-

- •Inventor of the crypto perpetual swap, shaping the derivatives market since 2014

- •20+ assets on spot and 73+ perpetual contracts with leverage up to 100x

- •Pro tools: multi-charting, hotkeys, trading bots, sub-accounts, and The Tie news feed

- •No fiat deposits or withdrawals, crypto-only funding

- •Copy trading with no profit-share cap, some traders take up to 50%

- •Strong security with multi-signature cold storage, MPC for altcoins, and publicly available proof of reserves for full transparency

- •Mobile app with full desktop functionality and 4.2 App Store rating

Known for pioneering crypto perpetual swaps, a product that has since become standard across the industry, BitMEX has grown into one of the most recognized crypto derivatives platforms. Over the years, it has expanded under multiple jurisdictions and now offers both derivatives and spot markets with deep liquidity. This BitMEX review looks at its products, fees, and security measures to understand where it stands in 2026. By evaluating the products and services provided by BitMEX, traders can make informed decisions about whether the exchange aligns with their trading objectives and risk appetite.

| Stats | BitMEX |

|---|---|

| 🚀 Founded | 2014 |

| 🌐 Headquarters | Seychelles |

| 🔎 Founder | Arthur Hayes |

| 👤 Active Users | 5M+ |

| 🪙 Supported Cryptos | 20+ |

| 🪙 Supported Perpetual Contracts | 73+ |

| 🔁 Spot Trading Fees (Maker/Taker) | 0.10% / 0.10% |

| 🔁 Leverage Trading Fees (Maker/Taker) | 0.05% / 0.05% |

| 📈 Max Leverage | 100x |

| 🕵️ KYC Verification | Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.2/5 |

| 💰 Bonus | $5,000 (Claim Now) |

BitMEX Overview

BitMEX was co-founded by Arthur Hayes in 2014 and is often credited with pioneering the concept of crypto perpetual swaps. That single innovation shaped the entire derivatives market, and perpetual contracts are still its most traded product. The exchange lists more than 130 futures contracts with leverage going up to 100x, giving traders access to deep liquidity and fast order execution. High-volume participants often prefer BitMEX because it can handle large positions without much slippage.

Its spot trading desk is relatively small, with just over 20+ supported cryptocurrencies, which is minimal compared to other exchanges that list hundreds. This keeps the focus firmly on derivatives, where BitMEX continues to invest most of its resources.

Security has been a key part of its reputation. BitMEX uses multi-signature cold storage for user funds, insurance funds to cover liquidations, and strict internal security processes. Despite its long history, the exchange has never experienced a major hack, which is rare among crypto platforms.

BitMEX is fully KYC-compliant, requiring users to verify identity before trading or withdrawing. It supports users from over 100 countries but is restricted in several regions, including the US, Canada (Québec), Hong Kong, Russia, and a few others listed in its jurisdiction policy. With more than 5 million users, a 200+ employee team, and operations based in Seychelles, BitMEX remains one of the most recognized derivatives-focused exchanges in the crypto market.

BitMEX Pros and Cons

| 👍 BitMEX Pros | 👎 BitMEX Cons |

|---|---|

| ✅ Oldest and most trusted crypto exchanges | ❌ Spot market is very limited |

| ✅ Customizable trading interface with multiple themes | ❌ Restricted in several major regions, including the US and Canada |

| ✅ Competitive fees with tiered discounts and BMEX token benefits | ❌ No fiat deposits or withdrawals supported |

| ✅ Strong security track record; never lost customer funds | ❌ High profit-sharing percentages on copy trading |

