- •CoinW was founded in 2017 and is headquartered in Dubai, UAE.

- •The exchange supports 389+ spot cryptocurrencies and 140+ futures contracts with leverage up to 200x.

- •Spot fees start at 0.20% maker/taker, while futures fees are 0.010% maker and 0.060% taker.

- •ETF trading is available with leverage options of ×3, ×4, and ×6.

- •Copy trading and automated bots are supported on both spot and futures.

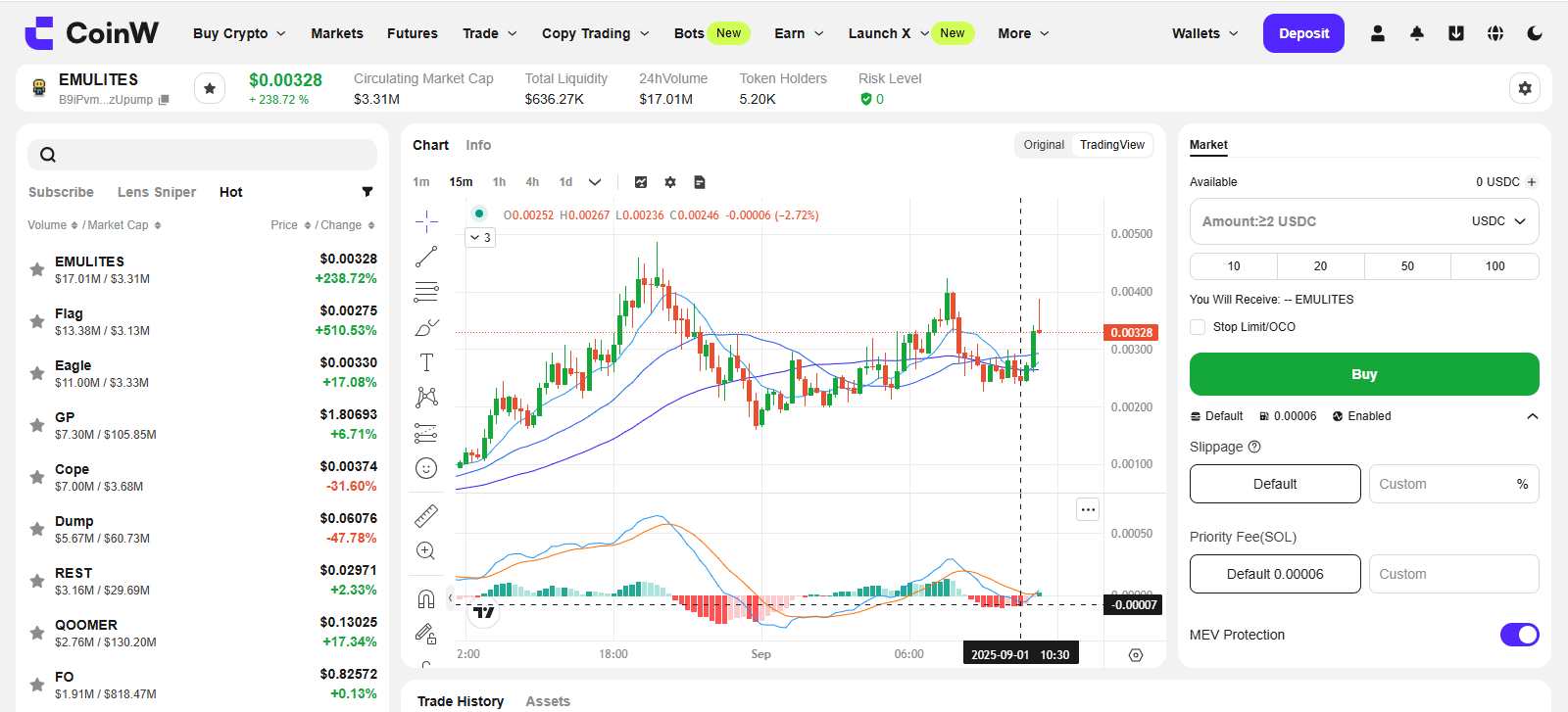

- •GemW provides access to early Solana-based on-chain opportunities.

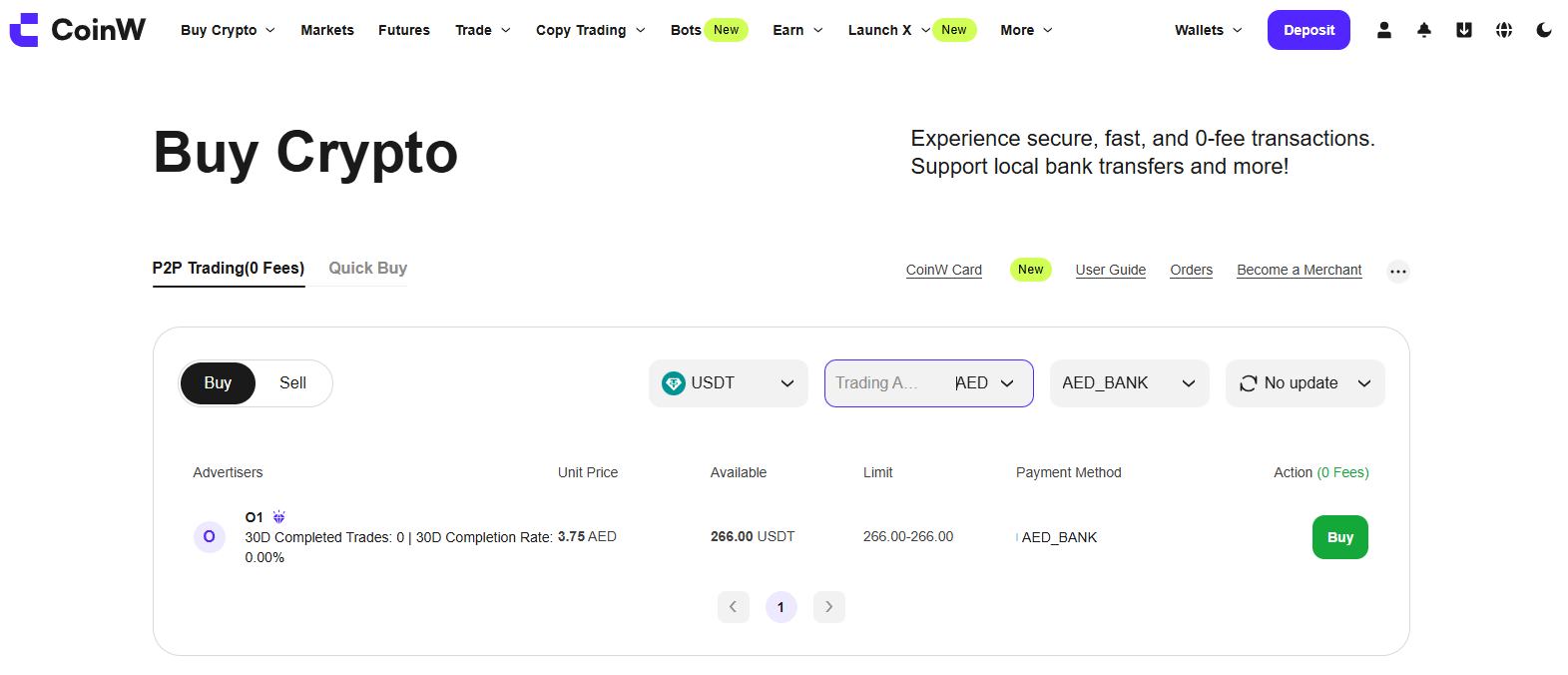

- •P2P trading is available with zero fees but limited liquidity.

