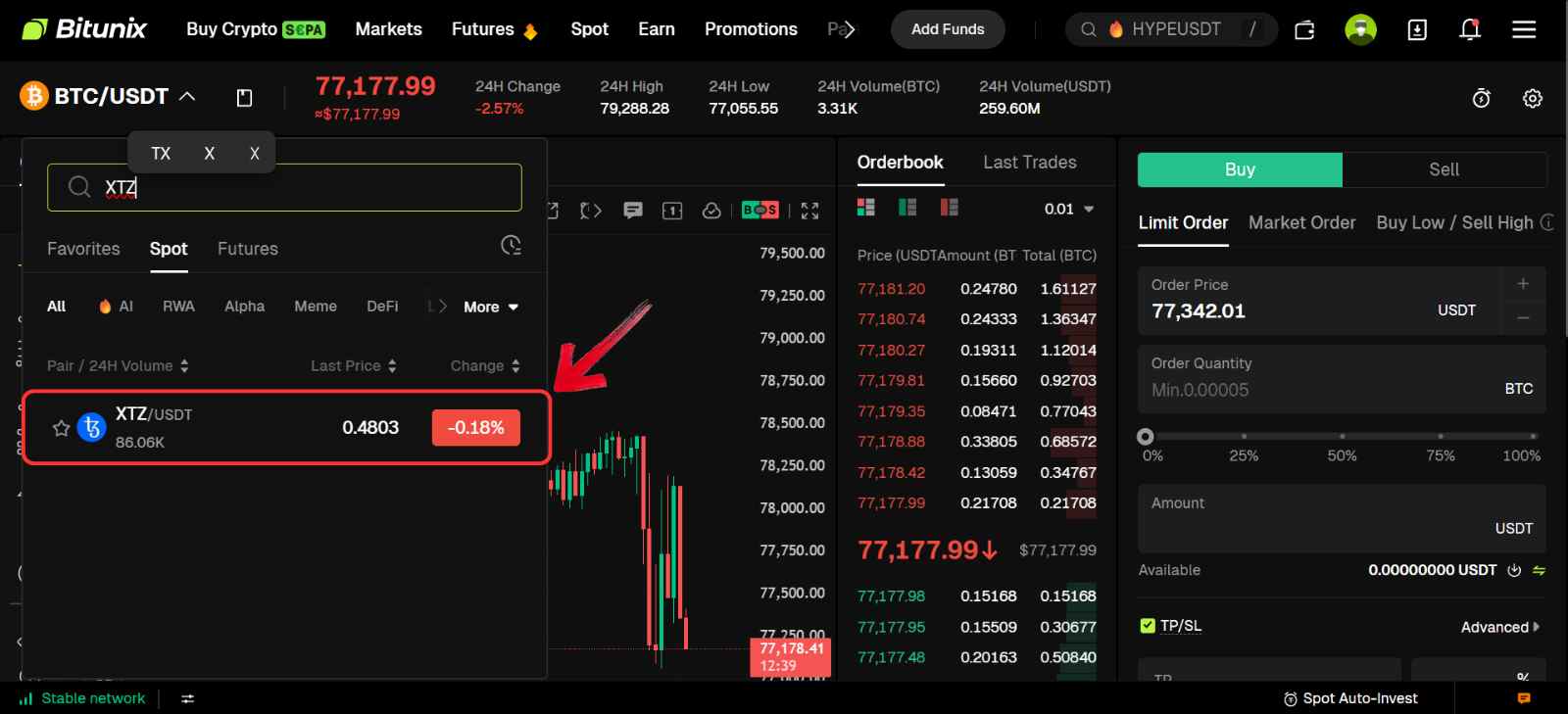

Step 3: On the Spot trading interface, click the Assets list, search for XTZ, and choose the XTZ/USDT trading pair.

