- •BTSE offers 277+ spot pairs and 110+ USDT-margined futures contracts with up to 100x leverage.

- •BTSE allows no-KYC trading with a $100K daily withdrawal limit for unverified users.

- •The exchange supports multi-asset collateral and settlement for flexible margin management.

- •Spot fees start at 0.20% maker/taker, and futures fees begin at 0.02% / 0.055%.

- •The platform combines strong security, an intuitive interface, and tools like BTSE Earn, AutoTrader, and the BTSE Card.

BTSE is a growing crypto exchange gradually gaining acceptance in most parts of the world. The exchange has over 260 crypto assets for trading spots and futures. Some features that make the exchange attractive to new and experienced traders are its low trading fees, friendly user interface, and security structure. We will take a comprehensive BTSE review in this article, looking at its trading options, supported cryptocurrencies, fee structure, security, customer support, and more.

| Stats | BTSE |

|---|---|

| 🚀 Founded | 2019 |

| 🌐 Headquarters | British Virgin Islands |

| 🔎 Founder | Jonathan Leong |

| 👤 Active Users | 5M+ |

| 🪙 Spot Cryptos | 277+ |

| 🪙 Futures Contracts | 110+ |

| 🔁 Spot Fees (maker/taker) | 0.20% / 0.20% |

| 🔁 Futures Fees (maker/taker) | 0.020% / 0.055% |

| 📈 Max Leverage | 100x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 3.8/5 |

BTSE Quick Overview

BTSE, which stands for Buy, Trade, Sell, and Earn, is a crypto exchange that was founded in 2019 by Jonathan Leong and is headquartered in the British Virgin Islands. Since its inception, BTSE has rapidly gained popularity and now has over 5 million users.

The platform provides a wide range of trading services, including spot trading, futures, and various other investment opportunities tailored for institutions, retail users, and newcomers to the crypto space. Users can access over 277+ cryptocurrencies, including the native BTSE token, and more than 110+ futures contracts, making it a versatile option for traders of all levels.

One of the standout features of BTSE is its no KYC (Know Your Customer) policy, which simplifies the onboarding process for users concerned about privacy. The platform’s intuitive and user-friendly interface ensures that navigating and trading various cryptocurrencies is seamless. The BTSE Mobile app further enhances the trading experience, offering a secure and accessible platform for managing digital assets on the go.

BTSE Pros And Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ 277+ spot pairs and 110+ futures contracts up to 100x leverage | ❌ Not available in regions like the US, North Korea, and Canada |

| ✅ Affordable tiered trading fees | ❌ Limited payment methods (SEPA, Swift, Astropay) |

| ✅ Multi-asset collateral for flexible margin trading | ❌ Minimum deposit of $100 required |

