- •dYdX is a decentralized perpetual exchange operating on its own Cosmos-based blockchain.

- •It offers strong liquidity on major perpetual markets with limited Solana-based spot trading.

- •Futures fees start at 0.01% maker and 0.05% taker, with volume-based discounts.

- •dYdX supports nearly 297 perpetual futures contracts with leverage and advanced order types.

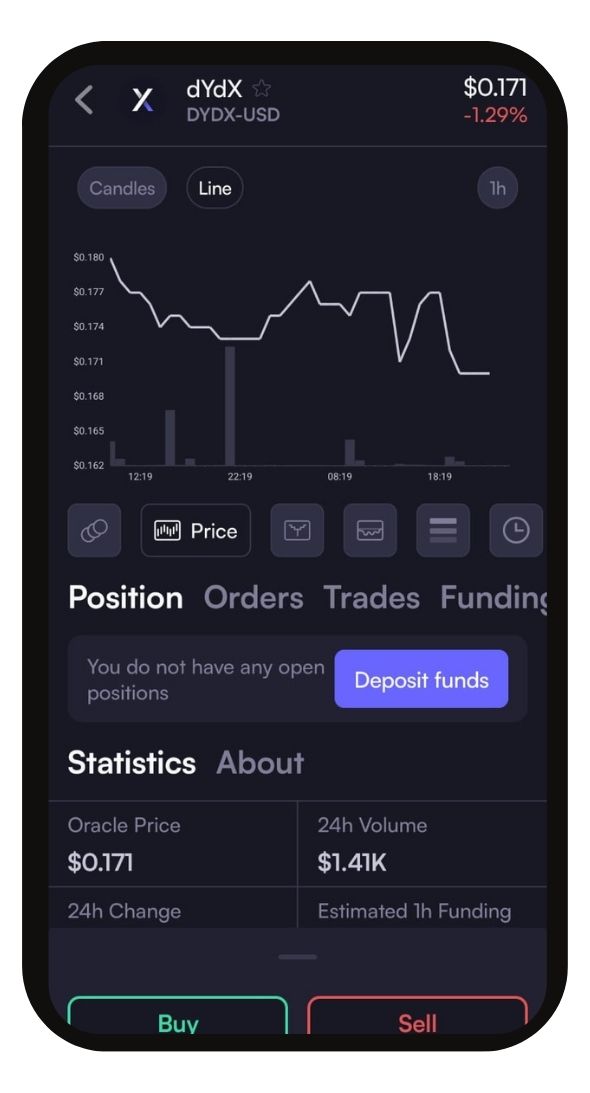

- •The mobile app supports trading, position management, and essential account functions.

