-

- •Founded in 2023 with focus on transparency and community

- •No KYC trading with limits and FATF restrictions

- •114+ spot pairs and 228 futures contracts up to 150x leverage

- •Competitive fees 0.1% spot and 0.02% maker 0.06% taker futures

- •Tools include Multi Trade TradingView and social features

- •Fiat on ramp available but no fiat off ramp withdrawals

- •Security with Proof of Reserves cold storage and 2FA

- •Missing bot trading advanced copy trading and stronger liquidity

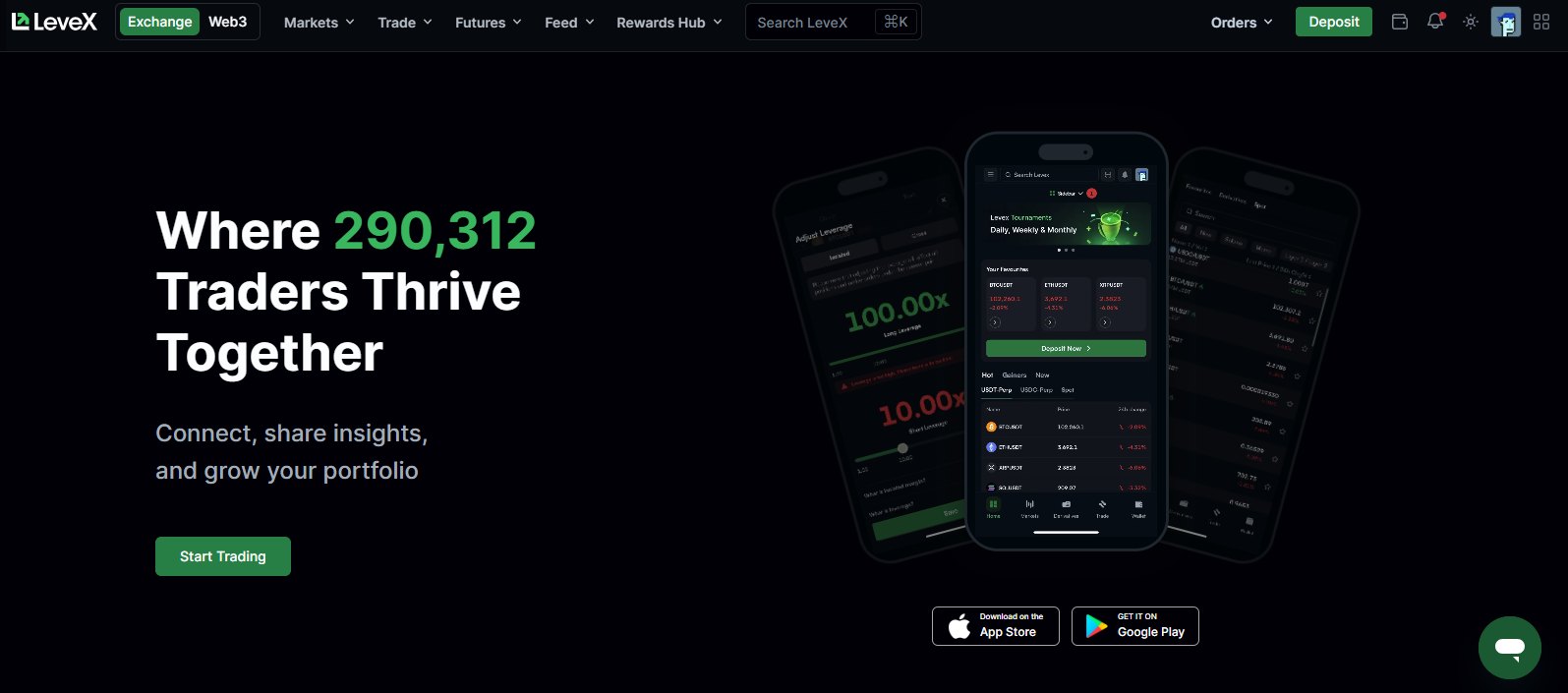

An exchange created by traders, for traders, that’s the story behind LeveX. The platform was built on the idea of giving visibility to traders and making sure their voices are not drowned out in the noise. But beyond the narrative, the real question is whether LeveX actually delivers the opposite of what its team once disliked. In this LeveX review, we’ll put the backstory aside and focus on what matters most: the services and features offered by the exchange. We’ll look at how it fits different trading styles, the competitiveness of its fees, and the accessibility of customer support to help you decide if this exchange is suitable for you.