| ✅ Advanced tools like trading bots, copy trading, and multi-charting |

BitMEX Sign-up and KYC

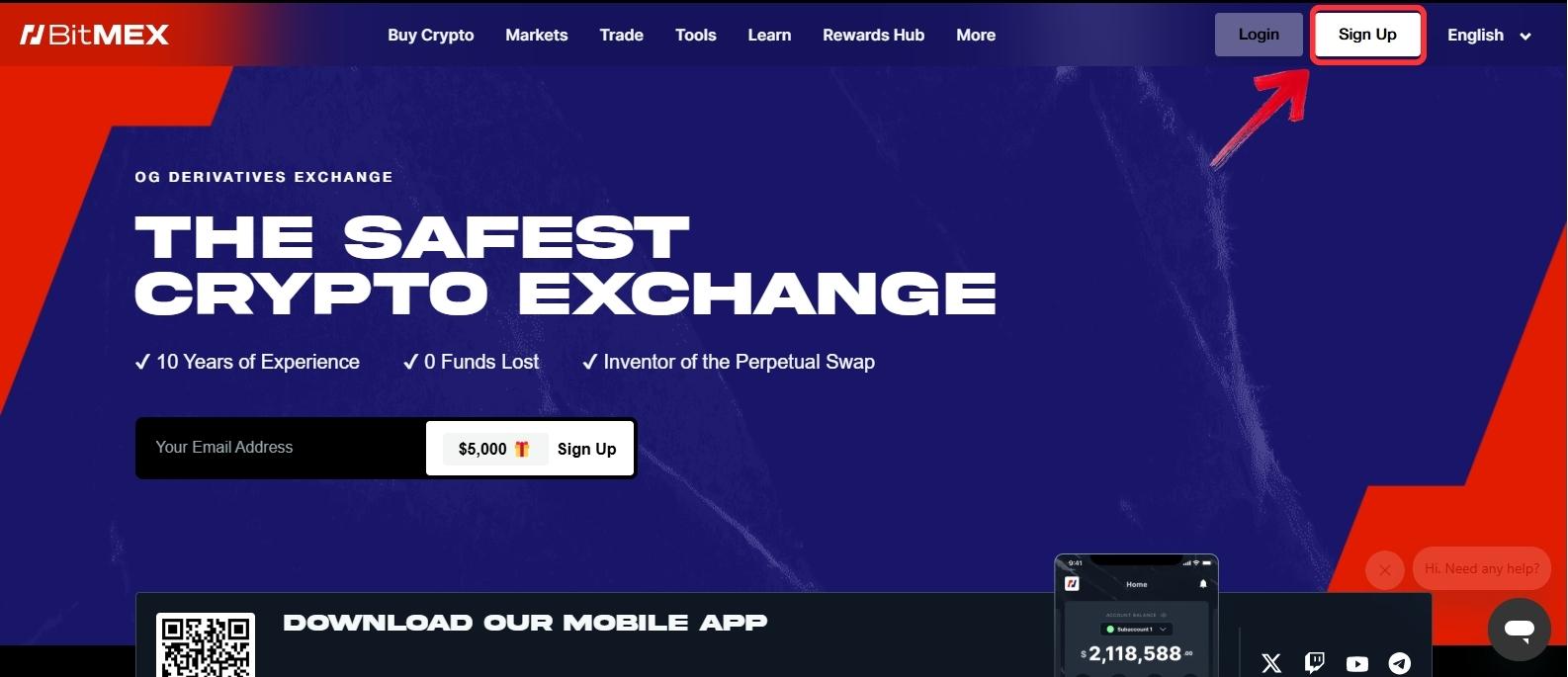

Signing up on BitMEX is very straightforward. You can create a new account using your email address and verify it within minutes. However, to enable trading and access all of BitMEX’s features, you’ll need to complete the full verification process. This involves submitting both proof of identity and proof of address. Once verified, you can deposit funds, withdraw, and start trading without restrictions.

Using a referral code during sign-up can also unlock extra benefits. The exclusive BitMEX referral bonus; K9yOte, makes you eligible for up to $5,000 in trading bonuses and gives you an additional 10% discount on trading fees. Here’s how you can get started with BitMEX:

Step 1: Open your browser and go to the official BitMEX website. Click on the “Sign Up” button at the top right.

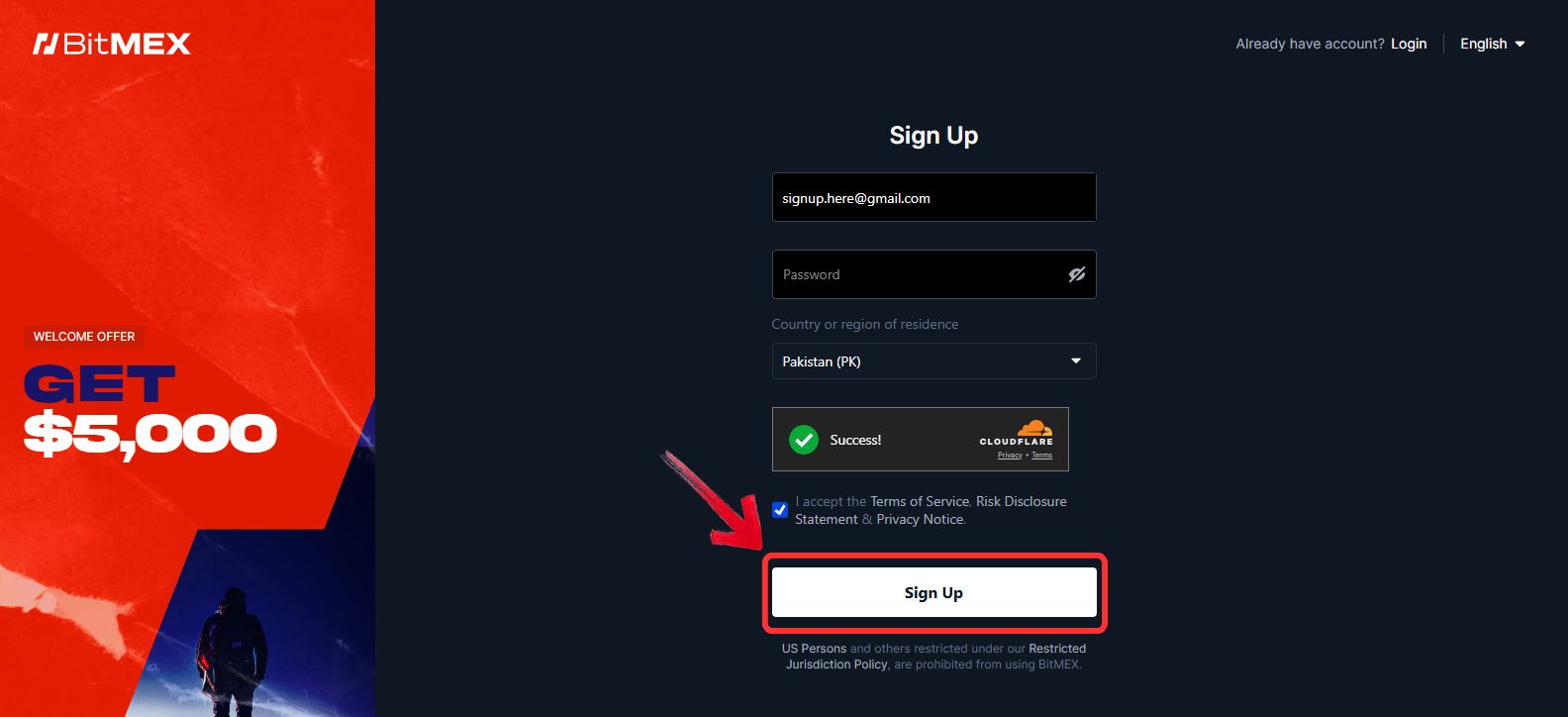

Step 2: Enter your email address, create a strong password, and click “Sign Up” to continue.

Step 3: You’ll receive a 6-digit verification code in your email. Open your inbox, enter the code, and your BitMEX account will be created.

From here, you’ll need to complete the required KYC verification before trading. Keep your national ID or driver’s license handy to complete proof of identity. For proof of address, you can submit a utility bill, a bank maintenance certificate, or even allow BitMEX to confirm your location through GPS. Once everything is submitted, verification is usually completed within a few minutes.

The process is simple, but because of AML and compliance regulations, BitMEX services are restricted in several regions. To avoid running into issues, you can use our BitMEX Country Checker to see whether your region is supported before signing up.

