- •Ethereum staking entry queue hit860,369 ETH (~$3.7B), the highest level since 2023.

- •35.7M ETH is currently staked, around 31% of total supply, with entry and exit queues nearing balance.

- •Over 70 treasuries now hold 4.7M ETH (~$20B), much of it directed into staking strategies.

Ethereum’s staking entry queue has climbed to its highest level in nearly two years, now totaling around $3.7 billion worth of Ether waiting to be staked. On Tuesday, on-chain data from Ultrasound.money showed 860,369 ETH in line, marking a notable return of interest from both retail and institutional players. This development comes as Ethereum balances between rising institutional demand, steady treasury involvement, and a recent price retreat. Despite the short-term pullback in value, many long-term holders appear to be prioritizing staking strategies over exits.

The Queue Reaches a Two-Year High

The Ethereum staking queue surged to 860,369 ETH, valued at approximately $3.7 billion, according to data from early September. This is the highest level since September 2023, when the Shanghai upgrade had allowed withdrawals and temporarily triggered large-scale validator exits. The latest figures highlight a reversal from the concerns of late August, when the exit queue briefly exceeded one million ETH before easing back by 20%.

Related read: Yunfeng Financial Group Acquires $44M in ETH for Web3 Expansion

Institutional Interest and Market Confidence

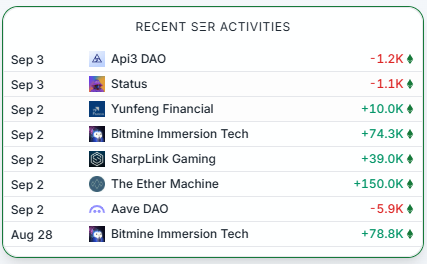

Staking protocol Everstake noted that such queues have not been seen since 2023, adding that this reflects renewed confidence in Ethereum’s long-term role. The combination of higher Ether prices, currently around $4,321, and historically low gas fees has made staking more appealing. Beyond retail involvement, institutional demand has grown significantly. More than 70 treasury participants now hold a combined 4.7 million ETH, worth over $20 billion, much of it allocated for yield-generating strategies.

Entry and Exit Queues Near Balance

For the first time since July, Ethereum’s staking entry and exit queues are close to equilibrium. This balance suggests a healthier environment for staking participation, reducing concerns about mass exits. The blockchain currently has 35.7 million ETH locked in staking contracts, equal to roughly 31% of its total supply. With both inflows and outflows stabilizing, Ethereum appears to be developing a more sustainable staking cycle.

Treasury Participation Strengthens

Corporate treasury involvement has been a critical factor in the recent queue surge. StrategicEtherReserve data shows more than 70 entities actively accumulating Ether for staking purposes. These corporate moves indicate that Ethereum is being treated as a yield-bearing asset within broader treasury strategies, reinforcing its role as an infrastructure layer for decentralized finance.

Source: StrategicETHReserve.xyz

Price Movements and Market Sentiment

While Ether has slipped 12.4% from its August 24 all-time high, the staking queue’s growth indicates that long-term holders remain committed. Instead of rushing to exit positions, many are waiting in line to earn on-chain yields. Daily fluctuations, such as a 1.2% decline to $4,321 at the time of reporting, have not slowed the momentum in staking demand. This dynamic points to staking as a stabilizing mechanism for market participation, even during price pullbacks.

Closing Thoughts

The fact that the Ethereum staking queue hits $3.7B underscores both institutional confidence and the growing role of treasuries in shaping on-chain activity. With entry and exit queues nearing balance and over 35 million ETH staked, Ethereum’s staking ecosystem continues to mature. Despite recent price corrections, the long-term commitment of treasury funds and retail participants signals that staking remains a central pillar of Ethereum’s growth trajectory.