Investing in cryptocurrency is generally legal across most Asian countries, albeit with varying regulations. Countries like Japan and the Philippines recognize and regulate digital assets as legitimate forms of payment or assets. On the contrary, China has banned ICOs and trading, but mere possession of cryptocurrency is not prohibited.

When it comes to the most significant regulatory bodies in the region, countries like Singapore and the Monetary Authority of Singapore stand out as pioneers in their region, endorsing trade and fostering opportunities within the crypto finance sector.

Evaluating the Top 6 Cryptocurrency Exchanges in Asia

Evaluating various cryptocurrency exchanges to compile a list of the top 6 accessible platforms in Asia. Continue reading to explore crucial details about the best cryptocurrency exchanges for traders in the region.

Discover the top crypto exchanges in Asia:

- Bitunix – no-KYC, User-friendly, 125x leverage

- MEXC – No KYC, Extensive Altcoin Selection, Lowest fees

- Bybit – Low fees, 100x leverage, 600+ tokens.

- Phemex – Semi centralized with DAO, On-chain proof of funds.

- Binance – Extensive assets, advanced features, low fees, VASP MBP license granted by VARA.

- Kraken – Transparency and security, 24/7 platform surveillance.

| Exchange | Cryptos | Spot Fees | Future Fees | Max Leverage | Bonus | KYC |

|---|---|---|---|---|---|---|

| 1. Bitunix | 317+ | 0.10% / 0.10% | 0.02% / 0.06% | 125x | $5,500 | No |

| 2. MEXC | 2437+ | 0.00% / 0.02% | 0.00% / 0.02% | 200x | $20,000 | No |

| 3. Bybit | 660+ | 0.10% / 0.10% | 0.02% / 0.055% | 100x | $30,000 | Yes |

| 4. Phemex | 355+ | 0.10% / 0.10% | 0.01% / 0.06% | 100x | $8,800 | No |

| 5. Binance | 414+ | 0.10% / 0.10% | 0.02% / 0.05% | 125x | $100 | Yes |

| 6. Kraken | 323+ | 0.16% / 0.26% | 0.02% / 0.05% | 50x | None | Yes |

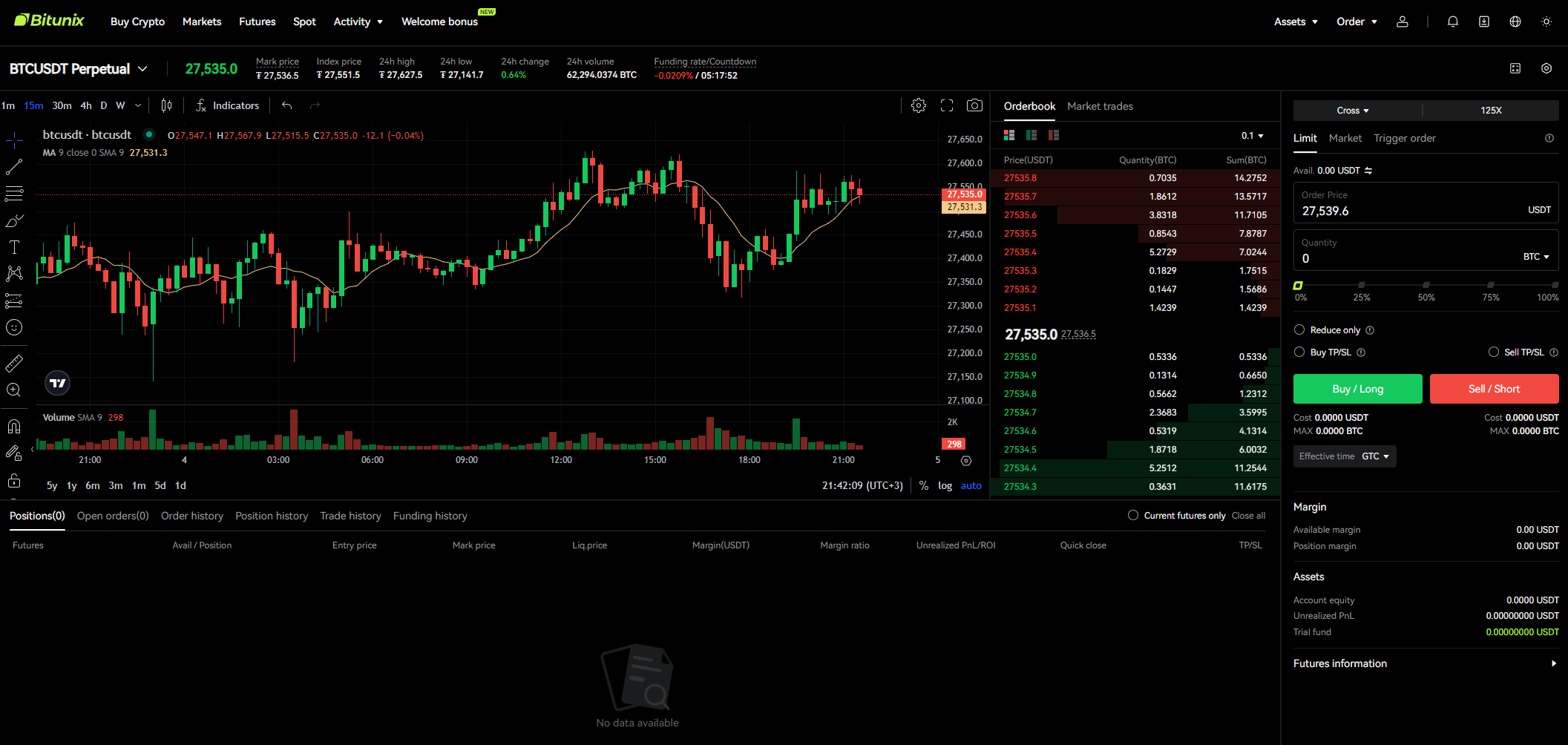

1. Bitunix

Bitunix is a Hong Kong-based cryptocurrency derivatives exchange that was founded in November 2021. It is acknowledged as the top no-KYC cryptocurrency exchange. In some regions of Asia and Africa, it is a strictly regulated exchange. Bitunix offers a plethora of functions and services with an intuitive UI. The platform is a fantastic option for users of all skill levels.

For the futures market, Bitunix imposes minimal fees, starting at 0.06% taker and 0.02% maker. In spot trading, it does, however, impose the industry standard taker/maker fee of 0.1%.

Bitunix allows users to deposit money on the platform using a variety of payment methods, including bank transfers, credit/debit cards, Apple Pay, Coinify, and Fatpay.

With a daily trading volume of over $7 billion, Bitunix is one of the most active crypto exchanges in Asia. The exchange supports more than 200 cryptocurrencies for trading. It has become a reliable spot and derivatives trading platform where users can get up to 125X leverage on their perpetual futures trading contracts.

