- •BYDFi was launched in 2019 and is headquartered in Singapore, now serving over 4 million users.

- •The platform lists 801+ spot assets and 421+ futures contracts, with stronger activity in derivatives trading.

- •Spot fees are flat at 0.10% maker/taker, while futures fees are 0.02% maker and 0.06% taker.

- •High leverage up to 200x is available on futures, alongside demo trading for practice.

- •No KYC is required to start trading, with daily withdrawal limits beginning at 1 BTC.

- •Products include copy trading, grid/martingale bots, P2P, fiat on/off ramps, and MoonX on-chain trading.

- •Security features include 2FA, cold wallets, multi-signature technology, and 1:1 Proof of Reserves.

- •Bank transfers and crypto deposits/withdrawals are free, while card transactions carry a 0.8% fee.

- •Customer support is available 24/7 via live chat and email, with generally quick response times.

The crypto market is expanding again, and traders are paying close attention to which exchanges can meet their needs. For some, that means ease of use and straightforward costs. For others, it’s access to advanced order types, higher leverage, and reliable liquidity. In this BYDFi review, we take a closer look at how the exchange balances these expectations. From spot and futures trading to additional products and services, this review lays out the details so you can assess whether BYDFi aligns with your trading approach.

| Stats | BYDFi |

|---|---|

| 🚀 Founded | 2019 |

| 🌐 Headquarters | Singapore |

| 🔎 Founder | Michael Hung |

| 👤 Active Users | 4M+ |

| 🪙 Supported Cryptos | 801+ |

| 🪙 Futures Contracts | 421+ |

| 🔁 Spot Fees (maker/taker) | 0.10% / 0.10% |

| 🔁 Futures Fees (maker/taker) | 0.02% / 0.06% |

| 📈 Max Leverage | 200x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.3/5 |

| 💰 Bonus | $300 (Claim Now) |

BYDFi Overview

BYDFi, launched in 2019 and based in Singapore, is an exchange that has grown to serve more than 4 million users. It lists over 418+ cryptocurrencies on spot and 421+ futures contracts, making it a platform with a wide range of markets. The daily futures trading volume often exceeds $9.8+ billion, while spot activity is comparatively lower at around $163 million. This gap highlights where most of its trading interest currently lies.

The exchange operates without mandatory KYC for entry-level use, setting daily withdrawal limits that scale with verification levels. Its fee model includes 0.10% for both maker and taker fees, and competitive rates on futures. BYDFi also supports high leverage of up to 200x on derivatives, alongside functions like copy trading and built-in strategies such as grid and martingale bots.

At the same time, limitations are present. Fiat withdrawals are not available, and liquidity in spot markets is smaller than leading exchanges. While safety measures include anti-phishing alerts and live chat support, BYDFi is still working to strengthen its position among established global players. With their focus on simplicity, low fees, simple usability, regulatory licenses, and global accessibility, BYDFI (previously BitYard) is attracting traders from around the world. You can easily buy Bitcoin on BYDFi.

BYDFi Pros & Cons

| 👍 BYDFi Pros | 👎 BYDFi Cons |

|---|---|

| ✅ Up to 200x leverage | ❌ Spot market liquidity is weak |

| ✅ Licensed in US | ❌ P2P marketplace has limited vendors and lower liquidity |

| ✅ Low Spot trading fees are low | ❌ Lacks passive income products |

| ✅ No KYC with 1 BTC daily withdrawal limit | ❌ No tiered fee discounts or token-based rewards |

| ✅ Proof of Reserves and cold wallets strengthen fund security | |

| ✅ User-friendly |

BYDFi Sign-up and KYC

The sign-up process on BYDFi is straightforward. Users can create an account with just an email address and password, without going through full KYC verification. This means trading can begin immediately, with daily withdrawal limits of up to 1 BTC for non-verified accounts. Here’s how to get started:

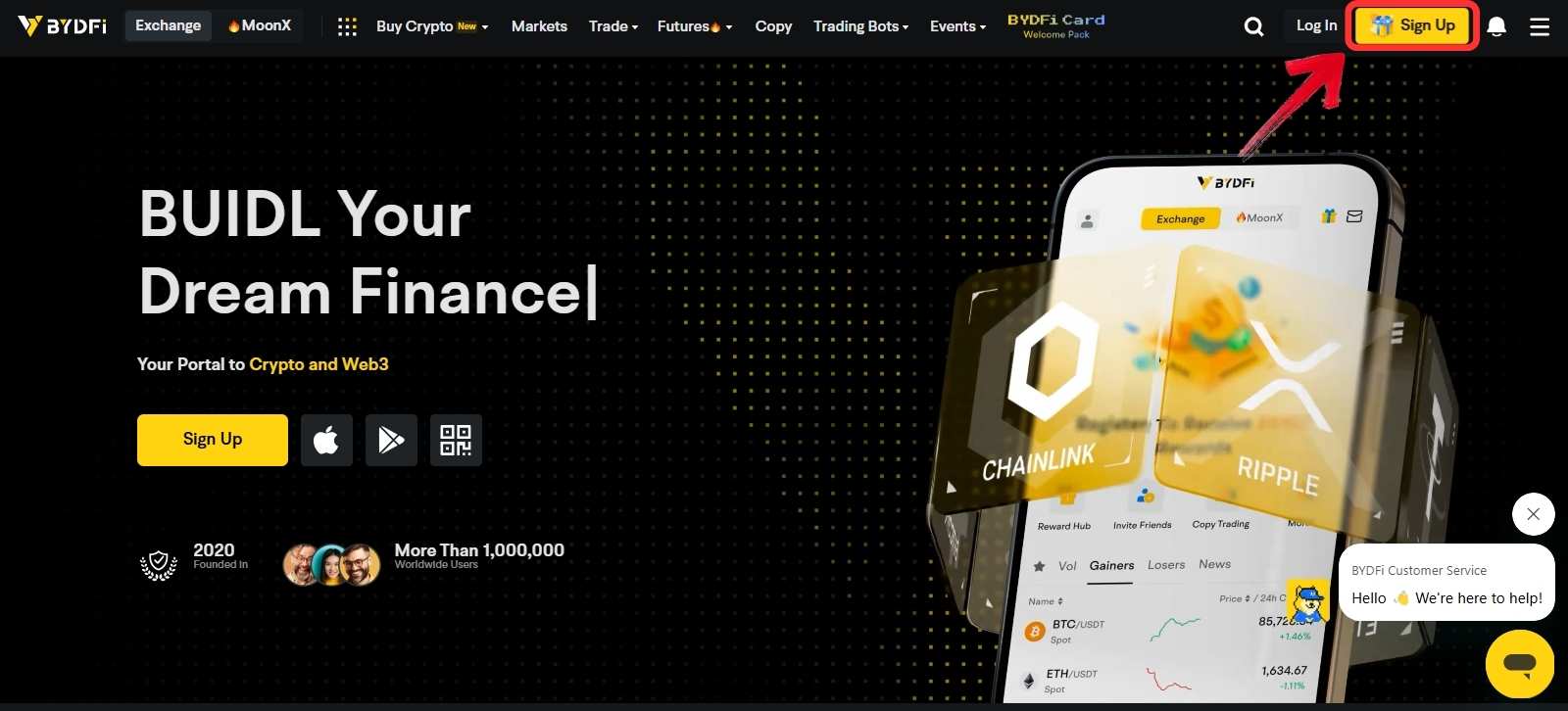

Step 1: Open the official BYDFi website in your browser and click the “Sign Up” button on the top right.

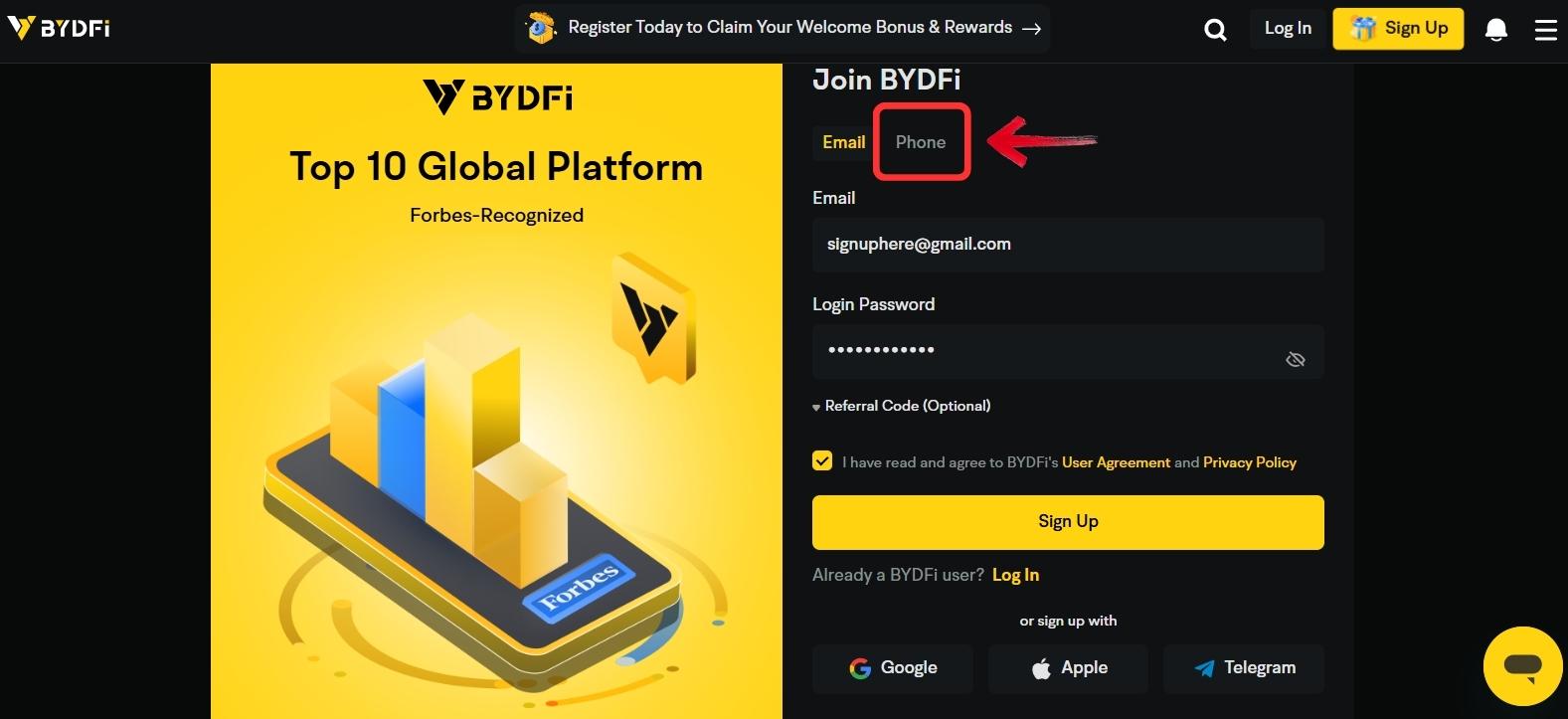

Step 2: Enter your email address, or switch to the “Phone” tab if you prefer registering with a mobile number. Set a secure password.