🌍 Free BitMEX Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, BitMEX does not support every country. To ensure that you are eligible to register on the exchange, you can use our free BitMEX country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

BitMEX Trading

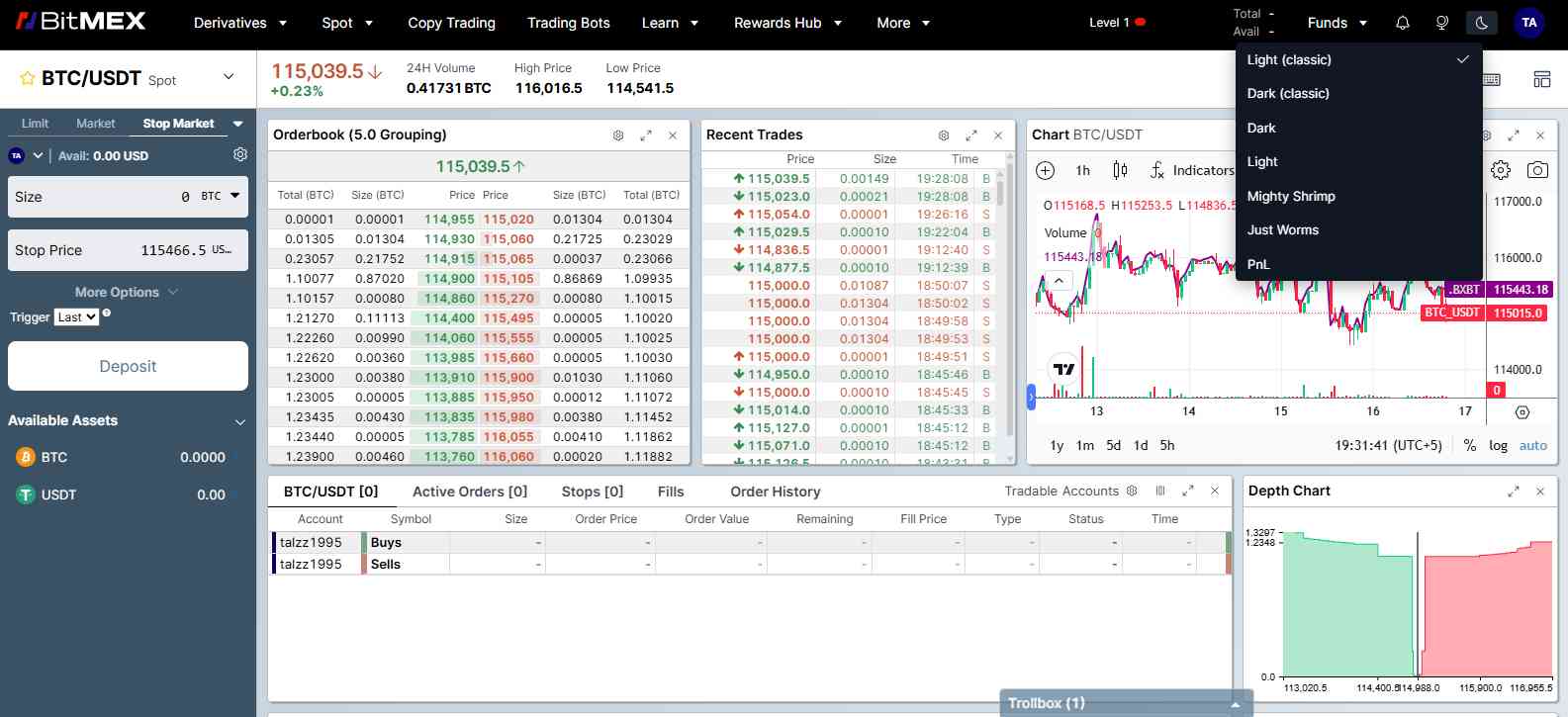

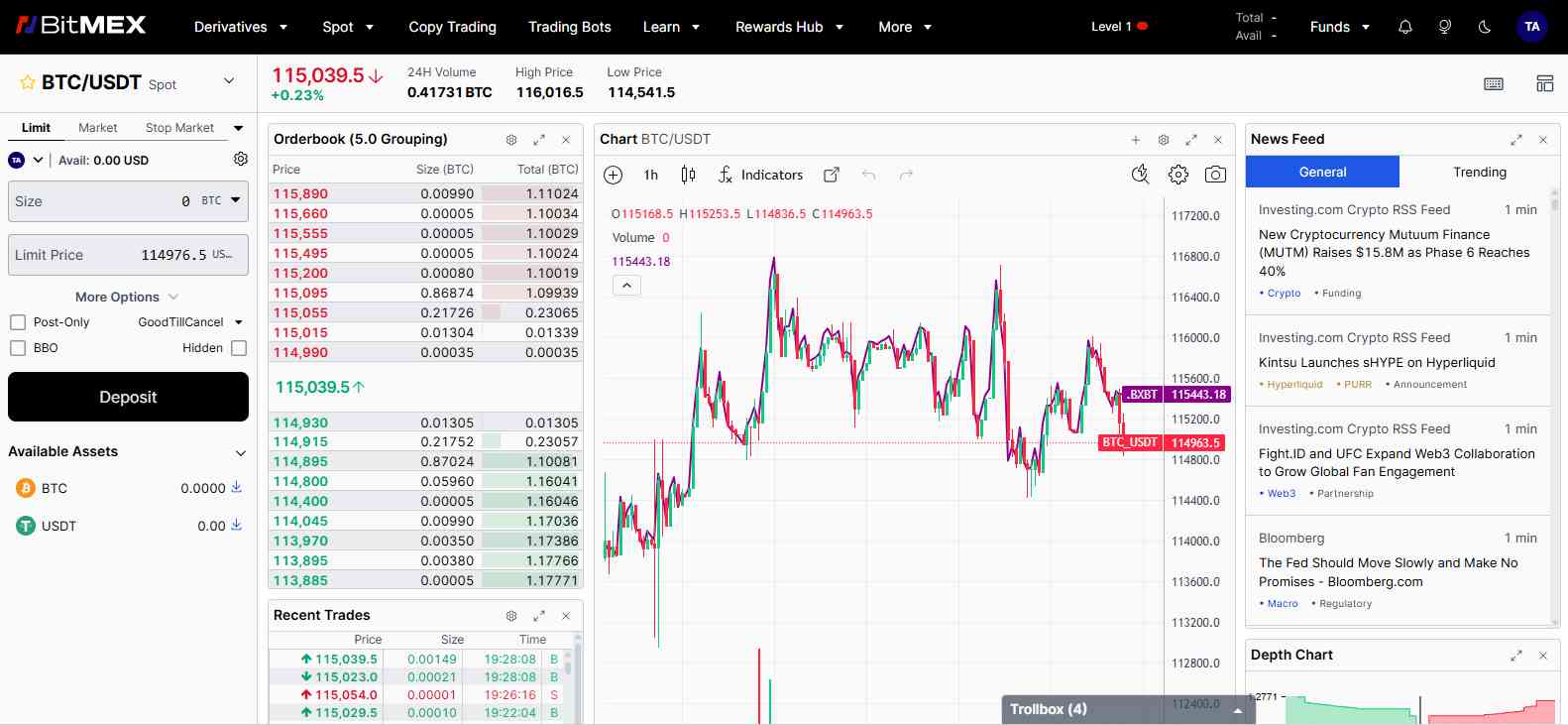

The BitMEX trading platform is designed to be functional and user-friendly, making it easy to navigate even for newer traders. The interface is clean and integrates TradingView charts, giving users access to live price charts, a wide range of indicators, and essential charting tools.

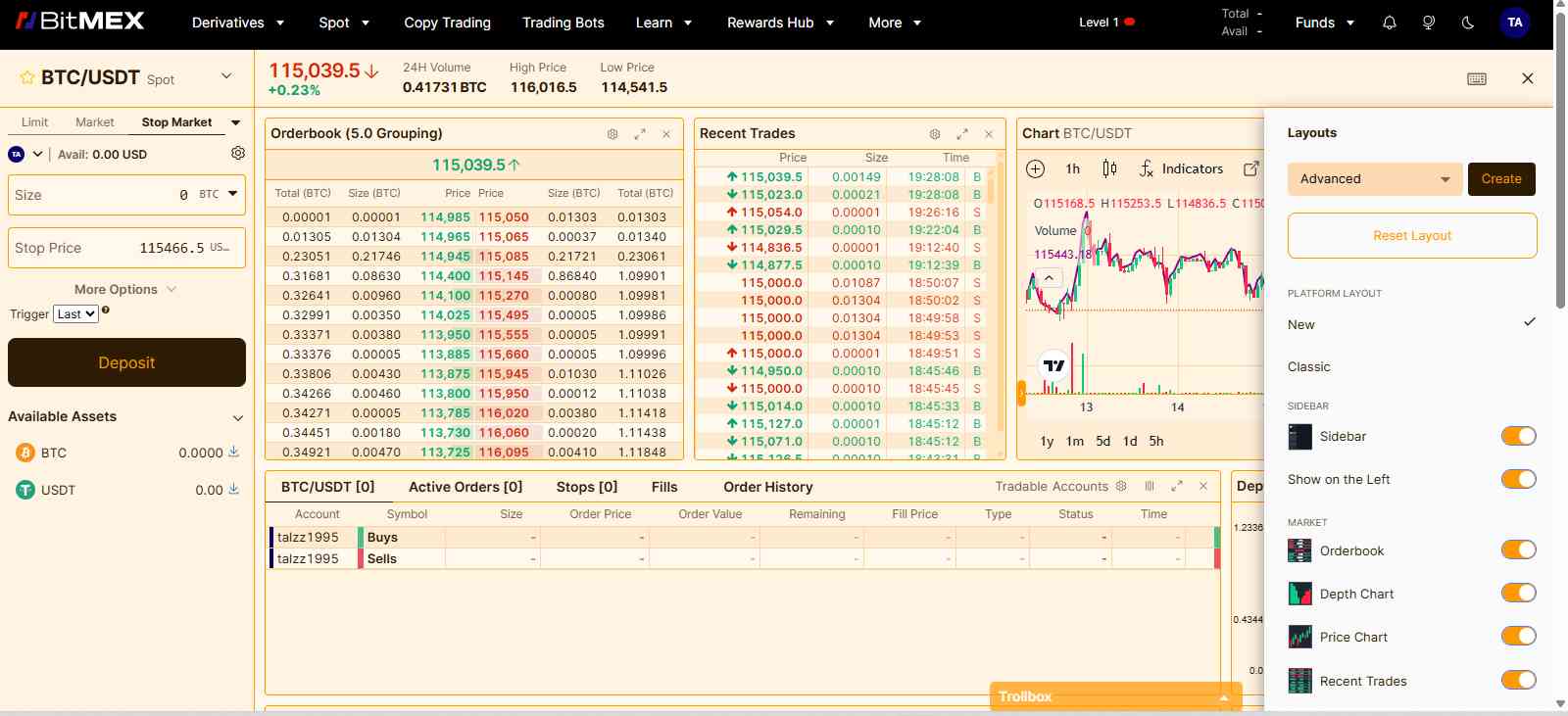

On the right side of the screen, the order panel provides two simple fields to place orders, keeping the layout uncluttered. Just above this section are two key options: Layout Setup and Modification Menu. The Layout Setup allows traders to customize their view by adding or removing elements such as the order book or recent trades panel, or by creating a fully custom trading layout. The Modification Menu offers features like enabling hotkeys, which can make order execution faster for experienced users.

BitMEX also includes a social feature called the Trollbox, a chat area where traders from around the world can share market commentary and ideas in real time.

When it comes to order types, BitMEX supports a full range of options. In addition to the standard market and limit orders, traders can use advanced types like Chaser, Stop Limit/Market, Trailing Stop, and Take Profit Limit/Market on both the spot and derivatives markets.

One notable touch is BitMEX’s theme customization. Traders can choose from multiple interface themes, such as Light, Dark, and playful options like “Mighty Shrimp” or “Just Worms”, allowing for a more personalized experience. The only downside observed was the order book liquidity and spreads, spreads felt wider than expected, and the liquidity was not very deep.

Spot Trading

BitMEX offers spot trading on just over 20 cryptocurrencies, and all pairs are denominated in USDT. The interface is smooth and easy to navigate, with a clean layout and TradingView integration for live charts and indicators.

Spot trading fees are set at 0.10% maker / 0.10% taker by default. These fees can be reduced by holding the native BMEX token or by achieving higher 30-day trading volumes, which unlock tiered discounts.

