Bybit and Gemini are among the most popular and trusted exchanges in 2025. This article will compare and contrast the two exchanges in-depth and highlight their key features.

An Overview of Bybit & Gemini

Bybit and Gemini are popular crypto exchange platforms within the marketplace. Bybit emerged in 2018, as led by Ben Zhou, while Cameron and Tyler Winklevoss founded Gemini in 2014. Bybit is based in Dubai, and Gemini operates from New York City, USA. Bybit has a large team of about 1000 employees and serves over 15 million users worldwide. On the other hand, Gemini’s team is still quite impressive, with more than 500 workers and catering to more than 1 million users globally.

In terms of trading, Bybit handles a vast 24-hour volume of $10 billion, while Gemini only deals with around $800 million. Both platforms support a vast number of different cryptocurrencies. Bybit offers more than 400 crypto tokens, and Gemini has over 100 cryptos available, including popular ones like Bitcoin and Ethereum.

If you’re into trading, Bybit has introduced incredible options and trading tools to aid its users. On the other hand, Gemini offers exciting features like Gemini Earn, where you can earn rewards, and Gemini Custody, a safe place to keep your crypto.

Both platforms have easy-to-use apps and prioritize security to protect users’ assets and information. They have received good ratings for their mobile apps, with Bybit having 5 million downloads and Gemini having a 5-star rating. However, neither of them offers Forex or commodities trading.

Bybit & Gemini Signup and KYC

Signing up for Bybit and Gemini is relatively similar and straightforward. For both exchanges, users need to first register on through the website or on their respective apps found on iOS and Android, provide their email addresses, create a strong password and agree to the terms and conditions to finalise the registration process.

From there on, a verification email will be sent for them to authenticate the validity of their registration. Lastly, and most importantly, users must apply 2 Factor Authentication to reinforce their security measures – this will be done through Google Authentication or SMS.

KYC – Know Your Customer

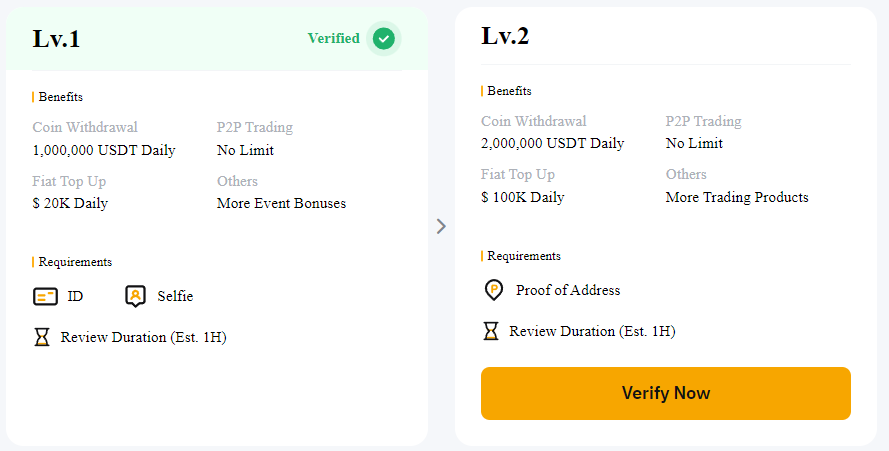

Both Bybit and Gemini require a KYC – When opening an account, and regularly after that, KYC checks must be performed to identify and confirm the client’s identity. In other words, similarly to banks, crypto exchange platforms have to make sure that the customers they are dealing with are indeed who they say they are. In addition, KYC is the gateway to full access to the exchange platform’s features, including trading, deposits and withdrawals, which are limited when a user has yet to be verified.,

Only official documents provided by your government, such as utility bills, bank statements, IDs, passports, and residence evidence, are accepted by Bybit as proof of residency. Please be aware that the Proof of Address must date from the past three months. Documents with a date of more than three months will not be accepted.

With Gemini, a user’s legal name, date of birth, address, phone number, social security number, and email must be collected under the law when opening a Gemini account. Complete verification and withdrawal from the exchange both demand further paperwork.

Among those records is: a valid passport or driver’s license is required for residents of the United States.

Residents from other countries: A valid passport, a driver’s license, and a national identity card are the minimum two government-issued identification documents that must be presented.

Passport, license, and social insurance number in good standing for Canadian citizens.