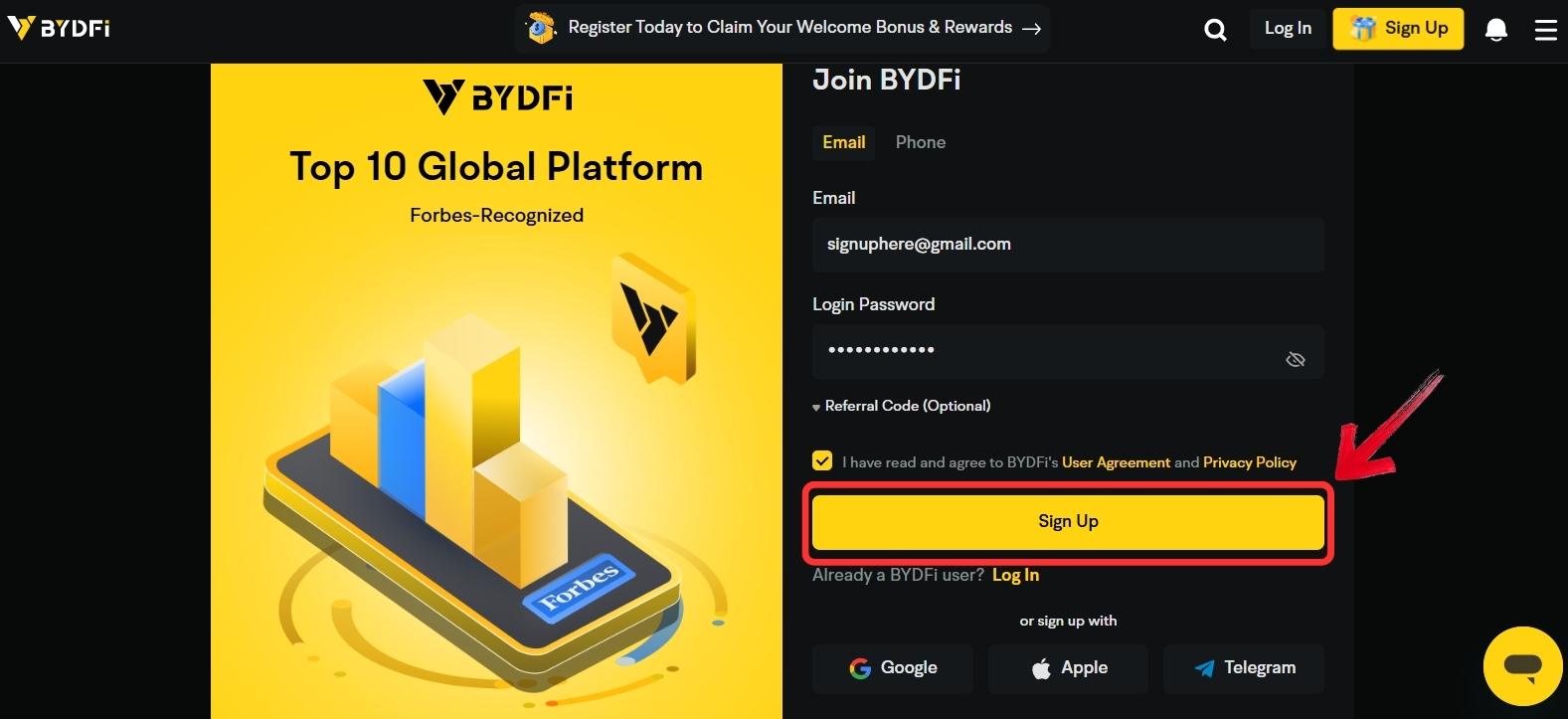

Step 3: Check the box to agree to the User Agreement and Privacy Policy, then click Sign Up to complete the process.

Once the account is created, users can access the platform immediately. Withdrawal limits can be increased by completing KYC verification, with Level 1 raising the limit to 1.5 BTC and higher levels unlocking more.

Learn more about the verification requirements in our full BYDFi KYC guide.

Level 1 verification raises the daily limit to 1.5 BTC, with higher levels unlocking even larger amounts. However, it’s important to note that operating without KYC does not guarantee availability of services in every region. BYDFi restricts access in certain countries, so it’s recommended to first check with CryptoWinRate’s BYDFi Country Checker to confirm whether your region is supported. If it isn’t, you may need to consider suitable alternatives before going through the sign-up process.

🌍 Free BYDFi Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, BYDFi does not support every country. To ensure that you are eligible to register on the exchange, you can use our free BYDFi country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

BYDFi Trading Features

Where BYDFi stands against its competitors really comes down to what kind of trader you are. If you’re more of an investor chasing narratives, then the number of coins on offer might be the deciding factor. But if you’re a futures trader, things like liquidity, spreads, and order types will matter much more. So, let’s take a closer look at what BYDFi actually offers.

