- •Founded in 2011 (London HQ); one of the longest-running crypto exchanges.

- •Never hacked to date; follows PCI DSS standards and uses 2FA.

- •Futures-focused platform with leverage up to 500x across 314+ contracts.

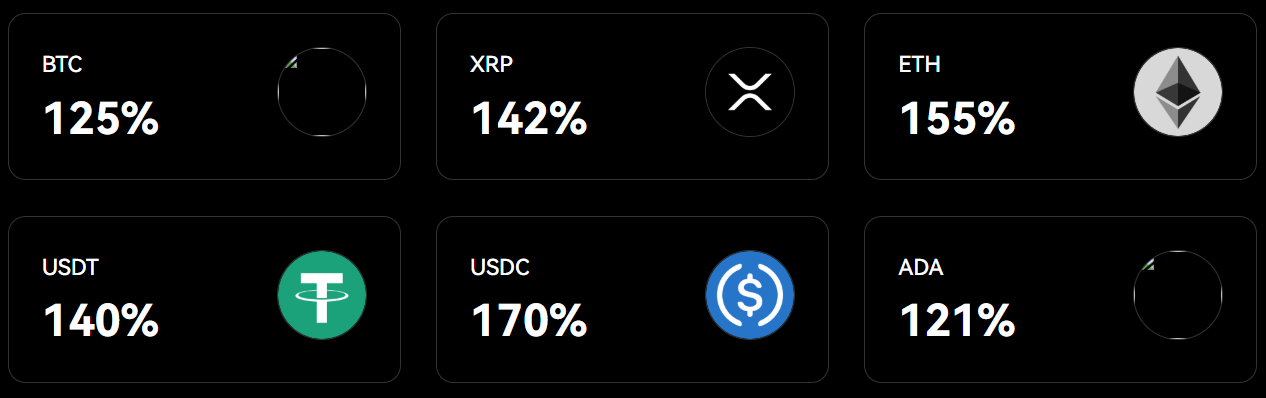

- •Proof of Reserves; reserve ratio ≥100% indicates all user assets are fully backed.

- •Strong liquidity with daily trading volume reported above $40.7B.

- •Spot trading supports 400+ assets with higher fees at 0.20% maker and 0.30% taker.

- •Futures trading uses a tiered fee model starting at 0.03%/0.06% and going as low as 0.01%/0.03% for top VIP levels.

- •No fiat off-ramp; fiat on-ramp buys USDT only. Crypto I/O via BTC Lightning, Ethereum, Solana, and more.

- •Demo trading, copy trading, plus tokenized stocks and precious metals.

- •iOS/Android app with full TradingView charts; 24/7 support and detailed user guides.

Cryptocurrency trading is booming again, with daily volumes crossing $790B+. Dozens of exchanges are competing for users, but not all deliver, some charge high fees, others lack trust. In this BTCC review, we will be looking at how BTCC, founded in 2011, has grown into a recognized futures trading platform. With up to 500x leverage and regulatory registrations in several regions, we’ll explore its liquidity, trading experience, and product range to see if it suits your trading style.

| Stats | BTCC |

|---|---|

| 🚀 Founded | 2011 |

| 🌐 Headquarters | London |

| 🔎 Founder | Bobby Lee |

| 👤 Active Users | 3M+ |

| 🪙 Supported Cryptos | 400+ |

| 🪙 Futures Contracts | 314+ |

| 🔁 Spot Fees (maker/taker) | 0.20% / 0.30% |

| 🔁 Futures Fees (maker/taker) | 0.02% / 0.045% |

| 📈 Max Leverage | 500X |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.7/5 |

| 💰 Bonus | $11.000 (Claim Now) |

BTCC Overview

BTCC was founded in 2011 by Bobby Lee and is headquartered in London, making it one of the longest-standing crypto exchanges in the industry. Over the years, it has expanded its regulatory footprint, including registration as a Money Services Business (MSB) with the U.S. FinCEN, which strengthens its compliance profile and reassures users about operational transparency.

The exchange is best known for futures trading, offering leverage of up to 500x, an unusually high figure compared to most competitors. Despite this, BTCC has managed to keep its fees competitive, while many other platforms raise costs significantly on high-leverage products. Liquidity is another strength, with daily trading volumes above $40.7 billion, ensuring smoother order execution and a reliable trading environment.

BTCC has also invested in building its brand presence, including appointing NBA player Jaren Jackson Jr. as an official ambassador. Alongside its derivatives products, the exchange offers features such as demo trading, copy trading, and limited spot markets. Having operated for more than a decade without a major security breach, BTCC continues to attract users, with its positioning shaped by both history and its emphasis on leveraged futures trading.