| ✅ No fees for USD deposits | |

| ✅ No-KYC access with $100K daily withdrawal limit | |

| ✅ Strong security and easy-to-use interface |

BTSE Signup and KYC

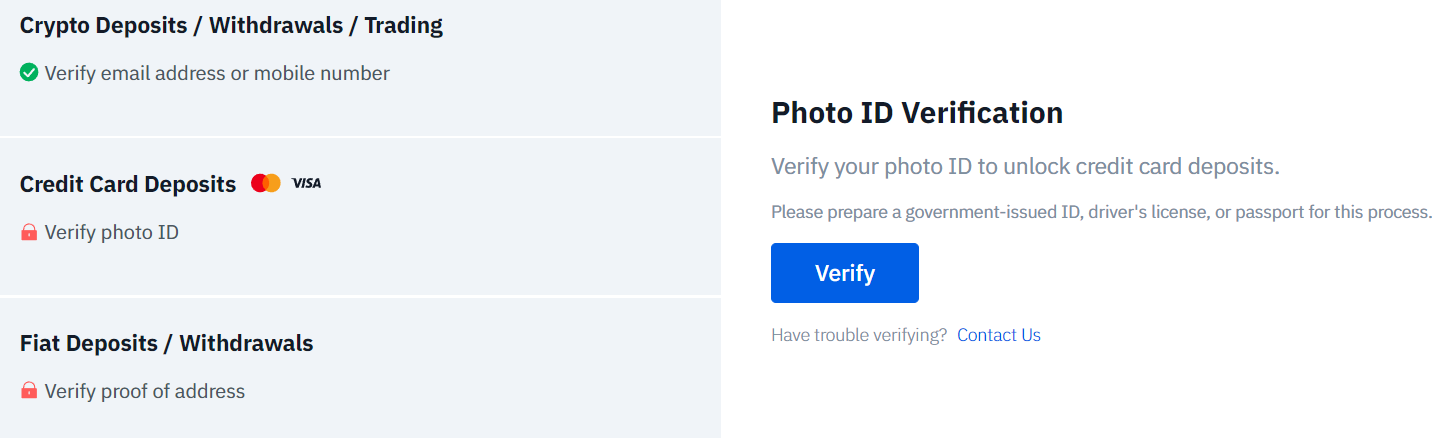

BTSE is a no-KYC crypto exchange, meaning you can get started with trading right away. The signup process on BTSE is simple and requires an email or phone number and a strong password. As users don’t have to verify their identity, you can deposit cryptos, trade, and eventually withdraw your cryptos again.

However, there are some limitations based on your KYC levels. Unverified users don’t have access to credit/debit card payment methods. Additionally, unverified users can’t access fiat support on BTSE.

What we like about BTSE are its generous 24-hour withdrawal limits. No KYC users can withdraw up to $100,000. For higher withdrawal limits, you must verify your identity with personal details such as a government-issued ID or Passport and proof of address.

For more information, check out our in-depth BTSE KYC guide.

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform. Due to regulations, BTSE does not support every country. To ensure that you are eligible to register on the exchange, you can use our free BTSE country checker.🌍 Free BTSE Country Checker

Simply type in your country and see if you can use the platform or if your country is restricted.

If you want to learn more about the restricted & banned countries on BTSE, read our in-depth BTSE banned countries guide.

BTSE Trading

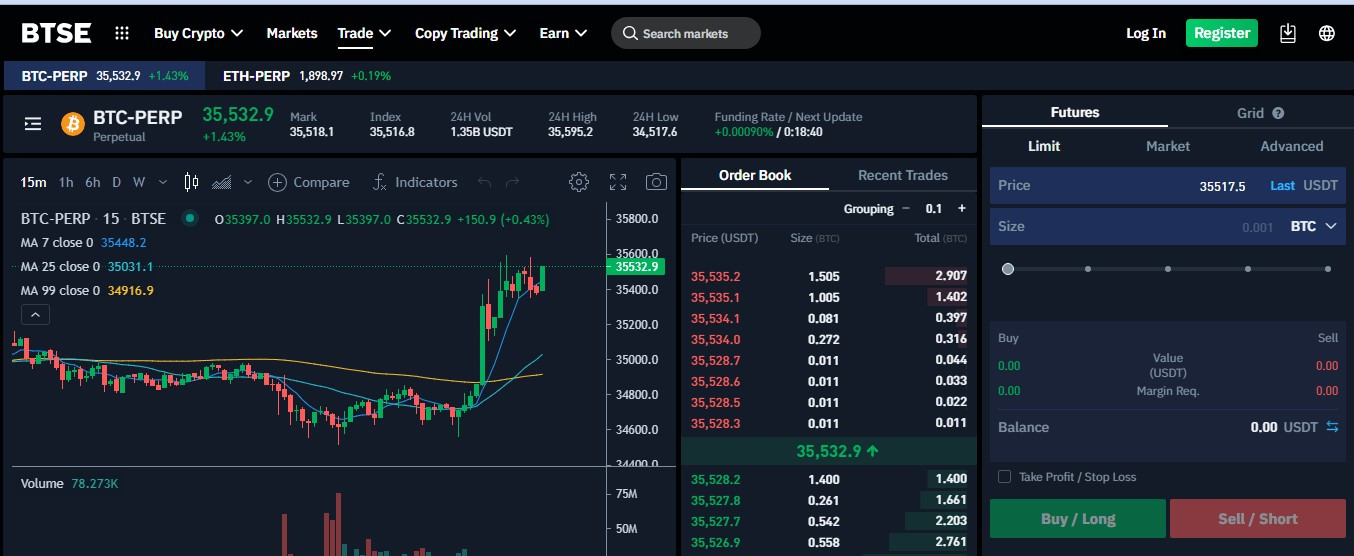

BTSE offers various trading products, including spot, futures, and NFT trading. You can trade crypto on the exchange from their mobile app or website. BTSE trading interface is both user-friendly and advanced. The interface features a trading view to monitor price movements when trading.