| Stats | LeveX |

|---|---|

| 🚀 Founded | 2023 |

| 🌐 Headquarters | Panama |

| 🔎 Founder | Harvey Liu |

| 👤 Active Users | 290K+ |

| 🪙 Spot Cryptos | 114+ |

| 🪙 Futures Contracts | 228+ |

| 🔁 Spot Fees (maker/taker) | 0.1% / 0.1% |

| 🔁 Futures Fees (maker/taker) | 0.02% / 0.060% |

| 📈 Max Leverage | 150x |

| 🕵️ KYC Verification | Not Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 3.2/5 |

| 💰 Bonus | One Free Position (Claim Now) |

LeveX Overview

LeveX is a no-KYC cryptocurrency exchange founded in 2023 by Harvey Liu, together with a team of traders and industry veterans. Headquartered in Panama, the platform was created to address gaps seen in other exchanges, with a focus on giving traders a stronger voice and building a supportive trading community.

The exchange lists over 114 spot cryptocurrencies and 228 futures contracts, with leverage available up to 150x. Fees are kept competitive at 0.1% for spot trading and 0.02% maker / 0.06% taker for futures. With more than 290,000 active users, LeveX is steadily expanding its presence in the global market.

Security is another priority. The platform provides Proof of Reserves, reassuring users that funds are transparently backed, and it ranks well on CER.live, which tracks the safety of exchanges.

Beyond numbers, LeveX is often noted for its clean interface and community-driven approach. Traders highlight features that encourage sharing strategies and insights, helping newer participants learn while giving experienced traders a space to engage with peers. Some users also mention pairing it with tools like ApeScreener for on-chain analysis, pointing out that the exchange remains underrated yet effective for both spot and futures trading.

By combining low fees, accessible services, and a community focus, LeveX positions itself as a practical choice for traders who value transparency and collaboration. While still a young platform, its mix of straightforward execution, social features, and security practices makes it appealing to both beginners and seasoned market participants.

LeveX Pros and Cons

| 👍 LeveX Pros | 👎 LeveX Cons |

|---|---|

| ✅ Fast and efficient trading system | ❌ Does not support FIAT withdrawals |

| ✅ Great user rewards system | ❌ Lower liquidity compared to larger exchanges |

| ✅ Competitive fees for spot and futures trading | ❌ Limited order types for advanced traders |

| ✅ Proof of Reserves and cold storage for security | ❌ No bot trading, staking or copy trading available |