- •The CoinW Token (CWT) no longer provides fee discounts.

Crypto is once again capturing global attention, with markets pushing new highs and institutions driving the on-chain narrative forward. For anyone stepping in, the first question is always where to trade, and countless exchanges claim to be the right choice. CoinW, with its focus on collaborative growth and a mix of innovation and practicality, is one of the names you’ll come across. This CoinW review walks you through its trading fees, services, security, and customer support, giving you the clarity needed to decide if it’s the right fit for your crypto-related needs.

| Stats | CoinW |

|---|---|

| 🚀 Founded | 2017 |

| 🌐 Headquarters | Dubai, UAE |

| 🔎 Founder | David Bai |

| 👤 Active Users | 5M+ |

| 🪙 Supported Cryptos | 389+ |

| 🪙 Futures Contracts | 140+ |

| 🔁 Spot Fees (maker/taker) | 0.2% / 0.2% |

| 🔁 Futures Fees (maker/taker) | 0.01% / 0.06% |

| 📈 Max Leverage | 200x |

| 🕵️ KYC Verification | Required |

| 📱 Mobile App | Yes |

| ⭐ Rating | 3.4/5 |

| 💰 Bonus | $1,000 (Claim Now) |

CoinW Overview

Founded in 2017 by David Bai, CoinW is a cryptocurrency exchange headquartered in Dubai, UAE. With more than 5 million users spread across 100+ supported countries, the platform positions itself around the mission of fostering “global financial freedom and inclusiveness” by focusing on collaborative growth between the exchange and its users. This philosophy is built into CoinW’s operations, from its product ecosystem to its approach to community engagement.

CoinW offers a wide range of services for traders. On the spot side, it supports 389 cryptocurrencies and advanced order types such as Smart Market, conditional, trailing stop, OCO, and iceberg. For futures, the exchange lists over 140 contracts with leverage up to 200x and maker/taker fees set at 0.010% and 0.060% respectively. The platform also features copy trading and automated strategies such as grid, auto-invest, CTA, and martingale bots.

Accessibility is another key aspect of CoinW’s model. The exchange allows trading without mandatory KYC, with withdrawal limits up to 2 BTC daily for non-verified users and higher limits for those completing KYC levels. Deposits can be made via cryptocurrencies, credit cards, and debit cards, while withdrawals are limited to crypto. Customer support is available through 24/7 live chat and email, though user ratings place it at a modest level of satisfaction. Overall, CoinW presents itself as a functional and globally accessible platform, balancing inclusivity with a broad range of trading options.

CoinW Pros and Cons

| 👍 CoinW Pros | 👎 CoinW Cons |

|---|---|

| ✅ Supports 389+ spot cryptocurrencies and 140+ futures contracts | ❌ Poor customer support |

| ✅ Futures trading with leverage up to 200x | ❌ Limited fiat support; no bank transfers available |

| ✅ Advanced order types available for spot trading | ❌ P2P liquidity remains relatively low |

| ✅ Offers copy trading and automated trading bots | ❌ Recent updates removed CWT trading fee discounts |