BTCC Pros and Cons

| 👍 BTCC Pros | 👎 BTCC Cons |

|---|---|

| ✅ BTCC has a long history and has never been hacked | ❌ Spot fees are expensive compared to other exchanges |

| ✅ High leverage up to 500x | ❌ No fiat withdrawals |

| ✅ Strong liquidity ensures fast order execution | ❌ Limited order types restrict advanced strategies |

| ✅ Proof of Reserves adds trust and transparency | ❌ Product offering is narrow versus competitors |

| ✅ Free demo trading supported | ❌ Only offers trading products, no passive income options |

| ✅ User-friendly trading interface | |

| ✅ Reliable customer service |

BTCC KYC and Sign-up

BTCC’s sign-up process is straightforward and only takes a few minutes. Traders can quickly set up an account and start trading without going through KYC verification. By default, accounts have access to all trading features with a daily withdrawal limit of $10,000.

Here’s how you can create a BTCC account:

Step 1: Open your browser and go to BTCC’s official website. Click on the “Register” button.

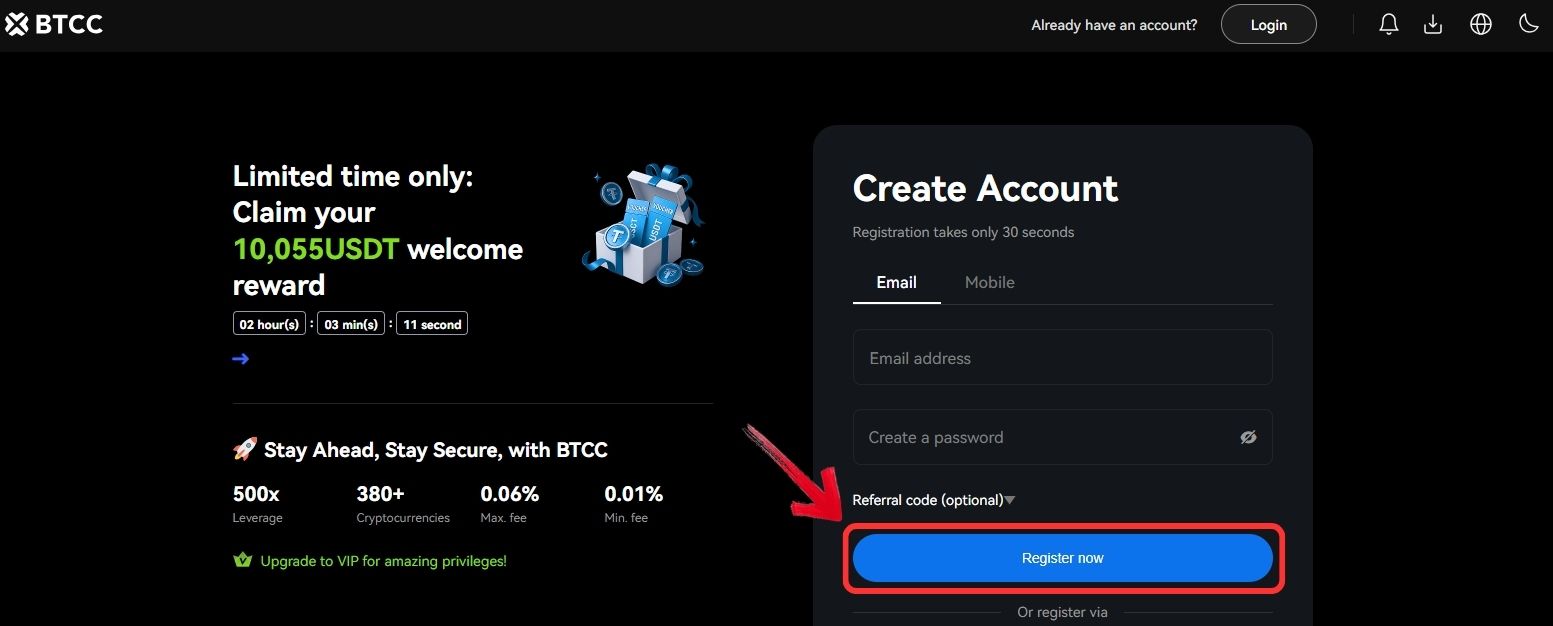

Step 2: Enter your email address, set a strong password, and click on “Register Now” to create your account.

Step 3: A 6-digit verification code will be sent to your email. Enter the code, and once verified, your account will be activated with immediate access to BTCC’s trading features.

If you want higher withdrawal limits and access to BTCC’s complete features, you’ll need to complete KYC verification. This requires a valid National ID or Driving License, along with a live photo for identity confirmation. Once approved, your daily withdrawal limit increases to $100,000.

Keep in mind that BTCC’s services are restricted in certain countries due to FATF regulations. Before signing up, it’s best to check your eligibility with our BTCC Country Checker to avoid issues later.

🌍 Free BTCC Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, BTCC does not support every country. To ensure that you are eligible to register on the exchange, you can use our free BTCC country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

BTCC Trading

Trading is the feature that defines any exchange, and platforms usually shape their tools around the needs of their user base. Some keep it simple with easy buy/sell options and basic charting, while others focus on advanced order types and customizable layouts. BTCC sits somewhere in between, offering both accessibility and depth.

