- •MEXC apologized to White Whale and released $3.1 million after public backlash over frozen funds and communication issues.

- •Cecilia Hsueh admitted internal flaws and announced a new fast-track channel for unresolved user accounts.

- •White Whale accepted the apology, donated all recovered funds, and urged MEXC to improve fairness and transparency.

MEXC has issued a public apology to the crypto trader known as White Whale, following a months-long dispute over frozen funds that sparked widespread attention across the trading community. The situation, which began in July 2025, centered around MEXC’s decision to freeze approximately $3.1 million belonging to White Whale under its internal “risk control” policy.

The trader, known for his profitable manual trading strategy, denied using bots or automation tools and argued that the freeze was unjustified. When attempts to resolve the issue privately failed, he took the matter public, accusing the exchange of mishandling the case and suggesting that he had been wrongly portrayed as engaging in illicit trading behavior.

Public Backlash on X

As the story spread on X, it attracted major voices from the crypto space, including ZachXBT and CryptoGodJohn, both of whom urged followers to stay cautious of MEXC. Many smaller traders joined the conversation, sharing similar experiences of account freezes and communication breakdowns.

In a post on October 20, White Whale detailed a one-hour call with Cecilia Hsueh, MEXC’s Chief Strategy Officer, who had recently joined the company. He claimed that during the conversation, Hsueh cited “evidence” of automated activity, pointing to simultaneous trade orders as proof of bot usage. White Whale countered this explanation, saying such instances could easily occur due to VPN lag.

He also stated that MEXC’s representatives wanted him to admit to breaking rules publicly in exchange for the release of his funds, something he refused to do. While the call ended on a polite note, he said there was no follow-up afterward, and tensions continued to rise.

Also read: Tether Records $10 billion Year-to-date Revenue in Q3

MEXC Issues a Public Apology

On October 31, 2025, Cecilia Hsueh made a public post on X that read, “We apologize to @TheWhiteWhaleV2, and his money is already released. He can claim it at any time”, The statement confirmed that the funds had been released and that MEXC accepted responsibility for poor communication.

Hsueh acknowledged that the company had grown too quickly for its internal systems to keep pace, saying that its risk, operations, and PR teams had not scaled with the exchange’s growth. She promised that MEXC would improve its transparency and internal review processes, adding that leadership was now aligned on making those changes.

Her apology received millions of views within hours. Some praised her openness, while others criticized the exchange for only responding after public pressure.

White Whale’s Response

In his reply, White Whale said he appreciated the apology but wished it had addressed the deeper issue, the public defamation he faced when MEXC initially implied wrongdoing. He reiterated that he had never used automation, secret APIs, or bots, and described himself simply as “a trader who wins or loses by his own hand”.

He also announced plans to donate 100% of the recovered funds. Half will go to early supporters of his NFT community, and the other half will be distributed to verified nonprofit organizations through a community vote. White Whale stated that while he accepted the apology, he hoped MEXC would commit to systemic changes to prevent similar situations for others.

In his statement, he urged MEXC to eliminate any financial incentive tied to holding customer funds and to create a faster, more transparent review process for accounts under investigation.

Explore Alternatives to MEXC

While this dispute may be resolved, it’s understandable if traders want to explore safer options. MEXC has its appeal, low trading fees, a huge range of altcoins, and no mandatory KYC, but it’s not the only player out there.

If you’re considering alternatives, we’ve compiled detailed guides that can help you compare and choose what fits best for you:

Next Steps from MEXC

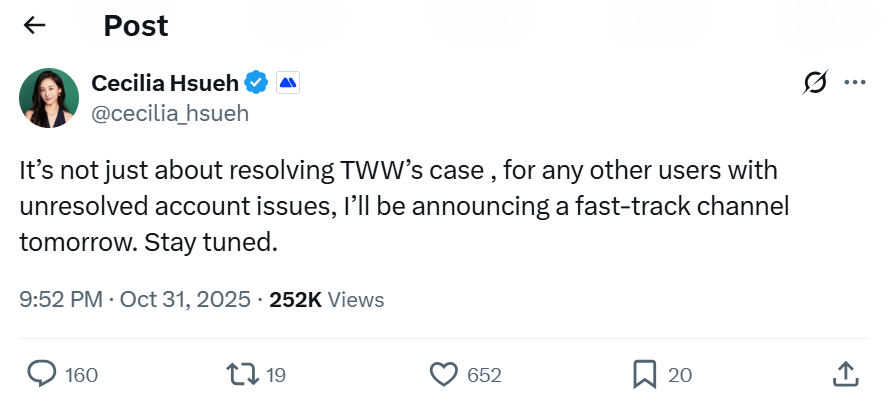

Shortly after her apology, Cecilia Hsueh shared another update, saying that MEXC plans to launch a “fast-track channel” for users with unresolved account issues. “It’s not just about resolving TWW’s case”, she wrote, “for any other users with unresolved account issues, I’ll be announcing a fast-track channel tomorrow”.

This move suggests that MEXC is beginning to address broader user concerns raised throughout the controversy. Although no detailed framework has been shared yet, the statement signals an intention to reform how disputes are handled internally.

A Turning Point for the Exchange

The release of funds and the public apology appear to have ended the dispute, but the episode left a visible mark on MEXC’s reputation. It became a reminder of the risks traders face when holding significant balances on centralized exchanges and of the need for fairer, faster dispute resolution mechanisms.

For now, MEXC apologizes to White Whale, the funds have been restored, and the company’s leadership has promised reforms. But as both sides have acknowledged, this story extends beyond a single case, it’s part of a larger push for accountability and transparency in the crypto industry.