- •Ostium lets users trade synthetic versions of real-world assets like gold, forex, and indices directly on-chain.

- •The platform offers 31+ markets with up to 200x leverage and low trading fees.

- •No KYC is required, allowing instant access through a Web3 wallet or email sign-up.

- •Liquidity vaults provide up to 15.24% APR for users supplying funds to support on-chain trading.

- •Built on Arbitrum, Ostium ensures faster transactions, lower costs, and transparent real-time pricing using Chainlink oracles.

- •Great choice for traders exploring RWA-based perpetual DEXs, though crypto asset options remain limited.

Interest in DeFi has been growing rapidly, with platforms like Hyperliquid and Aster competing for dominance and reaching record trading volumes. It’s clear that perpetual DEXes have become one of the biggest trends of 2025.

While many exchanges are experimenting in different directions, Ostium has gained attention for allowing users to trade synthetic versions of real-world assets such as gold, forex pairs, and global indices directly on-chain. The platform recently reached a daily trading volume high of 568 million dollars, showing the increasing interest in RWA-based perpetual trading.

Trusting a new platform is never easy, which is why we decided to explore Ostium ourselves. In this Ostium review, we share our findings on its features, trading experience, and safety measures to help you understand how the platform really works.

| Stats | Ostium |

|---|---|

| 🚀 Founded | 2024 |

| 🔎 Founder | Kaledora Fontana |

| 👤 Active Users | 13K+ |

| 🪙 Futures Contracts | 31+ |

| 🔁 Futures Fees (maker/taker) | 0.03% / 0.10% |

| 📈 Max Leverage | 200X |

| 🕵️ KYC Verification | Not Required |

Ostium Overview

Launched in October 2024 by Kaledora Fontana Kiernan-Linn and Marco Antonio Ribeiro, Ostium is a decentralized perpetual exchange built on Arbitrum, an Ethereum Layer-2 network known for speed and low fees. The platform gives traders on-chain exposure to real-world assets (RWAs) such as commodities, forex pairs, indices, and crypto without relying on centralized intermediaries.

Unlike tokenization projects that mint backed tokens, Ostium mirrors the price movements of real assets through perpetual contracts. It uses Chainlink Data Streams and Stork Network oracles to deliver accurate, near real-time pricing for both crypto and traditional markets.

As of now, DeFiLlama reports a TVL of around $56.6 million, with more than 13,000 users and a daily perpetual trading volume exceeding $180 million. The platform supports 31+ markets and offers up to 200x leverage. Traders pay a one-time fee when opening a position, while small ongoing fees adjust with market activity.

Ostium also features liquidity vaults and Strategies for its users. By bringing real-world markets fully on-chain, Ostium aims to push DeFi toward a more connected and inclusive financial future.

Ostium Pros and Cons

| 👍 Ostium Pros | 👎 Ostium Cons |

|---|---|

| ✅ Trade real-world assets (RWA) on-chain | ❌ Limited crypto assets available |

| ✅ Low fees and tight spreads | ❌ Only supports the Arbitrum network |

| ✅ Non-custodial, full fund control | ❌ No live chat support |

| ✅ No KYC requirements | |

| ✅ FIAT support |

Ostium KYC and Sign-up

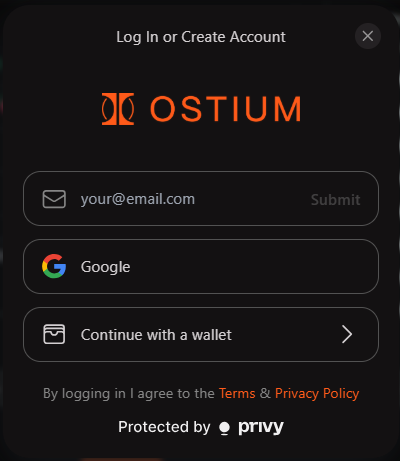

Ostium is a decentralized exchange, which means you can start trading without completing any KYC verification. Signing up is simple and takes only a moment. You can either connect a Web3 wallet like MetaMask or sign up using your email address. Here is how you can start trading RWA assets on Ostium.

