- •Tokenized silver provides silver price exposure without dealing with storage, transport, or physical security challenges.

- •Since few exchanges list tokenized silver, liquidity quality, platform security, and issuer backing matter more than brand recognition.

- •Tokens like $SLVON allow users to buy silver online, trade continuously, and hold highly fractional positions on-chain.

Currency debasement sits at the core of why crypto exists. As fiat money loses purchasing power, investors naturally look for hedges. Recently, that shift has pushed traditional hard assets higher, with silver seeing a sharp move as demand builds. At the same time, more people are searching for ways to buy silver online or buy tokenized silver, since holding physical bars comes with storage, security, and liquidity issues. Alongside this, real world asset tokenization is gaining momentum, with regulators openly discussing on-chain markets. So yes, tokenized silver is available, but careful selection matters. This guide explains where to buy tokenized silver and how to do so, step by step.

Where to Buy Silver Online

Buying tokenized silver starts with choosing the right platform, which matters more here than with standard crypto assets. Not every exchange supports real world asset tokens, and availability often depends on jurisdiction, custody setup, and compliance standards. Security, issuer credibility, on-chain transparency, and underlying metal backing should come first, followed by liquidity, fees, and withdrawal options.

Some platforms cater more to active traders, while others suit long term holders looking for a digital silver exposure without physical handling. To simplify that process, the table below highlights carefully selected exchanges that offer tokenized silver with solid liquidity.

How to Buy $SLVON on Ourbit

For buying $SLVON, Ourbit stands out as a practical choice, especially for users who want a simple setup without unnecessary friction. The platform allows quick account creation, with KYC kept optional, which means users can access spot markets faster compared to many regulated venues. This matters for tokenized metals, where timing and ease of entry often influence execution quality.

Cost structure is another key reason Ourbit was selected. Spot trading fees are set at 0%, which helps preserve exposure when buying tokenized silver rather than losing value to commissions. The interface is clean and intuitive, making it suitable for first time buyers who may be entering real world asset tokens for the first time.

Ourbit also offers signup bonuses of up to $10,000 when using an Ourbit bonus code. Importantly, the Ourbit exchange is available in the United States, allowing users to buy tokenized silver like $SLVON online through a compliant and accessible platform.

Here is how you can buy silver online on Ourbit using $SLVON, explained in a clear, step by step way.

Step 1: Open your browser and visit the official Ourbit website. New users need to create an account and verify their email address before accessing trading features.

Step 2: Once logged in, go to the homepage and click on the “Spot” tab in the top toolbar to enter the spot trading section.

Step 3: You will be redirected to the Ourbit spot interface. Use the search bar on the right side, type SLVON, and select the SLVON/USDT trading pair.

