- •Dash is built for fast, low-fee payments, with InstantSend confirmations and optional privacy through PrivateSend.

- •DASH is listed on many exchanges, but fees, liquidity, and extra features vary, so comparing platforms helps you get better value.

- •BloFin offers optional KYC, competitive spot fees, and deep liquidity, making it a practical option for buying and trading DASH.

Dash has long positioned itself as practical digital cash, known for quick confirmations, optional privacy, and a self-funded governance model. Recent partnerships and renewed market attention have brought it back onto trader watchlists, especially among users looking for efficient payments and undervalued assets. In this guide, we walk through where to buy DASH, compare major exchanges, and choose the option that offers the best overall value for different types of users.

Where to Buy Dash?

Dash has been around long enough to build a real footprint. Between its fast payments, low fees, and optional privacy tools like PrivateSend, DASH has earned listings across many major crypto exchanges. But those listings are not equal. Some platforms give better fees and tighter liquidity, others focus more on security and compliance, and a few also add futures markets or earn products if you want more than a simple spot buy.

Today, buying DASH is possible on several platforms. However, the overall value you get depends on the exchange you choose. Fees, liquidity, security measures, and extra products can all shape the experience. Instead of buying blindly, it is smarter to compare your options. Here are some exchanges where Dash is available.

How to Buy $DASH on BloFin

Out of the available options, we chose BloFin because it balances convenience, cost, and flexibility. The exchange offers optional KYC, competitive trading fees, and a clean, intuitive interface that makes spot purchases simple even for newer users. Despite being relatively new, BloFin has gained attention across the trading community, with many KOLs highlighting its liquidity and steady product expansion.

For DASH buyers, this means tight spreads on spot markets, plus the option to trade DASH futures with up to 100× leverage if you want more advanced exposure. New users can also access bonuses of up to $10,000 when signing up through a BloFin referral code.

Follow these steps to purchase DASH through the BloFin spot market.

Step 1: Open the BloFin exchange in your browser and sign in to your account.

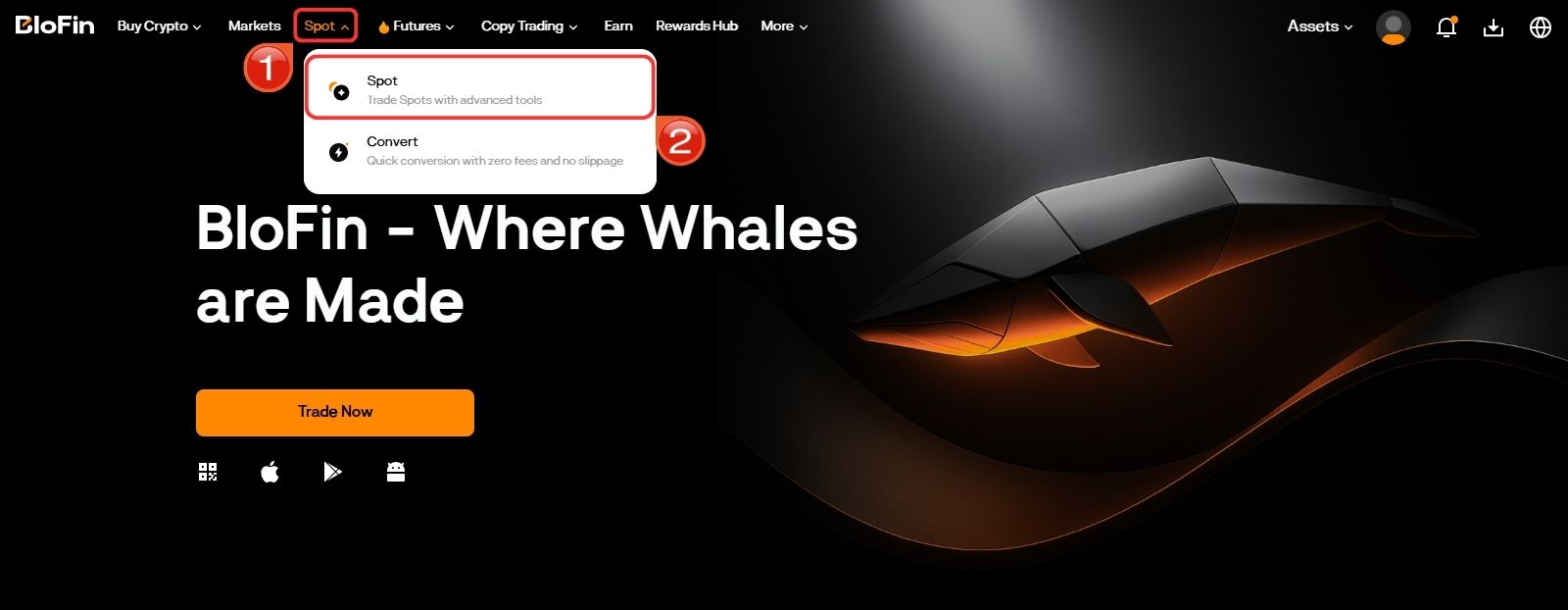

Step 2: From the top navigation bar, click Spot to open the spot trading interface.

