- •Spot and futures trading with full order type support (Market, Limit, Stop-Limit, Stop-Market, AL, FOK, IOC).

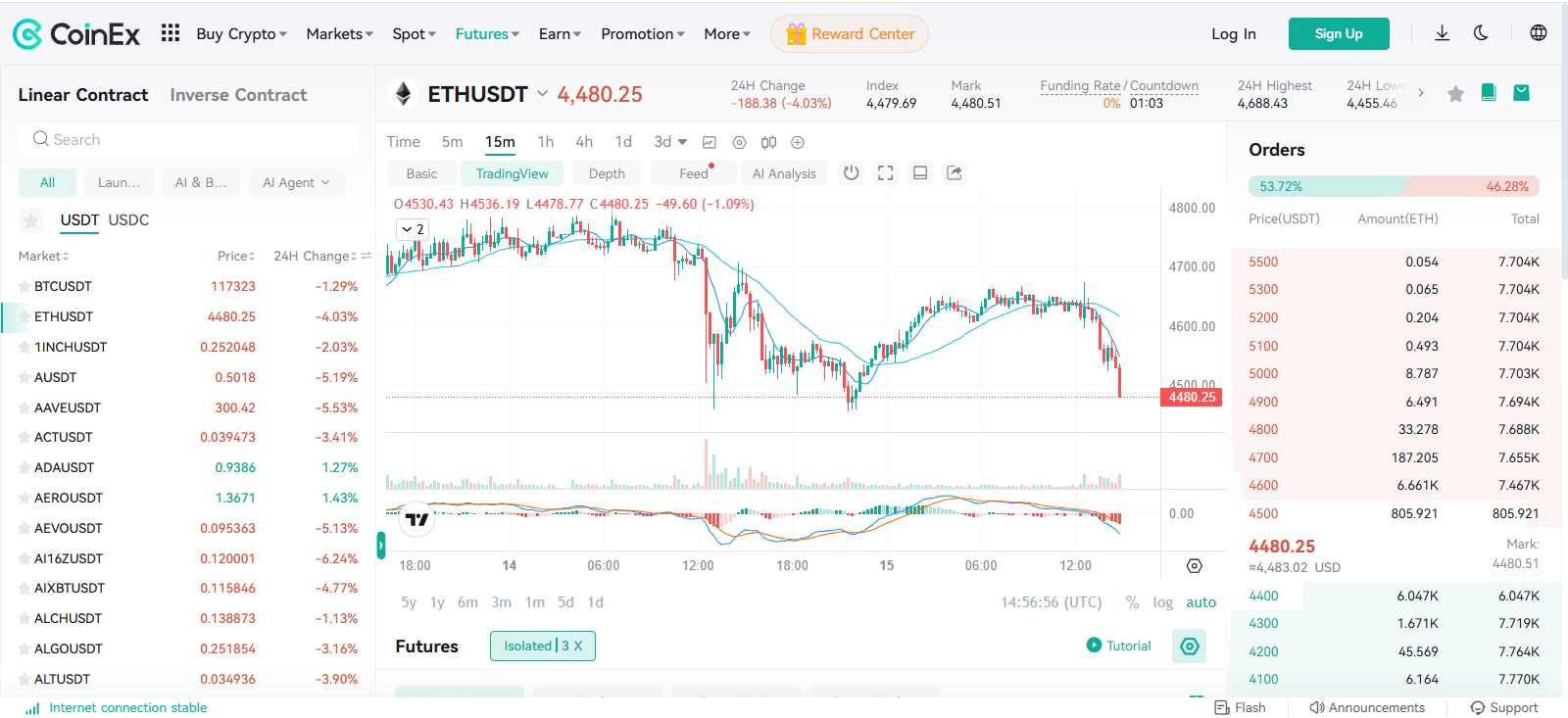

- •Integrated TradingView charts with technical indicators and drawing tools.

- •Access to staking, P2P marketplace, and copy trading.

- •In-app deposits and withdrawals for crypto and supported fiat channels.

- •Portfolio tracking with real-time PnL and balance updates.

- •Price alerts, order execution notifications, and customizable watchlists.

- •Security options including Google Authenticator 2FA, SMS verification, and withdrawal address whitelisting.

- •Multi-language support to cater to global users.

Joining a crypto exchange without proper research can often lead to disappointment, as each platform tailors its features to a specific audience. Some focus on advanced tools for futures traders, while others prioritize strict compliance with regional regulations to create a safer environment for beginners or long-term holders. CoinEx positions itself as a versatile option, offering a broad range of services to cater to different trading needs. This CoinEx review outlines its features to help you make a well-informed choice.

| Stats | CoinEx |

|---|---|

| 🚀 Founded | 2017 |

| 🌐 Headquarters | Hong Kong |

| 🔎 Founder | Haipo Yang |

| 👤 Active Users | 3M+ |

| 🪙 Supported Cryptos | 1281+ |

| 🪙 Futures Contracts | 224+ |

| 🔁 Spot Fees (maker/taker) | 0.20% / 0.20% |

| 🔁 Futures Fees (maker/taker) | 0.03% / 0.05% |

| 📈 Max Leverage | 100x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.3/5 |

| 💰 Bonus | $100 (Claim Now) |

CoinEx Quick Overview

CoinEx, founded in 2017 by Haipo Yang and headquartered in Hong Kong, positions itself as a globally accessible, altcoin-focused exchange with an emphasis on flexibility and reach. It offers a wide selection of over 1,280 spot cryptocurrencies and 224+ futures contracts, with leverage up to 100x for futures and 10x margin on spot. The platform maintains a no-KYC policy for daily withdrawals up to $10,000, while supporting multiple fiat deposit methods through third-party providers.

Beyond spot and futures markets, CoinEx provides grid and DCA bot trading, staking services, an affiliate program, and CoinEx Feed for real-time market updates. Futures fees are competitive, whereas spot fees are slightly above the industry norm. The exchange does not support fiat withdrawals and is restricted in certain jurisdictions, including the US, Canada, and parts of China.