Spot Trading

BTSE has a spot tab for trading various cryptocurrencies on the spot market. The exchange provides over 277+ spot trading pairs with an daily trading volume of about $ 145M+. BTSE offers 3 major order types for users’ different trading needs and to improve their experience. They include limit, market, and advanced orders.

The advanced orders also have various types, including stop orders, take profit orders, trailing stop orders, TWAP orders, OCO orders, and index orders. TWAP order stands for Time-Weighted Average Price order. With this advanced order, you can break down a single order into smaller parts over a particular period. This way, you will reduce the slippage use and trade at an average price.

Learn more in our BTSE spot trading guide.

Future Trading

BTSE has upgraded its futures trading system to support multi-asset collateral and settlement, allowing traders to use various margin assets beyond BTC. The platform now offers 110+ USDT-margined futures contracts, with leverage options reaching up to 100x for those aiming for higher exposure. The trading interface remains highly interactive and intuitive, equipped with advanced analytical tools that cater to both beginners and professionals. On average, BTSE records around $2.8B+ in daily trading volume, making it one of the more active futures exchanges in the market.

Like on their spot trading portal, you will also find advanced orders like stop orders, take profit orders, trailing stop orders, TWAP orders, OCO orders, and index orders.

Learn more in our BTSE futures guide.

BTSE Fees

When you carry out certain activities like trading, withdrawal, and deposit, BTSE charges you a certain fee. We will explore them here.

Trading Fees

BTSE charges trading fees based on a tiered structure that depends on your trading volume and VIP level. For regular users, the basic spot trading fee is 0.20% for both maker and taker orders, while futures trading starts at 0.02% maker and 0.055% taker fees. These rates serve as the baseline for all users who do not meet any minimum 30-day trading volume requirements.

Spot Fees

0.20% Maker

0.20% Taker

Future Fees

0.02% Maker

0.055% Taker

As your trading activity increases, BTSE automatically upgrades your VIP level, unlocking lower fees across both spot and futures markets. For example, traders with up to 2 million USDT in 30-day spot volume pay just 0.02% maker and 0.06% taker fees. Meanwhile, users holding at least 100 BTSE tokens, the exchange’s native asset, qualify for VIP 1, where fees drop to 0.15% maker/taker.

At the top level, VIP 10 spot traders; those with over $2 billion in 30-day volume, enjoy 0% maker and 0.025% taker fees. Similarly, in the futures market, high-volume traders reaching $4 billion+ in 30-day volume can access -0.0050% maker rebates and 0.02% taker fees, offering some of the most competitive rates in the industry.

Fiat Deposit & Withdrawal Fees

BTSE supports about 8 fiat currencies for withdrawal on the exchange. Some of them include USD, GBP, EUR, AUD, etc. They use payment methods like SWIFT, Sepa, credit cards, AstroPay, internet banking, eWallet, FPS, etc.

Withdrawing fiat currencies aside from USD on BTSE attracts a bank charge, remittance, or transfer fee. These fees are not imposed by the exchange but by the servicing bank concerned. USD withdrawals, on the other hand, attract a $50 minimum fee.

Learn more in our BTSE deposit guide.

Crypto Withdrawal Fees

The withdrawal fees for crypto on BTSE differ for each crypto and network. For instance, you will pay 0.0005 USD when withdrawing BTC through the BITCOIN network. Other cheap crypto withdrawal fees include that of Algorand network at 0.01 USD, doge (BEP20) at $0.82, DOT (POLKADOT) at $0.1, LINK (ERC20) at $0.419, etc.

BTSE Products & Services

In addition to spot and futures trading, BTSE provides an extensive array of services to enhance the trading experience. We will explore each of these offerings in detail below.

Mobile App

BTSE offers both a mobile app and a desktop app for trading. Their mobile app is user-friendly and has almost all the trading features as their desktop app. The BTSE mobile app on Google Play Store has over 10,000 downloads and rated 3.8 stars.

BTSE Reward Hub

Here, you get rewarded for being active on the platform and engaging in different tasks. The reward can be token airdrops, BTSE cash, and future trading test funds.