Bybit vs Gemini Products, Features and Services

Bybit is well known for providing features that cater to those new to the crypto industry and experts.These features, as previously mentioned, include:

Spot trading -Both exchanges offer spot trading services where one can buy, sell, and trade BTC and altcoins such as ETH, Solana, and more. With Bybit, spot traders are charged 0.1% for both makers and takers

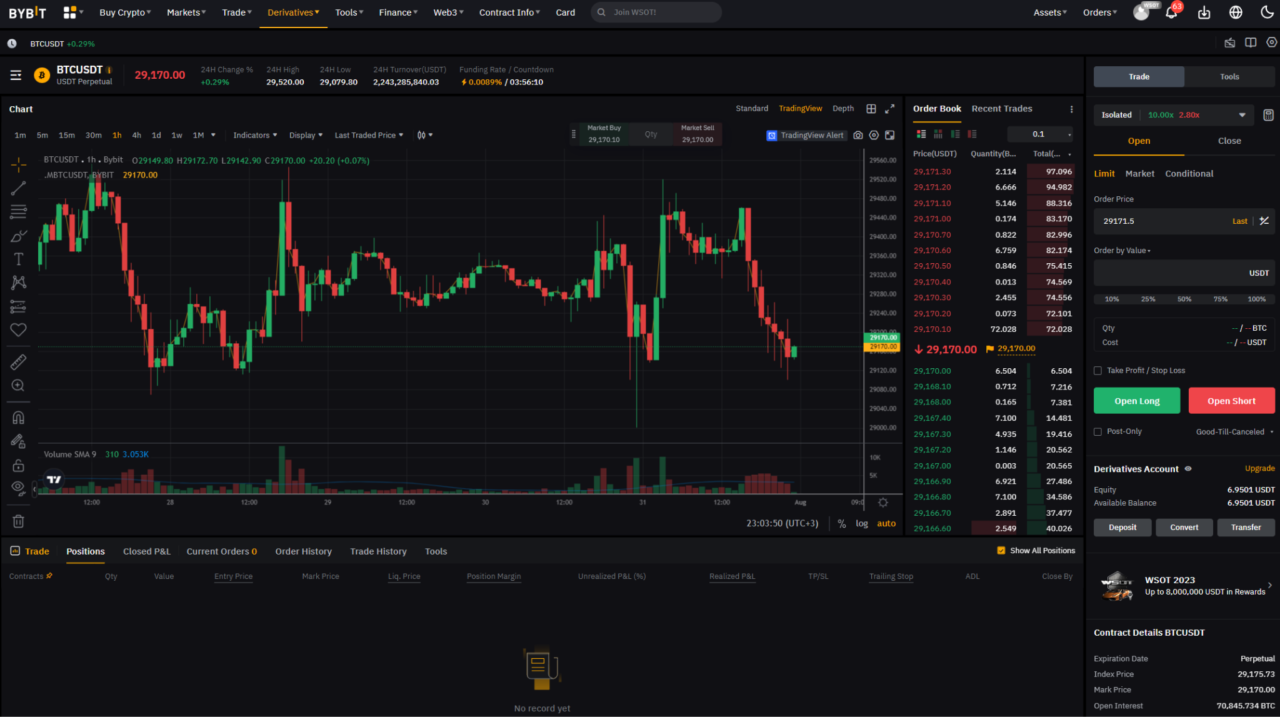

Futures trading – Both exchanges offer futures trading, which allows a user to speculate on the direction of a long or short asset. Using leverage will enable users to manage risk, generate returns, and gain directional exposure. Investors can open long and short positions using leveraged trading and long/short places worth more than their available cash. The maximum leverage offered by Bybit on futures contracts for Bitcoin (BTC) and Ethereum (ETH) is 100 times.

Options Trading – Bybit offers Options trading, which allows investors leeway to buy or sell securities on a specific date at a particular price. Furthermore, options function as a form of insurance that helps reduce risk caused by sudden changes in the market.

Advanced trading tools – Bybit has introduced technologically advanced trading tools designed for crypto derivatives and all the currencies within the platform. These tools include multiple-chart layouts, intelligent leverage selectors, conditional orders, real-time PNL monitoring, and trading view charts.

Gemini Main Products and Features

Gemini Earn – users may earn rewards on over 40 cryptocurrencies with Gemini Earn. Gemini Earn is a lending platform enabling users to lend out their cryptocurrency holdings in exchange for interest payments, although it is not specifically a staking program.

