- •Bitrue supports 699+ cryptocurrencies and 392+ futures contracts with leverage up to 125x.

- •Spot fees are 0.098%, though XRP pairs are higher; futures fees are 0.02% for makers and 0.06% for takers.

- •No mandatory KYC: unverified accounts allow 2 BTC daily withdrawals, while higher levels unlock up to 500 BTC.

- •Security remains a concern, with two past hacks totaling $27M and no proof of reserves released yet.

- •Customer support and platform speed have room for improvement, making alternatives like Bitget and MEXC worth exploring.

A good exchange is hard to find. The challenge isn’t that solid platforms don’t exist, it’s that the definition of “good” depends on what you value most. For a day trader, low fees and fast execution might be the deciding factors. Long-term investors may lean toward exchanges that provide more than just trading, such as staking or lending. This Bitrue review takes a closer look at what the platform brings to the table and helps you assess whether it aligns with your trading or investing needs.

| Stats | Bitrue |

|---|---|

| 🚀 Founded | 2019 |

| 🌐 Headquarters | Seychelles |

| 🔎 Founder | Curis Wang |

| 👤 Active Users | 10M+ |

| 🪙 Spot Cryptos | 699+ |

| 🪙 Futures Contracts | 392+ |

| 🔁 Spot Fees (maker/taker) | 0.098% / 0.098% |

| 🔁 Futures Fees (maker/taker) | 0.02% / 0.06% |

| 📈 Max Leverage | 125x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 3.8/5 |

| 💰 Bonus | $1000 (Claim Now) |

Bitrue Overview

Bitrue, founded in 2019 by Curis Wang and headquartered in Seychelles, has grown into a global exchange serving over 10 million users. The platform records a daily spot trading volume exceeding $607 million and lists more than 699+ cryptocurrencies alongside 392+ futures contracts, making it a popular choice for traders seeking breadth and liquidity.

One of Bitrue’s strongest appeals lies in its competitive pricing. Spot trading fees are set at just 0.098% for both makers and takers, giving it an edge for active traders who place frequent orders. Futures traders can also access leverage of up to 125x, while long-term investors benefit from additional services such as staking, copy trading, and automated bots.

Accessibility is another strength: with multilingual website support and crypto or card deposit options, users can get started quickly. Bitrue operates as a no-KYC exchange, allowing withdrawals of up to 2 BTC daily without verification, while higher KYC levels increase limits to as much as 500 BTC.

Despite its reach, Bitrue faces challenges. It is restricted in the United States, parts of Canada, China, Japan, and other jurisdictions, and users have noted concerns over customer support responsiveness. The platform operates with a “moderate” safety index, and regulatory clarity remains a work in progress.

Bitrue Pros and Cons

| 👍 Bitrue Pros | 👎 Bitrue Cons |

|---|---|

| ✅ 699+ spot coins and 392+ futures contracts | ❌ No FIAT withdrawals |

| ✅ Low spot fees | ❌ No proof of reserves available |

| ✅ 20% fee discount with BTR token | ❌ Two hacks caused $27M+ in losses |

| ✅ No KYC needed, 2 BTC daily withdrawal | ❌ Higher fees on XRP pairs |

| ✅ Very user-friendly | ❌ Customer support is slow |

| ✅ Features include staking, copy trading, and ETFs | ❌ Some pages load very slowly |

