-

- •WhiteBIT supports more than 346+ cryptocurrencies and 204+ futures contracts.

- •Spot fees are 0.10% for both makers and takers.

- •Futures fees are 0.01% for makers and 0.055% for takers.

- •Leverage goes up to 10x on spot and 100x on futures.

- •The exchange supports fiat payments through cards, SEPA, Apple Pay and other methods.

- •WhiteBIT does not offer copy trading, demo trading, NFT markets, or integrated trading bots.

- •The WBT token provides discounts for margin trading and borrowing.

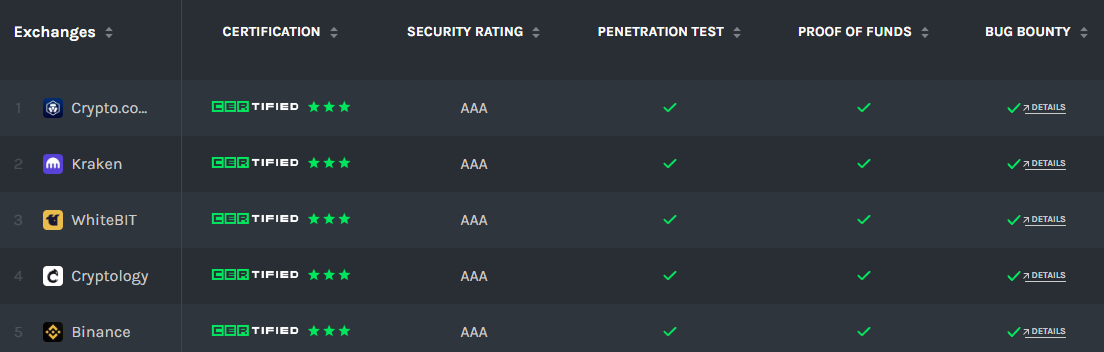

- •99% of customer funds are stored in cold storage and the exchange holds an AAA security rating from cer.live.

- •WhiteBIT follows AML standards and the FATF Travel Rule with full KYC requirements.

- •Ethereum is not listed in the spot market.

In crypto trading, the exchange you choose shapes your entire journey. From deposit options to fees and support, every detail matters. Yet with so many platforms, choice often brings confusion. This WhiteBIT review takes a closer look at its offerings, including tools, services, safety, and accessibility, helping you evaluate the exchange on your own terms.

| Stats | WhiteBIT |

|---|---|

| 🚀 Founded | 2018 |

| 🌐 Headquarters | Estonia |

| 🔎 Founder | Volodymyr Nosov |

| 👤 Active Users | 2M+ |

| 🪙 Supported Coins | 346+ |

| 🪙 Supported Futures | 204+ |

| 🔁 Spot Fees (maker/taker) | 0.1% / 0.1% |

| 🔁 Futures Fees (maker/taker) | 0.01% / 0.055% |

| 📈 Max Leverage | 100x |

| 🕵️ KYC Verification | Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.2/5 |

WhiteBIT Overview

Launched in 2018 by Volodymyr Nosov and headquartered in Estonia, WhiteBIT has positioned itself as a European-focused crypto exchange with more than 2 million users and over 500 employees. 346 cryptocurrencies on spot and 204 futures contracts. Futures trading allows leverage up to 100x, while margin trading on spot goes up to 10x. One surprising limitation, however, is the absence of Ethereum (ETH) from its listings, a notable gap given ETH’s position as the second-largest cryptocurrency by market cap.

The platform reports around $2.87 billion in daily spot volume and $10.82 billion in futures. Spot fees are fixed at 0.10% for makers and takers, competitive with other major exchanges. On futures, maker fees are set at 0.010% to encourage liquidity provision, while 0.055% taker fees remain competitive with other tier-1 exchanges.

WhiteBIT runs as a KYC exchange, following AML requirements and the FATF Travel Rule. On the payments side, it supports fiat deposits in USD, EUR, UAH, and a few other currencies through cards and crypto channels, while withdrawals remain crypto-only. The platform is available in many countries, but it does come with restrictions in places like the USA, UK, Canada, and Russia.

Beyond trading, WhiteBIT has expanded into a wider ecosystem of products and services. Its WBT token is central, offering trading fee discounts and access to certain platform features such as access to new projects through Launchpad. The exchange also runs WB Soul, a Web3 identity service on Whitechain, designed to let users recreate and define their on-chain identity based on their account. Alongside this, WhiteBIT continues to roll out payment solutions, DeFi integrations, and user-focused tools, while also strengthening its brand through official partnerships, including its role as an official partner of Juventus Football Club.

Support is accessible 24/7 via live chat and email, and the exchange is generally rated above average in terms of safety. Its primary focus stays on spot and futures markets, with straightforward fees and leverage options at the core of its offering. In short, WhiteBIT blends compliance, scale, and a developing ecosystem, leaving traders with enough detail to decide whether it suits their needs.

WhiteBIT Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Very user friendly | ❌ Strong security with 99% funds in cold storage and AAA rating |

| ✅ Regulated and licensed | ❌ No Proof of Reserves for transparency |

| ✅ Supports 346+ cryptocurrencies and 204 futures contracts | ❌ No copy trading, demo trading, NFT marketplace, or trading bots |

| ✅ Competitive spot fees at 0.10% maker and taker | ❌ Not ideal for users seeking direct fiat-to-crypto swaps |

| ✅ Low futures maker fee (0.01%) encourages liquidity | |

| ✅ Wide fiat payment methods including SEPA, cards, Apple Pay | |

| ✅ EUR trading pairs available alongside USDT markets | |

| ✅ Strong security with 99% funds in cold storage and AAA rating | |

| ✅ Supports P2P trading with options to buy and sell gaming skins and digital items |

