- •Tapbit was founded in 2022 in the British Virgin Islands

- •Supports 418+ cryptocurrencies and 130+ futures contracts with up to 150x leverage

- •Spot fees are 0.10% and futures fees are 0.01% and 0.06%

- •No mandatory KYC with 10 BTC daily withdrawal limit

- •CER.live audit gave CCC rating (55% score)

- •Offers copy trading, grid trading, and passive income products

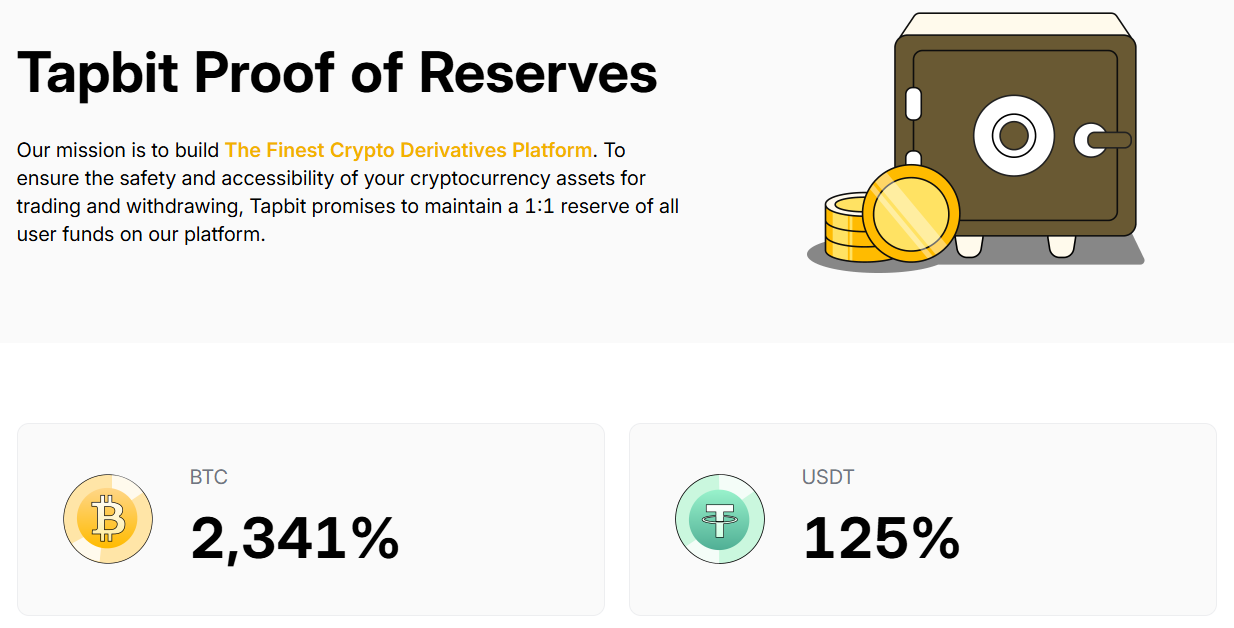

- •Publishes proof of reserves claiming 1:1 asset backing

Choosing an exchange can feel like sorting through endless promises, especially when the market is heating up again. Tapbit has started to surface in conversations for its global reach and multi-product offering, but the question remains; what does it really deliver? This Tapbit review breaks down the essentials: from trading fees and product range to security measures and customer service. The goal is simple: to provide clarity so you can weigh if Tapbit fits into your trading strategy.

| Stats | Tapbit |

|---|---|

| 🚀 Founded | 2022 |

| 🌐 Headquarters | British Virgin Islands |

| 🔎 Founder | Lucas Galvão |

| 👤 Active Users | 500K+ |

| 🪙 Supported Cryptos | 418+ |

| 🪙 Futures Contracts | 130+ |

| 🔁 Spot Fees (maker/taker) | 0.10% / 0.10% |

| 🔁 Futures Fees (maker/taker) | 0.02% / 0.06% |

| 📈 Max Leverage | 150x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 4.1/5 |

| 💰 Bonus | 1% (Claim Now) |

Tapbit Overview

Tapbit, founded in 2022 by Lucas Galvão and headquartered in the British Virgin Islands, is a newer player in the global crypto exchange space. Its mission is to create a secure, borderless trading environment that emphasizes compliance, user protection, and accessibility. The exchange positions itself around transparency and speed, aiming to offer traders a reliable platform for both spot and derivatives markets.

Tapbit supports more than 418+ cryptocurrencies, alongside over 130+ futures contracts with leverage options reaching up to 150x. Reported daily volumes highlight significant activity, with approximately $3.84 billion in spot trades and $53.65 billion in futures. This growing activity has helped the platform attract over 500,000 users.

On fees, Tapbit applies a flat 0.10% maker and taker charge for spot trading, while futures are priced at 0.020% maker and 0.060% taker. KYC is not required for basic use, with daily withdrawal limits of up to 10 BTC for unverified accounts and 60 BTC for Level 1 KYC. The exchange also offers fiat deposits in currencies such as SGD, HKD, and THB, supported through cards, bank transfers, and third-party providers.

Although relatively new, Tapbit has positioned itself as a global platform offering multiple trading options with competitive fee structures and flexible onboarding.

Tapbit Pros and Cons

| 👍 Pros | 👎 Cons |

|---|---|

| ✅ Supports 418+ spot cryptocurrencies and 130+ futures contracts | ❌ Newer exchange with limited reputation |

| ✅ Leverage is available up to 150x on futures | ❌ Security audit by CER.live gave a CCC rating |