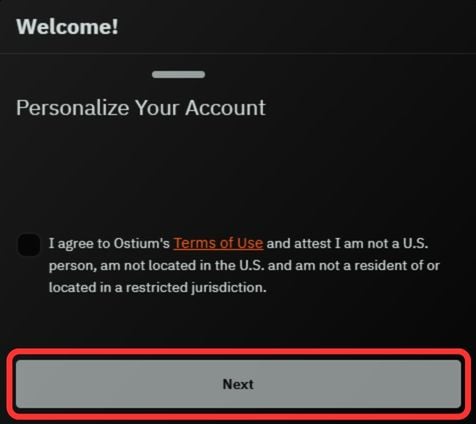

Step 1: Open your browser and visit the official Ostium website. Click on “Launch App” in the top-right corner.

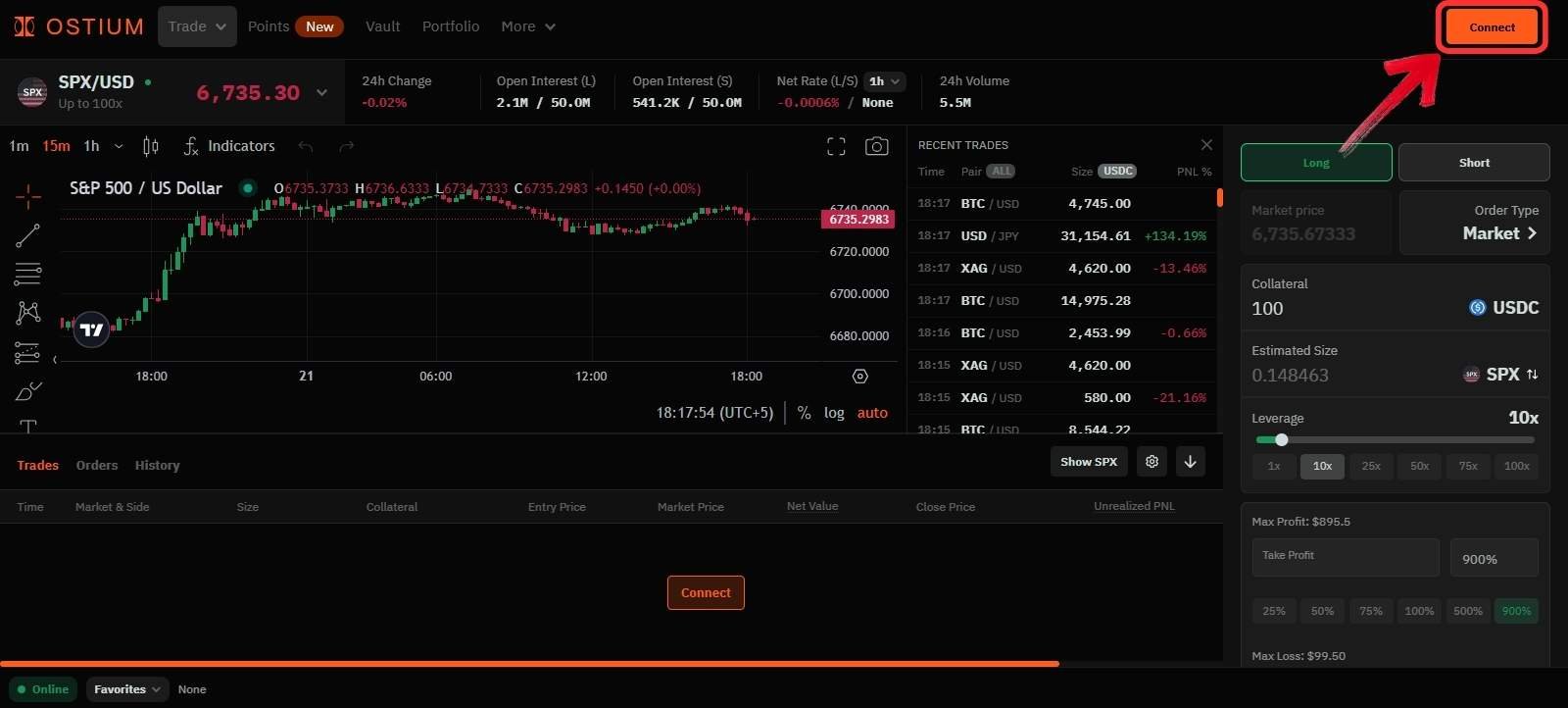

Step 2: Once you’re on the app, click “Connect” at the top-right.