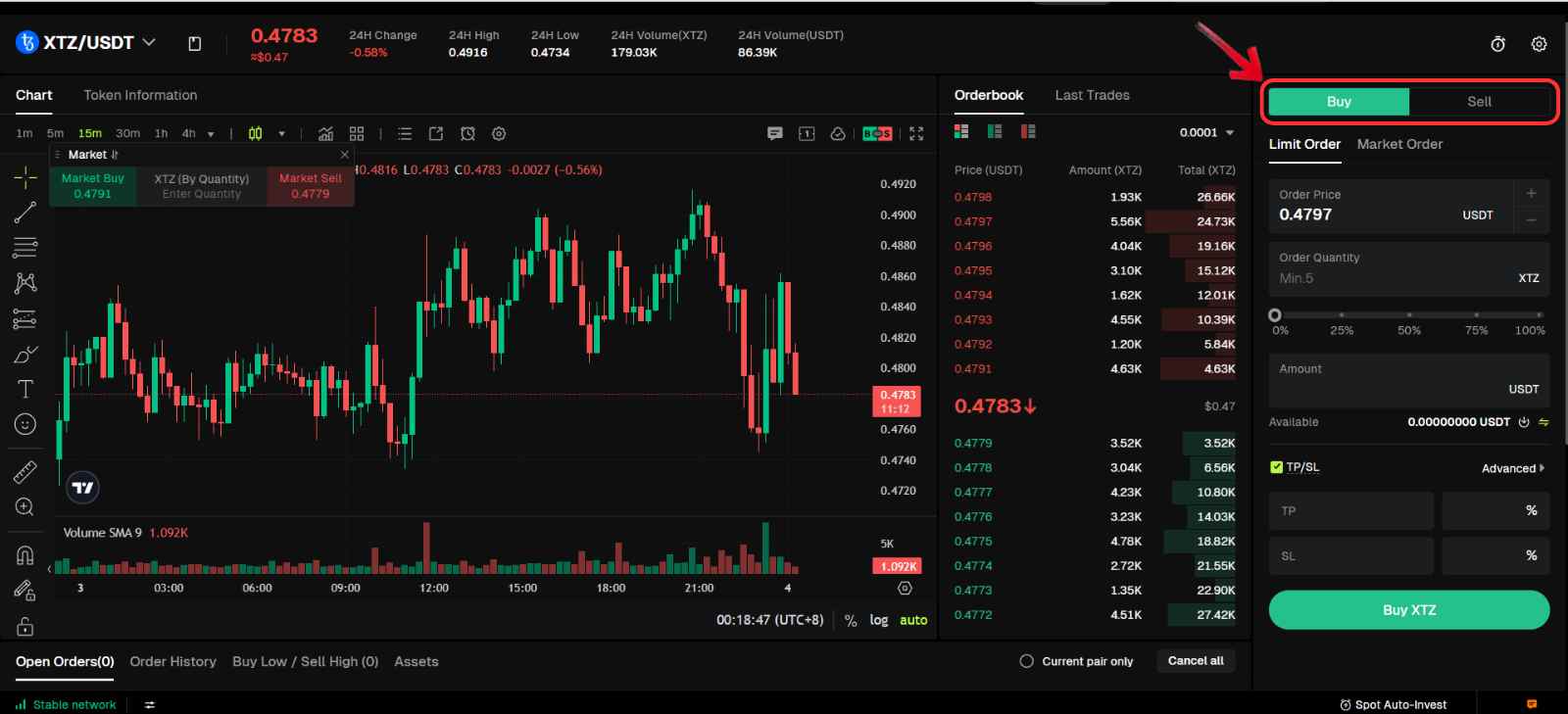

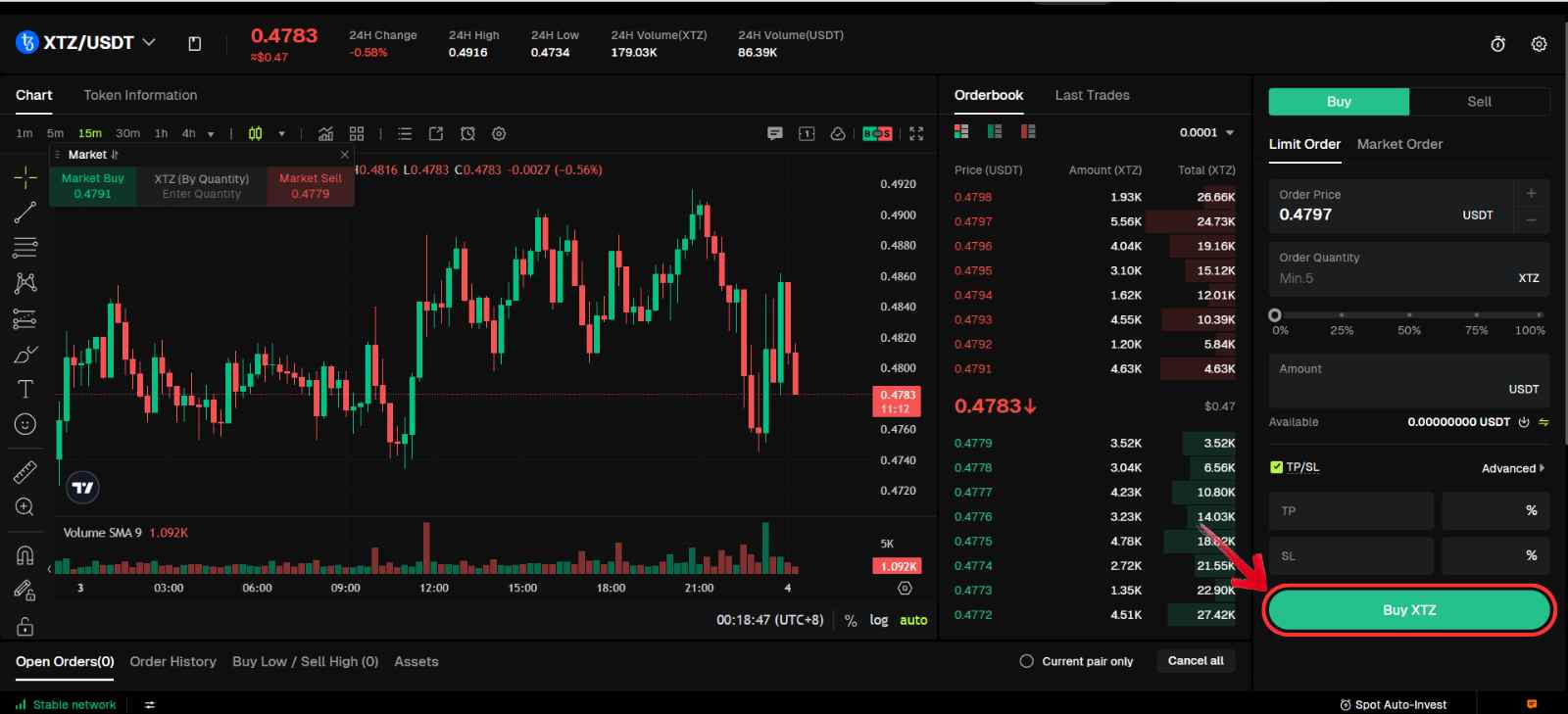

Step 4: Move to the order panel on the right. Here, you can select either a Market order for instant execution or a Limit order to set your preferred price.

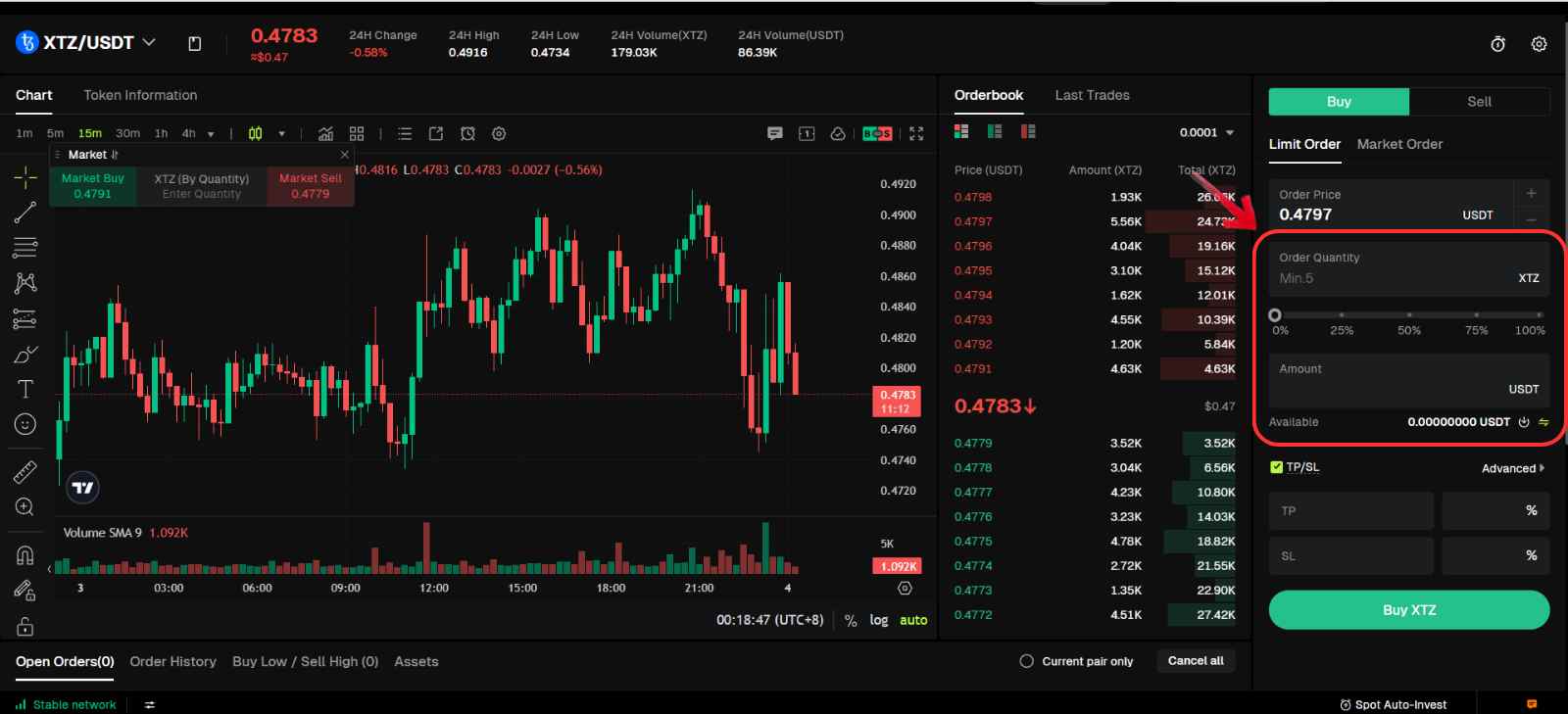

Step 5: Enter the amount of XTZ you want to buy, or input the USDT value you wish to spend. You can also use the slider for quick selection.

Step 6: Double-check the order details, then click Buy XTZ to complete the purchase.

Fees When Buying Tezos on Bitunix

Bitunix charges a flat 0.10% spot trading fee for both maker and taker orders. For example, if you buy $100 worth of XTZ at market price, the trading fee would be $0.10, and you would receive $99.90 worth of XTZ.

There are no hidden trading costs, but standard blockchain network fees apply when withdrawing XTZ to an external wallet. Bitunix also does not provide fee discounts through a native exchange token.