| ✅ Demo trading is available | ❌ Liquidity on P2P trading is low |

| ✅ No mandatory KYC with a 10 BTC daily withdrawal limit | |

| ✅ Offers copy trading, grid bots, and passive income products | |

| ✅ 24/7 customer support via live chat and email | |

| ✅ Low trading fees | |

| ✅ Proof of Reserves is published claiming 1:1 asset backing |

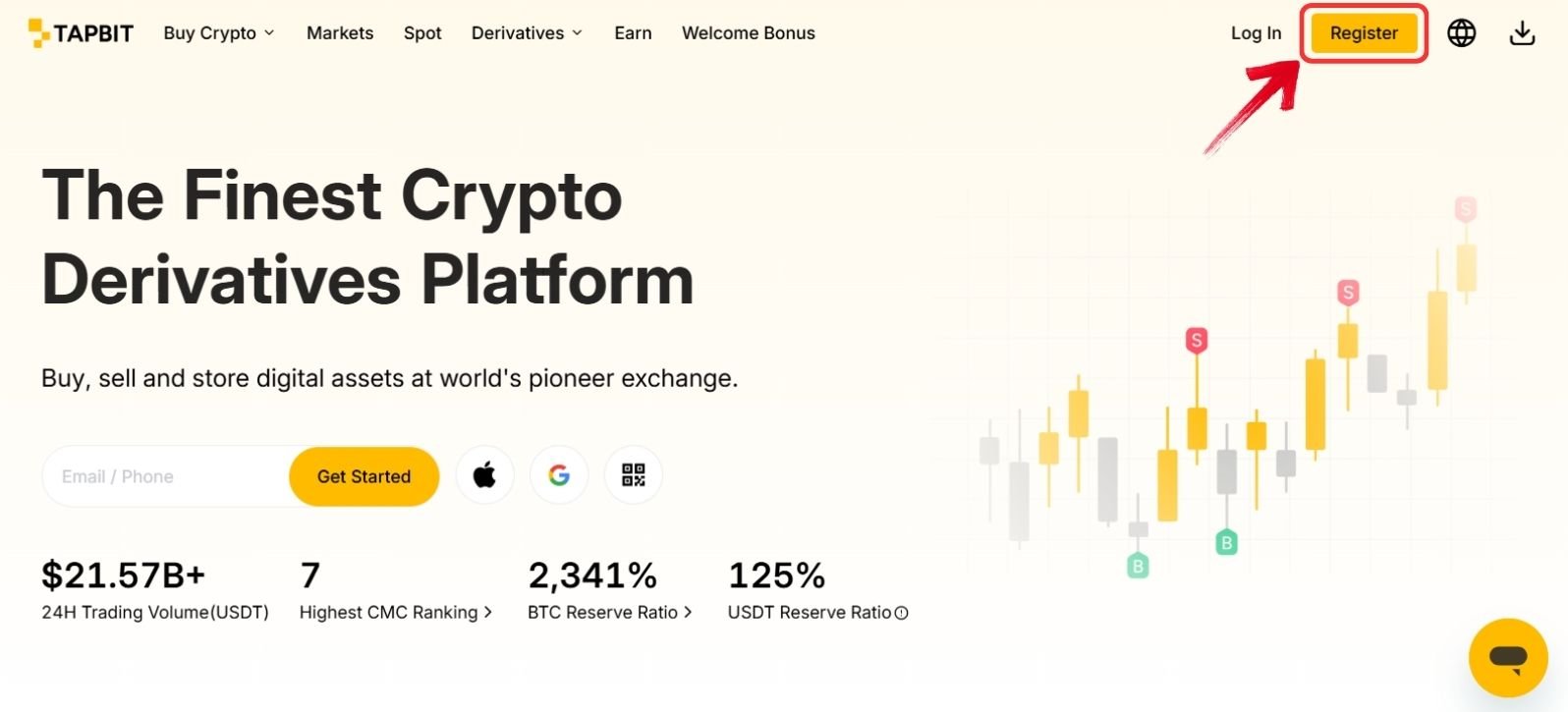

Tapbit Sign-up & KYC

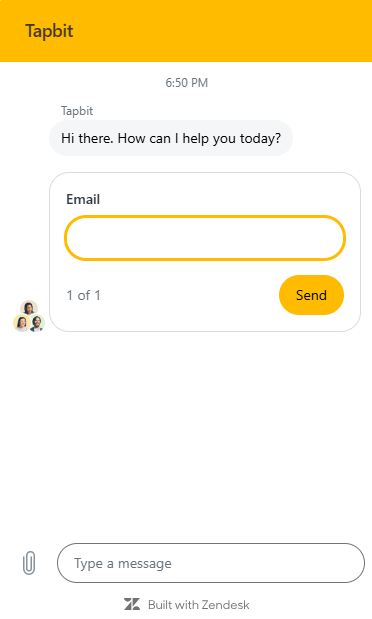

To get started on Tapbit, registration can be completed using either an email address or a phone number. Since the exchange does not enforce mandatory KYC, trading can begin immediately after a simple email verification. For users who prefer not to complete identity checks, Tapbit allows daily withdrawals of up to 10 BTC. This provides flexibility for those seeking to trade without strict verification requirements, while still offering higher withdrawal limits for accounts that undergo additional KYC levels. Here are the steps you can follow to get started with Tapbit.

Step 1: Open the official Tapbit website in your browser and select the “Register” option.