Gemini dollar (GUSD) – The Gemini Dollar was developed on the Ethereum network ifollowing the ERC-20 standard and is strictly linked one-to-one to the US dollar (USD). The Gemini Dollar blends blockchain technology with the USD’s credibility and stability.

Gemini custody – With a protected offline patented Cold Storage System, Gemini Custody offers an option for storing your cryptocurrency in a regulated, secure, and compliant manner. With a Gemini Custody account, customers’ cryptocurrency is segregated through unique cryptocurrency addresses that are independently verifiable and auditable on their blockchains.

Bybit vs Gemini Trading Fees

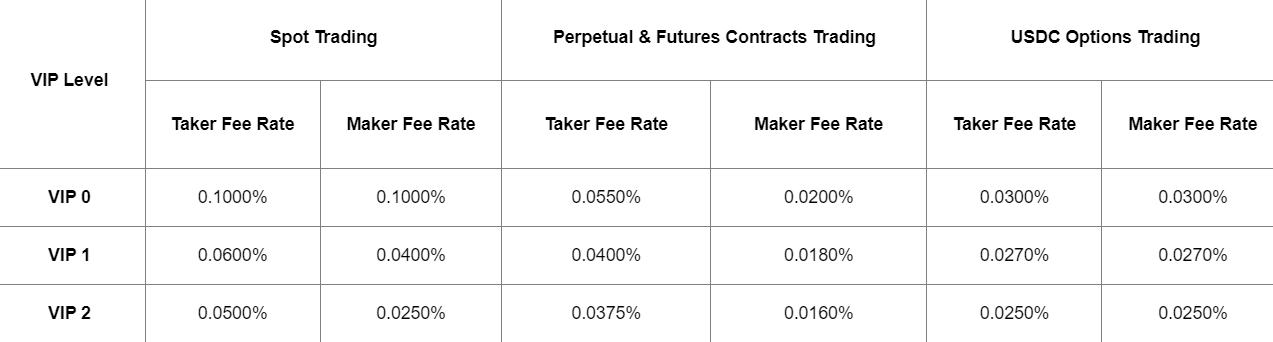

Although we have detailed a trend of similarities between Bybit and Gemini, these exchange platforms are vastly different regarding trading fees.

Bybit has lower fees compared to Gemini. For example, spot maker and taker fees are respectively charged 0.10%. And if you trade futures on Bybit, they will only charge you 0.02% as a fee for future makers and 0.055% for future takers.

The good news is that Bybit discounts these fees if you trade a lot. So, if you do a large amount of trading in a month, you can get a break on the fees, making it cheaper to trade.

On the other hand, Gemini has higher fees. They charge 0.20% for spot maker fees and 0.40% for spot taker fees. Like Bybit, they also offer some discounts if you trade over a certain amount in a month, but their fees are still higher than Bybit.

So, if you want to save money on trading fees, Bybit is the better choice between the two. It has lower fees overall and offers discounts for high-volume traders.