Tezos (XTZ)

New TokenToken Symbol

XTZ

Current Price

Loading...

Daily Change

Loading...

All-Time High

Loading...

Daily Low

Loading...

Daily High

Loading...

24h Volume

Loading...

Market Cap

Loading...

FDV

Loading...

Total Supply

Loading...

Max Supply

Loading...

How to Transfer $XTZ to a Web3 Wallet (Temple Wallet)

If you plan to use the Tezos network instead of just holding XTZ as an investment, you will need a compatible Web3 wallet. Tezos supports a range of on-chain activities, including staking, DeFi, NFTs, and governance, so keeping your tokens in a self-custodial wallet gives you full access to these features.

One of the most widely used wallets for Tezos is Temple Wallet, which is designed specifically for the network and works smoothly with its apps and services. After buying XTZ on an exchange, you will need to withdraw and transfer your tokens to your Temple Wallet address. This allows you to interact directly with the Tezos ecosystem and use its on-chain tools. Here is how you can transfer $XTZ from your Bitunix account to Temple Wallet:

Step 1: Move your cursor to the Wallet icon in the top menu and select Spot Account from the dropdown.

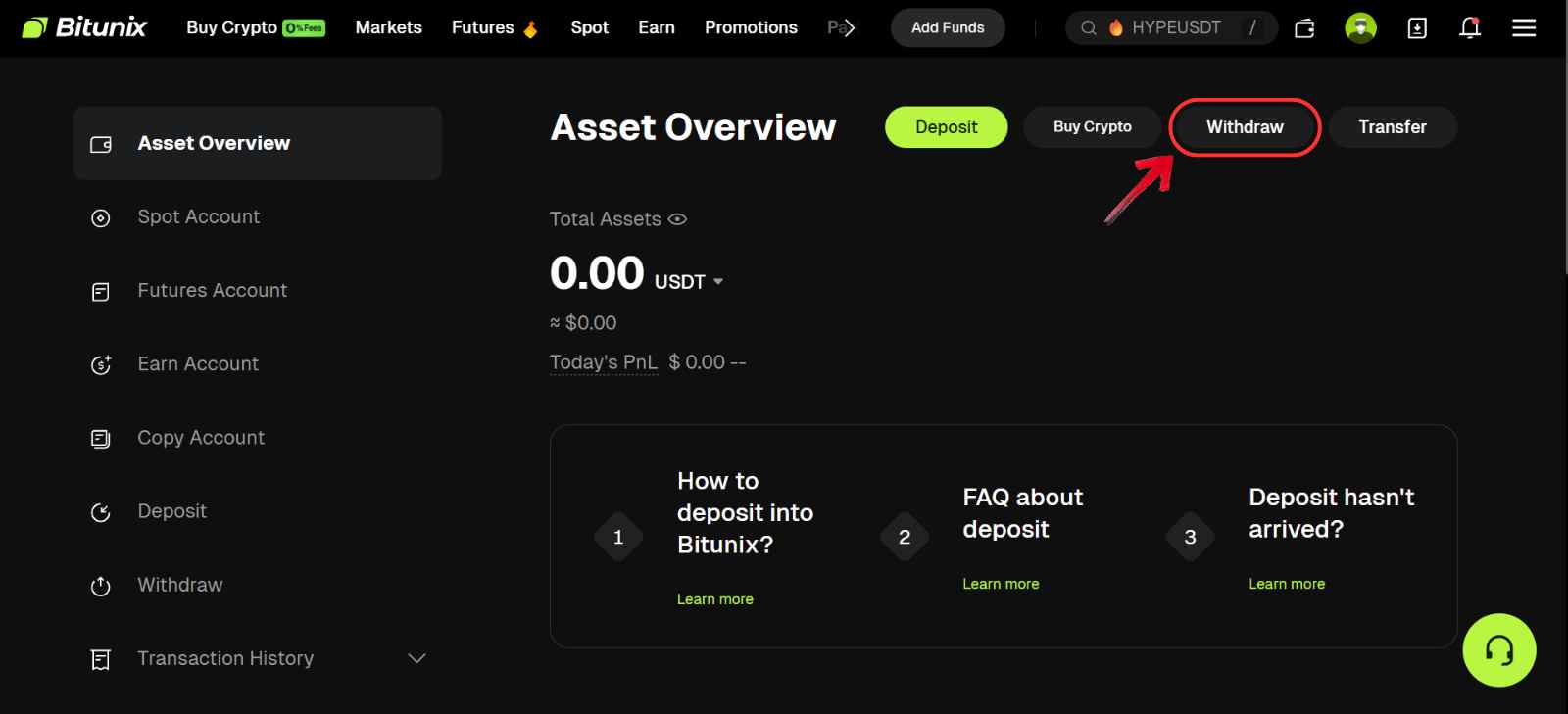

Step 2: In the Spot Account page, find your XTZ balance in the asset list and click the Withdraw option next to it.