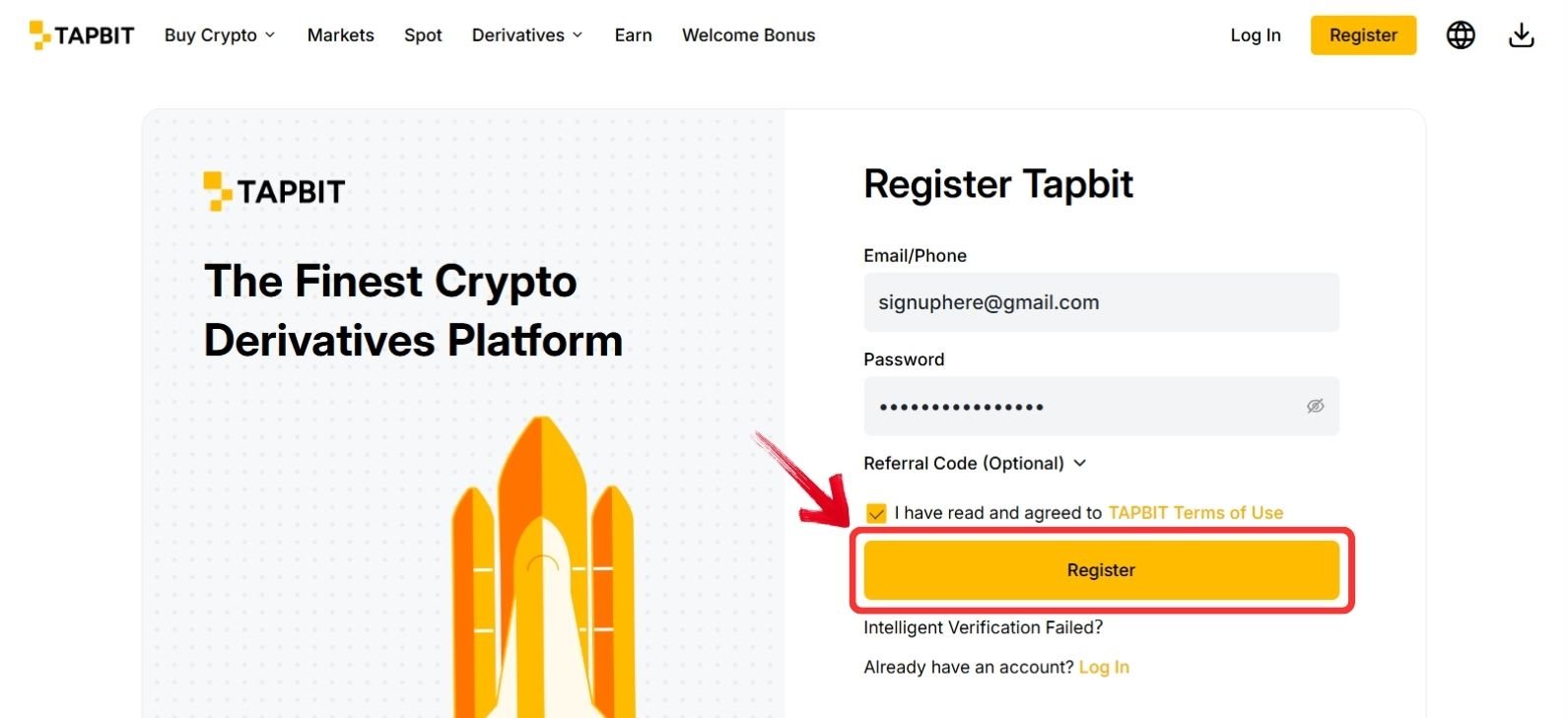

Step 2: On the sign-up form, enter your email address and set a secure password. You may also choose to register with a phone number.

Step 3: Click “Sign Up” and complete the verification process by entering the 6-digit code sent to your email.

KYC is not required to start trading, though users who want higher withdrawal limits can choose to verify their accounts. Level 0 accounts allow withdrawals of up to 10 BTC per day, while completing verification increases the daily limit to 60 BTC.

Before registering, check if Tapbit is supported in your country. Certain regions are restricted under FATF regulations. To avoid any problems, you can use our Tapbit country checker tool to confirm availability before proceeding.

🌍 Free Tapbit Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, Tapbit does not support every country. To ensure that you are eligible to register on the exchange, you can use our free Tapbit country checker.

Simply type your country and see if you can use the platform or if your country is restricted.