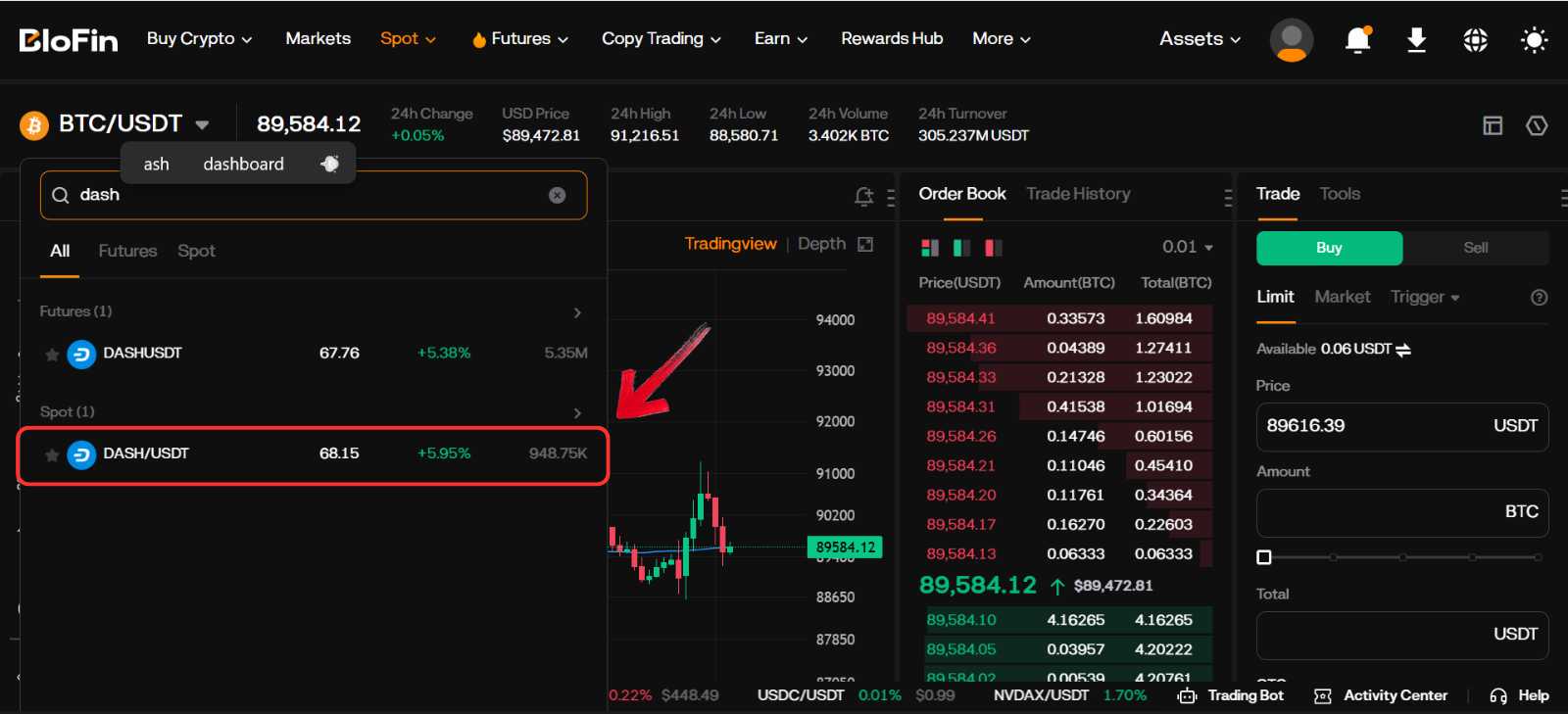

Step 3: Use the search bar to locate the DASH/USDT trading pair.