A comprehensive mobile app is supported for crypto enthusiasts. Looking to trade on the go

If you want to learn more about the platform, you can read our full Bitunix review.

Spot Fees: 0.1% maker / 0.1% taker

Futures Fees: 0.02% maker / 0.06% taker

Supported Cryptos: 150+

Futures Contracts: 320+

Payments: Credit/Debit card, Bank transfer, third-party payments

Customer Support: Multi-language chat support 24/7

Bitunix Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ User-friendly crypto exchange | ❌ Limited Payment Methods |

| ✅ High liquidity with minimal slippage | ❌ $10 minimum deposit |

| ✅ Strong security with cold wallets and reserve funds | ❌ Only supports crypto withdrawals |

| ✅ No KYC required | |

| ✅ Supports 540 + spot assets & 400 + futures, with $6.4 B daily futures volume |

2. MEXC

MEXC positions itself as a highly versatile cryptocurrency exchange in Asia, particularly in Singapore, the country from which it originates, providing users with access to an extensive range of cryptocurrencies. Distinguishing itself with the lowest trading fees and an impressive selection of over 1600 supported cryptos, MEXC emerges as the preferred choice for those eager to explore the diverse world of altcoins.

A notable feature of MEXC is its non-facilitation of fiat exchange or withdrawals, confining traders to acquire coins exclusively with US dollars and potentially explore P2P networks for cashing out.

Despite this limitation, MEXC compensates by offering a comprehensive suite of services, including margin trading, EFT indices, and a futures market, ensuring a multifaceted trading experience. Furthermore, the exchange goes beyond traditional offerings by supporting various fan tokens and regularly organizing engaging sports betting campaigns, adding an extra layer of excitement for its user base. With nearly 7 million users from 200 different countries and a trading volume of 2.7 billion, MEXC stands out as one of the most favored exchanges in Asia.

If you want to learn more about the platform, you can read our full MEXC review.

Spot Fees: 0.1% flat

Futures Fees: 0% maker / 0.02% taker

Supported Cryptos: 1600+

Futures Contracts: 400+

Payments: Bank transfer, P2P

Customer Support: Multi-language customer support 24/7

MEXC Pros and Cons

| 👍 MEXC Pros | 👎 MEXC Cons |

|---|---|

| ✅ 1700+ Cryptos | ❌ No NFT Market |

| ✅ Copy Trading | ❌ Lacks passive income products |

| ✅ Up to 200x Leverage | ❌ No Fiat Deposits/Withdrawals |

| ✅ Very User Friendly |

3. Phemex

Phemex, a prominent cryptocurrency exchange based in Singapore, distinguishes itself with swift and efficient crypto purchases, facilitating various payment methods and processing transactions at an impressive speed of 300,000 per second. Notably, the platform provides a non-KYC option, enabling users to deposit, withdraw, and trade without verification, appealing to both privacy-conscious and verified users.