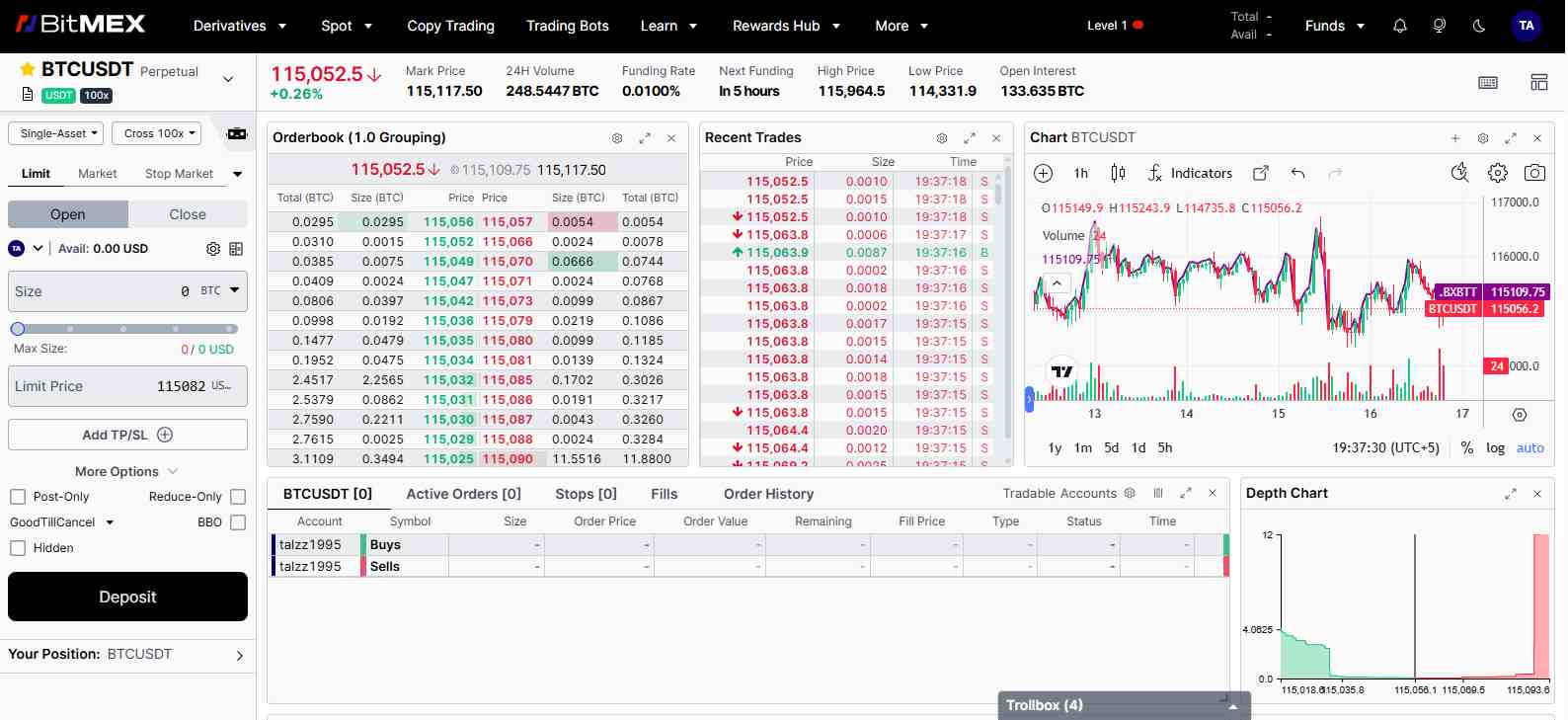

Derivatives Trading

Derivatives remain the core focus of BitMEX. The exchange offers 73+ perpetual trading contracts, with the majority paired against USDT and a few contracts available in EUR and USD as well. Traders can access up to 100x leverage on certain pairs, which makes BitMEX popular among professional and high-volume traders.

In addition to perpetuals, BitMEX lists 16+ futures contracts, giving users the option to trade with expiry dates when needed.

Trading fees for derivatives are simple and competitive, set at 0.05% maker / 0.05% taker, with the potential for fee reductions based on BMEX holdings or trading volume tiers.

BitMEX Deposits and Withdrawals Methods

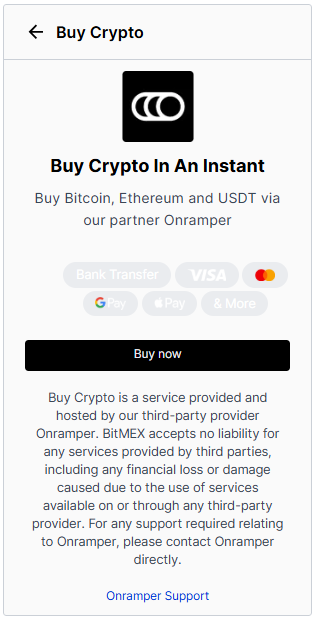

BitMEX currently does not offer its own native fiat on-ramp. Instead, it has integrated with Onramper, a third-party provider, to allow users to purchase crypto directly using various fiat payment methods. This option is available only for deposits.

For most users, deposits and withdrawals are handled through crypto network transactions, with support for major assets across multiple blockchains. This setup ensures fast and reliable transfers, but it means users must already hold crypto or buy through a supported on-ramp before they can start trading.

BitMEX Fees

Let’s take a closer look at the fees charged by BitMEX across its products and services.

Trading Fees

BitMEX follows a simple, competitive fee model across its products. Spot trading fees start at 0.10% maker and 0.10% taker, while derivatives trading fees are slightly lower at 0.05% maker and 0.05% taker. Both spot and derivatives follow a tiered fee structure based on 30-day trading volume. The higher the volume, the lower the fees, with VIP 5 traders (over $250,000,000 in monthly volume) paying as little as 0.0150% maker and 0.0320% taker on derivatives.

Spot fees can also drop to 0.0450% maker and taker at the highest tier. These discounts are not limited to volume-based traders. Holders of the BMEX token can also climb the VIP ladder, with 2,000,000 BMEX unlocking VIP 5 status and granting the same fee reductions even without reaching the required trading volume.