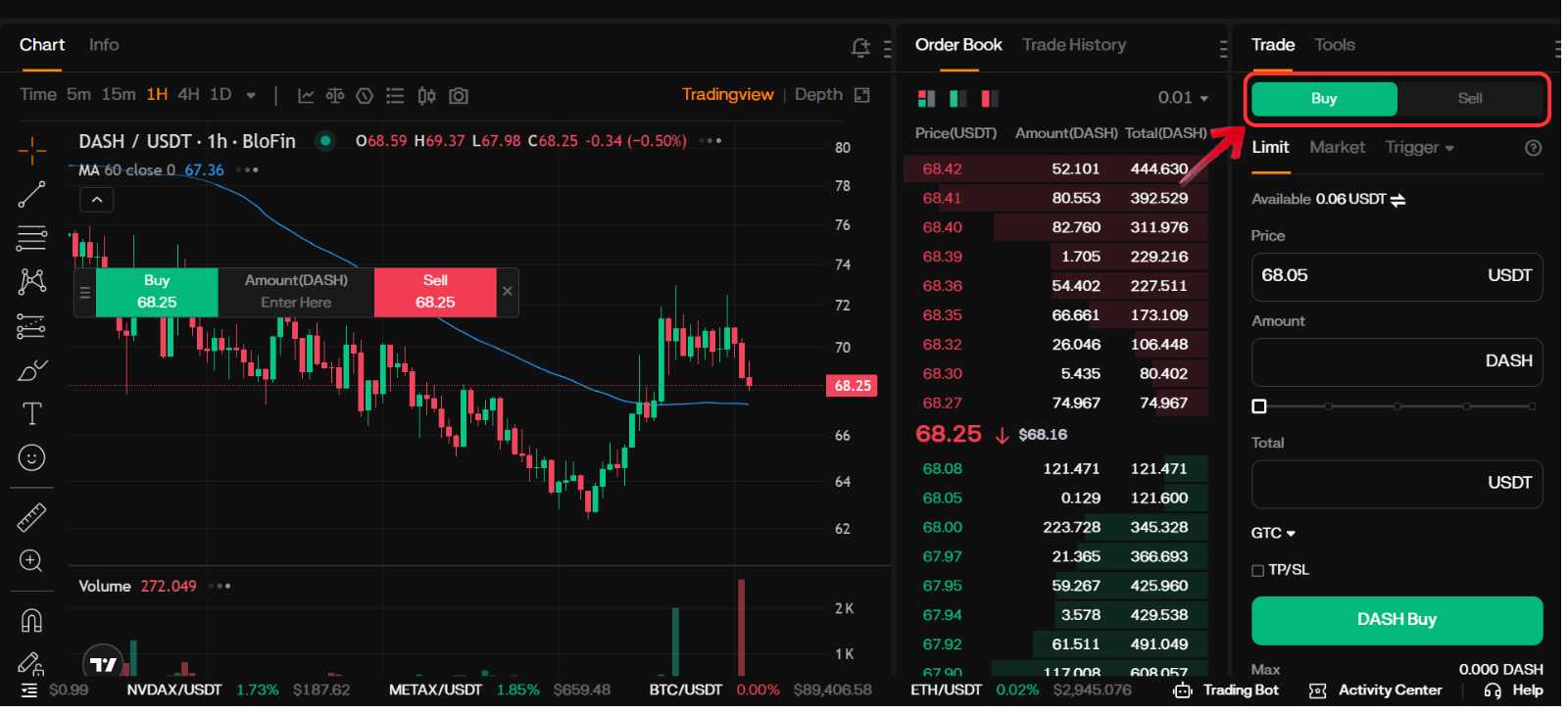

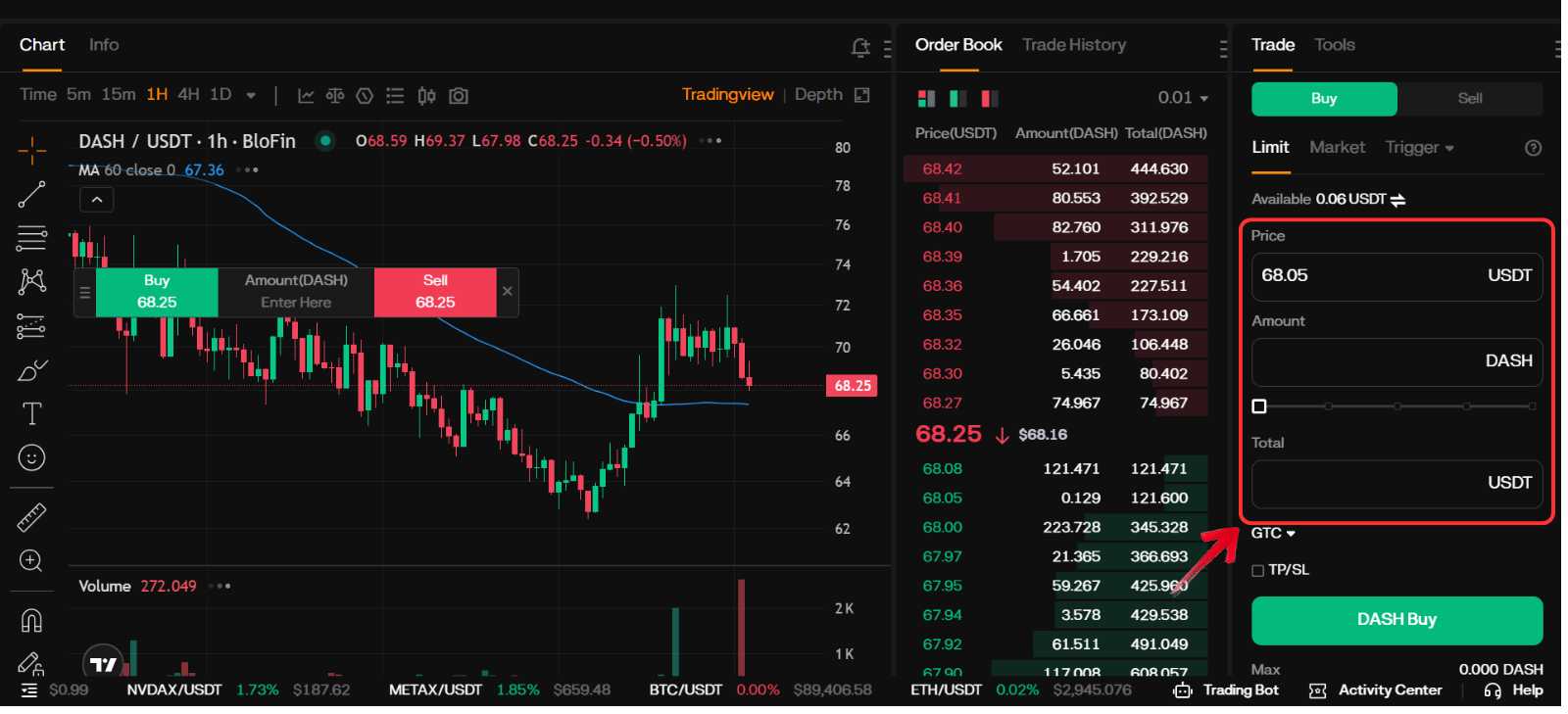

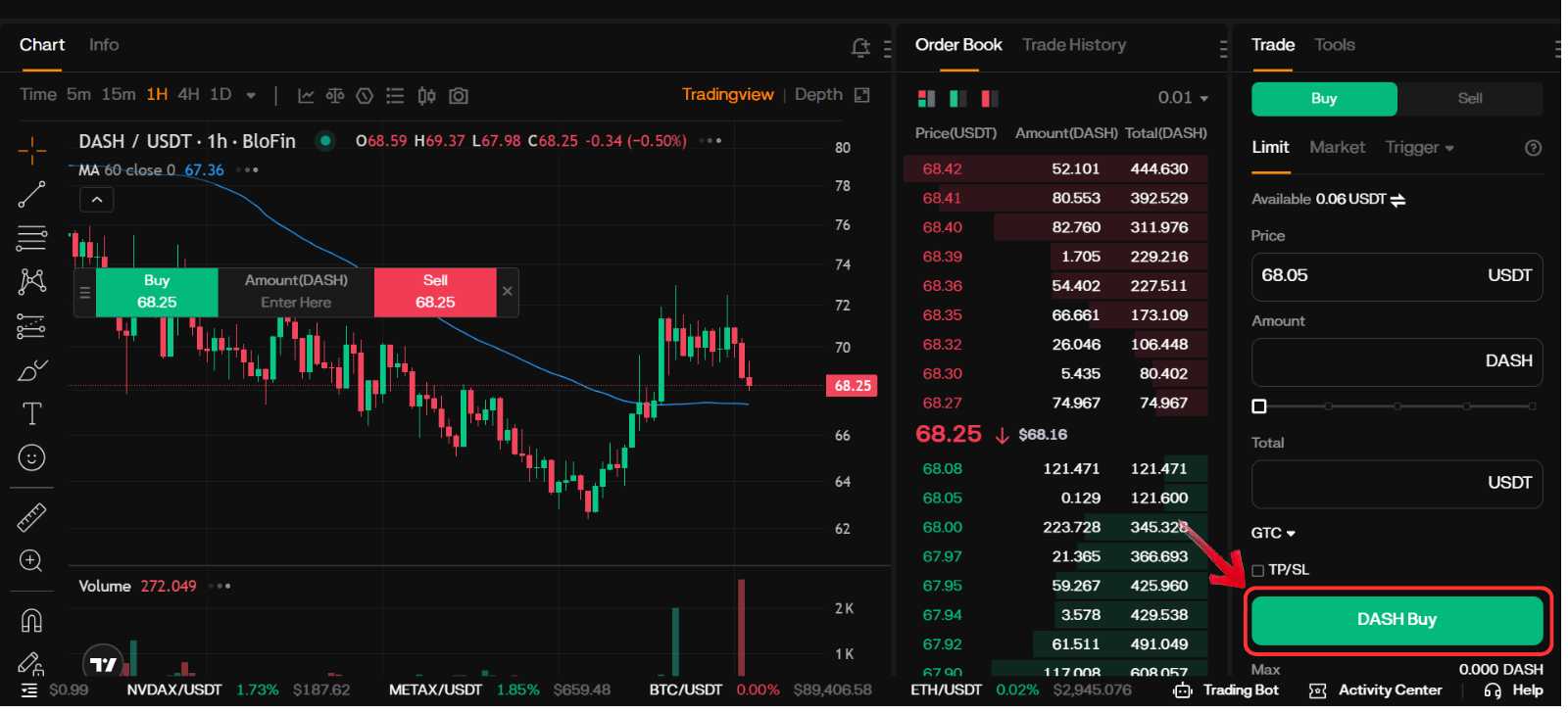

Step 4: In the order panel, select a Market order for instant execution or a Limit order if you want to choose your own price.

Step 5: Enter the amount of DASH you want to buy, either by typing it manually or using the percentage slider.

Step 6: Double-check the order details, then click Buy DASH to complete the purchase.

Fees When Buying Dash on BloFin

When purchasing DASH on BloFin’s spot market, the base trading fee starts at 0.10% for both maker and taker orders. The fee is applied directly to each completed trade. For instance, if you place a $1,000 spot order for DASH, the base-tier trading fee would be $1. BloFin follows a tiered structure, so fees can drop as your trading volume increases, though most standard spot trades begin at the 0.10% rate.

Dash (DASH)

New TokenToken Symbol

DASH

Current Price

Loading...

Daily Change

Loading...

All-Time High

Loading...

Daily Low

Loading...

Daily High

Loading...

24h Volume

Loading...

Market Cap

Loading...

FDV

Loading...

Total Supply

Loading...

Max Supply

Loading...

How to Transfer $DASH to a Web3 Wallet (MetaMask)

If you plan to use the Dash network rather than just hold the token, you will need a compatible wallet that supports its payment features. Dash is designed for fast, low-fee transactions with tools like InstantSend and optional privacy through PrivateSend, so using a native wallet gives you full access to these functions.

The most compatible option is the DashPay, which is built specifically for the Dash ecosystem. To start using the network, you will need to withdraw your DASH from the exchange and send it to your Dash network address. Once transferred, you can use DASH for payments, transfers, or other on-chain activities.

Here is how you can directly transfer your DASH tokens from BloFin to Dashpay using Dash network:

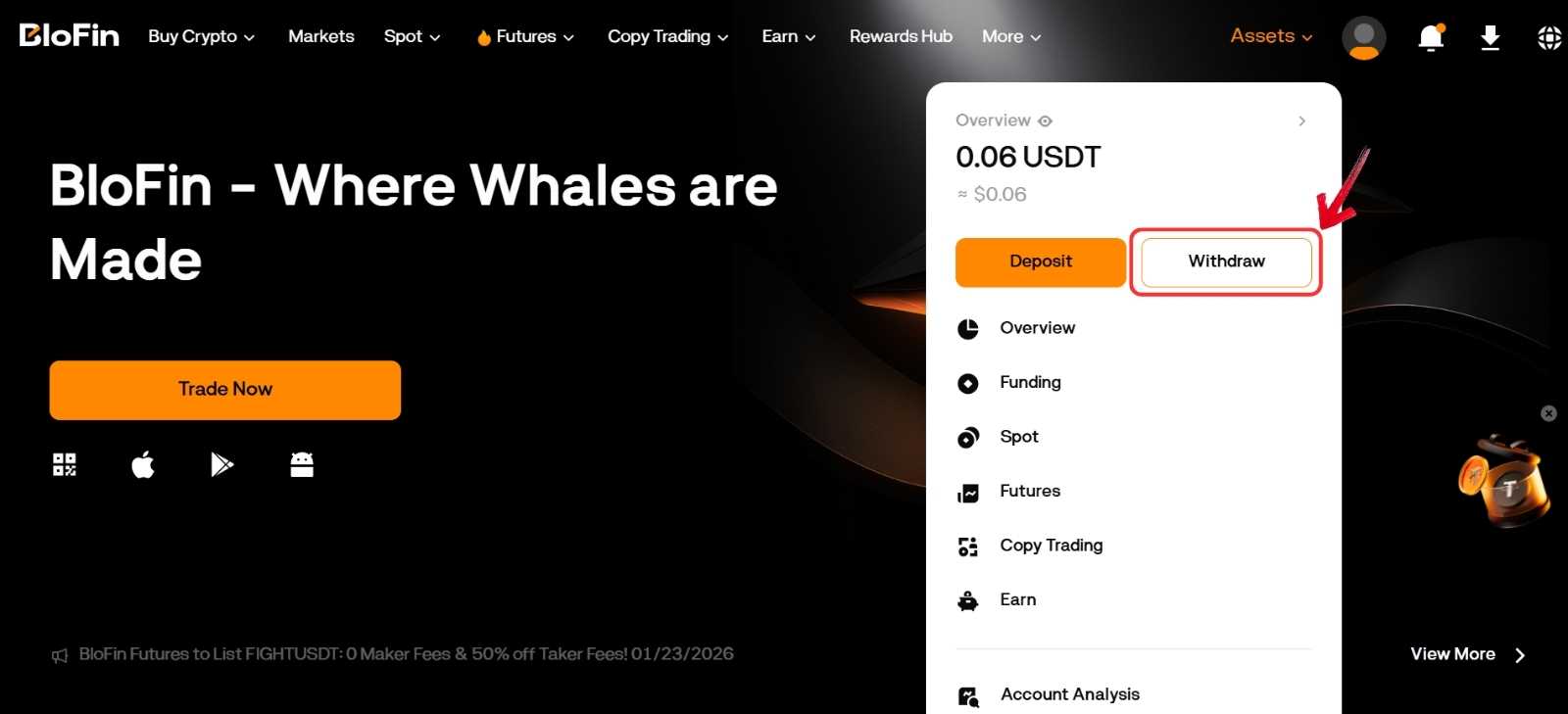

Step 1: Log in to your BloFin account and go to the Assets section. From there, select Withdraw.

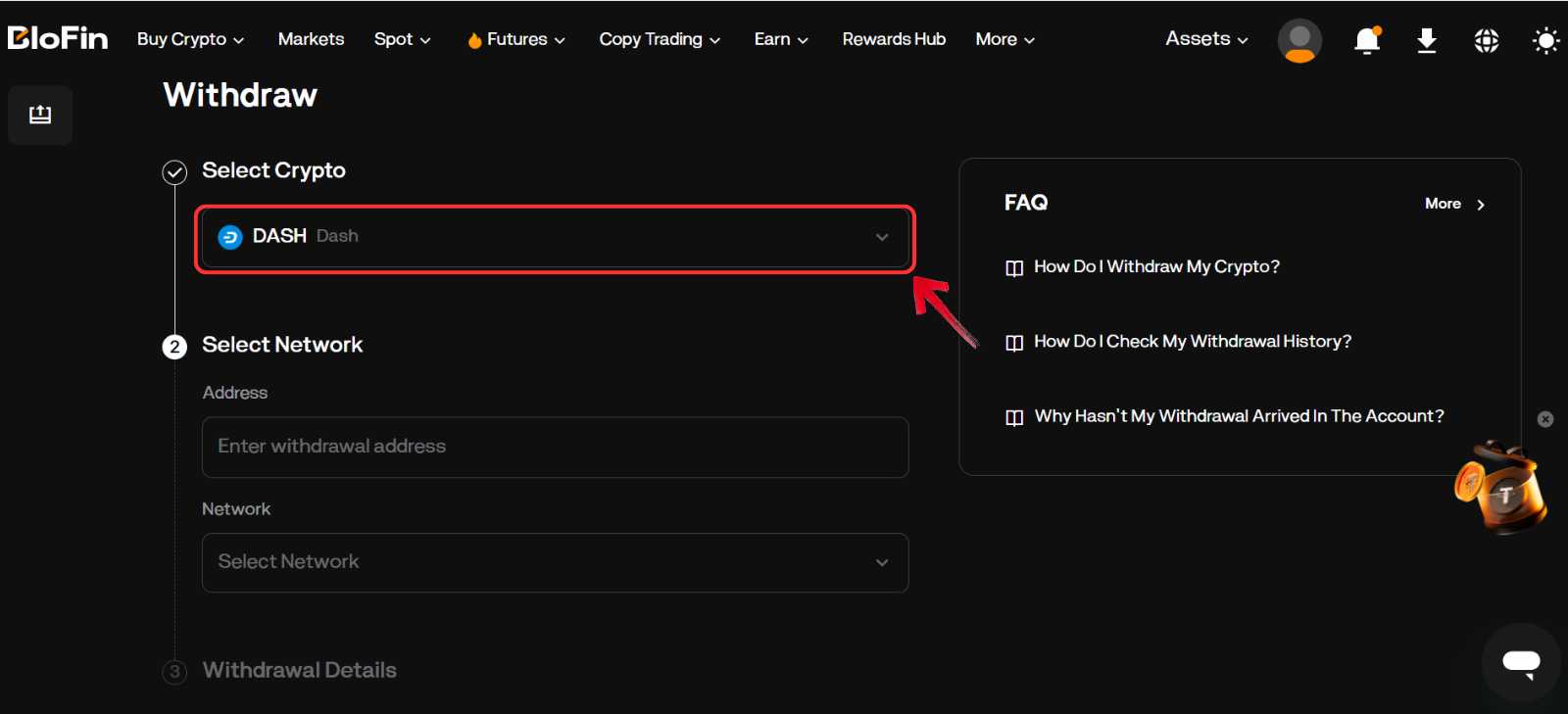

Step 2: On the withdrawal page, choose DASH from the list of available assets.