Spot Trading

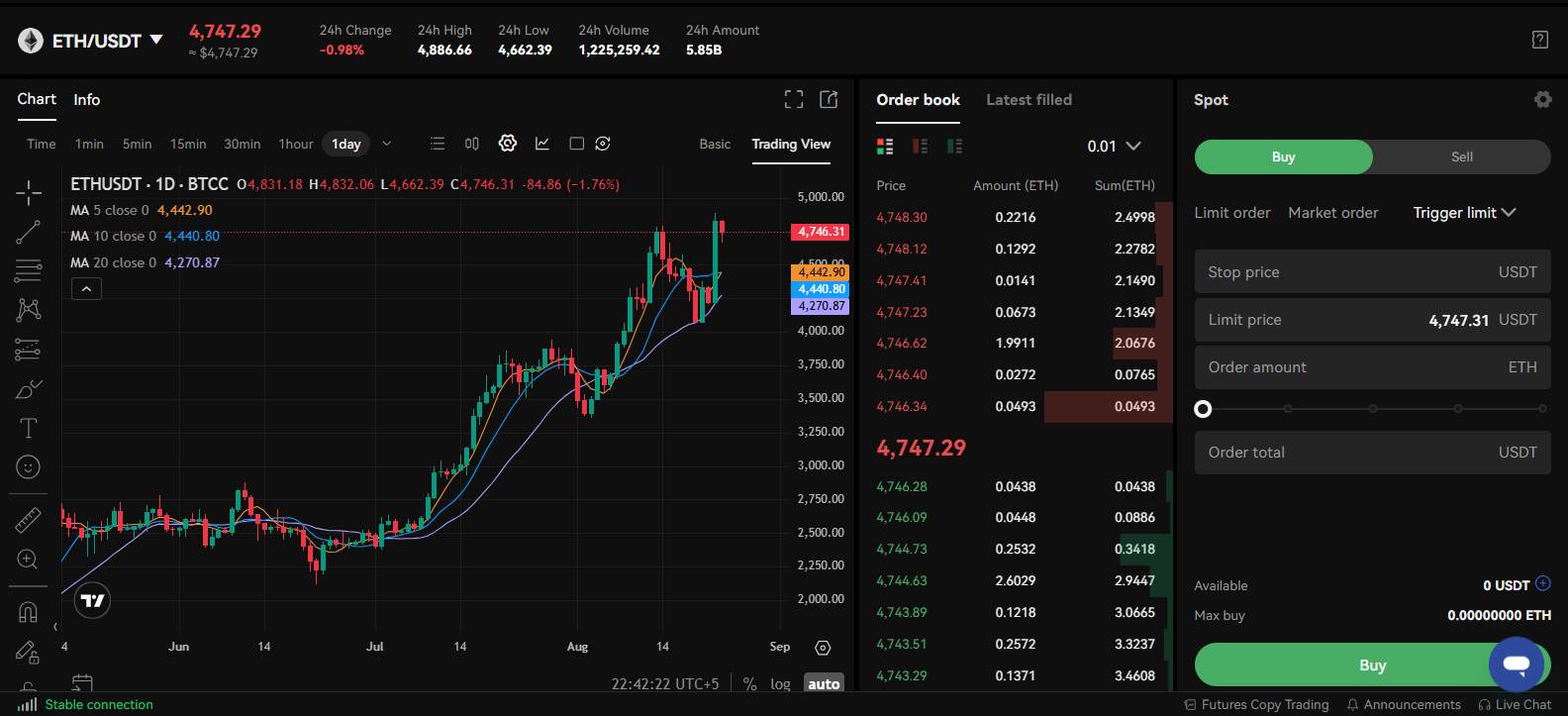

BTCC’s spot trading interface leans on the modern side. Unlike older layouts where buy/sell panels were tucked at the bottom, BTCC keeps everything compact and within reach. The exchange lists more than 400+ cryptocurrencies for spot trading. Fees, however, are on the higher side at 0.20% maker and 0.30% taker.

For analysis, charting is powered by TradingView, giving traders access to strategies, drawing tools, and indicators. In terms of orders, BTCC supports the basics; Limit and Market, along with Trigger Limit and Trigger Market options for more flexibility.