Step 3: Choose how you want to continue, either connect a Web3 wallet or sign up using your email address.

Step 4: Approve the connection and signature request on your wallet to enable trading.

Step 5: Once connected, accept Ostium’s Terms and Conditions, then click “Next” to fund your wallet and start trading.

The Ostium trading platform is easy to use, but since it’s decentralized, always make sure your wallet is secure. If you’re new to Web3, you can learn how to secure and back up your MetaMask before getting started.

Ostium restricts access from certain jurisdictions under its own terms and conditions. You can use our Ostium Country Checker to review the list and ensure your access fully complies with Ostium’s usage rules.

🌍 Free Ostium Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, Ostium does not support every country. To ensure that you are eligible to register on the exchange, you can use our free Ostium country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

Ostium Trading

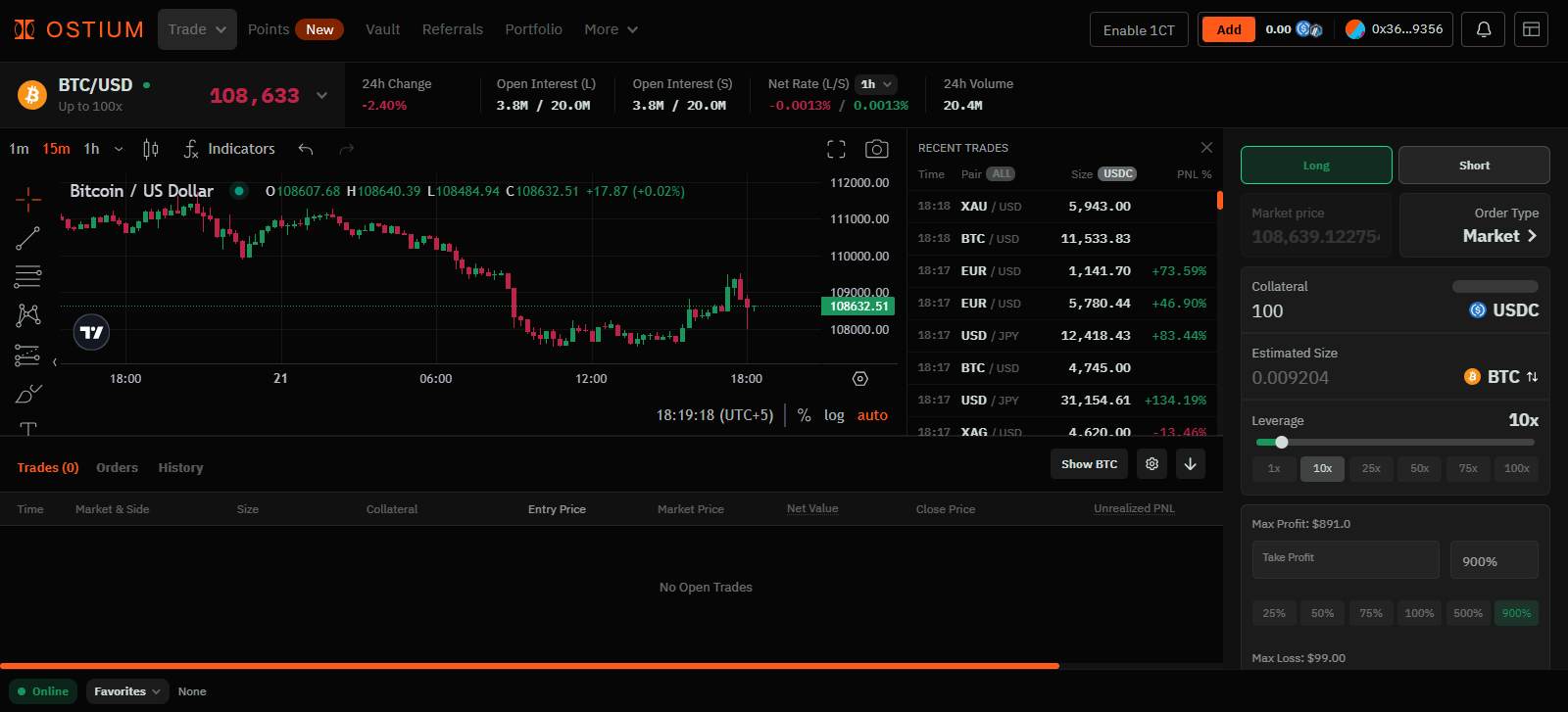

Ostium focuses entirely on perpetual trading, offering over 31 different assets that include a mix of crypto, forex, indices, commodities, and stocks. Traders can open leveraged positions of up to 200x, depending on the market. For crypto traders, Ostium currently supports only three major pairs; BTC, ETH, and SOL, each allowing up to 100x leverage.