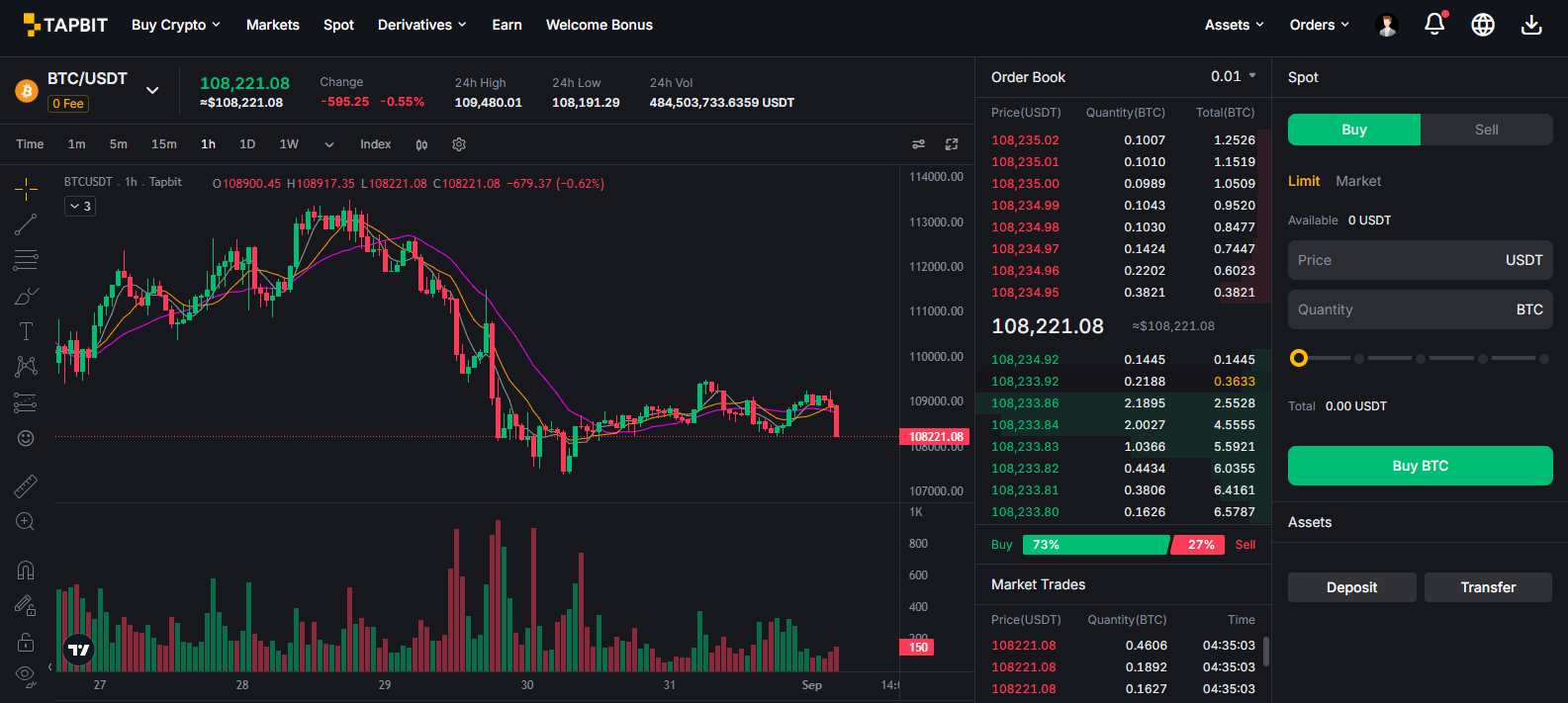

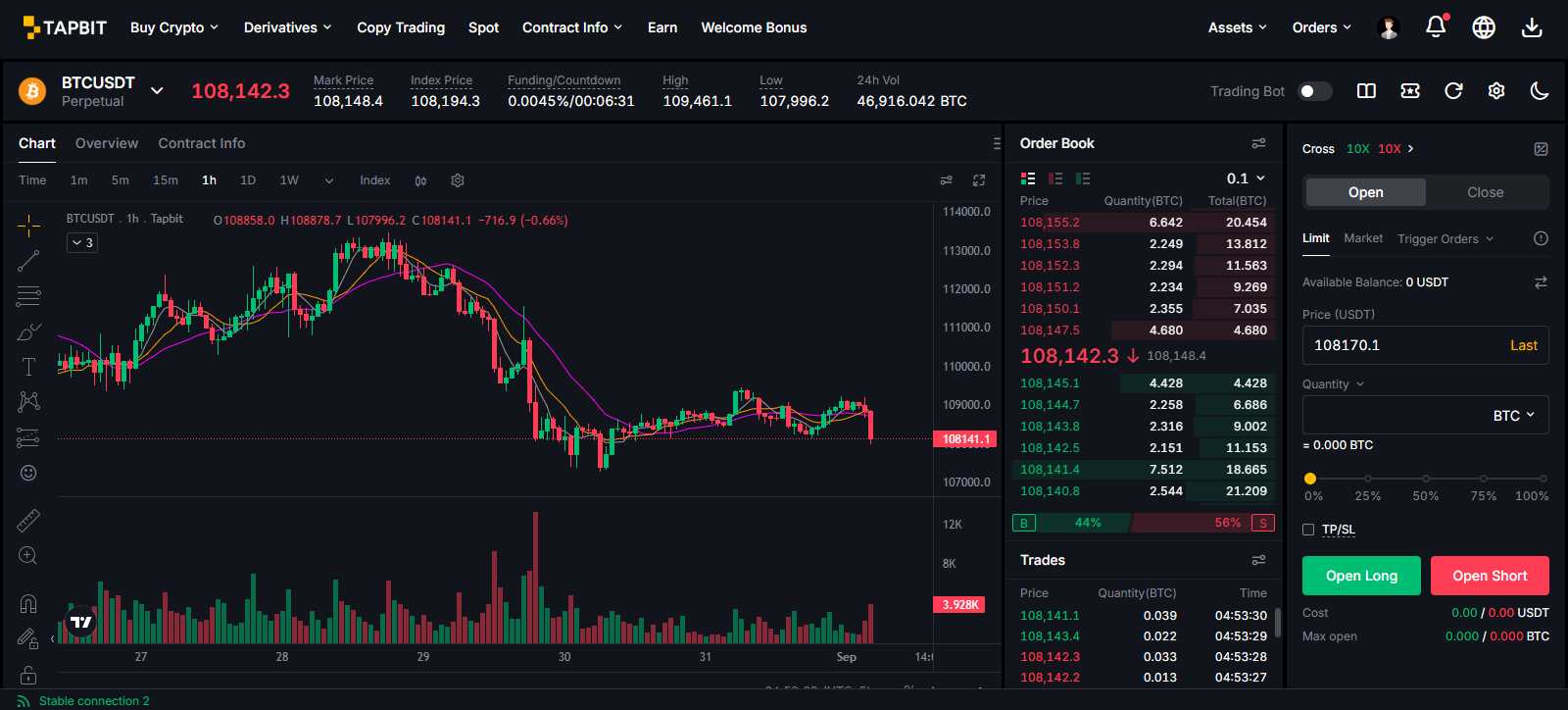

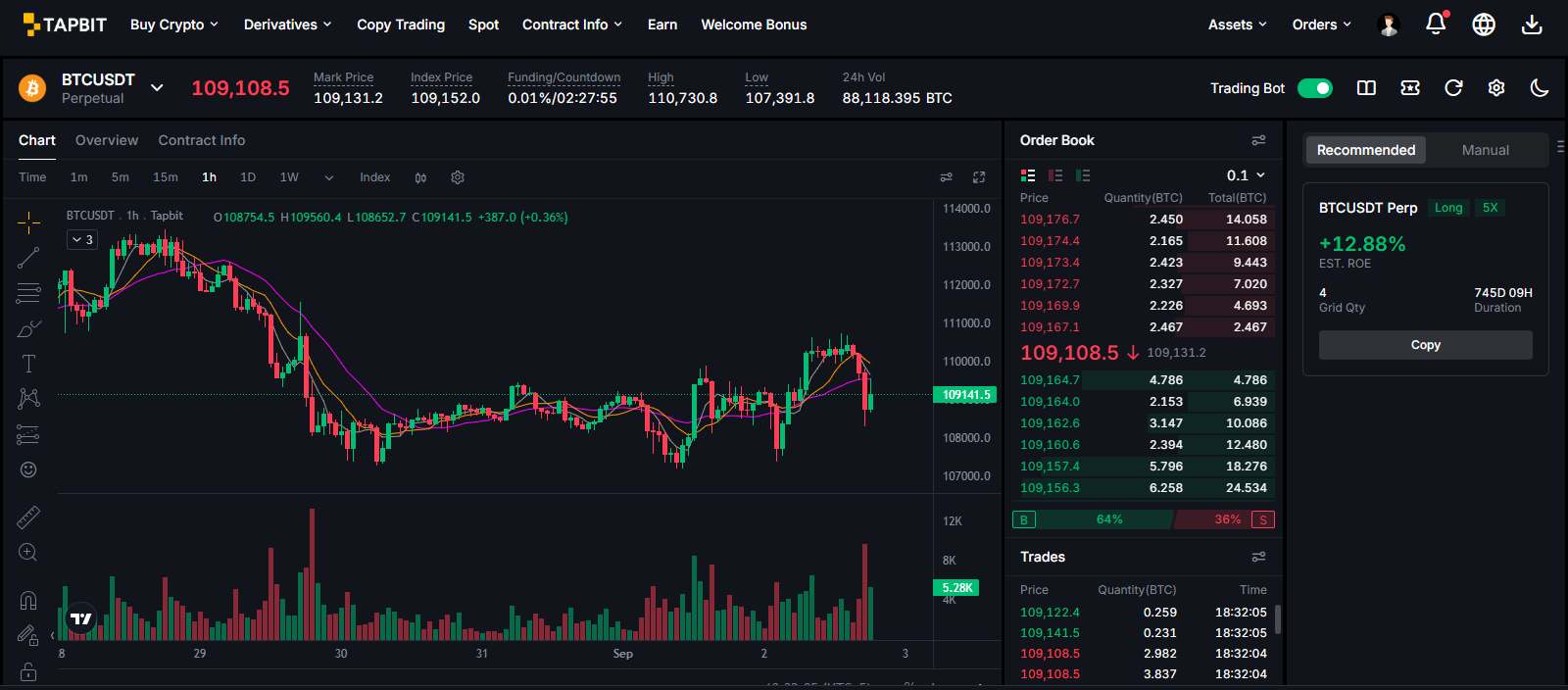

Tapbit Trading

Tapbit allows users to trade across both spot and futures markets. The platform’s interface follows a conventional layout, with trading charts, the order book, and the order panel positioned at the top, while sections such as open positions and trade history are placed directly below for easy access. The charts are powered by TradingView, giving traders a full range of indicators and tools to support different strategies.

The order book shows strong liquidity with tight spreads, though the choice of order types is limited to market and limit orders. Key asset information, including 24-hour trading volume, price highs and lows, and futures funding rates, is displayed above the chart, allowing users to quickly monitor market conditions while executing trades.