| ✅ Social trading tools with community features |

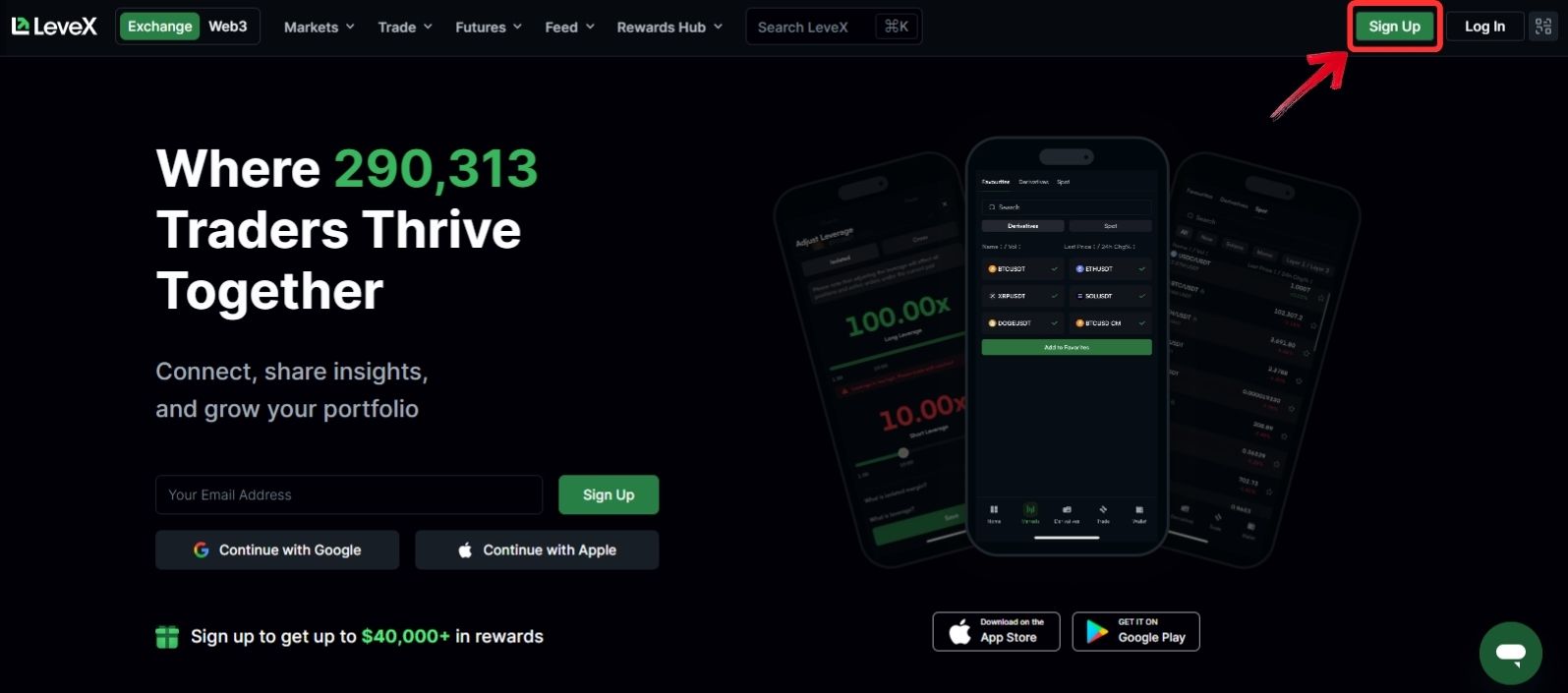

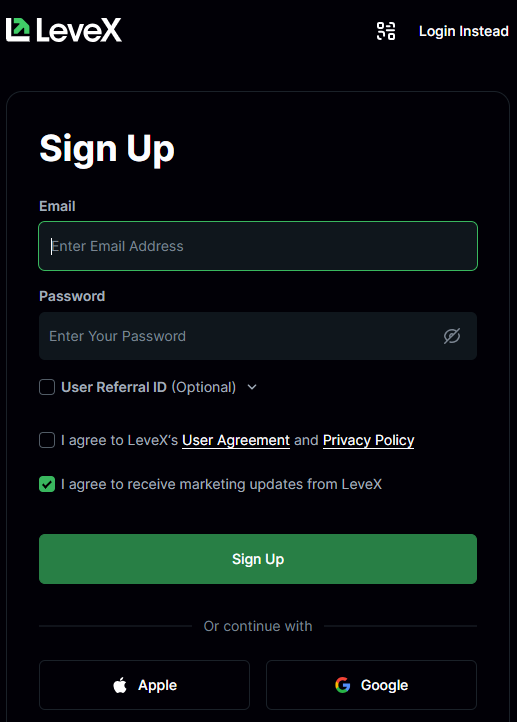

LeveX Sign-up & KYC

LeveX is a no-KYC crypto exchange, making it super simple for users to sign up to their platform. All you need to get started with trading on LeveX is an email address and a strong password. You can also use your Apple or Google account to create a LeveX account. Let’s take a look at the steps that you will need to follow in order to create your LeveX account.

Step 1: Visit the official LeveX website and click on the “Sign Up” button in the top-right corner.

Step 2: Enter your email address and create a strong, unique password.

Step 3: Confirm your account using the 6-digit code sent to your email inbox (check your spam folder if you don’t see it).

Step 4: Deposit funds into your account and start trading on LeveX.

Step 5: Protect your account by enabling Google Authenticator for two-factor security.