CoinW KYC and Sign-up

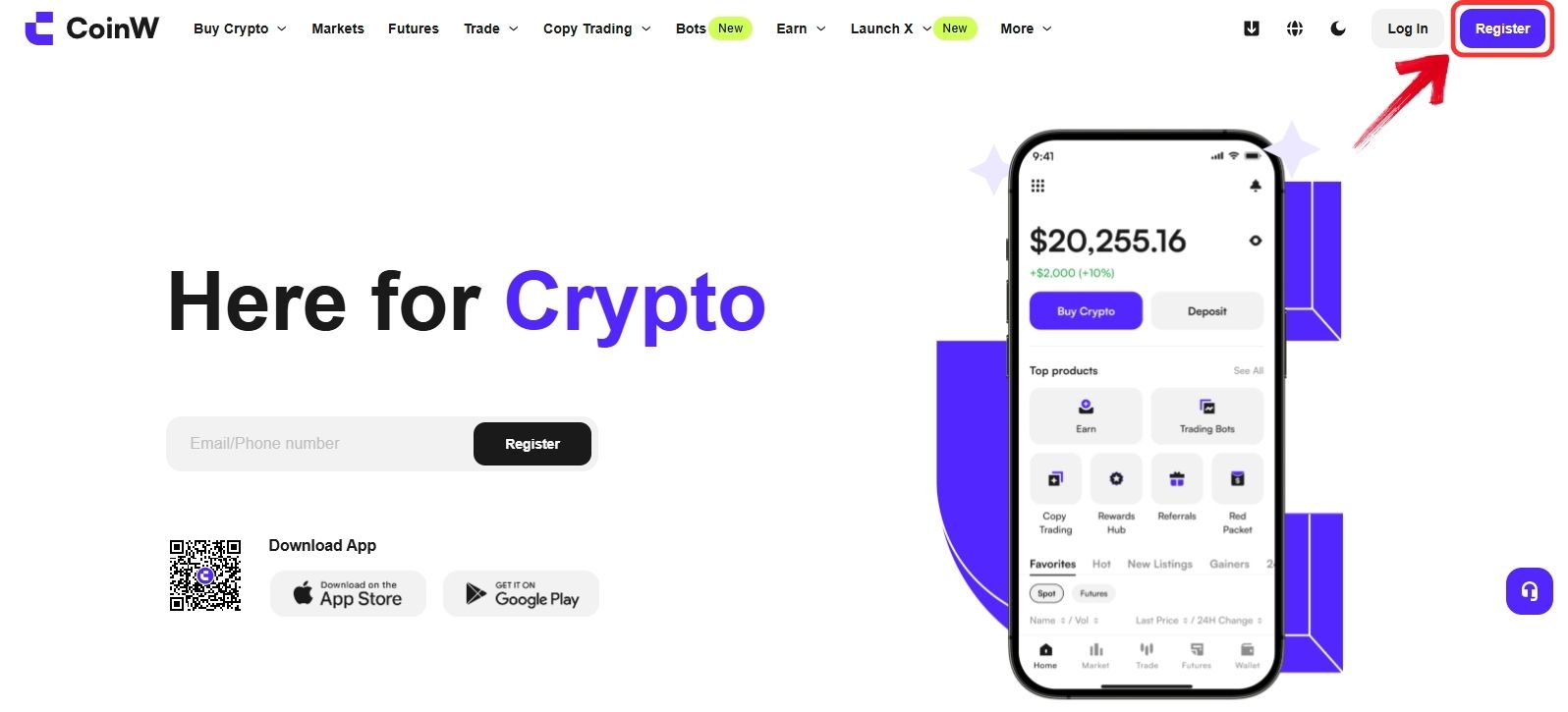

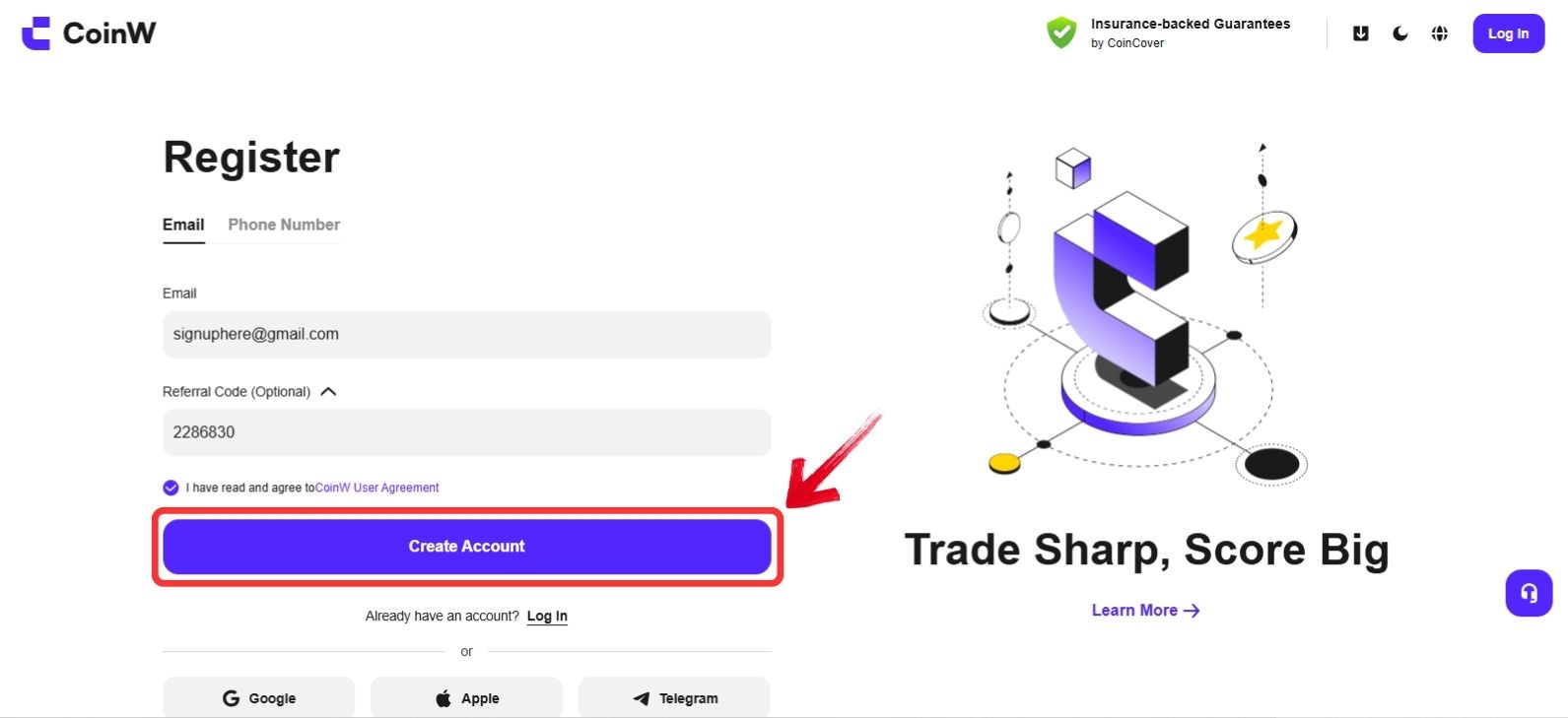

When accessing CoinW, users are presented with a modern web interface and a simple registration process. An account can be created using either an email address or a phone number. Basic KYC is required to activate the account, and once this step is completed, users can begin trading. With basic verification in place, the daily withdrawal limit is set at 2 BTC. Higher limits are available for those who complete additional KYC levels. Here is how you can get started with CoinW:

Step 1: Visit the official CoinW website through your preferred browser and click on the “Register” button.

Step 2: On the registration page, enter your email address and create a strong password. You also have the option to sign up using your phone number.

Step 3: Click “Create Account” and then complete email verification by entering the 6-digit code sent to you.

While withdrawal limits are capped at 2 BTC under Basic Verification (C1), users can unlock higher thresholds by completing additional verification levels.

| Level | Verification Type | 24H Withdrawal Limit |

|---|---|---|

| C0 | Unverified | – |

| C1 | Basic Verification | 2 BTC |

| C2 | Primary Verification | 10 BTC |

| C3 | Advanced Verification | 100 BTC |

Before registering, it is important to confirm whether CoinW is accessible in your region. Due to FATF regulations, services are restricted in certain countries. To avoid issues, you can use our CoinW Country Checker tool to ensure your sign-up process goes smoothly.

🌍 Free CoinW Country Checker

We strive to keep this information up-to-date, but regulations may change. While we regularly update this data, we make no guarantees, and it is your responsibility to verify whether your country is supported before using the platform.

Due to regulations, CoinW does not support every country. To ensure that you are eligible to register on the exchange, use our free CoinW country checker.

Type your country and see if you can use the platform or if your country is restricted.

