- •Bitpanda is a regulated European platform focused on simple, secure investing.

- •Best for beginners and long term investors who prefer an easy portfolio setup.

- •Bitpanda offers crypto, stocks, ETFs, metals and commodities in one platform.

- •Fees are relatively high compared to many global exchanges.

- •Bitpanda Crypto Index is the world’s first real crypto index for automated diversification.

- •Access is limited, with many countries restricted from using Bitpanda’s services.

- •Bitpanda Pro offers advanced tools but supports fewer order types than major exchanges.

Every exchange claims to simplify crypto trading, but real performance always tells the story. In this Bitpanda review, we’ll take a closer look at how this exchange performs in the real world. How does it manage user safety, what features does it bring, and how practical is it for everyday traders? The crypto space is crowded, and finding one that truly fits your needs takes time. We’ll help you figure out whether this exchange deserves a spot in your trading toolkit or if you should keep looking.

| Stats | Bitpanda |

|---|---|

| 🚀 Founded | 2014 |

| 🌐 Headquarters | Vienna |

| 🔎 Founder | Christian Trummer |

| 👤 Active Users | 4M+ |

| 🪙 Spot Cryptos | 210+ |

| 🔁 Spot Fees (maker/taker) | 1.49% / 1.29% |

| 🕵️ KYC Verification | Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.7/5 |

Bitpanda Overview

Bitpanda is a Vienna-based fintech company founded in 2014 by Christian Trummer and led by CEO Eric Demuth. Over the years, it has become one of Europe’s most trusted digital investment platforms, serving more than 4 million users across 30+ supported countries.

Fully licensed under European financial laws, Bitpanda is known for its strong regulatory standing and security framework. The platform focuses on accessibility and design, offering an experience that feels more like a modern investment app than a traditional exchange.

Bitpanda allows users to invest in a wide range of assets including cryptocurrencies, stocks, ETFs, precious metals, and commodities. Supporting over 210 cryptocurrencies, it gives investors a unified portfolio experience.

Fees are simple but slightly higher than average, with both maker and taker orders charged at 1.49%. Although Bitpanda doesn’t have a native token or advanced trading options like futures or margin trading, it provides 3x leverage on select instruments and maintains an easy-to-use structure.

Its standout feature is the Bitpanda Crypto Index, which lets users automatically invest in the top 5, 10, or 25 cryptocurrencies by market capitalization, as well as thematic indices like AI, DeFi, and Metaverse baskets.

With a focus on simplicity, security, and compliance, Bitpanda is ideal for beginners and long-term investors seeking regulated exposure to multiple asset classes. While it lacks the complexity needed by day traders, its reliability and transparency make it a solid choice for anyone prioritizing safety and ease of use.

Bitpanda Pros and Cons

| 👍 Bitpanda Pros | 👎 Bitpanda Pros |

|---|---|

| ✅ Simple interface ideal for beginners | ❌ No futures trading options |

| ✅ Fully regulated and compliant in Europe | ❌ Higher fees than most exchanges |

| ✅ 210+ cryptos and also supports stocks, ETFs, and metals | ❌ Low liquidity |

| ✅ Strong security with cold storage | ❌ Limited global availability |

| ✅ Simple EUR on/off ramps | ❌ Lacks advanced features; Order types are restricted |

