As a widely used cryptocurrency exchange with over 15 million users across the globe, Bybit provides a seamless platform for copy trading, enabling users to replicate the success of experienced traders effortlessly.

In this blog post, we’ll walk you through the entire process from selecting traders and implementing risk management strategies. Let’s go ahead and explore.

Bybit Overview

Founded in 2018 by CEO Ben Zhou, ByBit is a reputable cryptocurrency exchange headquartered in the British Virgin Islands and Dubai, with a team of 1200 employees and 20 million users globally. With a 24-hour trading volume exceeding $10 billion, ByBit ranks among the top 3 exchanges worldwide.

Supporting 400+ crypto assets and 600+ trading pairs, ByBit operates in 160 countries. However, regulatory constraints limit its availability in certain regions like the USA and Canada.

For customers in these areas, alternatives such as BingX or MEXC are recommended. Bybit’s rapid ascent in the crypto exchange hierarchy is attributed to its efficient derivatives trading feature, featuring futures contracts with up to 100x leverage and competitive fees.

Beyond its web platform, Bybit offers a mobile app downloaded over 10 million times with a rating of 4.5 that enables users to trade on the go with both iOS and Android versions available. For more details about the platform check out our comprehensive Bybit review.

Pros & Cons of Bybit Copy Trading

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Potential for profits as successful trades by experienced traders can be replicated | ❌ Investors may face losses if the selected trader's strategy performs poorly |

| ✅ Gain insights into trading strategies and market dynamics by observing seasoned traders | ❌ Reliance on the skills and decisions of the chosen trader, which may not align with personal risk tolerance |

| ✅ Allows individuals with limited trading knowledge to participate in the market | ❌ Less control over individual trades and strategy adjustments, as decisions are made by the copied trader |

| ✅ Access a variety of trading strategies and markets by copying different traders | ❌ Trading mistakes can increase losses, constraining deposit flexibility |

| ✅ Minimize the time commitment required for active trading by leveraging the expertise of others |

How is Copy Trading on Bybit Different?

Bybit’s copy trading allows users to replicate the strategies of experienced traders seamlessly. Users can select a preferred trader, allocate funds, and automatically mirror their trades. This social trading feature enhances accessibility, enabling less experienced traders to benefit from the expertise of others, and fostering a collaborative trading environment on the platform.

Bybit Copy Trading Market

Copy trading operates through two primary products: USDT perpetual trading and the futures grid bot. As a master trader, initiating a trade in USDT perpetual trading prompts followers to replicate the signal. Followers can copy the trade proportionately based on their available balance relative to the master trader’s or choose a fixed margin amount, as specified in their settings.

Note that followers replicate trades executed by the Master Trader from the moment they start following. Moreover, when a master trader creates a trading bot, followers can mirror the same bot by copying the parameters set by the master trader. Once copied, the execution of orders within the trading bot follows the standard process as in a regular account.

Types of Bybit Copy Trading

1: USDT Perpetual Copy Trading

Master traders on Bybit can lead the way in USDT perpetual trading, initiating trades that prompt followers to mirror signals and replicate trades. Followers have the flexibility to mimic trades for a margin amount, as per your set price. It’s important to note that followers will only copy trades executed by the Master Trader from the moment they start following.

2: Grid Bot Futures Copy Trading

Copy trading on Bybit extends to the futures grid bot, where trading bots can strategically engage in trading activities. You can lick “Create Bot” to enter the Futures Grid Bot creation page. Follow suggested bot strategies from Bybit’s Aurora AI, or customize parameters.

Fees

The trading fee and funding fee mirror the rates on Bybit’s derivatives platform.

No additional charges apply, ensuring a straightforward and transparent fee structure for users.

| Taker Fee Rate | Maker Fee Rate |

|---|---|

| 0.055% | 0.02% |

Apart from these regular fees, a percentage of the profits attained by traders, varying from 10% to 15%, is allotted to the trader in lead.

Traders vs Followers

Followers effortlessly replicate expert traders’ patterns and strategies with a simple click, benefiting from automated processes. They can customize parameters for precise operations, continue autonomously, and choose new traders to imitate. Traders share their expertise on the platform. In Bybit’s copy trading, a portion of the profits, ranging from 10% to 15%, goes to lead traders, based on profit-sharing levels they set.