| ❌ No Proof of reserves |

Bitrue KYC and Sign-up

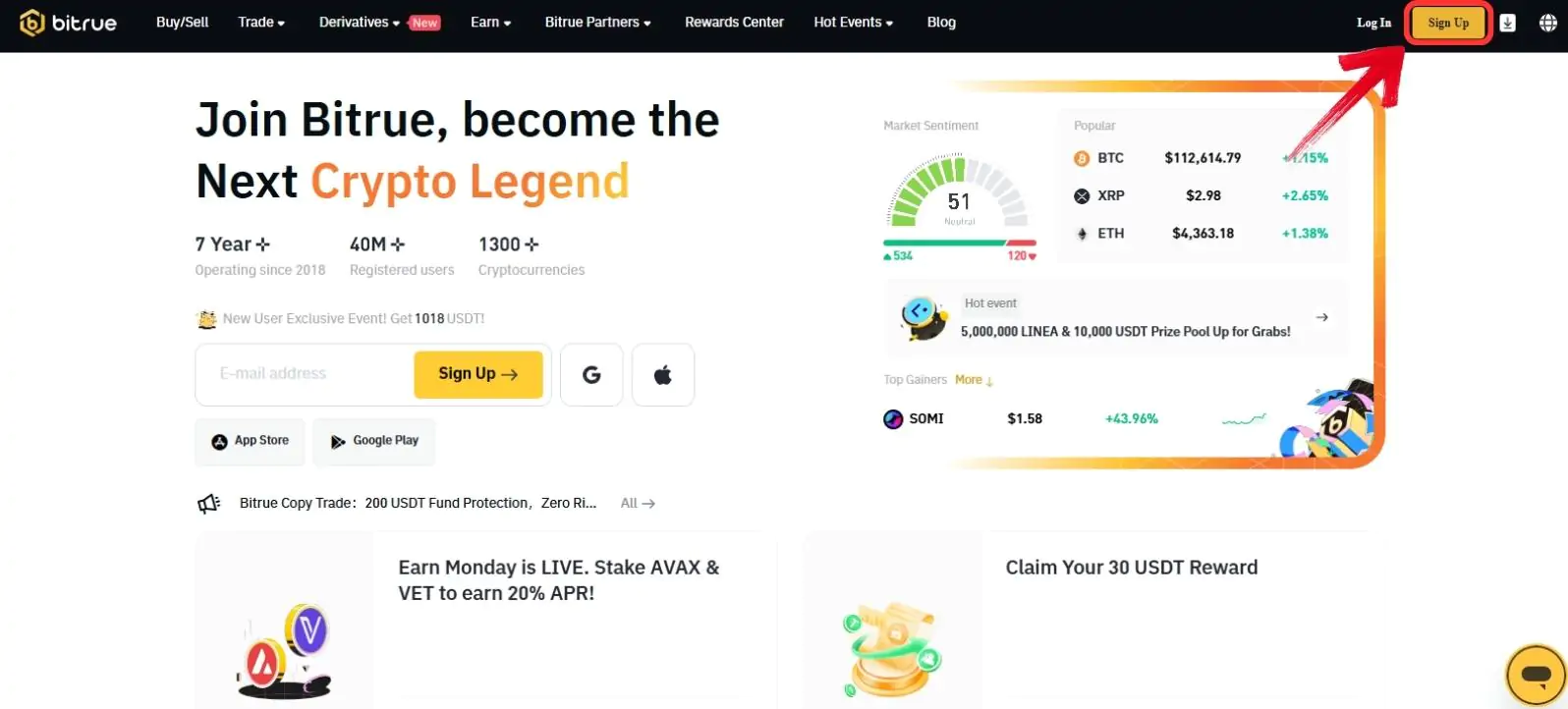

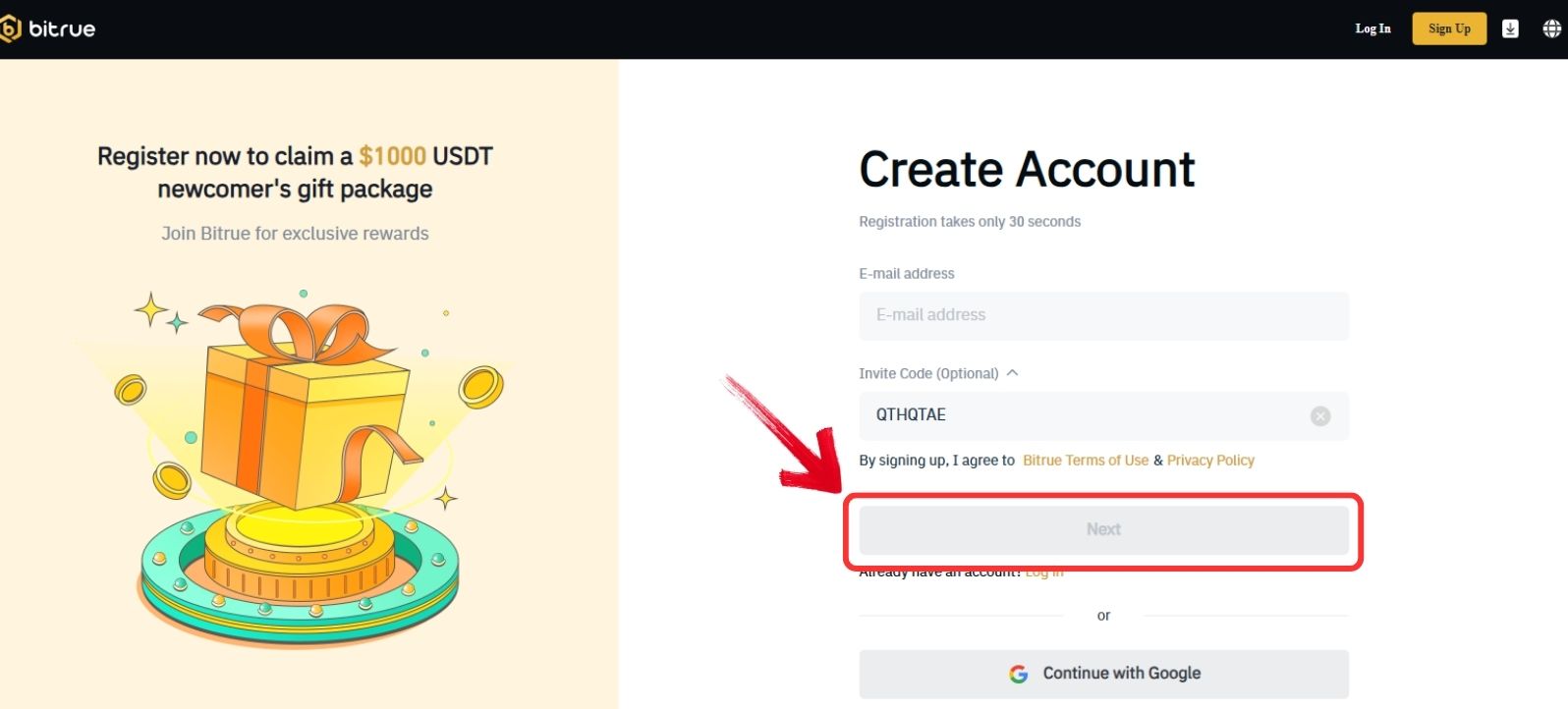

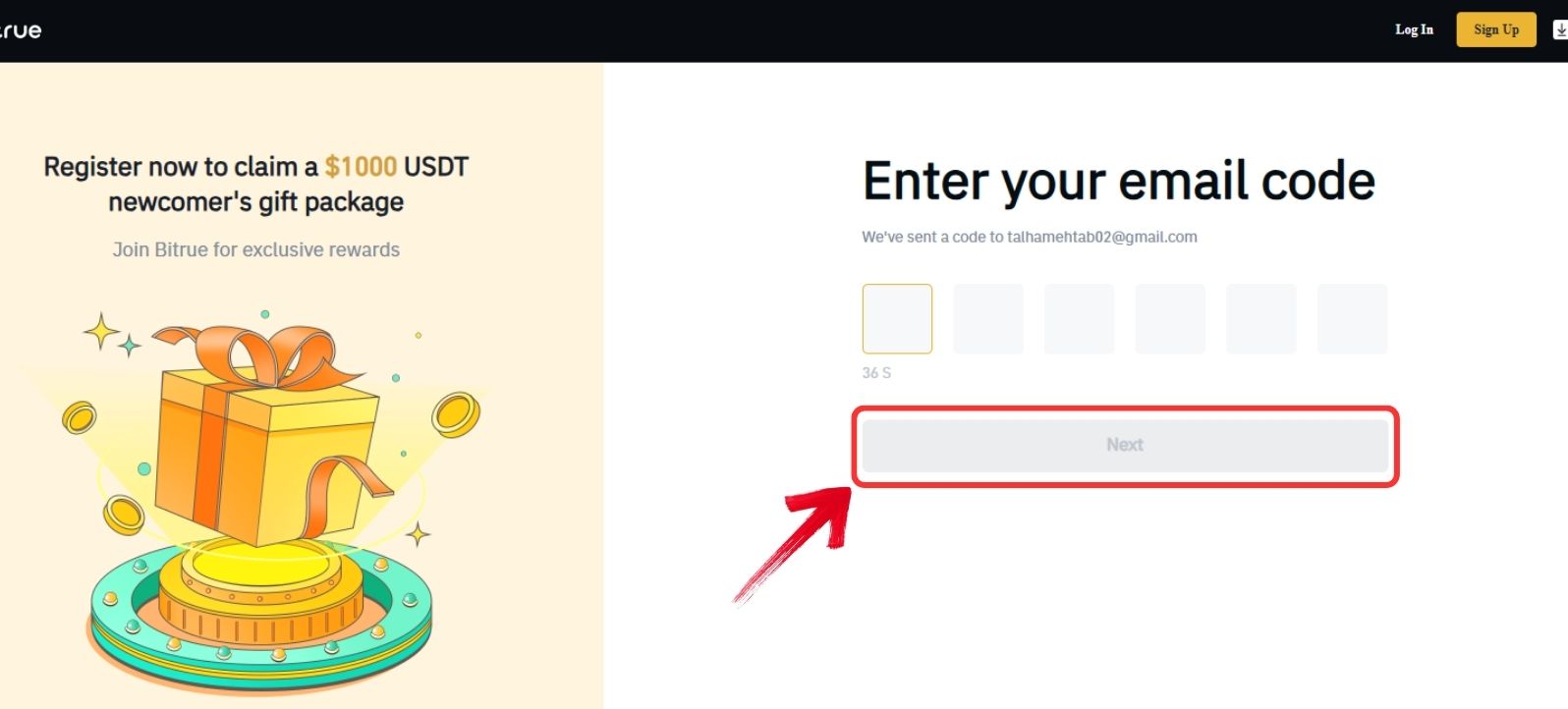

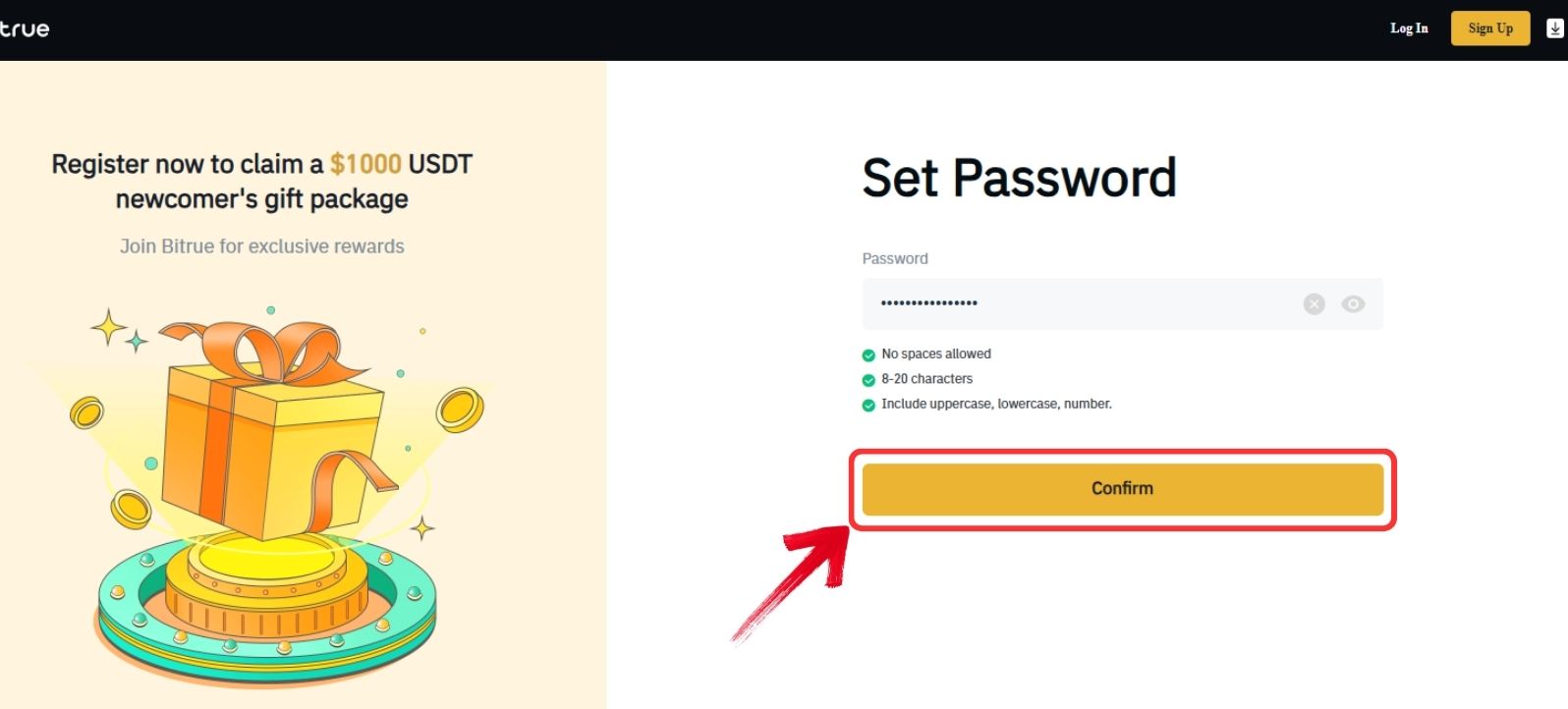

Signing up on Bitrue is simple and straightforward, much like any other exchange. You can register a new account using just your email address or phone number. KYC is not mandatory on Bitrue, so once your email is verified, you can instantly access the trading platform. Non-KYC accounts come with a daily withdrawal limit of 2 BTC, while higher verification levels unlock larger limits. Here’s how you can create an account on Bitrue.

Step 1: Open your browser, go to the official Bitrue website, and click on the “Sign Up” button.

Step 2: Enter the email address you want to register with on Bitrue, then click “Next”.