| ✅ Passive income products | ❌ No Proof of Reserves |

| ✅ Unique Bitpanda Crypto Index available |

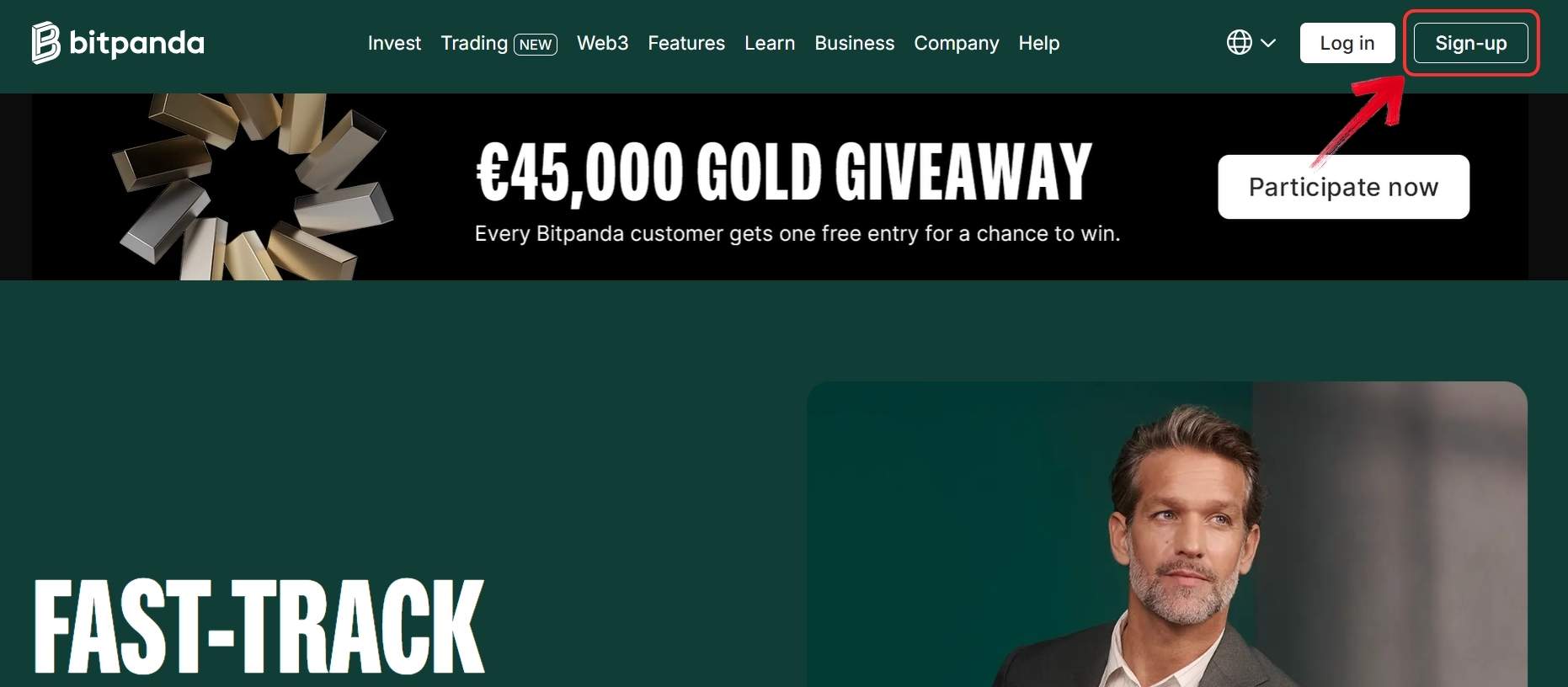

Bitpanda Sign Up & KYC

To access Bitpanda’s services, users must go through a complete verification process, since it is a fully regulated exchange. Getting started begins with creating an account using your email address, followed by identity verification. This KYC process is mandatory before you can start trading or withdrawing funds. Once verified, users can withdraw up to $5 million per day, depending on their account level. Here is how you start the process of start

Here’s how you can begin the process of creating an account on Bitpanda:

Step 1: First, go to the official Bitpanda website and click on the “Sign Up” button located in the top-right corner.