The trading interface is simple and beginner-friendly. It loads quickly and gives you room to personalize your layout, such as adjusting colors or themes to suit your style. The integrated TradingView charts make analysis easier, offering access to key indicators, drawing tools, and multiple timeframes.

Order options on Ostium are quite limited, offering only Market, Limit, and Stop orders. There’s no order book, just a live feed where you can view recent trades as they happen.

Fees on Ostium follow a forex-style model rather than the usual maker-taker system. When you open a trade, a small opening fee is charged, which varies slightly depending on the asset type. Crypto pairs include additional costs like funding rates, while non-crypto markets such as forex or indices apply a rollover fee when positions stay open for longer. These ongoing fees adjust with market conditions and help balance long and short positions. Closing trades are generally free, so you only pay while your position remains active.

Ostium Deposit and Withdrawal Methods

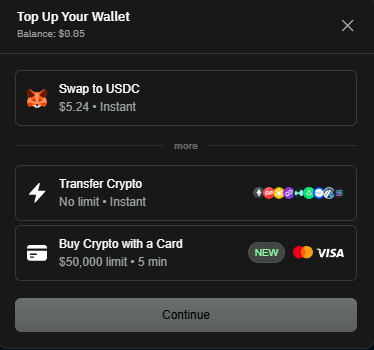

Ostium lets users fund their trading wallets using a Debit or Credit card, with a minimum deposit of $50. The platform doesn’t charge any extra fees on card deposits, and the process usually takes around five minutes to complete.

You can also add funds through the Arbitrum network, which is the only supported network on Ostium. On-chain deposits are typically instant, though timing can vary slightly with network congestion.

In addition, you can swap tokens already available in your Web3 wallet to USDC instantly for trading. The minimum swap amount is $5, making it quick and accessible for smaller deposits as well.

Ostium Fees

Let’s take a closer look at how Ostium charges users across its main features; trading, deposits, and withdrawals. The trading fee structure on Ostium works a bit differently from what most crypto traders are used to.

Trading Fees

Ostium uses a transparent, forex-style fee model instead of the usual maker–taker system on crypto exchanges. When you open a position, a small one-time fee is charged, usually expressed in basis points (bps), where 1 bps equals 0.01%.

For most traditional markets like forex, indices, and stocks, the opening fee is 0.04% (4 bps). For crypto pairs, the maker fee is 0.03% and the taker fee is 0.10%.

There are no closing fees, except for a small $0.10 oracle fee when closing manually, which is refunded once the trade successfully executes. Crypto trades can also include funding rates between long and short positions, while non-crypto markets apply rollover fees for holding trades overnight.

| Category | Opening Fee |

|---|---|

| Crypto Pairs | 0.03% / 0.10% |

| Forex | 0.03% – 0.05% |

| Indices | 0.05% |

| Stocks | 0.05% |

| Commodities | 0.03% – 0.20% |

Deposits and Withdrawals Fees

Ostium doesn’t charge any fees for deposits or withdrawals, keeping the process simple for users. If you fund your account using a Debit or Credit card, there are no charges from Ostium, though bank or card provider fees may apply and can vary by region.

When transferring funds directly through the Arbitrum network. The fee is usually just a few cents, typically under $0.10 depending on network congestion, but it can change slightly if you’re bridging assets from another network to Arbitrum.

For token swaps, a small swap fee applies based on the network and the Web3 wallet you’re using. Overall, the cost of deposits and withdrawals on Ostium remains very low compared to most platforms.

Ostium Products and Services

When we reviewed Ostium, its available services were quite limited. Let’s take a quick look.