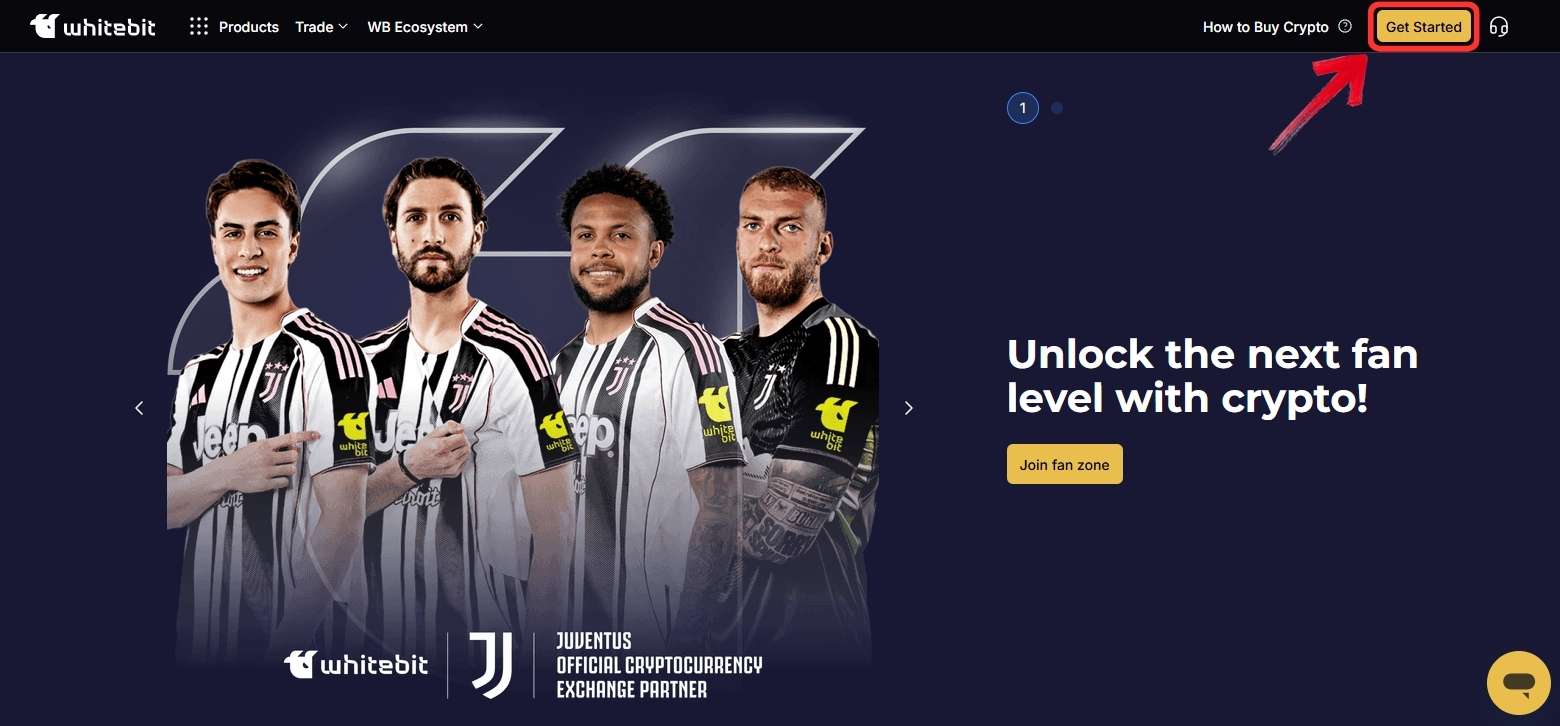

WhiteBIT Sign-up and KYC

Signing up on WhiteBIT is simple; you can create an account using just your email address. However, to access all of WhiteBIT’s products and enable withdrawals, completing KYC verification is required. Here’s how to get started:

Step 1: Go to the official WhiteBIT website and click the “Get Started” button in the top right corner.

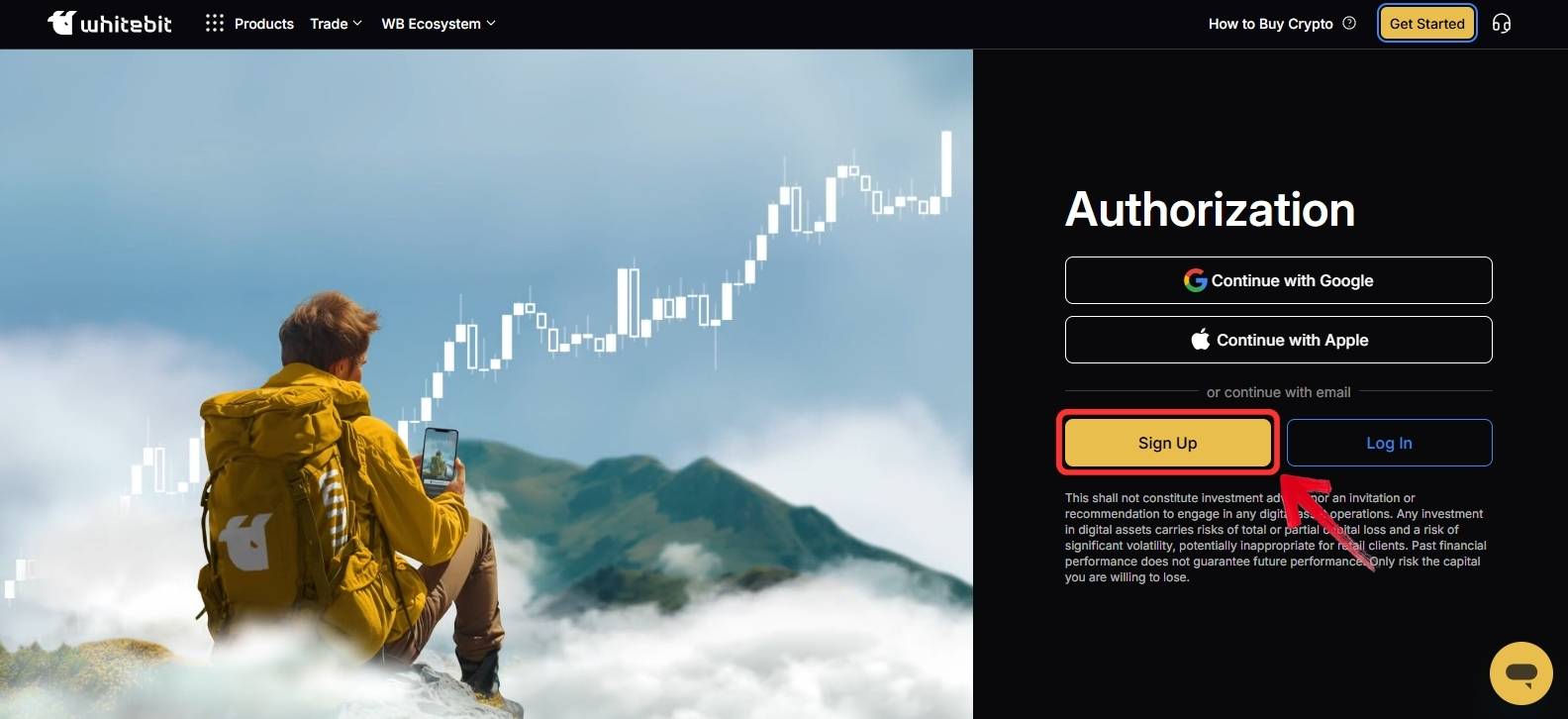

Step 2: You can choose “Continue with Google” for a quick setup or select “Sign Up” to create an account manually.