With its broad asset coverage and varied trading tools, CoinEx’s position in the market is aimed at serving different trader profiles, ranging from those seeking altcoin variety to users exploring automated strategies, while focusing on regions where operational access remains open.

CoinEx Signup and KYC

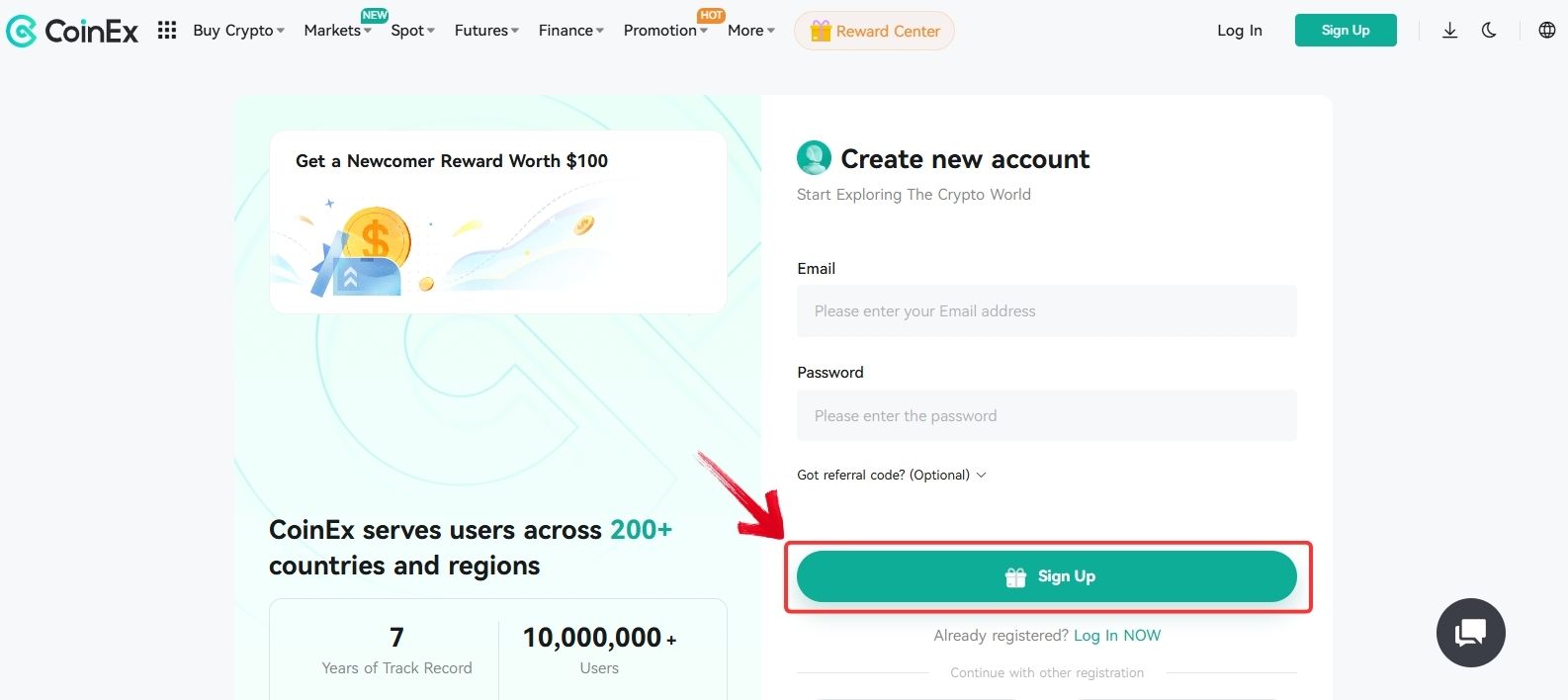

CoinEx is a no-KYC exchange, meaning you can start trading without providing personal information, just by using your email address. The daily withdrawal limit is currently set at $10,000. To increase this limit, you can complete the KYC verification process, which requires providing details such as a national ID and a live selfie.