Permanent nicknames and profile pictures are established by both followers and traders for identity representation on the copy trading page. Master Traders, as experienced investors, can showcase their trading strategies on Bybit. They attract new Followers and earn a corresponding percentage of the net profit generated by each Follower, based on their Master Trader level:

- Cadet: 10%

- Bronze: 10%

- Silver: 12%

- Gold: 15%

Bybit Copy Trading: Step-by-Step Procedure

Here is our step-by-step guide for copy trading on Bybit. Follow these steps for a smooth copy trading experience.

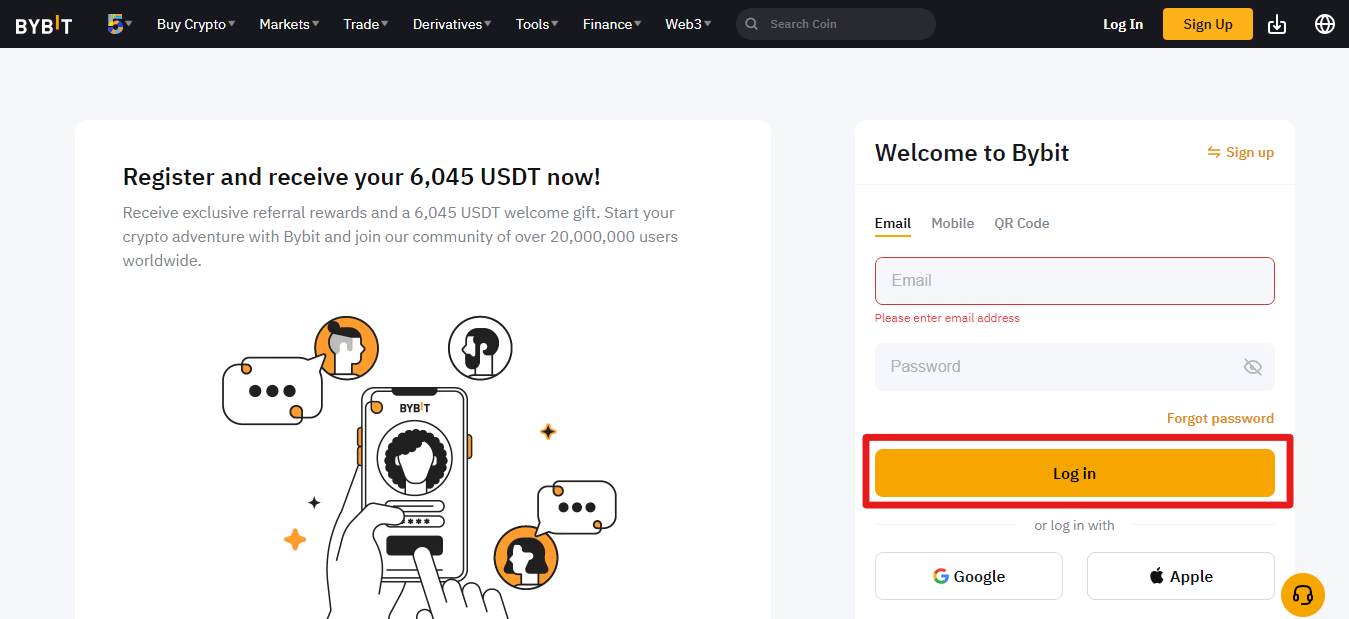

Step 1: Logging into Your Bybit Account

Open the Bybit website or mobile app, and enter your credentials to log in to your account.

