- •Tokenized gold provides on-chain exposure to physical gold without storage or custody handling.

- •Tether Gold (XAUt) is issued by Tether and backed by allocated physical gold held in secure vaults.

- •Buying XAUt depends on exchange liquidity, trading fees, spreads, and account access conditions.

Bitcoin, often called digital gold, has not moved the way many crypto participants expected. Over the same period, gold reached new all time highs, rising close to 70% across the last two quarters of 2025. That shift has brought renewed focus to gold as a hedge, especially as more financial assets move on-chain.

This raises a practical question. Can investors buy tokenized gold instead of holding physical bars? The answer is yes. Tokenized gold products already exist and are actively traded. This guide focuses on Tether Gold, or XAUt, which holds the largest market cap among gold-backed tokens and is generally viewed as one of the more secure options. Below, we explain where to buy it and how to buy gold online step by step.

Where to Buy Gold Online

Tokenized gold has gained steady traction as investors look for on-chain exposure to physical assets without custody or storage friction. Because of that demand, products like Tether Gold are listed on several centralized crypto exchanges with varying levels of liquidity, security standards, and account requirements.

That said, not every exchange offers the same buying experience. Factors such as regulatory posture, proof of reserves, trading fees, supported networks, and withdrawal rules matter when choosing where to buy tokenized gold. Some platforms focus on deep liquidity and tight spreads, while others prioritize access and simpler onboarding.

The table below highlights carefully selected exchanges that meet baseline standards for security and liquidity, helping you choose a reliable venue to build your online gold position.

How to Buy Digital Gold on Bitunix

Bitunix was selected primarily for its simple onboarding and flexible access. Account setup is fast, with KYC kept optional, which suits users who want quicker entry while still having the option to verify later. Funding options are another key reason. Users can add funds through fiat on-ramps, P2P trading, or direct crypto network deposits, making it accessible across regions. For trading, the XAUt/USDT pair on Bitunix typically maintains a tight 0.01% spread, which helps reduce entry costs when buying tokenized gold.

The platform is relatively new but well structured, with a clean interface that works well for beginners. New signups can access bonuses up to $5,500 when using a Bitunix bonus code. On the security side, Bitunix publishes proof of reserves, adding transparency around asset backing and custody practices. Here is how you can start building your gold position on Bitunix:

Step 1: Visit the official Bitunix website using your browser. If you are new, select “Sign Up” to create an account.

Step 2: Complete the registration form and verify your email address to activate your account.

