• Ethereum Foundation plans to convert 1,000 ETH to stablecoins using CoWSwap’s TWAP.

• The move is part of the Foundation’s plan to build a more sustainable treasury management practice.

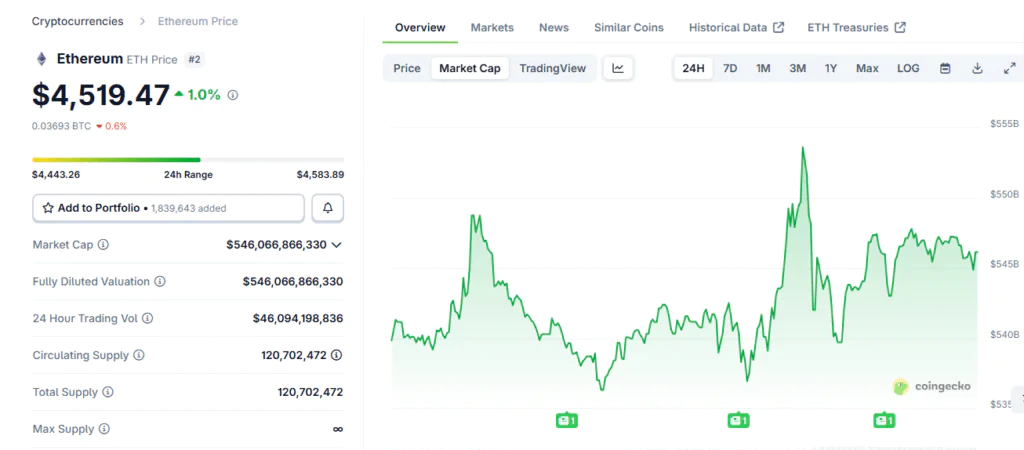

• ETH nears record highs as institutional demand and ETF inflows drive market momentum.

The Ethereum Foundation (EF) has announced plans to convert 1,000 ETH into stablecoins through CoWSwap’s TWAP system. The move reflects both its focus on maintaining liquidity and ecosystem growth, with its long-term approach to treasury stability. It also underlines Ethereum’s expansive positioning within the broader development of decentralized finance (DeFi).

Ethereum Foundation Uses CoWSwap TWAP for Coin Conversion

The Ethereum Foundation revealed in a post on X that it will convert 1,000 ETH into stablecoins using CoWSwap’s TWAP feature. The move is part of its ongoing effort to fund research, development, grants, and donations, while also highlighting its focus on decentralized finance infrastructure.

The conversion follows EF’s Treasury Policy released in June, which outlines how it manages capital. The policy’s framework stresses resilience against volatility, transparency in treasury activities, and responsible allocation to safeguard long-term ecosystem growth.

Part of a Broader Initiative

The transaction is part of EF’s broader treasury approach, designed to balance short-term liquidity with long-term strategy. The plan aligns with the Foundation’s long-term goal to lower spending to 5% from 15% by 2030. This conversion ensures that accrued assets can support research, development, grants, and community donations while leaving core ETH reserves intact for growth.

Careful asset deployment is meant to ensure stability during this period. Stablecoins provide predictable liquidity, protecting against volatility while keeping resources available for operations.

Ethereum Foundation’s choice of CoWSwap and its TWAP system aligns directly with this strategy. TWAP works by splitting large trades into smaller, timed parts, which lowers volatility and reduces market disruption. CoWSwap’s design is built to limit slippage and prevent front-running, providing extra protection and making it a suitable platform for handling transactions at EF’s scale.

A Move in Step with Industry Growth

While EF has not disclosed which stablecoin it will receive, the move coincides with rapid growth in the stablecoin sector. New launches such as Hyperliquid’s USDH and Tether’s USAT are aligned with US policy. Sui Group’s native stablecoin initiative and Circle’s partnership with Deutsche Börse in Europe also highlight that stablecoins are becoming central to on-chain finance. Their increasing use in payments, lending, and settlements underscores why EF’s decision to diversify with stablecoins reflects a broader industry shift. The timing signals a strategy that not only stabilizes EF’s operations but also ties Ethereum’s future to the wider rise of stablecoin adoption.

ETH Rallies Near All-time High amid rising Institutional Demand

Ethereum broke above $4,500 on Friday as investors showed renewed interest in the altcoin market, according to CoinGecko data. The top altcoin is trading 8% below its all-time high of $4,946 set in August and is showing potential for further upside.

The rally comes as institutions continue to place bets on the Ethereum network through the establishment of Ethereum-focused treasuries. These firms, including SharpLink Gaming, Bit Mine, and Bit Digital, have continued stacking ETH over the past few months, currently holding 3.6 million ETH.

Likewise, US spot Ethereum ETFs have also recorded $1 billion in inflows since Monday, marking a shift in sentiment among institutional investors.