Once you’ve completed your account registration, you can immediately start using LeveX trading features. At the basic level (Lv.1), users can withdraw up to $20,000 per day. This limit increases to $500,000 per day at Lv.2 and up to $1,000,000 per day at Lv.3. The KYC process itself is quick, usually taking just one to two minutes.

For Lv.1, you’ll need to provide Proof of Identity such as a national ID card or driving licence. To move up to Lv.2, you’ll be asked for Proof of Address, which can be a bank maintenance certificate, utility bill, or similar document.

| Level | Daily Limit | Monthly Limit | Requirements |

|---|---|---|---|

| Lv.0 | $20,000 | $100,000 | No KYC |

| Lv.1 | $500,000 | Unrestricted | Proof of ID (National ID / Driving Licence) |

| Lv.2 | $1,000,000 | Unrestricted | Proof of Address (Utility Bill / Bank Certificate) |

One important thing to keep in mind is that no-KYC does not mean unrestricted access everywhere. LeveX follows FATF guidelines and, as a result, does not provide services in certain regions. Before you begin the registration or verification process, it’s best to use our LeveX Country Checker to confirm that the exchange is available in your region.

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform. Due to regulations, Levex does not support every country. To ensure that you are eligible to register on the exchange, you can use our free LeveX country checker.🌍 Free LeveX Country Checker

Simply type in your country and see if you can use the platform or if your country is restricted.

LeveX Trading

LeveX was built by a group of traders, so it’s safe to say they understand what fellow traders look for in a platform. From a clean interface to reliable liquidity, the exchange offers a range of features designed to support different trading styles. With useful tools and advanced order types available, LeveX aims to make the trading experience smoother and more efficient. Let’s take a closer look at what it provides.

Spot Trading

LeveX’s spot market offers access to over 114 trading pairs across two base currencies, USDT and USDC. Traders can buy and sell leading coins like BTC and ETH, along with a variety of altcoins. Fees are set at 0.1% maker / 0.1% taker, which are competitive compared to many established exchanges.

The spot trading interface is designed to be clear and user-friendly. Each pair includes live price charts, an order book, and trading history, giving traders the essential information needed to place trades. On top of this, LeveX is integrated with TradingView, allowing users to apply charting tools and indicators for deeper market analysis within the platform itself.

Liquidity remains one of the weaker points. With an average daily spot volume of around $35.38M+, the order book is not as deep as those on larger exchanges. This can result in less efficient execution for bigger trades, as prices may not always be as tight compared to higher-volume platforms.

When it comes to order types, LeveX keeps things simple. Available options include market, limit, and conditional orders, which cover the basics but may feel limited for advanced traders.