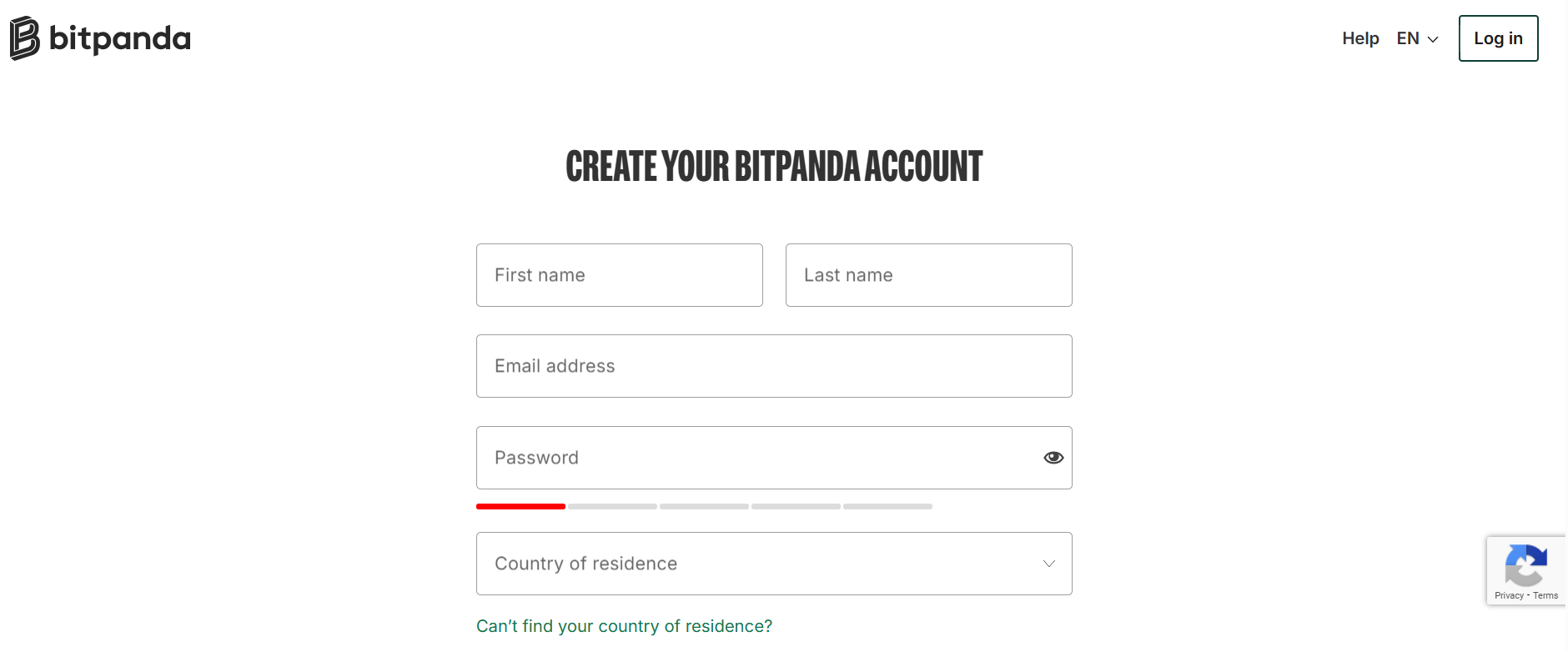

Step 2: You’ll be redirected to Bitpanda’s registration page, where you’ll need to enter your personal details and follow the on-screen instructions to create you Bitpanda account.

Step 3: After confirming your email, you must answer a few questions about compliance with EU anti-money laundering regulations. These questions mainly revolve around your income and planned annual trading volume, including:

- What’s the source of your investing funds?

- What’s your employment status?

- How much do you earn monthly after taxes?

- What’s your rough net worth?

- How much do you plan to invest in one year?