The user-friendly interface caters to beginners, and detailed charts powered by TradingView enhance the experience for expert traders. Phemex’s support for crypto staking adds another dimension, offering opportunities for passive income with competitive Annual Percentage Yields (APYs) of up to 19.0%. Whether seeking swift transactions, a user-friendly interface, or staking opportunities, Phemex provides a comprehensive solution for crypto enthusiasts in Asia.

If you want to learn more about the platform, you can read our full Phemex review.

Spot Fees: 0.1% maker/taker

Futures Fees: 0.01% maker and 0.06% taker

Supported Cryptos: 360+

Futures Contracts: 230+

Payments: P2P Mainly (Supports PayPal, Apple Pay, Google Pay, Skrill and more)

Customer Support: 24/7 live chat support

Phemex Pros and Cons

| 👍 Phemex Pros | 👎 Phemex Cons |

|---|---|

| ✅ Wide Crypto Coins Range | ❌ Lacks Fiat & Options Trading |

| ✅ No KYC Required | ❌ Limited OTC Trading |

| ✅ Copy Trading | |

| ✅ Great Mobile Application |

4. Bybit

Bybit plays a significant role in Asia’s cryptocurrency landscape, offering a variety of deposit methods for activities like buying, selling, and trading across a diverse portfolio of 480+ digital assets. Operating globally, but located in Dubai as mentioned in our article, Bybit stands out with a user-friendly interface, robust security measures, and advanced trading features. The platform caters to the needs of both novice and experienced traders in Asia, providing a substantial security fund and transparent practices. With an impressive trading volume of almost $6.5 billion, Bybit solidifies its position as a key player in the world of cryptocurrency exchanges in Asia.

If you want to learn more about the platform, you can read our full Bybit review.

Spot Fees: 0.1% maker / 0.1% taker

Futures Fees: 0.02% maker / 0.055% taker

Supported Cryptos: 430+

Futures Contracts: 240+

USD Payments: P2P mainly, credit card

Customer Support: 24/7 live chat support

Bybit Pros and Cons

| 👍 Bybit Pros | 👎 Bybit Cons |

|---|---|

| ✅ Low trading fees | ❌ Highly advanced for beginners |

| ✅ Many options to fund the account | ❌ Fiat withdrawals only via P2P |

| ✅ User-friendly interface | |

| ✅ Passive income products | |

| ✅ Over 400 cryptocurrencies | |

| ✅ Copy Trading | |

| ✅ Full Proof of reserves |

5. Binance

Binance stands as a global cryptocurrency giant, serving over 100 million registered users in Asia. This exchange offers an extensive array of over 1000 trading pairs across various categories, including spot, margin, futures, and options trading. Binance charges variable deposit fees depending on the method used, while withdrawals are typically free. The spot trading fee is set at a competitive 0.1%, with attractive maker and taker rebates of 0.02% and 0.04%, respectively, available for derivative trading.

Binance FZE has obtained a Virtual Asset Service Provider (VASP) MVP license from the Virtual Asset Regulatory Authority (VARA). This license authorizes Binance FZE to offer VARA-approved services, including Exchange Services, Broker Dealer Services, and Payments, with an initial focus on qualified investors. Thanks to that, Biannce provides an extra layer of security and compliance. Users who prioritize operating within a regulated environment may find this appealing. Binance offers 24/7 customer support through live chat, email, and an online ticketing system, ensuring users in Asia have access to assistance when needed. Asian users can conveniently deposit local currencies through various methods, including credit/debit cards, bank transfers, SEPA transfers.

If you want to learn more about the platform, you can read our full Binance review.

Spot Fees: 0.1% maker / 0.1% taker

Futures Fees: 0.02% maker / 0.05 taker

Supported Cryptos: 385+

Futures Contracts: 300+

Payments: Multiple deposit methods, including credit/debit cards, bank transfers, SEPA transfers

Customer Support: 24/7 live chat support

Binance Pros and Cons

| 👍 Binance Pros | 👎 Binance Cons |

|---|---|

| ✅ Extensive selection of trading pairs | ❌ Limited futures fees information |

| ✅ Competitive trading fees | |

| ✅ Regulatory oversight by VARA in Dubai | |

| ✅ 24/7 customer support | |

| ✅ Diverse deposit methods |

6. Kraken

Kraken is globally recognized as a leading cryptocurrency exchange, serving over 10 million users in Asia and more. Renowned for its unwavering commitment to transparency and security, the exchange implements robust security protocols, including two-factor authentication, compliance with regulations across over 190 countries, withdrawal whitelist functionality, and continuous 24/7 platform monitoring. This approach fosters a high level of trust among users in Asia.