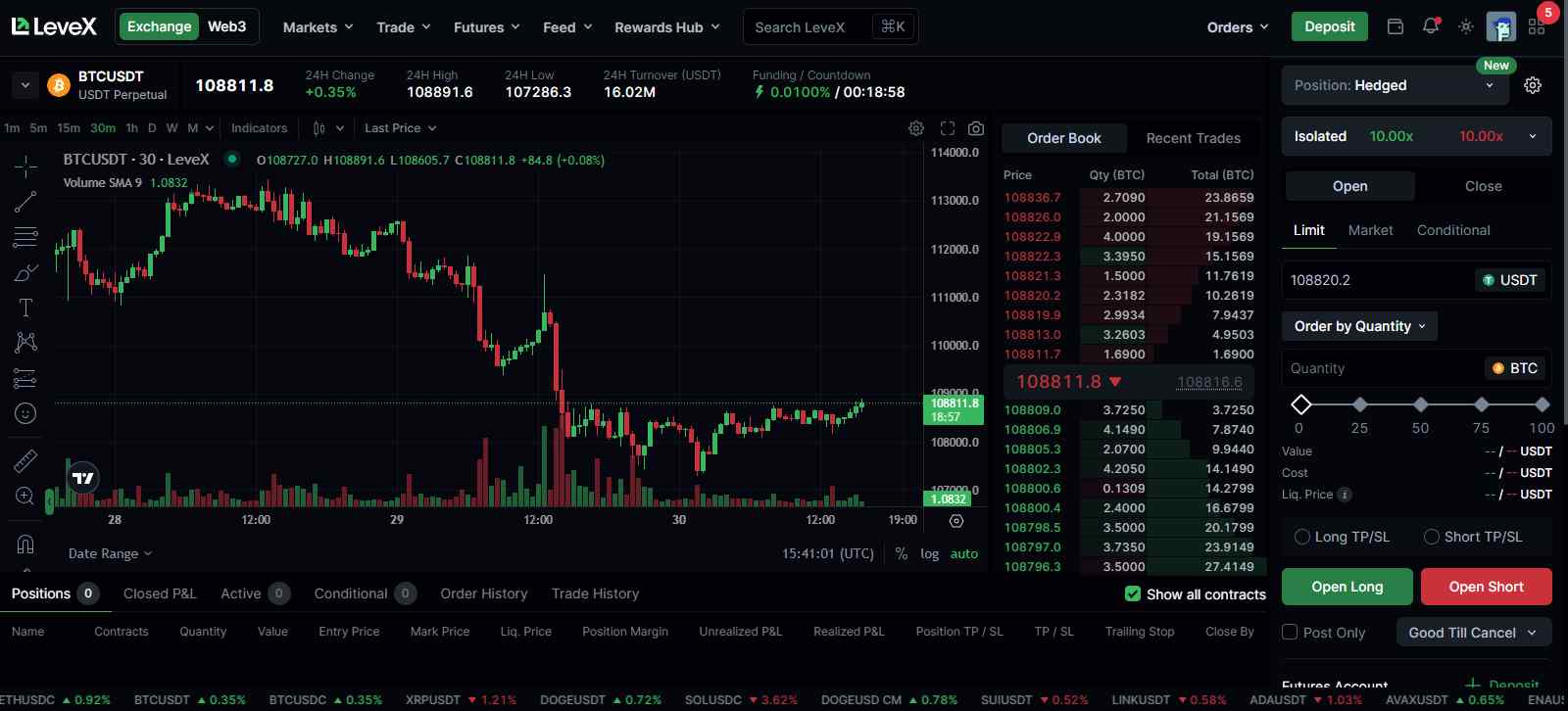

Futures Trading

LeveX offers a clear and easy-to-use futures trading platform with more than 228 contracts available across USDT and USDC pairs. Traders can access leverage of up to 150x, which is suitable for most retail users. However, if you are specifically looking for platforms that go beyond this and offer even higher leverage, you can check our guide on the Highest Leverage Crypto Exchanges. Fees are competitive, set at 0.02% maker / 0.06% taker, which matches standard industry levels.

The interface follows the same design as spot trading, with TradingView integration that provides basic charting tools and indicators. This makes it simple for traders to analyze markets and execute trades without leaving the platform.

Order types include the basics; market, limit, and conditional orders, along with execution instructions such as GTC (Good Till Cancelled), IOC (Immediate or Cancel), and FOK (Fill or Kill). These options allow traders to manage how long their orders remain active and how they should be executed, offering more control even though the range is not as broad as on some advanced platforms.

Liquidity, however, is still on the weaker side. With a less active order book compared to top-tier derivatives exchanges, spreads can appear wide at times, which may affect the precision of entry and exit prices.

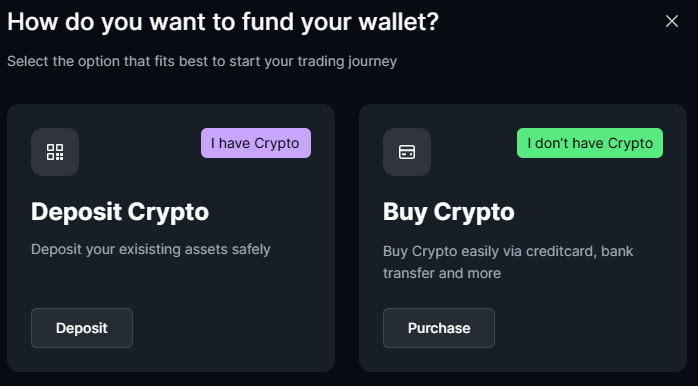

LeveX Deposits and Withdrawals

LeveX makes it simple to fund your account with multiple options. The platform has a built-in fiat on-ramp that supports more than 15 currencies, allowing deposits through credit or debit cards, Google Pay, and SEPA transfers. However, an off-ramp is not available, which means you cannot withdraw funds directly to a bank account.