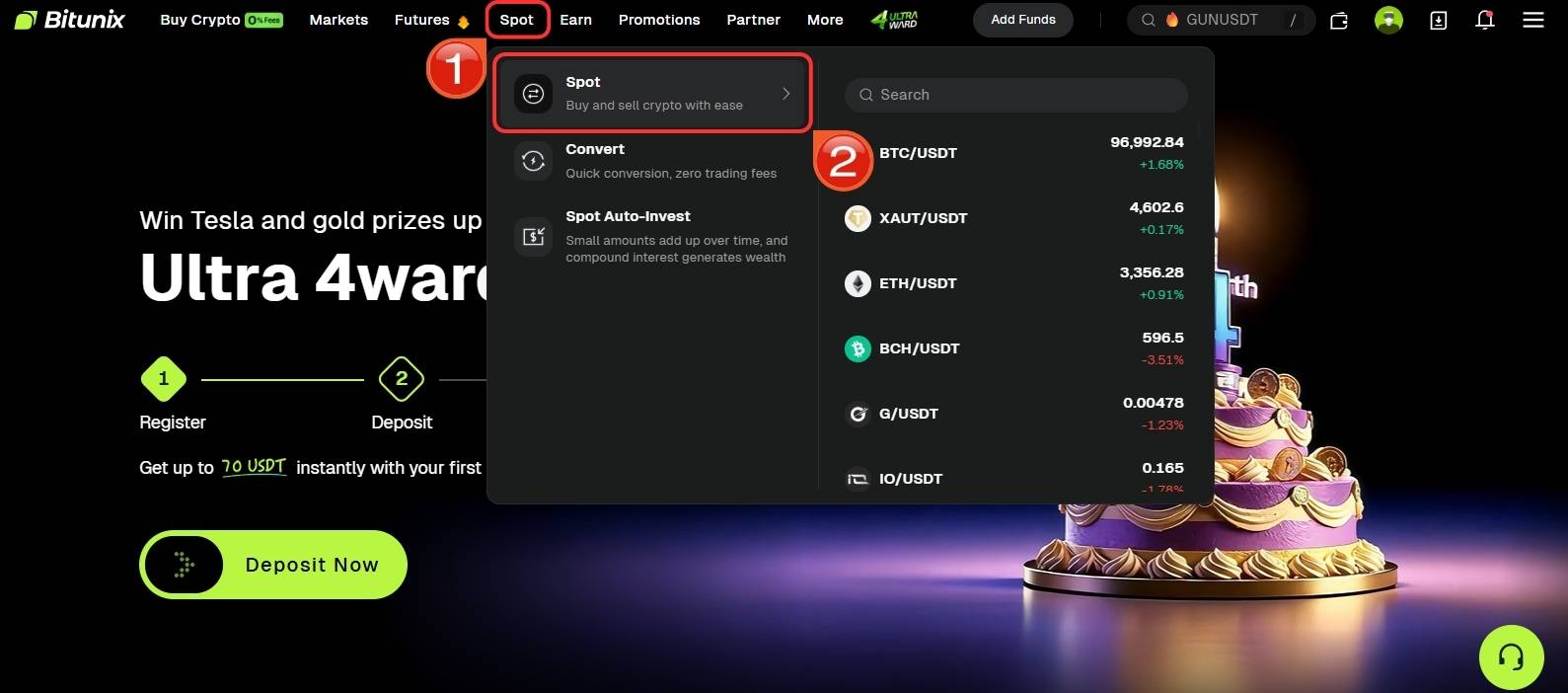

Step 3: After logging in, hover over the “Spot” section in the top navigation bar and click on “Spot” again in the drop-down menu.

Step 4: You will land on the spot trading interface. Open the asset list to view available markets.

Step 5: Use the search field to type “XAUt” and choose the XAUT/USDT trading pair.