Step 3: Open your Dashpay, copy your DASH receive address, and keep it ready for the transfer.

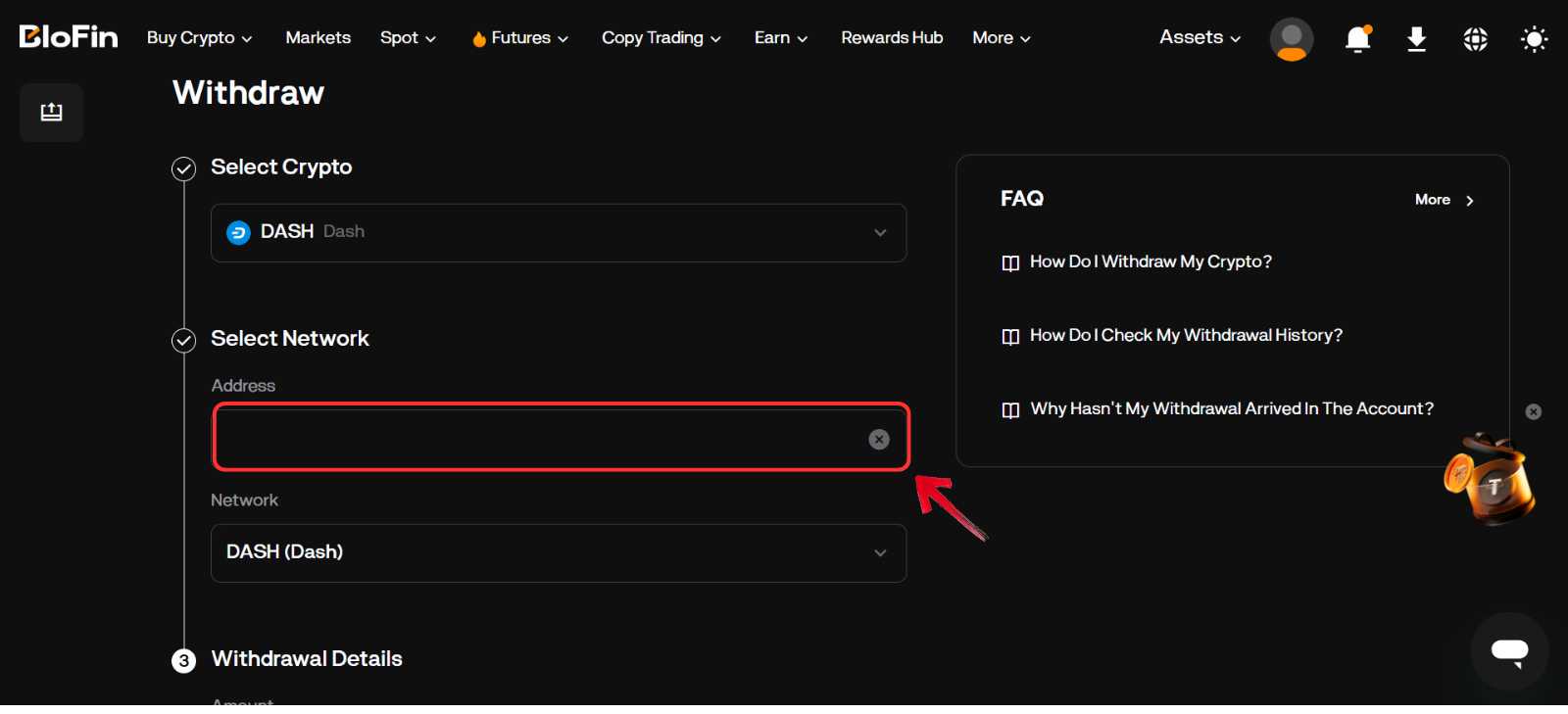

Step 4: Paste the copied DASH address into the Withdrawal Address field on BloFin.