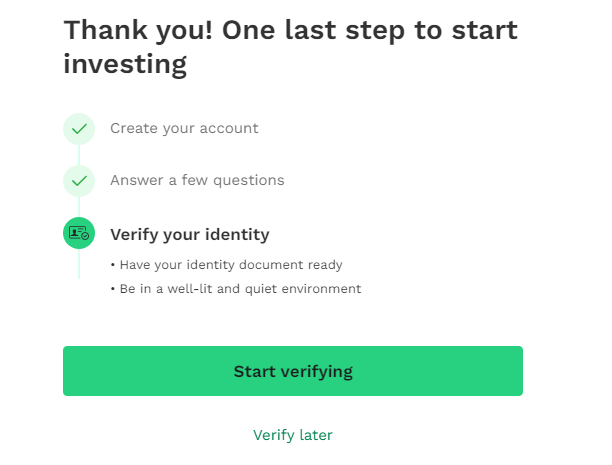

Step 4: Additionally, you’ll need to verify your account by providing the required identification documents. While you can temporarily skip this verification step, please note that you must complete it before making deposits or starting trading activities.

After completing the verification steps, you can easily deposit funds and start trading or investing in cryptocurrencies, stocks, ETFs, and other supported assets directly through Bitpanda’s secure platform.

Before creating your account, confirm that Bitpanda’s services are available in your region. You can easily check this through our Bitpanda Country Checker tool to avoid any location-based restrictions.

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform. Due to regulations, Bitpanda does not support every country. To ensure that you are eligible to register on the exchange, you can use our free Bitpanda country checker.🌍 Free Bitpanda Country Checker

Simply type in your country and see if you can use the platform or if your country is restricted.

Bitpanda Trading

Bitpanda offers two trading interfaces designed for different types of users. The beginner interface is very simple, with no charts or advanced tools. You just choose the asset you want to buy or sell, enter the amount and confirm the order.

For experienced traders, Bitpanda provides its Bitpanda Pro platform, where users can trade more than 210 spot assets including cryptocurrencies, indices, commodities, stocks and forex. Bitpanda Pro is fully integrated with TradingView, giving traders access to live charts, an order book and essential analysis tools, although the available order types are limited compared to major exchanges. The platform charges a 1.49 percent fee on every buy order and a 1.29 percent fee on every sell order.

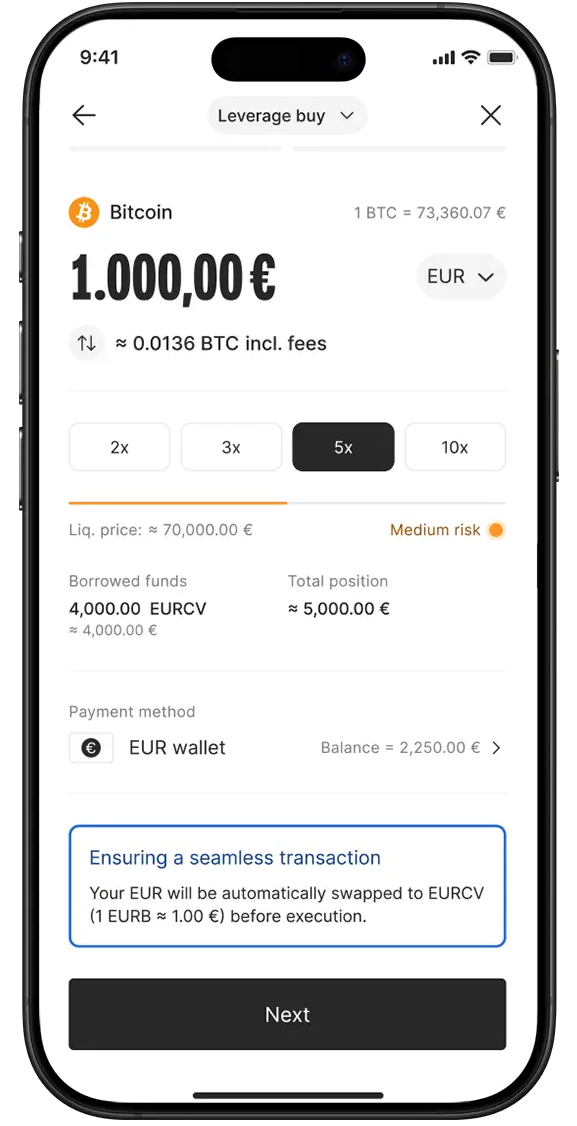

Bitpanda also supports margin trading with up to 10x leverage, along with leveraged tokens that allow traders to take 2L or 2S positions on popular assets like BTC and ETH.