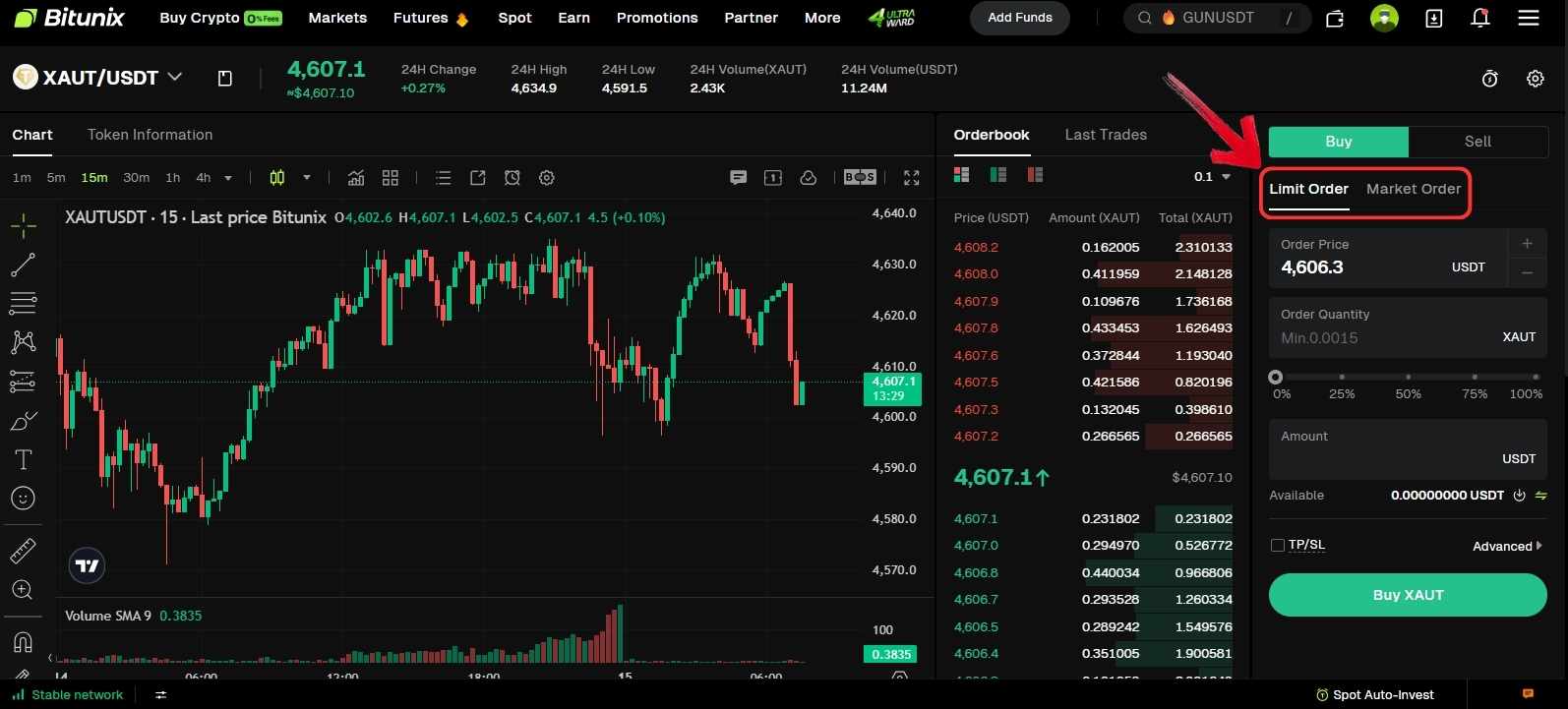

Step 6: On the trading panel, select either a Market or Limit order based on your preference.

