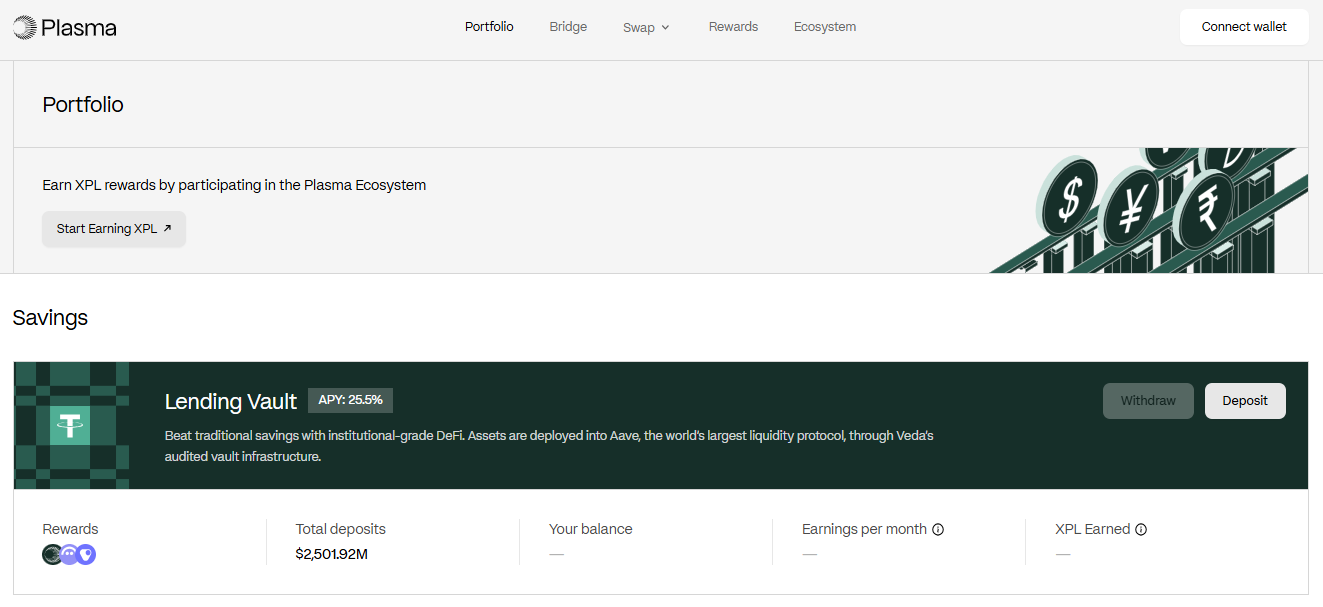

- •Plasma launched with $2B+ TVL, placing it among the top 10 blockchains by stablecoin liquidity.

- •Bridge to Plasma using Stargate Finance or Rhino.fi, with support for USDT and XPL tokens.

- •Gas fees on Plasma are paid in XPL, so keep a small balance to complete on-chain transactions.

Plasma, a newly launched Layer-1 blockchain for global stablecoin payments, entered the market with over $2 billion in stablecoin total value locked (TVL). With interest growing quickly, many users are preparing their Web3 wallets to join the network. The next challenge is learning how to bridge to Plasma, which can be confusing for first-time users. This guide explains the process step by step, so you can bridge to Plasma and begin using the network.

Can I Bridge to Plasma Network?

Yes, you can bridge funds to Plasma. To do so, you currently need to use a cross-chain bridge or a bridge aggregator that supports moving assets to and from the Plasma network. Since the blockchain has only recently launched, available bridging options are still limited. However, as Plasma continues to gain adoption and attract liquidity, more bridge platforms are expected to add support, making the process easier over time.

But before proceeding, it’s important to prepare a few essential tools to ensure the bridging process is smooth and error-free.

