- •33 listed companies now hold 714,000 BTC worth about $83B, with MicroStrategy leading as the largest corporate Bitcoin holder.

- •Ethereum has become the second most popular treasury asset, with firms like BitMine and SharpLink holding billions in ETH and using staking income as part of their strategy. Solana, Dogecoin, XRP, and even BNB have entered balance sheets, with XRP holdings alone around $10B at SBI Holdings.

- •The 2023 FASB accounting change lets companies mark crypto at fair value. In 2025 SEC Chair Paul Atkins said very few tokens are securities. These two developments give companies more confidence to add crypto to their reserves.

Roughly a year ago, the idea of American companies building a Crypto Native Treasury was still front-page news. The headlines focused almost entirely on Bitcoin; MicroStrategy’s billion-dollar bet, Tesla’s initial splash, and a handful of miners adding the coins they produced to their balance sheets. Back then, it was shocking enough that boardrooms would swap part of their cash reserves for a volatile digital asset.

But in 2025, that story feels different. The once-radical experiment has become a playbook, one that other companies are adapting to their own advantage. Corporate treasuries now hold not just Bitcoin, but also Ethereum, Solana, Dogecoin, BNB, and XRP. Some firms made the move to survive, others to generate yield, and a few because they see themselves as long-term stakeholders in blockchain networks. At CryptoWinRate, we tracked how the once-isolated Bitcoin treasury experiment has expanded into a multi-asset phenomenon, reshaping how public firms think about liquidity and reserves, and giving rise to the era of the Crypto-Native Treasury.

Bitcoin as the Blueprint

Bitcoin remains the reference point for every treasury strategy. It started in 2020 when MicroStrategy converted part of its reserves into Bitcoin, calling it a hedge against inflation and a superior long-term store of value. By August 2025, the company had accumulated more than 629,000 BTC, worth roughly $71 billion. Investors began treating its stock less like a software firm and more like a listed Bitcoin trust.