Read our full BTSE bonus guide to learn more about the best perks and benefits on the platform.

BTSE Card

The BTSE Card allows you to spend your cryptocurrency gains in the real world. You can top up your card with crypto, which is instantly converted to Euros or USD for transactions at over 53 million merchants globally. With features like 2-factor authentication and card freezing, your assets remain secure while you enjoy convenient spending. Experience the ease of using crypto for your everyday purchases with the BTSE Card.

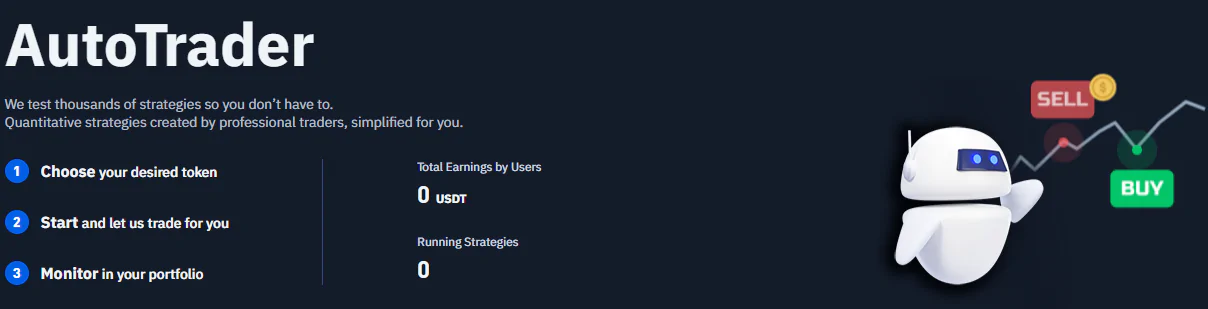

AutoTrader

With BTSE’s AutoTrader, you can simplify your trading experience by leveraging advanced crypto bots. You choose your desired token, and the platform executes trading strategies on your behalf while you monitor your portfolio. With highlighted strategies showing potential profits, you can easily tap into the expertise of professional traders to maximize your earnings.

BTSE Token

The BTSE token is the platform’s native token, allowing you to stake and elevate your VIP level quickly. By staking BTSE tokens, you get lower maker fees, starting as low as 0.005%, along with other exclusive benefits.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