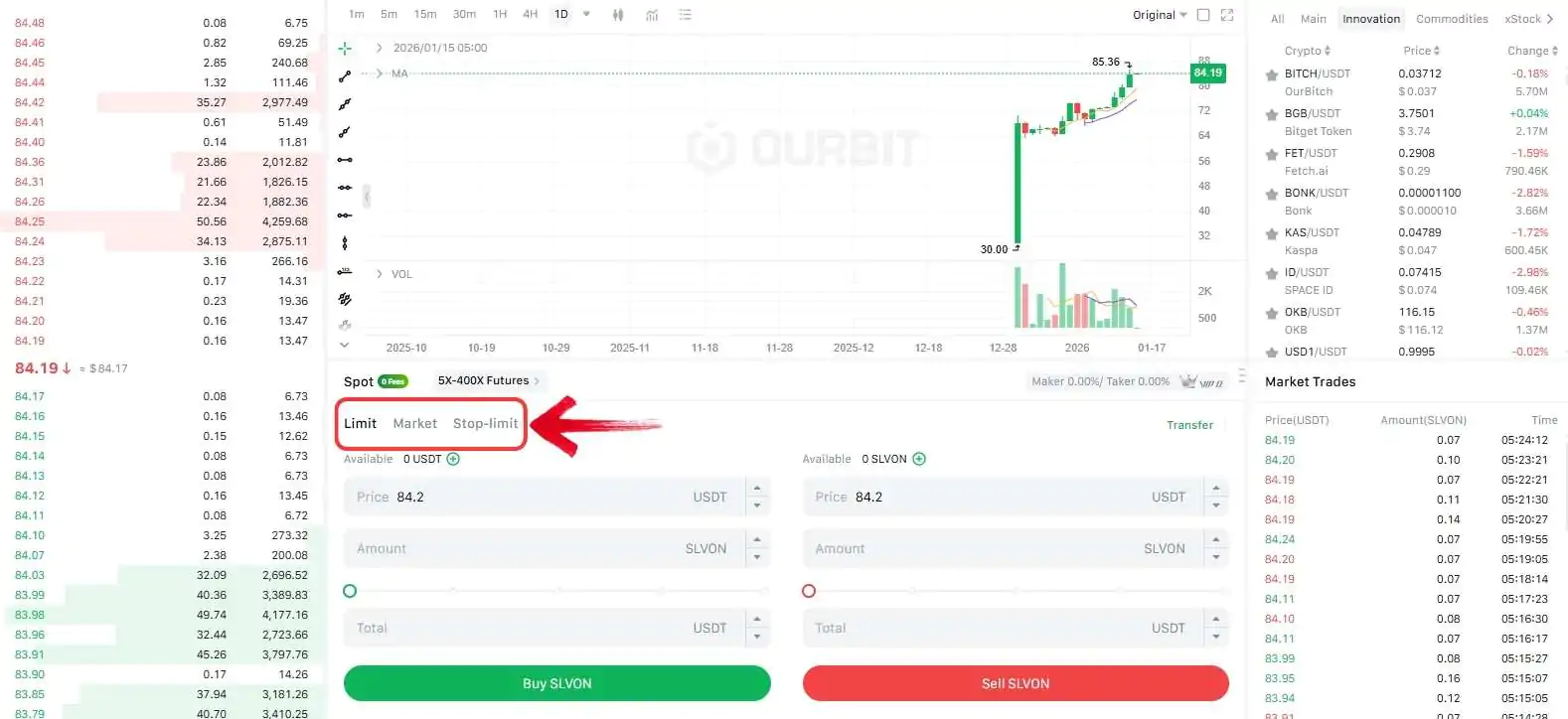

Step 4: Scroll down to the trading panel and choose your order type. You can select a Market order or a Limit order to buy silver on Ourbit.