Bybit vs Gemini Deposit Methods

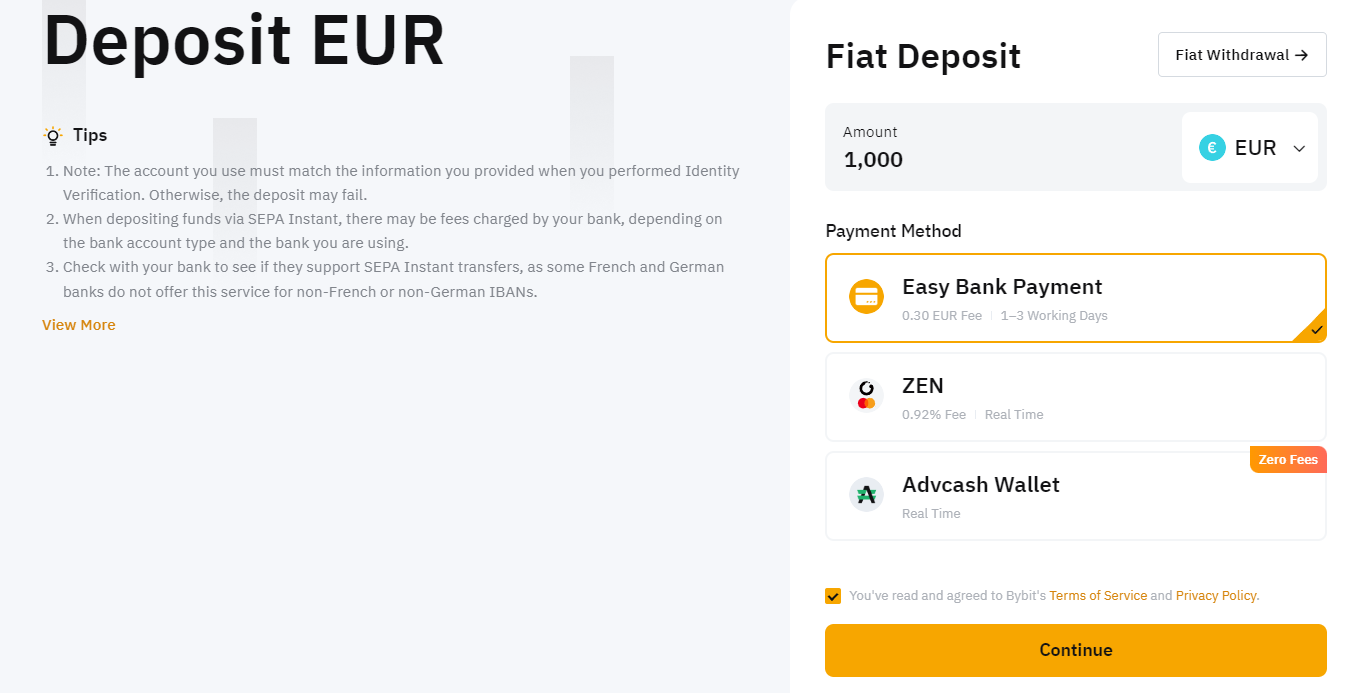

Bybit and Gemini have distinct methods of making a deposit.

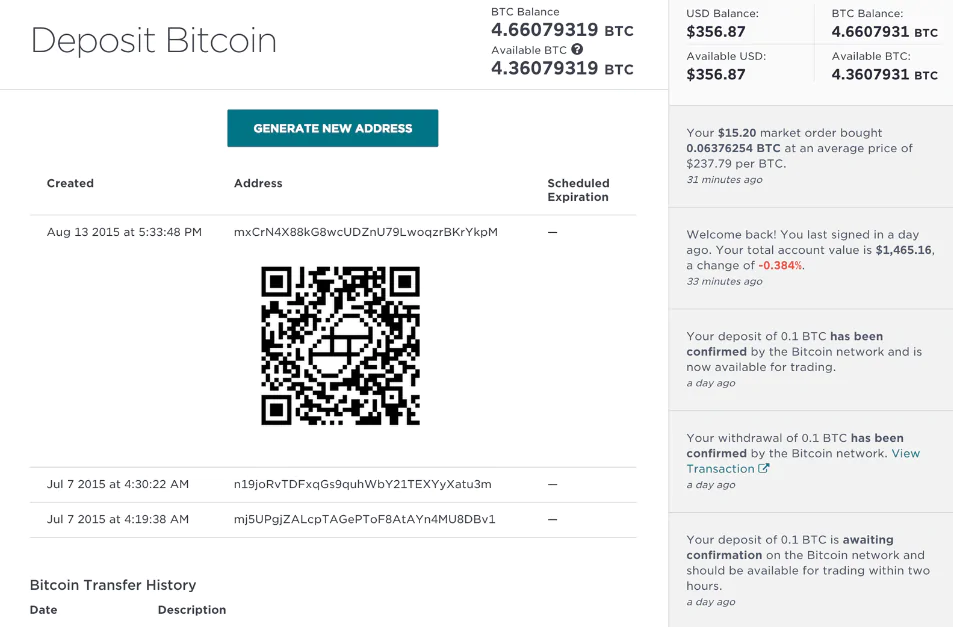

Bybit allows users have access to 50+ fiat currencies which can be used to buy BTC, ETH, USDT and more through different transfer methods, including credit/debit payments, third-party payments, fiat deposits, and P2P trading. Third-party prices are the most affordable, as there are no transaction fees when buying crypto via one click.

On the other hand, Gemini accepts eight fiat currencies, including USD, EUR, and GBP. You can deposit using Bank Transfer (ACH/Wire), Debit Card, or PayPal for USD, EUR, and GBP. Bank transfers don’t have any fees, but debit card transfers cost 3.49%, and PayPal deposits have a 2.5% fee.

Bybit supports several currencies but has some fees for Wire Transfers. Gemini offers free bank transfers but charges debit card and PayPal deposit fees.

Lastly, both exchanges support on-chain crypto deposits with no fees.