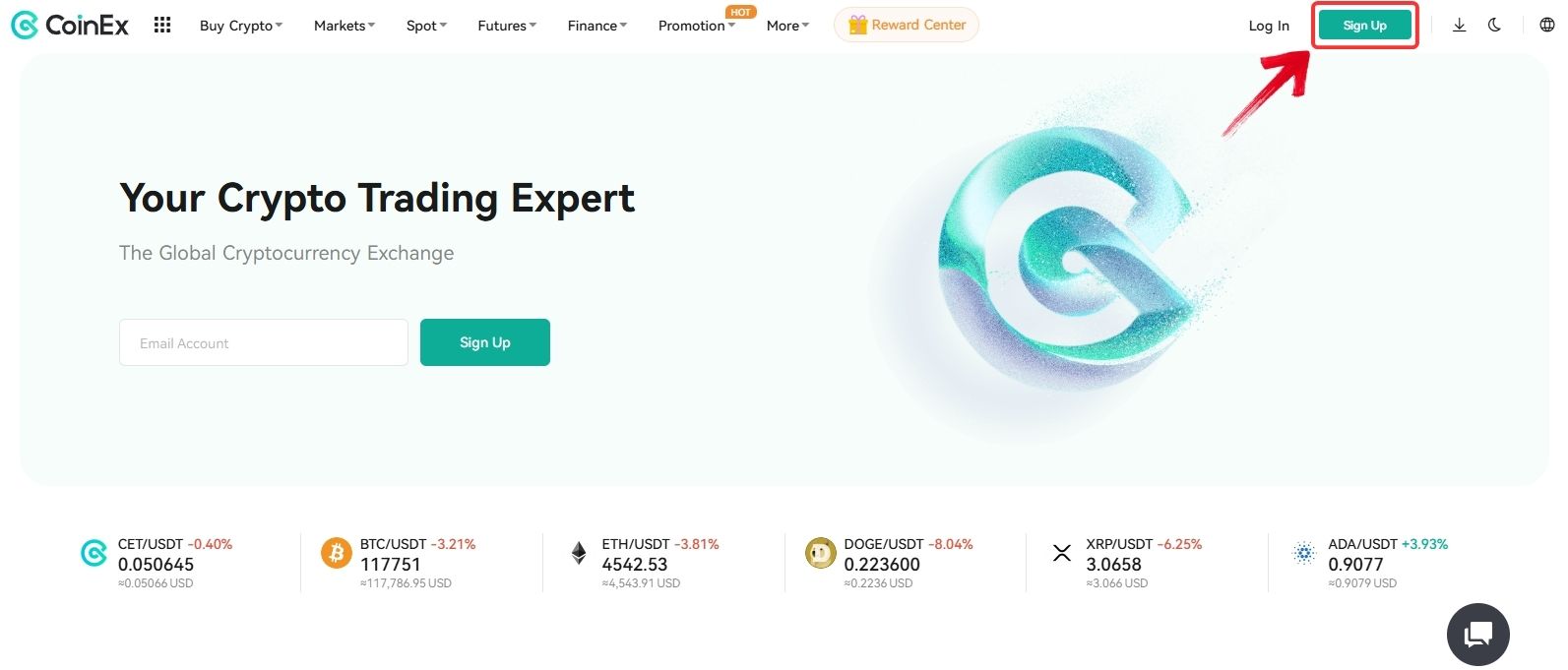

Here is how you can sign up for free on CoinEx:

Step 1: Go to CoinEx on your browser and click the “Sign Up” button located at the top right corner.

Step 2: On the Sign Up page, enter your email address, set a password for your CoinEx account, and then click the “Sign Up” button.

Step 3: You will receive a code in your email. Enter the code to verify your email address and start trading on CoinEx.

Being a non-KYC exchange does not guarantee accessibility, as geolocation restrictions may prevent you from using CoinEx in your region. To save time, check whether CoinEx is available in your country using CryptoWinRate’s CoinEx Country Checker. You can also explore the best alternatives to CoinEx if it is unavailable in your region.

🌍 Free CoinEx Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, CoinEx does not support every country. To ensure that you are eligible to register on the exchange, you can use our free CoinEx country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

CoinEx Pros and Cons

| 👍 CoinEx Pros | 👎 CoinEx Cons |

|---|---|

| ✅ Strong security controls, including 2FA and address whitelisting | ❌ Limited fiat deposit options |

| ✅ 1281+ trading pairs | ❌ P2P market liquidity is lower |

| ✅ High spot volume | ❌ No FIAT withdrawals |

| ✅ 100x leverage | |

Trading on CoinEx

CoinEx offers a full trading interface that supports both spot and futures markets. Whether you prefer straightforward spot trades or leveraged futures positions, the platform includes the necessary tools and order types to execute them.

Spot Trading

CoinEx’s spot market supports over 1,281+ cryptocurrencies with a daily trading volume exceeding $428 million. Spot trading fees is set at 0.20% for both makers and takers, offering competitive rates. The interface is straightforward and user-friendly, with integrated TradingView charts that provide a range of indicators and tools for planning entries and exits.

Available order types include Market, Limit, Stop-Limit, and Stop-Market, along with advanced options such as Always Valid (AL), Fill or Kill (FOK), and Immediate or Cancel (IOC). Traders can also disable maker orders to consistently benefit from the lower taker fee rate.

Futures Trading

The futures market on CoinEx lists over 224+ cryptocurrencies for trading futures contracts, along with two inverse contracts for BTC and ETH. It supports up to 100x leverage and records a daily trading volume of more than $1.98 billion. Futures fees are 0.020% for makers and 0.05% for takers. The interface mirrors the simplicity of leading exchanges, featuring TradingView chart integration with a variety of indicators and strategy tools.

Users can choose from Market, Limit, Stop-Limit, and Stop-Market orders, along with advanced types such as Always Valid (AL), FOK, and IOC. Similar to spot trading, the option to disable maker orders is available for those preferring to trade exclusively at the taker fee rate.

CoinEx Fees

No matter what your trading activity looks like; whether you invest and hold, swing trade, or trade futures, fees can have a direct impact on your profits. Before moving to any exchange, it’s important to understand its fee structure and consider how it aligns with your trading style. With that in mind, let’s take a closer look at CoinEx’s fees, including trading fees as well as deposit and withdrawal costs.

Trading Fees

CoinEx’s trading fees are slightly on the higher side compared to some other exchanges. Spot trading fees start at 0.20% for both makers and takers under the standard tier, with a tiered structure that can reduce rates to 0.10% at VIP 5. Futures trading follows a similar model, beginning at 0.03% maker and 0.05% taker fees, with the lowest tier offering 0.02% maker and 0.04% taker.

The exchange also has its own native token, CET, which offers additional discounts. Holding CET lowers the spot trading fee to 0.16% for both makers and takers, and at higher VIP levels, fees can drop further to 0.08%.

CoinEx also features an AMM (Automated Market Making) market. Regular users in this market are charged 0.3% for both makers and takers, but subscribing to the service can reduce maker fees to 0%.

Spot Fees

0.20% Maker

0.20% Taker

Future Fees

0.03% Maker

0.05% Taker

Deposits and Withdrawals

CoinEx supports on-chain cryptocurrency deposits, which are free except for standard network gas fees depending on the asset and blockchain used. The platform also offers Quick Buy, a built-in fiat-to-crypto service that allows users to purchase or sell crypto directly on CoinEx without being redirected to third-party platforms. However, fiat support is currently limited, with BRL being the only available currency.

To address the fiat limitation, CoinEx also offers a P2P market, although liquidity here is relatively low, and buyers or sellers often charge a premium. The platform further supports on-ramp and off-ramp services through third-party providers such as MoonPay, Mercuryo, and others. These services have their own platform fees but provide a secure way to deposit and withdraw funds. However, KYC registration with the respective provider is required for all deposit and withdrawal methods, except for standard on-chain cryptocurrency transactions.