Spot Trading

Tapbit offers access to over 418 cryptocurrencies, with trading fees set at 0.1% for both makers and takers. For some major assets, including BTC, ETH, and a few others, trading is available at zero fees. Most pairs are denominated in USDT, though a limited selection of USDC pairs is also supported. This combination of variety and competitive pricing makes the spot market straightforward for traders seeking both popular and emerging assets.

Futures Trading

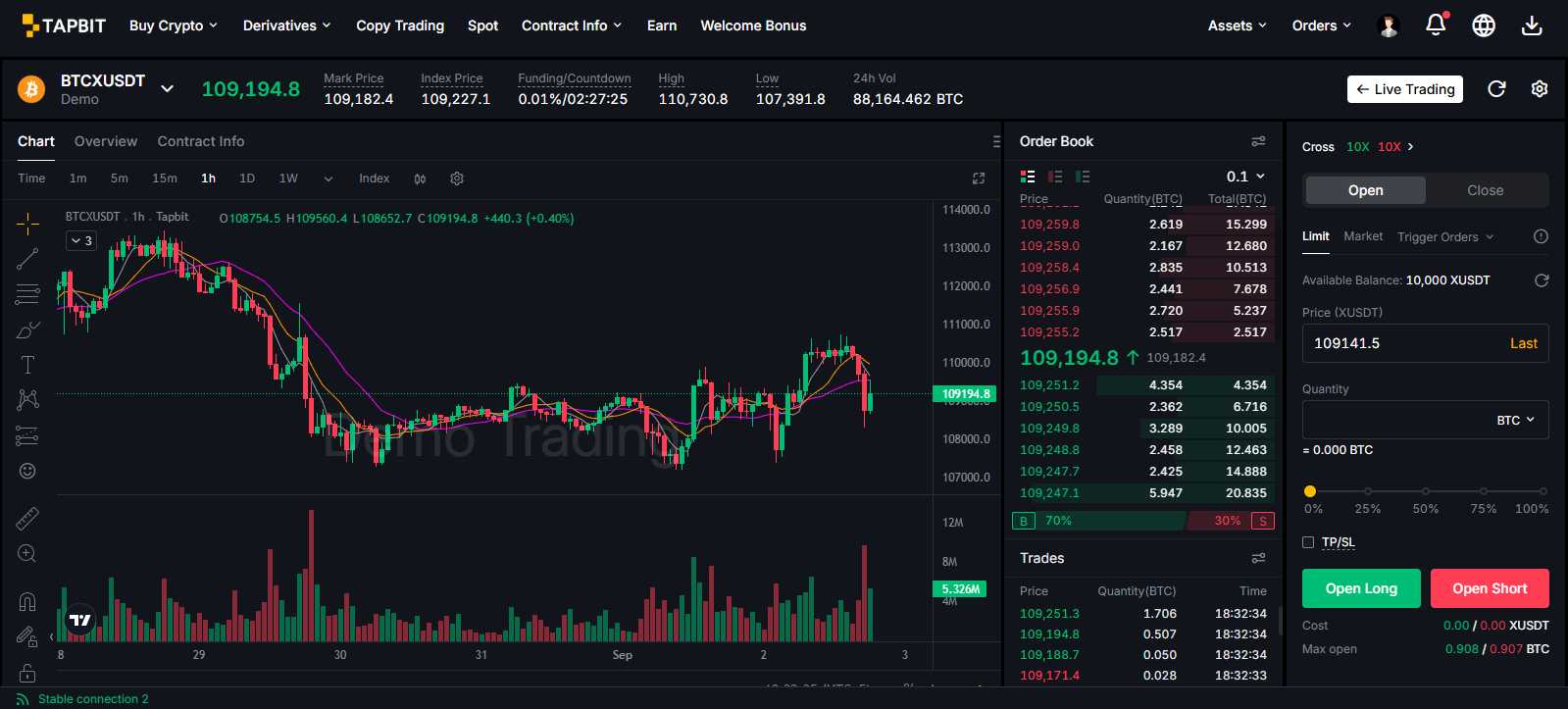

The futures market on Tapbit includes more than 130 contracts with leverage options of up to 150x. Trading fees are competitive at 0.02% for makers and 0.06% for takers, with all contracts quoted in USDT. The platform also provides a demo trading feature, where users can practice strategies using 10,000 XUSDT in virtual funds. This allows traders to build leverage trading skills without risk before moving into live market conditions. Read our Tapbit Demo Trading Guide to learn how to get started.

Tapbit Deposit and Withdrawal Methods

Adding funds to Tapbit is simple. The platform offers a fiat on- and off-ramp, allowing users to purchase crypto with credit or debit cards through third-party providers such as Volet, Mercuryo, and others. More than 44 fiat currencies are supported for buying, while the off-ramp is limited to around three fiat currencies for selling. Direct bank transfers are not supported.

In addition, Tapbit supports deposits and withdrawals through multiple crypto networks, making it easy to move funds directly on-chain. For users seeking more flexibility, a P2P trading option is also available. This feature enables buying or selling crypto with other users, using local payment methods that match your region.

Tapbit Fees

Trading fees are a key consideration when selecting an exchange. Below, we’ll review Tapbit’s fee structure and highlight any available discounts.

Trading Fees

Tapbit keeps its spot trading fees straightforward at 0.1% for both makers and takers. For futures trading, fees are set at 0.01% for makers and 0.06% for takers, following a fixed structure without additional tiers. This makes the cost of trading clear and predictable for users.

Spot Fees

0.10% Maker

0.10% Taker

Future Fees

0.01%% Maker

0.06% Taker

Deposits and Withdrawals

For fiat deposits through the on-ramp, Tapbit does not charge its own fee. Instead, any costs come from third-party providers such as Volet or Mercuryo, and these vary depending on the payment method and currency. P2P trading is free of charge, allowing users to fund or cash out without added platform fees.

Crypto deposits are also free, though withdrawals include a fee that combines Tapbit’s charge with the applicable network fee. These costs differ based on the token and blockchain selected, so they can vary from one transaction to another.

Tapbit Products and Services

Beyond trading itself, there are other factors that can shape the value of an exchange. Features such as copy trading, which lets users follow experienced traders, or staking options that allow earnings on idle assets, are often important considerations for those looking to get more out of their platform.

Tapbit Trading

Tapbit delivers a comprehensive trading environment with support for spot, futures, and passive trading options like copy trading and grid trading. Users can also access the P2P marketplace, which provides localized payment options for funding accounts or selling crypto directly. Both spot and futures platforms integrate with TradingView, ensuring traders have access to advanced charting tools and indicators for informed decision-making.