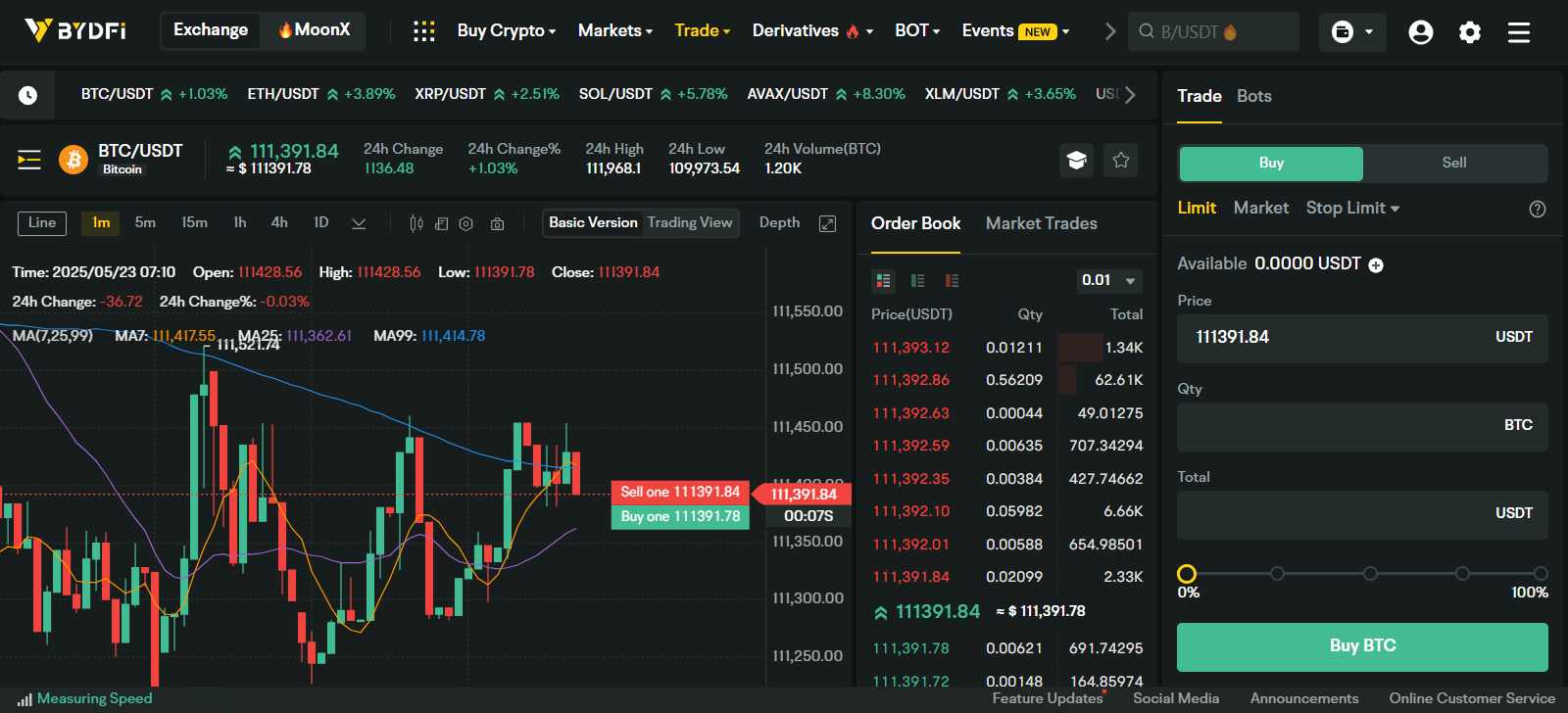

Spot Trading

On the spot side, you get access to 801+ cryptocurrencies. Maker fees are set at 0.10% and taker fees at 0.10%, which can be attractive for anyone running high-frequency trades. The platform provides a basic charting view for quick price checks but also lets you switch to a full TradingView integration. That means indicators, drawing tools, and strategy setups are available without leaving the exchange.

What it doesn’t have, though, is a customizable interface where you can move windows around to set up your own trading layout. In terms of order types, you’ll find the basics like limit and market orders, plus a few advanced setups such as Stop Limit, Stop Market, and OCO.

Want to learn more about spot trading? Check out our BYDFi spot trading guide!