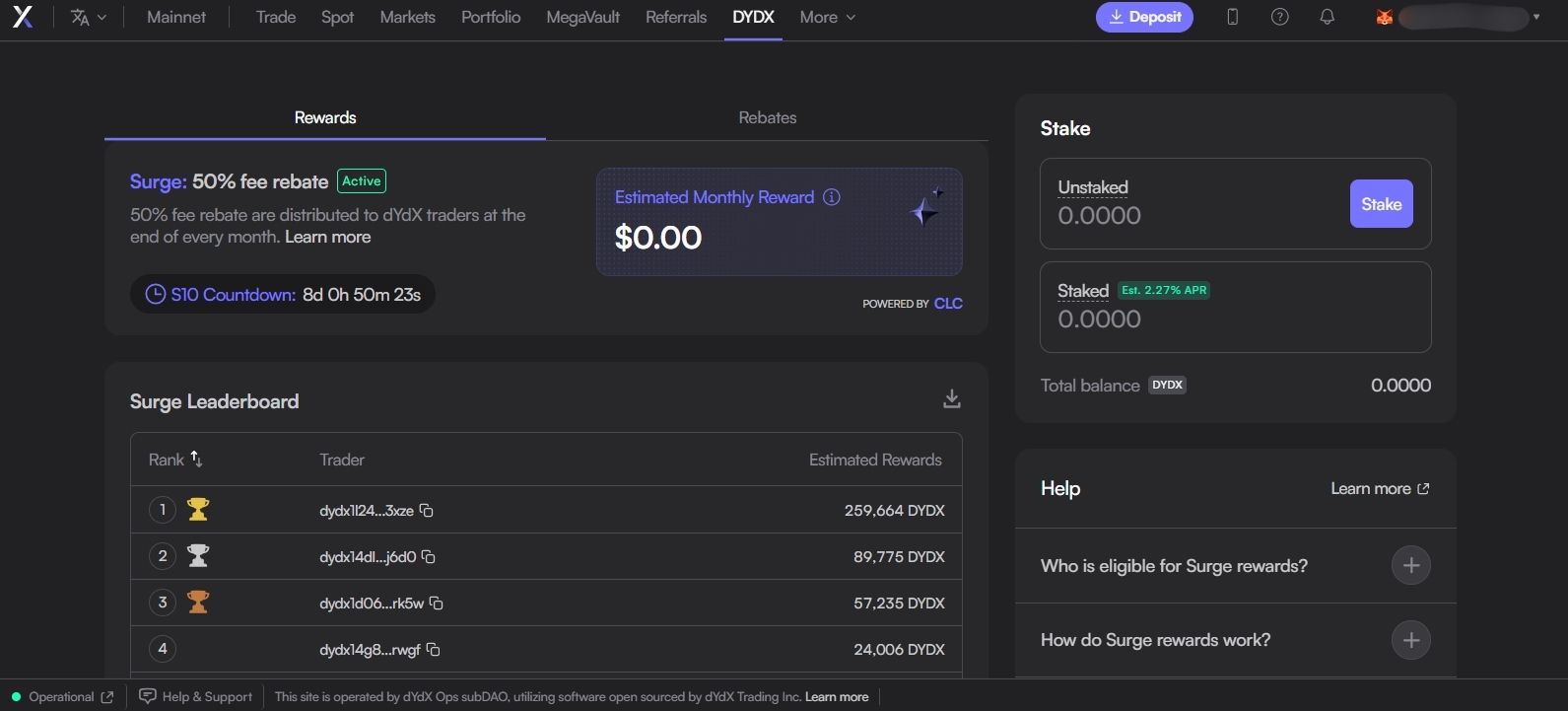

- •The dYdX token offers fee discounts, governance rights, and staking rewards paid in USDC.

Many traders view perpetual trading as a recent development, often associating its rise with platforms like Hyperliquid, where the niche gained mainstream attention. In reality, dYdX entered this space much earlier. Launched in 2017, dYdX was among the first decentralized platforms to offer margin trading and perpetual derivatives at scale. Over time, it built a reputation for advanced tools and a trader focused design. Today, with more than 9,000 active users, it remains relevant. In this dYdX review, we sift through its services, features, fees, and limitations to help you assess the exchange better.