1. Gas Fees:

To bridge funds, you need XPL tokens in your wallet to cover gas fees. Since XPL is the native token of the Plasma network, make sure your Plasma-compatible wallet has a small amount of XPL before you begin bridging. This ensures you can complete on-chain transactions without delays.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

2. Wallet:

Bridging to Plasma requires a Web3 wallet. In this guide, we will use MetaMask, one of the most widely used wallets, to bridge assets to the Plasma network. Since Plasma is an EVM-compatible Layer-1 blockchain, it is fully supported by MetaMask. Alternatively, you can use any other EVM-compatible wallet of your choice.

3. Add Support to Wallet:

You will need to add the Plasma network to your wallet by entering its RPC details manually. This ensures your wallet can interact with Plasma and display your bridged assets correctly. Once added, you’ll be ready to connect and proceed with the bridging process.

How to Bridge to Plasma Network?

At this early stage, there are limited options available for bridging to the Plasma network. For this guide, we focus on two of the most trusted and reliable platforms currently supporting Plasma. These platforms allow users to move assets to and from the network securely and with minimal friction, making them suitable choices until additional bridges add support in the future.

Using Stargate Finance

Stargate Finance is a composable cross-chain liquidity transport protocol that enables seamless asset transfers between multiple blockchains. It currently supports 17 networks, including Ethereum, HyperEVM, Berachain, Rootstock, and others, making it one of the most widely integrated bridging solutions available.

With a total value locked (TVL) exceeding $431 million, Stargate is a proven and reliable choice for cross-chain transactions. It is also officially listed on the Plasma website as the recommended bridge for the network, at present, the only cross-chain option endorsed by Plasma. Following its listing, 24-hour transaction volume surged from $265 million to over $2.9 billion, representing a more than 1,000% increase.

Follow these steps to bridge assets to the Plasma network using Stargate Finance.