The exchange also emphasizes accessibility through responsive 24/7 live chat and email support. Combined with features like demo trading for practice, Tapbit provides a structured experience for both new and experienced users who want a balance of active and passive trading options.

Learn how to get started with demo trading in our complete Tapbit Demo Trading Guide.

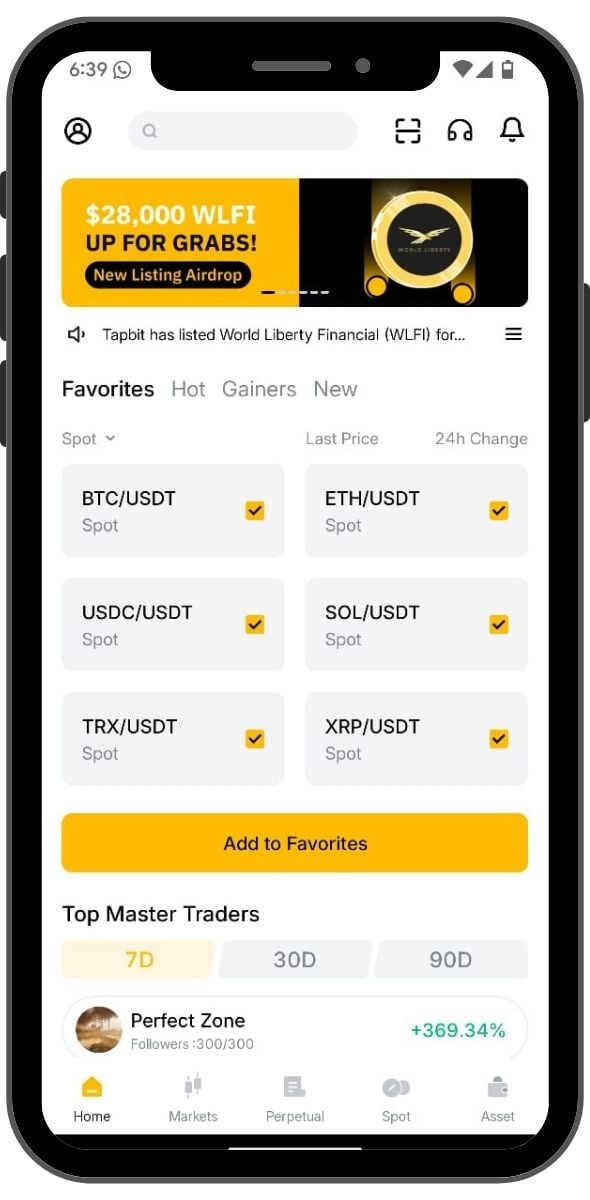

Mobile App

Tapbit’s mobile app is available for both iOS and Android, offering full access to spot and futures markets as well as additional features like copy trading and P2P. The interface is designed to be smooth, with easy navigation that mirrors the desktop platform. Charting is powered by TradingView, so traders can apply the same tools and strategies on the go. This ensures users can monitor positions, manage risk, and trade efficiently, no matter where they are.

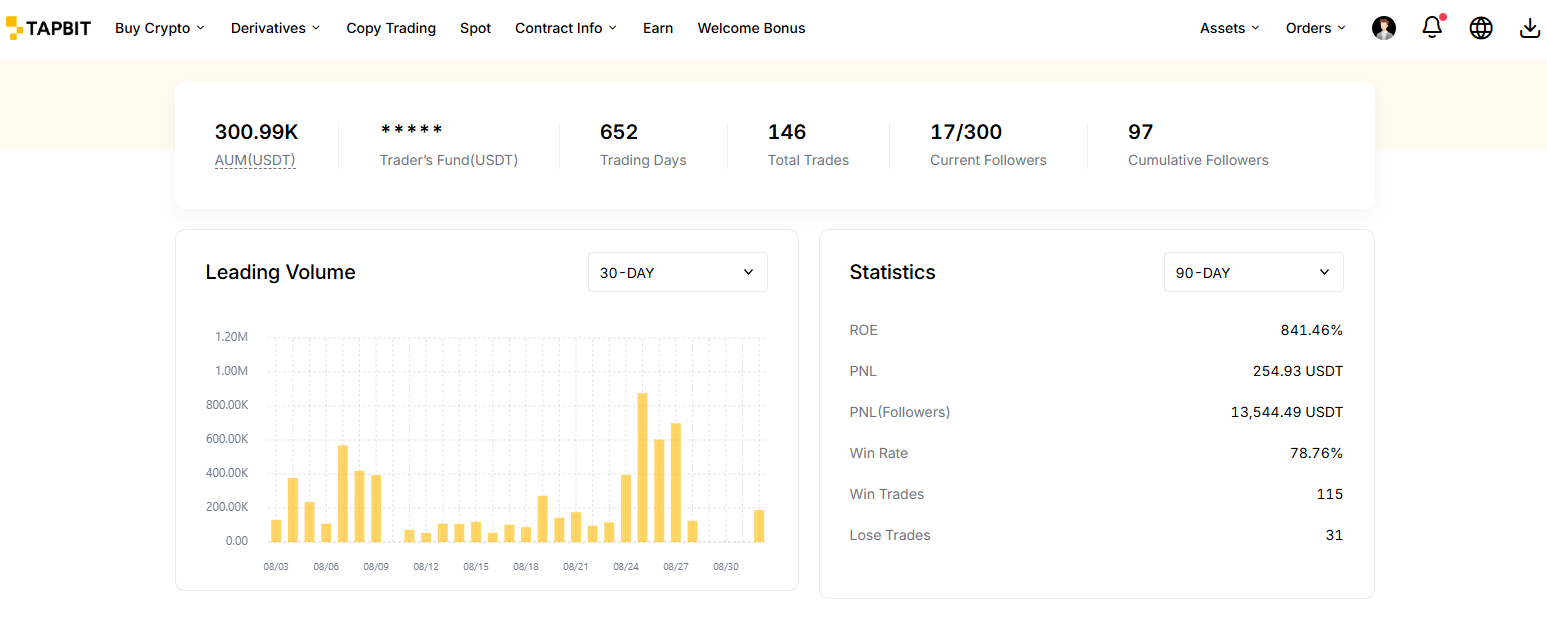

Copy Trading

Tapbit features over 1,200 master traders available to follow, providing a straightforward entry point for passive investing. The platform uses strong security practices, with cold wallet transfers requiring Level 2 manual review and offline signatures to protect funds. Detailed statistics on each master trader, such as performance and risk levels, are provided to help users make informed choices. To maintain fairness, the profit share for copy trading is capped at 10%, keeping the system transparent and predictable.