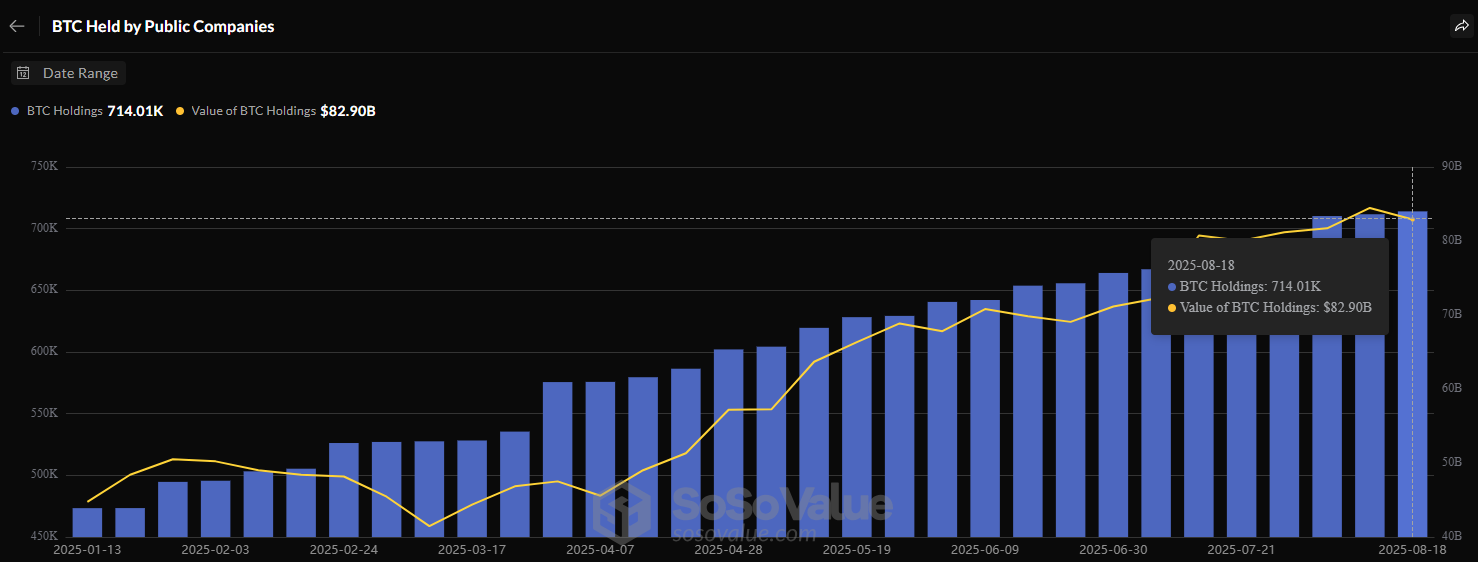

And MicroStrategy is no longer alone. According to SoSoValue, 33 public companies worldwide now hold Bitcoin, with a combined total of 714,000 BTC worth nearly $83 billion. The roster includes U.S. miners like Marathon and Riot, Tesla’s trimmed but still notable position of around 11,509 BTC, and a mix of international players. Bitcoin has become the corporate anchor, proof that digital assets can sit on a balance sheet alongside dollars and bonds.

Ethereum and the Move Toward Yield

If Bitcoin is digital gold for companies, Ethereum is shaping up as digital infrastructure. Firms like SharpLink Gaming and BitMine Immersion Technologies have turned their Crypto Native Treasuries into massive ETH vaults. SharpLink, after rebranding under Ethereum co-founder Joseph Lubin’s guidance, now holds about 740,000 ETH, worth more than $3 billion. BitMine went further, surpassing 1.5 million ETH, with a value of around $6.6 billion, making it the second largest public crypto holder after MicroStrategy.

The logic is not the same as Bitcoin. Ethereum, post-Merge, allows companies to stake holdings and earn yield, often around 4–6% annually. This transforms reserves into productive assets rather than idle bets. For SharpLink and BitMine, staking income has become a line item on their financial statements. That twist, combining speculation with cash flow, makes Ethereum treasuries stand apart.

The Broader Wave: Dogecoin, BNB, XRP, and Others

Beyond Bitcoin and Ethereum, a handful of companies are experimenting with other tokens, each for their own reasons.

Solana has attracted firms like DeFi Development Corp and Upexi, which raised billions in facilities to buy SOL and run validator nodes. For them, Solana’s speed and developer ecosystem make it a bet on the future of scalable finance.

Dogecoin, once dismissed as a meme, was adopted by Bit Origin Ltd., which purchased more than 70 million DOGE. The company argues Dogecoin’s growing role in micropayments could pay off in the long run. Whether it proves prescient or reckless will depend on the coin’s cultural staying power.

BNB, native token of Binance Smart Chain, proved riskier. Windtree Therapeutics, a biotech on the edge of delisting, pivoted into BNB holdings in a last-ditch effort to regain relevance. Instead, its stock collapsed more than 90% and the company was delisted in August 2025. It remains a case study in how a crypto pivot can accelerate failure if investors see it as desperate rather than strategic.

Then there’s XRP. Long tied up in lawsuits, its standing improved once U.S. courts suggested it should not be treated as a security. That clarity opened the door for treasuries. Japan’s SBI Holdings is the standout, with an estimated $10 billion XRP position, and smaller American firms across sectors have added nearly $1 billion collectively. For them, XRP is less about yield and more about its role in payments and settlement.

