- •Coinbase Institutional’s December recovery outlook is driven by improving liquidity, higher rate cut expectations, and supportive macro signals.

- •The firm’s projections follow its earlier view that November would be weak, with a potential rebound supported by monetary flow indicators.

- •Institutional activity from firms like Vanguard and Bank of America adds context to a market environment that is showing renewed engagement.

Coinbase Institutional suggests that crypto markets may be entering a period where conditions support a December recovery. Their latest commentary points to improving liquidity, rising expectations of a rate cut, and macro signals that favor risk assets. This type of environment often sets the stage for sentiment shifts, especially after a quieter November that already aligned with their earlier projections. The firm’s assessment remains grounded in data from its internal metrics and broader market indicators rather than short term reactions. With institutions becoming more visible in recent headlines, the landscape feels more active than earlier in the quarter.

Coinbase Institutional’s View on Market Conditions

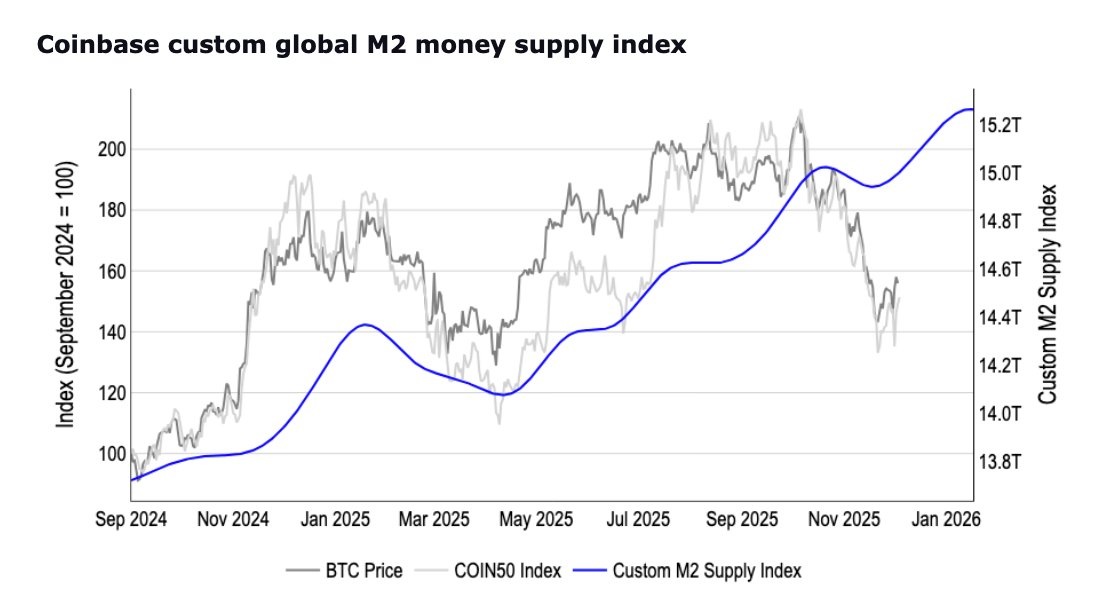

The core of Coinbase Institutional’s December recovery outlook centers on liquidity. Their custom M2 index, which measures monetary flows that influence asset prices, is showing signs of improvement. This aligns with the narrative they hinted at in October when they projected a weaker November followed by a stronger December. According to their update, these conditions are now unfolding.

Another driver is the sharp increase in expectations for a Federal Reserve rate cut. As of early December, various prediction platforms priced the odds above ninety percent. A shift of this size generally affects risk assets, and Coinbase notes it as a meaningful factor behind their view. They also highlight that concerns around an AI-related bubble have not materialized, which keeps certain growth-oriented sectors steady enough to support broader market confidence. On the currency side, short positions on the US dollar remain attractive at current levels, adding another layer to the argument for a potential recovery.

Related read: Coinbase Launches ETH-Backed Loans for USDC Borrowing

Institutional Signals Adding Context

Although bitcoin remained lower for the week, it recovered from its deepest pullbacks. Part of this stabilization may relate to stronger institutional attention appearing in headlines. Vanguard reversed its policy on crypto ETFs, which marked a notable change for a firm long viewed as conservative in its approach to digital assets. Bank of America also authorised wealth advisers to suggest crypto allocations of up to four percent, expanding access for clients who want controlled exposure.

These moves do not guarantee immediate market momentum, but they show increased engagement from established financial institutions. When paired with Coinbase Institutional’s December recovery outlook, the broader environment shows signs of renewed activity after weeks of mixed market action. Each development contributes to a picture where liquidity, macro trends, and institutional decisions intersect in a consistent way.

Also read: Do Kwon Sentencing Request Filed by US Prosecutors

A Measured View on the Path Ahead

Coinbase Institutional’s December recovery outlook does not rely on bold predictions. Their commentary frames the market as one where liquidity is recovering, macro conditions appear supportive, and institutional participation is becoming more visible. These pieces together create room for momentum to return, although the exact pace still depends on confirmed policy decisions and how markets digest them.

For traders and observers, the value lies in tracking how these factors evolve through the month. A recovery is not assured, but the conditions identified by Coinbase Institutional outline why December is shaping up as a more constructive period than recent weeks.

- Coinbase Institutional – Official December recovery update – (Dec 2025)

- Coinbase – Market Commentary and Research Insights – (Dec 6, 2025)

- Yahoo Finance – Coinbase sees crypto recovery as liquidity improves – (Dec 6, 2025)