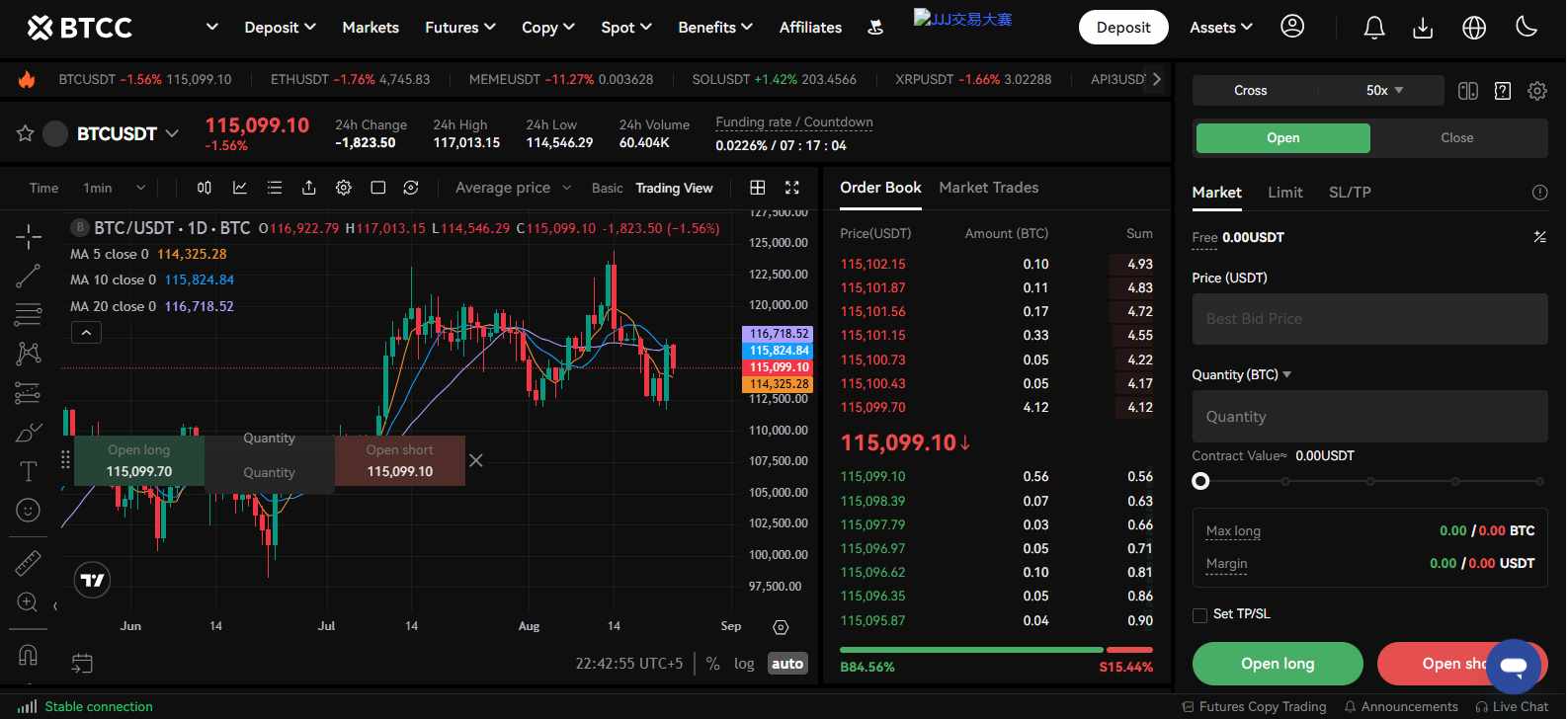

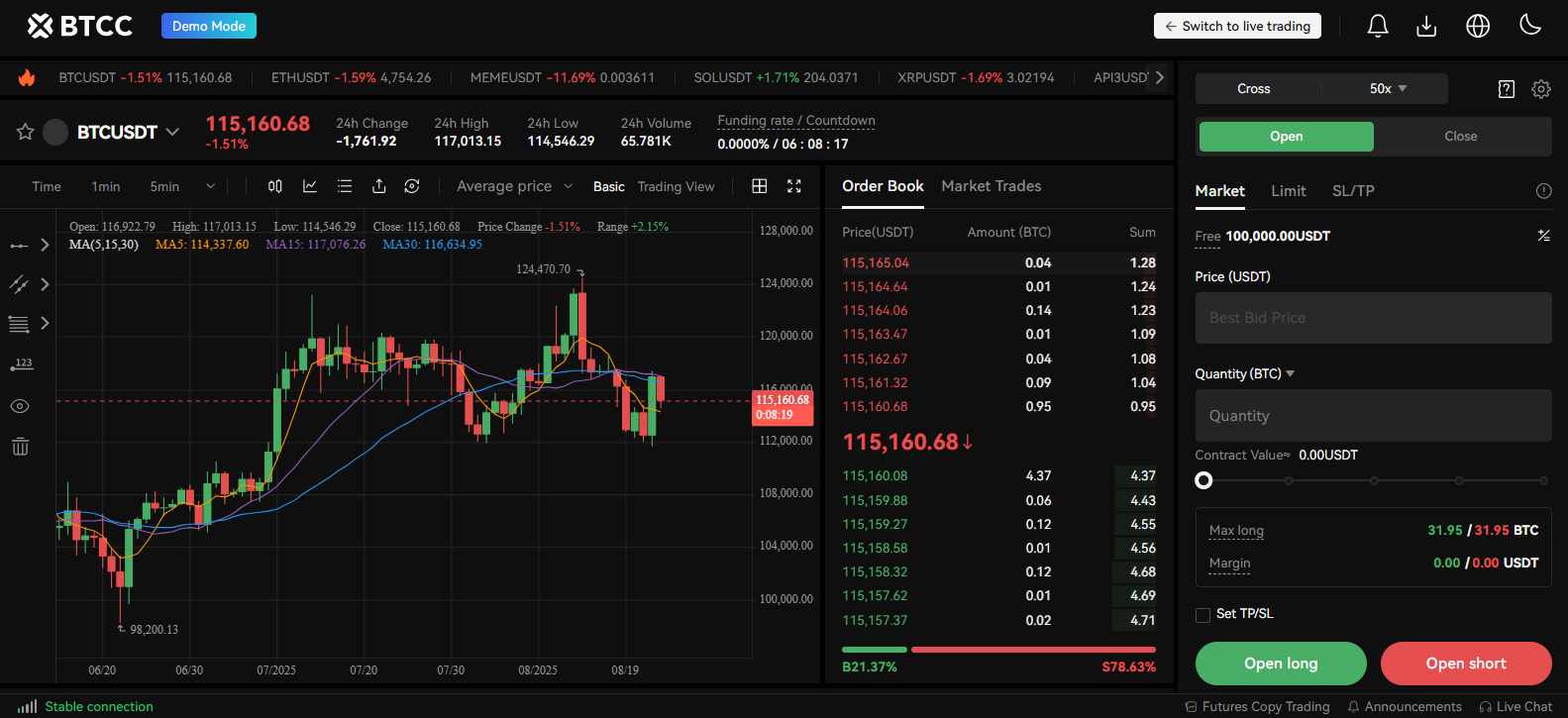

Futures Trading

Futures are where BTCC stands out. The platform offers 314+ contracts, covering both USDT and Coin-M perpetuals, with leverage reaching up to 500x. Fees are kept competitive at 0.03% maker and 0.06% taker.

Users can switch between basic charts and full TradingView mode with a single click. The interface follows a clean design, with order panels placed to the right for easier navigation. Order types, however, are limited to Limit, Market, and Stop Loss/Take Profit (SL/TP), which may feel restrictive for advanced futures traders used to more options.

Learn how to trade futures on BTCC from our complete guide.

BTCC Fees

Fees directly impact trading profits, so it’s one of the most important factors to consider before choosing an exchange. Here’s how BTCC’s fee structure looks.

Trading Fees

BTCC’s spot trading fees are set at 0.20% maker and 0.30% taker, which are relatively high compared to other tier-one exchanges and remain fixed regardless of trading volume or VIP level. In contrast, futures trading follows a tiered structure, starting at 0.03% maker and 0.06% taker, with the lowest possible rates reduced to 0.01% maker and 0.03% taker for top-tier VIPs. Unlike some competitors, BTCC does not issue a native token or offer additional discounts on trading fees.