CoinW Trading

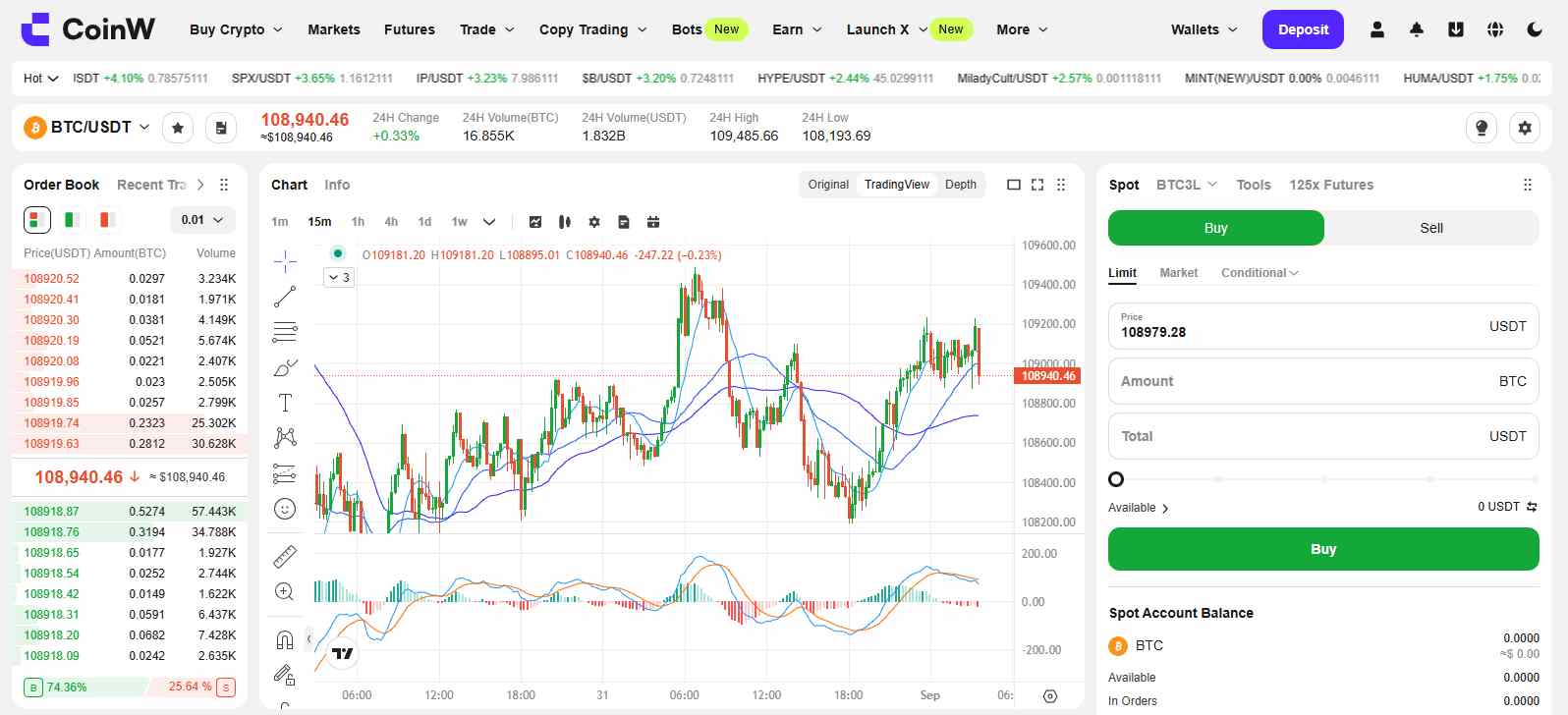

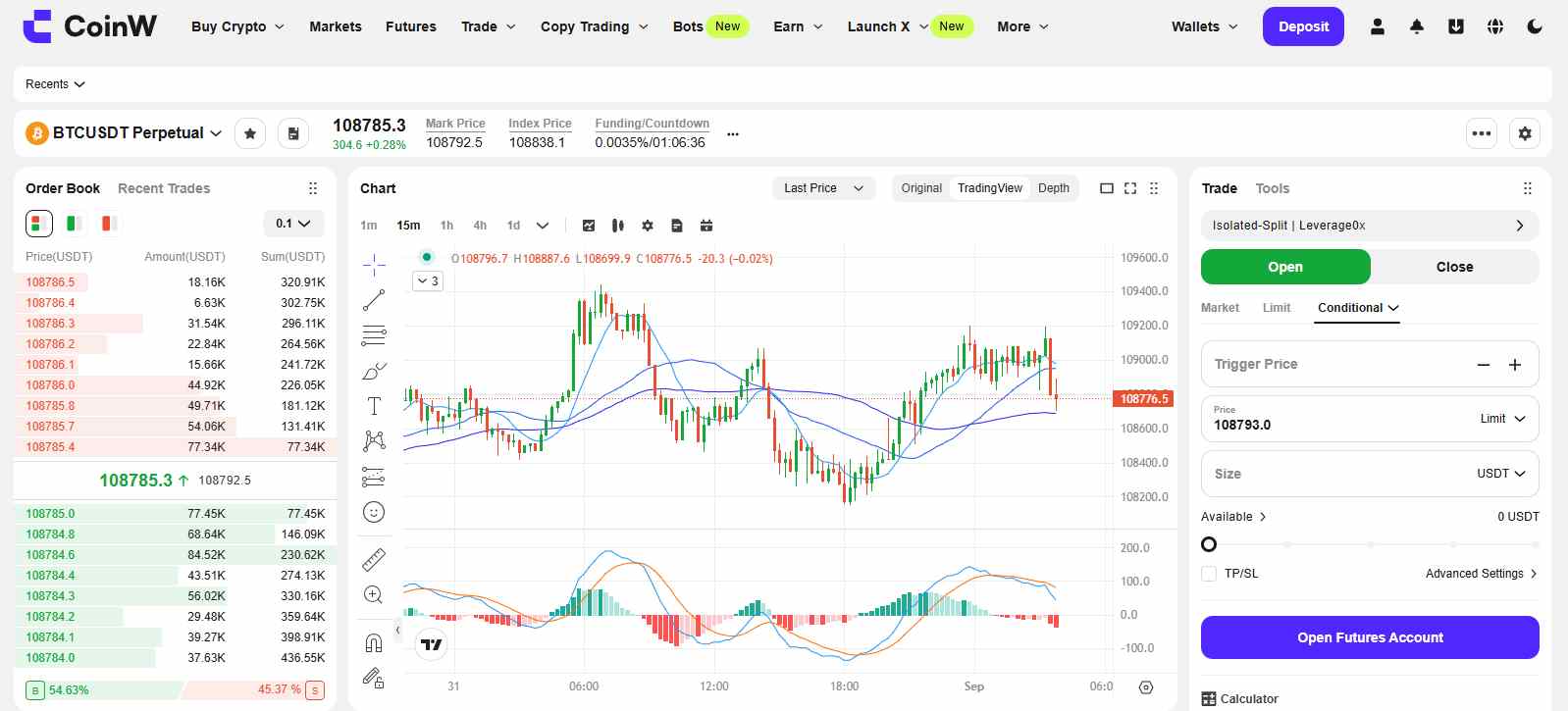

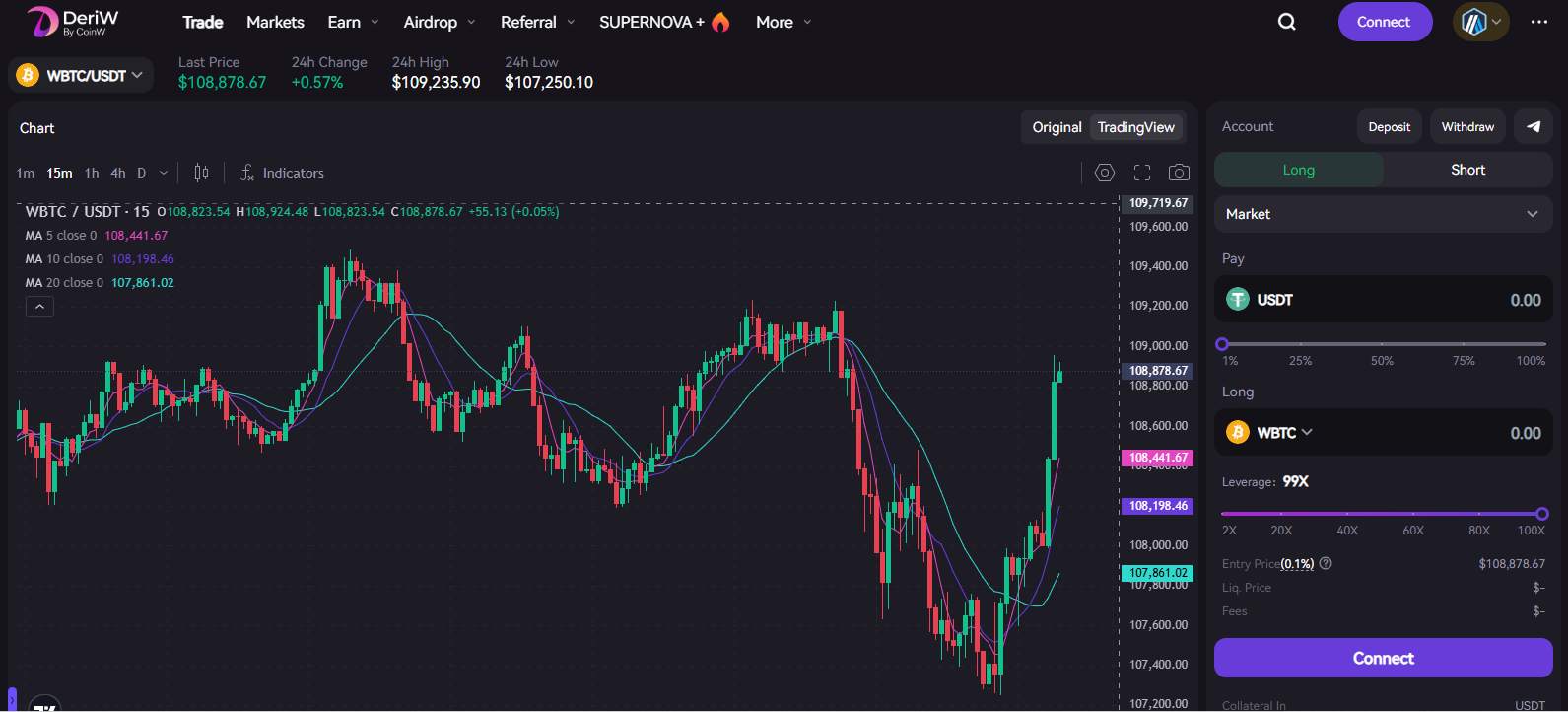

CoinW offers both spot and futures trading, giving users flexibility to choose between direct asset purchases or leveraged contracts. The interface is modern and clean, though it can feel slightly compact in its default layout. Users have the option to resize sections to suit their preferences, making navigation flexible. Charts are powered by TradingView, providing essential tools and indicators to support different trading strategies.