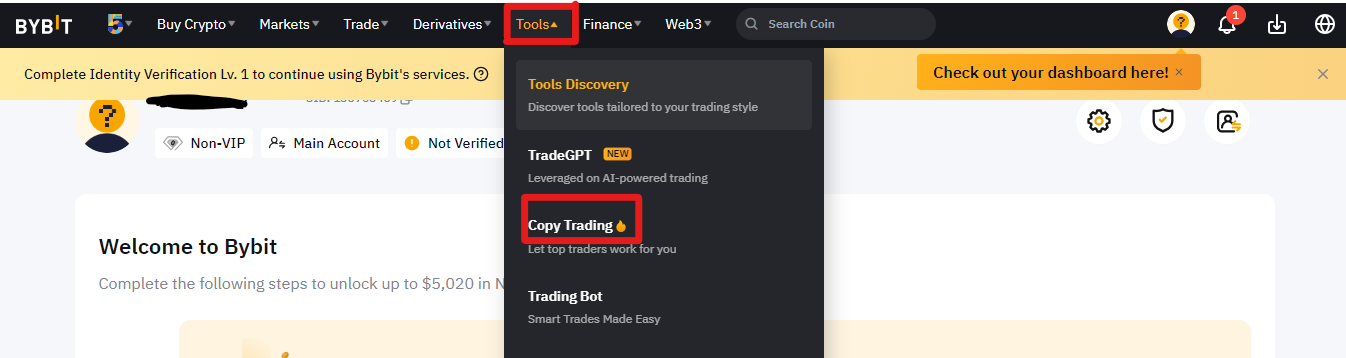

Step 2: Click on the Tools Option

Once logged in, navigate to the Tools section. This is typically located in the main menu or dashboard.

Step 3: Select Copy Trading Option from the Dropdown Menu

In the Tools section, locate the dropdown menu. Click on it, and from the options that appear, choose “Copy Trading.” This should lead you to the Copy Trading platform within Bybit

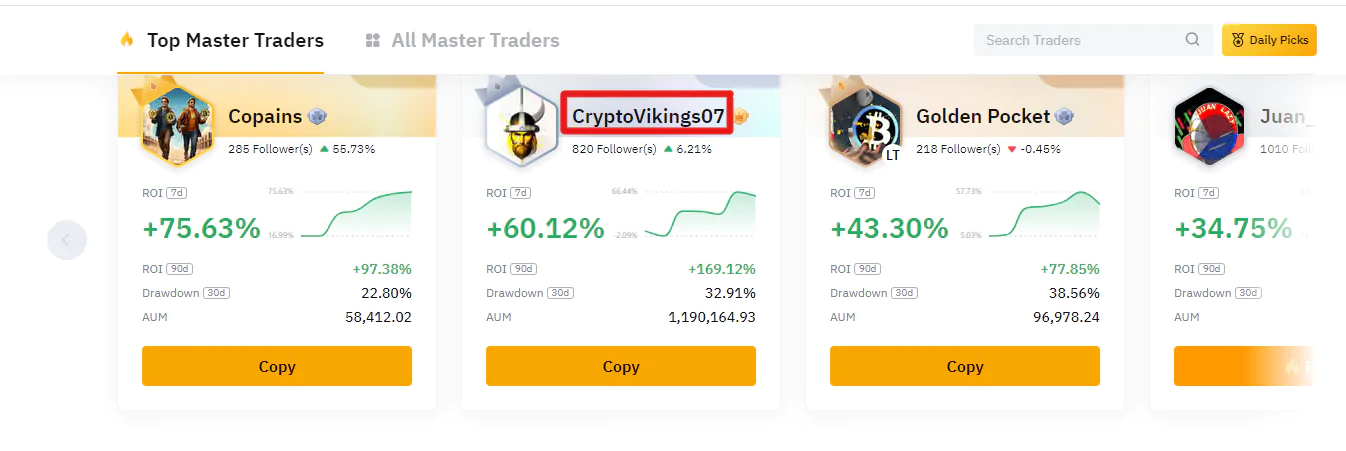

Step 4: Access Copy Trading Page and Scroll Down to Select a Trader

Scroll through the available traders and carefully review their performance metrics like ROI, days of trading and followers.