Step 3: Enter the 6-digit code sent to your email to verify your address, and then click “Next”.

Step 4: Once your email is verified, you’ll be prompted to create a strong password for your Bitrue account. After setting the password, click “Continue”.

Before creating an account, make sure that Bitrue is accessible in your region. The exchange follows AML and CFT standards based on FATF guidelines, which means its services are restricted in some countries. To save yourself from potential issues later on, you can use our Bitrue Country Checker to confirm availability in your location before signing up.

🌍 Free Bitrue Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, Bitrue does not support every country. To ensure that you are eligible to register on the exchange, you can use our free Bitrue country checker.

Simply type in your country and see if you can use the platform or if your country is restricted.

Bitrue Trading

Bitrue provides users with both spot and derivatives trading options. The spot market uses a slightly older-style layout, with the chart and order book displayed alongside available assets, while the trading tools are placed at the bottom of the screen. For futures, the layout follows the standard trading grid, where all tools, charts, and trade options are organized within a single frame.

TradingView chart is integrated, giving traders access to advanced charting tools and indicators. For those who prefer a simpler view, Bitrue allows you to collapse the charting panel by clicking on a small arrow.

When it comes to order types, Bitrue is fairly limited, offering only limit, market, and limit TP/SL (take profit/stop loss) options. As for the order book, liquidity can be considered moderate, which may affect execution speed and slippage during high market volatility.