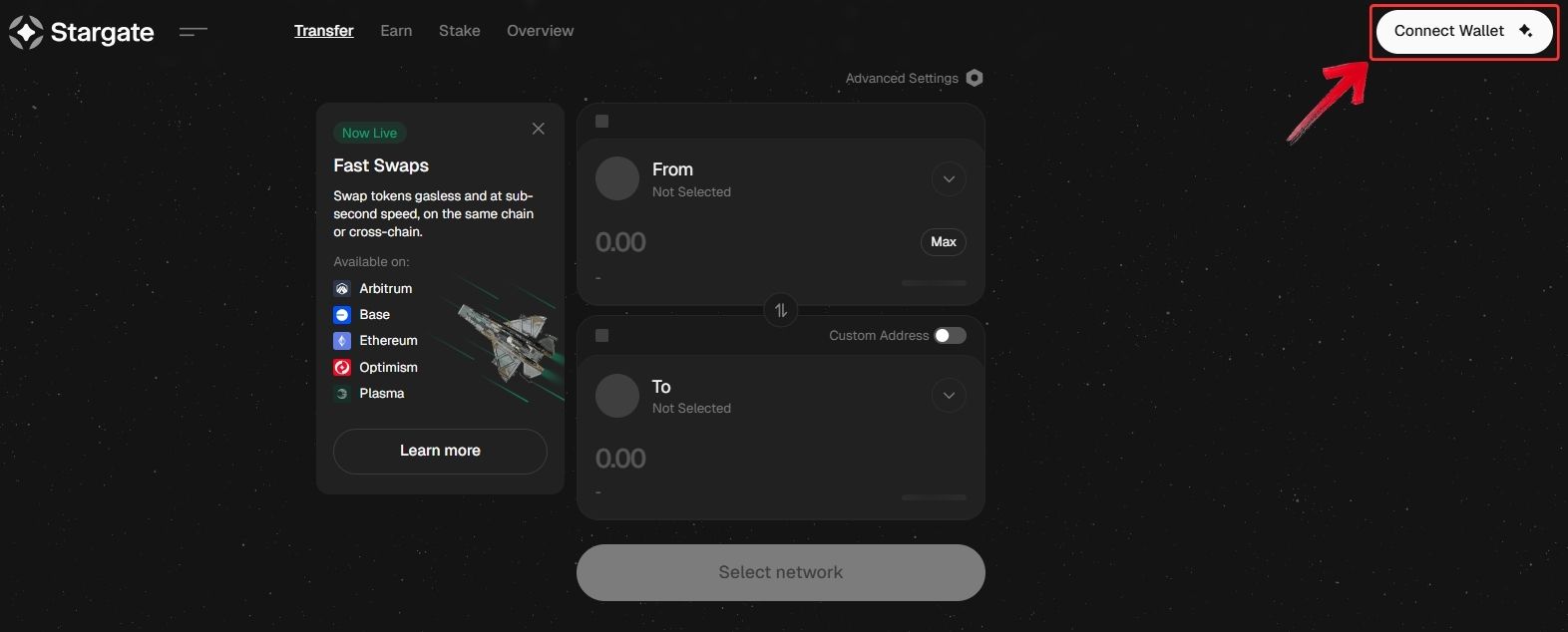

Step 1: Open your browser and go to the official Stargate Finance website, and click on the “Connect Wallet” button.

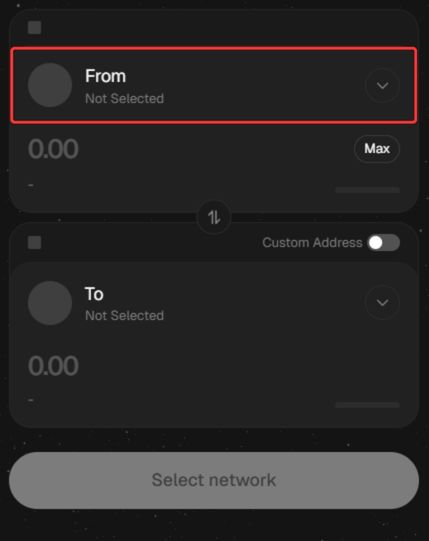

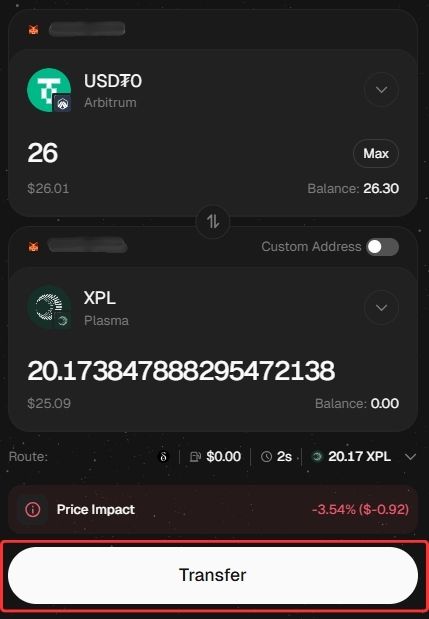

Step 2: Once your wallet is connected, go to the “From” field and select the source network and token you want to bridge.

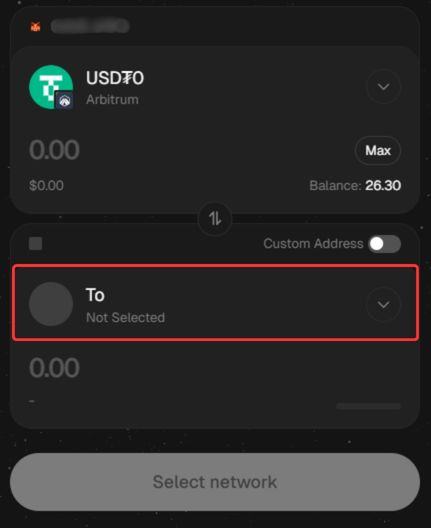

Step 3: In the “To” field, scroll to find “Plasma” and select “XPL” as the token to receive in your Plasma wallet.