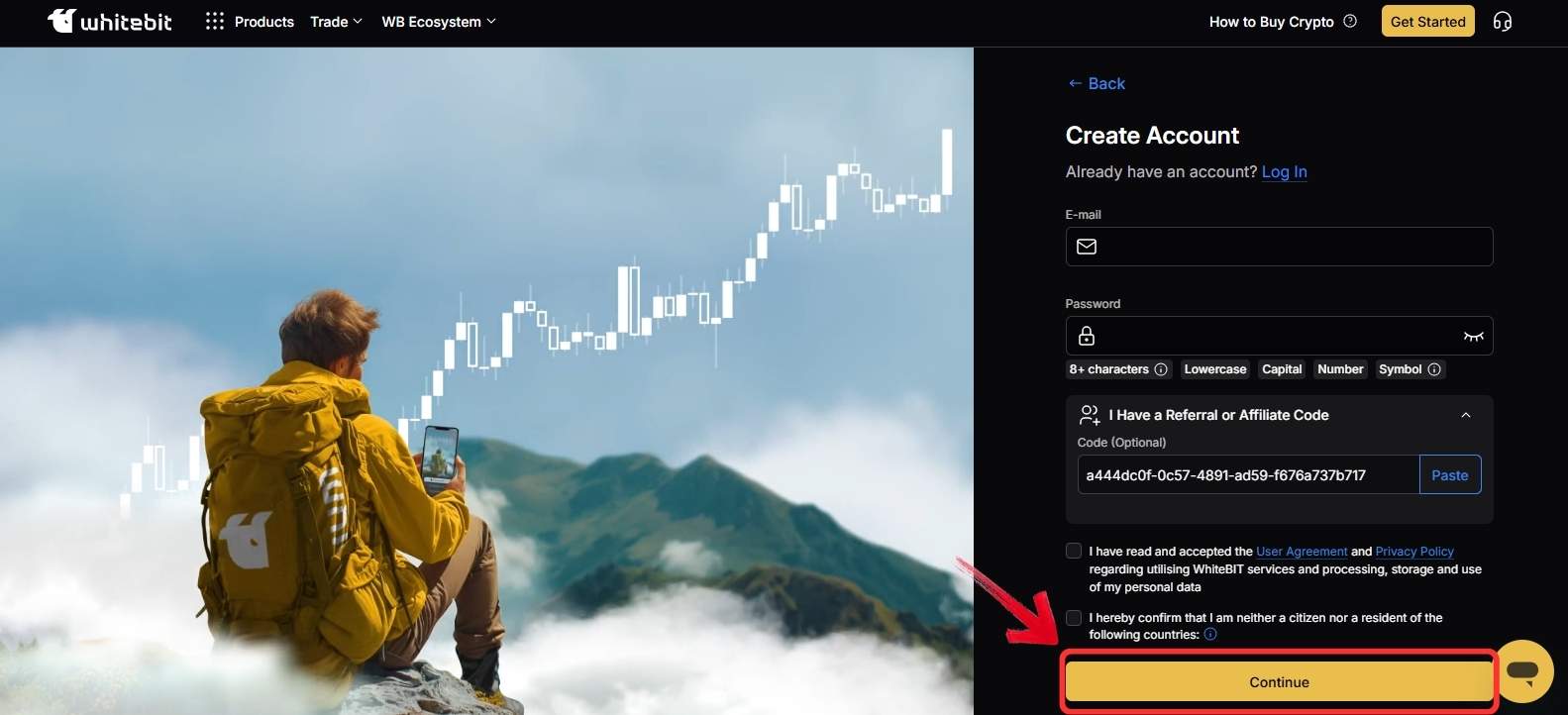

Step 3: Enter your email address, set a strong password, and click “Continue”. To unlock an exclusive bonus, you can use the CryptoWinRate referral.

Step 4: A 6-digit code will be sent to your email. Enter it to verify your account.

Step 5: Once your email is verified, go to the Verification tab and complete KYC. You’ll need to provide:

- A live selfie

- Proof of identity (Passport or Government-issued ID)

After submission, you’ll receive a confirmation email once your KYC is approved. Keep in mind, withdrawals remain locked until verification is complete.

Finally, before starting the signup process, check the restricted countries list. WhiteBIT does not provide services in certain jurisdictions due to FATF and AML regulations. You can use our WhiteBIT Country Checker to confirm eligibility in advance.

🌍 Free WhiteBIT Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, WhiteBIT does not support every country. To ensure that you are eligible to register on the exchange, you can use our free WhiteBIT country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

Trading on WhiteBIT

WhiteBIT currently offers both Spot and Futures platforms to its traders. Let’s take a look at the features of each platform individually.

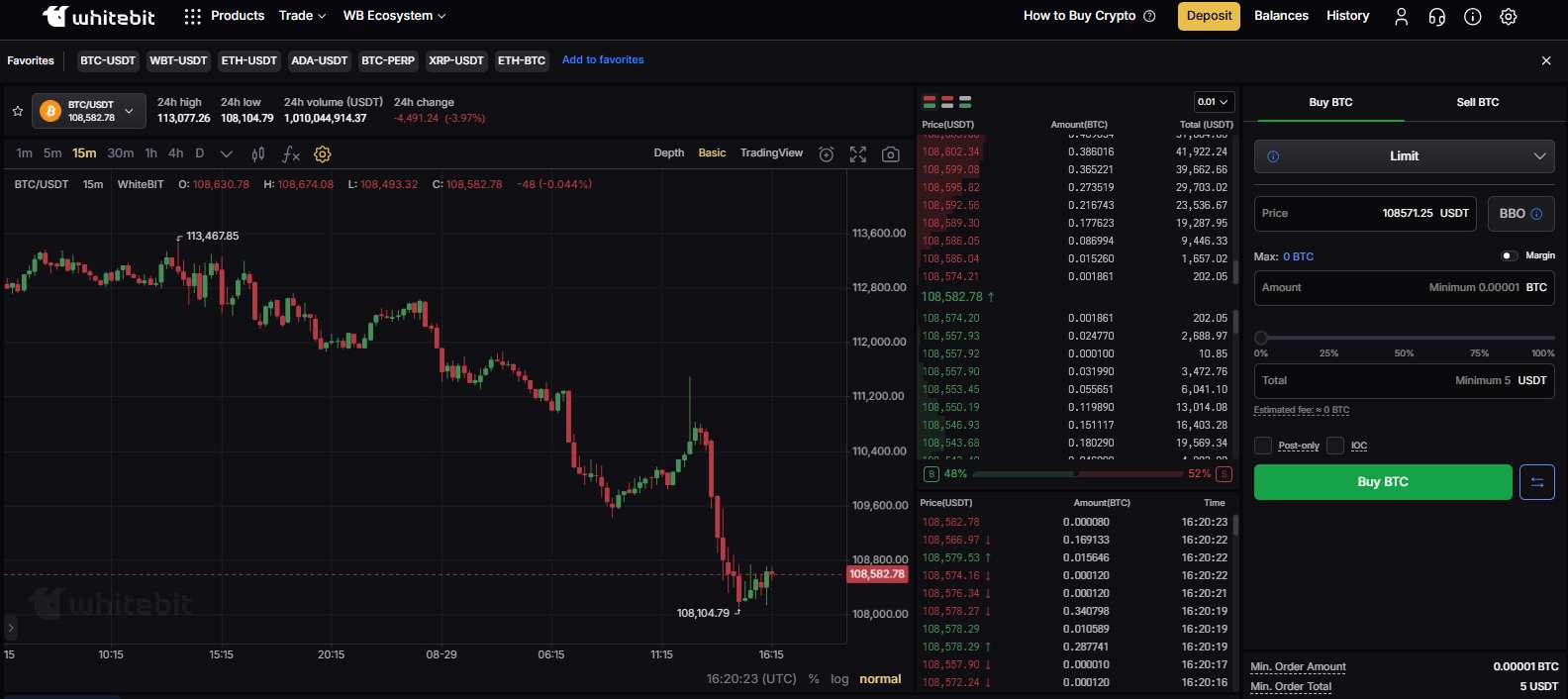

Spot Trading

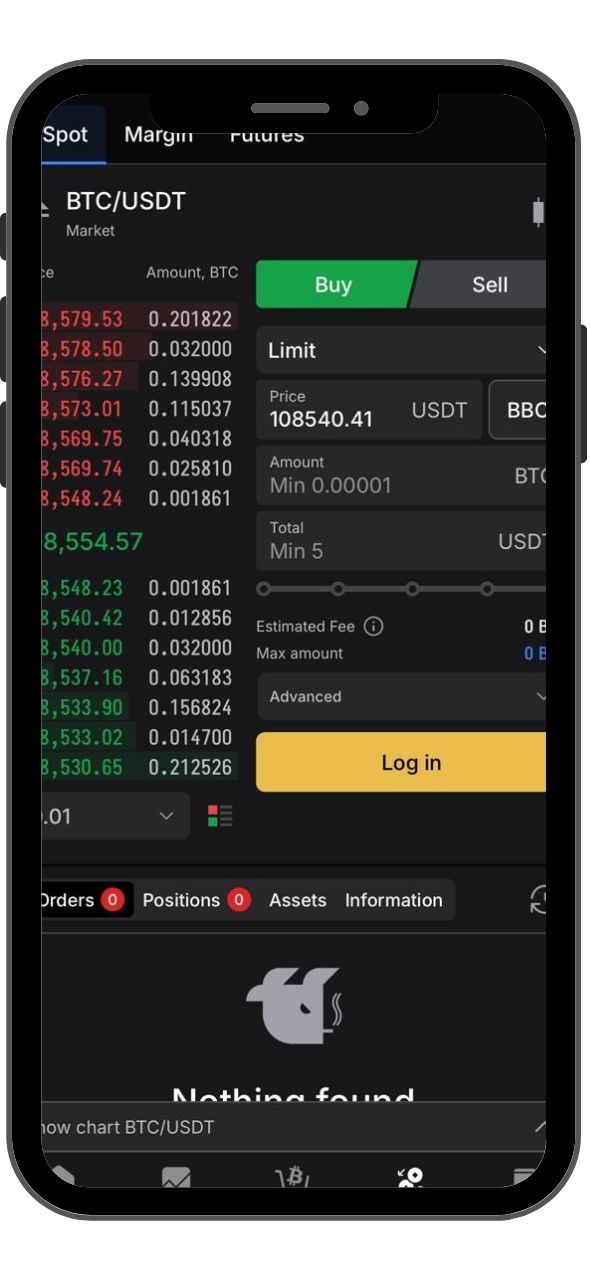

WhiteBIT’s spot market gives access to more than 346 cryptocurrencies and consistently ranks within the Top 50 global spot exchanges. Trading fees are straightforward at 0.10% for both makers and takers, keeping them competitive. Most trading pairs are quoted against USDT, with some EUR pairs also available.