The order book shows a wider spread on both spot and futures markets, but the range of order types is strong. Beyond the basics of market and limit, traders can use stop-limit, trailing stop, iceberg, and other advanced options.

Asset details such as 24-hour volume, price highs and lows, and futures funding rates are displayed above the chart for quick reference, making it easier to follow market conditions while trading.

Spot Trading

Spot trading on CoinW gives access to more than 389+ cryptocurrencies, with fees set at 0.20% for both maker and taker orders. Daily spot volume averages above $2.7 billion, and all pairs trade against USDT. Assets are organized into categories in the dropdown menu, making it easier to filter projects. The spot market also includes ETF trading, where users can go long or short with leverage options of ×3, ×4, and ×6 on BTC, ETH, SHIB, DOGE, and XRP.

Futures Trading

The futures market on CoinW includes more than 140 contracts, all paired with USDT. Traders can use leverage of up to 200x, with fees at 0.010% for makers and 0.060% for takers. The interface supports advanced order types, displays funding rate data, and provides charting through TradingView. You also get a built-in calculator to estimate potential profit or loss before entering a position, adding an extra layer of clarity when planning trades.

CoinW Deposit and Withdrawal Methods

With CoinW, adding funds is fairly simple. The Quick Buy feature lets you purchase crypto directly using a credit or debit card, supporting more than 62 fiat currencies through third-party providers. Bank transfers aren’t an option, but crypto deposits are available and free of charge. When it comes to withdrawals, you can only cash out in crypto.

Another way to fund or cash out from your account is through CoinW’s P2P trading platform. Here you can buy or sell crypto directly with vendors, using local payment methods that fit your region.

CoinW Fees

Fees are a critical factor when choosing an exchange. Here’s how CoinW structures its fees and what discounts are available.

Trading Fees

CoinW keeps its standard spot trading fees at 0.10% for both makers and takers. The exchange also runs a tiered fee structure, where active traders can unlock lower rates. At the highest tier (VIP 9), spot fees drop to 0.020% for makers and 0.030% for takers, provided monthly trading volumes reach $60 million.

Futures trading follows a fixed model, with fees set at 0.010% for makers and 0.060% for takers. Interestingly, following a recent update, CoinW no longer provides additional spot trading discounts to holders of its native CoinW Token (CWT).

Spot Fees

0.10% Maker

0.10% Taker

Future Fees

0.02%% Maker

0.06% Taker

Deposits and Withdrawals

CoinW does not charge fees for fiat deposits made through its Quick Buy feature, although third-party payment providers may apply their own charges depending on the method and currency. P2P trading is free of charge, allowing users to buy or sell crypto directly with vendors using local payment methods. Crypto deposits are also free. For withdrawals, CoinW applies a fee that includes the network charge, which varies depending on the blockchain and asset being withdrawn.

CoinW Products and Services

While trading is at the core of CoinW, the platform also includes a range of complementary features. From automated tools like copy trading and grid bots to its native CWT token. Let’s break down what else the exchange provides beyond the standard spot and futures markets.

CoinW Trading

CoinW provides access to spot and futures trading along with several additional tools. Spot trading supports more than 389 cryptocurrencies, while the futures market offers over 140 contracts with leverage up to 200x.

The platform also includes ETF products with leverage options, copy trading functions, and trading bots. GemW introduces on-chain trading focused on Solana projects. TradingView charts are integrated for technical analysis, and the interface supports a range of order types. These features are intended to give users multiple ways to trade, from direct asset purchases to automated or leveraged strategies.

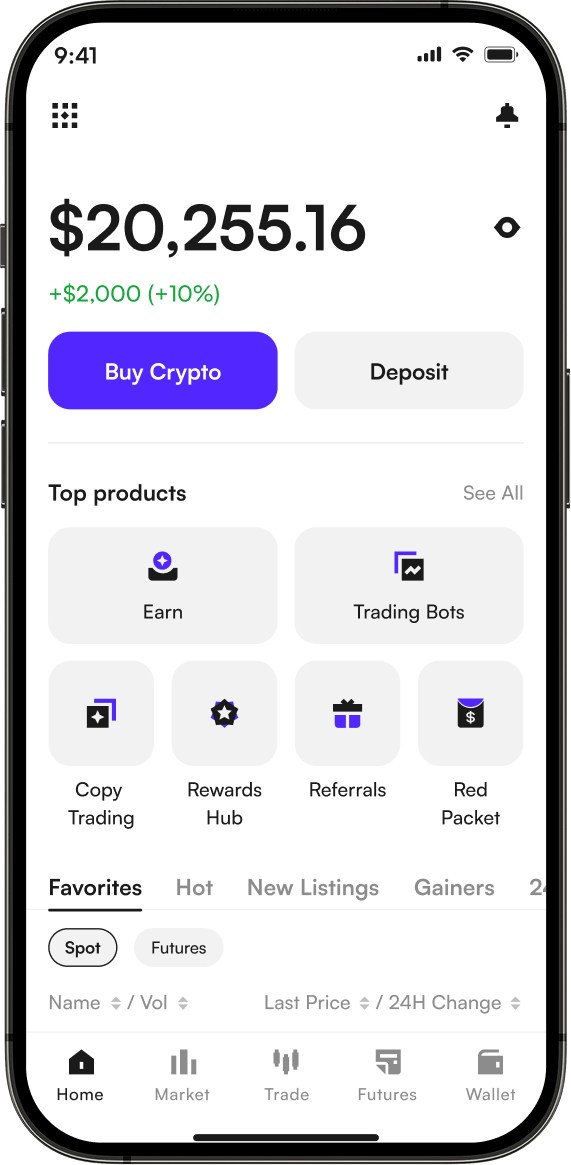

Mobile App

The CoinW mobile application is available on both iOS and Android. It provides access to spot and futures markets, copy trading, bots, and other platform features. TradingView integration is also included for charting on mobile. The app is rated 3.4, showing mixed feedback across different regions.

Deposits, withdrawals, and account management tools are available directly within the app, allowing users to continue trading and managing funds without relying solely on the web interface.

Earn

CoinW Earn provides options for users to generate returns on idle crypto holdings. It supports both flexible and fixed terms across more than 107 assets. Auto-Invest is also available, operating on a dollar-cost averaging (DCA) model.

Users can either choose from preset plans or set up custom ones, allocating funds to specific assets at regular intervals. These products are intended for users looking to add passive or systematic investment elements to their overall trading activity.

CoinW Token (CWT)

CWT is the native token of CoinW. Holders have access to certain rights within the platform and receive sub-tokens from projects associated with the ecosystem. A buyback and burn mechanism is in place, reducing supply over time.

A recent update removed the trading fee discount for CWT holders, but the token continues to serve as a utility and governance asset tied to various activities within CoinW’s framework.

Loading...