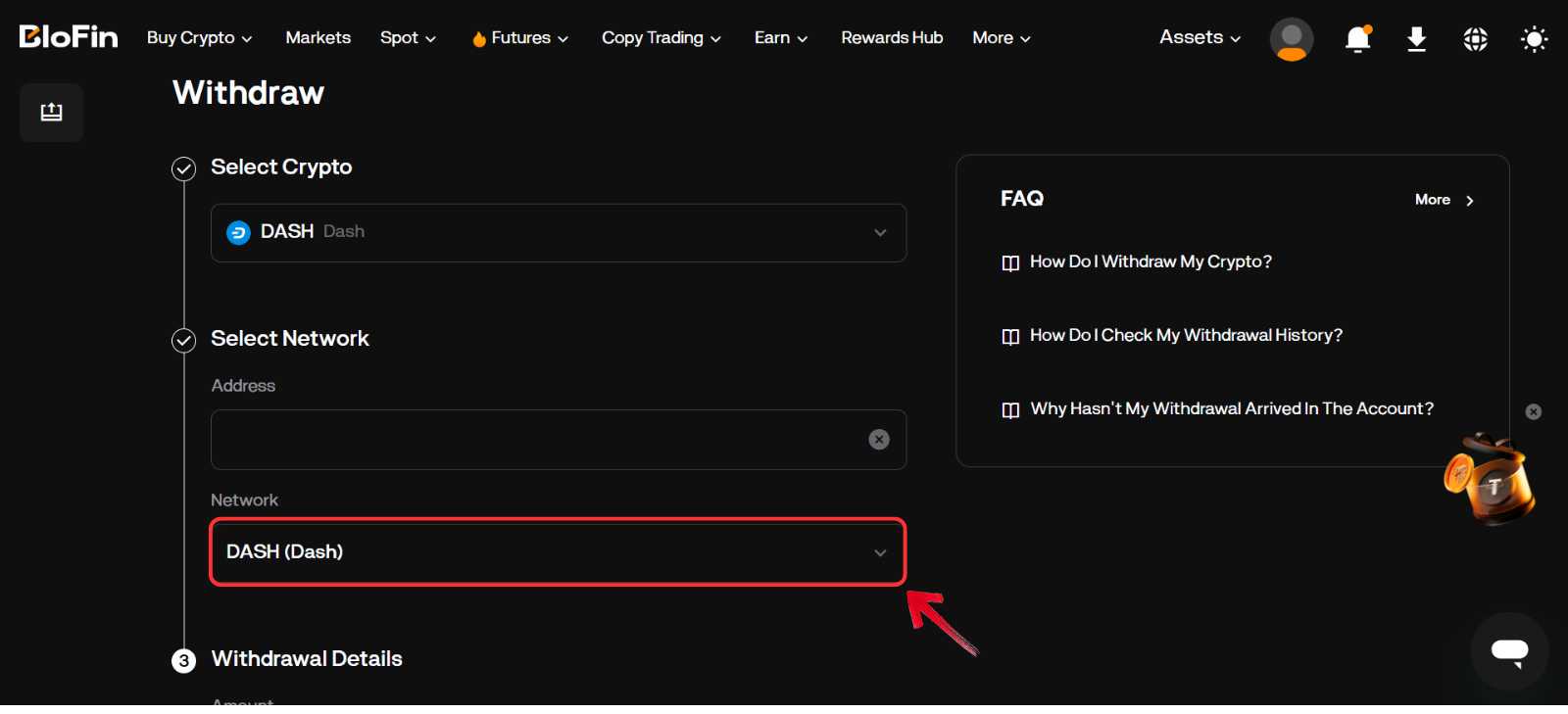

Step 5: Select the Dash network as the withdrawal network. No memo or tag is required for DASH transfers.