CoinEx Products and Services

Products and services can be seen as add-ons to the core crypto trading features of an exchange, often adding value for a wide range of users. Let’s take a closer look at the different products and services available on CoinEx to help you assess whether the exchange fits your trading objectives.

Trading

When it comes to the trading experience, CoinEx offers standard spot and futures platforms. While the interface may feel slightly outdated compared to the more compact layouts of some top-tier exchanges, it remains functional and easy to use. This simplicity works well for both beginners and users applying different trading strategies. In addition to traditional trading, CoinEx provides other options such as Strategic Trading (bot-based strategies), demo trading, and futures copy trading.

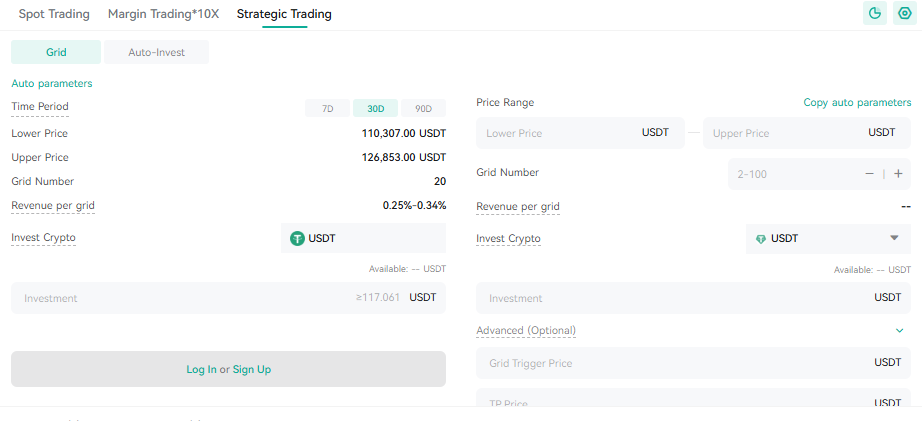

Strategic Trading

Strategic Trading lets users set up automated bot strategies in the spot market, defining upper and lower price limits and funding the strategy accordingly. Fees for this feature are the same as regular spot trading.

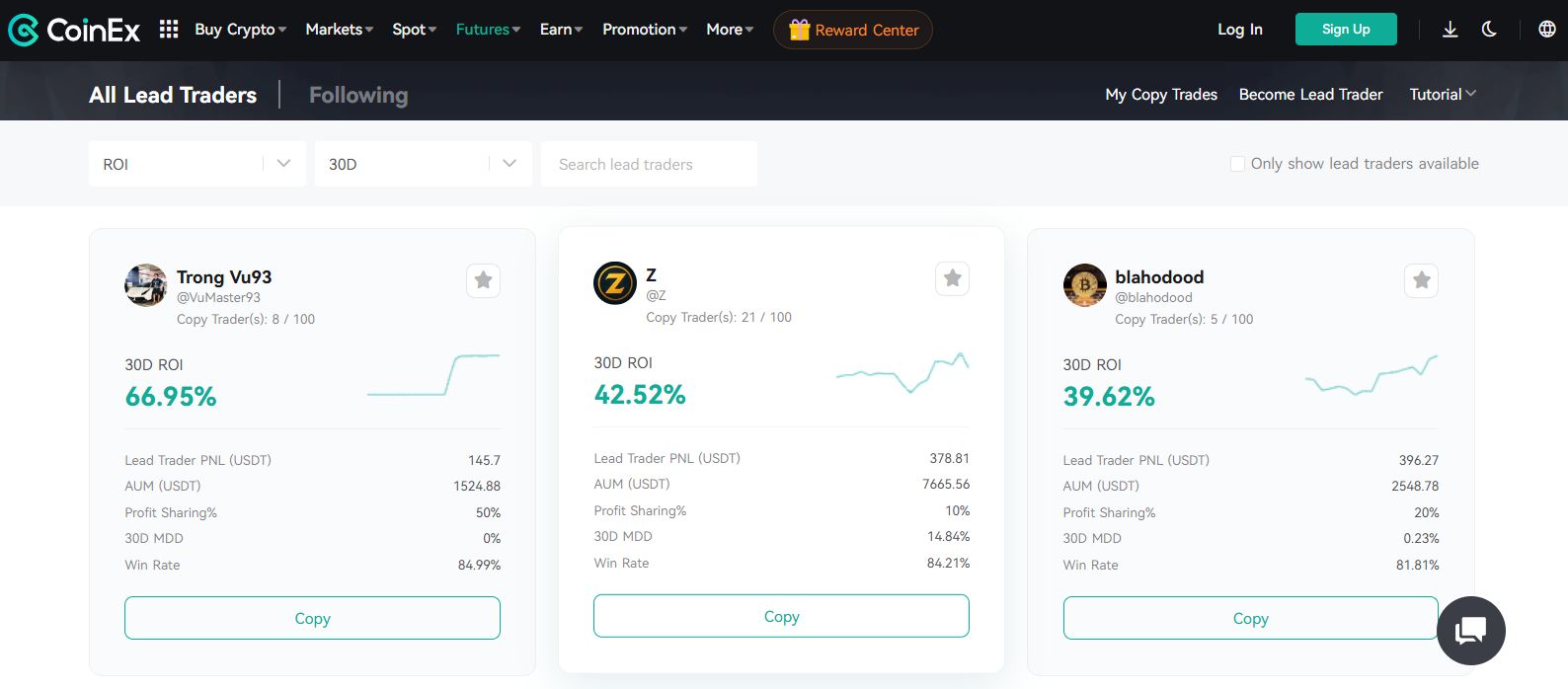

Copy Trading

CoinEx’s copy trading feature allows users to mirror the trades of selected futures traders. Profit-sharing rates vary from trader to trader, and the system operates on a performance-based model.

