-

-

- •CEXs have lower, fixed fees and offer native XRP, ideal for direct purchases.

- •DEXs involve gas fees and deliver wrapped XRP, not suitable for all wallets.

- •Total cost depends on more than just trading fees; check token type and transaction flow.

-

For anyone planning to buy XRP, the most common question that comes up is where to do it, on a centralized exchange (CEX) or a decentralized exchange (DEX)? At first glance, it seems like a basic cost issue, but when you look closer, the answer isn’t so simple. There are differences in fee structures, token formats, and even how the assets reach your wallet. And yes, if you’re not careful, one option might eat away more of your money than the other.

In this article, we’ll go over how XRP purchase fees differ between CEXs and DEXs. But the numbers are only part of the picture, understanding what you’re actually getting matters just as much.

Buying XRP on Centralized Exchanges

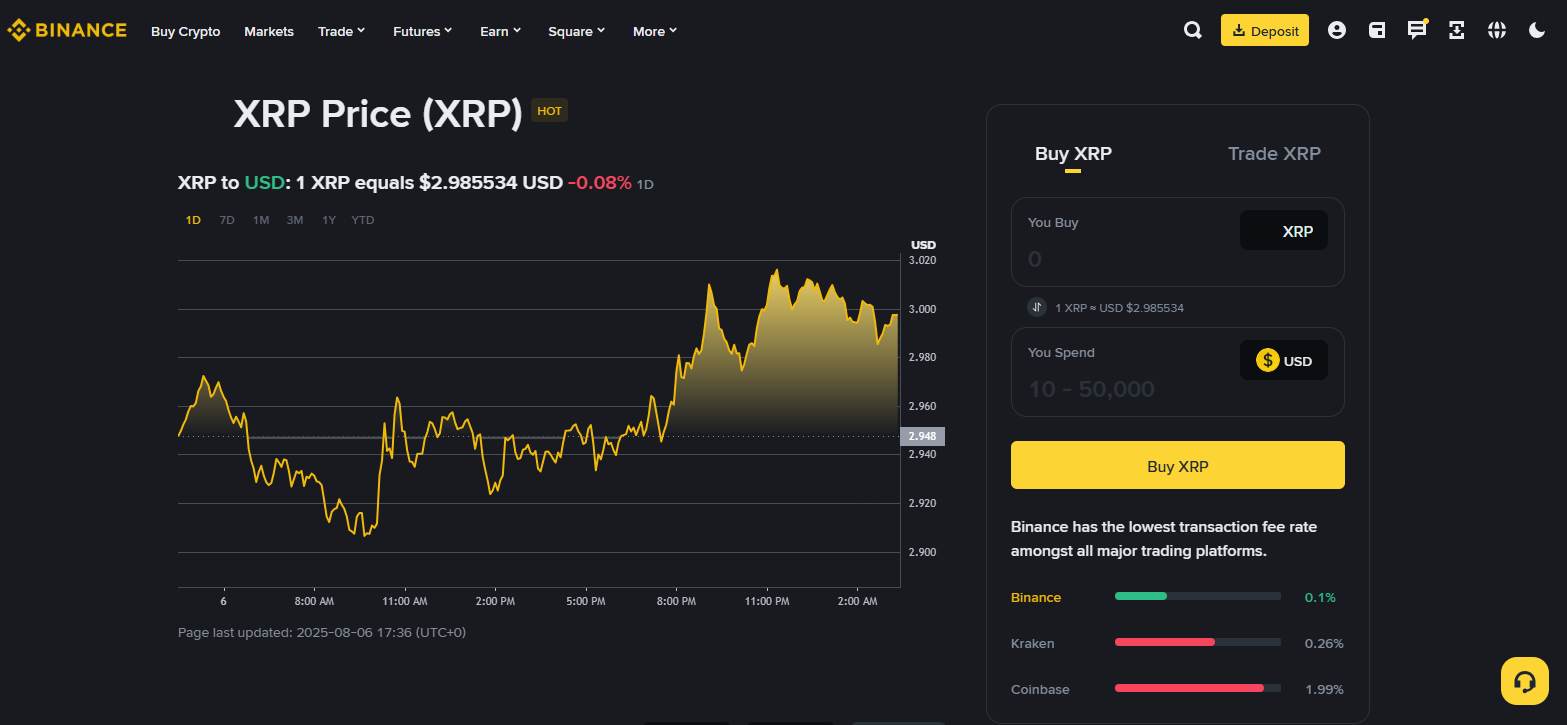

Centralized exchanges are often the go-to for first-time users. They operate on a simple trading model. You create an account, fund it through bank transfers or card payments, and then use that balance to buy XRP directly. Most platforms charge trading fees between 0.1% to 0.25% per transaction. That part’s easy to calculate.