Bitpanda Deposit and Withdrawal Methods

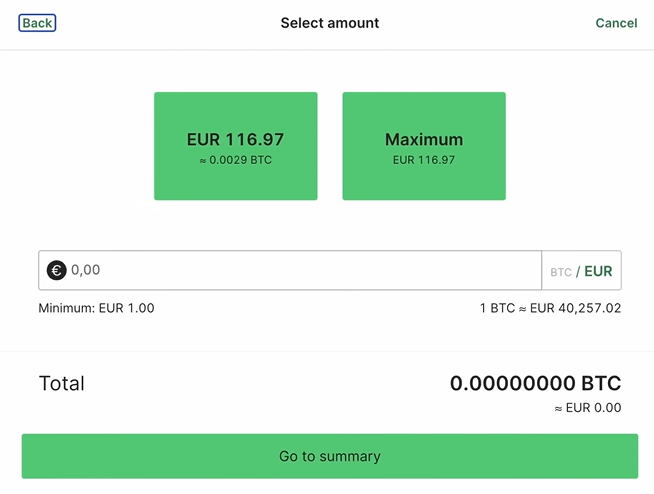

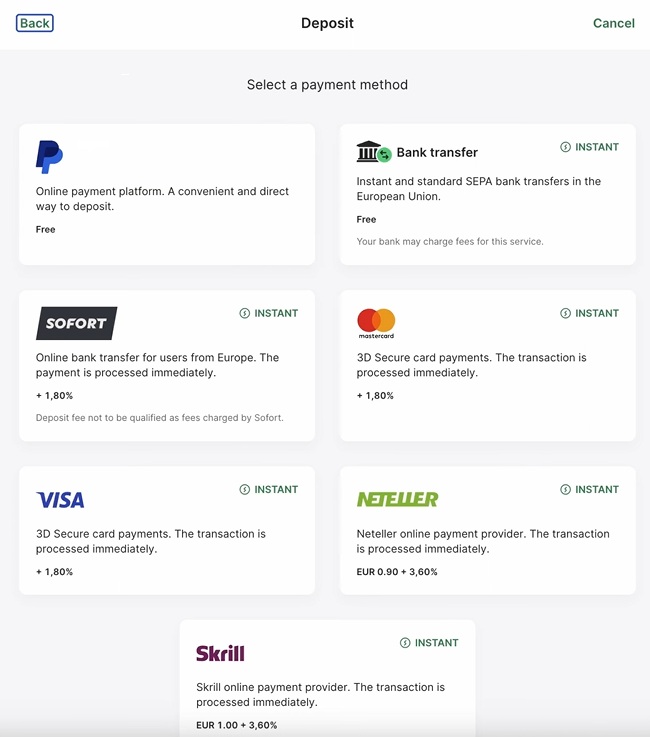

Bitpanda supports both crypto and fiat deposits and withdrawals, giving users flexibility in how they fund or cash out their accounts. For fiat transactions, the platform accepts SEPA transfers, traditional bank transfers, and debit or credit card payments. Crypto deposits are also supported, but it’s important to confirm whether the network you’re using is supported by Bitpanda before sending any funds to avoid losses.

Bitpanda Fees

Now let’s take a quick look at how Bitpanda structures its fees across trading, deposits, and other platform services.

Trading Fees

Bitpanda uses a simple fee model, charging 1.49 percent for buying crypto and 1.29 percent for selling. The platform also offers its native token, Vision (VSN), which can be used to pay trading fees at a 20 percent discount, making transactions slightly more cost efficient for active users.