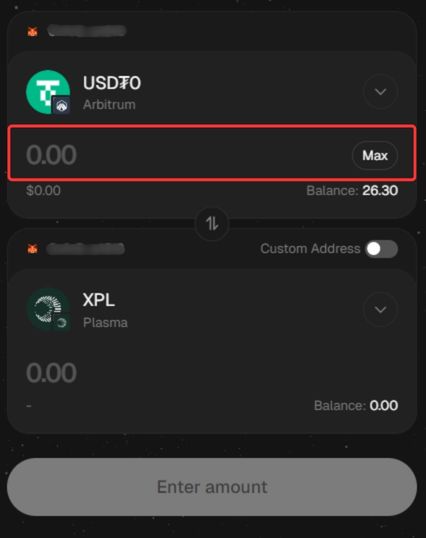

Step 4: Enter the amount you wish to transfer and review the transaction details carefully, including the amount you will receive and the estimated transfer time.

Step 5: Click “Transfer” to confirm and initiate the bridge. Your funds will be delivered to your Plasma address shortly.

Using Rhino.fi

Rhino.fi is a decentralized finance platform that allows users to transfer funds across multiple blockchains and Layer-2 networks, providing seamless access to a wide range of DeFi opportunities. Supporting over 29 networks, Rhino.fi operates as a bridge aggregator, meaning it searches for optimal bridging routes across different protocols.

While its fees may be slightly higher compared to direct cross-chain bridges, Rhino.fi offers greater flexibility. It supports more asset sources and destinations, including the ability to bridge assets from networks such as Solana to Plasma.

Here is the process for transferring assets to Plasma through Rhino.fi’s bridge aggregator.