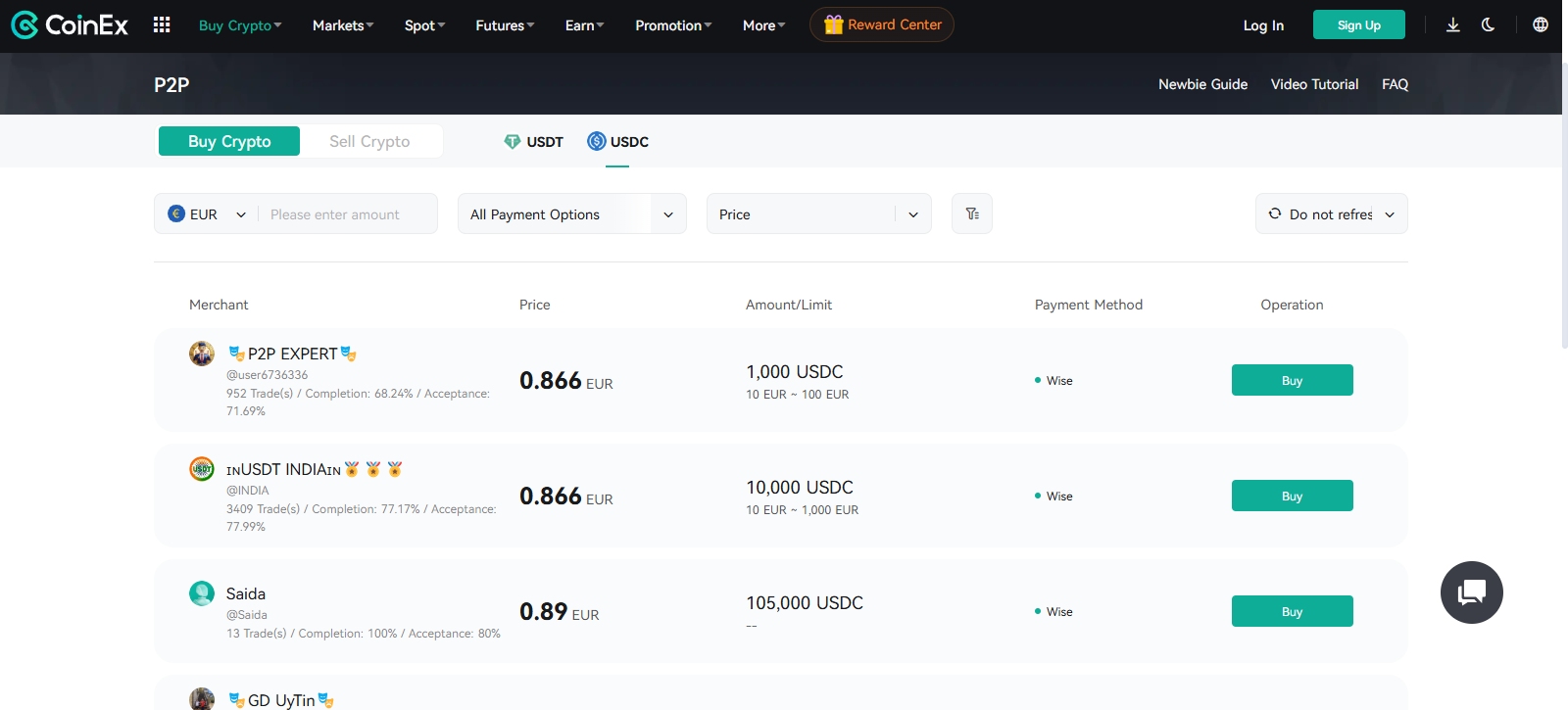

P2P Trading

For users in regions with restricted access to crypto, P2P trading can be essential. CoinEx’s P2P platform supports USDT and USDC with 28 fiat options. While it provides a gateway to crypto, vendor availability is limited, meaning users may pay a premium on trades. This limitation is worth noting when comparing to the best P2P exchanges in the market.