| Stats | dYdX |

|---|---|

| 🚀 Founded | 2017 |

| 🌐 Headquarters | San Francisco, United States |

| 🔎 Founder | Antonio Juliano |

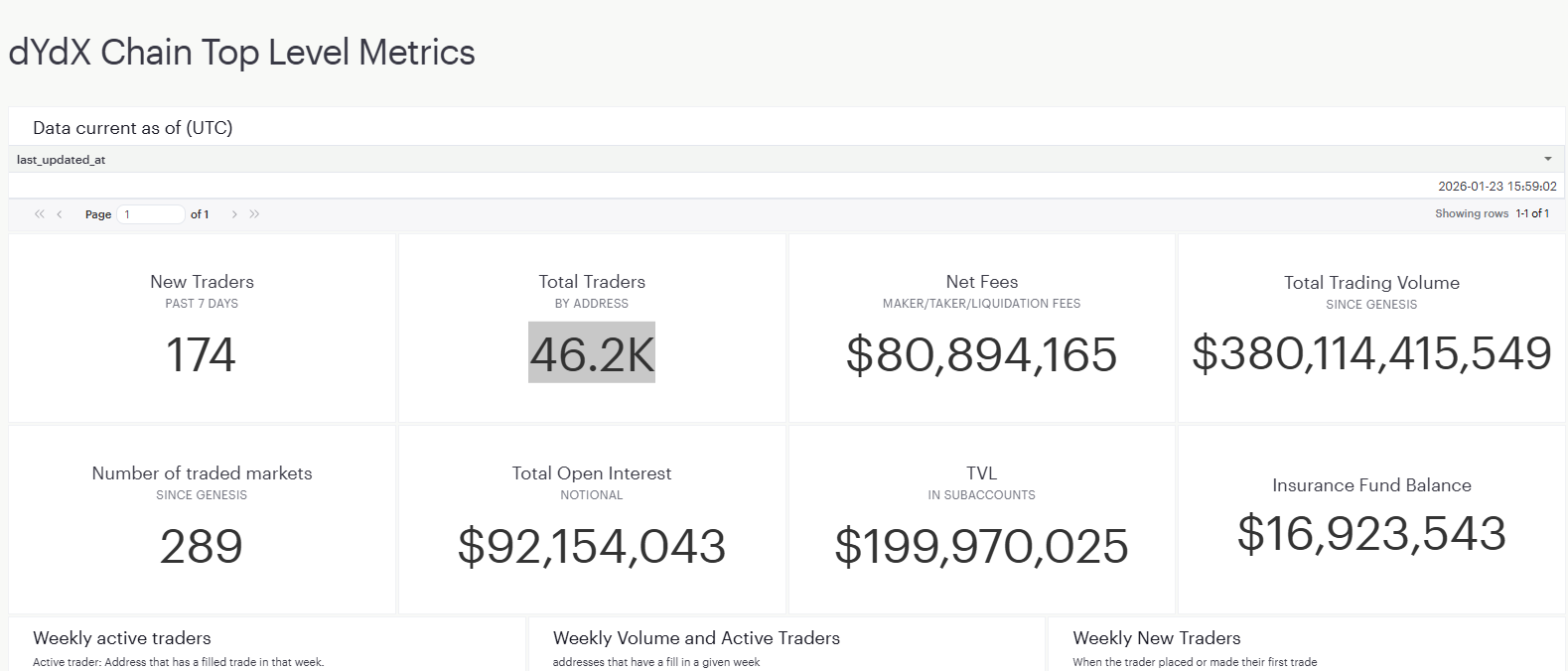

| 👤 Active Users | 46K+ |

| 🪙 Supported Coins | 200+ |

| ♾️ Supported Perps | 297+ |

| 🔁 Spot Fees (maker/taker) | 0.1% / 0.1% |

| 🔁 Futures Fees (maker/taker) | 0.01% / 0.05% |

| ⚙️ Network Supported | 7+ |

| 📈 Max Leverage | 50x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 3.3/5 |

| 💰 Bonus | $550 (Claim Now) |

dYdX Overview

Perpetual trading is built around transparency, self-custody, and scalability, and dYdX was designed with those principles from the start. Founded in 2017 by former Coinbase engineer Antonio Juliano, dYdX set out to provide decentralized access to advanced trading tools that were traditionally limited to centralized exchanges. Instead of custodial accounts, the platform allows users to connect self-custody wallets such as MetaMask or Phantom, with no mandatory KYC requirements, like every other Perp trading platform. dYdX operates on its own independent blockchain, the dYdX Chain, which is built using the Cosmos SDK and runs on a Tendermint Proof-of-Stake consensus mechanism to support high-throughput perpetual trading.

Today, dYdX operates as an independent decentralized chain and supports multiple networks through bridging, allowing users to transfer assets like USDC and ETH from Ethereum and other EVM-compatible ecosystems. This structure removes reliance on centralized intermediaries while keeping trading execution efficient.