Spot Fees

Buy: 1.49%

Sell: 1.29%

Deposit and Withdrawal Fees

When it comes to fees, Bitpanda does not charge for fiat deposits or withdrawals made via SEPA transfers, bank transfers, or PayPal. However, payments made through SOFORT or Visa and Mastercard come with a 1.80% platform fee, in addition to the charges applied by the payment provider. Other payment methods may have varying fees depending on the region and service used. For Bitpanda withdrawals, the minimum fiat withdrawal amount is EUR 25, and it’s completely free of charge.

For crypto deposits, Bitpanda applies a small platform fee on top of the regular network gas fee. For instance, Bitcoin deposits via the Lightning Network include a 0.0001 BTC charge, though deposits above 0.05 BTC are exempt from this additional fee.

Bitpanda Products and Services

Now let’s take a look at the different services and features Bitpanda offers its users beyond simple trading tools.

Bitpanda Trading

Bitpanda offers both a simple and an advanced trading experience. The basic interface is designed for beginners who want quick buy or sell options without dealing with charts or technical tools. You choose the asset, enter the amount and confirm the order. For experienced traders, Bitpanda Pro delivers a deeper market view with TradingView charts, real time price data and an aggregated order book that pulls liquidity from major exchanges, market makers and other providers into one place. While trading on Bitpanda, you are not limited to cryptocurrencies alone. The platform also lets you trade stocks, ETFs, indices, commodities and even forex, giving users a wide range of investment options in a single ecosystem.

Mobile App

Bitpanda’s mobile app provides the same functionality as the web version, making it easy to manage your portfolio on the go. Users can buy, sell or swap assets, track charts, view their indices and monitor market movements in real time. The app also supports deposits, withdrawals, verification steps and security features like two factor authentication. Its clean layout keeps everything simple for beginners while still giving advanced traders access to charts and price tools whenever they need them.

Vision Token

Bitpanda’s Vision token (VSN) works as the main utility token across the Bitpanda Web3 ecosystem. It connects features like staking, rewards, governance and fee payments into one system. For users, holding VSN can make the platform more cost effective and rewarding. You can pay trading fees using VSN and get up to a 20 percent discount. It also gives XP boosts for missions, early access to Launchpad projects and helps you unlock higher loyalty levels over time.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

Bitpanda Savings Plans

Bitpanda’s Savings Plans let you automate your investments across crypto, stocks, ETFs, metals, commodities and all Bitpanda Crypto Indices. You choose an asset, set the amount and pick a schedule, and Bitpanda buys it for you automatically. This approach helps smooth out price volatility through cost averaging and removes the pressure of timing the market. It’s useful for users who prefer long term growth, steady accumulation and a stress free way to build a diversified portfolio without constant manual buying.

Bitpanda Earn

Bitpanda Earn allows users to earn passive rewards through staking and stablecoin earning options. You simply choose an eligible asset and activate staking, and weekly rewards are added to your balance automatically. There are no lock ins for most assets, so you can unstake whenever you need your funds. Rewards are restaked by default, helping your balance grow through compounding. This feature is helpful for users who want their assets to work in the background while keeping full control of their holdings.

Bitpanda Card

The Bitpanda Card lets you spend your crypto, metals and stocks like regular money anywhere Visa is accepted. You choose which asset pays at checkout, and the app handles the conversion instantly. You also earn one percent cashback in crypto on every purchase, which adds extra value over time. With zero monthly fees and no foreign exchange fees for non Euro payments, it’s useful for users who want to use their investments in daily life while keeping full control through the Bitpanda app.