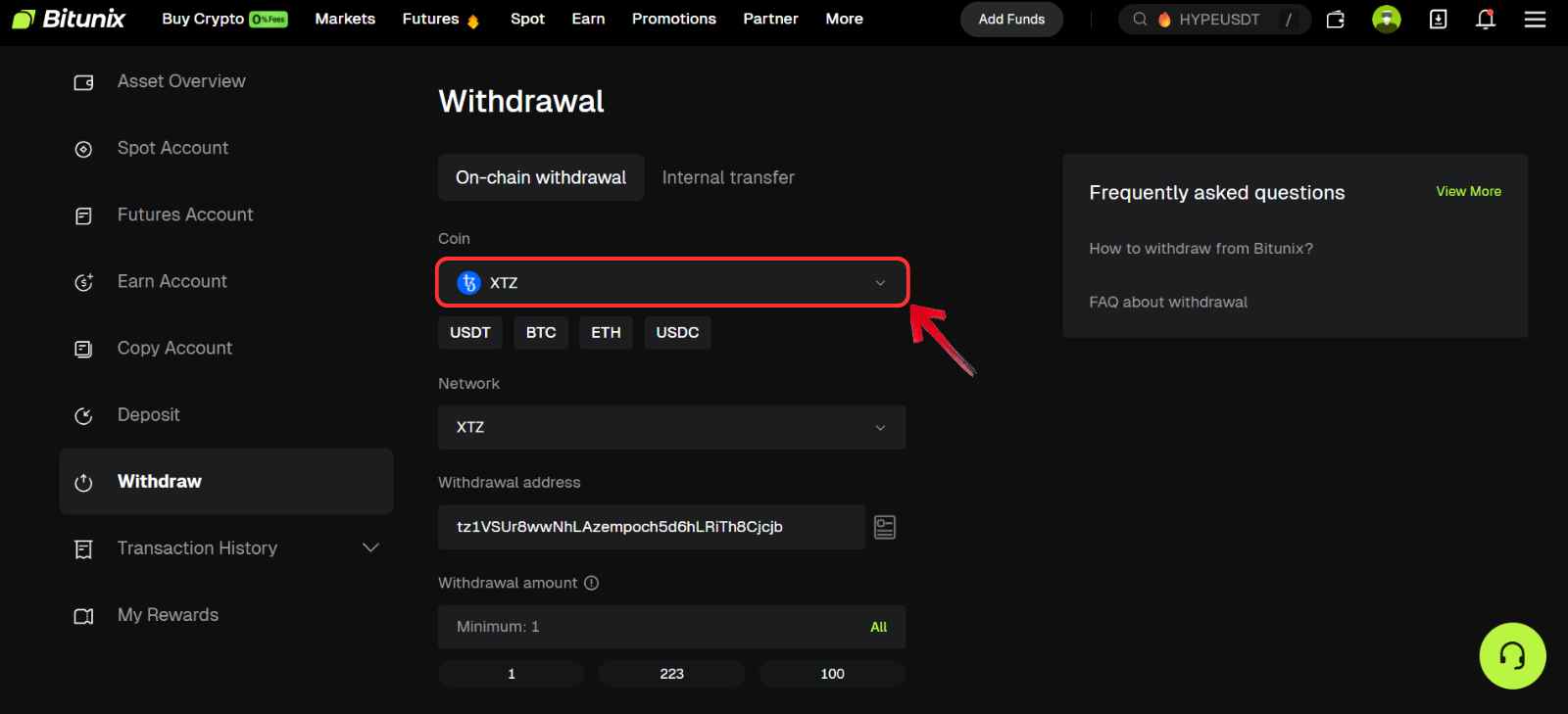

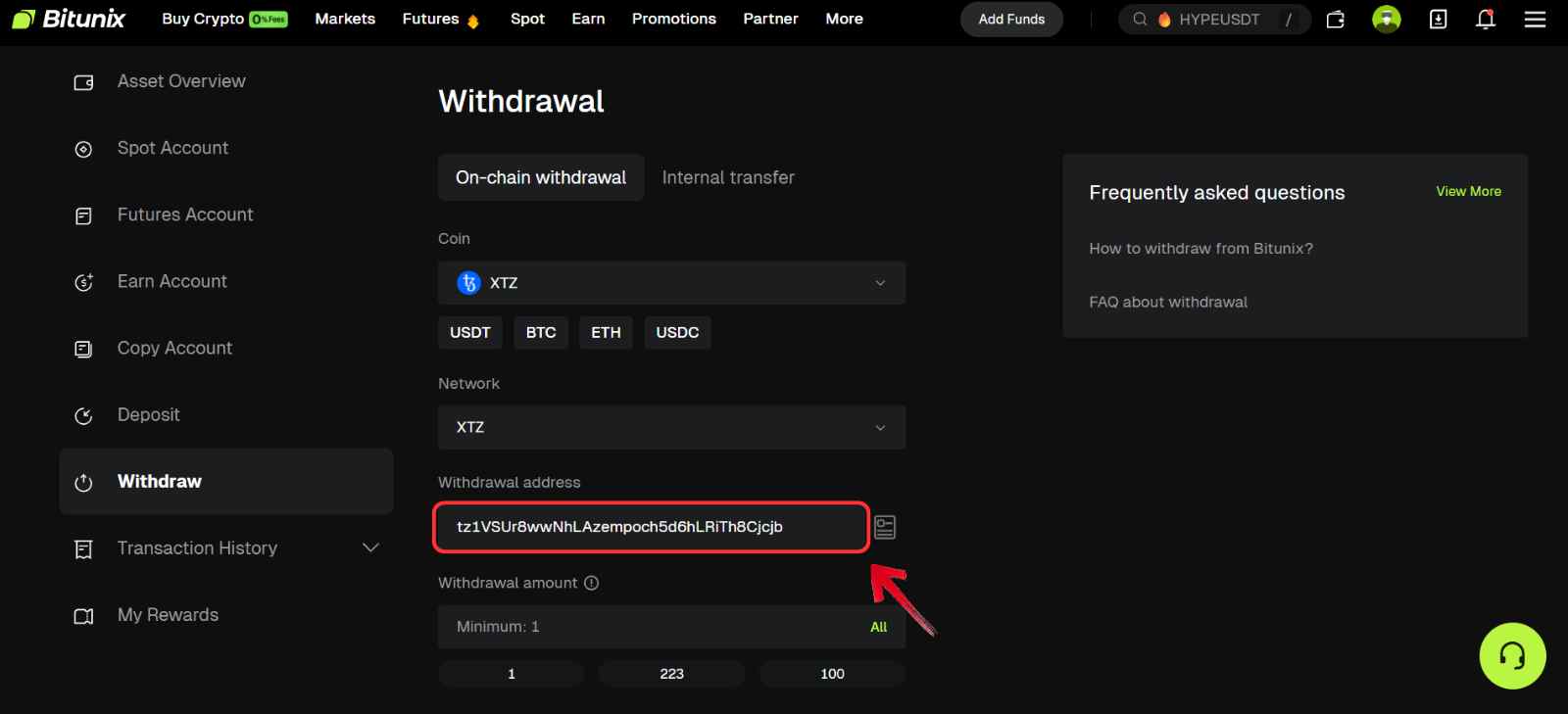

Step 3: You will be taken to the withdrawal form. Make sure