Spot Fees

0.10% Maker

0.10% Taker

Future Fees

0.05% Maker

0.05% Taker

Deposits and Withdrawals Fees

BitMEX does not charge any fees for deposits or withdrawals. The integrated Onramper fiat ramp also has no platform fees, though third-party charges may apply. Crypto deposits and withdrawals are completely free, with users only paying standard blockchain network fees when moving funds on-chain.

BitMEX Products and Services

Every exchange structures its products and services to attract new users and provide value to existing ones.

BitMEX Trading

BitMEX is best known as the inventor of the perpetual swap, a product that shaped the entire crypto derivatives market. Its trading interface is clean and highly customizable, with integrated TradingView charts, multiple layout options, and hotkeys for faster order execution. Traders can enable or disable sections like the order book or recent trades, build custom layouts, and even switch between different interface themes such as Light, Dark, or fun options like “Mighty Shrimp”.

For advanced users, BitMEX includes professional-grade tools like trading bots, multi-charting, sub-accounts for portfolio separation, and a live Tie News Feed for market updates directly within the platform. The social Trollbox feature adds a community aspect, letting traders interact in real time. Together, these tools make BitMEX a strong choice for users who want a mix of functionality, speed, and customization in their trading setup.

Mobile App

The BitMEX mobile app carries a 4.2-star rating on the App Store and mirrors the full functionality of the desktop platform. Available for both iOS and Android, the app is intuitive and easy to navigate, with no hidden sub-menus or complicated steps. Traders can access charts, place orders, manage positions, and even customize layouts directly from their mobile devices, making it ideal for trading on the go.

BMEX Token

BMEX is BitMEX’s native exchange token and offers multiple utilities for active users. It can be staked on the platform to get additional benefits such as fee discounts and VIP tier upgrades. Holding BMEX allows traders to climb the VIP ladder faster and access the same lower fee rates offered to high-volume accounts without meeting the trading volume requirement, giving long-term users a clear incentive to hold and stake.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

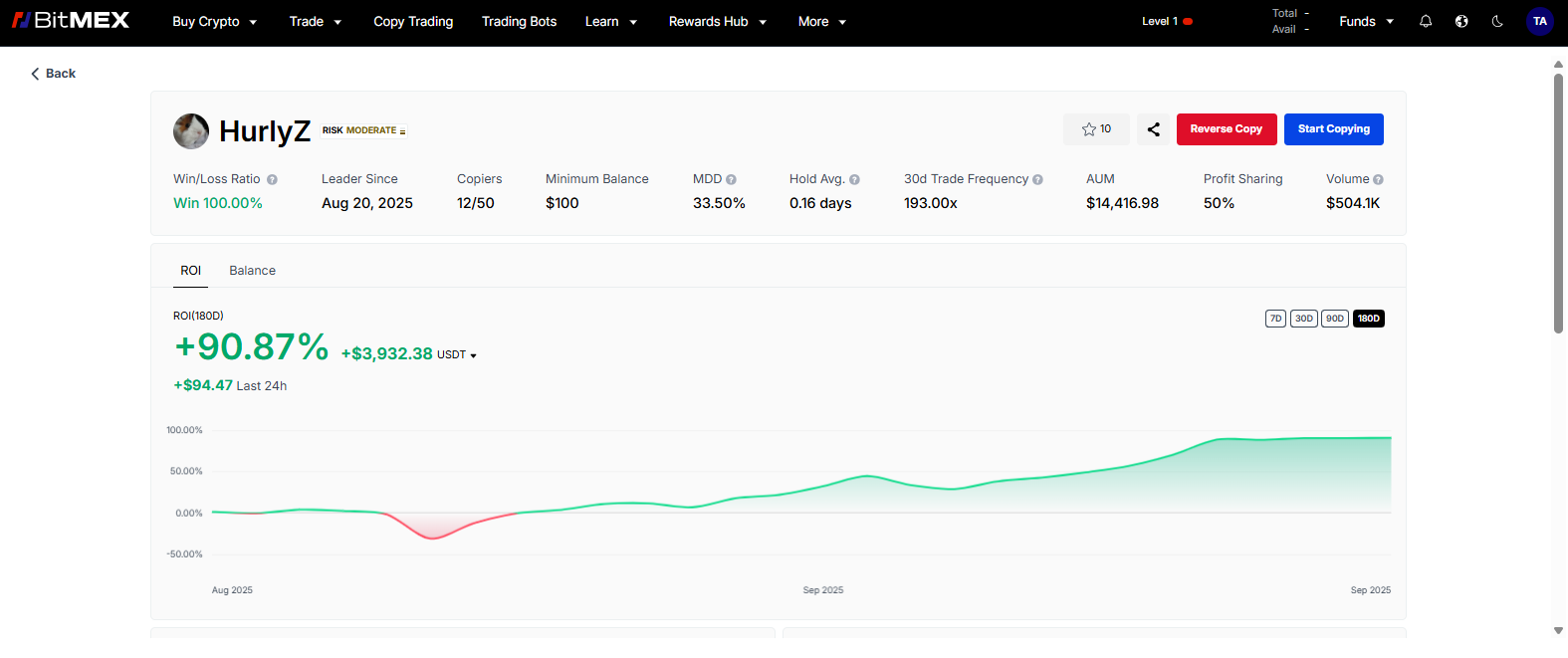

Copy Trading

BitMEX’s Copy Trading tool lets users mirror the strategies of experienced traders in real time. You can choose funding amount, set Stop Loss, and Take Profit levels before copying trades. There’s no cap on profit sharing, which can be a drawback, some traders take as much as 50% of the profits from successful trades. Still, it’s a convenient option for those who prefer to follow proven strategies instead of trading manually.