Rank —Token Symbol

-

All-Time High

-

Current Price

-

Market Cap

-

Total Supply

-

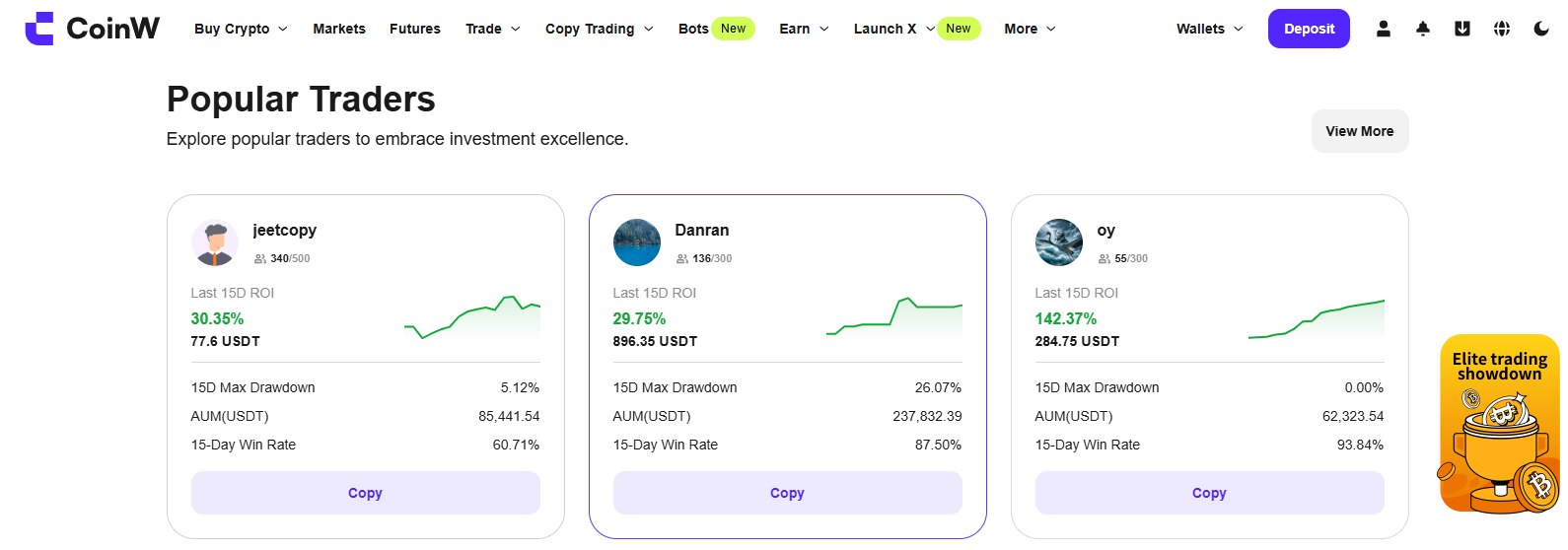

Copy Trading

CoinW offers copy trading for both spot and futures markets. More than 90,000 traders are listed on the platform, and users can choose to mirror their strategies. A profit-sharing model applies, with a 15% cap.

The feature provides transparency by showing trader performance data before copying, allowing users to evaluate strategies. Copy trading is presented as an option for those who want to participate in markets by following more experienced traders.

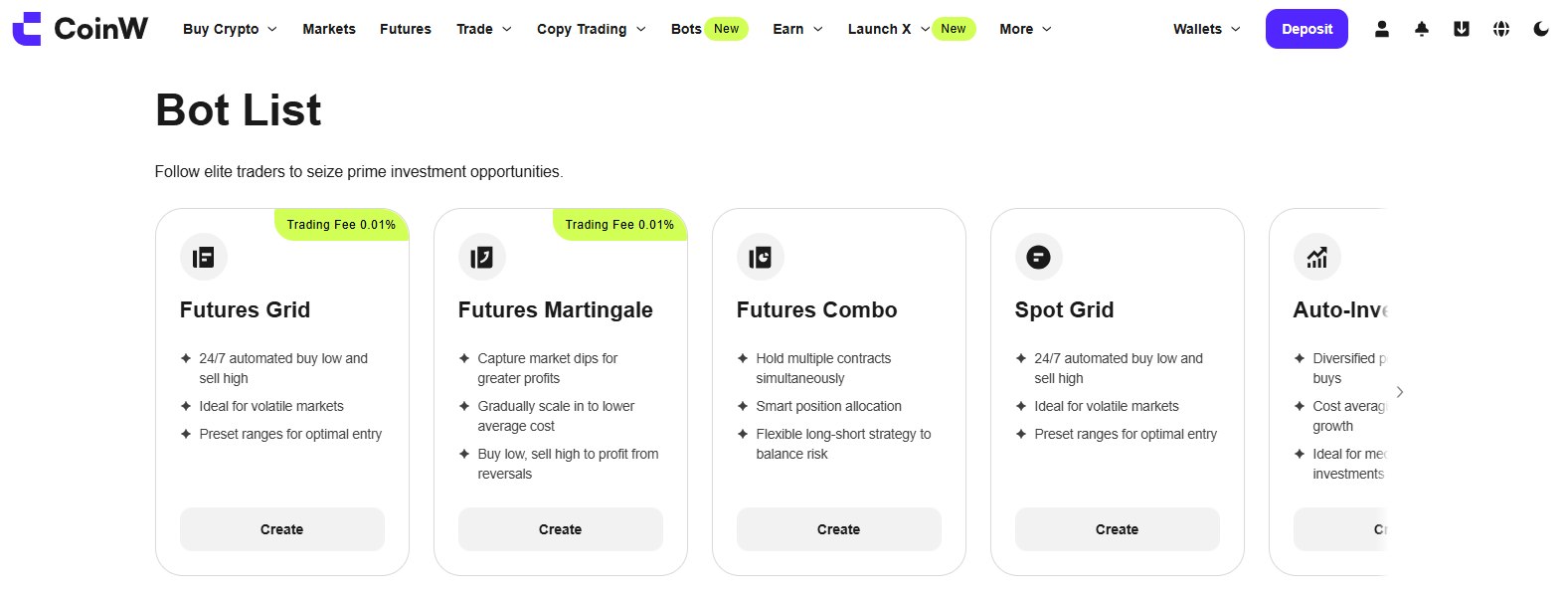

Trading Bots

CoinW includes a range of automated trading bots for both spot and futures markets. These bots use predefined strategies to execute trades automatically. In addition, the platform has a marketplace where users can follow and copy strategies built by professional traders.

P2P Trading

The P2P marketplace allows users to trade crypto directly with vendors using local payment methods. CoinW charges no fees for P2P transactions. The feature supports 22 fiat currencies, though liquidity is limited. At present, only USDT is supported as the trading asset.

P2P can be used for both buying and selling, making it a way to fund accounts or withdraw to fiat through local payment rails outside of traditional card or bank options.

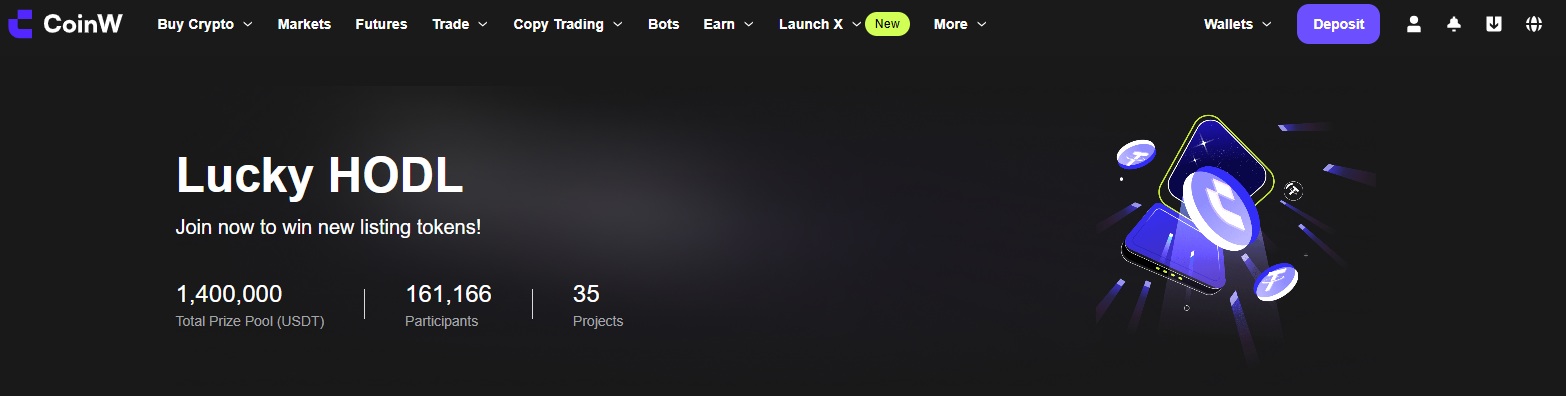

LaunchX

LaunchX is CoinW’s project launch platform. It has two components: Lucky HODL and W Drops. Lucky HODL enables users to stake tokens such as BTC, ETH, or USDT for a chance to participate in token airdrops.