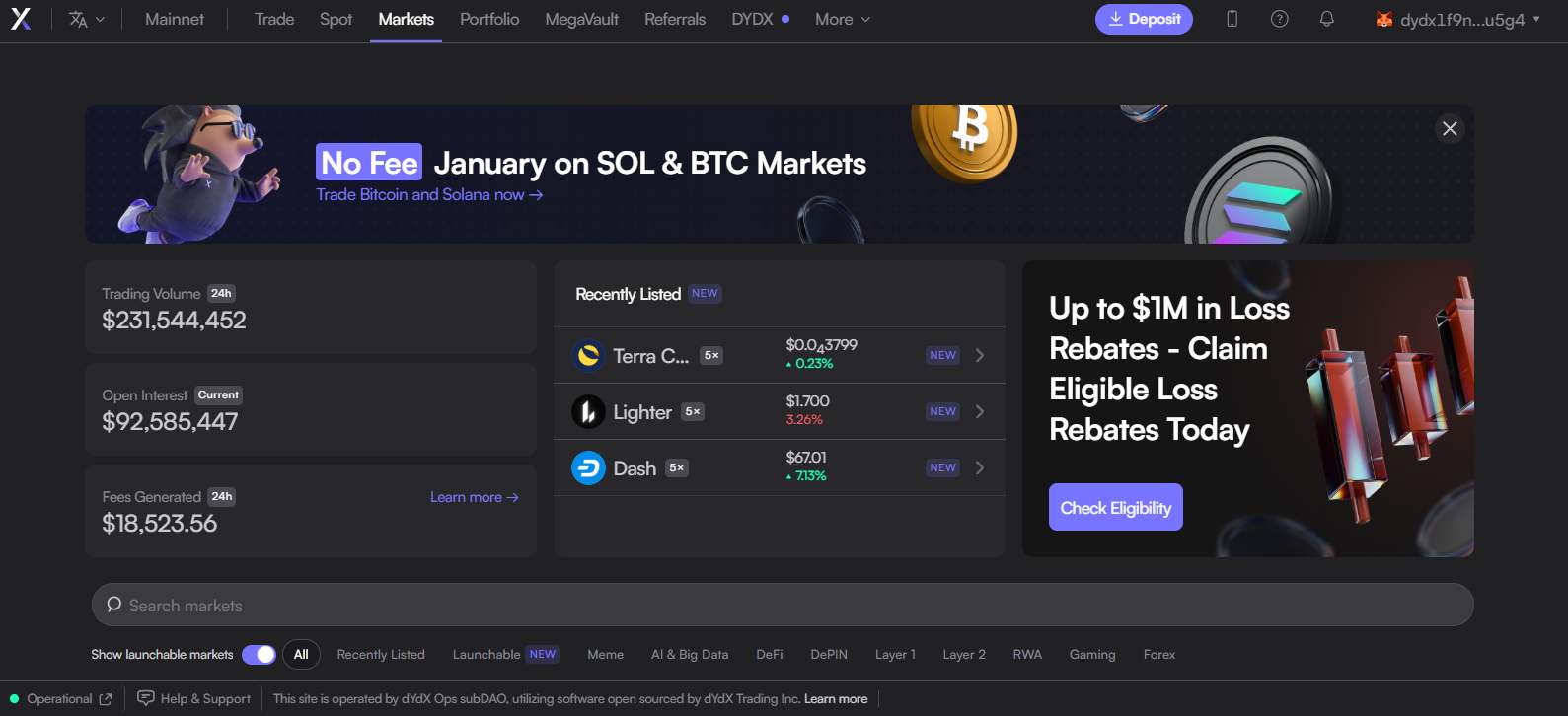

The platform reports more than 46K active traders and records daily trading volume exceeding $200 million. dYdX is also a major player in decentralized derivatives, with cumulative trading volume surpassing $1.55 trillion as of its 2025 annual report. It supports both spot and perpetual markets across more than six languages.

Spot traders can access over 200 crypto assets, largely paired with USDT, with maker and taker fees set at 0.10%. The derivatives section offers nearly 300 perpetual markets with leverage up to 100x, where futures trading fees are 0.01% for makers and 0.05% for takers.