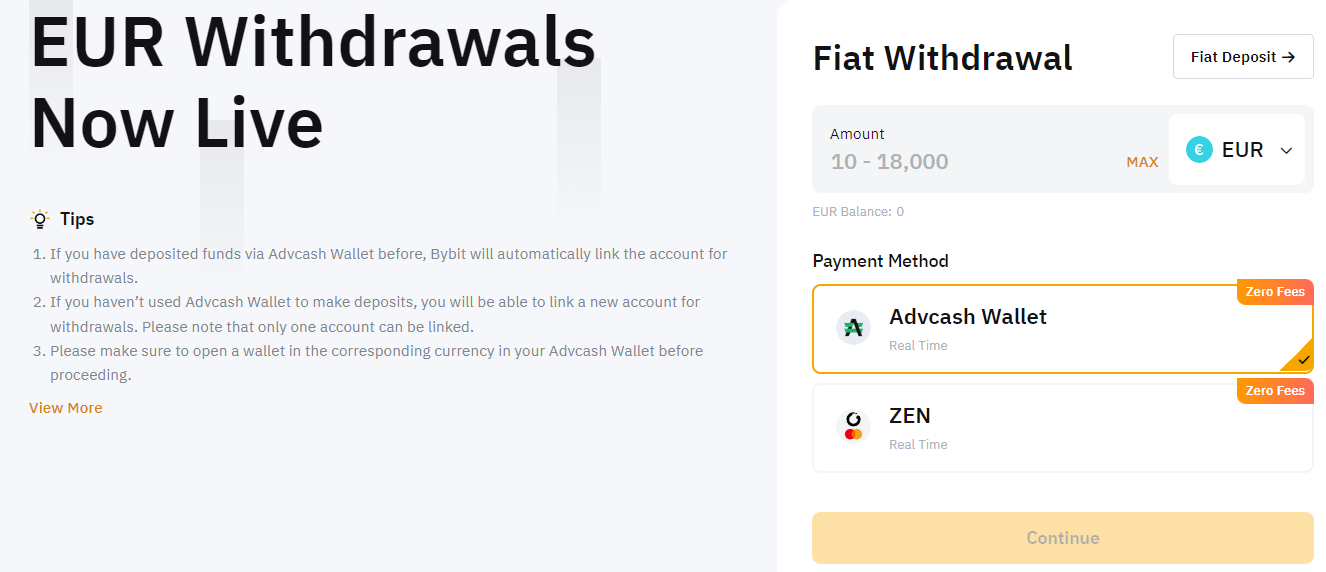

Bybit vs Gemini Withdrawal Methods

Bybit offers ten fiat currencies that can be withdrawn, some of the most notable currencies being USD, GBP, EUR, TRY, and UAH. Withdrawing TRY and BRL from the bank is free, but if you want to withdraw in USD using a wire transfer, it will cost you $25.The fees are low when you take out your cryptocurrency from Bybit. For Bitcoin, it’s 0.005 BTC; for Ethereum, it’s 0.005 ETH; for Solana, it’s 0.01 SOL; and for USDT, it’s 10 USDT.

In comparison, Gemini allows one to withdraw their fiat currency in USD, EUR, and GBP through the bank, and they don’t charge any fees for that. Gemini’s cryptocurrency withdrawal fees are also reasonable. For Bitcoin, it’s just 0.0001 BTC, and Ethereum withdrawals are free. But if you withdraw Solana, there’s a fee of 0.005 SOL, and for USDT, it costs $3.

Bybit and Gemini have convenient and relatively cheap ways to withdraw regular money and cryptocurrency. Bybit is better if you want to withdraw BRL or TRY without any fees, while Gemini is a good choice for larger withdrawals in USD, EUR, or GBP, as they have no fees for those. Remember to check the fees for each cryptocurrency you want to withdraw on each platform.