W Drops provide CWT holders early access to projects vetted by CoinW, sometimes at discounted pre-listing prices. The program is designed to connect users with new listings and projects under CoinW’s selection criteria.

GemW

GemW is an on-chain trading tool focused on Solana projects. It provides access to early-stage tokens, with data and risk assessments supported by CoinW Institute research.

Features include automatic pre-listing purchases, risk-level indicators, and the option to follow trading strategies used by KOLs. Users can also set slippage, choose order types such as stop-limit and OCO, and prioritize transactions through fee adjustments. GemW is intended to support trading in early on-chain opportunities.

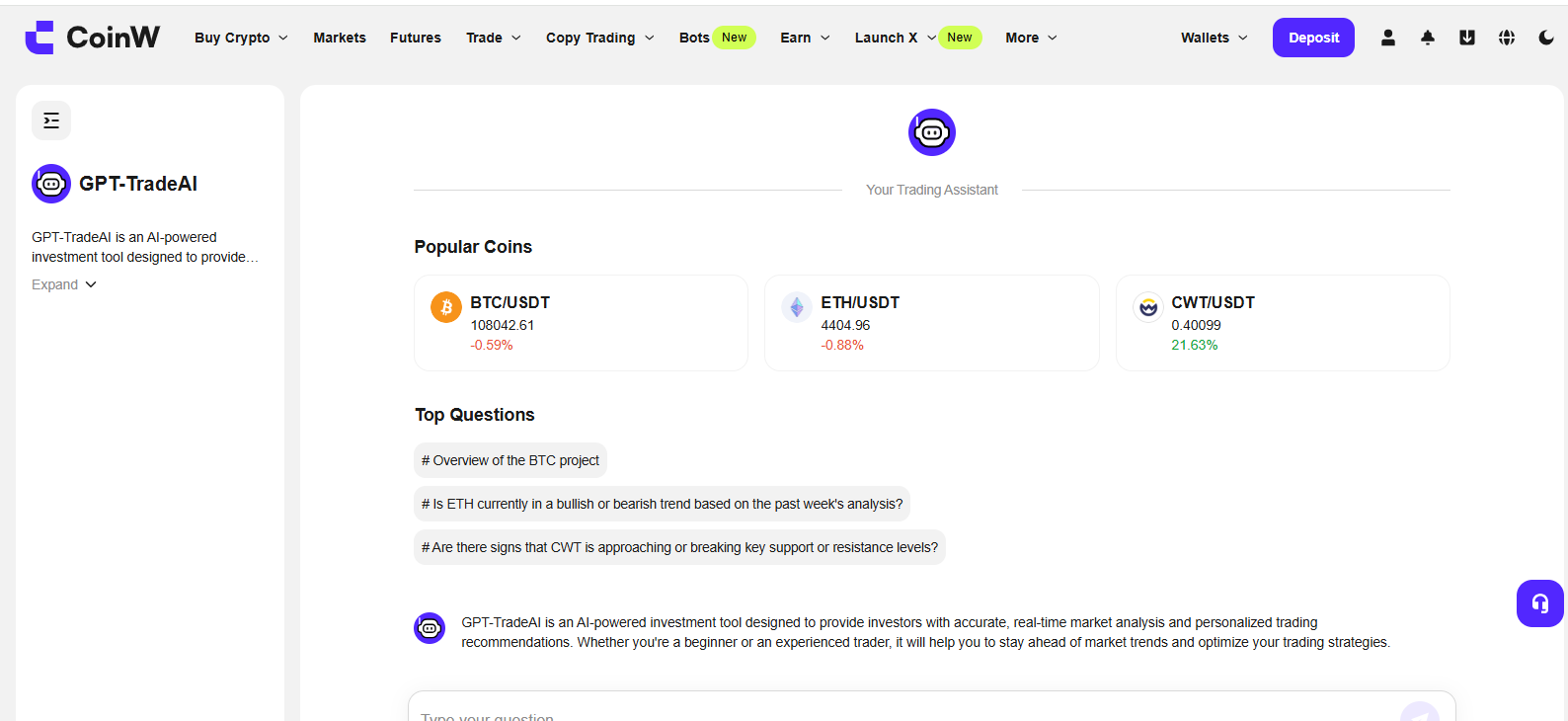

GPT-TradeAI

GPT-TradeAI is an AI-based tool integrated into CoinW. It delivers real-time analysis of market conditions and generates trading recommendations. The system is designed for both new and experienced users, providing automated insights into market trends. By combining AI analysis with user strategies, GPT-TradeAI aims to support decision-making rather than replace manual trading.

DeriW

DeriW is a decentralized perpetual trading platform connected to the CoinW ecosystem. Built on Arbitrum, it uses Layer-3 technology to reduce costs, with minimal slippage and no gas fees for trades. DeriW includes staking pools, allowing users to provide liquidity and earn rewards. It functions as a separate venue from CoinW’s centralized platform, offering exposure to decentralized trading infrastructure with perpetual contracts and liquidity incentives.

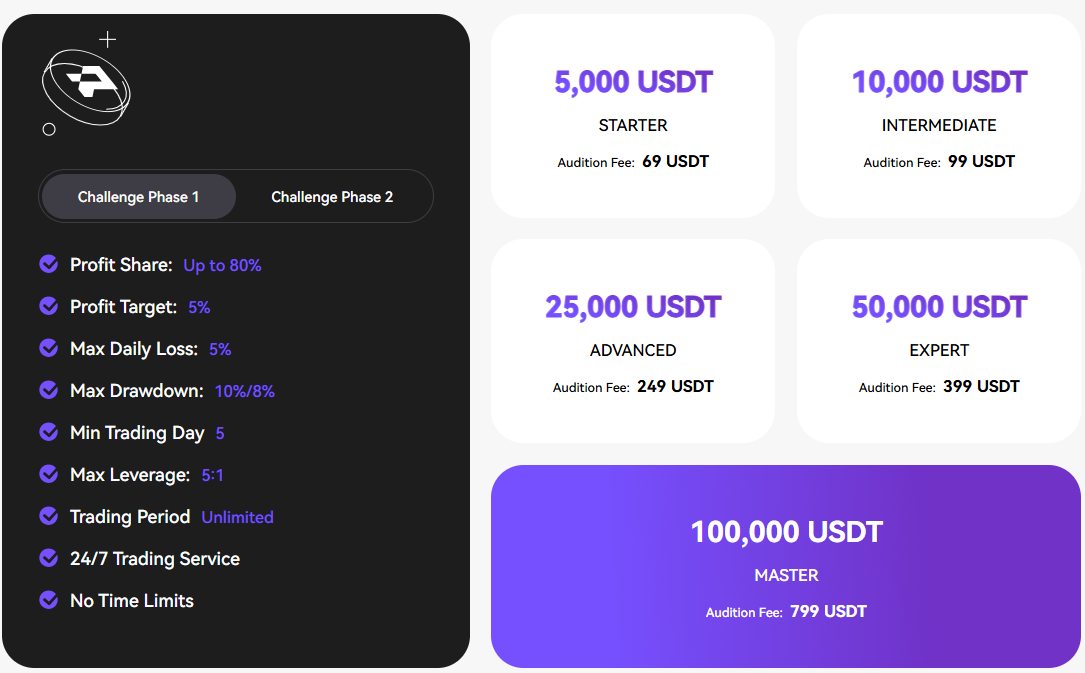

PropW

PropW is CoinW’s proprietary trading program. Approved participants can access funding of up to $200,000 after completing a challenge with predefined rules such as maximum drawdown and daily loss limits.