Spot Trading

In spot trading, Bitrue offers access to more than 699+ cryptocurrencies. The fees are notably low compared to many exchanges, set at 0.098% for both maker and taker orders. However, the fee structure is not consistent across all markets.

For XRP pairs, fees are higher: XRP/BTC, XRP/USDT, and XRP/ETH are charged at 0.196%, while other XRP pairs carry a fee of 0.280%. Trading pairs are available in USDT and USDC, along with USD1, the stablecoin issued by World Liberty Finance. Bitrue also provides ETF trading options for those seeking additional exposure.

Derivatives Trading

On the derivatives side, Bitrue supports USDT-margined futures with more than 392+ contracts and leverage of up to 125x. The fee structure is competitive, set at 0.02% for maker and 0.06% for taker. Beyond USDT, the platform also offers Coin-M futures and USDC-margined futures contracts, catering to different trading preferences.

Bitrue Deposits and Withdrawals Methods

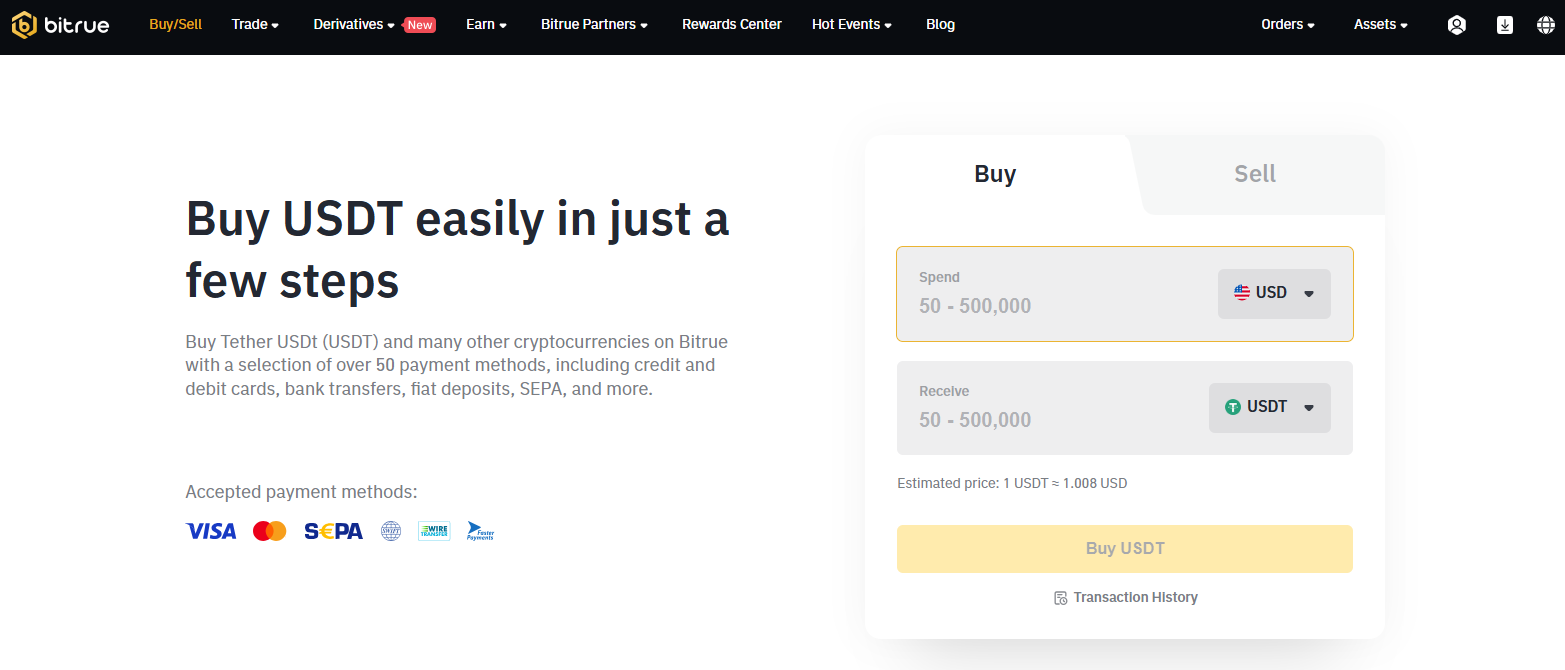

Bitrue offers a wide range of payment options, supporting more than 50 methods for deposits and withdrawals. These include credit and debit cards, bank transfers, SEPA, and fiat deposits, with coverage for over 52 fiat currencies.

In addition to fiat, Bitrue also supports on-chain crypto deposits and withdrawals across major networks such as Ethereum, the Lightning Network, Solana, and several others. This flexibility makes it easy for users to move funds in and out of the exchange using both traditional and blockchain-based channels.

Bitrue Fees

Bitrue keeps its fees simple, offering flat rates for both spot and futures trading without tiered pricing or complex structures.