Spot Fees

0.20% Maker

0.30% Taker

Future Fees

0.03%% Maker

0.06% Taker

Deposits and Withdrawals Fees

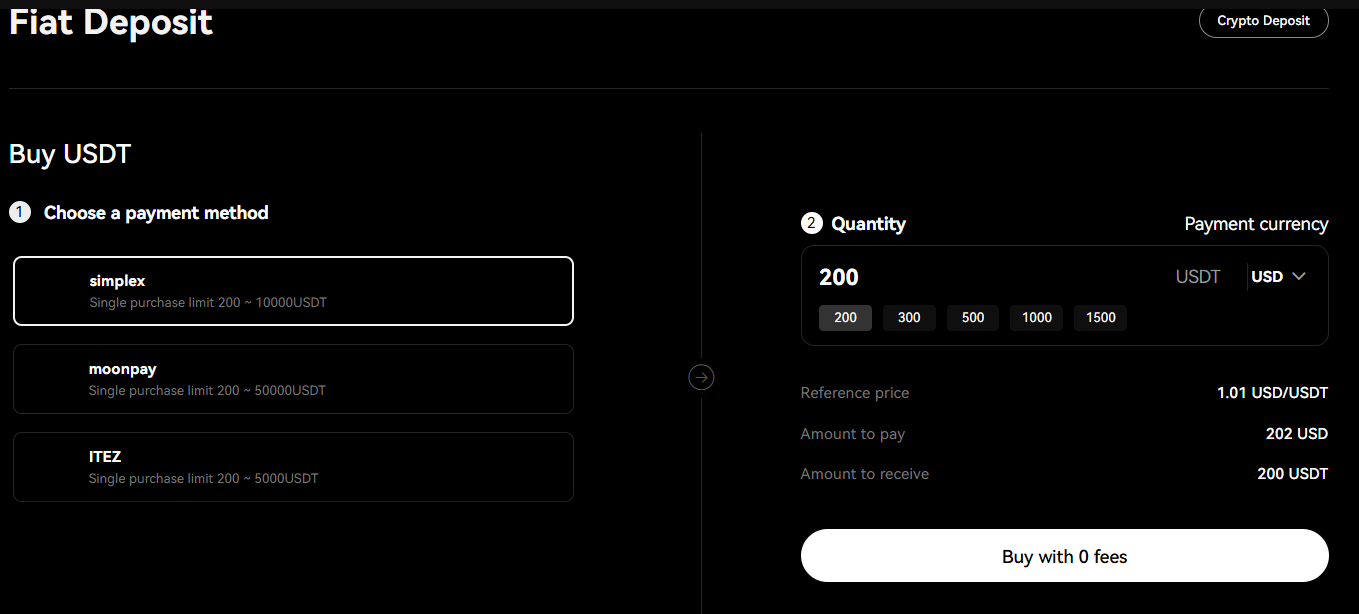

BTCC supports a fiat on-ramp for deposits, allowing users to purchase crypto directly with debit or credit cards. The exchange itself does not charge any fees for these transactions, but service providers apply their own charges.

Withdrawals through cards or bank transfers are not available at the moment. Instead, users can rely on on-chain deposits and withdrawals. BTCC does not apply extra fees for these transactions; only standard network fees are charged, which vary depending on the blockchain being used.

BTCC Deposits and Withdrawals

BTCC supports deposits through its fiat on-ramp in over 5+ fiat currencies, allowing users to purchase USDT, which can then be traded for BTC or other supported cryptocurrencies. However, fiat withdrawals are not available, there is no off-ramp or bank transfer option.

For crypto transactions, BTCC offers deposits and withdrawals across multiple major networks, including the Bitcoin Lightning Network, Ethereum, Solana, and other widely used blockchains. This gives traders flexibility in moving funds quickly and at varying costs depending on the network selected.

For step-by-step instructions, check out our BTCC Withdrawal Guide.

BTCC Products and Services

BTCC’s product lineup is relatively limited compared to larger exchanges, but it maintains a strong focus on leveraged products. Here’s an overview of what it offers.