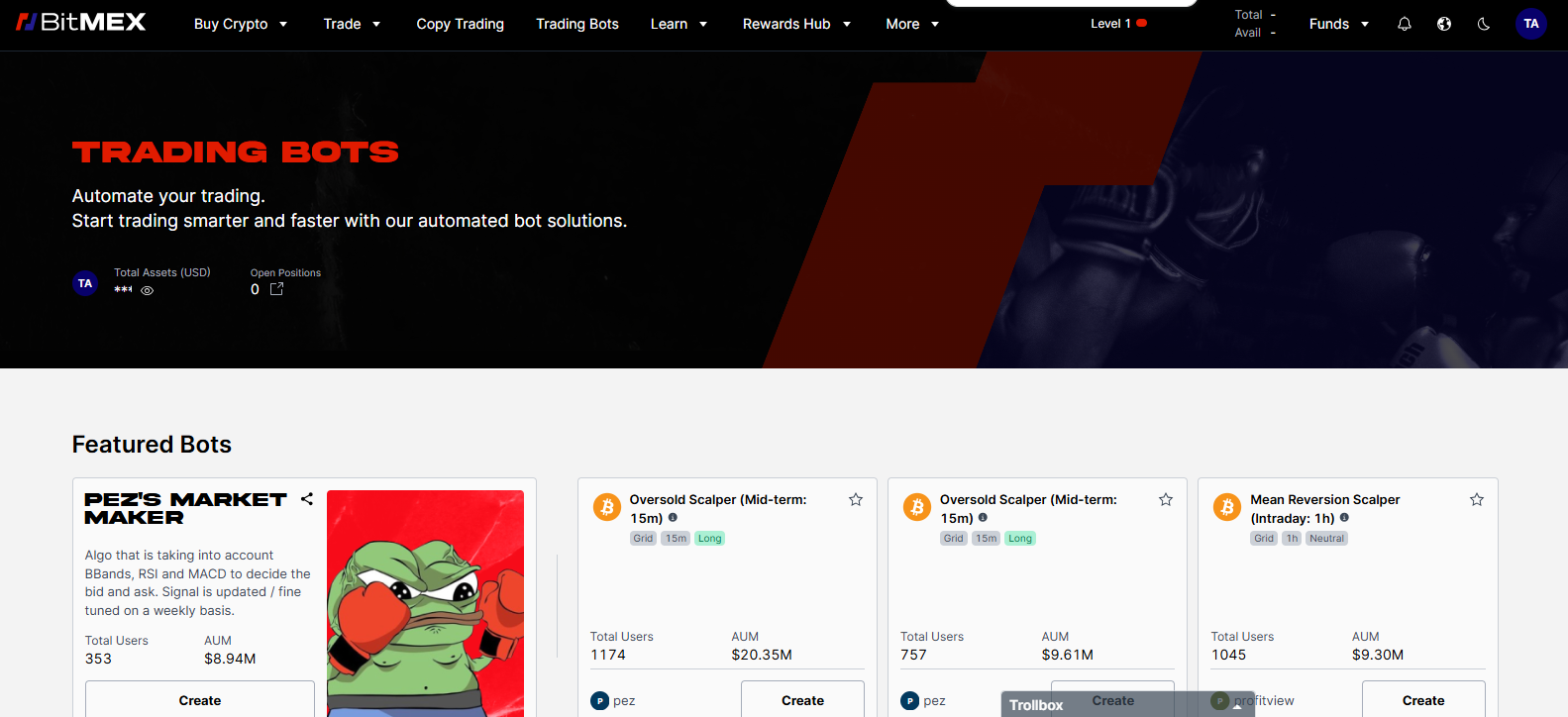

Trading Bots

BitMEX offers an entire marketplace of pre-built, tested trading bots designed to automate strategies. Examples include Pez’s Market Maker, which uses BBands, RSI, and MACD signals, and various scalpers like the Oversold Scalper and Mean Reversion Scalper with thousands of active users and millions in AUM. These bots help traders execute trades faster and smarter with strategies that are updated and fine-tuned regularly, removing much of the manual effort from trading.