Trading Fees

Bitrue keeps its trading fees simple and transparent. For spot markets, the standard fee is 0.098% for both maker and taker orders, which is lower than many competing exchanges. However, XRP trading pairs follow a separate structure: XRP/BTC, XRP/USDT, and XRP/ETH are charged at 0.196%, while other XRP pairs are set at 0.280%.

On the derivatives side, USDT-margined futures contracts are priced competitively, with a 0.02% fee for makers and 0.06% for takers. Users who pay fees using the exchange’s native BTR token can benefit from an instant 20% discount, further lowering overall trading costs.

Spot Fees

0.098% Maker

0.098% Taker

Future Fees

0.02% Maker

0.06% Taker

Deposits and Withdrawals Fees

Fiat deposits and withdrawals are free, though users must cover transaction costs charged by third-party providers. For cryptocurrency transfers, only standard blockchain network fees apply. This straightforward structure makes it easier for traders to calculate costs in advance, without hidden charges or unexpected platform-imposed withdrawal fees.

Bitrue Products and Services

Bitrue provides a diverse ecosystem of trading and investment options designed to meet the needs of both traders and investors.

Trading

Bitrue provides a wide range of trading opportunities, combining spot and derivatives markets with additional tools to suit different strategies. Spot trading covers more than 699 cryptocurrencies, while derivatives include over 392 contracts with leverage reaching 125x. Beyond the basics, Bitrue also offers copy trading, allowing users to mirror strategies from experienced traders, as well as ETF trading options for broader exposure.

The interface integrates TradingView for charting and indicators, though order types remain limited to market, limit, and TP/SL. One drawback is the absence of demo trading, a feature especially valuable for beginners practicing without risk.

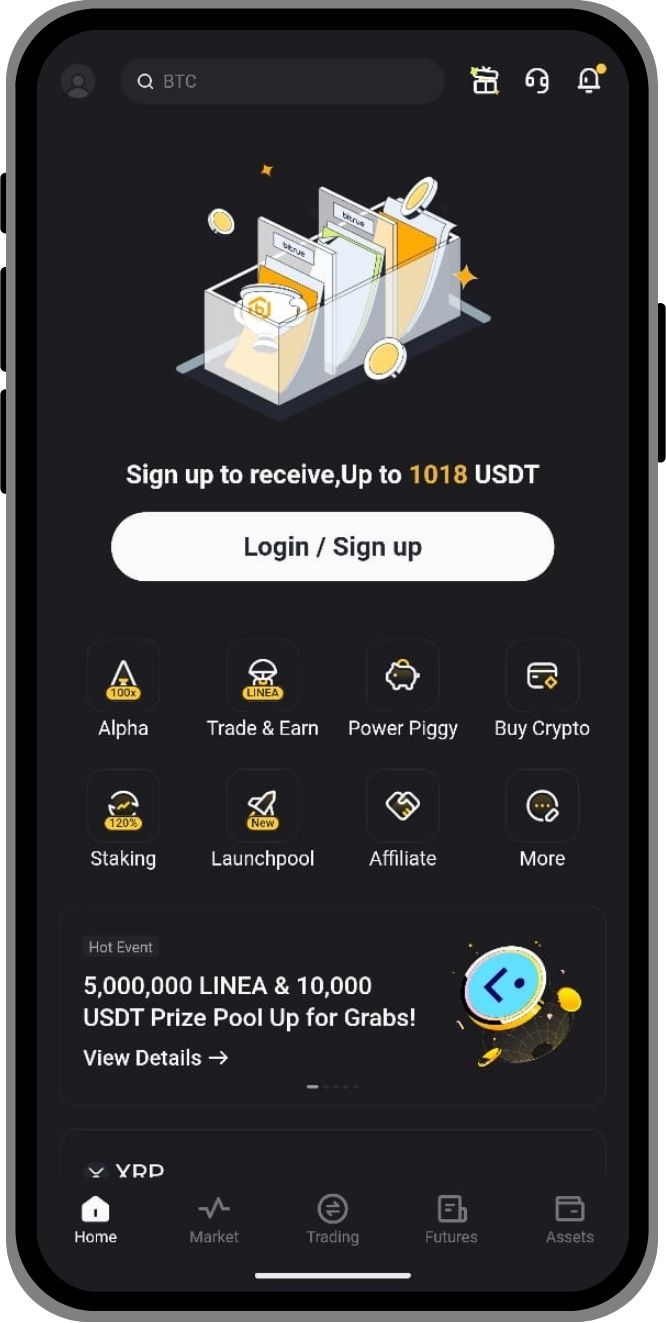

Mobile App

The Bitrue mobile app is available on both iOS and Android, bringing nearly all desktop features into a pocket-friendly format. Users can trade spot and futures markets, manage staking, and access account tools with ease. The app is particularly suitable for traders who prefer flexibility and want to monitor markets on the go. With a rating of 3.8, it delivers functionality, though some users note performance and responsiveness could improve compared to the web platform.

BTR Token

Bitrue Coin (BTR) is the native token of the Bitrue exchange and plays a central role in its ecosystem. Holding BTR allows users to enjoy a 20% discount on spot trading fees, making it a cost-effective choice for active traders. Beyond trading, BTR supports multiple utilities including cash deposits for projects, voting on new token listings, participation in wealth management programs, and access to Bitrue’s loan services, creating long-term value across the platform’s services.