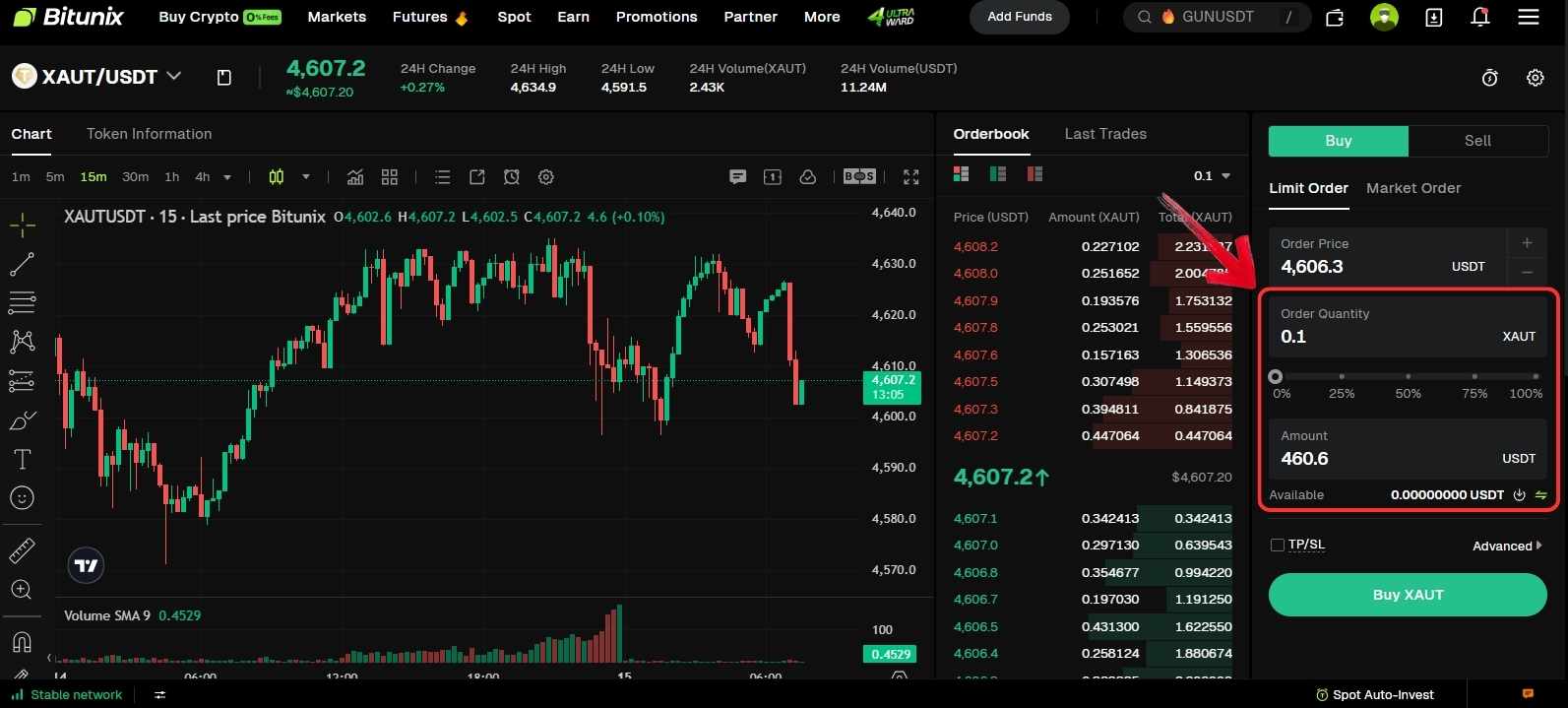

Step 7: Enter the amount of XAUt you want to buy or the USDT amount you plan to spend.