In addition to fiat, traders can use crypto deposits and withdrawals to move funds in and out of LeveX. The exchange supports all major networks, making transfers straightforward and flexible for users who prefer handling crypto directly.

LeveX Fees

Fees play a major role when choosing a trading platform. For many traders, especially day traders and scalpers, even small differences in fees can have a big impact on overall profitability. That’s why understanding LeveX’s fee structure is essential before getting started.

Trading Fees

LeveX keeps its trading fees competitive and easy to understand. On the spot market, both maker and taker fees are set at 0.1%, which puts them at the lower end compared to many established exchanges. For futures contracts, the fee structure is also reasonable, with 0.02% for makers and 0.06% for takers, keeping it aligned with industry standards.

Spot Fees

0.10% Maker

0.10% Taker

Future Fees

0.02% Maker

0.06% Taker

The platform also follows a tiered 30-day volume model, where active traders can unlock lower fees based on trading activity and account balance. At the highest level, known as the Ultimate tier, users who achieve $200M in trading volume and maintain an account balance of $3,000,000 can see fees reduced significantly. At this level, futures fees can drop to 0.0060% maker and 0.0300% taker, while spot trading fees go as low as 0.0100% maker and 0.0325% taker. This structure rewards high-volume traders by giving them meaningful savings on every order.

Deposits and Withdrawals Fees

When it comes to moving funds, LeveX keeps the process straightforward by not charging its own deposit or withdrawal fees. If you buy crypto through the fiat on-ramp using cards, SEPA transfers, or Google Pay, the platform does not add extra charges. However, users should be aware that third-party payment providers may apply their own service fees.

Crypto deposits are completely free, making it convenient to bring assets onto the platform. Withdrawals are also free from the exchange’s side, with traders only needing to cover the standard blockchain network gas fees. This approach ensures that costs remain transparent and predictable, with no hidden charges applied by the exchange itself.

LeveX Products and Services

Beyond standard trading, LeveX offers a range of features designed to give traders more tools and flexibility. These services are built to complement spot and futures markets, while also adding value through education and community-driven resources. Let’s take a closer look at what’s available.

Trading Tools

LeveX provides a set of trading tools that go beyond what’s found on a basic exchange. A standout feature is Multi-Trade position management, which allows traders to open up to 99 independent positions on the same trading pair. This makes it possible to place layered buy orders at different price levels or even hold long and short positions on the same coin at once. Such flexibility supports strategies like hedging and scaling in or out of trades, all from a single account.

The platform also integrates TradingView charts, giving users access to indicators and drawing tools without leaving the interface. An order book, trade history, and live charts are displayed alongside, helping traders monitor markets in real time. In addition, LeveX brings in creator tools, allowing users to follow traders and analysts directly for strategy insights and exclusive market updates.

Mobile App

For traders who prefer staying active on the move, LeveX offers a mobile app for both iOS and Android. The app mirrors the core functions of the web platform, letting users trade spot and futures markets, track live prices, and manage balances with ease. The interface is designed for smaller screens, with clear tabs for markets, portfolio, and social features. Advanced charting and order options are also included, so technical analysis and limit orders can be handled directly from your phone. Security is supported through 2FA, plus fingerprint or face ID for quick access.

Social Trading

LeveX sets itself apart with an integrated social trading environment. Instead of trading in isolation, users can connect through a built-in feed, follow experienced traders, and view real-time market insights. Many share analysis, trade ideas, or updates, creating a collaborative space within the platform. Copy trading is also supported, allowing followers to mirror trades from top performers transparently and at their own discretion. Leaderboards and competitions add a community feel, where users discuss strategies and learn from results. For traders who value interaction and shared knowledge, LeveX provides a space that blends trading with community learning.