Bybit vs Gemini Security

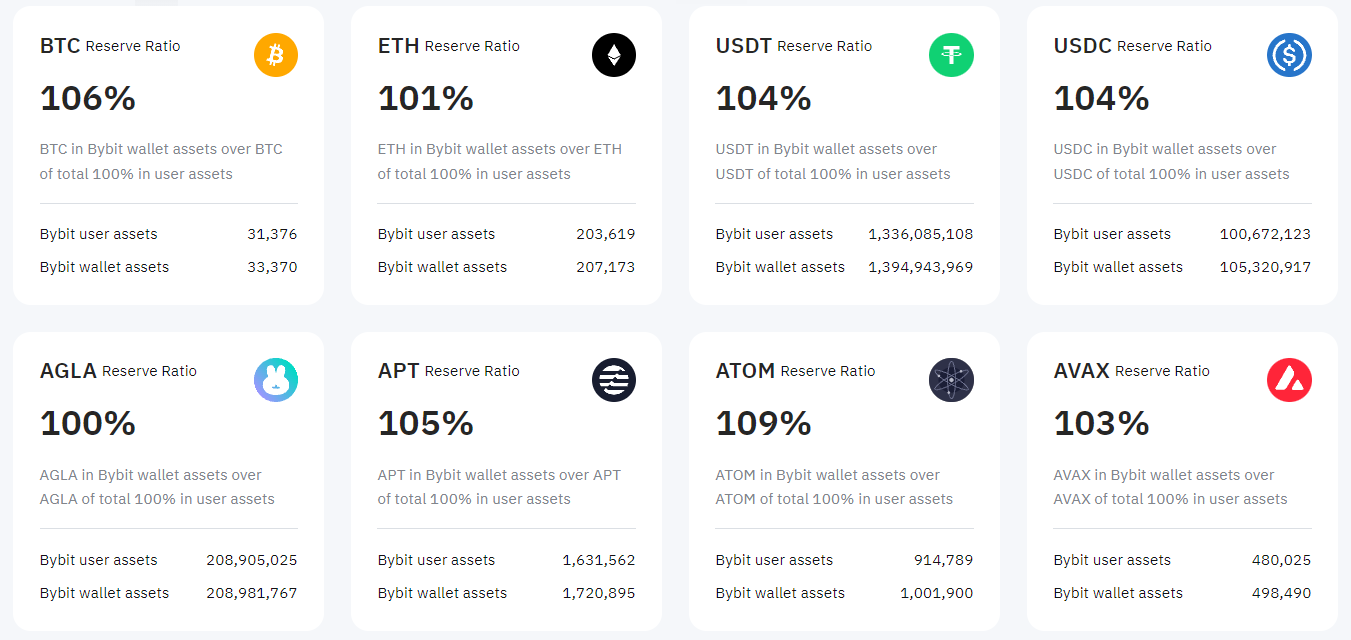

To ensure and maintain reliability and transparency, Bybit uses Proof of Reserves (PoR). Through Bybit Proof of Reserves, users can verify the following:

- The balance of your assets in our exchange via Merkle Tree

- The balance and ownership of the wallet addresses we disclose

- The reserve ratio

In addition to the above, it is imperative to note that since its inception, Bybit has never been hacked. That is due to the unmatched security it provides and the fact that it is one of the most trustworthy crypto exchanges. Additionally, the platform highly advises users to set up anti-phishing code incorporated within the platform and secure their assets using Google 2FA. That aids in alerting consumers to any questionable behavior, such as non-matching codes.

In contrast with the above, according to the Gemini team, the company offers Industry Leading Security Controls.

This platform has implemented the following fortified security controls to secure customer accounts and assets and mitigate the risk of insider threats:

- Two-Factor Authentication (2FA) is required by default to access your account and withdrawals.

- Support for hardware security keys, like Yubikey, allows for a more secure 2FA experience for account access.

- Address allow listing allows users to restrict cryptocurrency withdrawals to allow listed cryptocurrency addresses.

Although Gemini claims to have industry-leading security, a security breach in December 2022, led to the company being sued for approximately $37 Million by IRA Financial because of the crypto heist. Gemini’s Trust Center reported that the exchange had adopted a proof-of-reserves strategy since the hacking incident to promote transparency and provide consumers peace of mind that their investments are secure. Gemini continues to uphold its commitment to transparency by making this data accessible on CoinMarketCap, a platform for cryptocurrency market statistics.

Conclusion

To conclude, it is quite evident that Bybit is the best crypto exchange platform as compared to Gemini. Although both platforms have numerous similarities, Bybit is safer, more efficient, and incredibly affordable.

That is not to disregard the fact that both platforms have unique functions that will serve a user’s different purposes. So, if you want a platform fortified security and lower fees, then Bybit is for you.

However, if you are looking for regulatory compliance and user experience, Gemini is a better option as it prioritizes such.

In essence, although various points have been highlighted to show the strengths and weaknesses of both platforms, a user or crypto enthusiast needs to determine their goals and preferences to make an informed decision that will benefit them.