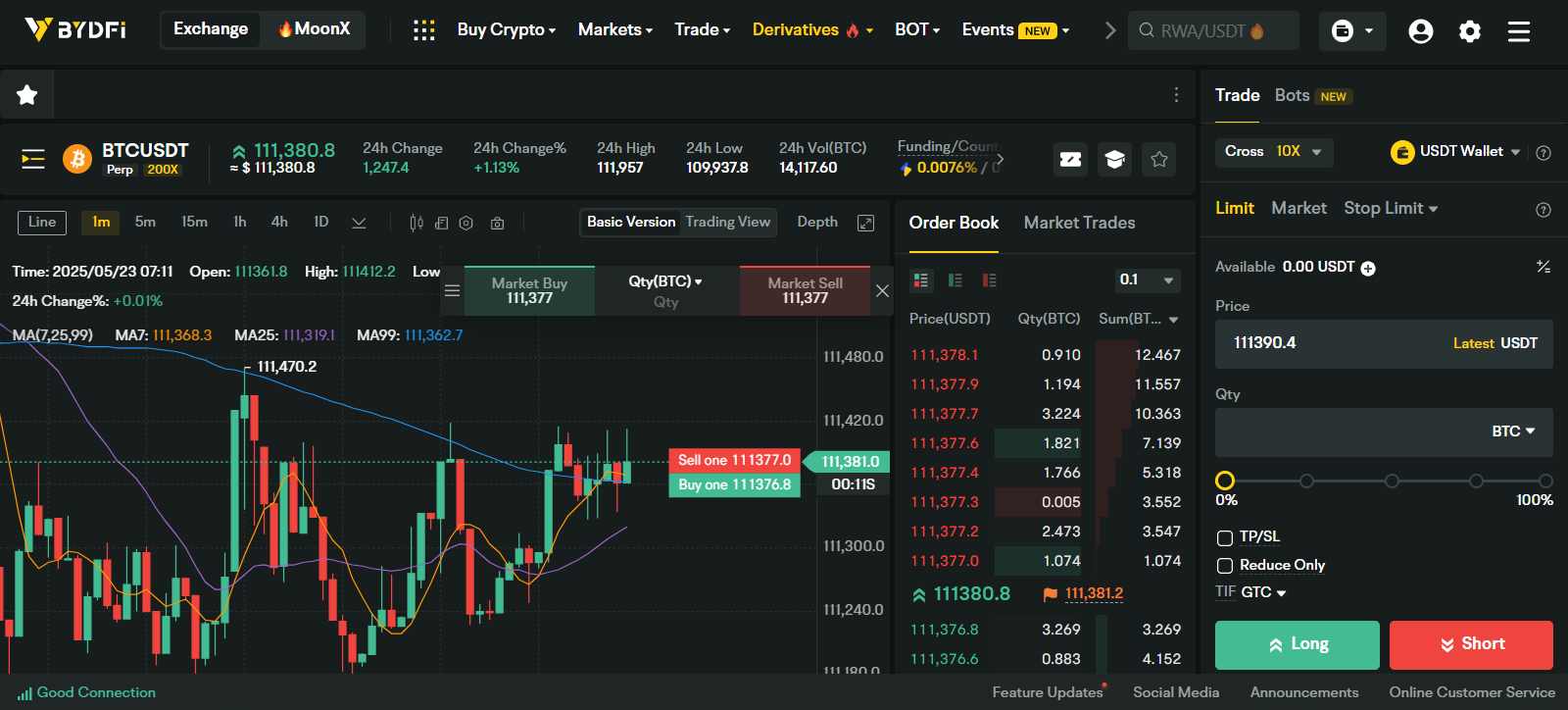

Futures Trading

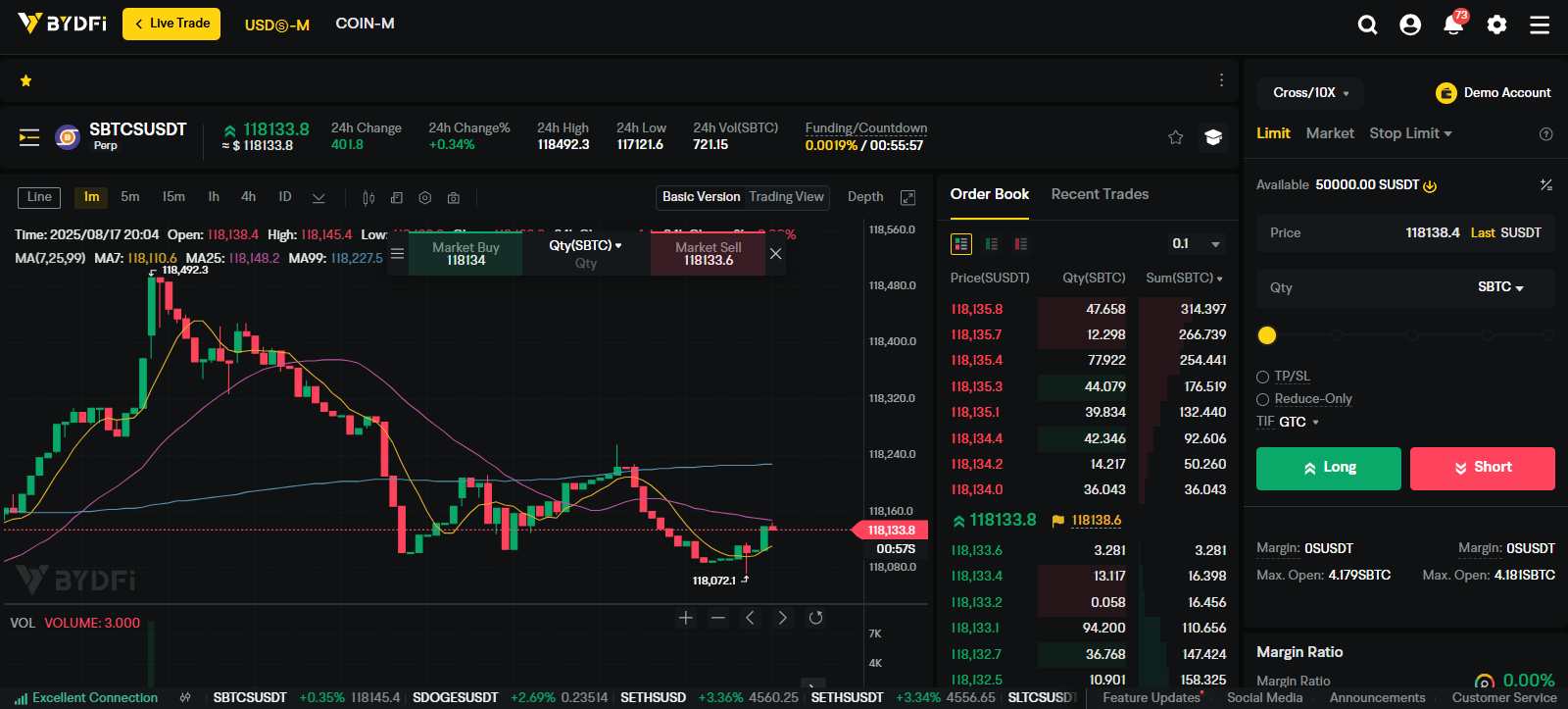

For futures, BYDFi lists 421+ contracts with leverage that goes up to 200x. Fees are competitive at 0.02% for makers and 0.06% for takers. Daily volume crosses $10.5 billion, showing there’s activity, though the depth is still moderate compared to bigger platforms. Futures traders again get TradingView integration along with order flexibility, from GTC, IOC, and FOK to Stop Limit and Stop Market. And if you’re just starting out, there’s also a demo trading mode to test strategies before committing real funds.

When it comes to futures, BYDFi offers 421+ contracts with leverage that stretches up to 200x. Fees sit at 0.02% for makers and 0.06% for takers, putting it in line with what most active derivatives traders would expect. Daily trading volume regularly passes $10.5 billion, which shows there’s activity, though the order book depth isn’t quite at the same level as the very largest exchanges. You can read out BYDFi futures guide to learn how to trade on the platform.

Charting here also comes with TradingView built in, so you can track market moves with indicators and strategies rather than relying on just the basics. Order execution is fairly flexible too. Alongside standard market and limit orders, you get access to options like GTC, IOC, and FOK, plus Stop Limit and Stop Market for tighter trade management. For anyone still learning the ropes, BYDFi also includes a demo trading feature; a chance to test strategies in real time without risking funds.

Read our BYDFi demo trading guide to get started.

BYDFi Deposits and Withdrawals

BYDFi supports multiple ways to move funds in and out of the platform. For deposits, there are no charges from the exchange itself. Users can add funds through debit or credit card purchases, bank transfers, or by sending crypto directly via on-chain transfers. A fiat on/off ramp is also available, making it easier to convert local currency into USDT or other supported cryptocurrencies. For those looking for more localized options, BYDFi’s P2P marketplace allows buyers and sellers to trade directly, often with a range of local payment methods.

Withdrawals work differently. While BYDFi doesn’t add extra charges on its side, each cryptocurrency has its own network fee that applies when funds are moved. These fees vary by token and blockchain, and can rise temporarily if a network is congested.

Check our BYDFi withdrawal guide for more information.

BYDFI Fees

Fees are one of the most important factors to consider, no matter what your trading style is, so it’s worth keeping an eye on those if you’re an active trader.