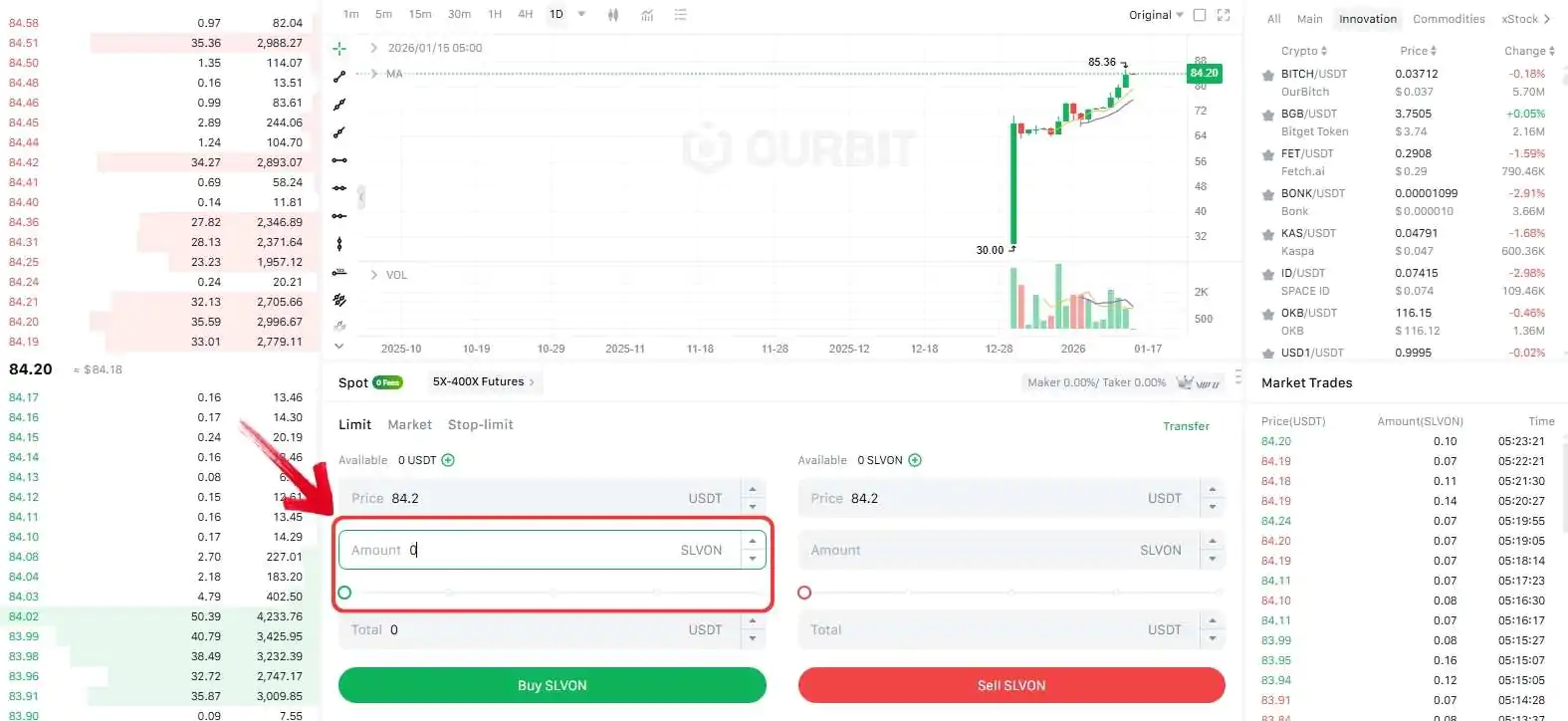

Step 5: Enter the amount of USDT you want to spend on silver, or use the percentage slider to allocate your available balance.