Grid Trading

Tapbit offers pre-built, tested futures bots for automated grid trading, designed to capture market swings within defined ranges. In addition, users can manually configure their own grids by setting price ranges and leverage preferences. However, this feature is currently limited to BTC contracts, making it narrower in scope compared to platforms that offer multi-asset grid trading. Despite the limitation, the option can still be useful for traders who want to automate their Bitcoin futures strategies.

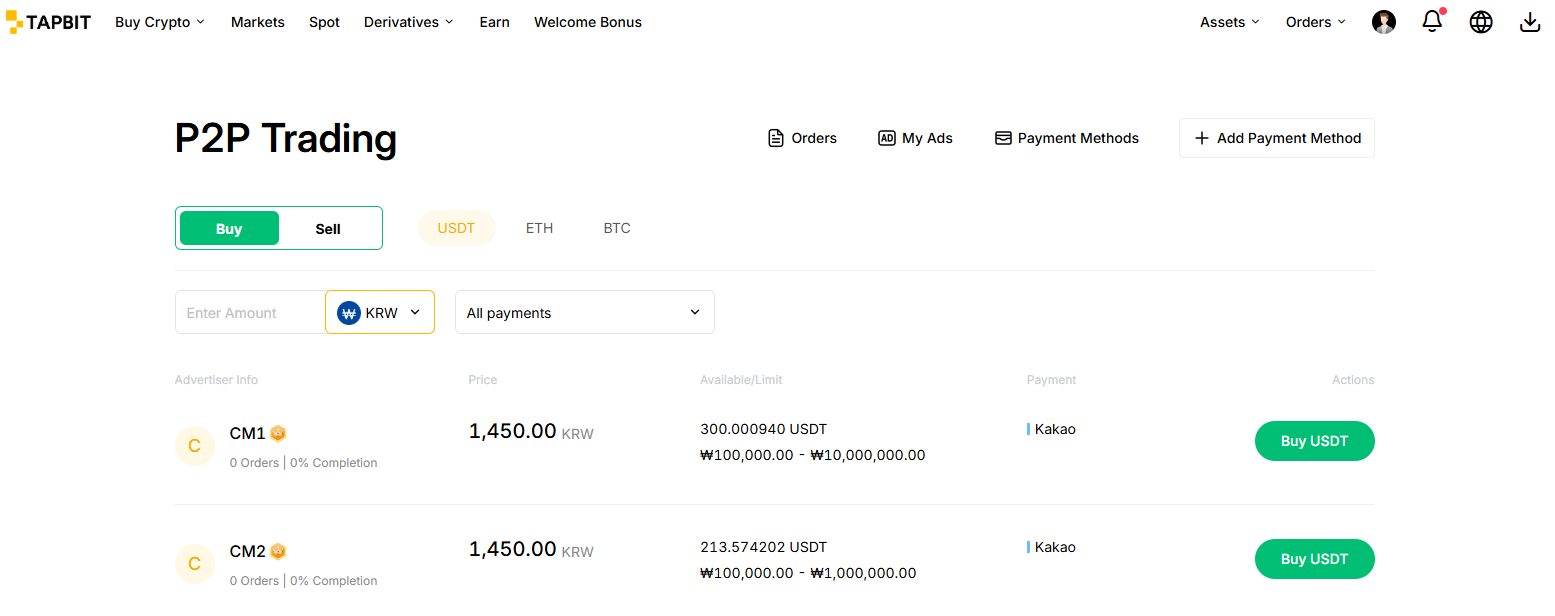

P2P Trading

The P2P marketplace on Tapbit supports nine fiat currencies, though liquidity remains relatively low. Users can buy and sell key assets such as USDT, BTC, and ETH directly with other participants. This model enables the use of local payment methods, giving traders flexibility where traditional fiat support is limited. While not as developed as Tapbit’s core spot and futures markets, the P2P option serves as an alternative way to fund or cash out when other methods aren’t convenient.

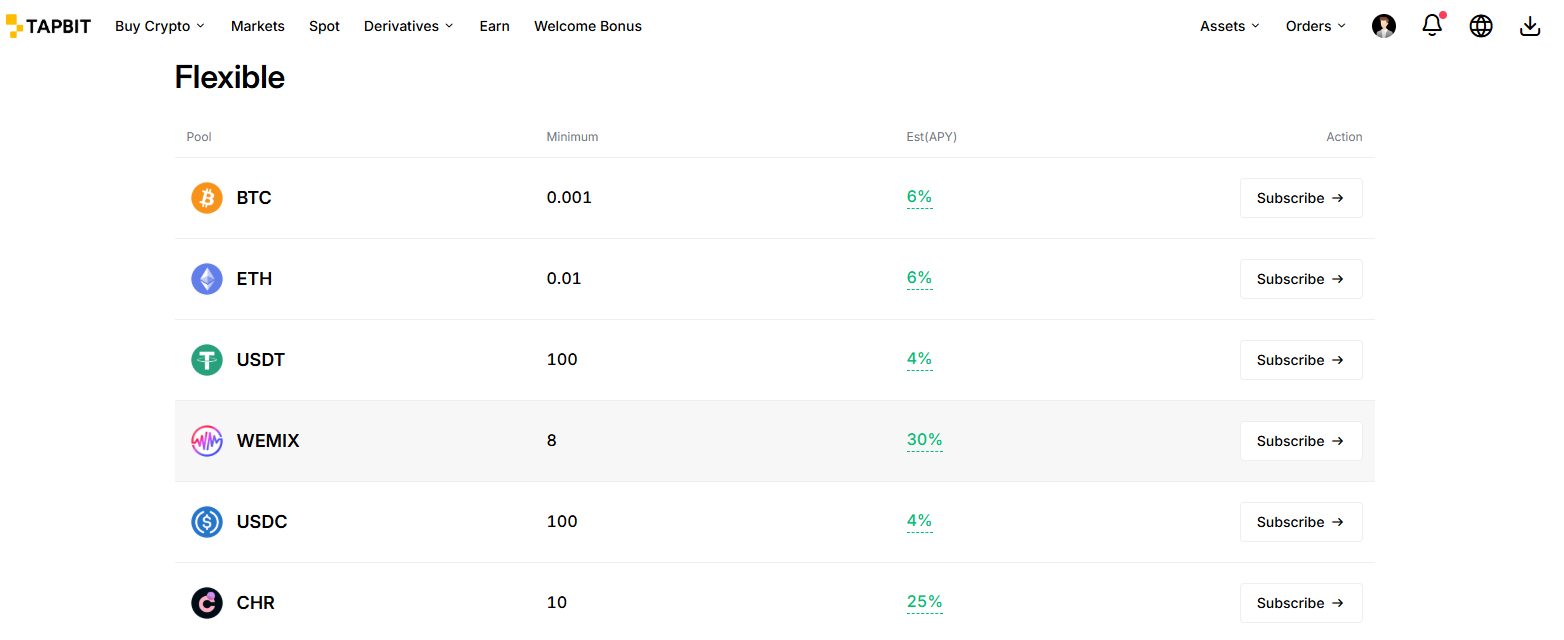

Earn

Tapbit’s Earn program allows users to generate passive income on deposits, with support for more than seven cryptocurrencies. Yields can reach up to 25% APY, though the range of supported assets is limited compared to larger exchanges. Interest products vary by token and period, offering both fixed and flexible options. To reinforce safety, Tapbit maintains a 1:1 reserve fund, ensuring user assets are backed at all times. While not the most extensive earning program in the market, it provides opportunities for users to grow idle balances with a focus on asset security.

