• USDH is now live on Hyperliquid’s DEX platform with a USDC pair.

• Native Markets claimed the USDH ticker last week after winning the bidding war.

• The debut follows a rise in DEX competition as Aster poses a threat to Hyperliquid.

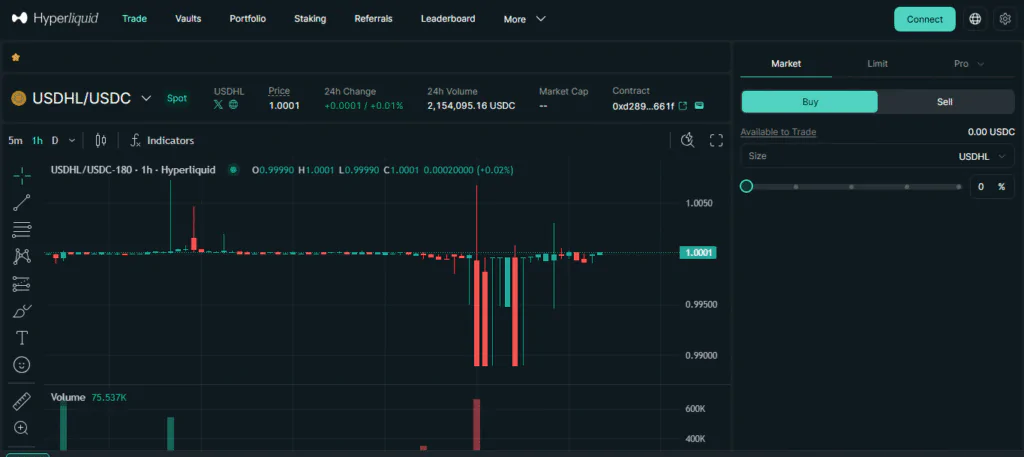

USDH, the native stablecoin of decentralized exchange (DEX) Hyperliquid, has gone live on the platform with a 24-hour volume of $2.2 million and a USDC pair.

USDH Debuts on Hyperliquid Market

Native Markets, the official team responsible for issuing the USDH stablecoin, has launched the Dollar-backed cryptocurrency on Hyperliquid, with trading now available against USDC.

USDH marks the first US Dollar–linked token approved through Hyperliquid’s validator-driven vetting system. The asset was deployed natively on HyperEVM and is transferable across the broader Hyperliquid ecosystem. Data on the DEX showed that USDH is trading on Hyperliquid at a volume of $2.2 million.

Native Markets claims that more than $15 million of USDH were pre-minted 24 hours before its debut. Analysts stated that USDH’s strong opening, with $2.2 million in trading volume within 24 hours, demonstrates immediate traction and reflects both Hyperliquid’s growing user base and the appetite for stablecoins.

Native Markets Emerged Won Bid for Hyperliquid’s USDH ticker

Native Markets secured the USDH ticker after a competitive bidding process, which included proposals from Agora, Paxos, Frax, and Ethena Labs. Through this process, the group underscored its commitment to building liquidity and trust within Hyperliquid’s markets.

The firm stated in its proposal that USDH would be backed by a mix of cash and US Treasury equivalents managed by Bridge, a platform acquired by Fintech giant Stripe in 2024, and that it would comply with regulations in both the US and Europe.

USDH Could Replace Other Stablecoins on Hyperliquid DEX

USDH’s integration ensures compatibility across the Hyperliquid ecosystem. This positions it as a backbone for fiat-backed transactions across the ecosystem, and is likely to compete with other stablecoins, including USDC, on the DEX.

Native Markets emphasized that USDH reserves are fully backed by cash and short-term US Treasuries. The design combines off-chain management with an on-chain layer made transparent through oracle feeds, while also creating an economic loop that channels part of reserve earnings into HYPE buybacks.

USDH’s debut comes as the stablecoin market cap soared to $292 billion on Wednesday, reflecting the increased demand for reliable fiat-pegged digital assets.

Rising Competition among Decentralized Exchanges

Hyperliquid’s stablecoin debut comes as the exchange faces a new contender for decentralized trading.

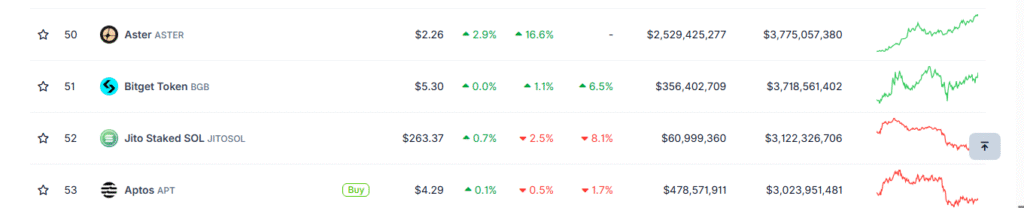

Changpeng “CZ” Zhao-backed decentralized exchange Aster has surged onto the scene, with its token rallying sharply since last week’s debut, according to CoinGecko data.

Aster continues to follow closely behind and has attained a 24-hour volume of $2.5 billion compared to Hyperliquid’s $900 million.

Both platforms focus on perpetual futures trading, a niche Hyperliquid has long dominated. But Aster’s rapid rise signals a credible challenge to one of crypto’s biggest players.

Hyperliquid’s HYPE token declined over 3% on the day, while Aster has maintained a 17% rally in the past 24 hours.