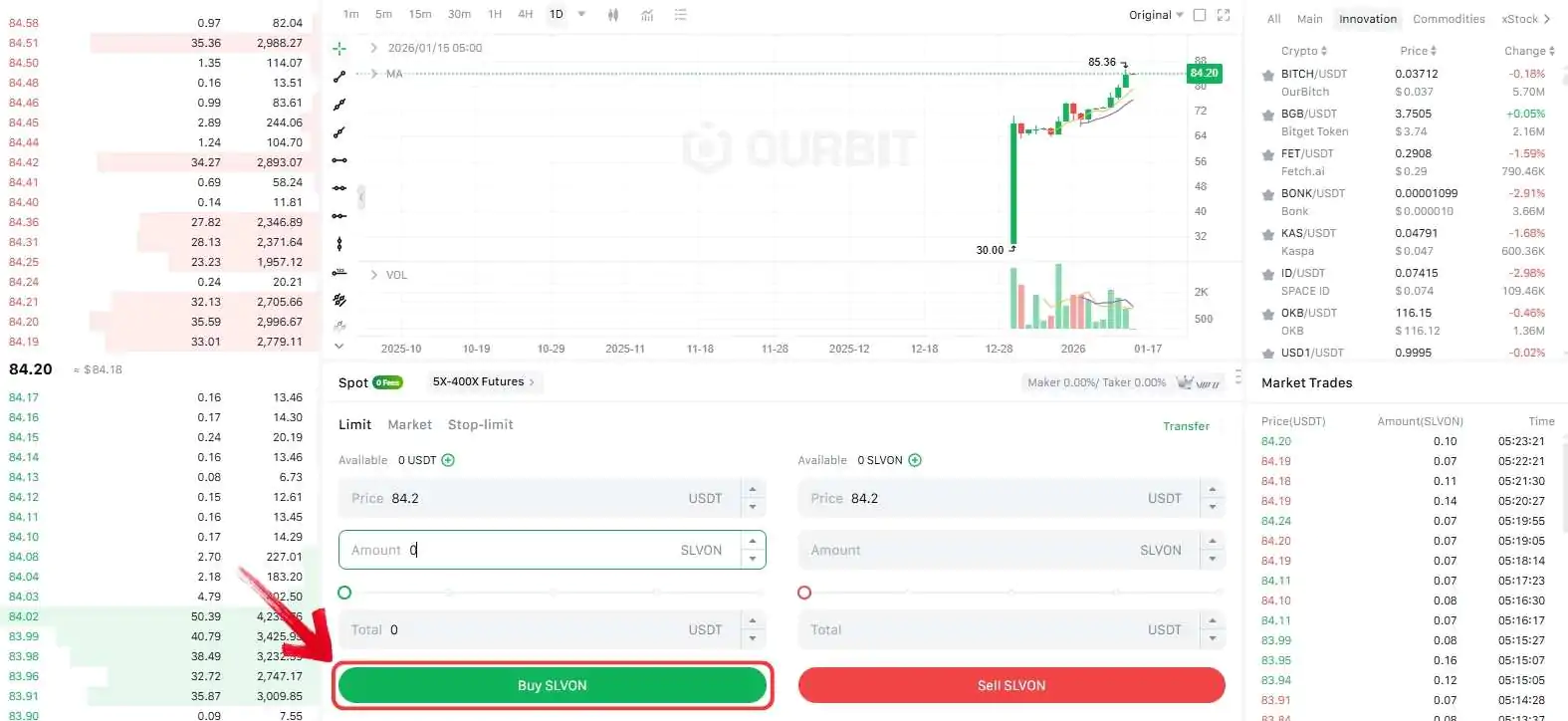

Step 6: Click “Buy SLVON” to confirm the order. Once the trade is filled, you will receive a confirmation, and the $SLVON tokens will appear in your spot wallet.

Fees When Buying Tokenized Silver on Ourbit

Ourbit applies a 0% fee model for spot trading, which means you pay no maker or taker fees when buying tokenized silver like $SLVON. Whether you place a market order or a limit order, the full amount of your USDT goes toward the purchase without deductions.

iShares Silver Trust (Ondo Tokenized Stock) (SLVON)

New TokenToken Symbol

SLVON

Current Price

Loading...

Daily Change

Loading...

All-Time High

Loading...

Daily Low

Loading...

Daily High

Loading...

24h Volume

Loading...

Market Cap

Loading...

FDV

Loading...

Total Supply

Loading...

Max Supply

Loading...

iShares Silver Trust (Tokenized Silver) Explained

The iShares Silver Trust tokenized version represents digital exposure to physical silver through an on-chain structure. These tokens are issued and managed through Ondo, which handles the tokenization layer and connects traditional financial products with blockchain based access. Each token is designed to mirror the value of silver held by the underlying trust, allowing users to gain price exposure without dealing with storage, insurance, or physical delivery.

For crypto users, this structure makes silver accessible in a familiar format, while still referencing a traditional silver vehicle. The key consideration is that ownership reflects economic exposure rather than direct possession of physical metal. This makes tokenized silver suitable for portfolio hedging, on-chain transfers, and integration with other digital assets, while relying on the issuer and custodian framework managed through Ondo.

Bottom Line

Holding physical silver has never been simple. Even a modest allocation of around $1,000 translates into roughly 11 one-ounce bars, which already demands storage space, careful handling, and added security. As allocations grow, those challenges scale quickly and turn a hedge into a logistical task. Tokenized silver solves a clear real world problem by moving exposure on-chain while still tracking silver’s value. It reflects how markets are shifting toward access, portability, and efficiency rather than physical handling. If tokenized metals interest you, exploring how digital gold works is a natural next step. Our guide on how to buy gold online breaks that process down in the same practical way.

FAQs

1. What is tokenized silver?

Tokenized silver represents on-chain exposure to silver’s price through blockchain-based tokens backed by real world assets.

2. Is tokenized silver backed by physical silver?

Most tokenized silver products are backed through custodial structures or trusts, but backing methods vary by issuer and platform.

3. Can I buy tokenized silver without holding physical bars?

Yes. Tokenized silver removes the need for storage, transport, and physical security while maintaining price exposure.

4. Is tokenized silver the same as owning silver?

It provides price exposure, not direct possession. Ownership relies on the issuer and custody framework behind the token.

5. Can tokenized silver be traded like crypto?

Yes. It can be bought, sold, and transferred on supported exchanges similar to other spot crypto assets.

6. How does tokenized silver differ from physical silver or silver ETFs?

Physical silver requires storage, transport, and security, while traditional ETFs involve management fees and limited trading hours. Tokenized silver trades on-chain, supports fractional buying, settles instantly, and is accessible 24/7.

7. What are the most popular tokenized silver tokens in 2026?

Kinesis Silver (KAG) remains the largest by market capitalization and liquidity. Other options include XAGx Silver Token on Avalanche, Gram Silver, and tokenized ETF exposure such as SLVON issued through Ondo.

8. What is the minimum amount of tokenized silver I can buy?

Most platforms allow highly fractional purchases, often starting from small dollar equivalents. In many cases, users can buy fractions as low as 0.00001 troy ounces.

9. Can tokenized silver be traded 24/7?

Yes. Tokenized silver trades on crypto markets, which operate continuously without the time restrictions seen in traditional metal or ETF markets.