Tapbit Security

Security is a key consideration when assessing any crypto exchange, and Tapbit outlines several measures aimed at protecting user funds. The platform enforces two-factor authentication (2FA) for sensitive actions, applies encryption standards, and stores most assets in offline, multi-signature cold wallets. These are consistent with industry practices intended to reduce the risk of compromise.

In December 2024, Tapbit reported a temporary disruption following a DDoS attack allegedly initiated by a competitor. According to the company, no customer funds were impacted and normal operations resumed shortly after. While the incident did not lead to financial losses, it highlighted the importance of infrastructure resilience in a competitive market.

Independent evaluations present a more mixed picture. A recent audit by CER.live gave Tapbit a CCC security rating with a score of 55%. The review noted missing penetration testing, incomplete certifications such as ISO 27001 and the CryptoCurrency Security Standard, and a proof-of-reserves process still listed as ongoing. On the positive side, Tapbit received better marks for user-level protections and its bug bounty initiatives.

To address transparency, Tapbit publishes its own Proof of Reserves figures. The platform claims to maintain a 1:1 reserve ratio for all assets, with current disclosures showing 2,341% coverage for BTC and 125% for USDT. These figures suggest over-collateralization, though they remain self-reported and have not yet been independently verified.

Regulatory-wise, Tapbit is registered as a Money Services Business (MSB) in the United States and holds licenses in other jurisdictions, with further state-level approvals reportedly being pursued.

Tapbit Customer Support

Tapbit offers 24/7 customer support through live chat and email, giving users access to assistance whenever issues arise. The support team is available to address inquiries ranging from technical problems to account-related concerns, ensuring that problems are handled in a timely manner.

The exchange also includes an in-app chat feature, allowing users to connect with support directly while navigating the platform. This is particularly useful for resolving questions without leaving the trading interface.

For new users, Tapbit provides a Beginner’s Guide within the app. This guide covers the basics of using the platform, including how to buy and transfer crypto, manage accounts, and understand essential trading features. The goal is to make onboarding straightforward and help users feel comfortable navigating Tapbit, even if they are new to crypto trading.

Tapbit Alternatives

Tapbit is a newer exchange with high leverage, but if you’re looking for alternatives, check these out:

- BloFin: A good option if you prefer a no-KYC exchange with a wide selection of cryptocurrencies and fiat deposit options.

- Bybit: Offers a similar range of features with deep liquidity and a large user base.

- MEXC: Known for its low fees and massive selection of altcoins.

| Feature | Tapbit | BloFin | Bybit | MEXC |

|---|---|---|---|---|

| Established | 2022 | 2019 | 2018 | 2018 |

| Spot Fees (Maker/Taker) | 0.10% / 0.10% | 0.10% / 0.10% | 0.10% / 0.10% | 0.05% / 0.05% |

| Futures Fees (Maker/Taker) | 0.020% / 0.060% | 0.020% / 0.060% | 0.020% / 0.055% | 0.000% / 0.020% |

| Max Leverage | 150x | 150x | 100x | 500x |

| KYC Required | No | No | Yes | Yes |

| Supported Cryptos (Spot) | 418+ | 564+ | 726+ | 3137+ |

| Futures Contracts | 130+ | 440+ | 578+ | 433+ |

| No KYC Withdrawal Limit | 10 BTC | $20,000 | Not Allowed | Not Allowed |

| 24h Futures Volume | $53.65B+ | $1.52B+ | $32.87B+ | $30.71B+ |

| Trading Bonus | None | $5,000 | $30,000 | $20,000 |

| Key Features | • No KYC required • High leverage (150x) • New exchange |

• No KYC required • High leverage (150x) • Good futures volume |

• Highest futures volume • Most advanced features • Best trading bonus |

• Most cryptocurrencies (3137+) • Lowest fees by far • No KYC required |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

Tapbit is still a relatively new exchange, but it has made noticeable progress in expanding its services and attracting a growing user base. With support for spot and futures trading, high leverage, copy trading, grid bots, and P2P options, it offers a diverse set of tools for both active and passive traders. Low and transparent fees, multiple funding options, and 24/7 customer support also strengthen its appeal.

That said, Tapbit is not without areas for improvement. Independent security audits have highlighted gaps in certifications and penetration testing, and liquidity on certain features such as P2P remains limited. For cautious investors, these factors should be weighed alongside Tapbit’s ongoing development.

Overall, Tapbit may be best suited for traders who want access to futures markets with high leverage, competitive fees, and flexible onboarding, while keeping in mind that the exchange is still building its reputation.

Frequently Asked Questions

1. Is Tapbit suitable for beginners?

Yes, Tapbit can be used by beginners thanks to its straightforward interface, demo trading option, and in-app guides that explain basic functions like buying, transferring, and trading crypto. However, features such as high leverage and advanced order types are more suited to experienced traders, so new users should start cautiously and make use of demo accounts before moving to live trading.

2. Does Tapbit require KYC to Trade?

No, Tapbit does not require KYC verification before users can trade. However, KYC verification is required to access all the features and remove all restrictions on deposits and withdrawals.

3. Is Tapbit Registered and Licensed?

Tapbit is registered as a Money Services Business with FinCEN. As an MSB, Tapbit complies with the Bank Secrecy Act (BSA) requirements. Also, Tapbit is currently applying to obtain money transmitter licenses from multiple States within the United States.

4. What is the Least Amount You Need to Start Trading on Tapbit?

The minimum deposit amount required to start trading on Tapbit is 1 USD. However, the amount may vary depending on the account type and funding method.

5. What is the Maximum Leverage on Tapbit?

Tapbit offers leverage of up to 150x on derivatives and perpetual contracts with access to over 150 futures contracts for trading.