- •Layer 1 network are the base blockchain that validate and finalize transactions directly on-chain.

- •Bitcoin, Ethereum, and Solana are Layer 1 examples, but they use different designs and consensus models.

- •Speed, fees, and decentralization vary because Layer 1 networks make different trade-offs in how they scale.

A Layer 1 blockchain is the base network that records transactions, secures value, and keeps the entire system honest. When people talk about Bitcoin, Ethereum, or Solana, they are talking about Layer 1 networks. These networks do not depend on another chain to function. They validate transactions themselves and act as the final source of truth.

If you are trying to understand where economic value actually sits in crypto, this is the layer that matters most. Over the years, investor focus has shifted from speculation to infrastructure that can support real usage. A Layer 1 blockchain now plays a direct role in how capital moves on-chain, how trust is enforced, and why institutions care about security and liquidity rather than speed alone.

What Is a Layer 1 Network?

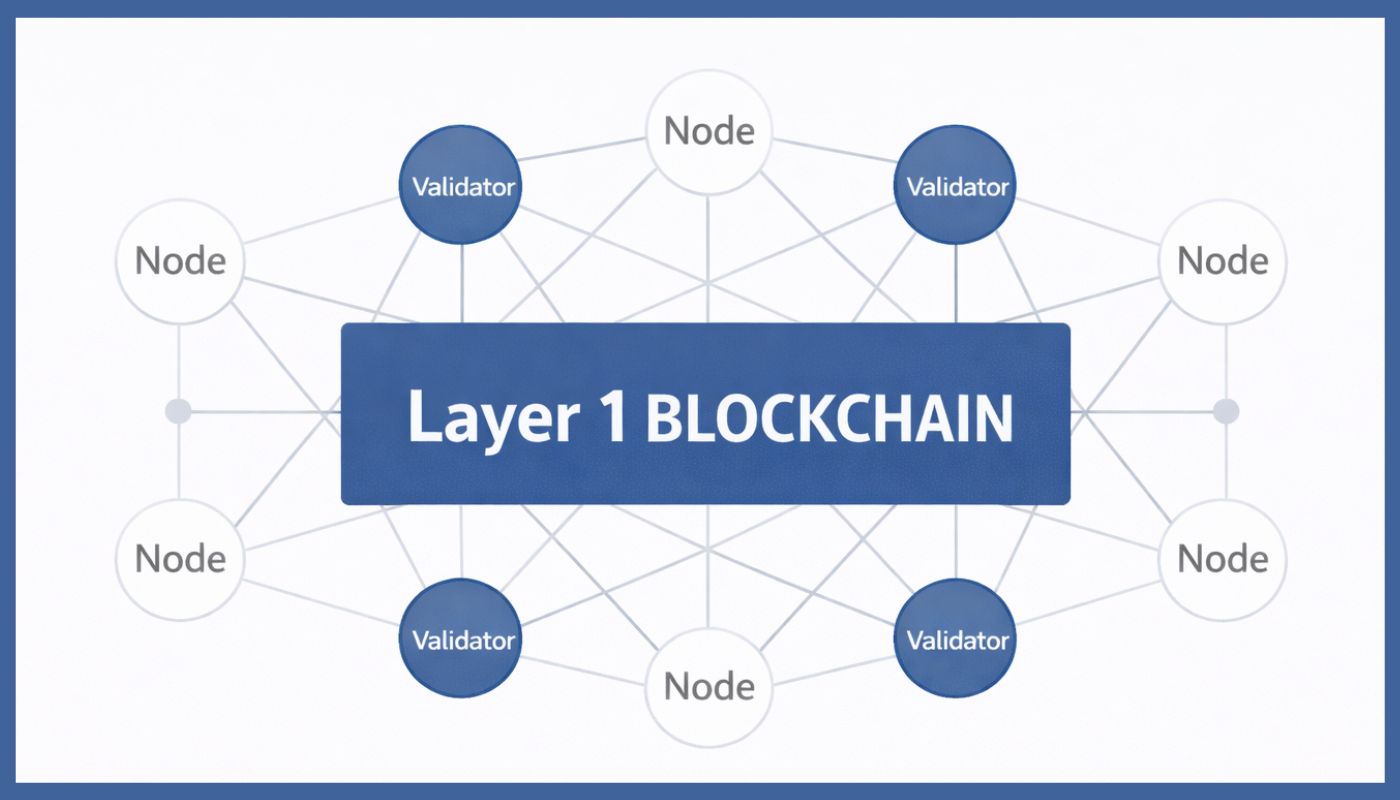

A Layer 1 blockchain is the main protocol that runs a distributed ledger. It is responsible for ordering transactions, validating them, and recording the final state of the network. There is no higher authority above it. If you send value on a Layer 1 network, that transaction settles directly on the base chain.