BYDFi Trading Fees

When it comes to fees, BYDFi keeps things simple. Spot trading is charged at 0.10% for both makers and takers. There are no tiered levels like you’ll find on bigger exchanges, and no native token that gives you discounts. On the futures side, the rates are slightly sharper, set at 0.02% for makers and 0.06% for takers, and these apply to both opening and closing a position.

The structure is easy to follow, which means you always know what you’re paying without tracking VIP levels or holding a platform token. Leveraged tokens work a bit differently, carrying a 0.2% fee plus a small daily management cost, while trading bots such as grid or martingale simply follow the same fee rules as the markets they operate in.

| Trading Type | Maker Fees | Taker Fees |

|---|---|---|

| Spot Trading | 0.1% | 0.1% |

| Futures Trading | 0.02% | 0.06% |

| Spot Grid Bot Trading | 0.1% | 0.1% |

| Futures Grid Bot Trading | 0.02% | 0.06% |

| Leveraged Tokens | 0.02% | 0.06% |

Deposits and Withdrawal Fees

BYDFi keeps deposit and withdrawal costs relatively simple. Bank transfers and crypto deposits/withdrawals are free of charge, with no additional platform fees applied. If you prefer using a debit or credit card, a minimum fee of 0.8% applies to both deposits and withdrawals. For crypto withdrawals, while BYDFi does not add its own charges, each blockchain network has its own miner or gas fee, which can vary depending on network activity and congestion.

| Coin | Futures |

|---|---|

| Bitcoin | 0.0002 BTC |

| Ethereum | 0.0018 ETH |

| Solana | 0.008 SOL |

| Tether | 1 USDT |

Aside from offering great trading products, BYDFi also has a generous welcome crypto bonus of over $2,888 for new users. We have a full guide on how to receive all BYDFi bonuses, which you should definitely check out if you are interested in trading on the exchange.

For users seeking passive income products, BYDFi offers an affiliate program where you can earn lifetime commissions from your invitees.

Read our BYDFi affiliate program review to learn more.

BYDFi Products and Services

Crypto exchanges today are no longer just about buying and selling coins. To keep users engaged, most platforms build an entire ecosystem around trading. offering tools, products, and extra features that create a more complete experience. BYDFi follows the same approach, with its own set of services designed for different types of traders. From automated strategies to copy trading and investment options, the exchange tries to provide more than just basic spot and futures markets. Let’s take a closer look at what’s available.

BYDFi Trading

BYDFi provides a full trading experience with support for spot, margin, futures, copy trading, P2P, demo accounts, and even on-chain trading. The platform offers two interface options: a simple chart version for quick overviews and a

TradingView-powered version with more advanced indicators and strategy tools. Order types include basic options such as limit and market, plus moderate advanced orders like Stop Limit, Stop Market, and OCO. Liquidity on spot markets is moderate, while futures depth is stronger but still below top-tier platforms. Overall, it gives users a complete suite of trading tools without becoming overly complex.

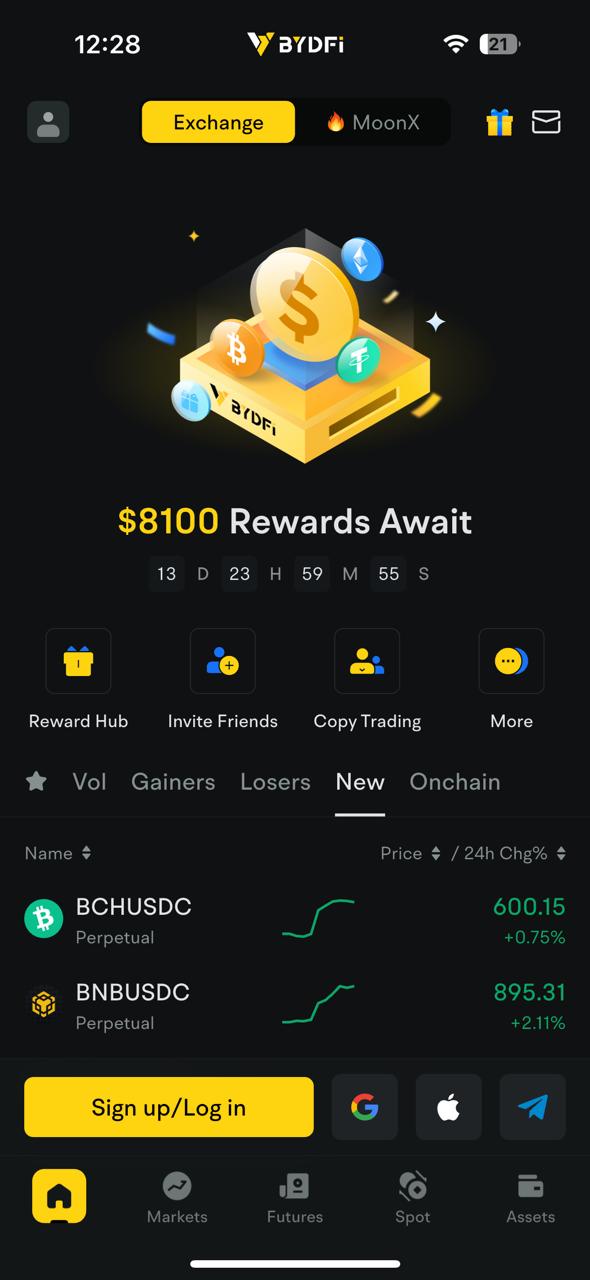

Mobile App

BYDFi’s mobile app is designed to mirror the web experience, giving traders access to the same range of markets and features on the go. The app supports TradingView charts, basic and advanced order types, and allows users to monitor positions in real time. A built-in live chat feature adds convenience for customer support. For those who prefer trading outside of a desktop setup, the app offers a streamlined, user-friendly way to manage accounts and execute trades.

Copy Trading

BYDFi offers a copy trading feature that allows users to mirror the strategies of more experienced traders. The platform lists a wide range of traders, organized by categories such as ROI, PnL, or follower count, making it easier to evaluate performance before selecting one. Once chosen, trades are copied automatically, giving beginners an opportunity to learn and participate without building strategies from scratch.