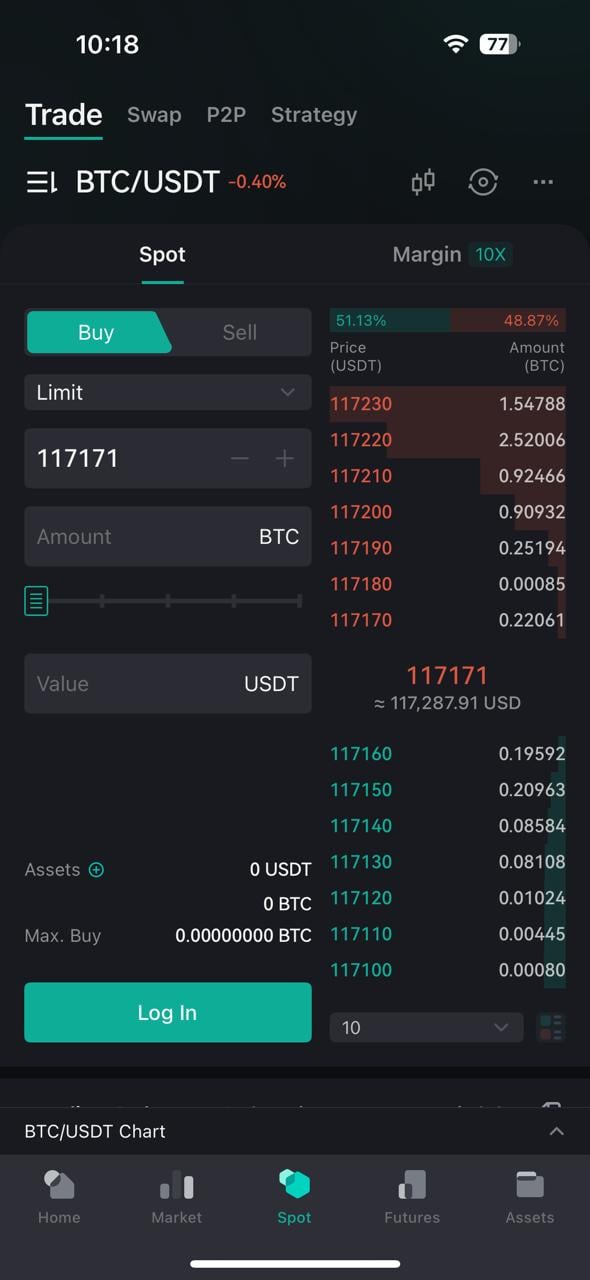

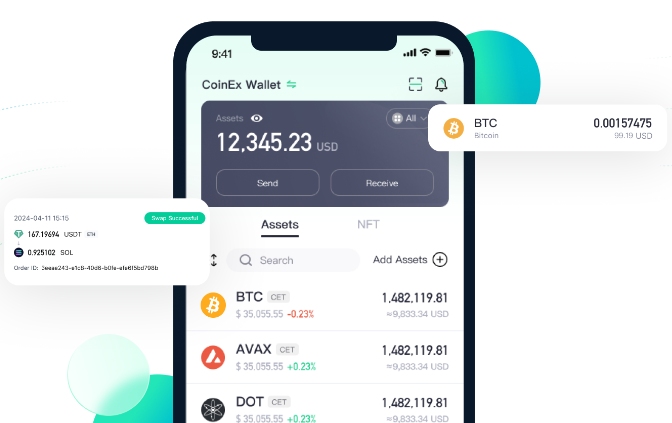

CoinEx Mobile App

The CoinEx mobile app, available for Android and iOS, provides access to the full range of exchange features in a portable format. Users can trade spot and futures markets, manage staking positions, access the P2P platform, use copy trading, and monitor their portfolios in real time. The app integrates TradingView charts with technical indicators, supports multiple order types, and offers push notifications for order updates and price alerts.

It also includes account security tools such as two-factor authentication and withdrawal address management. With an interface designed for both beginners and experienced traders, the app allows users to deposit, withdraw, and manage funds directly without switching to the desktop platform.

CoinEx Wallet

The CoinEx Wallet offers 100% asset control through private key self-custody. Users can manage multiple blockchain assets, benefit from advanced security measures, swap cross-chain cryptos, and earn interest on idle holdings.

CoinEx Vault

Designed for businesses, CoinEx Vault is a self-custodial wallet with multi-signature + cold wallet storage. Features include offline key storage, security audits by firms like SlowMist, real-time transaction monitoring, and a risk isolation framework to prevent single points of compromise.

CET Token

CET is CoinEx’s native token, used to access trading fee discounts, participate in promotions, and pay gas fees within the platform’s ecosystem. Holding CET can lower spot fees from 0.20% to 0.16%, with further reductions at higher VIP tiers.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

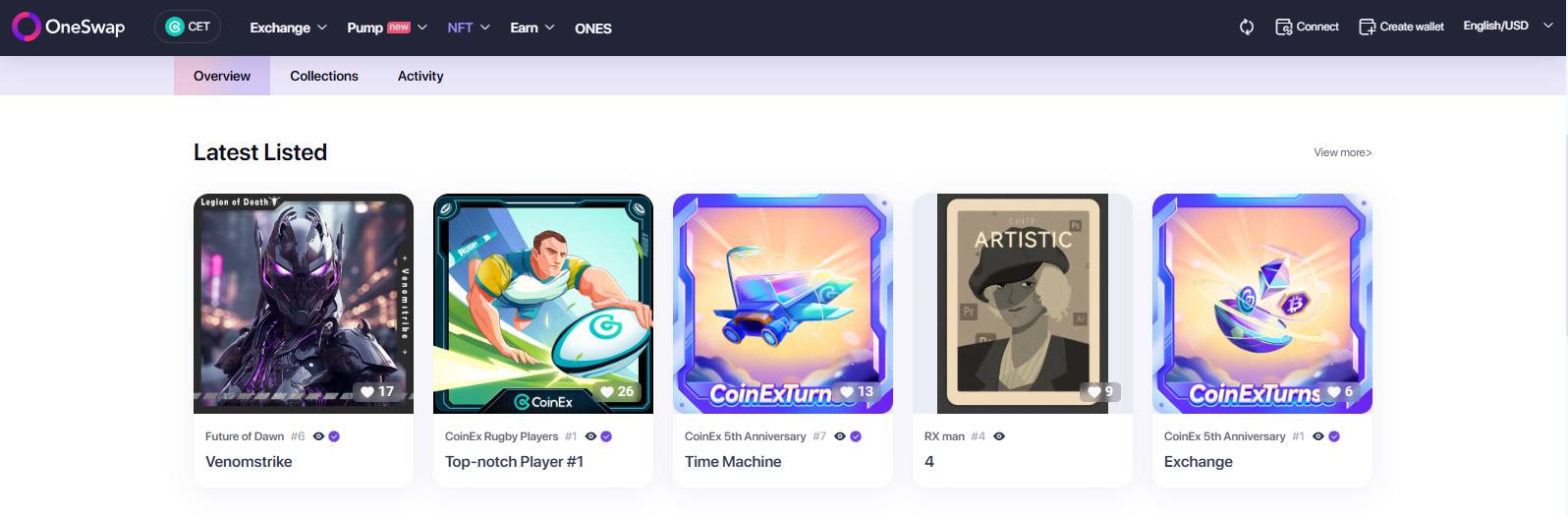

OneSwap (AMM)

OneSwap combines token swapping, liquidity pools, and limited NFT functionality. Liquidity is low, with only a pool for ONES tokens offering 0.20% APR at low volume. Adding liquidity to CoinEx’s AMM can grant maker fee discounts for trades executed within AMM markets.