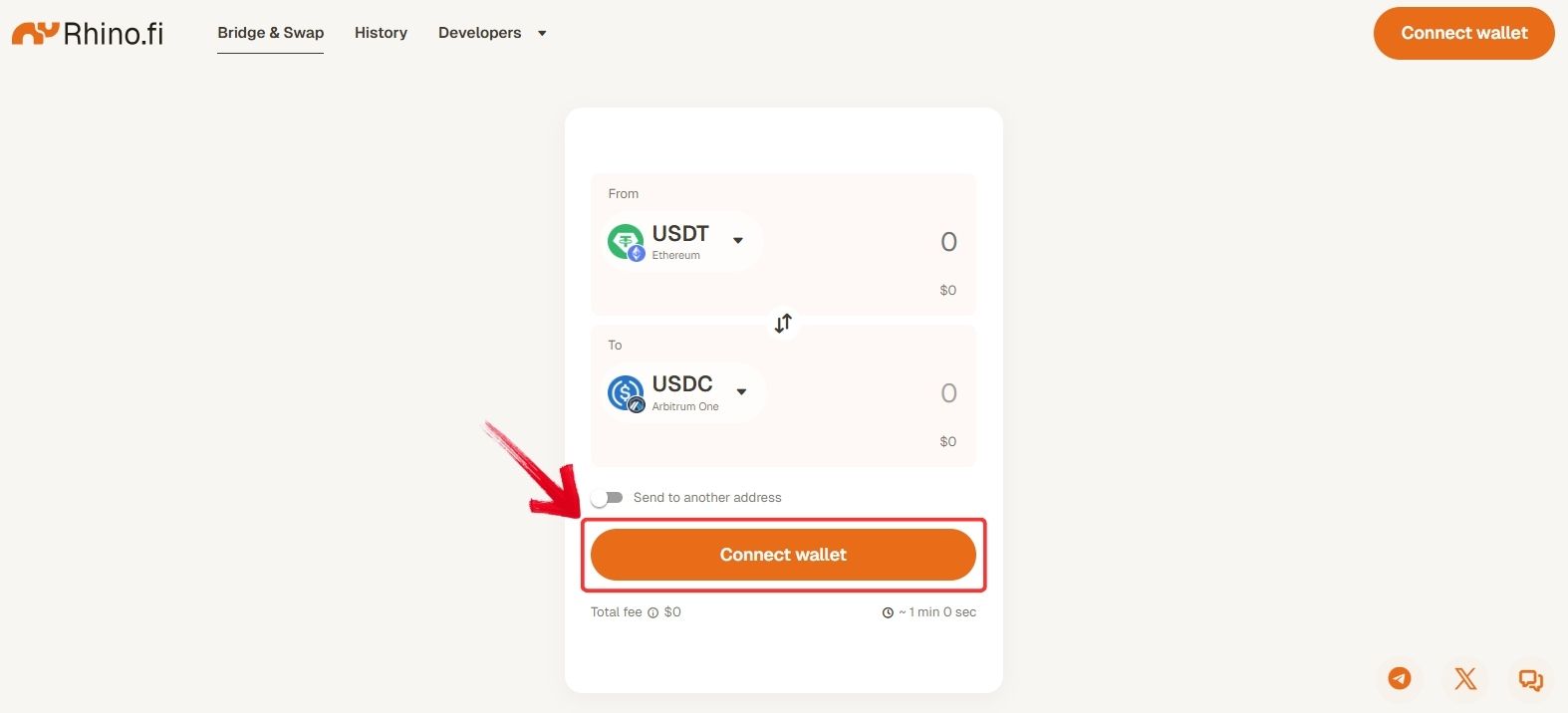

Step 1: Open your browser and navigate to the official Rhino.fi website. Click on the “Connect Wallet” button.

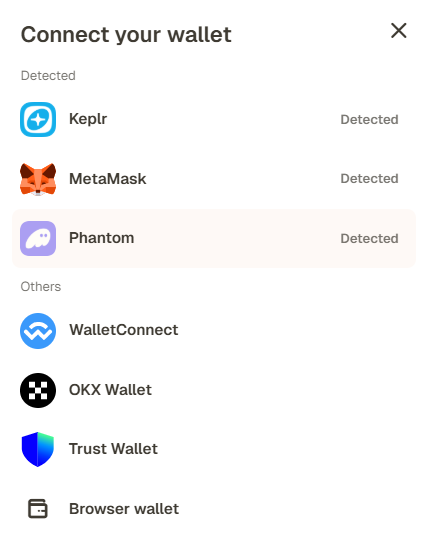

Step 2: A dialog box will appear with a list of wallet options. Select the wallet that holds the funds you want to transfer to Plasma.

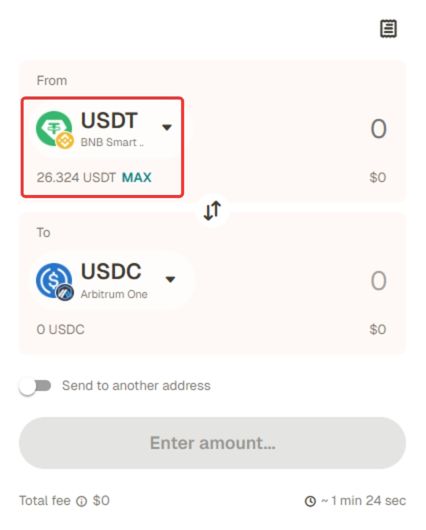

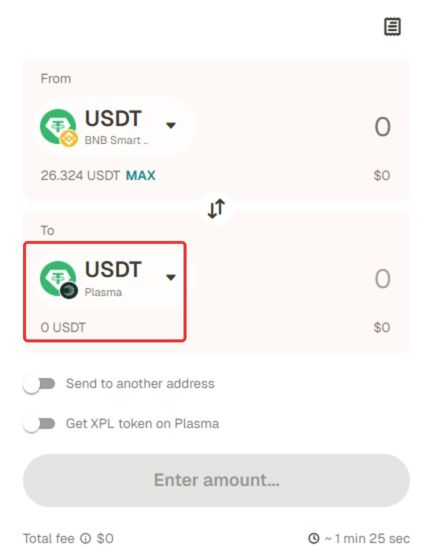

Step 3: Once your wallet is connected, choose the source network in the “From” field and select the token you want to bridge.

Step 4: In the “To” field, select Plasma as the destination network. At present, Rhino.fi only supports USDT on the Plasma network.