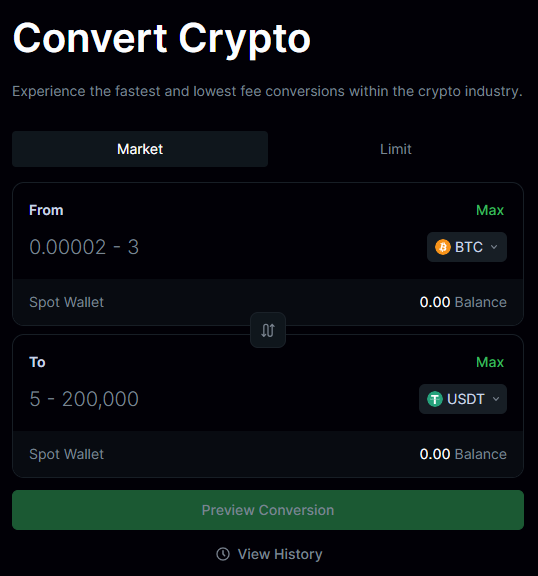

Convert

LeveX features a Convert tool that allows users to swap cryptocurrencies quickly without using the order book. With just a few clicks, you choose the asset you hold and the one you want, and the platform provides an instant quote. The service supports both market conversions for immediate trades and limit convert orders, where you can set a preferred rate and even decide how long the order stays active. This makes the tool useful for anyone who wants fast, simple, and flexible crypto swaps without managing detailed trading screens.

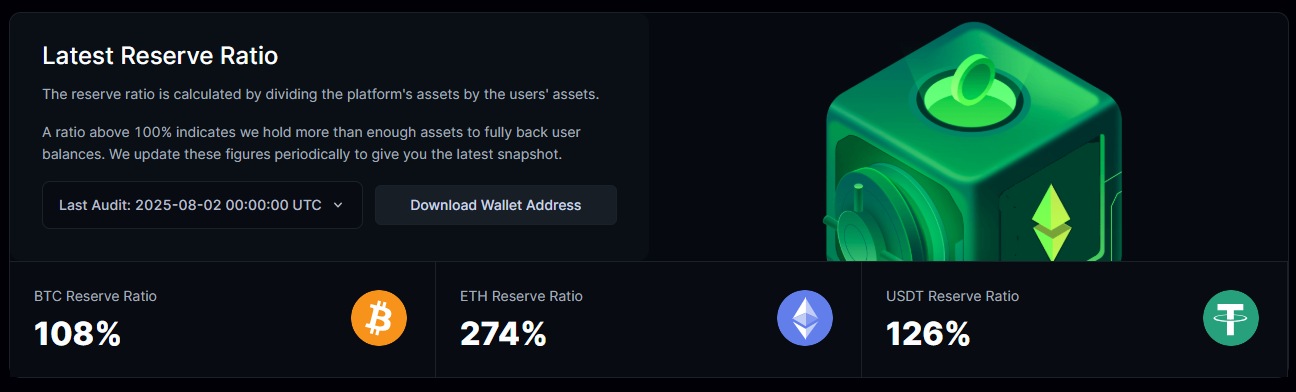

LeveX Security

Security is central to LeveX, and the exchange uses several measures to protect user funds. A key feature is its Proof of Reserves system, backed by Merkle Tree audits, which allows traders to verify that assets are held one-to-one and not misused. Most funds are stored in cold wallets, with only a small portion kept in hot wallets for withdrawals, reducing exposure to hacks.

On the account side, users can enable two-factor authentication (2FA) for logins and withdrawals, along with address whitelisting to restrict transfers only to approved wallets. LeveX also conducts penetration tests and monitors activity in real time. Independent platforms like CER.live track its security and rank it among safer exchanges, with no major incidents reported so far.

While LeveX is not licensed in major jurisdictions, it follows global standards such as AML compliance. Users benefit from privacy, but personal precautions remain important.

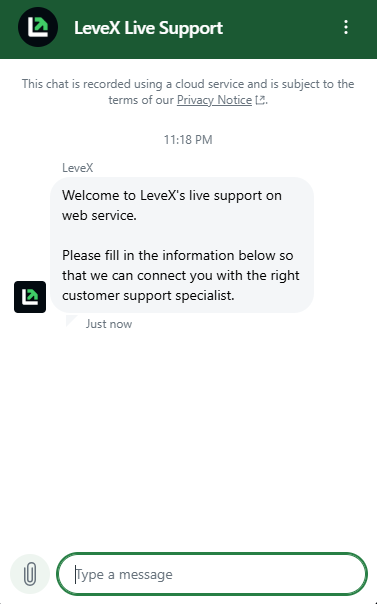

LeveX Customer Service

LeveX provides several ways for users to get help when needed. The exchange offers 24/7 live chat support directly through its website, giving traders quick access to assistance. Many users highlight the support team’s responsiveness, which is also reflected in positive Trustpilot reviews.