An audition fee is required to join. Traders who pass can retain a portion of profits, with an 80% share available in Challenge 1. PropW is aimed at users who want to demonstrate trading ability in exchange for access to larger capital resources.

CoinW Card

The CoinW Card is offered in both virtual and physical formats, operating on Visa and Mastercard networks. The virtual card carries a $98 issuance fee, a €1 monthly fee, and a 1.5% top-up fee. ATM withdrawals are limited to €500 per transaction and €1,000 per day. The physical card has its own fee schedule and limits, which differ slightly. The card is positioned as a tool for spending or withdrawing crypto through established payment channels.

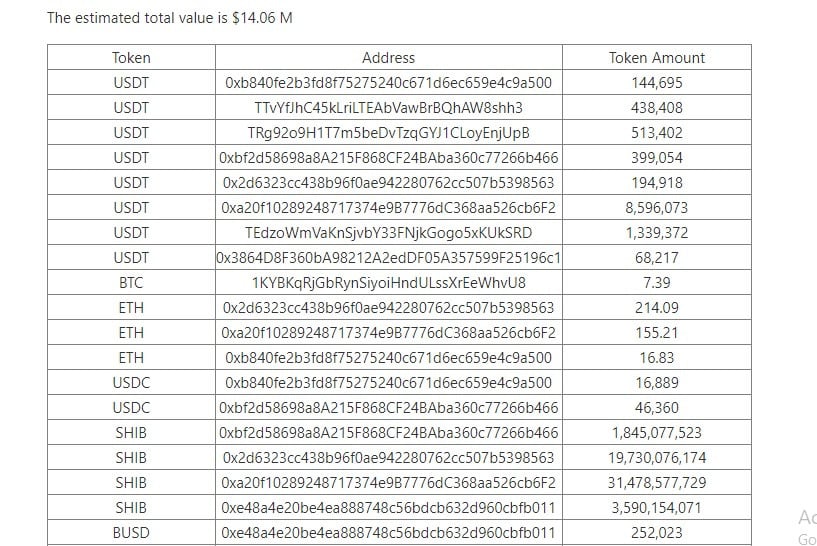

CoinW Security

CoinW uses various security measures to ensure customer accounts and funds’ safety. They require multiple verifications before customers can log in, generate API keys, or withdraw funds. They verify user identity using tools such as cell phone verification code, Google Authenticator, Twilio, or U2F security key.

The exchange also uses advanced security tools to record and monitor IP data of customer login. They report suspicious activities on their customers’ accounts by sending them a confirmation mail.

CoinW also prioritizes the storage of customer’s funds. They use MPC (Multi-Party Computing) wallets to manage on-chain transactions. In addition, most of their exchange funds are stored in offline cold wallets, which require multiple signatures from several of their senior members to access.

They are also one of the exchanges that occasionally publish their Proof of Reserves (PoR). They do this by disclosing available assets in their cold and hot wallet.

If you wish to delete your account, you can refer to our detailed guide on Delete CoinW Account.

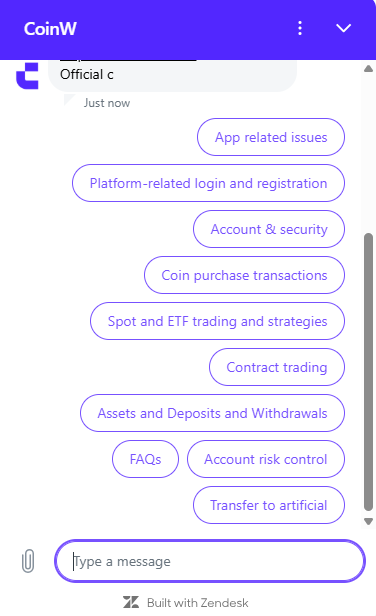

CoinW Customer Support

CoinW’s customer support is available through multiple channels but could benefit from being more comprehensive. The platform has a Help Center that contains articles, FAQs, and guides covering both the web and mobile versions of the exchange. From there, users can also submit support requests directly. Beyond the Help Center, CoinW maintains an active presence across social platforms such as Twitter, Facebook, Telegram, and Medium, where updates and announcements are frequently shared.

The exchange also operates around 16 local trading centers across 13 countries, offering regional presence for its users. Language support is currently limited to Chinese, Korean, and English, which may restrict accessibility for traders in other regions.

CoinW Alternatives

CoinW is a newer exchange with a focus on altcoins, but if you’re looking for alternatives, consider these:

- KuCoin: Kucoin is a popular choice for altcoin traders, with a wide selection of coins and a user-friendly interface.

- Phemex: Phemex is known for its focus on futures trading and offers high leverage and a variety of trading tools.

| Feature | CoinW | KuCoin | Phemex |

|---|---|---|---|

| Established | 2017 | 2017 | 2019 |

| Spot Fees (Maker/Taker) | 0.20% / 0.20% | 0.10% / 0.10% | 0.10% / 0.10% |

| Futures Fees (Maker/Taker) | 0.020% / 0.060% | 0.020% / 0.060% | 0.010% / 0.060% |

| Max Leverage | 200x | 125x | 100x |

| KYC Required | Yes | Yes | No |

| Supported Cryptos (Spot) | 389+ | 987+ | 536+ |

| Futures Contracts | 140+ | 410+ | 440+ |

| No KYC Withdrawal Limit | Not Allowed | Not Allowed | $50,000 |

| 24h Futures Volume | $33.06B+ | $1.03B | $0.86B |

| Trading Bonus | $1,000 | $10,500 | $8,800 |

| Key Features | • High leverage (200x) • Good liquidity |

• Most cryptocurrencies • Trading bots available • Great for altcoins |

• No KYC required • Low futures maker trading fees • User-friendly platform |

| Sign Up | Sign Up | Sign Up | Sign Up |

Bottom Line

CoinW presents itself as a global exchange with a broad set of tools, covering spot, futures, copy trading, bots, and additional products such as GemW and LaunchX. It combines a tiered fee structure, optional earning programs, and multiple account verification levels to cater to different types of users. While there are areas that may require further development, the exchange provides a wide range of services and features that can be reviewed when considering how it fits into your trading needs.

FAQs

1. Does CoinW require KYC?

Yes, basic KYC is compulsory to activate an account. Higher verification levels allow larger withdrawal limits.

2. What trading options does CoinW provide?

CoinW supports spot, futures, ETF trading, copy trading, trading bots, P2P trading, and on-chain tools like GemW.

3. What are CoinW’s trading fees?

Spot trading fees start at 0.20% maker/taker, while futures fees are fixed at 0.010% maker and 0.060% taker.

4. Does CoinW support fiat deposits and withdrawals?

Fiat deposits are available through credit/debit cards via third-party providers. Withdrawals are limited to crypto only.

5. Is CoinW available in all countries?

No. CoinW is restricted in several regions due to regulations, including the United States, Canada, Singapore, and parts of Asia and Africa.