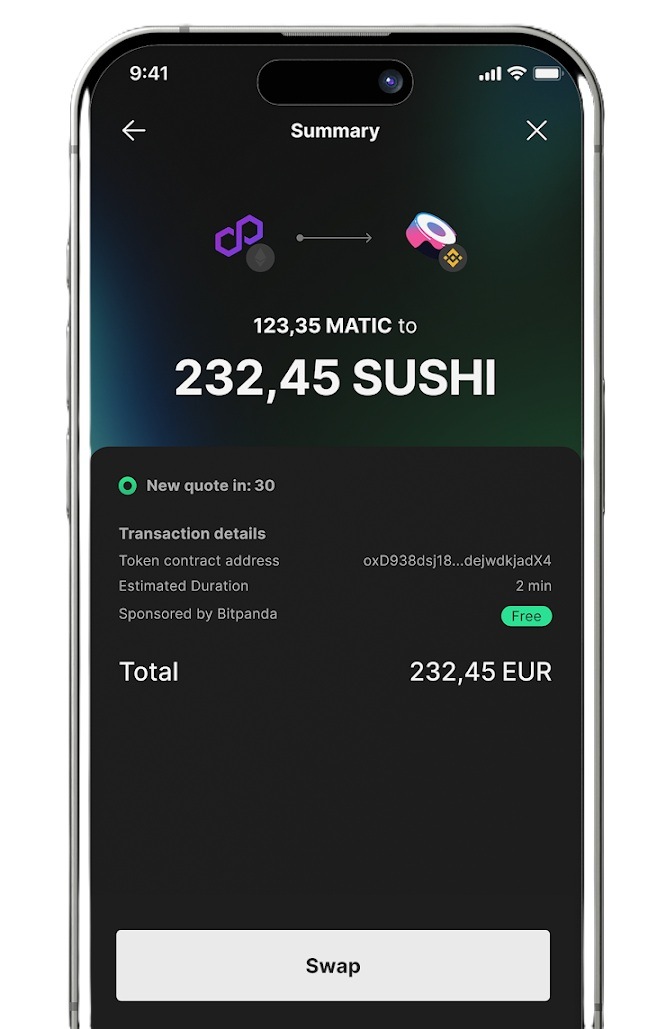

Bitpanda Web3

Bitpanda Web3 brings all of Bitpanda’s decentralised tools into one ecosystem powered by the Vision token. The Bitpanda DeFi Wallet lets you swap thousands of assets in one tap, stake crypto, earn through lending and complete missions for rewards. It also removes seed phrase stress by offering optional account recovery and gas sponsorship on eligible transactions.

Vision Protocol powers cross chain liquidity, helping users move assets easily. Vision Chain will introduce a regulated European Layer 2 for tokenised assets and compliance focused applications. For users who want a simpler, safer entry into DeFi without managing complex wallets or high fees, Bitpanda Web3 offers a guided, unified experience.

Bitpanda Crypto Index

Bitpanda Crypto Indices offer a hands off way to invest in the broader crypto market. Options like BCI5, which includes BTC, ETH, BNB, SOL and XRP, automatically adjust each month based on market performance. You choose an index, buy once and Bitpanda handles rebalancing for you. This helps users diversify across top cryptocurrencies without picking individual coins. It’s helpful for anyone who wants long term exposure to the market while avoiding the effort and risk of constantly managing their portfolio.

Bitpanda Security

Bitpanda is one of the most regulated digital investment platforms in Europe. It is registered with the Austrian Financial Market Authority and the French AMF, and its payments arm holds a PSD2 licence. The company follows strict European laws such as MiFID II, PSD2 and GDPR, which set high standards for financial compliance, user protection and data security. Because of these regulations, Bitpanda does not operate in regions that fall under sanctions, legal restrictions or enforcement risks.

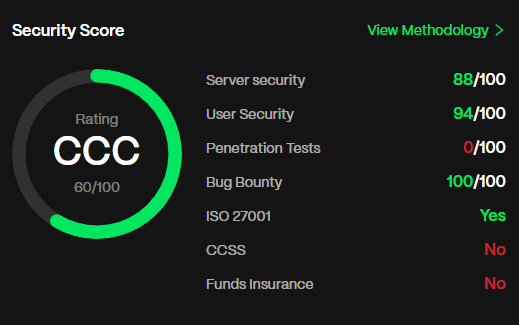

Most user assets are stored in offline cold wallets and audited regularly by independent firms such as KPMG. Bitpanda also holds ISO 27001 certification and has operated for nine years without a single security breach. According to CER.live, Bitpanda holds a CCC security rating with a 60% security score, including 88/100 for server security and 94/100 for user security.