Loading...

Rank #Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

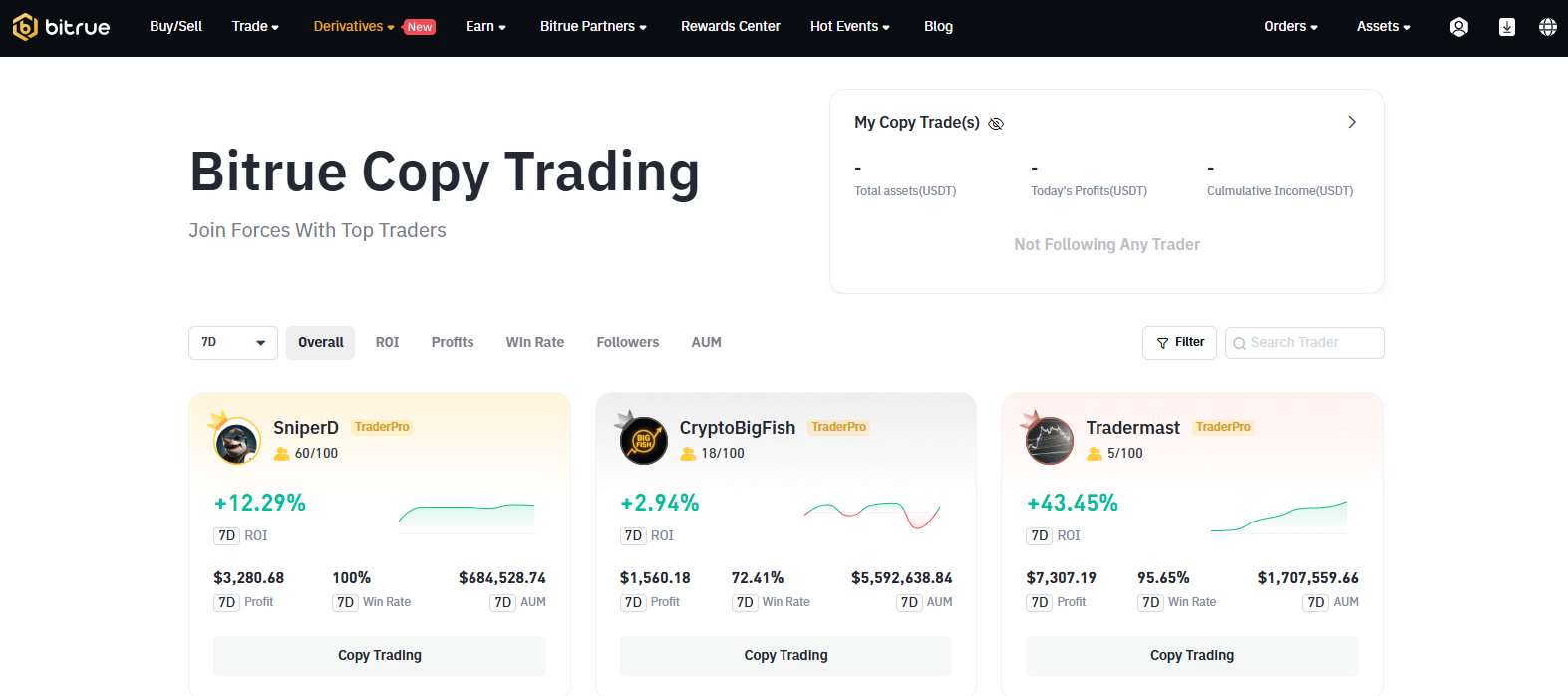

Copy Trading

Bitrue’s copy trading feature offers a passive way to grow your portfolio by following verified trading experts. Each trader is reviewed based on strict criteria, including a historical return rate above 70%, a success rate over 60%, and at least 100 days of activity. Users can filter and select traders to match their goals. The profit share ratio is capped at 20%. For skilled traders, Bitrue offers higher profit-sharing opportunities compared to many competing platforms.

Earn

Bitrue Earn provides multiple ways to generate passive income. Its flagship product, Power Piggy, allows users to earn interest on over 100 assets, including stablecoins like USD1. The platform also offers on-chain staking options, which carry higher risk but deliver more attractive APYs. Another option is the Launchpool, where users can stake BTR or other campaign-specific tokens to earn allocations in new projects. This mix of flexible and fixed-income opportunities gives both conservative and high-risk investors the ability to maximize returns while diversifying their crypto holdings through Bitrue’s wealth management ecosystem.

Affiliate Program

Bitrue’s affiliate program offers partners the chance to earn up to 65% commission. Affiliates receive exclusive one-on-one customer support to maximize performance. The program also features dedicated campaigns, such as user sign-up and trading events, with special rewards to attract and engage followers. Bitrue regularly updates affiliates with the latest promotions and benefits, helping them expand their reach and visibility on social platforms. This makes the program appealing for influencers and community leaders seeking consistent income opportunities.