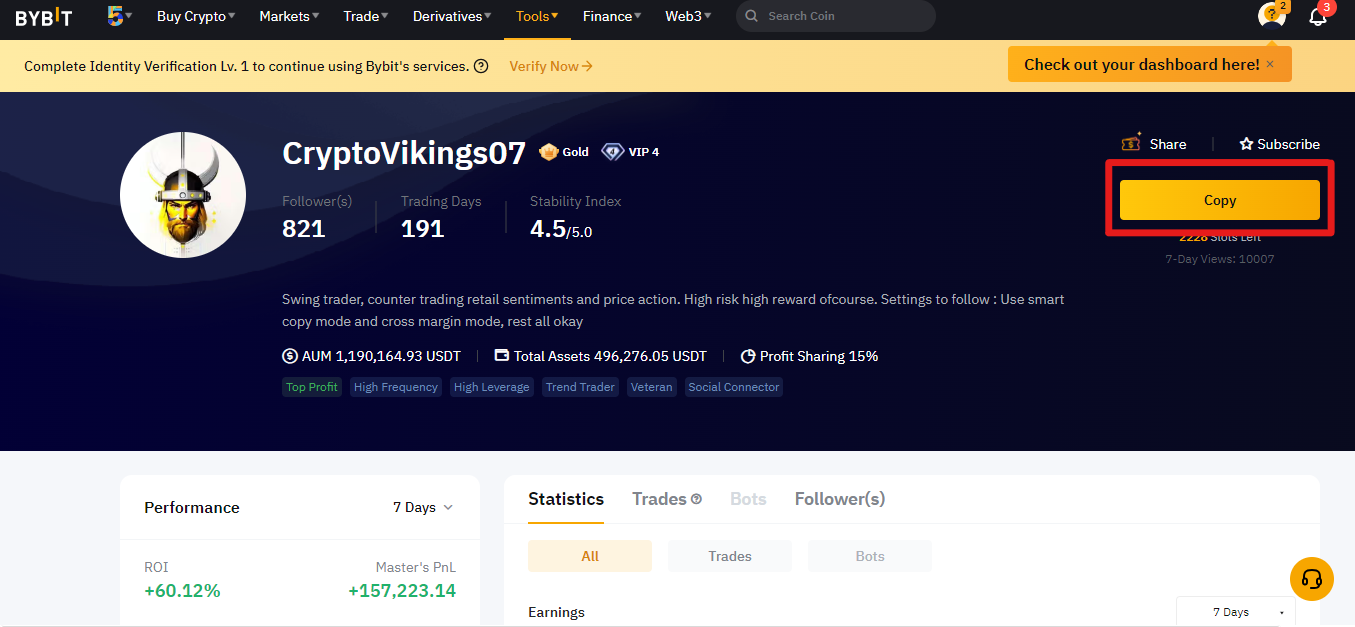

Step 5: Open Prefered Trader Profile

Click on the profile of the trader you prefer to copy to access more detailed information about their trading strategies.

Step 6: Scroll Down and Look at Their Details

Scroll down within the trader’s profile to explore additional details, such as historical performance, risk level, win rate, followers and trading preferences.

Step 7: Click on the Copy Button

Once you’ve thoroughly reviewed the trader’s profile, click on the “Copy” button to initiate the copying process.

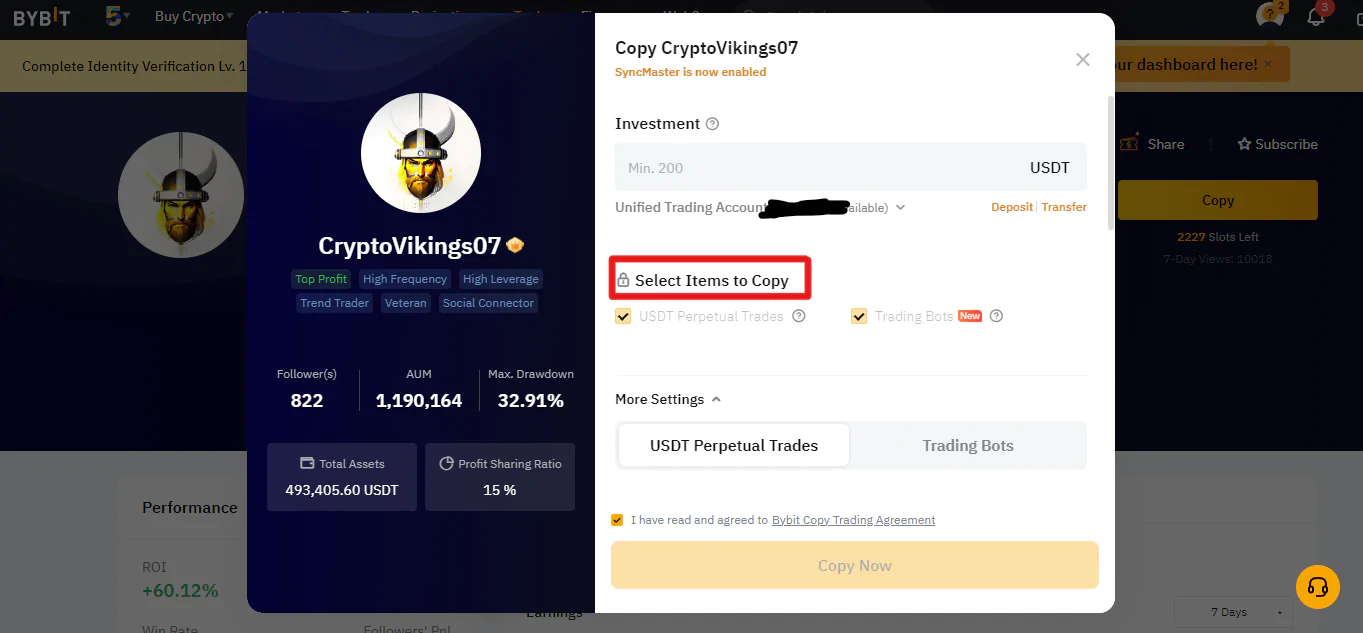

Step 8: Set an Investment Amount

Insert your preferred amount for investment. It may vary something between a minimum of 50 to 200 USDT depending on the rules of the platform.