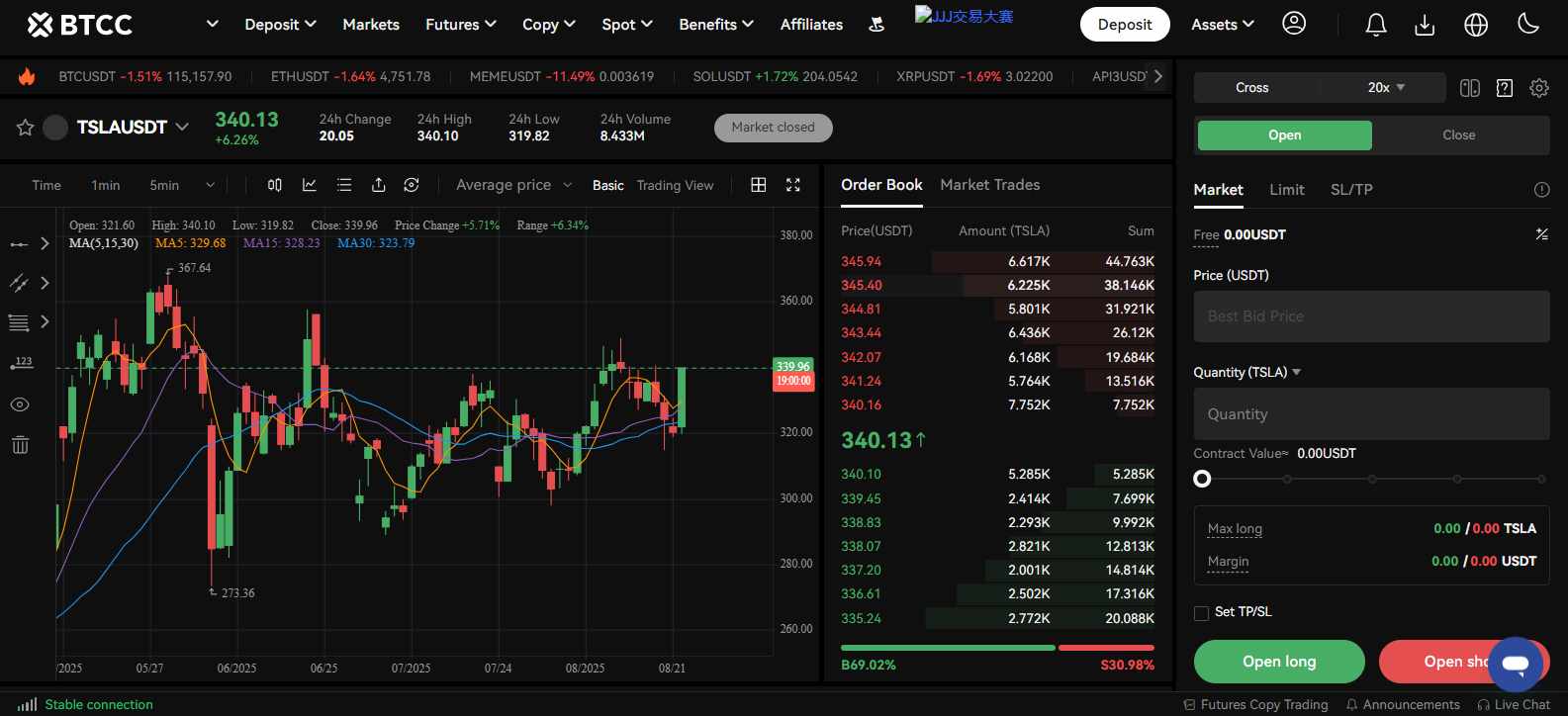

BTCC Trading

BTCC provides both spot and futures trading through a TradingView-powered interface. Order types remain limited, but users can access a demo trading mode to practice strategies without risking real funds. In addition to crypto, BTCC also supports tokenized stocks and precious metals, available on both spot and futures markets.

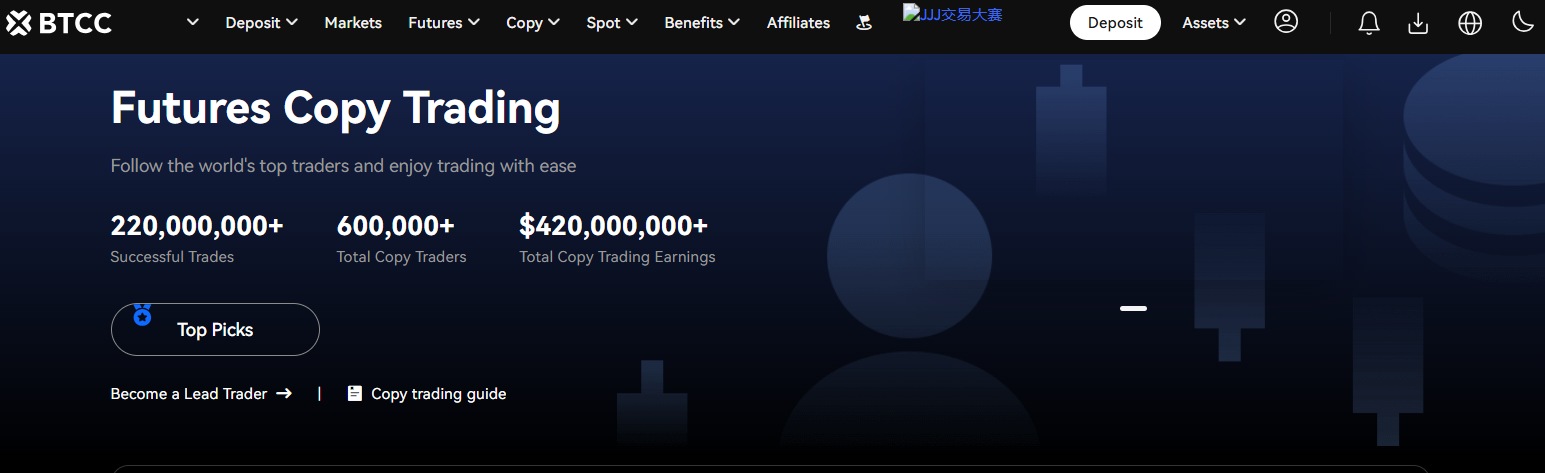

Copy Trading

The copy trading platform allows users to follow experienced futures traders and replicate their strategies. Before selecting a trader to copy, users can review key performance details, set a copy trading margin, and define a maximum margin for better risk control. Advanced features like stop loss and take profit orders are included, while profit-sharing ratios are in line with industry standards, capped at 10%.

Tokenized Stocks

BTCC gives users exposure to popular stocks such as Tesla and Apple, as well as precious metals like gold. These assets can be traded in both spot and futures markets, offering diversification beyond crypto.

FIAT ON Ramp

The fiat on-ramp supports more than five currencies and allows direct purchases of USDT via debit or credit card. While fiat withdrawals are not supported, this feature enables quick funding without third-party intermediaries.

Affiliate Program

BTCC runs an affiliate program that provides up to 70% commission, along with tiered bonuses of up to 120%. The program includes same-day settlements and advanced tracking tools, allowing affiliates to monitor conversion performance across different channels.

BTCC Security

With a global user base of more than one million, BTCC emphasizes both regulatory compliance and platform security as central to its operations. The exchange holds licenses in multiple jurisdictions, including the United States, Canada, and Europe, aligning its services with local requirements. This dedication to compliance has helped BTCC maintain recognition in the industry, consistently ranking among the top 40 exchanges on CoinMarketCap. Users should also note that BTCC is not available everywhere, and details on restricted regions can be found in our BTCC Restricted Countries Guide.