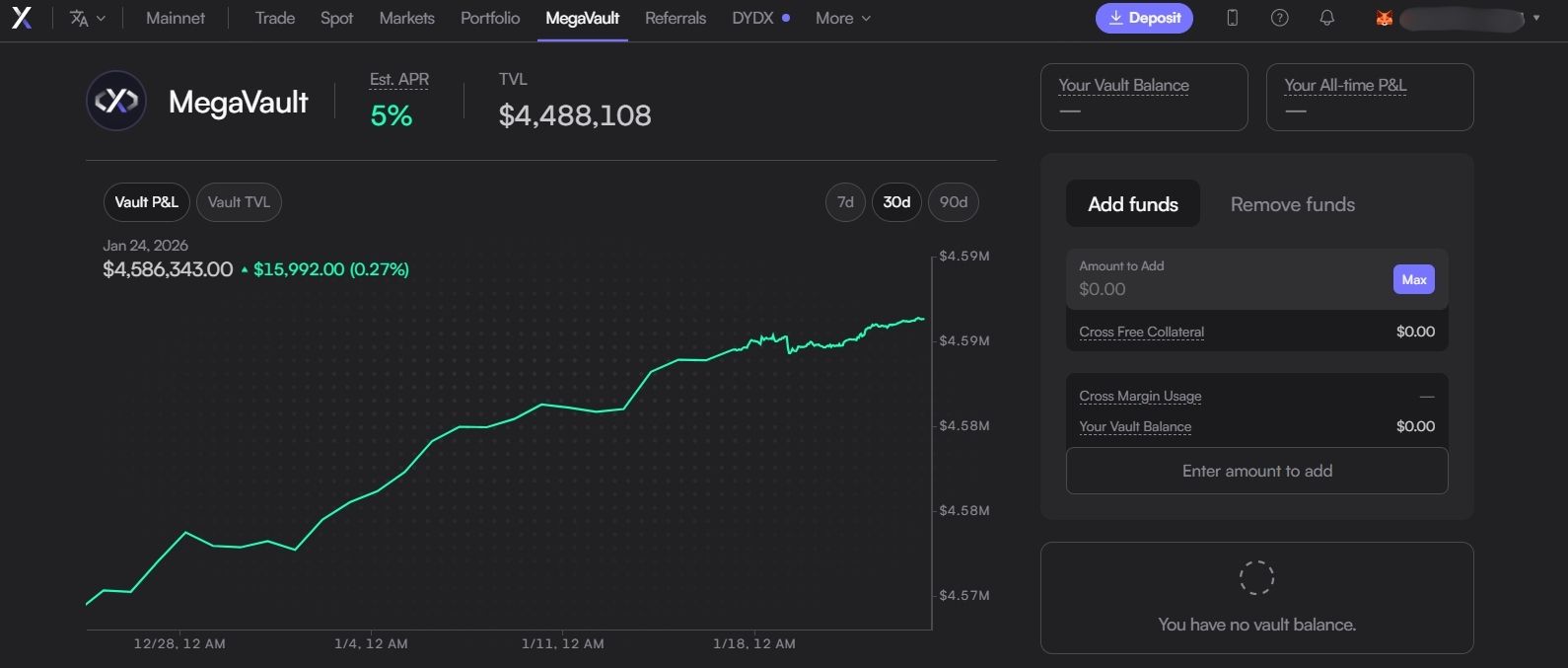

Beyond trading, dYdX provides additional features such as staking through its MegaVault, offering an estimated yield of up to 5% APR, depending on network conditions.

From a security standpoint, dYdX follows a rigorous audit process and has been reviewed by firms including OpenZeppelin, PeckShield, CertiK, and Certora. In 2023, the dYdX V3 protocol experienced a targeted price manipulation attack that resulted in approximately $9 million in losses at the protocol level. The incident was linked to a flaw in protocol logic rather than a wallet breach, and the team confirmed that user funds were not directly impacted. Since then, further safeguards and monitoring mechanisms have been implemented to reduce similar risks.

With the overview in place, the following sections examine dYdX’s features, risks, and usability in more detail.

dYdX Pros and Cons

| 👍 dYdX Pros | 👎 dYdX Cons |

|---|---|

| ✅ Fully decentralized, non-custodial trading platform | ❌ Leverage lower than some competitors |

| ✅ No mandatory KYC for trading | ❌ Unavailable in key markets like US, Canada |

| ✅ dYdX token offers trading fee discounts | ❌ No tokenized stocks or commodities trading |

| ✅ Beginner friendly interface for onchain trading | |

| ✅ MegaVault enables passive USDC participation | |

| ✅ Mobile trading supported with key trading functions | |

| ✅ Deep liquidity on major derivative markets | |

| ✅ Gasless on-chain execution on own blockchain |

dYdX KYC and Sign-up

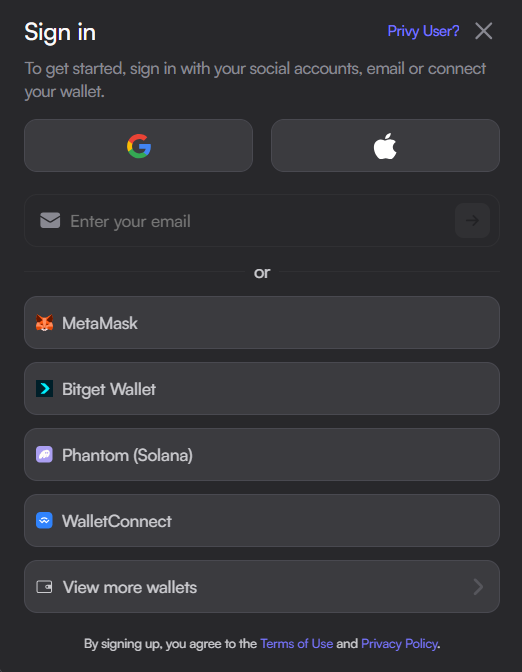

dYdX operates as a decentralized trading platform, meaning users can access its services by connecting a Web3 wallet without completing traditional KYC procedures. There are no account forms, identity checks, or withdrawal limits tied to verification levels. Getting started takes only a few steps.

Step 1: Visit the official dYdX website and click on the “Sign In” option.

Step 2: Select a supported wallet such as MetaMask or Phantom. Approve the connection request from the wallet popup.

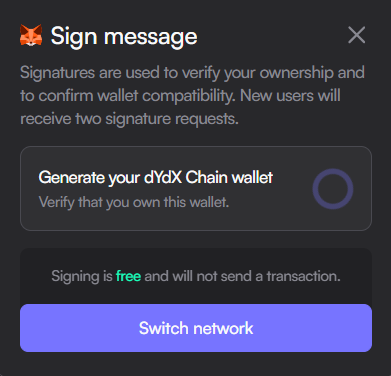

Step 3: After connecting, dYdX will prompt you to sign a message. This step confirms wallet ownership and does not involve any transaction or gas fee. Approve the request in your wallet.