Step 9: Choose Between USDT Perpetual Trading or Trading Bot

Decide whether you want to copy the trader’s USDT perpetual trading or utilize their trading bot.

Note: Click “Create Bot” to enter the Futures Grid Bot creation page. Follow suggested bot strategies from Bybit’s Aurora AI, or customize parameters.

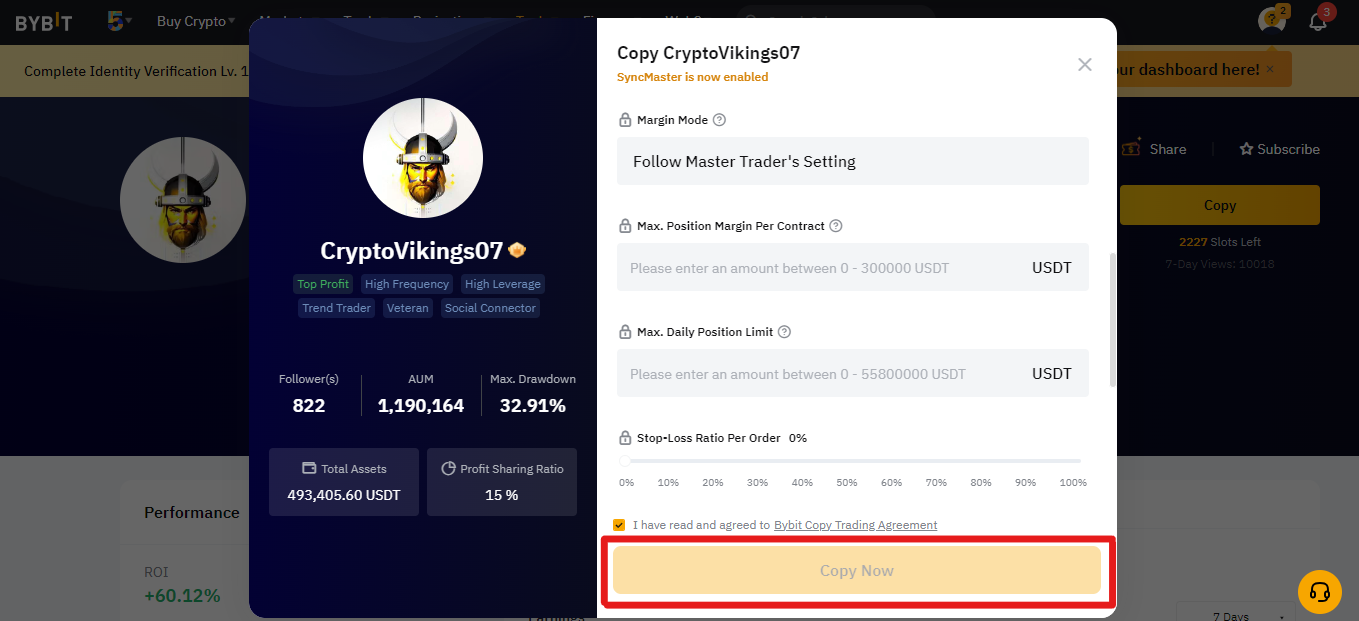

Step 10: Configure Advanced Settings

Configure additional options like stop-loss, max daily position limit, or any other risk management parameters based on your preferences.

Step 11: Review and Hit “Copy” Button

Once you have adjusted all the necessary settings, click the “Copy” button to finalize the process and start copying the selected trader’s strategies.

By following these steps, you’ll be able to seamlessly engage in copy trading on Bybit, utilizing the chosen trader’s expertise to enhance your own trading experience.

Bybit Copy Trading Checklist

Here is our carefully crafted checklist for Copy Trading on Bybit to evaluate the compatibility of a trader for your investment journey.