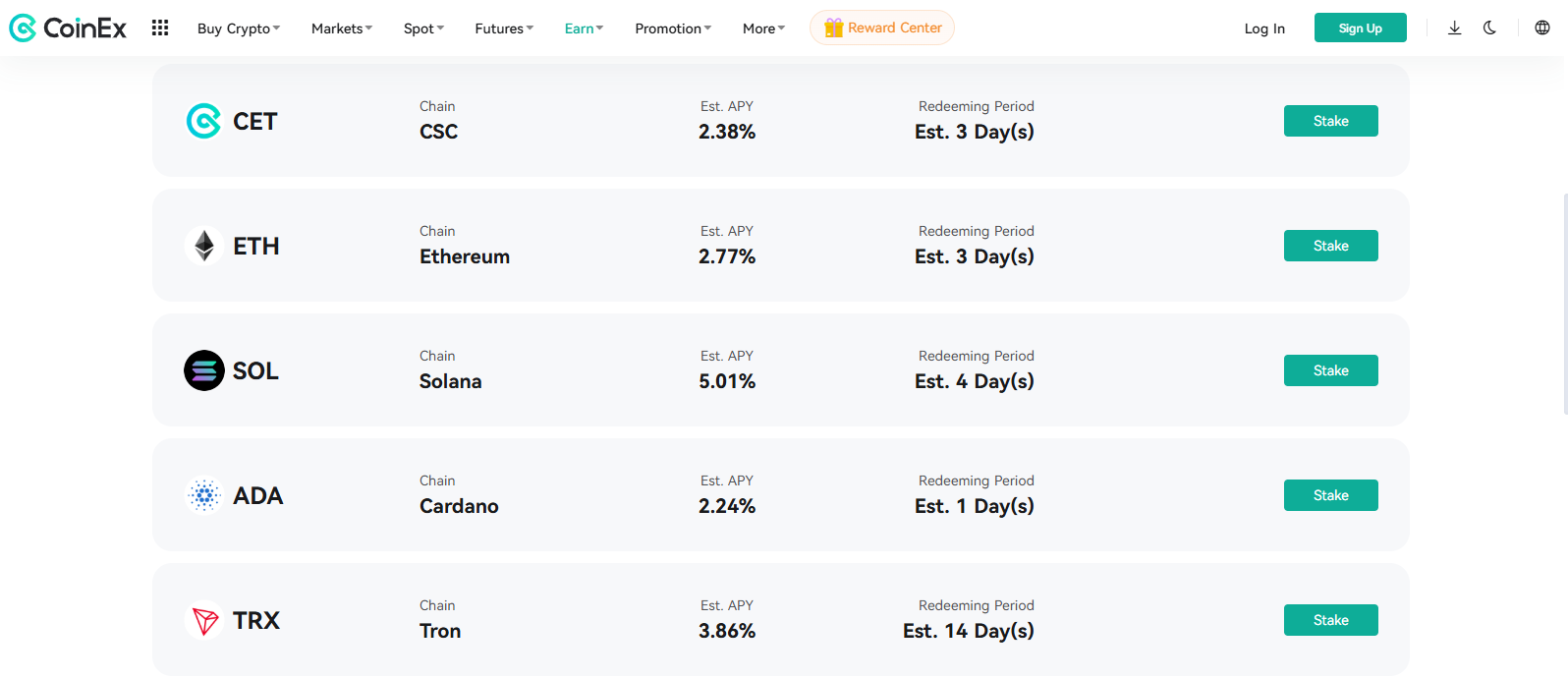

CoinEx Staking

CoinEx offers staking for multiple assets with short to medium lock-up periods, allowing users to earn rewards on holdings without active trading. Rewards are credited automatically at the end of the term, and the process is simple; select an asset, choose the term, and confirm.