For those who prefer self-service, LeveX hosts a Help Center with FAQs, guides, and tutorials that cover most common questions. The content is organized and easy to navigate, making it useful for both beginners and experienced traders.

If an issue requires more attention, users can submit a support ticket or send an email, with responses typically arriving within a day. Beyond official channels, LeveX’s social features also allow experienced community members or moderators to answer questions informally in discussion areas, adding another layer of support.

LeveX Alternatives

LeveX is a community-first exchange built by traders, it offers both spot and futures markets with competitive fees, social trading features, and a no-KYC model. But if this is not what you were looking for, there a few alternatives you can consider:

- Phemex: Offers a strong social trading platform where users can follow and learn from others. It combines competitive fees with a wide range of markets.

- Binance: The largest exchange by volume, known for deep liquidity and diverse trading pairs. It also incentivizes users through leaderboards, copy trading, and rewards.

- BloFin: A newer no-KYC exchange that appeals to privacy-focused traders. It provides competitive fees, supports many assets, and is quickly gaining recognition.

| Feature | LeveX | Phemex | Binance | BloFin |

|---|---|---|---|---|

| Established | 2023 | 2019 | 2017 | 2019 |

| Spot Fees (Maker/Taker) | 0.10% / 0.10% | 0.10% / 0.10% | 0.10% / 0.10% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.02% / 0.060% | 0.01% / 0.06% | 0.02% / 0.05% | 0.02% / 0.06% |

| Max Leverage | 150x | 100x | 125x | 150x |

| KYC Required | No | No | Yes | No |

| Supported Cryptos (Spot) | 114+ | 536+ | 508+ | 564+ |

| Futures Contracts | 228+ | 440+ | 520+ | 440+ |

| No KYC Withdrawal Limit | $20,000 | $50,000 | None | $20,000 |

| 24h Futures Volume | $183.56M+ | $1.28B+ | $58.97B+ | $1.03B+ |

| Key Features | • No KYC required • Social trading features • Proof of Reserves |

• Social trading tools • Competitive fees • Copy trading |

• Deep liquidity • Large asset variety • Advanced tools |

• No KYC required • Competitive fees • Growing asset list |

| Sign Up | Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

LeveX was created with the vision of giving traders a platform where their voices matter, and in many ways, it delivers on that idea. The exchange combines a clean interface, competitive fees, Proof of Reserves, and community-driven features that bring a fresh approach compared to many traditional platforms. Its social trading environment and multi-trade tools make it stand out for users who value interaction and control.

At the same time, some areas remain underdeveloped. Features like bot trading, advanced copy trading, and fiat withdrawals are missing, which limits flexibility for traders who rely on those tools. Liquidity is still catching up to larger exchanges, and order type options are more basic than what professionals may expect.

Overall, LeveX reflects the ambition of being a trader-first exchange. It’s growing in the right direction, but there’s still work to do before it matches the completeness of more established platforms.

FAQS

1. Is LeveX legit?

LeveX is a crypto exchange platform that is leading in the area of transparency and fairness. It is a legitimate platform for users worldwide to buy and sell crypto assets.

2. What are LeveX fees?

LeveX exchange fees are standard crypto fees for makers and takers in its spot and futures markets. LeveX spot trade attracts a 0.1% taker/maker fee, while its futures trade requires a 0.02% maker and a 0.06% taker fee. Crypto withdrawal fees differ among the assets.

3. Is LeveX available in the US?

No, LeveX exchange is available to users in the United States.

4. Does LeveX have a Native token?

LeveX exchange currently does not have a native token on its platform. All trades are done using more popular crypto assets.

5. Does LeveX require KYC?

LeveX is a no-KYC exchange, meaning users can trade without completing identity verification.