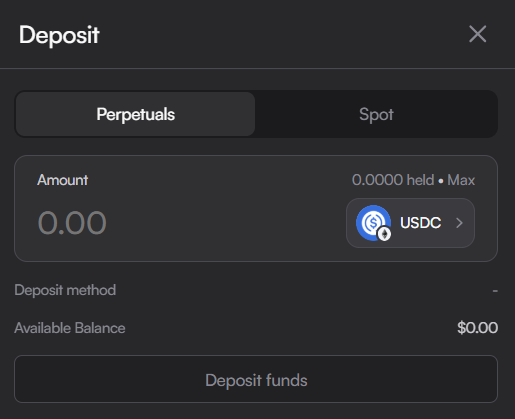

Step 4: Deposit funds to begin trading. dYdX supports deposits in ETH, USDC, and SOL, depending on the network used.

Once completed, your dYdX account is ready for trading, with full access to platform features and no custodial withdrawal restrictions commonly found on centralized exchanges. That said, while the platform remains technically accessible, certain regions may be restricted due to regulatory requirements. Users can check availability in their country using our dYdX country checker before trading.

🌍 Free dYdX Country Checker

We strive to keep this information up to date, but regulations may change. Always verify eligibility before using the platform.

Due to regulations, dYdX does not support every country. To ensure that you are eligible to use the platform,

use our free dYdX country checker.

Type your country and see if you can use the platform or if your country is restricted.

Networks Supported

Currently, dYdX supports seven networks. One of these is the Solana network, which allows users to transfer USDC directly. The remaining six networks include Ethereum, Polygon, Arbitrum, Base, Avalanche, and Optimism. These networks can be used to transfer USDC, while Ethereum also supports ETH deposits to a dYdX account.

dYdX Trading

The dYdX trading interface is designed to be accessible without feeling oversimplified. The layout is clean and beginner friendly, with core trading components such as charts, the order book, position details, and trading tools placed in clearly defined sections of the screen. Navigation feels intuitive, allowing users to focus on execution rather than interface complexity. Charts are powered by TradingView, giving traders access to a full range of indicators and charting tools for technical analysis.

Looking at market depth, liquidity is strong on major pairs such as BTC-USD, where spreads are typically tight and execution is smooth. On newer or less active markets, spreads can widen, which may lead to higher slippage during fast market movements or large order sizes.

Spot Trading

Spot trading on dYdX is currently centered around Solana-based assets, which positions the platform closer to a Solana-native DEX model rather than a multi-chain spot exchange. Traders can access more than 200+ Solana tokens, all paired exclusively with USDC. This structure keeps pricing simple while maintaining fast settlement through the Solana network.

The interface supports preset order values such as $5 or $100, allowing users to place trades quickly without manual sizing. Spot trading on dYdX is limited to limit orders, with positions placed using either USDC or SOL amounts. Since many listed assets are early-stage Solana tokens, the platform also displays additional token data such as holder distribution, developer allocation, and basic project metrics to support more informed trading decisions.

Derivatives Trading

The derivatives section gives access to nearly 297+ perpetual futures markets, with leverage available up to 50x depending on the asset. Traders can choose between cross margin and isolated margin, offering flexibility in how risk is managed across positions.

Order functionality extends beyond basic limit orders. Users can place market orders as well as conditional orders such as stop limit and stop market. Execution controls like Good Till Cancelled and Immediate Or Cancel are also available, providing greater precision for active and high-frequency trading strategies.

Deposit and Withdrawal Methods

Deposits and withdrawals on dYdX are handled exclusively through crypto networks, which is standard for decentralized exchanges. There are no fiat on-ramps or bank transfers supported directly on the platform. For deposits, users can choose from seven supported networks to transfer ETH or USDC. These assets are commonly purchased on centralized exchanges such as Coinbase and then transferred to dYdX using the selected network.

Withdrawal options are slightly broader. dYdX supports more than ten networks for withdrawals, including Osmosis, Neutron, and Noble, giving users added flexibility when moving funds out of the platform. Network availability and fees depend on the selected chain at the time of transfer.

dYdX Fees

Every exchange structures its fees differently, and understanding how dYdX applies trading and network costs helps set clear expectations before placing any orders.

