- •Ethereum revenue dropped 44% in August, totaling $14.1 million despite ETH hitting an all-time high of $4,957.

- •Network fees fell 20% month-over-month, influenced by the March 2024 Dencun upgrade that lowered layer-2 transaction costs.

- •Institutional interest in ETH staking continues to grow, positioning yield generation as a key driver of Ethereum’s long-term value.

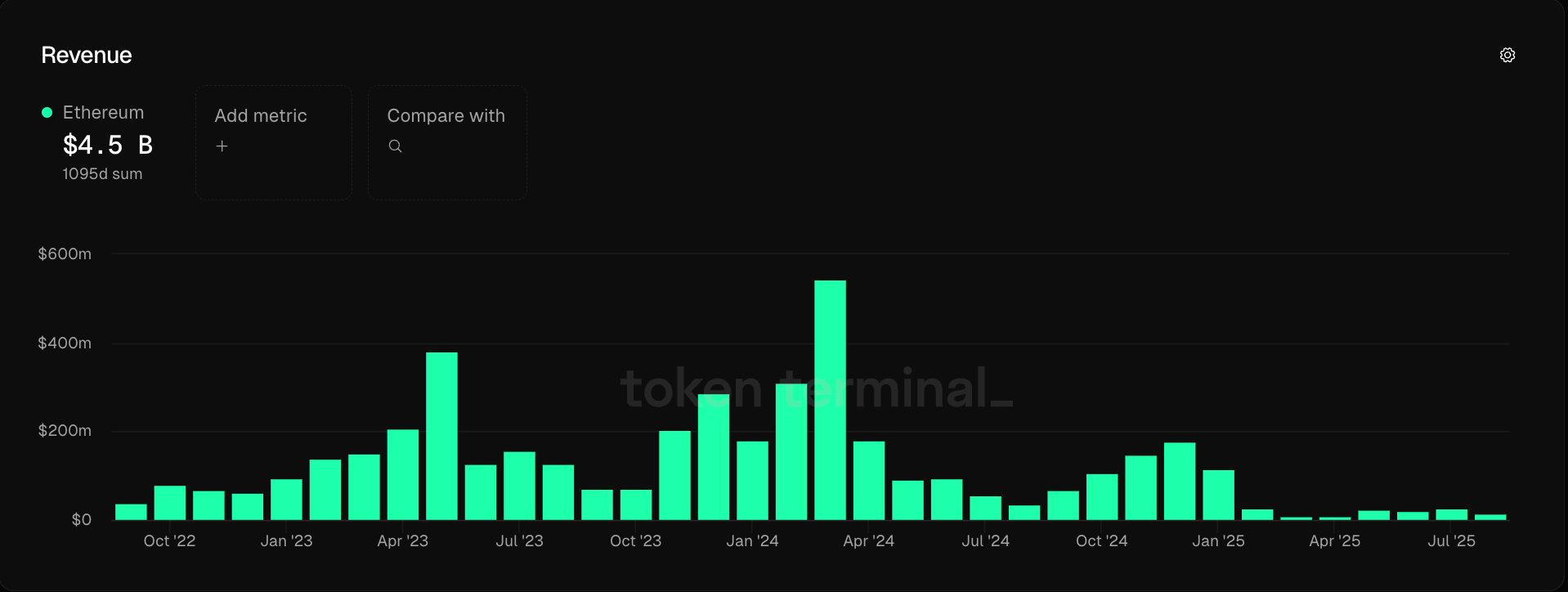

Ethereum revenue dropped 44% in August amid ETH all-time high, marking a striking contrast between price action and network income. According to data from Token Terminal, Ethereum revenue fell to $14.1 million in August, down from $25.6 million in July. At the same time, ETH’s price surged by 240% since April, reaching a record high of $4,957 on August 24. This divergence has opened up conversations across the market about the sustainability of Ethereum’s financial model. While network fees decreased, institutional demand for staking continued to build momentum.

ETH Hits Record Price While Revenue Declines

Ethereum’s market performance told two different stories in August. On one hand, ETH rallied to new all-time highs, crossing $4,957 on August 24. On the other, revenue generated through token burns and network fees dropped significantly. Revenues in August stood at $14.1 million, compared to $25.6 million in July. The decline highlights a shift in how Ethereum now generates income, even as trading activity and institutional adoption grow.

Analysts note that this divergence is not entirely unexpected. Ethereum’s rally has been fueled by strong investor interest, especially from institutions exploring ETH as a yield-generating asset. However, activity on the base layer has slowed, leading to fewer transactions and, consequently, lower revenues.

Network Fees After the Dencun Upgrade

Ethereum’s network fees also saw a notable decline. Fees fell by 20% month-over-month, dropping from $49.6 million in July to $39.7 million in August. Much of this trend can be traced back to the Dencun upgrade rolled out in March 2024.

The upgrade made transactions significantly cheaper for layer-2 networks that use Ethereum as their settlement layer. While this improved efficiency and lowered costs for users, it also reduced the amount of ETH burned monthly. As a result, Ethereum holders saw smaller rewards, and the network’s revenue stream weakened.

Institutional Interest in ETH Staking

Despite falling fee revenue, institutional participation in Ethereum has been on the rise. Public market entities and treasury firms are exploring staking as a way to turn ETH into a yield-bearing asset. Staking allows institutions to lock ETH for network security and validation while earning a return, similar to how companies generate earnings.

In September, Etherealize, a public relations firm advocating for Ethereum, raised $40 million to promote ETH to listed companies. According to Bitwise CIO Matt Hougan, the ability to stake ETH and generate income resonates with traditional investors familiar with earnings-driven models.

Related read: Ethereum Staking Queue Hits $3.7B Amid Institutional Surge

Looking Ahead

Ethereum revenue dropped 44% in August amid ETH all-time high, showing a complex dynamic between price growth and fee-based income. While the Dencun upgrade has made Ethereum cheaper and more scalable, it has also reduced base layer revenues. At the same time, institutional interest in staking suggests Ethereum’s value proposition is shifting toward yield generation rather than transaction fees alone. The coming months will show how this balance between growth and revenue sustainability plays out.