the Coin field is set to XTZ.

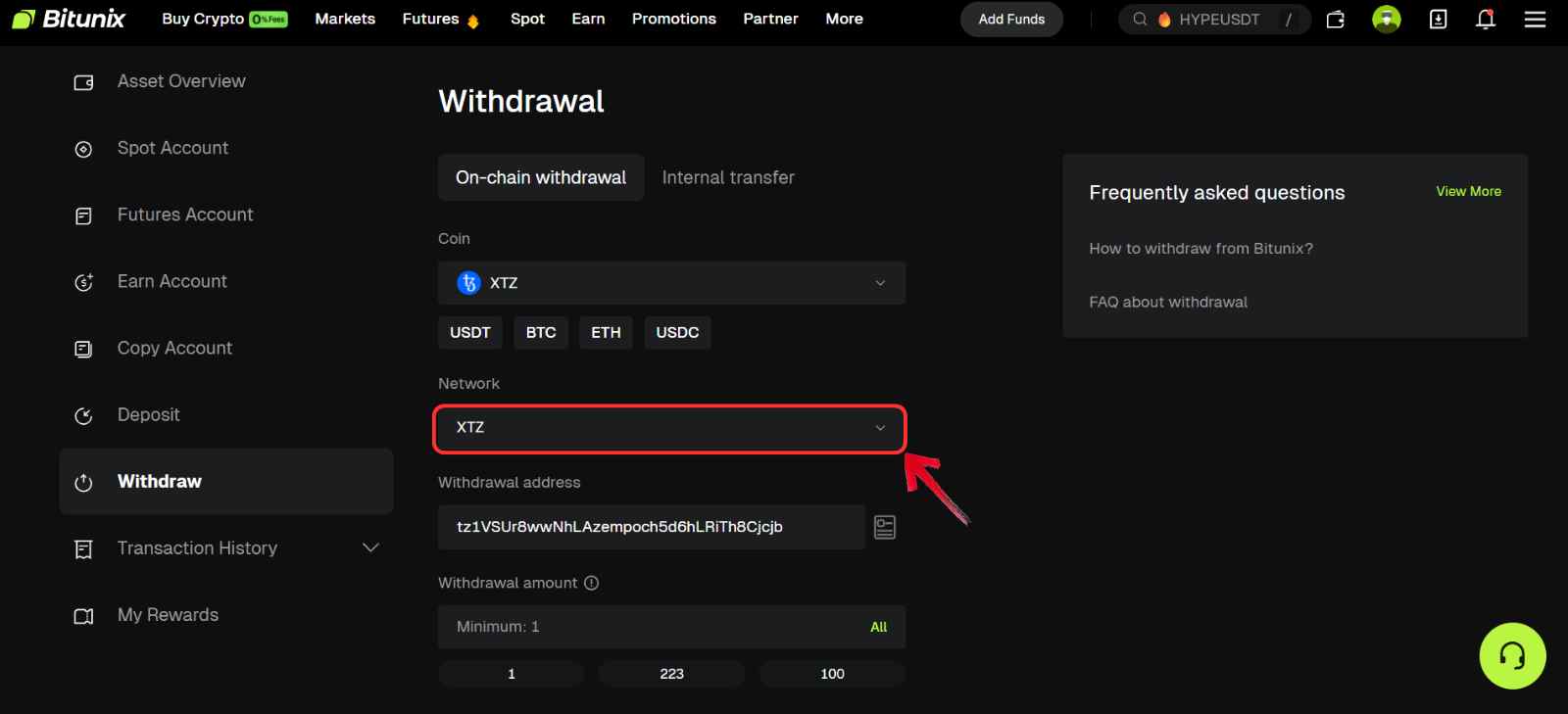

Step 4: From the Network dropdown, choose the Tezos (XTZ) network.