Bitrue Security

Bitrue operates without formal licensing or regulation, which raises concerns about oversight and transparency. The exchange has faced two major breaches: in June 2019, around $4.2 million in XRP and ADA was stolen from roughly 90 accounts, and in April 2023, a hot wallet hack resulted in the loss of $23 million in assets including ETH, QNT, and SHIB. Bitrue reported that less than 5% of funds were affected and stated that all impacted users were compensated.

To safeguard assets, Bitrue stores the majority of customer funds in multi-signature cold wallets, while hot wallets remain protected by a dedicated 24/7 security team. Security features include two-factor authentication, PIN protection for withdrawals, SMS verification, and IP whitelisting. Bitrue also maintains an insurance fund in XRP and BTR to cover losses in case of platform-related breaches. However, the exchange has not released a proof of reserves, leaving questions about full 1:1 backing of customer funds.

Bitrue Customer Support

Bitrue provides several customer support channels to assist its users. The exchange features a comprehensive Help Center that includes step-by-step guides, FAQs, and detailed instructions covering account setup, trading, security, and troubleshooting. For real-time issues, Bitrue offers online chat support, although response times can vary depending on demand.

Users can also reach out through email support when live chat is unavailable. Beyond direct assistance, Bitrue maintains a regularly updated blog and research section, offering insights into emerging market trends, platform updates, and educational resources.

While these tools create a solid foundation for customer support, user feedback often highlights the need for faster resolutions and more consistent responsiveness, making this an area with room for improvement.

If you’re considering leaving the platform altogether, you can follow our step-by-step guide on how to delete your Bitrue account.

Bitrue Alternative

Bitrue is known for its high leverage and variety of trading tools, but if you’re looking for alternatives, consider these:

- MEXC: MEXC offers a wider selection of altcoins and generally has more competitive trading fees.

- Kraken: Kraken is a well-established exchange with a strong reputation for security and a wide range of features.

- Bitunix: If you need a no-KYC option with a user-friendly platform and high leverage, Bitunix exchange is a great option.

| Feature | Bitrue | MEXC | Kraken | Bitunix |

|---|---|---|---|---|

| Established | 2019 | 2018 | 2011 | 2022 |

| Spot Fees (Maker/Taker) | 9.80% / 9.80% | 0.05% / 0.05% | 0.16% / 0.26% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.000% / 0.000% | 0.000% / 0.020% | 0.020% / 0.050% | 0.020% / 0.060% |

| Max Leverage | 125x | 500x | 50x | 125x |

| KYC Required | No | Yes | Yes | No |

| Supported Cryptos (Spot) | 699+ | 3137+ | 516+ | 541+ |

| Futures Contracts | 392+ | 433+ | 348+ | 400+ |

| No KYC Withdrawal Limit | 2 BTC | Not Allowed | Not Allowed | $10,000 |

| 24h Futures Volume | $11.09B+ | $22.91B+ | $873.60M+ | $5.28B+ |

| Trading Bonus | None | $20,000 | None | $5,500 |

| Key Features | • No KYC required • High leverage (125x) • Copy trading available |

• Largest crypto selection • Zero-fee spot trading • High leverage (500x) |

• Highly regulated • Established reputation • Strong security |

• No KYC required • User-friendly • Multiple fiat options |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

Bitrue presents itself as a feature-rich exchange with access to hundreds of assets, futures trading, staking, and copy trading, which may appeal to both new and experienced traders. Its interface is simple enough for beginners, but slow loading times can disrupt the overall experience.

On the downside, Bitrue’s history of security breaches and the absence of proof of reserves raise legitimate concerns about fund safety. Futures fees are competitive, yet spot fees for XRP pairs stand out as unusually high. Customer support, while available through multiple channels, has not always met user expectations.

Whether Bitrue is suitable ultimately depends on your priorities. If security and stronger support are key, exploring alternatives like Bitunix or MEXC may help inform your choice.

FAQs

1. Is Bitrue Safe?

Bitrue was hacked twice in the last 4 years which resulted in over $27 million being stolen from customers. Unfortunately, we can not consider Bitrue to be a safe and secure crypto exchange.

2. Does Bitrue require KYC?

No, Bitrue does not require KYC verification, meaning that you can trade on Bitrue while staying anonymous with withdrawal limits of upto 2 BTC.

3. What are the fees on Bitrue?

The spot fees on Bitrue are 0.098% for makers and takers. On the futures market, you will have to pay 0.02% maker and 0.06% taker.

4. What are the best alternatives to Bitrue?

Some of the best alternatives to Bitrue are Bitunix, MEXC, and Kraken. The exchanges have never been hacked, and offer low fees, full proof of reserves, 24/7 live chat customer support, and a flawless interface.

5. Does Bitrue offer copy trading?

Yes, Bitrue offers copy trading with a capped 20% profit share. Verified traders are reviewed based on return rates, success history, and activity.