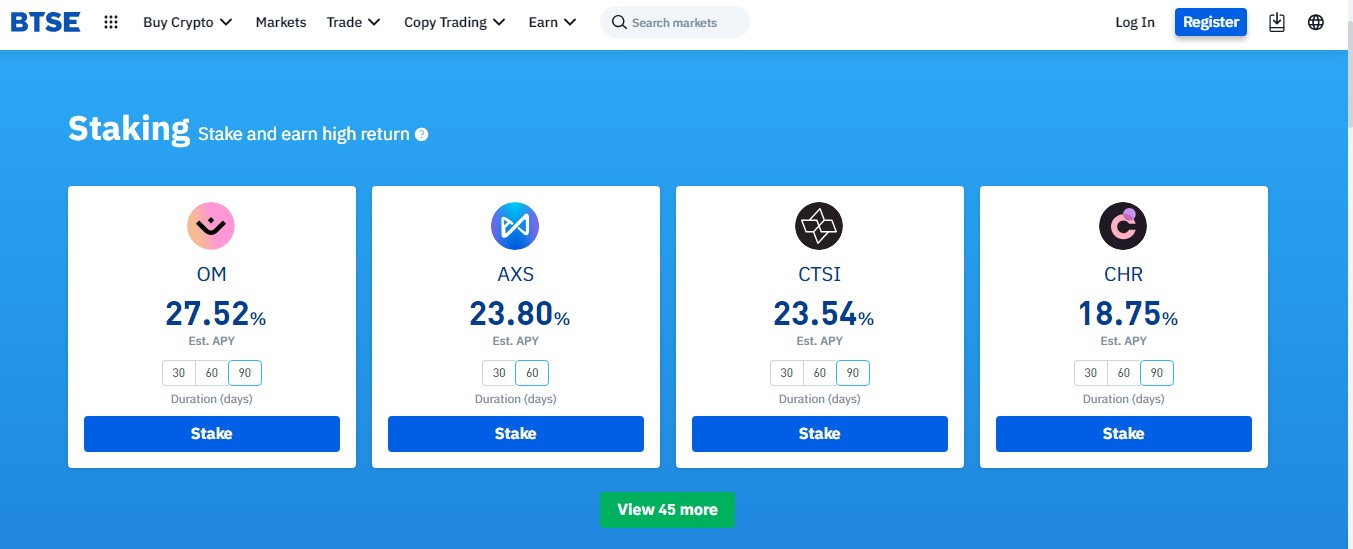

BTSE Earn

You can earn from your assets on BTSE in several ways, including staking and lending. With staking, you earn interest on specific crypto assets by holding them in your wallet for a particular period. Staking is a flexible term deposit, meaning you can redeem your asset anytime. Lending, on the other hand, is a fixed-term deposit product. You earn interest on your assets when you lend them to BTSE’s capital pool.

Learning Materials

BTSE has a learning center where users can access crypto resources that could improve their trading experience. In addition, this learning center also guides users on how to use the BTSE exchange platform. The learning center includes a blog section, a support center, and a YouTube channel.

BTSE Security

BTSE has implemented several security measures to ensure your funds are safe. The exchange uses an in-house security infrastructure, i.e., they don’t depend on third parties for security.

They also separate customer’s funds from theirs by storing about 99% of them in a cold wallet. Furthermore, they also have an insurance fund that they use to compensate customers during any security incidents.

BTSE Customer support

There are various ways in which BTSE offers support to their customers. They include email support, AI chatbot, and social media support. They have an active presence on Twitter, Telegram, LinkedIn and YouTube.

The AI chatbot is a new addition, where customers get immediate responses to their queries online. You can access the AI bots through a female icon named Selene on the bottom right corner of the page.

BTSE Alternatives

BTSE is a solid choice with high leverage and a variety of trading tools, but if you’re exploring other options, consider these:

- MEXC: MEXC offers a wider selection of altcoins and generally has more competitive trading fees.

- BYDFi: If you’re looking for high leverage and no KYC requirements, BYDFi is a great choice.

| Feature | BTSE | MEXC | BYDFi |

|---|---|---|---|

| Established | 2018 | 2018 | 2019 |

| Spot Fees (Maker/Taker) | 0.20% / 0.20% | 0.05% / 0.05% | 0.00% / 0.10% |

| Futures Fees (Maker/Taker) | 0.020% / 0.055% | 0.00% / 0.02% | 0.020% / 0.060% |

| Max Leverage | 100x | 500x | 200x |

| KYC Required | No | Yes | No |

| Supported Cryptos (Spot) | 277+ | 3137+ | 801+ |

| Futures Contracts | 110+ | 433+ | 421+ |

| No KYC Withdrawal Limit | $100,000 | None | 1 BTC |

| 24h Futures Volume | $2.84B+ | $42.2B+ | $3.96B+ |

| Trading Bonus | $3,000 | $20,000 | $300 |

| Key Features | • Regulated exchange • Forex trading • Strong security |

• Largest coin selection (3137+) • Lowest trading fees • High leverage (500x) |

• No KYC required • High leverage (200x) • Zero-fee spot trading |

| Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

BTSE Exchange provides a comprehensive platform for trading services that caters to both new and experienced traders. With features like AutoTrader for automated trading strategies and the BTSE Card for an easy way of cryptocurrency spending in the real world, the exchange enhances your trading experience. Their All-in-One Order Book simplifies the trading process by consolidating all pairs into a single interface, eliminating the hassle of navigating multiple menus.

While BTSE’s competitive trading fee structure, strong security measures, and generous reward programs make it an attractive option, it’s essential to note that trading options are limited, and the platform is restricted to specific locations. If you’re looking to focus your trading on spot and futures markets, BTSE could be a great choice for your crypto journey.

FAQs

1. How Do I Verify My BTSE Account?

You can verify your BTSE account by visiting the KYC section when you log into your account. To verify your account, you must provide relevant documents such as a government-issued ID, proof of address, and a clear selfie.

2. How Long Does It Take For BTSE Verification?

It takes about 1 to 2 business days to verify your account on BTSE. However, this can vary depending on the volume of demand.

3. What Are The Payment Methods For BTSE?

BTSE supports various payment methods, including credit cards, SWIFT, Sepa, and Astro Pay.