But what often slips past unnoticed is the withdrawal fee. This is not a percentage, it’s fixed, usually somewhere between 1 to 10 XRP per transaction, depending on the exchange. So, if you’re buying a small amount and planning to move it to self-custody, this fixed fee suddenly becomes a large percentage of your total.

Another cost that comes in is fiat deposit or conversion fees. For instance, using a credit card can bring an extra 1% to 3% in hidden charges. For large transactions, that adds up. But the advantage here is that you’re getting native XRP, which means the coin you receive can go directly to supported XRP wallets without any conversions or bridging involved.

Centralized exchanges also benefit from deep liquidity pools. That means less slippage, so the price you see is more or less the price you get. But keep in mind, most CEXs require KYC, which could be a dealbreaker for those who want to maintain privacy.

Ripple (XRP)

New TokenToken Symbol

XRP

Current Price

Loading...

Daily Change

Loading...

All-Time High

Loading...

Daily Low

Loading...

Daily High

Loading...

24h Volume

Loading...

Market Cap

Loading...

FDV

Loading...

Total Supply

Loading...

Max Supply

Loading...

Buying XRP on Decentralized Exchanges

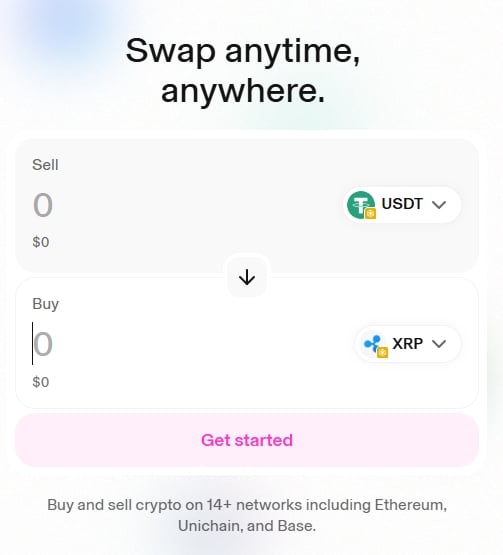

Now let’s talk about DEXs. When someone uses Uniswap, PancakeSwap, or any other decentralized exchange, they’re not actually buying native XRP. What they’re getting is a wrapped version, usually wXRP or XRPB, issued on a different chain like Ethereum or BNB Chain.

Trading fees on DEXs are usually fixed around 0.3%. But that’s just the start. You also need to pay gas fees. On Ethereum, these gas fees can go as high as $30, especially if the network is busy. BSC or Polygon networks are cheaper, but still require a gas token to be present in your wallet. This means that before you even hit swap, you might need to buy ETH or BNB just to complete the trade.

There’s no withdrawal fee here because you’re swapping directly from your own wallet. Once the swap goes through, the wrapped XRP lands back into the same wallet. It’s convenient for those who already use DeFi protocols or are interested in things like farming or staking. But remember, it’s not native XRP. If you want to move this wrapped version back to the XRP Ledger, you’ll need to bridge to XRPL, which brings its own gas fees and potential delays.

Slippage is another issue. On low-liquidity pools, prices can shift quickly, which means users often receive less XRP than expected. That’s why people using DEXs need to double-check the “minimum received” warning before confirming a trade.

Fee Comparison: Centralized vs DEX

The difference in how fees are applied between these two systems is worth noting. Let’s look at a side-by-side overview of how XRP purchase costs differ between centralized and decentralized platforms.

| Category | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

|---|---|---|

| Trading Fee | 0.1% to 0.25% | ~0.3% swap fee |

| Withdrawal / Gas | Fixed (e.g., 1–10 XRP) | Variable gas fees (ETH/BSC) |

| Token Format | Native XRP | Wrapped XRP (wXRP, XRPB) |

| Slippage Risk | Low | Moderate to High |

| Custody | Held on exchange | Goes to user wallet |

| KYC Required | Yes | No |

| Ease of Use | Simple for beginners | Requires wallet setup |

Bottom Line

XRP purchase fees can look small on the surface, but the real cost depends on how you’re buying it and where it’s going. Before jumping in, it’s smart to check not just trading fees but also what kind of token you’re receiving and what your next steps are. For those who start with wrapped XRP and later need to move to real XRP, bridging might add another layer of expense, so knowing how to bridge to XRPL becomes essential too. Either way, XRP purchase fees are not always what they seem. Knowing the full picture can help avoid paying more than needed.