The platform is built for accessibility, offering basic charts for quick checks and full TradingView integration for advanced users who rely on indicators and strategy tools. Margin trading is supported on 26 assets with leverage up to 10x, mainly across USDT pairs and a few BTC pairs. Using BTC or fiat pairs for margin can sometimes reduce exposure to stablecoins, which do not always hold a perfect $1 peg and can fluctuate in value.

Liquidity is generally strong across crypto pairs, with tight spreads and an active order book. However, fiat markets on WhiteBIT remain thin, with very limited trading volume, so caution is advised when trading directly against fiat currencies. Standard order types such as Market and Limit are available, along with advanced options like Stop Limit, Stop Market, and Multi-Limit.

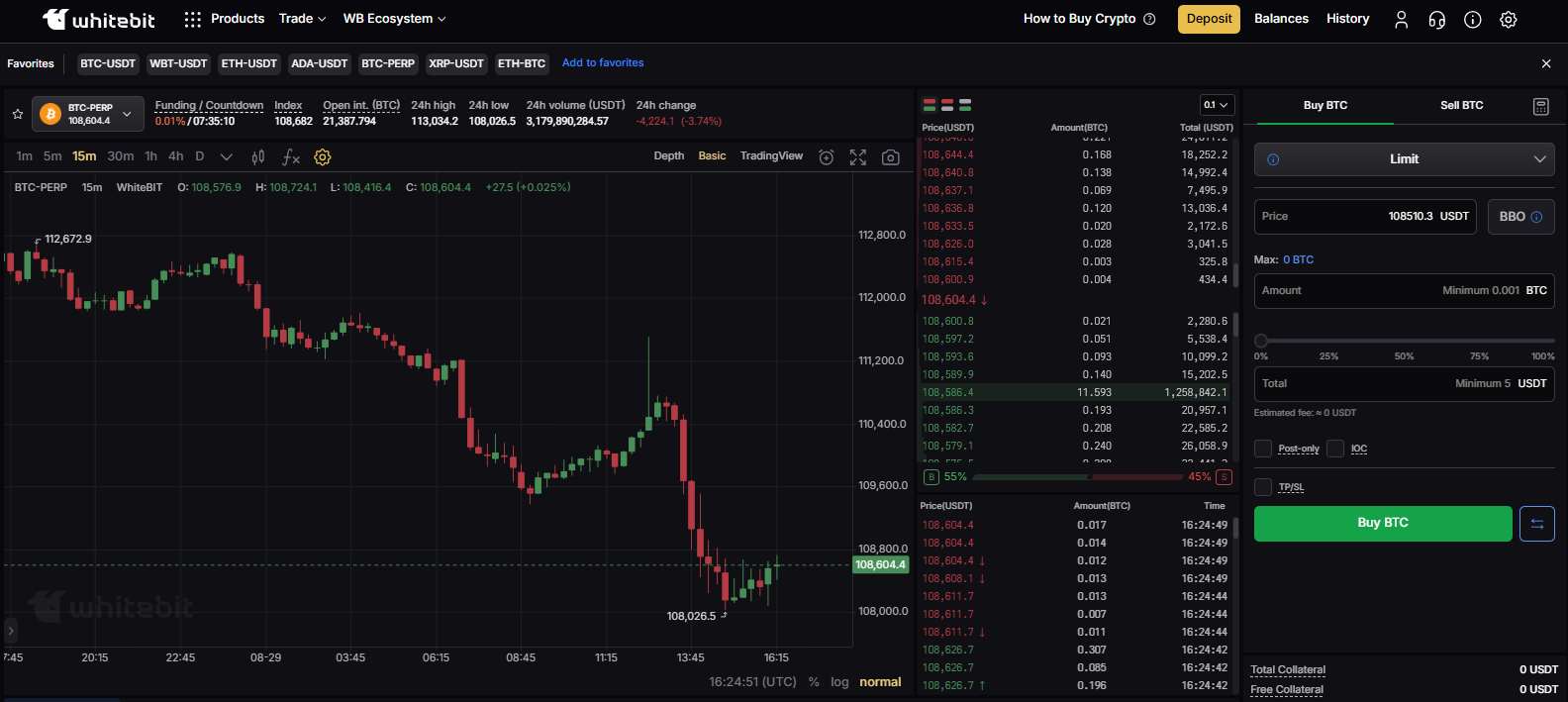

Futures trading

WhiteBIT’s futures platform provides access to more than 204 contracts with leverage up to 100x. Similar to its spot market, the platform is built to balance ease of use with advanced tools, making it approachable for beginners while still offering depth for experienced traders. Users can view simple price action charts or rely on TradingView integration for indicators, strategies, and detailed technical analysis. For traders seeking even higher leverage, you can also check out our Rollbit futures trading review.

Most contracts are paired against USDT, with only a limited number of EUR pairs available. Liquidity is generally solid across key markets, supported by tight spreads and an active order book, which helps maintain consistent execution during volatile periods.

Futures trading fees are set at 0.01% for makers and 0.055% for takers. The taker fee is competitive compared to industry averages, while the lower maker fee provides an incentive for traders who add liquidity to the order book. The platform also supports a variety of order types.

Alongside standard Market and Limit orders, advanced options include Stop Limit, Stop Market, Multi-Limit, and OCO (One Cancels the Other), giving traders more flexibility in managing positions and risk.

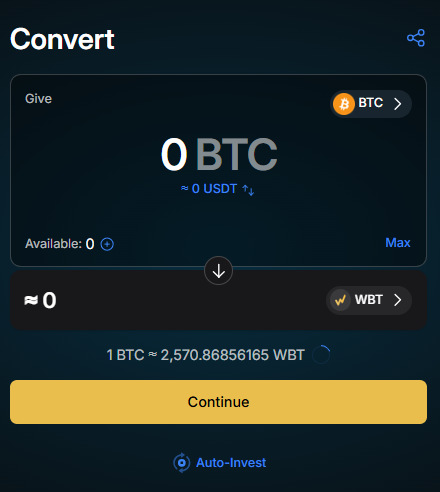

Crypto Convert

The Convert feature is designed for beginners who want a straightforward way to swap one cryptocurrency for another. Transactions are processed instantly, with the rate locked in upfront so there’s no slippage. The interface is simple and easy to navigate, making it a practical option for users who prefer not to deal with order books, trade histories, or multiple order types.

WhiteBIT also offers an Auto-Invest feature, which allows users to set up a recurring purchase plan and build a dollar-cost averaging (DCA) strategy. This is particularly useful for those who want to steadily accumulate crypto over time without reacting to short-term price swings.

WhiteBIT Deposits and Withdrawal Methods

WhiteBIT provides several ways to fund and withdraw from your account. For fiat, the platform supports debit and credit cards along with popular payment options such as SEPA, Volet, Apple Pay, Google Pay, and ZEN. Card payments are usually instant, while SEPA transfers may take longer but can be more cost-efficient.