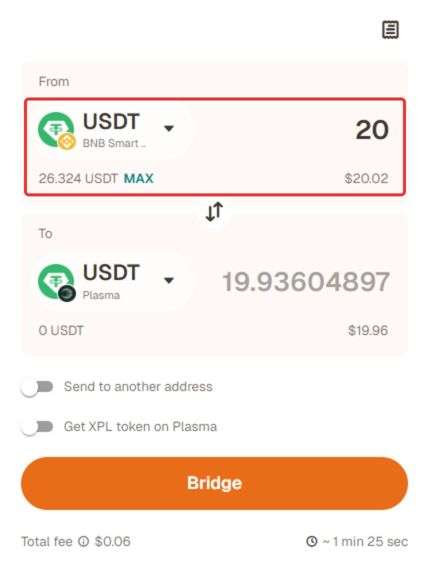

Step 5: Enter the amount you want to transfer and carefully review the transaction details.

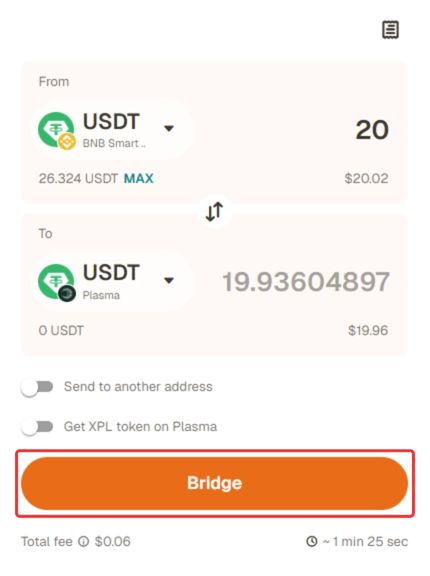

Step 6: Click “Bridge” to confirm. Your funds will appear in your Plasma wallet within a few minutes.

Plasma Network Bridging Fees

Bridging to Plasma is relatively inexpensive compared to many other networks. When using Stargate Finance, fees typically range between $0.80 and $1.50 when transferring from Layer 2 networks such as Arbitrum. On Rhino.fi, fees can be slightly lower, averaging around $0.50 per transfer.

Keep in mind that fees fluctuate based on several factors, the network you are bridging from, the time of your transaction, and the price of the native token used for gas. Since fees are charged in the source and destination chain’s native token, token price movements can directly impact your total cost.

What is Plasma?

Plasma is a Layer-1 blockchain designed specifically for global stablecoin payments. It aims to create a seamless and cost-efficient infrastructure for transferring stablecoins across borders, targeting both retail and institutional users. Unlike general-purpose blockchains, Plasma focuses on payment use cases, offering low transaction fees, high throughput, and near-instant settlement.

At launch, Plasma secured over $2 billion in stablecoin total value locked (TVL), immediately placing it among the ten largest blockchains by stablecoin liquidity. Its native token, XPL, is used to pay gas fees for transactions and interact with smart contracts on the network.

Plasma is fully EVM-compatible, meaning it supports Ethereum-based tools, wallets, and dApps. This compatibility allows users to connect with wallets like MetaMask, use cross-chain bridges, and access DeFi applications without needing a separate learning curve.

Bottom Line

Bridging to Plasma is straightforward but still limited to a few platforms. Moving funds from unsupported networks can be challenging. Alternatively, users can buy XPL on a centralized exchange like BloFin, transfer it to Plasma, and start exploring its yield-generating opportunities.

FAQs

1. Which tokens can I bridge to Plasma?

Currently, Plasma primarily supports bridging USDT and XPL. Support for additional assets will expand as the network grows.

2. What are Plasma’s bridging fees?

Fees typically range between $0.50 and $1.50, depending on the source network, token price, and network congestion.

3. Why do I need XPL tokens?

XPL is required to pay gas fees on the Plasma network. Without it, you won’t be able to make transactions or interact with dApps.

4. Is bridging to Plasma safe?

Yes, provided you use trusted platforms like Stargate Finance or Rhino.fi and verify that you are on their official websites.

5. What can I do once my funds are on Plasma?

You can interact with DeFi protocols, provide liquidity, and explore yield opportunities offering attractive APYs.

![How to Change the Language in Phantom [2026]](https://www.cryptowinrate.com/wp-content/uploads/2026/02/How-to-Change-the-Language-in-Phantom-2026-1024x576.jpg)