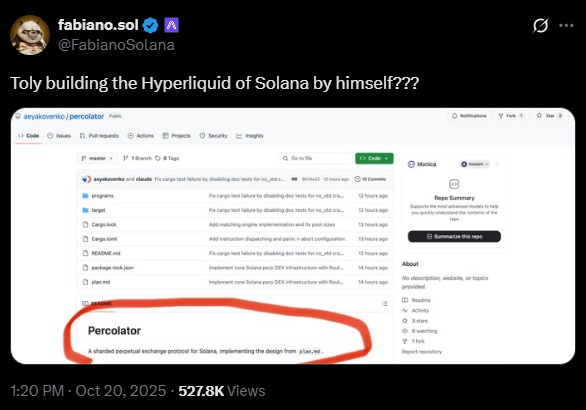

- •Fabiano’s post on X sparked speculation that Solana founder Anatoly Yakovenko might be building the “Hyperliquid of Solana”.

- •Yakovenko’s GitHub proposal, called Percolator, outlines a potential on-chain perpetual DEX concept, not an official launch.

- •The discussion follows reports of Hyperliquid attracting traders from Solana, adding context to renewed interest in Solana DeFi.

The Solana community lit up this week after a GitHub post from Anatoly Yakovenko, widely known as Toly, surfaced online. What caught everyone’s attention wasn’t an official launch or announcement, but a simple proposal outlining a new on-chain perpetual exchange concept called Percolator.

It all started when Fabiano, a well-known voice in the Solana ecosystem, shared a post on X asking, “Toly building the Hyperliquid of Solana by himself???” That one line set off a wave of discussion, with many wondering if Yakovenko is quietly working on something that could rival Hyperliquid, one of the most active decentralized derivatives exchanges in the market.

Why the Comparison to Hyperliquid?

The comparison to Hyperliquid isn’t random. In July, a VanEck report revealed that Hyperliquid captured around 35% of all blockchain revenue, partly by drawing high-value traders away from Solana and other major chains. Researchers attributed this growth to Hyperliquid’s simplicity, functional design, and steady rollout of new features, including spot trading and permissionless contract creation.

More recently, Hyperliquid introduced an upgrade (HIP-3) allowing builders to deploy their own perpetual futures with independent parameters, further decentralizing its ecosystem. This permissionless model has been viewed as a defining innovation in on-chain derivatives trading.

Given this backdrop, it’s understandable why the community would interpret Toly’s Percolator concept as an effort to reclaim Solana’s edge in decentralized trading, especially since Hyperliquid’s momentum came, at least partly, at Solana’s expense.

Also read: Hyperliquid to Early Stage Solana – Cathie Wood Sees Parallels

DEX Competition Heats Up

Perpetual DEXs have become one of the most competitive niches in DeFi. Platforms like Hyperliquid, Aster, and Drift are all racing to capture traders seeking CEX-like performance without centralized custody.

Aster, built on Binance’s BNB Chain, has recently overtaken Hyperliquid in daily trading volume with $14.5 billion, nearly tripling Hyperliquid’s 24-hour metrics. However, monthly data from DefiLlama still places Hyperliquid ahead, with $309 billion in 30-day volume compared to Aster’s $145 billion.

Amid this rivalry, Solana’s move to incubate a new perpetual DEX could signal its intention to compete directly in this growing market. Percolator’s design also aligns with Solana’s broader vision of on-chain scalability, the same vision that fueled the network’s high-speed trading narrative since 2021.

A Closer Look at Percolator

According to Cointelegraph, Yakovenko’s GitHub entry describes Percolator as a “sharded perpetual exchange protocol” meant to operate natively on Solana. It’s not a product or a confirmed roadmap item yet, just a technical concept that outlines how such a DEX might function.

The document mentions two on-chain programs: Router and Slab. The Router would handle collateral, portfolio margins, and cross-slab routing, while the Slab would serve as the core perpetuals engine for liquidity providers, managing order matching and settlement on its own.

In essence, Percolator explores how decentralized perpetual trading could be built directly on Solana’s architecture. The structure resembles the modular efficiency seen in platforms like Hyperliquid, which might explain why the community drew parallels between the two.