On the crypto side, WhiteBIT supports all the major blockchain networks, giving users the flexibility to deposit and withdraw assets directly through Bitcoin, Ethereum, ERC-20, TRC-20, and many others. This wide coverage makes it easier for traders to move funds in and out without being restricted to only a few networks.

WhiteBIT Fees

Fees are always an important element when trading because they have a direct impact on profits. WhiteBIT’s fee structure is fairly detailed, covering spot, futures, margin, and borrowing. Let’s break it down.

Trading fees

WhiteBIT uses a maker–taker model. For spot trading, both maker and taker fees are set at 0.10%, which is in line with other major exchanges. Liquidity is solid across main pairs, so slippage is generally minimal.

On the futures side, fees are different. Makers pay 0.01%, while takers are charged 0.055%. The taker fee is competitive with industry averages, but the lower maker fee provides an advantage for traders adding liquidity through limit orders.

Spot Fees

0.10% Maker

0.10% Taker

Future Fees

0.01% Maker

0.055% Taker

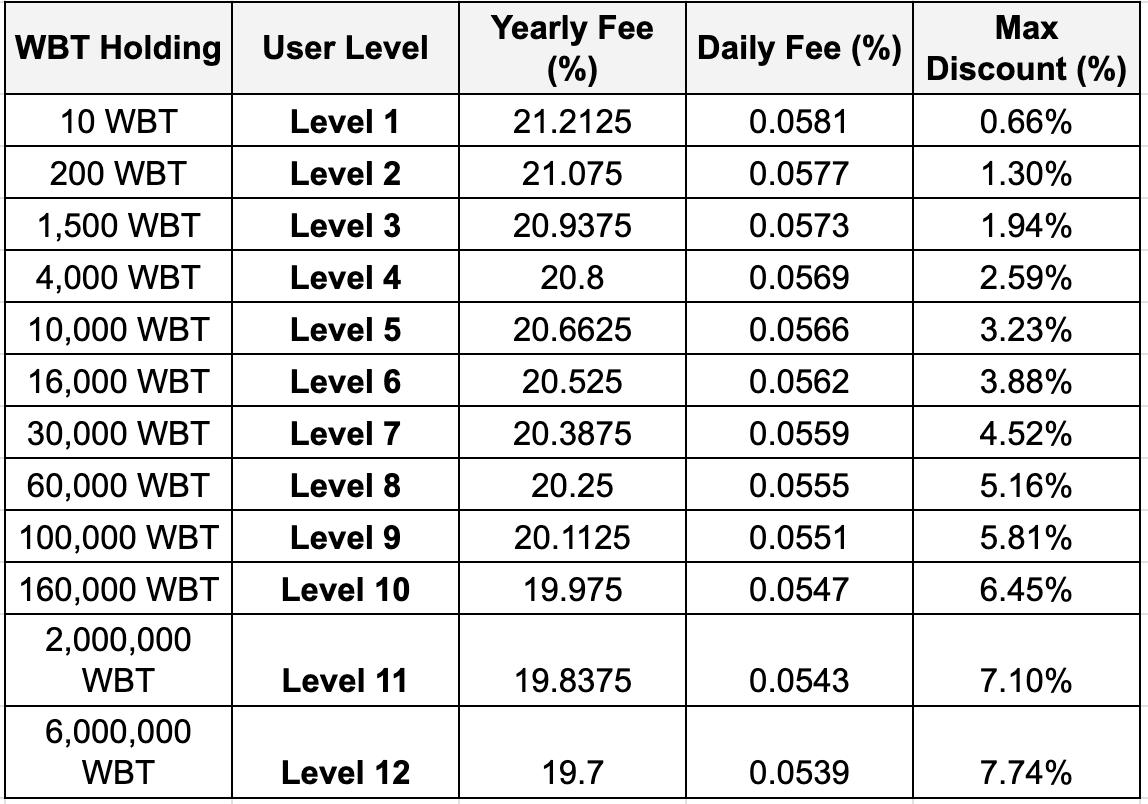

Unlike some exchanges that use a flat fee or tiered structure based on trading volume, WhiteBIT ties certain fees to WBT token holdings. For margin trading and borrowing, there is a daily interest fee of 0.0585%. This can be reduced if you hold WBT tokens, starting with a 0.66% discount at Level 1 (10 WBT) and going up to a 7.74% discount at Level 12 (6,000,000 WBT).

It’s worth noting that holding WBT does not reduce spot or futures trading fees, the discount only applies to leveraged funds used in margin trading and borrowing.

Deposit and Withdrawal Fees

WhiteBIT applies different fees depending on whether you’re depositing or withdrawing in fiat or crypto. Fiat methods such as cards, SEPA, and third-party providers have their own charges, while crypto deposits are free aside from network costs. Withdrawals, on the other hand, include both blockchain gas fees and WhiteBIT’s platform fee.

Fiat Deposits (EUR and USD)

WhiteBIT allows users to fund accounts in both EUR and USD through multiple channels. Payment methods include Visa/Mastercard, SEPA, Volet, Apple Pay, Google Pay, and ZEN. Card deposits are instant, while SEPA transfers may take longer but are often cheaper.

| Method | EUR Fee | USD Fee |

|---|---|---|

| Visa/Mastercard | 0 EUR | 0 USD |

| Volet.com | 1.5% | 1.5% |

| SEPA | 0.2% | – |

| Apple Pay | 1.5% | 1.5% |

| Google Pay | 1.5% | 1.5% |

| ZEN | 1% | – |

Fiat Withdrawals (EUR and USD)

For withdrawals, WhiteBIT supports the same range of fiat methods, but the fee structure is different. While card withdrawals are available, they come with higher costs compared to SEPA or Volet.

| Method | EUR Fee | USD Fee |

|---|---|---|

| Checkout (Card) | 0 EUR | 0 USD |

| Visa/Mastercard | 2 EUR + 2% | 2 USD + 2% |

| Volet.com | 1.5% | 1.5% |

| SEPA | 5 EUR | – |

| ZEN | 1% | – |

Crypto Deposits and Withdrawals

On the crypto side, WhiteBIT supports all major blockchain networks, including Bitcoin, Ethereum (ERC20), and several others. Deposits are free (only the blockchain network fee applies). For withdrawals, WhiteBIT charges both the standard network fee and an additional platform fee, depending on the asset.

| Network | Deposit Fee | Withdrawal Fee |

| BTC Network | 0 BTC | 0.00009 BTC |

| ERC20 | 0 ETH | 0.0001509 ETH |

WhiteBIT Products and Services

Beyond its core spot and futures markets, WhiteBIT has expanded into a broader ecosystem designed to give traders more than just basic exchange functionality. Let’s take a closer look at the products and services that build on its trading foundation.

Trading Tools

WhiteBIT provides access to spot and futures trading, alongside margin trading with up to 10x leverage. The platform includes advanced order types such as Stop Limit, Stop Market, Multi-Limit, and OCO, giving traders flexibility. Liquidity is moderate, which works fine for most pairs, though it may not compete with top-tier exchanges. On the downside, WhiteBIT lacks features many traders look for elsewhere, such as demo trading, copy trading, NFT markets, or integrated trading bots. Overall, the tools are reliable and user-friendly, but more advanced traders may find the ecosystem limited compared to competitors.

Mobile App

WhiteBIT offers a mobile application for both iOS and Android devices, supporting core functions like trading, lending, deposits, withdrawals, and customer support. In testing, the app performed smoothly with no major issues, and the design is intuitive enough for new users. However, reviews paint a mixed picture: over 1M+ downloads and 21K+ ratings average to just above four stars, with complaints around order history and OCO execution. Despite this, many users appreciate the overall trading experience. We tested the app in August 2025 and found it stable, raising questions about the gap between user reviews and actual performance.