Trading Experience

Trading on Ostium feels smooth and straightforward, even with its mix of crypto and real-world markets. The platform has over 13,000 traders and handles more than $180 million in daily volume, showing strong on-chain activity. You can set your slippage tolerance as low as 0.5%, keeping trades tight and efficient.

Fees and spreads are low, especially for crypto markets where spreads often stay around 0.002%. Traders can open long or short leveraged positions, while liquidity providers back the system through market-making vaults. Overall, Ostium offers a clean and reliable trading setup built around speed, low costs, and flexibility.

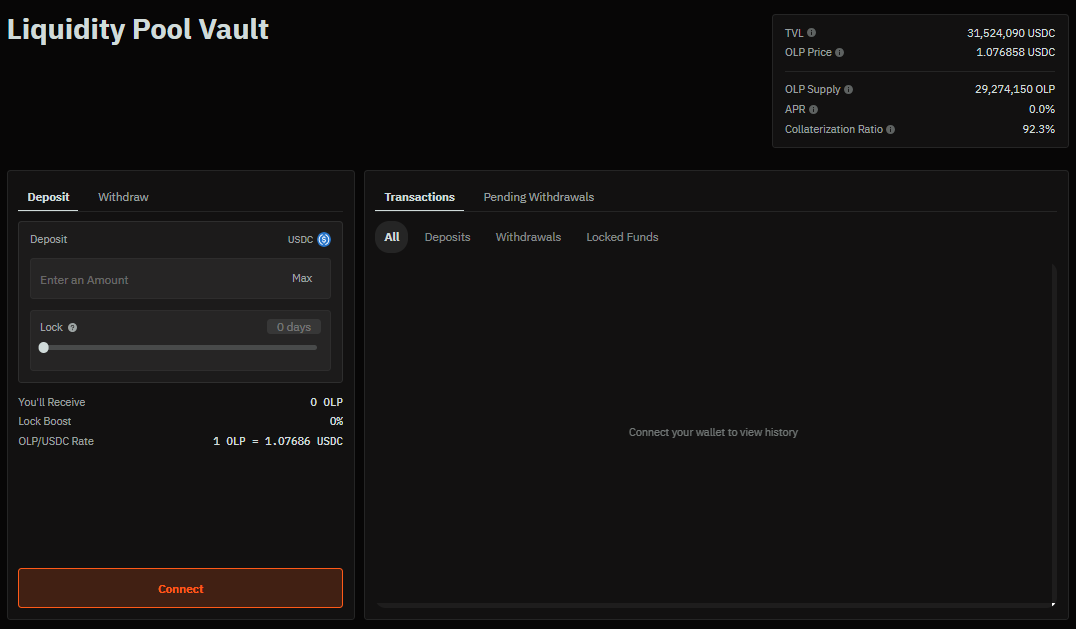

Vaults

On Ostium, you’ll find a dual vault system that keeps trading fair and stable. It includes a Liquidity Buffer and a Market Making Vault (MMV). The Liquidity Buffer acts as the first layer to settle trades, collecting fees and trader losses to cover profitable positions. If the buffer runs low, the MMV steps in, using liquidity provider funds to keep everything running smoothly.

As a liquidity provider, you can currently earn around 15.24% APR through the Market Making Vault, gaining a share of trading and liquidation fees in return for the risk you take on. This setup helps reduce fluctuations in returns and removes the usual “trader versus LP” conflict found on many perpetual DEXs.