Notably, Kraken’s dedication to transparency extends to its fee structures and regular audits, earning praise from its user community. The platform consistently provides audited proof of reserves, assuring customers in Asia that their assets are always held at a 1:1 ratio on the platform. This emphasis on transparency and security aims to instill confidence and peace of mind among Kraken’s clientele.

Positioning itself as a versatile and budget-friendly platform, Kraken caters to a diverse range of cryptocurrency traders in Asia, from beginners to seasoned experts. Its standout feature is its competitive pricing, particularly evident on Kraken Pro and in the futures markets. However, it’s important to acknowledge that the interface complexity of Kraken Pro may pose a learning curve for newcomers. For those prioritizing simplicity, exploring alternative options becomes essential. With support in over 190 countries, a user base exceeding 10 million, and a quarterly trading volume surpassing 207 billion, Kraken distinguishes itself for its versatility, accommodating both small and large-scale investors in Asia.

If you want to learn more about the platform, you can read our full Kraken review.

Spot Fees: 0.16% maker, 0.26% taker

Futures Fees: 0.02% maker, 0.05% taker

Supported Cryptos: 190+

Futures Contracts: 500+

Payments: apple or google pay, Wire transfer, credit card

Customer Support: 24/7 Support

Kraken Pros and Cons

| 👍 Kraken Pros | 👎 Kraken Cons |

|---|---|

| ✅ User-friendly interface | ❌ Slow account funding process |

| ✅ Offers advanced trading features | ❌ Costly hacks with limited support |

| ✅ Low fees for advanced traders | ❌ Higher transaction fees on the main platform compared to Kraken Pro |

Is Crypto Legal in Asia?

In Asia, the legality of cryptocurrency varies across countries, with differing regulations on taxation and treatment of digital assets. While many countries have established tax systems for crypto transactions, the rates and rules vary, often treating gains as capital gains subject to different tax categories. Some countries apply progressive rates based on profit margins.

Cryptocurrency investing is generally legal in most Asian countries, but specific regulations differ. For instance, countries like Japan and the Philippines have legalized and regulated digital assets, considering them forms of payment or assets. However, in countries like China, ICOs and trading are banned, although the possession of crypto itself is not illegal.

Individuals looking to invest in digital currencies in Asia should be aware of and adhere to their respective country’s laws and regulations. It is crucial to use reputable and secure exchanges that comply with local regulations and have robust security measures to protect investments.

Potential investors in Asia must be well-versed in their country’s specific laws and regulations regarding digital currencies. Opting for reputable and secure exchanges that comply with local regulations and prioritize robust security measures is crucial to safeguard investments. The recommended approach for cryptocurrency investment in Asia involves using exchanges approved by national financial authorities, enabling users to deposit and transact with local currencies like Japanese Yen, Chinese Yuan, or Indian Rupee through popular payment methods such as bank transfers, digital wallets, and major credit or debit cards.

How to Buy Crypto in Asia

For investors in Asia looking to enter the crypto market with their local currency, follow these steps:

- Choose a reputable exchange: Opt for platforms that comply with local regulations and have a trustworthy standing in the cryptocurrency space.

- Set up and authenticate your account: Sign up using your email, create a password, and undergo the KYC (Know Your Customer) process by providing identification and proof of address documents.

- Deposit funds in local currency: Fund your account with the local currency through bank transfers or other authorized payment methods.

- Acquire cryptocurrency: Select the cryptocurrency you wish to purchase, define the amount, and then confirm the transaction.

- Safeguard your investments: Strengthen the security of your cryptocurrencies by transferring them to a personal wallet.

Final Thoughts

In summary, the regulatory landscape for cryptocurrencies in Asia varies across countries, with some nations like Japan and the Philippines embracing digital assets as legal and regulated forms of payment or assets. However, others, like China, have imposed restrictions on certain crypto activities while not outright banning possession. Taxation on cryptocurrency transactions is also diverse, with different countries applying various rules, especially regarding gains, mining, and staking activities.

For investors in Asia, it is crucial to stay informed about the specific regulations in their respective countries and use reputable exchanges that adhere to local laws. Considering the comprehensive services and global popularity of MEXC, it emerges as a standout choice for Asian investors. With a diverse range of cryptocurrencies, low trading fees, and a multitude of trading pairs, MEXC provides a versatile and secure platform for those navigating the dynamic crypto landscape in Asia.

![How to Change the Language in Phantom [2026]](https://www.cryptowinrate.com/wp-content/uploads/2026/02/How-to-Change-the-Language-in-Phantom-2026-1024x576.jpg)