User accounts are protected through modern password hashing, two factor authentication and detailed session monitoring. Bitpanda also provides transparency through third party reviews of its crypto reserves, and customers can request previous proof of reserves reports directly from the website.

Bitpanda Customer Support

Bitpanda is widely regarded as one of the safest regulated platforms in Europe. The exchange operates under strict EU financial laws and follows full AML and KYC requirements. Most user funds are stored in offline cold wallets, reducing exposure to online attacks. All accounts are protected with mandatory identity verification, two factor authentication, and continuous monitoring systems designed to detect suspicious activity.

Bitpanda also uses encrypted communication, secure data handling practices, and regular security audits to maintain platform integrity. As a licensed European broker with a strong safety record, it prioritizes protecting user assets and personal information. For everyday investors who value regulation and security, Bitpanda offers a stable and reliable environment.

Bitpanda Alternatives

Bitpanda is a European-focused exchange with a user-friendly interface, but if you’re looking for alternatives with a broader reach or more features, consider these:

- KuCoin: A popular choice with a wide selection of altcoins and a user-friendly interface, catering to a global audience.

- OKX: A well-established exchange with a wide range of features, including high leverage, a variety of trading tools, and a strong reputation for security.

| Feature | Bitpanda | KuCoin | OKX |

|---|---|---|---|

| Established | 2014 | 2017 | 2017 |

| Spot Fees (Maker/Taker) | 1.49% / 1.29% | 0.10% / 0.10% | 0.08% / 0.10% |

| Futures Fees (Maker/Taker) | Not supported | 0.020% / 0.060% | 0.020% / 0.050% |

| Max Leverage | 10x | 125x | 125x |

| KYC Required | Yes | Yes | Yes |

| Supported Cryptos (Spot) | 210+ | 987+ | 349+ |

| Futures Contracts | None | 410+ | 410+ |

| No KYC Withdrawal Limit | Not Allowed | Not Allowed | Not Allowed |

| 24h Futures Volume | None | $4.66B+ | $21.74B+ |

| Trading Bonus | None | $10,500 | $10 |

| Key Features | • Fully regulated EU broker • Very beginner-friendly • Stocks & commodities trading |

• 987+ cryptocurrencies • Multiple trading bots • Great for altcoins |

• High futures volume • Low trading fees • Advanced features |

| Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

In the end, Bitpanda is best suited for people who want a simple, regulated way to invest rather than an aggressive trading platform. It works especially well for beginners and long term investors in Europe who value security, a clean interface and the ability to hold crypto, stocks, ETFs and metals in one place. Its features, like separate trading interfaces and the Bitpanda Crypto Index, show a clear focus on making crypto more accessible without overwhelming new users.

On the downside, access is very limited outside supported regions and the fees are higher than many global exchanges. Active day traders, futures users or fee sensitive scalpers will likely find better value on other platforms.

FAQs

1. Is Bitpanda safe to use?

Yes. Bitpanda is fully regulated in Europe, uses cold storage, follows strict EU laws and has never experienced a security breach.

2. Does Bitpanda support futures or margin trading?

Futures are not supported. Margin trading is available with limited options and up to 10x leverage.

3. What payment methods does Bitpanda accept?

SEPA, bank transfers, PayPal, Visa, Mastercard and supported crypto networks.

4. Can I use Bitpanda outside Europe?

Access is limited. Many regions are restricted due to regulations.

5. Does Bitpanda have a mobile app?

Yes. The app supports buying, selling, staking, deposits and withdrawals.

6. Does Bitpanda require KYC?

Yes. Full identity verification is required before depositing or trading.