This layer defines how blocks are produced, how consensus is reached, and how the network stays secure. You can think of it as the accounting system of the blockchain world. Everything else, including scaling networks and applications, relies on the rules set at this level.

Each Layer 1 blockchain uses a native token. That token pays for transactions, secures the network through mining or staking, and aligns incentives between users and validators. When you interact with crypto at its core, you are interacting with a Layer 1 blockchain, whether you realize it or not.

How Layer 1 Networks Create and Secure Economic Value

Economic value on a blockchain is not created by speed alone. It comes from trust, final settlement, and liquidity that users are willing to rely on. A Layer 1 blockchain is where that trust is enforced. When value settles on the base layer, it becomes part of the permanent ledger that no single party controls.

Transaction fees exist because they prevent spam and reward those who secure the network. Staking or mining is not just a technical process. It is an economic system that forces participants to act honestly, because misbehavior carries real financial cost. This is why long-term capital looks at security first, not just low fees.

Liquidity also concentrates at the Layer 1 level. Most assets, tokens, and financial activity eventually depend on base layer settlement. If you are moving large amounts of value, you care about whether the Layer 1 blockchain can handle that without relying on trust assumptions elsewhere. That is where its economic role becomes clear.

Scalability Limits and Design Trade-Offs in Layer 1 Networks

Layer 1 blockchains face natural limits. Every transaction must be verified by many nodes across the world, which keeps the system secure but slows it down. This is why base layers cannot match centralized systems like payment processors, even if the technology improves.

There is also a constant trade-off between decentralization, security, and scalability. Improving one area often places pressure on another. If a network pushes too hard on throughput, it may reduce the number of participants who can validate the chain. If it focuses only on decentralization, fees and confirmation times can rise during heavy usage.

You should not judge a Layer 1 blockchain only by transactions per second. What matters more is how the network behaves under stress, how predictable settlement is, and whether users trust it during market volatility. These limits are not flaws. They are part of the design choices that define each base layer.

Investor and Institutional Interest in Layer 1 Networks

Investor interest in Layer 1 networks has changed over time. Early cycles focused on price and narratives. Recent cycles show more attention on where real value settles and where risk is lowest. As regulation becomes clearer and companies move on-chain, base layers matter more than ever.

Institutions tend to favor networks with deep liquidity, strong security history, and active developer ecosystems. A Layer 1 blockchain that supports many scaling networks and applications sends a clear signal about long-term usage. This is why some base layers are increasingly viewed as financial infrastructure rather than experimental technology.

You can also see a split in preferences. Some capital flows toward networks built for settlement and security. Other activity favors fast execution and lower transaction costs. Both approaches exist, but the common factor is that investors are no longer ignoring the base layer. They are evaluating it carefully.

Why Layer 1 Blockchains Anchor On-Chain Value

A Layer 1 blockchain is not built to handle everything. Its job is to secure trust, finalize transactions, and protect economic activity over time. That is why no single network has replaced all others. As scaling networks grow, the base layer becomes more important. You rely on it when trading, holding assets, or building applications. If you want to understand where crypto’s economic strength comes from, this is the layer that matters. To go one step deeper, you can explore Layer 0 protocols, which focus on how blockchains coordinate and connect beneath Layer 1.

FAQs

1. What are examples of Layer 1 solutions?

Common examples of Layer 1 blockchains include Bitcoin, Ethereum, Solana, BNB Chain, Cardano, and Avalanche. Each of these runs its own network and validates transactions on its base layer.

2. What are the benefits of Layer 1 blockchains?

Layer 1 blockchains provide direct transaction settlement, network security, and decentralization. They do not rely on another chain to operate, which makes them the core infrastructure of blockchain systems.

3. Is Bitcoin a Layer 1 crypto?

Yes, Bitcoin is a Layer 1 blockchain. It operates on its own network, validates transactions directly on-chain, and does not depend on any external blockchain for settlement.

4. What is the fastest Layer 1 blockchain?

Solana is considered one of the fastest Layer 1 blockchains. It can process thousands of transactions per second by using a Proof of History system alongside Proof of Stake, which helps order transactions efficiently.

5. Are Layer 1 blockchains the same as Layer 2 networks?

No. Layer 1 is the base blockchain. Layer 2 networks are built on top of it to improve speed or reduce costs, but they still depend on Layer 1 for security and settlement.