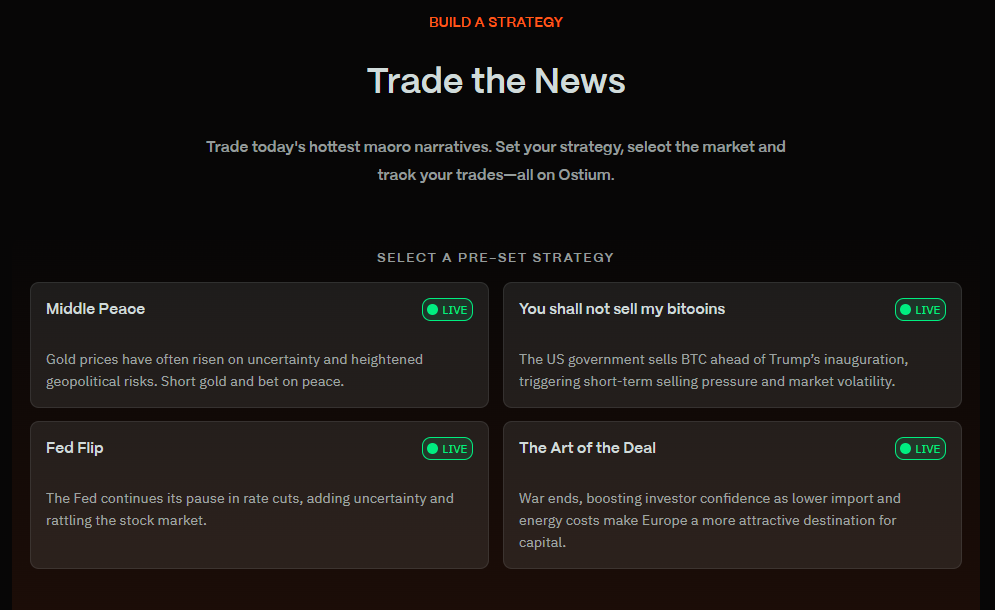

Strategies

With Ostium’s Strategies feature, you can trade based on real-world events or market trends. You can join live strategies linked to things like gold prices, rate changes, or political events, or build your own setup by selecting a market, leverage, and amount. It’s an easy way to turn global news into on-chain trading opportunities.

Ostium Security

Ostium takes security seriously, with independent smart contract audits, a bug bounty program, and integration with reliable oracle networks. The audits were done before and after launch to identify and fix potential risks. Chainlink powers real-time pricing, helping prevent manipulation and delays.

Ostium Customer Support

Ostium doesn’t offer live chat, but you can reach the team through active Telegram and Discord channels. These communities are responsive and provide direct access to Ostium’s support team for quick help and updates.

Ostium Alternatives

Ostium is a solid platform, but it does have a few limitations, such as support for only the Arbitrum network and a small selection of crypto assets. If you’re looking for similar platforms with broader options, here are a few good alternatives to explore:

1. Hyperliquid: Hyperliquid is a high-performance Layer 1 blockchain built specifically for DeFi. It offers deep liquidity, faster execution, and a larger range of crypto assets to trade, along with its own vault system.

2. Aster DEX: Aster DEX is a multi-chain, non-custodial Perp DEX that supports both spot and perpetual trading with leverage up to 1001x, giving traders more flexibility and access to multiple networks.

| Feature | Ostium | Hyeprliquid | Aster DEX |

|---|---|---|---|

| Cryptocurrencies | 3+ | 173+ | 93+ |

| Perp Trading Fees | 0.10% / 0.00% | 0.010% / 0.035% | 0.005% / 0.040% |

| Trading Volume | $180.42M+ | $8.04B+ | $10.82B+ |

| Max Leverage | 200x | 50x | 1001x |

| No. of Supported Chains | 1 | 1 | 4 |

| Key Feature | Variety of real-world and crypto markets | Layer-1 design with ultra-low slippage | Multi-chain trading with highest leverage |

| Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

Ostium brings something refreshing to DeFi by letting users trade real-world assets like gold, forex, and indices directly on-chain. Its low fees and clean interface make it appealing for traders who want exposure beyond typical crypto pairs.

That said, Ostium is still limited to Arbitrum and supports very few crypto assets, which might feel restrictive if you prefer multi-chain or broader market options. If that’s the case, you can explore more platforms in our Perpetual DEX trading platforms guide, where we review other leading alternatives for on-chain traders.

FAQs

1. Is Ostium a safe platform to trade on?

Yes, Ostium has undergone multiple smart contract audits and uses Chainlink oracles for real-time pricing, making trading more transparent and secure.

2. Does Ostium require KYC?

No, Ostium is a non-custodial platform, so you can trade without completing any KYC verification.

3. What assets can you trade on Ostium?

You can trade 31+ assets on Ostium, including crypto pairs, global indices, commodities, and forex markets with up to 200x leverage.

4. Is there a platform that offers forex, commodities, stocks, and crypto perp trading all in one?

Yes, Ostium is one of the few decentralized platforms that provides on-chain perpetual exposure to all these asset classes.

5. Which decentralized exchange offers real-world asset trading?

Ostium is among the first decentralized exchanges to bring real-world asset (RWA) trading fully on-chain through perpetual contracts.