WBT Token

The WBT token is WhiteBIT’s native utility asset, designed to integrate with various platform services. It does not reduce spot or futures trading fees, unlike many exchange tokens, but it does play a role in margin trading and borrowing, where users can unlock fee discounts by holding WBT. Levels start with as little as 10 WBT and scale to millions of tokens, offering greater discounts on leveraged funds. For everyday traders, its utility feels limited, though it adds value for those actively borrowing or using margin. Its role is focused but narrower than tokens from other exchanges.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

FIAT ON-OFF Ramp

WhiteBIT provides a broad fiat gateway, supporting EUR, USD, GBP, and more through methods such as Visa/Mastercard, SEPA transfers, Advcash, NixMoney, and bank transfers. This variety makes it accessible to traders across multiple regions. Deposits are straightforward, but the cost varies depending on the method, cards are often free from WhiteBIT’s side, while SEPA and third-party processors can add their own charges. Withdrawals also carry additional fees. Overall, the fiat coverage is extensive, with 10+ currencies supported, but the pricing structure means users should carefully select the payment method that suits them best.

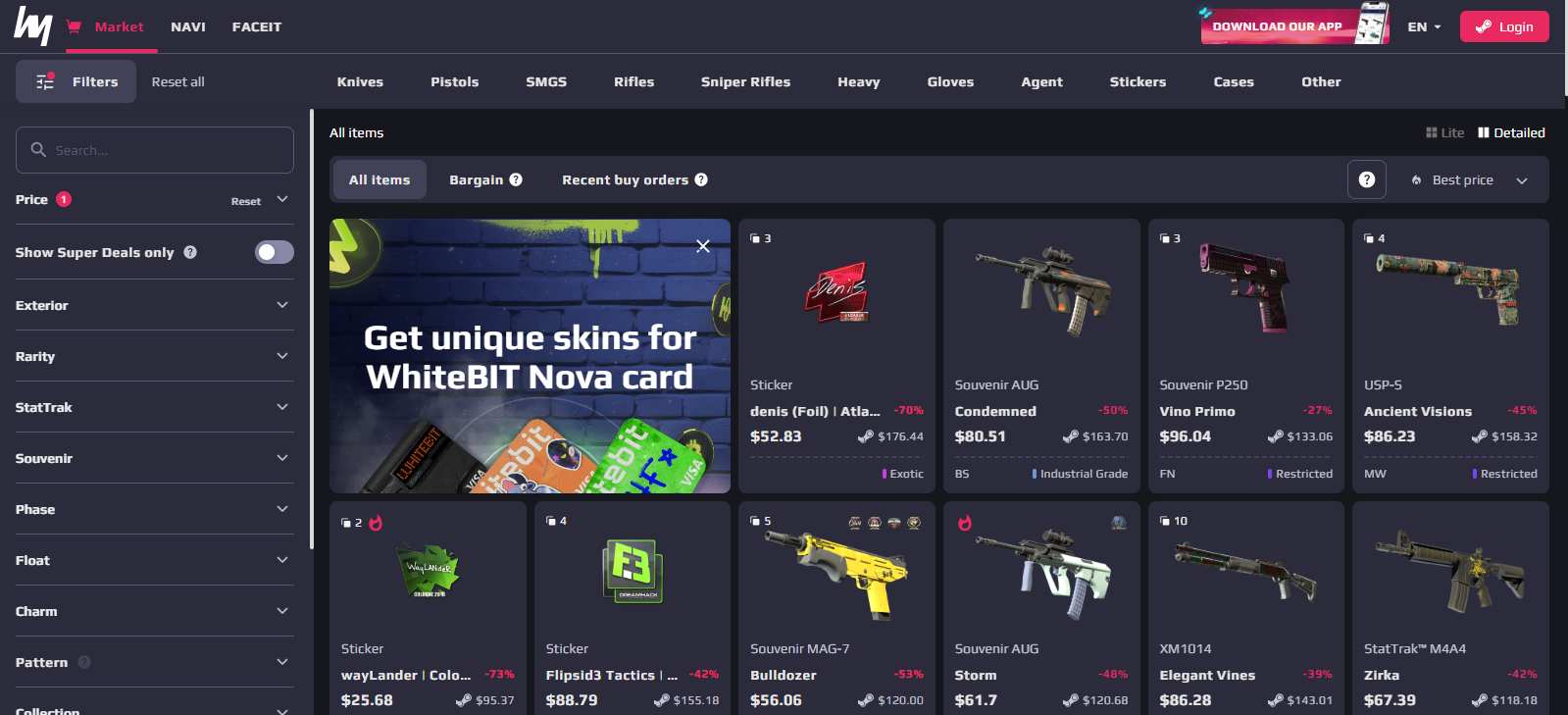

White.Market

White.Market offers a unique take on peer-to-peer trading. Instead of focusing solely on crypto-to-fiat swaps like most P2P platforms, it allows users to buy and sell gaming skins and digital items, often at discounted prices compared to Steam. Buyers pay no fees, and discounts of up to 35% are possible. Liquidity is not high across all categories, but for niche traders and gamers, it provides an unusual and useful marketplace. It’s not a replacement for standard P2P trading, but it adds a layer of variety that sets WhiteBIT apart from exchanges with more traditional P2P desks.

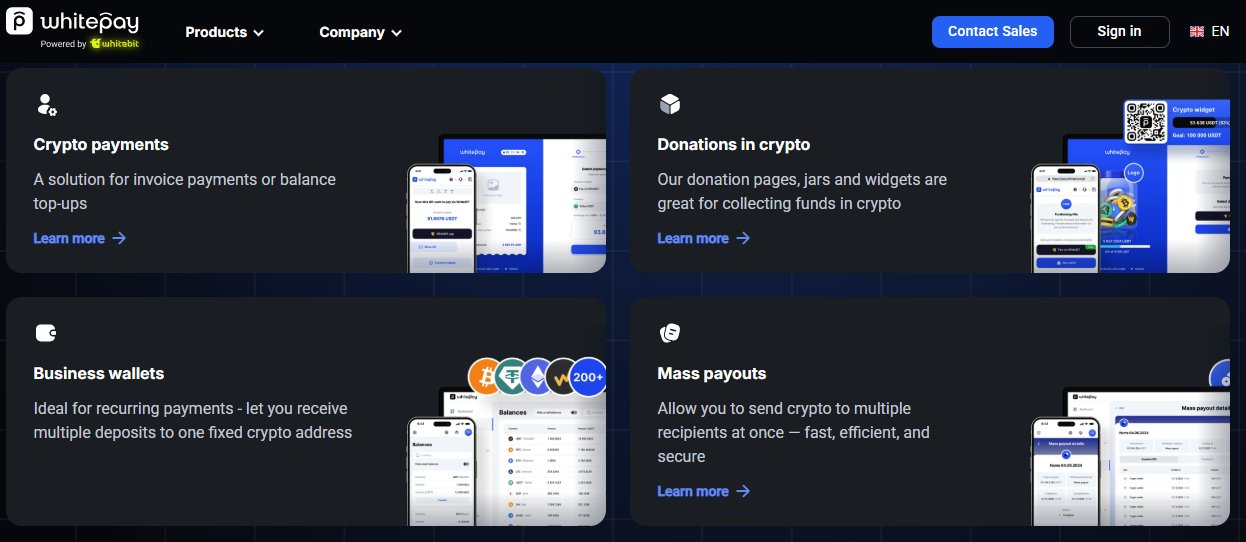

Whitepay

Whitepay expands WhiteBIT’s use cases into payments and merchant services. Supporting over 200 cryptocurrencies, it enables users to send donations, make everyday payments, or for merchants, accept crypto through business wallets. Features such as recurring payments, fixed wallet addresses, and mass payouts make it practical for businesses that want to accept digital currencies globally. Fees are kept relatively low compared to traditional processors, and settlement is fast. For individual users, it may feel like an add-on, but for merchants and organizations, Whitepay introduces a reliable gateway to integrate crypto into payments without high friction or technical complexity.