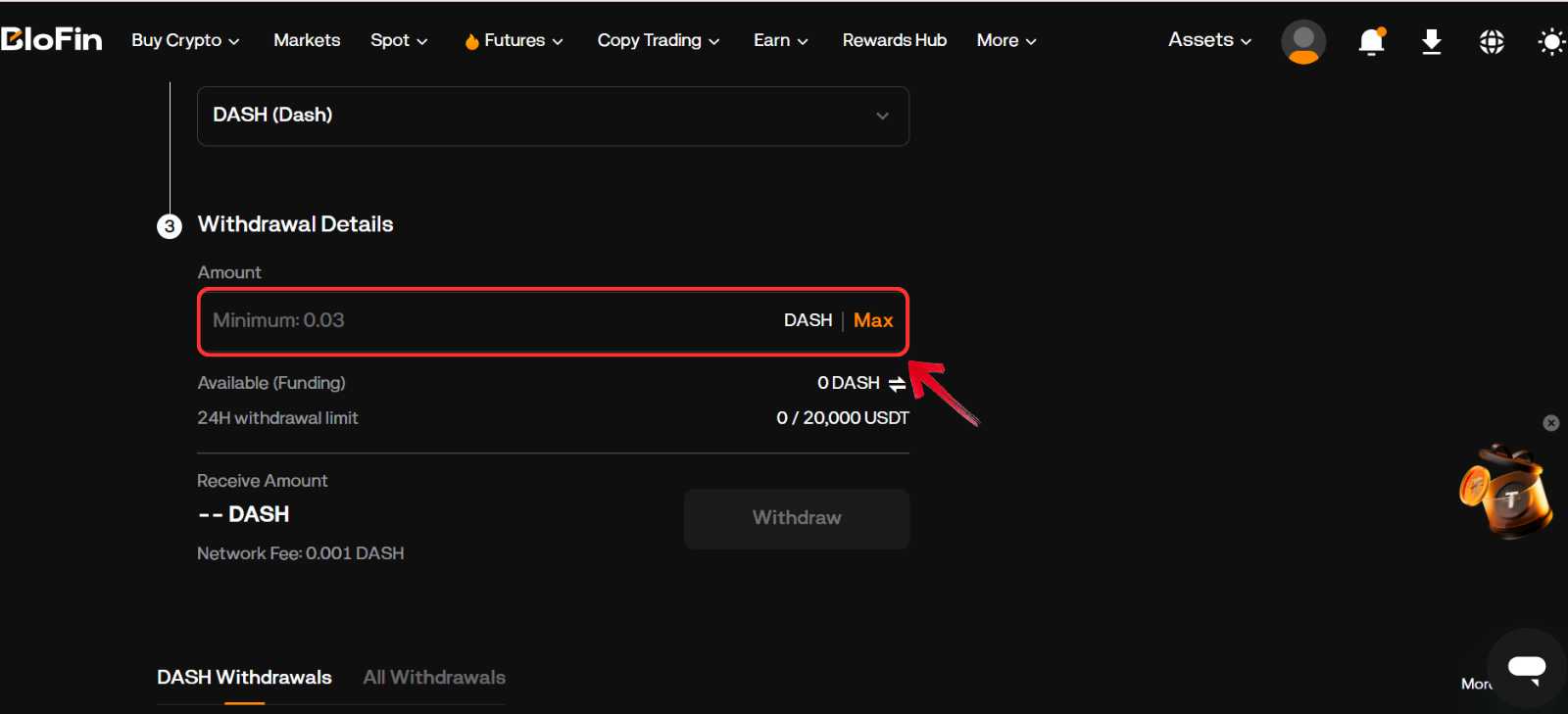

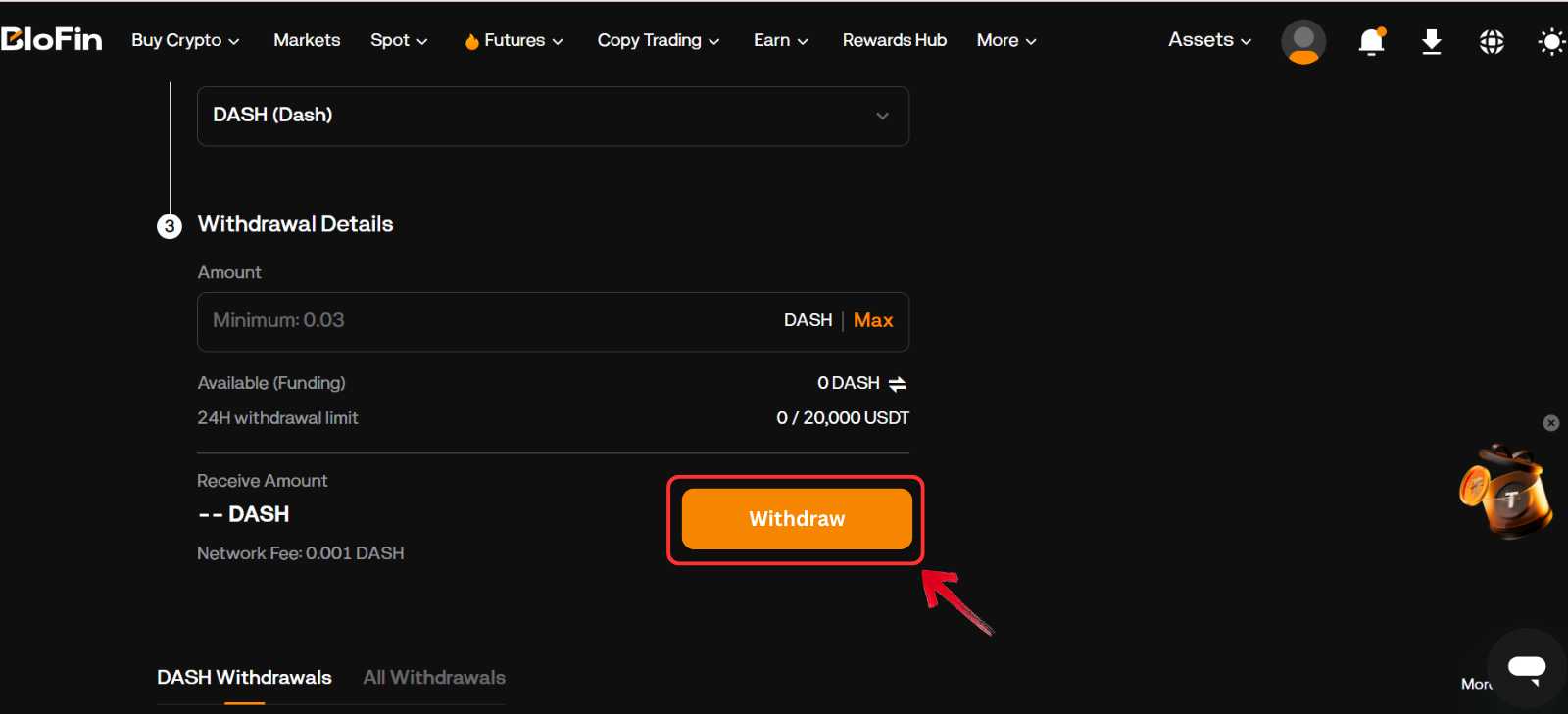

Step 6: Enter the amount of DASH you want to withdraw, then review the network fee and final amount.

Step 7: Confirm the details and click Withdraw. After processing, the DASH will appear in your MetaMask wallet once the network confirms the transaction.

You can track the status of your DASH withdrawal using the transaction ID provided by BloFin. After submission, the transaction can be monitored on the Dash explorer.

Dash Explained

Dash is a cryptocurrency built for everyday payments. It was created to improve on Bitcoin by offering faster confirmations, much lower fees, and easier usability for real-world spending. Transactions can settle in seconds through InstantSend, while optional privacy tools like PrivateSend allow users to keep payment details less visible when needed.

In the current privacy narrative, Dash often sits between fully private coins and transparent payment chains. It gives users the choice of faster, low-cost transactions, with privacy available as an option rather than a default. This balance has helped Dash stay relevant as both a practical payment coin and a long-standing digital cash network.

Bottom Line

What really matters is the overall value you get after the purchase, not just where you click the buy button. BloFin stood out here because of its optional KYC, competitive fees, and steady liquidity for DASH spot trades. Still, it is smart to compare exchanges based on costs, security, and extra features like staking if you plan to hold for the long run. Some readers also look into networks like Beldex, which follow a similar direction with privacy features and expanding dApp ecosystems.

FAQs

1. What is Dash used for?

Dash is mainly used for fast, low-cost digital payments. It is designed to work like everyday cash, with near-instant transactions and very small fees.

2. How fast are Dash transactions?

With InstantSend, most Dash transactions confirm in about 1–2 seconds, making it practical for point-of-sale payments and quick transfers.

3. Does Dash have privacy features?

Yes. Dash offers an optional feature called PrivateSend, which mixes transactions to make them harder to trace, while still keeping the network usable for regular payments.

4. What makes Dash different from Bitcoin?

Dash focuses on speed, low fees, and usability. It also uses a two-tier system with masternodes that help power features like InstantSend, PrivateSend, and governance.

5. Can I stake or earn rewards with Dash?

Dash does not use traditional staking. However, masternode operators earn rewards for supporting the network, and some exchanges may offer earn products for DASH holders.