Step 5: Open your Temple Wallet, copy your XTZ deposit address, and paste it into the Withdrawal Address field on Bitunix.

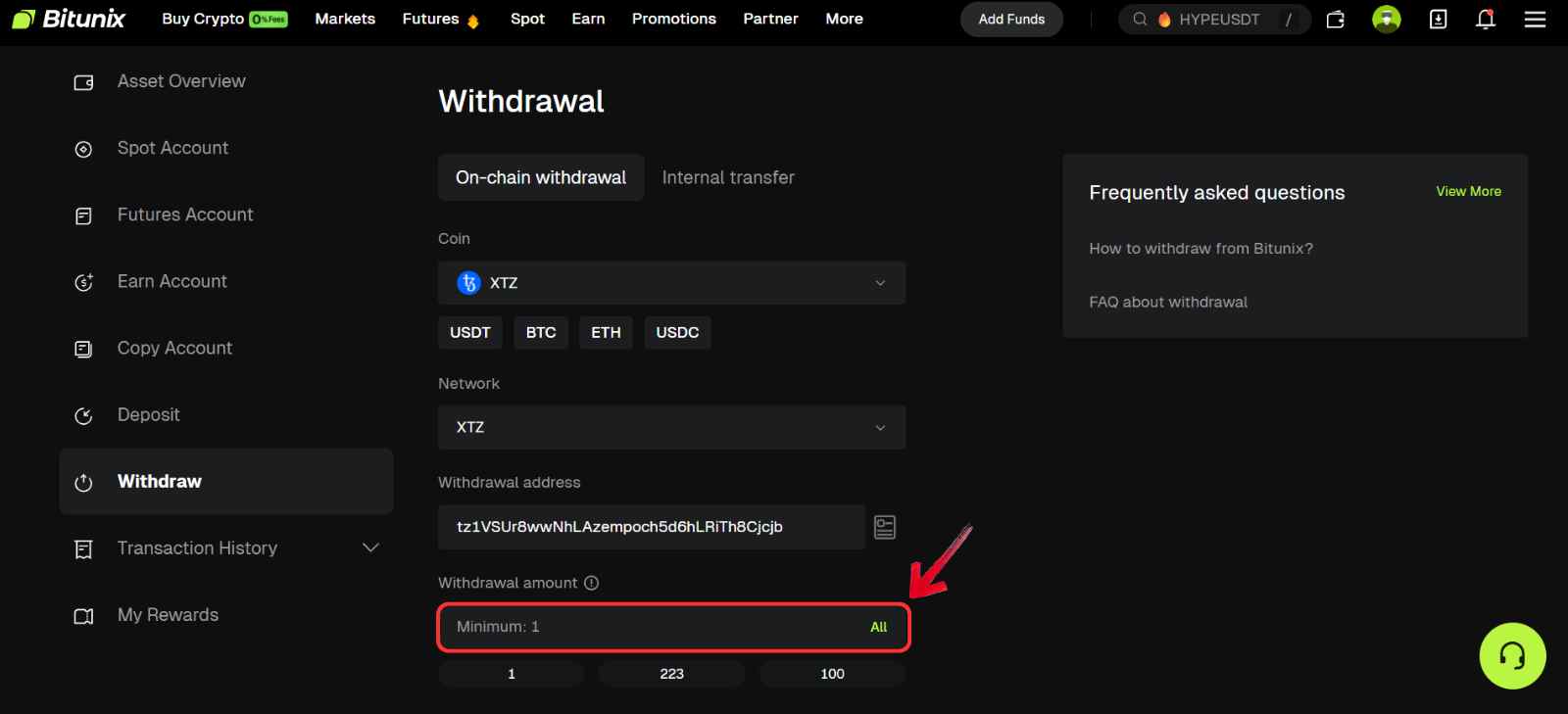

Step 6: Enter the amount of XTZ you want to transfer in the Withdrawal Amount section.