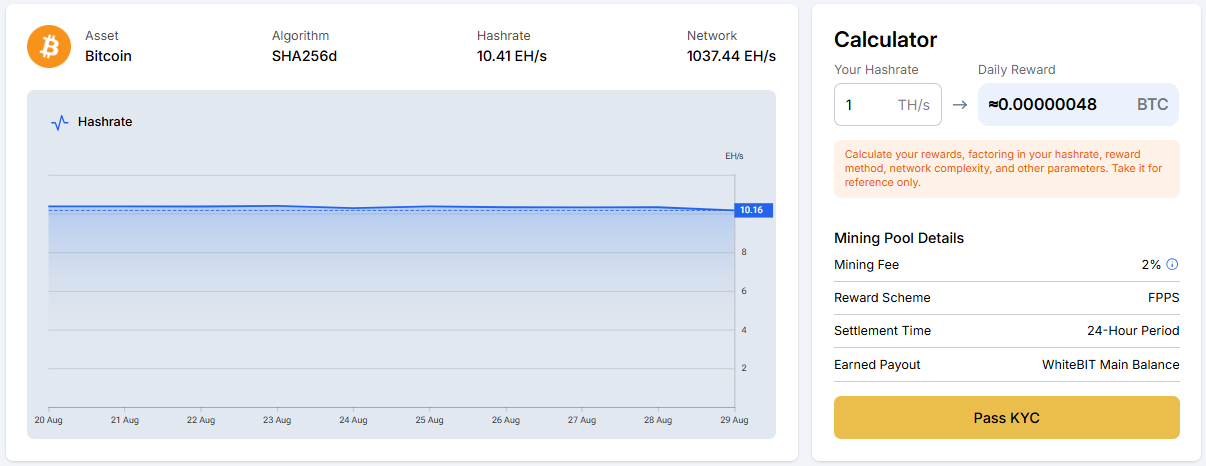

WhitePool

WhitePool is WhiteBIT’s mining pool, designed to aggregate computing power from miners around the world. It supports algorithms like SHA256 and SHA256AsicBoost, allowing miners to pool resources for greater efficiency. The platform emphasizes stable payouts and a user-friendly interface, making it easier for both professionals and smaller participants to join. For miners looking for a more consistent income than solo mining can provide, WhitePool is a practical option. However, it is limited in scope compared to global leaders in the mining space, so it may appeal more to existing WhiteBIT users than to the wider mining community.

WhiteSwap

WhiteSwap functions as WhiteBIT’s decentralized exchange, operating on both Ethereum and WhiteBIT Chain. It allows users to engage in swaps, provide liquidity to pools, farm tokens, and participate in DeFi-style mining. The DEX integrates with any EVM-compatible wallet such as MetaMask, making it accessible for users already active in the DeFi space. Liquidity is moderate and largely tied to the WhiteBIT ecosystem, which limits its competitiveness compared to leading DEXs. Still, for users seeking an on-chain trading experience connected to their WhiteBIT account, it provides a convenient bridge between centralized and decentralized services.

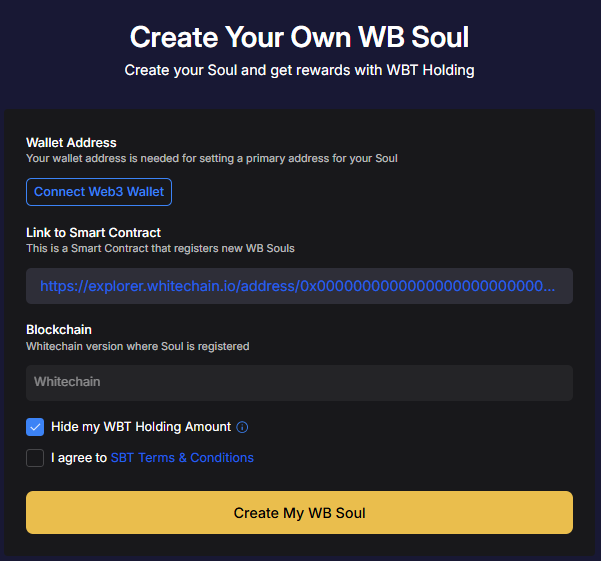

WB Soul

WB Soul is a Web3 identity tool developed on Whitechain. It allows users to recreate and manage their identity on-chain without exposing personal data, effectively giving each account a blockchain-based profile. This makes peer interactions more transparent and trustworthy, while also enabling unique account-linked attributes. The concept adds an extra layer of community trust to the ecosystem, though its practical use cases remain limited outside of WhiteBIT. For those invested in Web3 identity solutions, WB Soul is an interesting experiment, but for the average trader, it may feel like a feature with more potential than present utility.

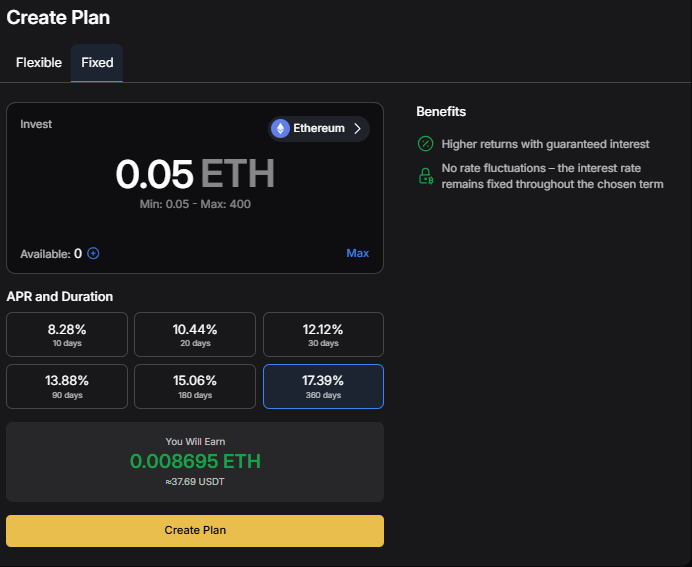

Crypto Lending and Borrowing

WhiteBIT supports both lending and borrowing services. Lending allows users to earn yield by depositing assets, with flexible options for USDT, USDC, BTC, and ETH, and fixed-term plans covering more than 90 assets with higher APRs. Borrowing enables users to take out crypto loans secured by their balance, which can then be used for trading, transfers, or withdrawals. The service is straightforward and efficient, but the range of supported assets on flexible plans is limited. For passive income seekers, lending can be appealing, while borrowing is best suited to active traders who need short-term liquidity.

Nova Card

The Nova Card makes it possible to use crypto for everyday purchases, offering up to 10% cashback depending on usage. It can be used for routine expenses like groceries, coffee, or online shopping, essentially bridging digital assets with daily spending. The card is free to order, which makes it attractive, though cashback benefits are often tied to terms and conditions users must check beforehand. As with most crypto cards, the appeal depends on how actively you spend digital assets. For those who want to integrate crypto into their regular lifestyle, Nova Card is a simple and accessible solution.