Trading Fees

dYdX applies a straightforward fee structure that differs between spot and derivatives markets. Spot trading uses a fixed fee model, with both maker and taker orders charged at 0.10%. For perpetual futures, the base fees start at 0.01% for makers and 0.05% for takers. These rates can be reduced further based on a trader’s 30 day futures trading volume. Additional fee reductions are also available for dYdX token holders. On major trading pairs such as BTC-USD and SOL-USD, futures trading fees are waived.

Spot Fees

0.10% Maker

0.10% Taker

Future Fees

0.01% Maker

0.05% Taker

Deposits and Withdrawals Fees

Deposit and withdrawal fees on dYdX vary by method and network rather than a flat platform charge. Skip Go Fast deposits cost 0.10% of the transfer amount plus gas, around $2.5 on Ethereum and $0.01 to $0.10 on L2 networks, with no fees for fast deposits above $100 on Ethereum and $20 on L2s. Skip Go (regular) deposits cost around $0.02, while withdrawals range from $0.10 to $7 plus gas fees. Coinbase via Noble charges standard Coinbase withdrawal fees plus $0.10 to $0.20 in IBC fees, and direct IBC transfers typically cost $0.10 to $0.50.

dYdX Products and Services

dYdX offers a range of tools designed to support active trading, governance participation, and capital efficiency.

dYdX Trading

The dYdX trading platform is built for perpetual-focused trading with an emphasis on speed, transparency, and non-custodial execution. Traders can access deep liquidity on major markets, advanced order types, and flexible margin options through a single interface. The platform supports both cross and isolated margin, making it suitable for different risk management strategies.

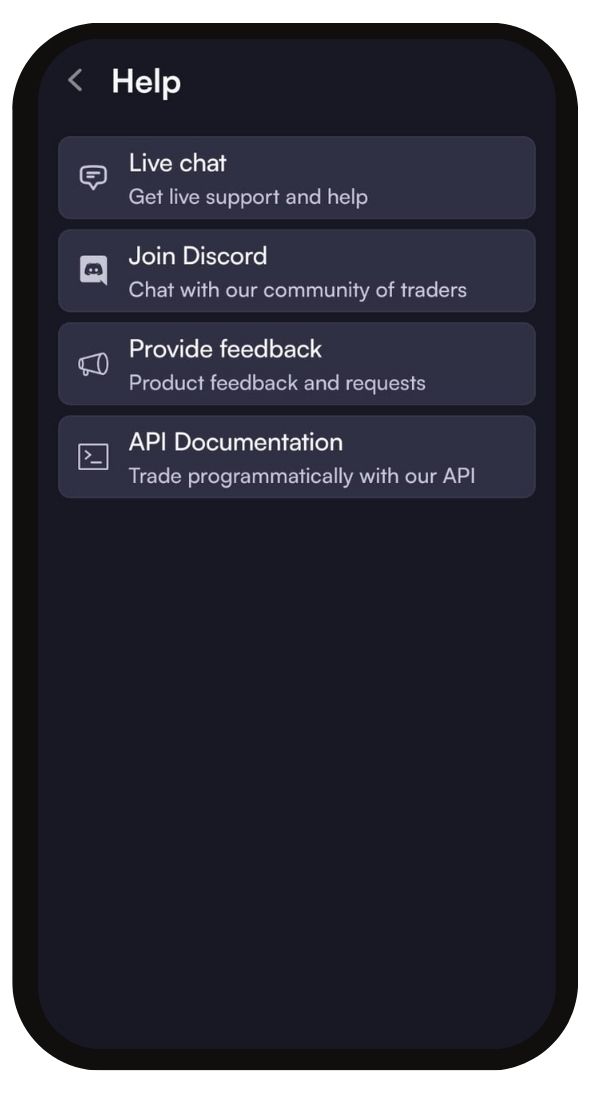

Mobile App

dYdX provides a mobile application for users who prefer to manage trades on the go. The app supports core trading functions including opening and closing positions, monitoring funding rates, managing margin, and tracking account balances. While the mobile interface is more streamlined than the web version, it retains essential tools needed for active trading. Wallet connections and security features remain consistent with the desktop experience.

dYdX Token

The dYdX token plays a central role in the ecosystem, primarily used for governance and protocol participation. Token holders can vote on network parameters, upgrades, and incentive programs. In addition, holding dYdX tokens can provide trading fee discounts and access to ecosystem incentives, aligning long-term users with the platform’s decentralized governance model.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

MegaVault

MegaVault allows users to deposit USDC into a shared liquidity pool that provides automated liquidity across dYdX spot and perpetual markets. Depositors gain proportional exposure to trading fees and strategy performance, without managing positions manually. Returns are variable and depend on market conditions, vault allocation, and overall trading activity, with no guaranteed yield.

dYdX Staking

dYdX staking lets users delegate DYDX tokens to validators on the dYdX Chain to help secure the network. In return, stakers earn a share of real protocol revenue, paid in USDC, rather than inflationary token rewards. Rewards fluctuate with trading volume, and unstaking requires a fixed unbonding period.

dYdX Security

Security on dYdX is built around a non-custodial model, where users retain full control of their funds through self-custody wallets. The platform operates in a fully decentralized manner on the dYdX Chain, meaning core trading activity, protocol parameters, and network performance are recorded on-chain and remain publicly verifiable. Users can view network statistics, validator data, and protocol activity at any time through on-chain explorers.