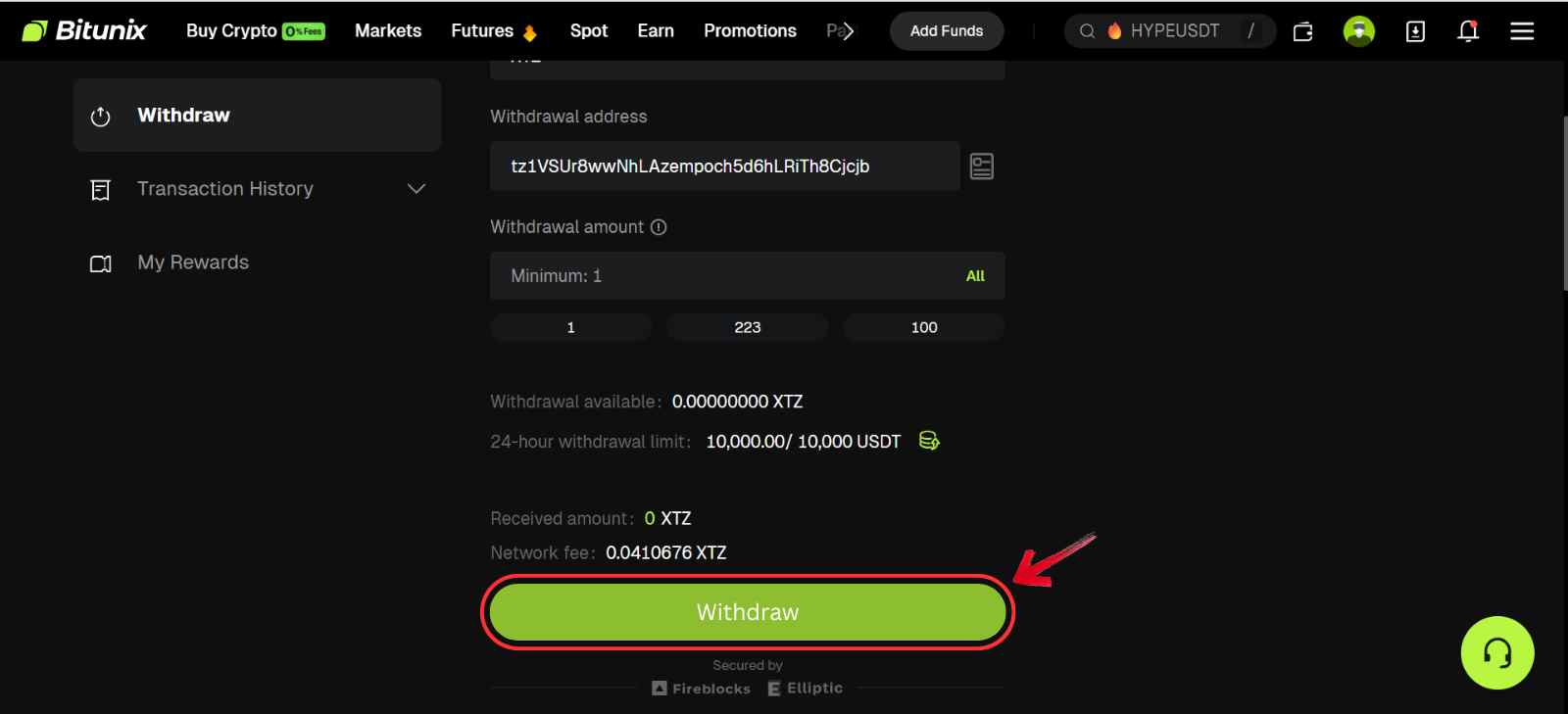

Step 7: Review the address, network, and amount carefully. Once everything looks correct, click “Withdraw” to send your XTZ to Temple Wallet.

After the transfer is complete, you will have full control of your XTZ inside Temple Wallet and can start using Tezos dApps, staking, or other on-chain features. Transactions can be tracked on a Tezos blockchain explorer.

Tezos Explained

Tezos is a blockchain designed to upgrade itself without breaking the network or forcing users to switch to a new chain. Instead of relying on hard forks, it uses on-chain governance, where token holders vote on upgrades. Once approved, the changes are applied directly to the protocol, which keeps the system stable and adaptable over time.

As the privacy narrative gains attention again, many users are looking for networks that offer long-term flexibility and strong control over their assets. Tezos fits into that discussion because of its self-amending design and proof-of-stake model, which allow the network to evolve while remaining energy-efficient and community-driven. In simple terms, Tezos is a blockchain that can change and improve itself without disrupting the people who use it.

Bottom Line

For most users, a platform with optional KYC, low spot fees, and a simple interface makes the buying process smoother, which is why Bitunix was our pick. Before choosing any exchange, it helps to compare liquidity, security, and whether the platform supports staking if you plan to hold long term. If the privacy narrative is what brought you here, you may also want to read our guide on how to buy Monero, another long-standing privacy-focused asset.

FAQs

1. What makes Tezos different from other blockchains?

Tezos uses on-chain governance, which allows the network to upgrade itself without hard forks. Token holders vote on changes, and approved upgrades are applied directly to the protocol.

2. What is Tezos staking and how does it work?

Tezos uses a proof-of-stake system called baking. You can either run your own validator or delegate your XTZ to a baker and earn rewards without locking your funds.

3. How much can you earn from staking XTZ?

Staking rewards vary depending on the baker and network conditions, but typical annual returns range between 4% and 7% after fees.

4. Is Tezos energy-efficient compared to other blockchains?

Yes. Because it uses proof-of-stake instead of proof-of-work, Tezos consumes far less energy than older mining-based networks.