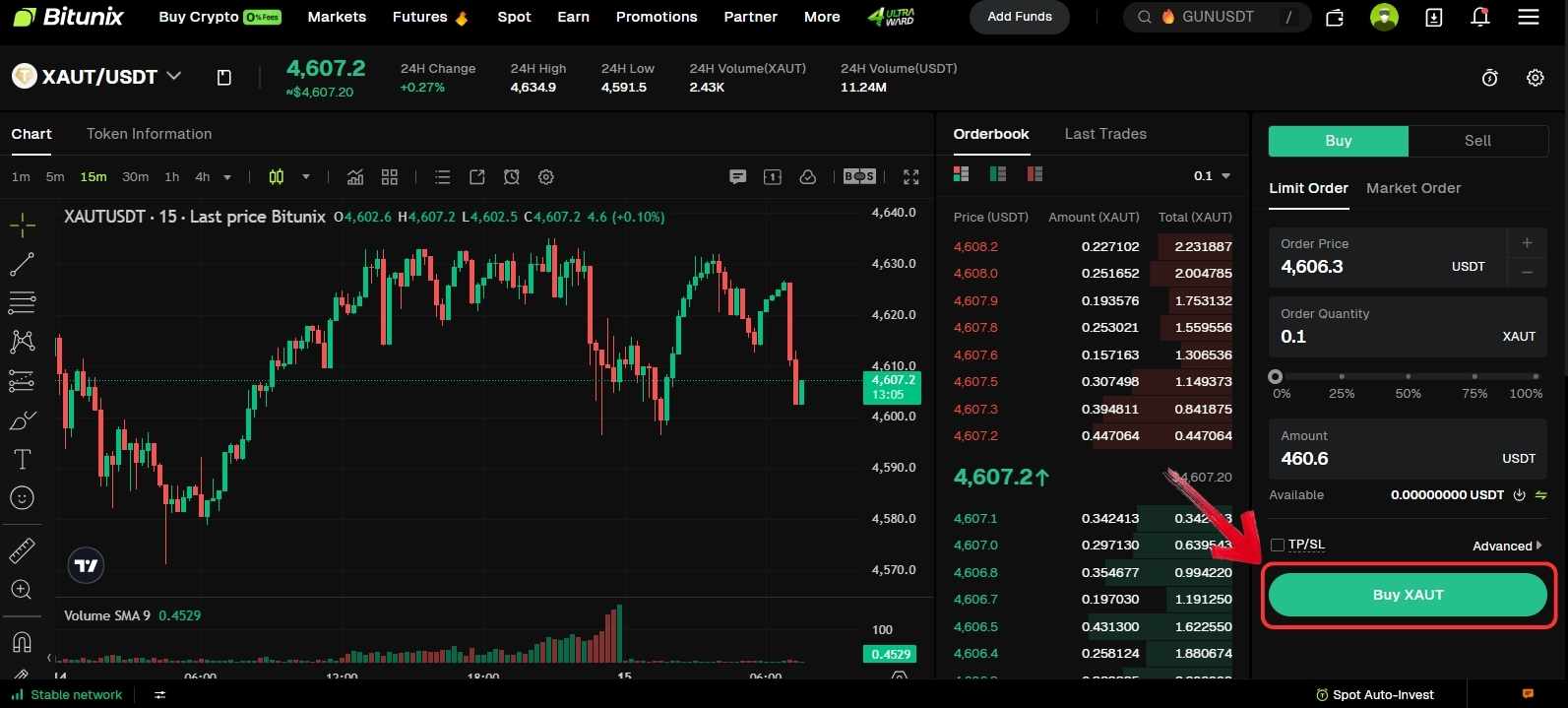

Step 8: Click “Buy XAUT” to place and complete your order.

Fees When Buying Tokenized Gold on Bitunix

Bitunix applies a straightforward spot fee structure when buying tokenized gold. Maker orders are charged at 0.08%, while taker orders carry a 0.10% fee, keeping trading costs in line with major centralized exchanges. This setup works well for both users placing quick market orders and those using limit orders to manage entry price.

In practical terms, purchasing $100 worth of Tether Gold (XAUt) would result in a fee of about $0.10 on a taker order, leaving you with roughly $99.90 in XAUt. That cost efficiency becomes more noticeable for larger positions or repeated buys over time.

Tether Gold (XAUt)

New TokenToken Symbol

XAUt

Current Price

Loading...

Daily Change

Loading...

All-Time High

Loading...

Daily Low

Loading...

Daily High

Loading...

24h Volume

Loading...

Market Cap

Loading...

FDV

Loading...

Total Supply

Loading...

Max Supply

Loading...

Tether Gold (Tokenized Gold) Explained

Tether Gold, known by its ticker XAUt, is a blockchain-based token designed to represent ownership of physical gold. Each XAUt token is backed by one troy ounce of fine gold held in secure vaults, giving holders direct exposure to gold prices without the need to manage storage or transportation. The token is issued by Tether and can be transferred, stored, and traded like any other digital asset.

XAUt bridges traditional gold ownership with on-chain infrastructure. It allows users to buy tokenized gold, move it across supported blockchain networks, and trade it on crypto exchanges. Because the gold backing remains allocated and verifiable, XAUt is often used by investors seeking a digital store of value that tracks physical gold rather than market sentiment.

Bottom Line

Tether Gold makes sense for investors who want gold exposure without stepping outside the crypto ecosystem. Being issued by Tether, the same company behind USDT, adds an extra layer of credibility, especially given its scale, reserve management experience, and long operating history. XAUt keeps the link to physical gold intact while allowing on-chain ownership, transfer, and trading.

The structure reflects how traditional assets are being adapted for digital settlement rather than speculative use. For readers reviewing different precious metals in tokenized form, it may also be useful to compare gold with other options. A separate guide on how to buy tokenized silver outlines how silver-based tokens operate under a similar on-chain model.

FAQs

1. What is tokenized gold?

Tokenized gold represents physical gold issued as a digital token on a blockchain, with each token linked to real gold held in custody.

2. What backs each XAUt token?

Each XAUt token is backed by allocated physical gold stored in secure vaults.

3. How does tokenized gold differ from physical gold or gold ETFs?

Physical gold requires storage and security, while ETFs are paper claims with management fees. Tokenized gold represents allocated gold on-chain, supports fractional ownership, and trades continuously.

4. Which tokenized gold tokens are most common in 2026?

The most used tokens are Tether Gold (XAUt), backed by gold in Swiss vaults, and Pax Gold (PAXG), backed by LBMA-accredited gold stored in London.

5. What is the minimum amount of tokenized gold I can buy?

Tokenized gold allows small fractional purchases, often starting around $20 to $50, depending on platform limits and gold prices.

6. Is tokenized gold backed by real gold?

Yes. Established issuers hold physical gold in professional vaults and provide reserve disclosures or third-party attestations.

7. Can tokenized gold be redeemed for physical gold?

Some issuers allow redemption. PAXG supports delivery of standard gold bars, while XAUt offers redemption through Swiss facilities.

8. Can tokenized gold be traded 24/7?

Yes. Tokenized gold trades around the clock on crypto exchanges, unlike traditional gold markets.