The protocol has undergone multiple third-party security audits by firms such as OpenZeppelin, PeckShield, CertiK, and Certora, covering smart contracts, protocol logic, and risk parameters. On the mobile app, dYdX also supports biometric authentication, adding an extra layer of access control for users.

In 2023, dYdX V3 experienced a targeted price manipulation attack that resulted in approximately $9 million in protocol-level losses. The incident did not involve wallet breaches, and the team confirmed that user funds were not directly affected. Since then, additional safeguards and monitoring measures have been implemented to strengthen risk controls.

dYdX Customer Support

dYdX primarily relies on its Help Center for user support, which covers everything from basic setup to advanced trading features. The articles and guides are detailed and regularly updated. For direct assistance, users are guided to the platform’s Discord through in-app support, where tickets can be raised and real-time help is available, including for issues like outages or account related concerns.

dYdX Alternatives

While dYdX helped shape decentralized perpetual trading, newer platforms may offer different advantages depending on trading needs. Some traders prefer exchanges that combine perpetuals with deeper spot markets, faster execution, or exposure beyond crypto, such as tokenized stocks or commodities. Exploring alternatives can help users find platforms better aligned with their strategy, asset preferences, or risk approach.

1. Hyperliquid: Hyperliquid is a high-performance perpetual DEX focused on speed, deep liquidity, and a centralized-style trading experience.

2. Ostium: Ostium is a derivatives-focused platform offering onchain exposure to real-world assets alongside crypto perpetual markets.

| Feature | dYdX | Hyperliquid | Ostium |

|---|---|---|---|

| Established | 2017 | 2024 | 2024 |

| Spot Fees (Maker/Taker) | 0.10% / 0.10% | 0.04% / 0.07% | N/A |

| Futures Fees (Maker/Taker) | 0.01% / 0.05% | 0.015% / 0.045% | 0.10% / 0.00% |

| Max Leverage | 50x | 50x | 200x |

| KYC Required | No | No | No |

| Supported Cryptos (Spot) | 200+ | 238+ | N/A |

| Futures Contracts | 297+ | 173+ | 117+ |

| No KYC Withdrawal Limit | Unlimited | Unlimited | Unlimited |

| 24h Futures Volume | $206.72M+ | $6.23B+ | $297.71M+ |

| Key Features | • Cosmos-based dYdX Chain • Solana based DEX • Governance + staking |

• Custom Layer-1 • Zero gas trading • Vaults + HYPE staking |

• Real-world asset exposure • Crypto perpetuals • High leverage markets |

| Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

dYdX may appeal to traders who value decentralized perpetual trading, self-custody, and a platform built around professional trading tools. Its long track record, community-driven governance, and relatively beginner-friendly trading interface make it suitable for users transitioning from centralized exchanges to onchain derivatives.

At the same time, dYdX may feel limiting for traders looking for broad spot market access, fiat on-ramps, or exposure beyond crypto derivatives. Newer perpetual DEXs may offer faster execution, additional asset classes, or more flexible trading experiences. For readers comparing options, the next step is to explore our detailed guide on top perpetual DEXs, which breaks down alternatives based on features, fees, and supported markets.

FAQs

1. Is dYdX a centralized or decentralized exchange?

dYdX is a decentralized exchange that operates on its own blockchain. Users trade directly from self-custody wallets without relying on custodial accounts.

2. Can I use dYdX on mobile?

Yes. dYdX offers a mobile app on Android and iOS that supports trading, position management, and account monitoring.

3. Is dYdX safe to use?

dYdX follows a non-custodial model and has undergone multiple third-party audits. While a protocol-level incident occurred in 2023, user funds were not directly affected.

4. What is MegaVault on dYdX?

MegaVault allows users to deposit USDC to provide automated liquidity across dYdX markets and earn variable returns based on trading activity.

5. What leverage is available on dYdX perpetuals?

Leverage on perpetual futures can go up to 50x, depending on the asset and market conditions.