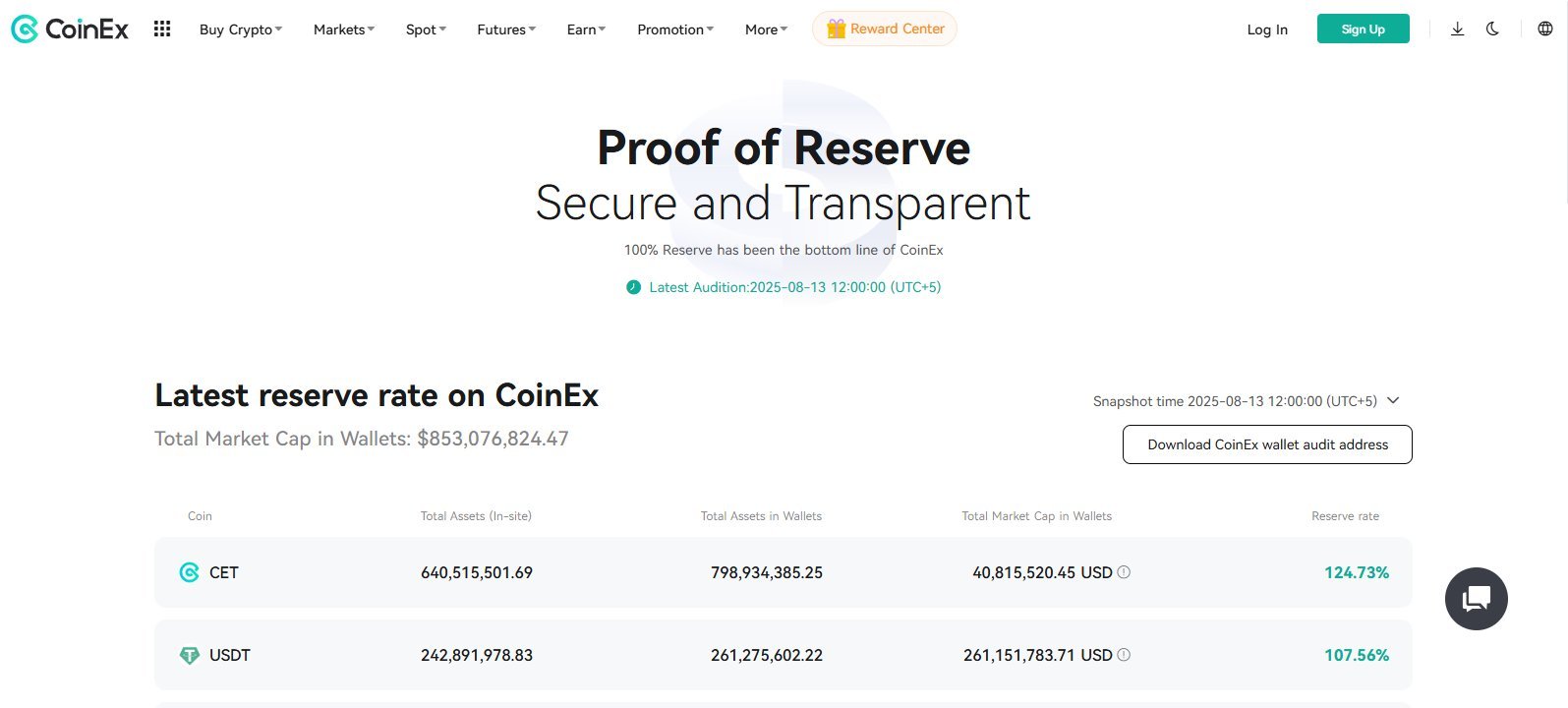

CoinEx Security

CoinEx secures customer funds using multisignature cold storage wallets. These wallets remain offline, disconnected from the internet, and require multiple authorizations to access, reducing the risk of unauthorized withdrawals. The exchange also publishes proof of reserves, demonstrating that customer assets are backed 1:1.

To strengthen platform security, CoinEx runs a bug bounty program that invites independent security researchers to identify and report vulnerabilities in exchange for rewards.

For account-level protection, CoinEx offers two-factor authentication (2FA) via Google Authenticator or SMS verification. Each time you log in or request a withdrawal, you must enter a time-sensitive 6-digit verification code in addition to your password, adding a second layer of security against unauthorized access.

Related reading: How to Delete CoinEx Account

CoinEx Customer Support

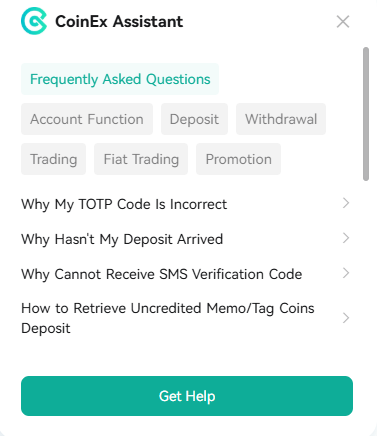

CoinEx does not provide 24/7 live chat. Support is available through email and official social media channels such as Twitter. Response times can be up to 24 hours. The exchange also maintains a Help Center with detailed guides, FAQs, and troubleshooting steps for common issues, allowing users to resolve many queries without direct support intervention.

CoinEx Alternatives

CoinEx is known for its wide variety of altcoins, but if you’re looking for alternatives, consider these:

1. MEXC: MEXC also has a massive selection of altcoins and often has more competitive trading fees.

2. BYDFi: BYDFi is a good choice if you’re looking for high leverage and no KYC requirements.

| Feature | CoinEx | MEXC | BYDFi |

|---|---|---|---|

| Established | 2017 | 2018 | 2019 |

| Spot Fees (Maker/Taker) | 0.20% / 0.20% | 0.05% / 0.05% | 0.00% / 0.10% |

| Futures Fees (Maker/Taker) | 0.030% / 0.050% | 0.00% / 0.020% | 0.020% / 0.060% |

| Max Leverage | 100x | 500x | 200x |

| KYC Required | No | Yes | No |

| Supported Cryptos (Spot) | 1281+ | 3127+ | 801+ |

| Futures Contracts | 224+ | 433+ | 421+ |

| No KYC Withdrawal Limit | $10,000 | None | 1 BTC |

| 24h Futures Volume | $1.40B+ | $41.74B+ | $7.4B+ |

| Trading Bonus | $100 | $20 | $300 |

| Key Features | • No KYC required • AMM DEX available |

• Largest coin selection • Zero-fee spot trading • Highest leverage (500x) |

• No KYC required • High leverage (200x) • Zero-fee spot trading |

| Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

CoinEx provides a broad range of tradable assets, covering over 1,280 spot cryptocurrencies and 224+ futures contracts, with leverage up to 100x. The platform combines standard trading features with options like copy trading, staking, and an affiliate program. Its no-KYC policy for withdrawals up to $10,000 per day offers additional flexibility for certain users, while fiat access is supported through on-chain deposits, a P2P market, and third-party payment providers.

Futures fees are competitive, though spot fees are slightly higher than some alternatives. The interface is straightforward and functional, catering to both beginners and experienced traders. While it does not provide 24/7 live chat and is restricted in some jurisdictions, it remains a viable choice for traders seeking variety and accessibility. As this CoinEx review shows, those focused on active trading may still wish to compare its features and costs with the top exchanges for day traders before deciding.

FAQ

1. Does CoinEx require KYC verification?

No, CoinEx does not require KYC verification or other identification methods. You can deposit, trade and withdraw on Coinex without verifying your identity.

2. What are the CoinEx fees?

Spot fees on CoinEx start at 0.2% for makers and takers but can be lowered to 0.16% when activating the CET discount. The futures trading fees start at 0.03% for makers and 0.05% for takers.

3. Is CoinEx safe?

Yes, CoinEx appears to be a safe and secure exchange. The platform holds customer funds in multisig cold storage and also provides proof of reserves. CoinEx has also never been hacked and has a clean track record.

4. How many cryptos does CoinEx support?

CoinEx offers over 1000 different trading pairs on its spot and futures market, making it one of the largest exchanges in terms of available crypto trading pairs.

5. Can I withdraw cash and FIAT?

No, CoinEx does not support FIAT withdrawals. If you wish to send your profits to your bank account, you must send your cryptos to another platform that supports FIAT withdrawals.