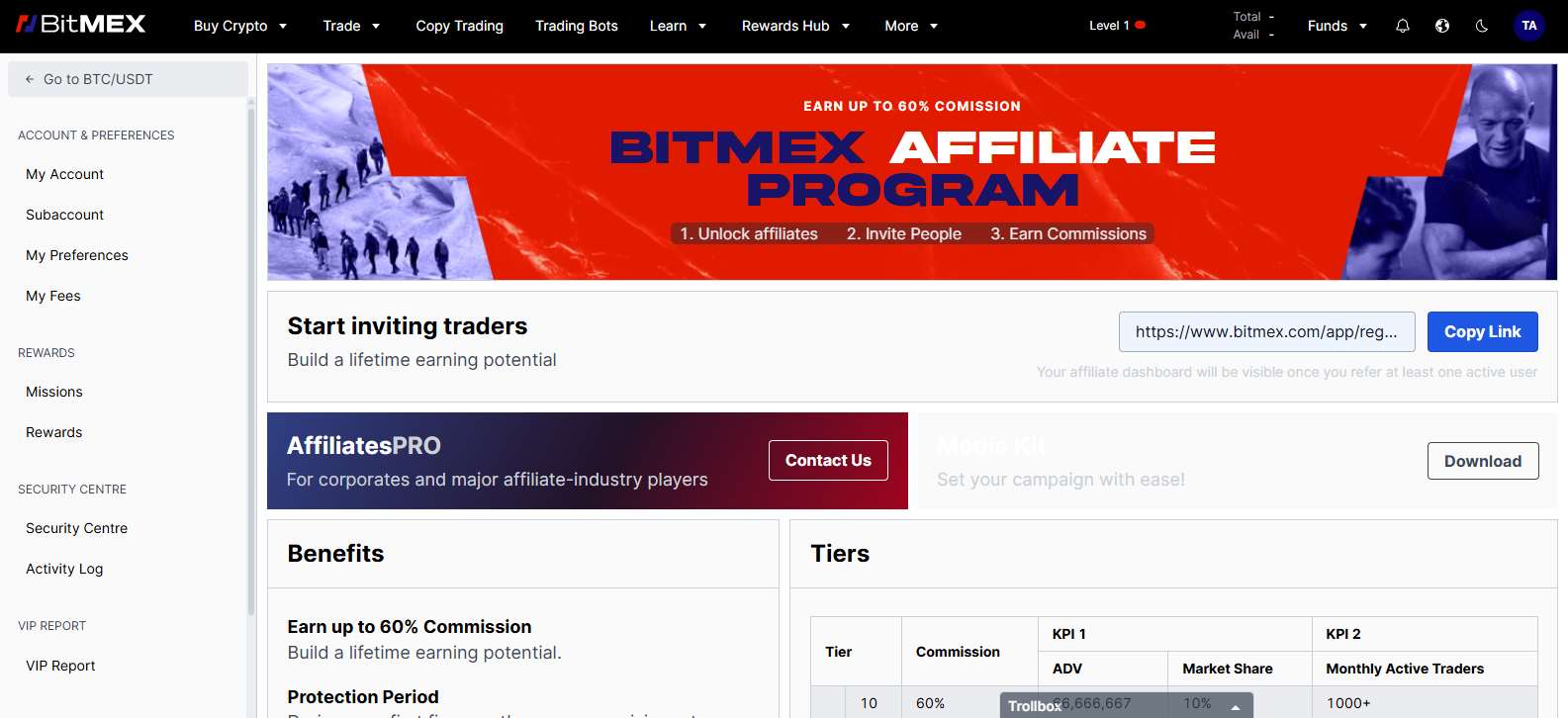

Affiliate Program

BitMEX’s Affiliate Program allows partners to earn up to 60% commission, creating the potential for lifetime earnings. During the first five months, commission rates can only increase based on performance. The platform also provides access to charts and data insights to help affiliates optimize their campaigns and track progress effectively. This program is designed for marketers and influencers looking to monetize their audience while promoting one of the most established derivatives exchanges.

BitMEX Security

BitMEX takes a layered approach to security, combining advanced technology with strict operational controls. Bitcoin custody relies on a multi-signature wallet system, with a quorum of signers required for transfers and no private keys stored on cloud servers. Other assets use secure MPC technology, distributing keys to remove single points of failure.

Balances are cross-verified with on-chain data every 10 minutes, and transactions require multiple signatures and Hardware Security Module (HSM) validation before processing. Client funds are fully segregated, never lent or rehypothecated.

Since launching in 2014, BitMEX has reported zero customer fund losses due to hacks. The exchange also maintains a publicly accessible Proof of Reserves and Liabilities, ensuring full transparency.

Want to stop using BitMEX? You can follow our step-by-step guide on how to delete your BitMEX account.

BitMEX Customer Support

BitMEX provides 24/7 online chat support directly on its platform, allowing users to get quick assistance with account issues, trading questions, or technical concerns. Beyond direct support, BitMEX also offers BitMEX Learn, a comprehensive resource hub that covers platform features, trading guides, and general blockchain education, making it a valuable tool for both beginners and experienced traders.

On mobile, live chat support is not embedded within the app. Instead, users are redirected to a dedicated Telegram support channel, where BitMEX representatives handle queries in real time. This ensures that mobile users still have access to help whenever needed, though the experience is slightly different from the desktop version.

BitMEX Alternatives

BitMEX is a well-established exchange for margin trading, but if you’re looking for alternatives, consider these:

- Bybit: Offers a similar range of features with deep liquidity, and a large user base.

- BYDFi: If you prefer no KYC requirements, BYDFi is a good choice with high leverage and a wide selection of cryptocurrencies.

- Bitunix: Another solid no-KYC option with a user-friendly platform and high leverage

| Feature | BitMEX | Bybit | BYDFi | Bitunix |

|---|---|---|---|---|

| Established | 2014 | 2018 | 2019 | 2022 |

| Spot Fees (Maker/Taker) | 0.10% / 0.10% | 0.10% / 0.10% | 0.00% / 0.10% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.05% / 0.05% | 0.020% / 0.055% | 0.020% / 0.060% | 0.020% / 0.060% |

| Max Leverage | 100x | 100x | 200x | 125x |

| KYC Required | Yes | Yes | No | No |

| Supported Cryptos (Spot) | 20+ | 726+ | 801+ | 541+ |

| Futures Contracts | 73+ | 578+ | 421+ | 400+ |

| No KYC Withdrawal Limit | Not Allowed | Not Allowed | 1 BTC | $500,000 |

| 24h Futures Volume | $631.41M+ | $23.24B+ | $4.75B+ | $4.45B+ |

| Trading Bonus | None | $30,000 | $300 | $5,500 |

| Key Features | • One of oldest exchanges • Customizable trading interface • Strong security features |

• Advanced trading features • High liquidity • Multiple trading bots |

• No KYC required • Highest leverage (200x) • Zero-fee spot trading |

• Very user-friendly • No KYC required • Multiple fiat options |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

BitMEX is a KYC-mandatory exchange that remains one of the most recognized names in crypto derivatives trading. Known for inventing the perpetual swap and for its strong security track record, BitMEX has never lost customer funds since its launch in 2014. Its platform focuses on derivatives with deep liquidity, up to 100x leverage, and advanced tools like trading bots, copy trading, and customizable layouts.

Spot trading is available but limited to just over 20 USDT pairs, keeping the main focus on futures and perpetual contracts. With competitive fees, a transparent Proof of Reserves system, and a decade of uninterrupted operations, BitMEX is best suited for traders seeking a professional environment to trade derivatives confidently and securely.

FAQs

1. Is BitMEX a secure crypto exchange for investors?

Yes, BitMEX is considered highly secure. It uses multi-signature cold storage, MPC for other assets, regular on-chain balance checks, and has never lost customer funds since its launch in 2014.

2. How long does a withdrawal from BitMEX typically take?

Withdrawals from BitMEX are processed daily, with requests submitted before 13:00 UTC included in the day’s batch processing, prioritizing the security of users’ funds.

3. Does BitMEX support multiple languages?

Yes, BitMEX supports a variety of languages, such as Japanese, English, Russian, Korean, and Chinese, ensuring a global reach and inclusivity within the crypto community.

4. Does BitMEX require KYC verification?

Yes, BitMEX is a fully KYC-mandatory exchange. Users must complete identity and address verification before trading, depositing, or withdrawing funds.

5. What are the trading fees on BitMEX?

Spot trading fees are 0.10% maker/taker, while derivatives fees are 0.05% maker/taker. Fees can be reduced further by holding BMEX tokens or reaching higher 30-day trading volume tiers.