To provide assurance of solvency, BTCC maintains a Proof of Reserves system, where the reserve ratio is calculated as Platform Reserves ÷ All User Assets. A ratio of 100% or higher confirms that the exchange holds sufficient funds to cover all withdrawals at any given time.

From a technical standpoint, BTCC follows the Payment Card Industry Data Security Standard (PCI DSS) to reduce risks tied to card transactions and cyberattacks. The platform has operated since 2011 without a major hack and continues to carry out regular updates and maintenance, keeping users informed of changes through official channels.

For those looking to discontinue their usage, BTCC provides an option to permanently close accounts. Learn more in our how to delete a BTCC account guide.

BTCC Customer Support

BTCC complements its trading platform with round-the-clock customer support. Users can reach the team through 24/7 live chat, email, or an online contact form for reporting issues. Beyond direct support, BTCC also provides detailed user guides that explain how to navigate the platform, making it easier for both new and experienced traders to find answers without waiting for assistance.

The exchange places value on user feedback, incorporating suggestions into platform updates and improvements. This ongoing responsiveness has helped it maintain a steady base of active users. BTCC also engages with its community through social channels, particularly Twitter, where it shares updates, announcements, and new product information.

By combining multiple support channels, educational guides, and active communication, BTCC works to provide a more reliable and accessible experience for its users.

BTCC Alternatives

BTCC is a solid choice for high-leverage traders, but here are some other exchanges worth checking out:

- BYDFi: A great choice if you want to avoid KYC and still get high leverage and a wide selection of cryptocurrencies.

- BloFin: Offers a nice balance of features with no KYC requirements, competitive fees, and support for multiple fiat currencies.

- Bybit: A feature-rich platform with top-notch security, deep liquidity, and a wide variety of trading tools, but keep in mind it does require KYC.

| Feature | BTCC | BYDFi | BloFin | Bybit |

|---|---|---|---|---|

| Established | 2012 | 2019 | 2019 | 2018 |

| Spot Fees (Maker/Taker) | 0.20% / 0.30% | 0.00% / 0.10% | 0.10% / 0.10% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.03% / 0.06% | 0.020% / 0.060% | 0.020% / 0.060% | 0.020% / 0.055% |

| Max Leverage | 500x | 200x | 150x | 100x |

| KYC Required | No | No | No | Yes |

| Supported Cryptos (Spot) | 400+ | 801+ | 564+ | 726+ |

| Futures Contracts | 314+ | 421+ | 440+ | 578+ |

| No KYC Withdrawal Limit | $10,000 | 1 BTC | $20,000 | Not Allowed |

| 24h Futures Volume | $40.71B+ | $6.88B+ | $1.39B+ | $30.54B+ |

| Trading Bonus | $11,000 | $300 | $5,000 | $30,000 |

| Key Features | • Highest leverage (500x) • No KYC required • Tokenized Stocks available |

• No KYC required • Zero-fee spot trading |

• No KYC required • User-friendly interface |

• Advanced features • Deep liquidity • Multiple trading bots |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Final Thoughts

BTCC has positioned itself as a futures-focused exchange with more than a decade of history behind it. The platform’s strength lies in its leverage options, solid liquidity, and consistent security record, making it a recognizable name for traders who value these factors. Its regulatory registrations and Proof of Reserves also add a level of reassurance that many newer platforms lack.

That said, BTCC is not trying to be everything at once. Its product offering is narrower, spot trading fees are higher than average, and there’s no fiat off-ramp. These trade-offs matter depending on what kind of trader you are.

If your priority is high-leverage derivatives with a platform that has stood the test of time, BTCC delivers. If you’re looking for a broader crypto suite with more products and lower spot fees, it may be worth comparing alternatives before making your choice.

FAQ

1. Can US investors trade on BTCC?

Yes, BTCC is accessible to users in the United States. The exchange provides a range of spot and futures trading options with leverage up to 500x. However, availability may vary depending on state regulations, so it’s important to confirm eligibility before registering.

2. Can you withdraw fiat from BTCC?

No, BTCC currently does not support fiat withdrawals. Deposits are possible through debit and credit cards, but withdrawals must be made in cryptocurrency across supported networks.

3. Is BTCC safe?

BTCC has been operating since 2011 without a recorded hack or major security breach. It follows compliance standards such as PCI DSS, uses two-factor authentication (2FA), and maintains a Proof of Reserves system with a reserve ratio above 100% to reassure users that assets are fully backed.

4. Does BTCC require KYC?

No, users can trade without completing KYC, but withdrawals are capped at $10,000 per day. Completing KYC raises the daily withdrawal limit up to $100,000 and unlocks full platform features.

5. What leverage does BTCC offer?

BTCC offers leverage of up to 500x on futures contracts, one of the highest among major exchanges. Spot trading is available but without leverage.