Profit sharing is set at a fixed 10%, which is deducted from successful trades. While copy trading can simplify decision-making, the results still depend heavily on the trader being followed, so it requires careful selection.

P2P Trading

The P2P marketplace on BYDFi provides a way to buy and sell crypto directly with other users. It’s particularly useful in regions where traditional on/off ramps are limited or unclear. Currently, the marketplace supports USDT, BTC, ETH, and XRP, though vendor numbers remain small and liquidity can be thin. This sometimes leads to prices carrying a slight premium compared to centralized order books. Still, for traders looking for localized payment options, P2P adds flexibility that direct fiat deposits may not always provide.

Fiat On/Off Ramp

BYDFi supports fiat on/off ramp services, allowing users to convert their local currency into USDT or other supported cryptocurrencies. Payments can be made through bank transfers, debit cards, credit cards, and third-party providers like Apple Pay and Google Pay. This makes it easier for users who don’t already hold crypto to get started, or for existing traders to top up balances directly. On the sell side, the same system can be used to cash out into fiat, although availability may vary depending on the payment partner or region.

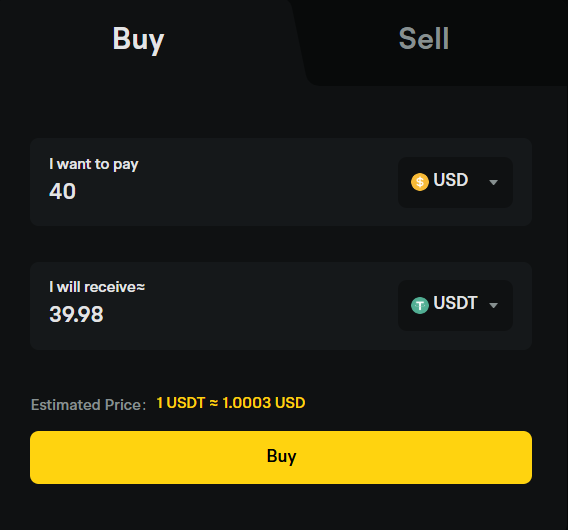

MoonX

MoonX is BYDFi’s decentralized trading platform, built as an extension of its ecosystem. It currently supports trading on the Solana and BSC networks, giving access to a wider pool of tokens beyond centralized listings. A built-in DEX screener helps users analyze liquidity and price action before executing trades. MoonX also includes XStocks, which provide on-chain exposure to major U.S. companies like Tesla, Microsoft, and Apple. This mix of crypto and tokenized stock access makes MoonX stand out as one of BYDFi’s unique features.

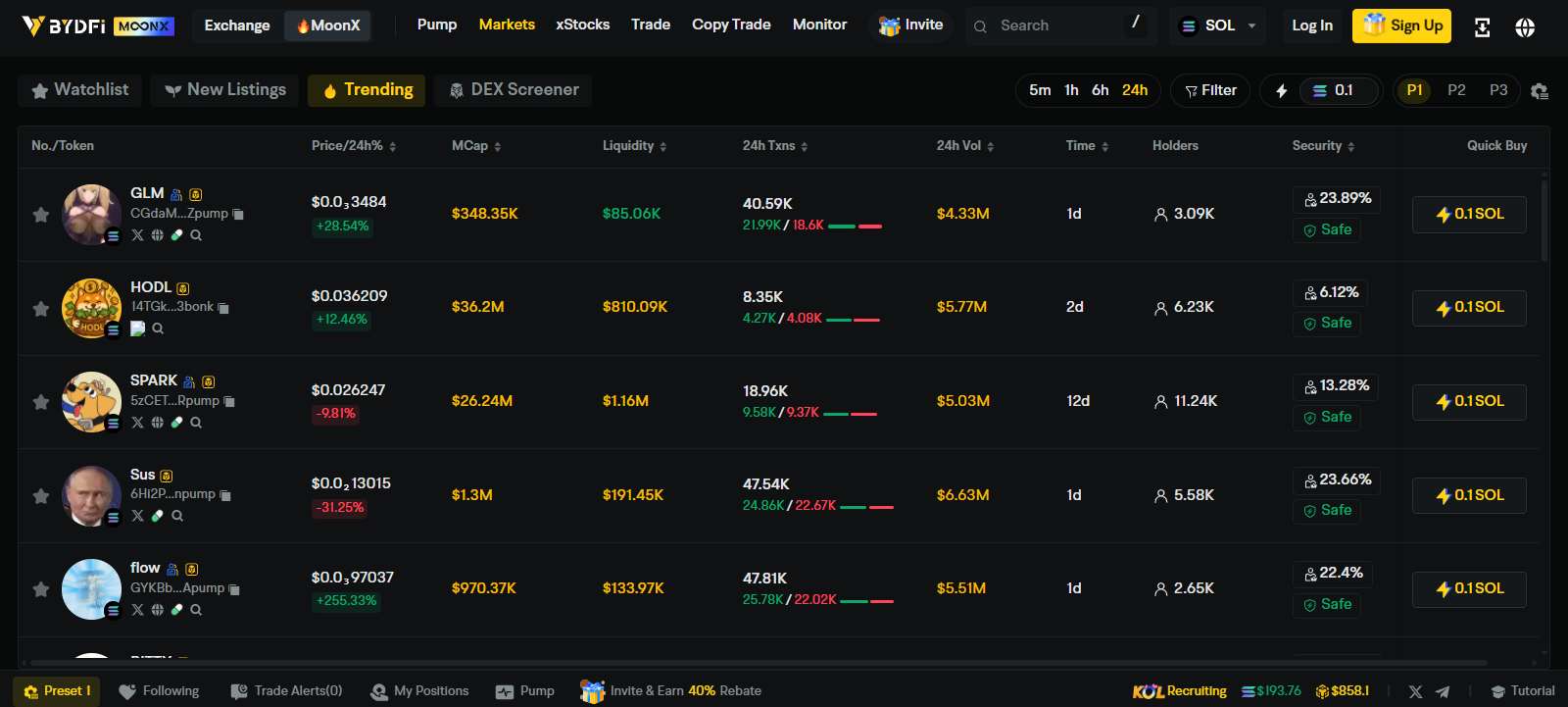

Trading Bots

For those interested in automation, BYDFi includes both spot and futures trading bots. Pre-designed options like grid, martingale, and futures grid bots are available for quick deployment, while custom bots can be created to suit individual strategies. These tools allow traders to run strategies around the clock without manually monitoring charts. While bots can help manage repetitive trades or market volatility, they require proper setup and risk management to avoid losses during sudden market swings.