Taken together, these moves show the diversification of the treasury trend. Where Bitcoin was once the only option, balance sheets now resemble a crypto ecosystem map.

| Company | Asset | Holdings | Value (Aug 2025) | Notes |

|---|---|---|---|---|

| MicroStrategy (US) | Bitcoin (BTC) | 629,000 BTC | $72B | Largest BTC treasury; model for others |

| Marathon Digital (US) | Bitcoin (BTC) | 50,000 BTC | $5.8B | Mining firm holding production as reserves |

| BitMine Immersion (US) | Ethereum (ETH) | 1.5M ETH | $6.6B | Largest ETH treasury holder |

| SharpLink Gaming (US) | Ethereum (ETH) | 740,000 ETH | $3.2B | ETH pivot, staking yield strategy |

| DeFi Development (US) | Solana (SOL) | 609,000 SOL | $97M | Rebranded around Solana validator model |

| Bit Origin (US) | Dogecoin (DOGE) | 70M DOGE | $16M | First DOGE treasury |

| SBI Holdings (Japan) | XRP | ~$10B worth | $10B | Largest institutional XRP position |

| Windtree (US) | BNB | $60M worth | $60M | Pivot failed, delisted from Nasdaq |

Why Companies Are Doing This

The motivations are layered. Some firms see building a Crypto Native Treasury as a survival play. Their stock prices are weak, and rebranding as a crypto treasury vehicle attracts new investor interest. That attention allows them to raise fresh equity, which is then converted into digital assets. Shareholders monitor a new metric, “crypto per share”, to decide whether dilution is worth it.

Others frame it as innovation in treasury management. Bitcoin and XRP act as hedges against currency weakness, while Ethereum and Solana bring staking rewards that resemble interest income. In a world where cash may lose value and traditional yields are uncertain, crypto presents an unconventional alternative.

Regulation has also lowered the barriers. In 2023, FASB accounting changes allowed companies to mark crypto to market, recognizing both gains and losses rather than carrying assets at impaired cost.

Recently, SEC Chair Paul Atkins went on record to say that “very few crypto tokens are securities”, while pledging to future-proof the space against what he called “regulatory mischief”. For corporate boards, that statement was as good as a green light: adding Bitcoin, Ethereum, or XRP to treasuries would not invite endless legal battles. Combine that with a more pro-crypto political climate under Trump-era momentum, and the risk calculus for treasuries looks far different than it did just a few years ago.

Also read: SEC Chair Paul Atkins Pushes for Clear Crypto Guidelines

The Cracks in the Model

The strategy is not without risks. Crypto’s volatility can wipe billions from balance sheets in a matter of weeks. Companies that lean too heavily on share issuance risk losing investor trust if their crypto-per-share metric falls.

There are reputational dangers too. Windtree’s failed pivot into a Crypto Native Treasury shows how quickly markets punish moves that feel like gimmicks. Investors distinguish between conviction strategies, like MicroStrategy or BitMine, and acts of desperation.

And then there’s regulation. Bitcoin and Ethereum may be relatively safe, but the status of Solana, Dogecoin, or BNB remains uncertain. A shift in regulatory stance could reclassify them as securities, dragging corporate holders into unwanted oversight.

Looking Ahead

The question now is whether this wave will broaden further. Could ADA, SEI, or SUI become part of corporate treasuries in the next cycle? So far, no listed company has gone down that path, but it is not unthinkable if liquidity deepens and staking models mature.

There is also the chance of consolidation. Instead of each company betting on a single asset, we could see mergers or new structures that resemble multi-asset corporate ETFs. That would give shareholders broader exposure and reduce reliance on the fate of a single coin.

And of course, the biggest domino would be a Fortune 500 giant allocating even 1–2% of reserves to a Crypto Native Treasury strategy. That level of validation would normalize the practice overnight. At the sovereign level, countries like Brazil have floated Bitcoin reserve proposals, showing that the idea is moving beyond companies to states themselves.

Bottom Line

A year ago, the phrase Crypto Native Treasury meant Bitcoin and only Bitcoin. Now it stretches across Ethereum, Solana, Dogecoin, BNB, and XRP. Some companies will thrive and become living case studies in financial innovation. Others will crash, like Windtree, and serve as cautionary tales. But the direction is set. Crypto has left the trading floor and entered the balance sheet.