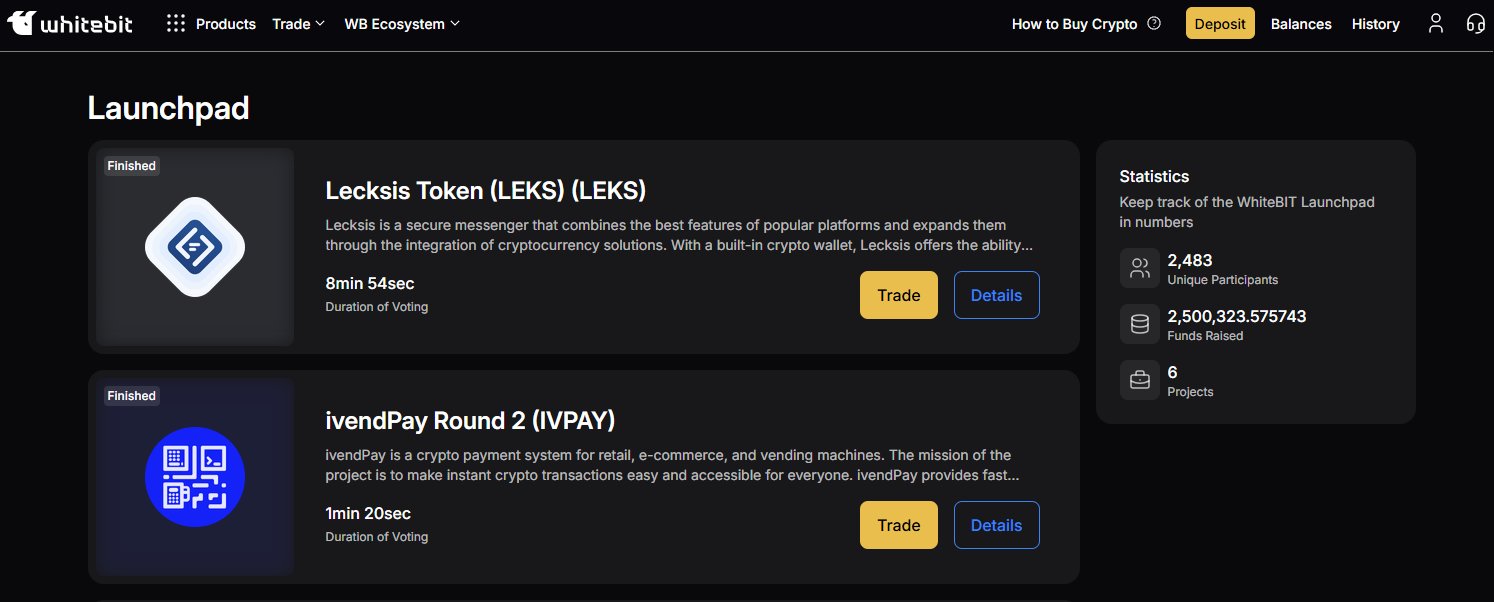

Launchpad

The WhiteBIT Launchpad introduces new crypto projects to the exchange’s ecosystem. Users can explore upcoming tokens, support listings by voting, and gain early access before market launch. Unlike some rival platforms, operations are managed via a partner company, Nova Fintech LLC, registered in Saint Vincent and the Grenadines. This structure means WhiteBIT’s involvement is partially external. The Launchpad is a useful way for traders to access early projects, though opportunities are limited compared to larger exchanges with broader networks. It’s more of an additional feature than a primary reason to use WhiteBIT.

WhiteBIT Security

In terms of security, WhiteBIT seems to be taking customer protection very seriously. According to their website, 99% of all customer funds are stored in multi-sig cold storage. These are offline wallets that can not be accessed through the internet, making it near impossible to hack them. Furthermore, multi-sig wallets require signatures from multiple individuals to unlock them so that one single bad actor can not steal the funds. WhiteBIT is on rank 3 in the security section with an AAA security rating according to cer.live.

If you want to protect your WhiteBIT account with more than just a password, you can set up 2-factor Authentication through Google Authenticator. Additionally, you can add an anti-phishing code which will be displayed in official WhiteBIT emails to you. If an alleged email from WhiteBIT does not have this code, you know that it is a fake email.

On the compliance side, WhiteBIT follows AML standards and the FATF Travel Rule, and it also provides an anti-money laundering tool that allows you to check whether a wallet address you’re dealing with has been flagged for money laundering activities. However, one limitation is that WhiteBIT does not currently provide a Proof of Reserves report, which many exchanges use to demonstrate solvency and transparency.

Lastly, if at any point you decide that you no longer want to keep your account, WhiteBIT allows full account deletion. You can follow our complete delete your WhiteBIT account guide for step-by-step instructions.

WhiteBIT Customer Support

WhiteBIT offers comprehensive customer support via 24/7 live chat, telegram, email, and even phone. When testing the live chat, we figured out that the support is helpful but sometimes very slow.

Finding certain information and clarifications can take a while as the support is not schooled well enough. A simple question about fees could take 30 minutes to be solved after going back and forth. We hope to see some improvements with that. However, on a fair note: At the end of the support session, we always had our queries solved.

Lastly, WhiteBIT has a comprehensive Help Center where you can read frequently asked questions and read guides. What really stood out was the phone support which is available in Ukrainian, Turkish, Spanish, and English.

WhiteBIT Alternatives

WhiteBIT is a decent option with low fees and high leverage, but if you’re looking for alternatives, consider these:

- MEXC: A global exchange recognized for its ultra-low trading fees and one of the largest selections of altcoins in the market.

- Bybit: A widely used platform offering deep liquidity, advanced trading features, and a large active user base.

| Feature | WhiteBIT | MEXC | Bybit |

|---|---|---|---|

| Established | 2018 | 2018 | 2018 |

| Spot Fees (Maker/Taker) | 0.10% / 0.10% | 0.05% / 0.05% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.01% / 0.055% | 0.000% / 0.020% | 0.020% / 0.055% |

| Max Leverage | 100x | 500x | 100x |

| KYC Required | Yes | Yes | Yes |

| Supported Cryptos (Spot) | 346+ | 3137+ | 726+ |

| Futures Contracts | 204+ | 433+ | 578+ |

| No KYC Withdrawal Limit | None | None | None |

| 24h Futures Volume | $10.82B+ | $37.75B+ | $40.34B+ |

| Trading Bonus | None | $20 | $30,000 |

| Key Features | • European focused • Zero futures fees • 100x leverage |

• Largest altcoin selection • Lowest fees overall • 500x leverage |

• Highest volume • Advanced trading bots • Deep liquidity |

| Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

WhiteBIT positions itself as a European-focused exchange that combines low fees, high leverage, and a steadily expanding ecosystem of products. With over 346+ cryptocurrencies available on spot and more than 204+ futures contracts, along with margin trading, a fiat on/off ramp, and tools such as Whitepay and White.Market, it offers a balanced mix for everyday traders and those seeking additional utility.

The lack of Ethereum (ETH) support is a surprising omission, and liquidity, while sufficient for retail traders, may not fully meet the needs of high-volume institutional users. Another drawback is the absence of a Proof of Reserves report, which some consider a key benchmark of transparency.

For beginners and mid-level traders, WhiteBIT presents a practical choice: user-friendly, compliant with AML and FATF Travel Rule standards, and backed by above-average security. Advanced traders, however, may want to weigh liquidity depth against larger tier-1 exchanges.

In short, WhiteBIT is a capable platform with room for growth and is worth considering if you’re looking for a compliant exchange with competitive fees and a growing suite of services. If you want to learn more about crypto exchanges, check out our list of the top 10 crypto exchanges for day trading.

FAQ

1. Is WhiteBIT safe?

Yes, WhiteBIT is a safe and secure crypto exchange. The platform is regulated and licensed in Europe and Asia. Customer funds are stored in multisig cold wallets.

2. Can I use WhiteBIT in the US?

No, users from the United States can not use WhiteBIT’s service.

3. Does WhiteBIT require KYC?

Yes, WhiteBIT requires KYC verification. You can verify your identity with personal information such as ID, Passport, and driver’s license.

4. What are WhiteBIT fees?

Spot fees are 0.1% for makers and takers. The futures trading fees are 0.01% maker and 0.055% taker. WhiteBIT has some of the lowest fees in the crypto space.

5. Is WhiteBIT beginner friendly?

Yes, WhiteBIT is very beginner friendly. However, advanced users might miss some features and also miss liquidity.