BYDFi Card

The BYDFi Card extends the platform’s services into payments, supporting Apple Pay, Google Pay, and multi-currency transactions. It allows users to spend crypto more flexibly, with high spending limits and support for both online and offline purchases. A 3D Secure feature adds an extra layer of safety for authorizations. The card also highlights lower forex fees on USD transactions, which can make it a practical tool for those who want to use digital assets in everyday payments.

BYDFi Security

BYDFi places a strong emphasis on account and fund security. Users can enable two-factor authentication (2FA) with Google Authenticator, adding an extra layer of protection against unauthorized access. For asset safety, the platform uses layered deterministic cold wallets combined with multi-signature technology, reducing the risks of single points of failure or lost access. These measures are designed to keep digital assets secure while also giving users control, including the option to permanently delete their account if they choose to stop using the exchange.

In addition, BYDFi maintains a 1:1 Proof of Reserves, pledging 100% backing of all user assets. Current disclosures show reserve ratios of 157% for BTC, 171% for ETH, and 154% for USDT, supported by an 800 BTC Guardian Fund. Proof of Reserves is important as it confirms user funds are fully backed, builds transparency, and minimizes risks tied to liquidity shortfalls.

BYDFi Customer support

One of the most frustrating things for traders is dealing with subpar customer support at exchanges. We’ve all been there, waiting for days on end for those support tickets to be answered. But let me tell you about BYDFI, they’ve truly raised the bar when it comes to customer support. Their 24/7 live chat function is the quickest and easiest way to get in touch with them. No matter the time of day, the agent remains connected and is not only incredibly helpful but also shows a genuine desire to help. It’s refreshing to see such a high standard of customer support, and other exchanges should take note.

BYDFi Alternatives

BYDFi is great for traders who want high leverage and no KYC, but if it’s not quite what you’re looking for, here are some other great options:

- BTCC: BTCC is one of the oldest crypto exchanges out there, and it has a lot to offer, including spot and futures trading, margin trading, and a mobile app. It also offers high leverage and a no-KYC option. BTCC is known for its high leverage and diverse trading options, including forex and commodities.

- Bitget: Bitget is a popular exchange with a wide range of features, including spot and futures trading, margin trading, and even copy trading. It also has a mobile app and 24/7 customer support. Bitget is a good option if you’re looking for an exchange with a ton of features, including copy trading and a variety of trading bots.

- Bitunix: Bitunix is a newer exchange with a variety of features, including spot and futures trading, margin trading, and a mobile app. It also has a no-KYC option and is known for its user-friendly interface. Bitunix is a great choice if you want a no-KYC exchange with high leverage and an easy-to-use platform.

| Feature | BYDFi | BTCC | Bitget | Bitunix |

|---|---|---|---|---|

| Established | 2019 | 2011 | 2018 | 2022 |

| Spot Fees (Maker/Taker) | 0.01% / 0.10% | 0.20% / 0.30% | 0.10% / 0.10% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.020% / 0.060% | 0.020% / 0.045% | 0.020% / 0.060% | 0.020% / 0.060% |

| Max Leverage | 200x | 500x | 125x | 125x |

| KYC Required | No | No | Yes | No |

| Supported Cryptos (Spot) | 801+ | 400+ | 871+ | 541+ |

| Futures Contracts | 421+ | 314+ | 488+ | 400+ |

| No KYC Withdrawal Limit | 1 BTC | $10,000 | Not Allowed | $10,000 |

| 24h Futures Volume | $10.58B+ | $39.40B+ | $53.13B+ | $8.57B+ |

| Trading Bonus | $300 | $11,000 | $20,000 | $5,500 |

| Key Features | • No KYC required • High leverage (200x) |

• Highest leverage (500x) • No KYC required • Forex/commodity trading |

• Most cryptocurrencies (871+) • Multiple trading bots • Great for EU users |

• No KYC required • User-friendly • Multiple fiat options |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

BYDFi is truly a game-changer in the world of leveraged exchanges. They have successfully made complex trading instruments accessible and user-friendly for traders of all skill levels while complying with law makers and regulations in several countries, including the US. With a trading experience that boasts no slippage and liquidations, BYDFi ensures smooth and seamless transactions, allowing traders to focus on their strategies rather than worrying about technical hurdles. What sets BYDFi apart is its commitment to security. With licenses from four different regulators and advanced coin management protocols, traders can have peace of mind knowing their assets are well-protected. The exchange’s rigorous risk management policies further add to its reputation as a secure platform for trading.

FAQ

1. Is BYDFi safe?

BYDFi applies security features such as fund protection measures, wallet monitoring, and anti-phishing alerts. While these steps strengthen account safety, users should also enable personal protections like two-factor authentication.

2. Is BYDFi suitable for beginners?

The platform is relatively beginner-friendly, offering a simple interface and demo trading for practice. Features like copy trading may help newcomers learn, though they still carry risk depending on the traders followed.

3. What is the withdrawal limit at BYDFi?

Limits depend on verification status. Non-KYC accounts can withdraw up to 1 BTC daily, while completing KYC raises the limit to 1.5 BTC or higher depending on the level.

4. Does BYDFi require KYC?

No, users can trade without verification, though limits are lower. Higher KYC levels unlock larger withdrawal allowances and may be needed for compliance in certain regions.