- •BlackRock considers the November 2.3 billion dollar IBIT outflows as normal behavior for a liquid ETF rather than a sign of deeper issues.

- •Cristiano Castro noted that IBIT and IBIT39 previously came close to reaching 100 billion dollars in combined assets during peak demand.

- •The withdrawals reflect typical reactions during price compression, especially in ETFs with strong retail participation.

BlackRock’s latest commentary around the BlackRock IBIT November outflows brings a calmer perspective to what looked like a tense month for the world’s largest asset manager. The firm’s business development director for Brazil, Cristiano Castro, shared that the recent withdrawals from the spot Bitcoin ETF fall within normal market behavior rather than signaling deeper structural concerns. He added that the ETF’s earlier demand cycle already pushed allocations close to the 100 billion dollar mark, giving the firm enough data to understand how quickly flows can shift. His comments came shortly after IBIT closed November with more than two billion dollars in net outflows.

IBIT’s November Flow Pattern and Castro’s Explanation

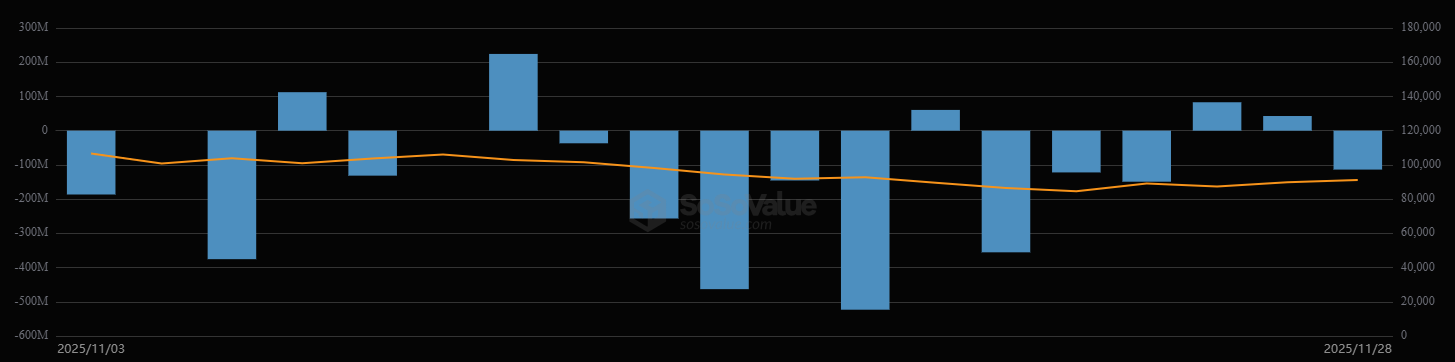

IBIT, BlackRock’s spot Bitcoin ETF in the United States, ended November with approximately $2.34 billion in net outflows. The heaviest withdrawals occurred on November 14 and November 18, where roughly $463 million and $523 million exited the fund.

Castro viewed this as routine behavior for an instrument built for liquidity. He explained that ETFs exist to help investors adjust their allocations quickly, especially during moments when the underlying asset experiences compression.

He also emphasized that the product attracts a significant retail base, a segment known for reacting faster to short-term market moves. Because of that, episodes of concentrated outflows can occur without indicating a structural shift in long-term demand. From the firm’s perspective, these movements still align with the intended use of the ETF.

Related read: Avalanche ETF Staking Pushes Institutional Momentum

Record Demand Earlier in the Cycle Supported BlackRock’s View

Castro pointed to earlier inflows as a reminder of the scale IBIT achieved this year. Between the US-listed IBIT and its Brazilian counterpart IBIT39, combined allocations reached levels that came very close to 100 billion dollars at their peak. He described this outcome as a surprise even for BlackRock, noting that initial expectations did not anticipate such fast adoption.

These earlier inflows offer context for November’s reversal. While the charted data shows a series of withdrawals throughout the month, the broader trend also includes periods of strong demand that helped IBIT holders return to profit as Bitcoin recovered above ninety thousand dollars late in the month. According to related reporting, cumulative gains for IBIT investors recently moved back into positive territory, reversing earlier losses from the market pullback.

Also read: CoinShares ETF Withdrawals Ahead of U.S. Market Entry

A Levelheaded Closing View on IBIT’s Market Moment

The BlackRock IBIT November outflows story ultimately fits into a larger cycle rather than a concerning deviation. The firm continues to view the ETF as a liquid tool designed for fast adjustments, and Castro’s remarks underline that the behavior seen in November aligns with what such an instrument is meant to deliver. In practical terms, this means the withdrawals do not undermine the strong demand the ETF received earlier this year or the scale it reached across both US and Brazilian markets. For now, BlackRock maintains a steady interpretation of the product’s position, with no indication from executives that recent flows suggest a change in strategy.