- Evaluate Performance Metrics: Investigate the overall Return on Investment (ROI) and compare it with the 7-day ROI for consistency assessment. Prioritize consistency over sporadic high gains. Look for traders with steady and reliable performance to minimize potential risks.

- Performance History: Before copying a trader on Bybit, look into their performance history. Analyze profit and loss trends over time to gauge their consistency and overall success.

- Risk Level: Align your risk tolerance with the trader’s risk appetite. Evaluate their approach to risk management to ensure it suits your comfort level.

- Trading Strategy: Understand the trader’s approach to the market. Determine if they are trend followers, day traders, or if they employ specific strategies that resonate with your investment goals.

- Prioritize PNL Ratio: Emphasize the trader’s Profit and Loss (PNL) ratio over win rates, as a higher PNL ratio indicates superior investment profitability.

- Number of Followers: Consider the number of followers a trader has. A substantial following may indicate credibility and proficiency in their trading strategies.

- Time in the Market: Assess the trader’s experience by examining how long they’ve been actively participating in the market. Experience often contributes to a trader’s ability to navigate various market conditions.

Remember, thorough research is a crucial step before deciding to copy a trader on Bybit. Understanding these factors will empower you to make informed decisions and optimize your copy trading experience.

Tips for Success in Copy Trading

- Research and Choose Traders Wisely: Conduct thorough research on available traders on Bybit. Consider their trading history, risk management strategies, and overall performance. Choose traders with a consistent and proven track record to increase the likelihood of successful copy trading.

- Diversify Your Copy Trading Portfolio: Avoid concentrating all your funds on a single trader. Diversify your portfolio by copying multiple traders with different trading styles. This helps mitigate risk and ensures that potential losses from one trader do not significantly impact your overall investment.

- Set Realistic Profit and Loss Targets: Establish clear profit and loss targets based on your risk tolerance and financial goals. Set realistic expectations and avoid being overly ambitious. By having predefined targets, you can automate the exit strategy and prevent emotional decision-making during market fluctuations.

- Regularly Review and Adjust Your Portfolio: Periodically review the performance of the traders you are copying on Bybit. If a trader’s strategy no longer aligns with your goals or if their performance becomes inconsistent, consider adjusting your portfolio. Stay informed about market trends and adapt your copy trading strategy accordingly.

- Stay Informed About Market Conditions: Keep yourself updated on cryptocurrency market trends and news. Understand how external factors may impact the market and, consequently, your copy trading positions. Being well-informed allows you to make informed decisions and adjust your strategy based on changing market conditions.

- Do Not Fear Losses – Embrace Risk Management: Losses are an inherent part of trading. Instead of fearing them, focus on implementing effective risk management strategies. Set stop-loss orders to limit potential losses, and only invest what you can afford to lose. A disciplined approach to risk management is key to long-term success in copy trading on Bybit.

Summary

Mastering the art of copy trading on Bybit becomes seamless with this step-by-step guide. From navigating the platform to selecting traders and implementing risk management, every aspect has been covered. Now equipped with the necessary insights, you’re ready to embark on your copy trading journey on Bybit, leveraging its user-friendly features for a successful and rewarding experience.

FAQs

1. What is the fundamental concept behind Bybit Copy Trading, and how does it differ from traditional trading approaches?

Bybit Copy Trading enables users to automatically replicate the trades of experienced traders. The fundamental concept is to leverage the expertise of others for potentially profitable outcomes. This differs from traditional trading by offering a hands-off approach, allowing users to benefit from skilled strategies without active management.

2. Are there any fees associated with Bybit Copy Trading, and if so, how are they structured?

Yes, Bybit Copy Trading involves fees. The fees are typically composed of a performance fee, which is a percentage of the profit generated by the copied strategy, and a management fee, calculated on the total assets under management. Users should review Bybit’s fee structure for specific details.

3. Are there any specific requirements or qualifications for individuals to participate in Bybit Copy Trading?

To participate in Bybit Copy Trading, individuals typically need a verified Bybit account. While there are no specific qualifications, users should have a basic understanding of cryptocurrency trading. It’s essential to comply with the platform’s terms and conditions, including any regional restrictions that may apply.

4. How does the risk management aspect work in Bybit Copy Trading?

In Bybit Copy Trading, risk management is crucial. Users can set parameters, including stop-loss levels and capital allocation, to control potential losses. Diversification of copied traders and careful consideration of their performance history contribute to an effective risk management strategy, enhancing overall portfolio stability.